Navigating the world of student loans can feel overwhelming, especially when faced with the choice between federal and private options. Both offer funding for higher education, but their structures, eligibility requirements, and repayment terms differ significantly. Understanding these differences is crucial for making informed decisions that align with your financial circumstances and long-term goals. This guide explores the key distinctions between federal and private student loans, empowering you to choose the best path for your educational journey.

This comparison will delve into the intricacies of each loan type, examining aspects such as lenders, eligibility criteria, interest rates, repayment plans, and the impact on your credit score. By understanding these nuances, you can confidently navigate the complexities of student loan financing and make informed choices that support your academic aspirations without jeopardizing your financial future.

Lender and Funding Source

Federal and private student loans differ significantly in their funding sources and the institutions involved in lending. Understanding these differences is crucial for borrowers to make informed decisions about financing their education. This section will clarify the distinctions between these two loan types, focusing on the entities providing the funds and the overall lending process.

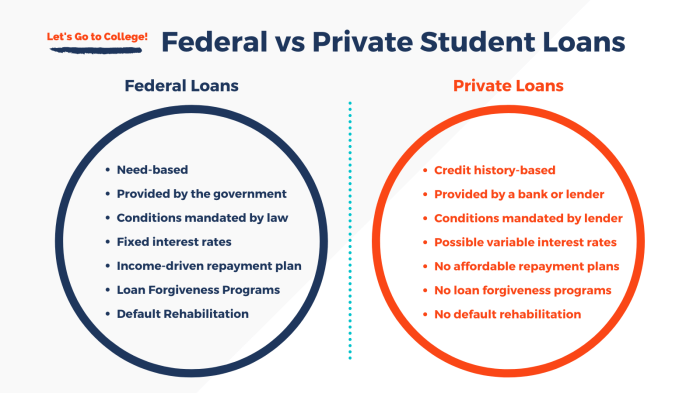

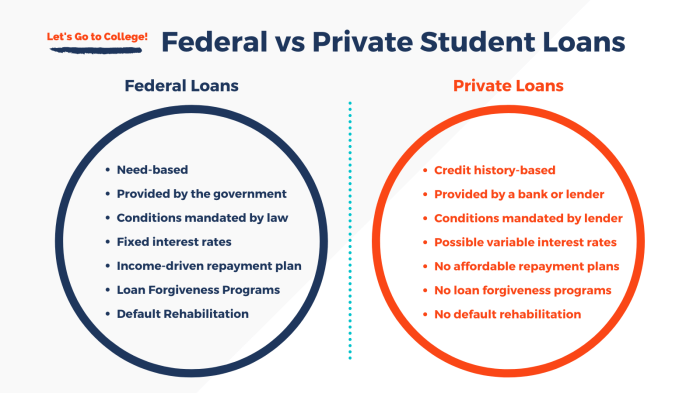

The primary difference lies in the source of the funds. Federal student loans are funded by the U.S. government, specifically through various government agencies. Private student loans, on the other hand, are funded by private financial institutions, such as banks, credit unions, and online lenders. This fundamental difference impacts several aspects of the loan, including interest rates, repayment options, and borrower protections.

Government’s Role in Federal Student Loans

The government plays a central role in federal student loans, acting as both the guarantor and, in many cases, the direct lender. The Department of Education oversees the federal student loan programs, setting eligibility criteria, interest rates, and repayment plans. This government backing provides significant benefits to borrowers, including more favorable interest rates and robust borrower protections. The government also manages the loan disbursement process and handles default management. Several government agencies are involved, including the Federal Student Aid (FSA), which manages the application process and disbursement of funds.

Lending Institutions Involved

Federal student loans are disbursed through the government or its designated lenders, ensuring a consistent and standardized process. In contrast, private student loans involve a diverse range of private lending institutions, each with its own lending criteria, interest rates, and repayment terms. This can make comparing private loan options more complex.

Examples of Private Lending Institutions

Many private financial institutions offer student loans. Examples include large banks such as Sallie Mae, Discover, and Wells Fargo. Credit unions and smaller regional banks also participate in the private student loan market. Numerous online lenders specialize in student loans, offering streamlined application processes and sometimes more competitive interest rates. The variety of lenders means borrowers have a wider choice, but also requires more careful comparison shopping.

Comparison of Lender Types

| Loan Type | Lender Type | Examples | Government Guarantee |

|---|---|---|---|

| Federal Student Loan | Government Agencies (e.g., Department of Education, FSA) | Direct Loans, Federal Perkins Loans, FFEL Program (discontinued) | Yes |

| Private Student Loan | Private Financial Institutions | Sallie Mae, Discover Student Loans, Wells Fargo Student Loans, Credit Unions, Online Lenders | No |

Eligibility and Application Process

Navigating the world of student loans requires understanding the key differences between federal and private options. A crucial aspect of this understanding lies in the eligibility criteria and the application process for each. Federal loans generally have broader eligibility, while private loans often impose stricter requirements.

Federal Student Loan Eligibility Criteria

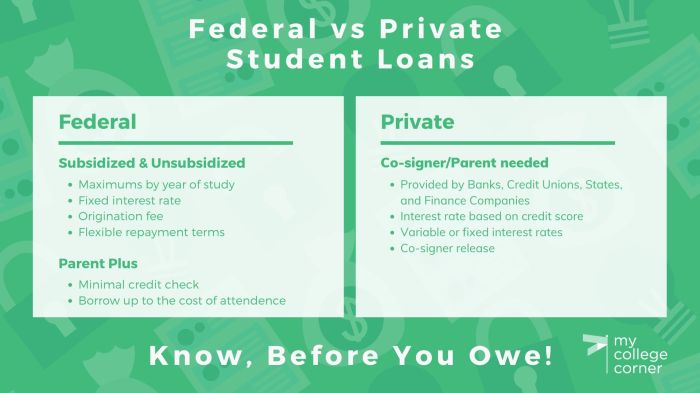

Eligibility for federal student loans hinges primarily on enrollment status and U.S. citizenship or eligible non-citizen status. Applicants must be enrolled or accepted for enrollment at least half-time in a degree or certificate program at a participating institution. A valid Social Security number is also required. While a credit check is not a primary eligibility factor, a satisfactory credit history can influence the loan terms offered, particularly for PLUS loans (Parent PLUS loans for parents of dependent students and Grad PLUS loans for graduate students). Finally, federal student aid requires the completion of the Free Application for Federal Student Aid (FAFSA). The FAFSA assesses financial need, influencing the amount of federal aid, including loans, a student may receive.

Comparison of Federal and Private Loan Eligibility

Federal student loans generally have more lenient eligibility requirements than private loans. Private lenders, in contrast, scrutinize applicants’ creditworthiness more rigorously. A strong credit history, including a high credit score and a record of responsible borrowing, is usually a prerequisite for securing a private student loan with favorable terms. Income plays a significant role in private loan eligibility, as lenders assess the applicant’s ability to repay the loan. Federal loans, while considering financial need through the FAFSA, do not explicitly require a minimum income level for eligibility. Students with poor credit or limited income might find it challenging to obtain private loans, or they might receive less favorable interest rates and loan terms.

Federal Student Loan Application Process

The application process for federal student loans begins with completing the FAFSA. This form gathers information about your financial situation and educational plans. Once processed, your eligibility for federal student aid, including loans, is determined. You then accept the offered loans through your school’s financial aid office, usually online via a student portal. No additional documentation is usually required beyond what’s included in the FAFSA, unless you’re applying for a PLUS loan, which requires a credit check.

Private Student Loan Application Process

Applying for a private student loan typically involves completing an online application with a private lender. This application requires significantly more personal and financial information than the FAFSA. Lenders will perform a credit check and review your income and debt to assess your creditworthiness. Depending on the lender, additional documentation may be needed, such as proof of enrollment, tax returns, and bank statements. The approval process can take longer than with federal loans and may be subject to stricter criteria.

Application Process Flowchart

The following text describes a flowchart illustrating the application process for both federal and private student loans. The flowchart would begin with a decision point: “Applying for Federal or Private Loan?”. For Federal Loans, the path would lead to “Complete FAFSA,” then to “Receive Award Notification,” followed by “Accept Loan Offer.” For Private Loans, the path would lead to “Complete Private Lender Application,” then to “Credit Check and Financial Review,” followed by “Loan Approval/Denial,” and finally, “Loan Disbursement (if approved).” The flowchart visually represents the distinct steps and decision points in each application process, highlighting the differences in complexity and requirements.

Interest Rates and Fees

Understanding the interest rates and fees associated with federal and private student loans is crucial for responsible borrowing and effective financial planning. These costs significantly impact the overall cost of your education and your repayment burden. While both loan types involve interest charges, the specifics differ considerably, affecting your long-term financial health.

Interest rates and fees are determined differently for federal and private student loans, leading to varying repayment costs. Federal student loan interest rates are set by the government and are generally lower than those offered by private lenders. Private student loan interest rates, on the other hand, are determined by the lender based on factors such as credit history, credit score, income, and the loan’s terms. This results in a wider range of interest rates for private loans compared to the more standardized rates for federal loans.

Federal Student Loan Interest Rates and Fees

Federal student loans typically have lower interest rates than private loans. These rates are set by the government and can vary depending on the type of loan (e.g., subsidized or unsubsidized), the loan’s disbursement date, and prevailing market conditions. While there aren’t typically origination fees for federal student loans, late payment fees can significantly increase the total cost of borrowing. Changes in interest rates directly impact monthly payments; a rise in rates leads to higher payments, and a decrease results in lower payments. For example, a 0.5% increase on a $50,000 loan can significantly increase the total interest paid over the life of the loan.

Private Student Loan Interest Rates and Fees

Private student loans offer a variable interest rate structure, influenced by the borrower’s creditworthiness and the prevailing market conditions. Lenders consider factors like credit history, credit score, and debt-to-income ratio to determine the interest rate. Unlike federal loans, private loans often include origination fees, which are added to the principal amount, increasing the overall loan amount. Late payment fees are also common. Fluctuations in interest rates directly impact the monthly payments and the total interest paid over the loan’s life. A borrower with a lower credit score might face significantly higher interest rates compared to a borrower with excellent credit.

Comparison of Interest Rates and Fees

The following table summarizes the typical differences in interest rates and fees between federal and private student loans. Note that these are ranges and actual rates and fees can vary based on individual circumstances and lender policies.

| Loan Type | Interest Rate Range | Origination Fee | Late Payment Fee |

|---|---|---|---|

| Federal Subsidized/Unsubsidized Loans | Variable, typically lower than private loans (e.g., 4-7%) | Usually none | Varies by lender, typically a percentage of the missed payment |

| Private Student Loans | Variable, dependent on creditworthiness (e.g., 5-15%) | Often present, can range from 1-5% of the loan amount | Varies by lender, typically a percentage of the missed payment or a flat fee |

Repayment Options and Terms

Understanding repayment options and terms is crucial for managing your student loan debt effectively. Federal and private student loans offer different repayment structures, impacting your monthly payments and overall repayment period. The consequences of default also vary significantly between the two loan types.

Federal Student Loan Repayment Options

Federal student loans provide a range of repayment plans designed to accommodate various financial situations. These plans offer flexibility in terms of monthly payment amounts and repayment periods. The most common options include Standard Repayment, Extended Repayment, Graduated Repayment, and Income-Driven Repayment (IDR) plans. Standard Repayment involves fixed monthly payments over a 10-year period. Extended Repayment extends the repayment period to up to 25 years, lowering monthly payments but increasing total interest paid. Graduated Repayment starts with lower monthly payments that gradually increase over time. IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base your monthly payment on your income and family size. These plans often result in lower monthly payments but can extend the repayment period significantly.

Private Student Loan Repayment Options

Private student loans generally offer fewer repayment options compared to federal loans. Common options include standard repayment plans with fixed monthly payments over a set period (often 5-15 years), and sometimes graduated repayment plans. However, income-driven repayment plans are rarely available with private loans. Repayment terms and options are determined by the lender and are specified in the loan agreement.

Repayment Term Comparisons

Federal student loans typically offer longer repayment terms, ranging from 10 to 25 years depending on the repayment plan chosen. Private student loans usually have shorter repayment terms, typically ranging from 5 to 15 years. The longer repayment terms of federal loans generally result in lower monthly payments but lead to higher total interest paid over the life of the loan. Conversely, shorter repayment terms for private loans mean higher monthly payments but lower total interest paid.

Consequences of Default

Defaulting on a federal student loan can have serious consequences, including wage garnishment, tax refund offset, and damage to your credit score. The Department of Education can also pursue legal action to recover the debt. Defaulting on a private student loan can also severely damage your credit score, making it difficult to obtain future loans or credit. While collection agencies may pursue legal action, the specific consequences vary depending on the lender and state laws. However, the impact on your creditworthiness is significant for both.

Examples of Repayment Schedules

Let’s consider two examples: a $20,000 federal loan and a $20,000 private loan. For the federal loan under the standard 10-year repayment plan with a 5% interest rate, the monthly payment might be approximately $212, totaling approximately $25,440 repaid over 10 years. A private loan with the same principal and interest rate, but a 7-year repayment plan, could have a monthly payment of approximately $310, resulting in a total repayment of approximately $25,820. These are estimates and actual figures depend on the specific interest rate and repayment plan.

Advantages and Disadvantages of Repayment Options

The choice of repayment plan significantly impacts your financial situation. Consider the following:

- Federal Loan Repayment Options:

- Standard Repayment: Advantage: Predictable payments, shorter repayment period. Disadvantage: Higher monthly payments.

- Extended Repayment: Advantage: Lower monthly payments. Disadvantage: Longer repayment period, higher total interest paid.

- Graduated Repayment: Advantage: Starts with lower payments. Disadvantage: Payments increase over time, can become unaffordable.

- Income-Driven Repayment: Advantage: Payments based on income, potentially lower monthly payments. Disadvantage: Longer repayment period, potential for loan forgiveness after 20-25 years (depending on the plan and eligibility), but still accruing interest.

- Private Loan Repayment Options:

- Standard Repayment: Advantage: Predictable payments. Disadvantage: Higher monthly payments, limited flexibility.

- Graduated Repayment (if offered): Advantage: Lower initial payments. Disadvantage: Payments increase over time, limited flexibility.

Loan Forgiveness and Deferment

Navigating the complexities of student loan repayment often involves understanding the options for loan forgiveness and deferment. These programs can significantly impact your long-term financial picture, offering relief during periods of financial hardship or rewarding service to the public. However, the availability and specifics of these programs differ significantly between federal and private student loans.

Federal student loans offer a wider array of forgiveness and deferment options compared to private loans. This is primarily due to the government’s role in promoting access to higher education and supporting borrowers facing financial challenges. Private lenders, on the other hand, operate under different guidelines and are generally less flexible in their forgiveness and deferment programs.

Federal Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, each with specific eligibility requirements. These programs aim to reduce or eliminate loan debt for borrowers who meet certain criteria, such as working in public service or teaching in underserved areas. The most prominent programs include Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Income-Driven Repayment (IDR) plans which can lead to forgiveness after a specified period of payments.

- Public Service Loan Forgiveness (PSLF): Forgives the remaining balance of your Direct Loans after you’ve made 120 qualifying monthly payments under an eligible IDR plan while working full-time for a qualifying government or non-profit organization.

- Teacher Loan Forgiveness: Forgives up to $17,500 of your federal student loans if you’ve taught full-time for five complete and consecutive academic years in a low-income school or educational service agency.

- Income-Driven Repayment (IDR) Plans: These plans calculate your monthly payment based on your income and family size. After making payments for 20 or 25 years (depending on the plan), any remaining balance may be forgiven. However, this forgiven amount is considered taxable income.

Private Student Loan Forgiveness and Deferment

Private student loan forgiveness programs are significantly less common than those offered for federal loans. Private lenders are not obligated to offer loan forgiveness programs in the same way the government is. While some private lenders might offer limited forgiveness programs under specific circumstances (e.g., death or disability), these are typically less generous and have stricter eligibility requirements.

Loan Deferment and Forbearance

Both federal and private student loans offer the possibility of deferment or forbearance, which temporarily postpone or reduce your loan payments. However, the availability and terms of these options vary considerably.

Federal Student Loan Deferment and Forbearance

Federal student loans offer various deferment and forbearance options, often based on economic hardship or specific life circumstances, such as unemployment, military service, or graduate school enrollment. These options typically require submitting an application and documentation supporting the reason for the request. It’s important to note that interest may still accrue during deferment or forbearance periods, except for certain deferment types.

Private Student Loan Deferment and Forbearance

Private lenders have more discretion in granting deferment or forbearance. The availability and terms depend entirely on the lender’s policies. Some private lenders may offer these options, but they are often less flexible and may require more stringent documentation. Additionally, interest typically continues to accrue during deferment or forbearance periods with private loans.

Application Processes

Applying for federal loan forgiveness or deferment typically involves completing an application through the Federal Student Aid website (studentaid.gov). This often requires providing documentation to support your eligibility. For private loans, the application process varies by lender and involves contacting the lender directly to inquire about available options and submit the necessary documentation.

Eligibility Criteria Differences

The eligibility criteria for loan forgiveness and deferment differ significantly between federal and private loans. Federal programs have specific eligibility requirements based on factors like income, employment, and loan type. Private loan eligibility is determined solely by the lender’s policies and may be significantly more restrictive. For example, a borrower might qualify for PSLF with a federal loan, but a similar private loan would not offer such a program.

Impact on Credit Score

Managing student loan debt significantly impacts your credit score. Understanding how federal and private loans affect your credit differently is crucial for responsible borrowing and repayment. Both types of loans are reported to credit bureaus, but the nuances of reporting and the available protections can significantly alter their effect on your creditworthiness.

Federal Student Loan Repayment and Credit Score

Federal student loans, when repaid on time, positively contribute to your credit score. On-time payments demonstrate responsible credit management, a key factor in credit scoring models. Consistent, timely payments build your credit history, boosting your credit score over time. Conversely, missed or late payments negatively impact your score. The severity of the negative impact depends on the frequency and duration of late payments. The credit bureaus track this information, and it can stay on your report for several years. Furthermore, the federal government offers various repayment plans and hardship programs, which, while potentially affecting your credit report initially, might mitigate long-term negative consequences compared to private loans.

Private Student Loan Repayment and Credit Score

Similar to federal loans, on-time payments on private student loans improve your credit score. However, private lenders often have stricter policies and fewer options for borrowers facing financial hardship. Missed or late payments on private student loans can result in more severe and rapid negative impacts on your credit score than with federal loans. Private lenders may not offer the same flexibility in repayment plans as the federal government, leading to a more pronounced negative impact on your creditworthiness in cases of financial difficulty. Additionally, the collection practices of private lenders can vary significantly, potentially leading to more aggressive collection efforts impacting your credit score further.

Impact of Late Payments or Defaults

Late payments or defaults on both federal and private student loans severely damage your credit score. A late payment will typically lower your score, and the longer the payment is overdue, the greater the impact. Defaulting on a loan, meaning you completely stop making payments, has an even more substantial and long-lasting negative impact. This can lead to difficulty securing future loans, higher interest rates, and other financial difficulties. While the federal government provides various options to avoid default, private lenders often pursue more aggressive collection methods, potentially leading to legal action and further damage to your credit.

Factors Influencing Credit Score Impact

Several factors influence the extent to which student loan repayment (or non-repayment) impacts your credit score. These include the length of your credit history, the number of accounts you have, your credit utilization ratio (the amount of credit you’re using compared to your total available credit), and your mix of credit accounts. A longer credit history and a diverse mix of credit accounts can help mitigate the negative effects of late payments or defaults on student loans. Similarly, keeping your credit utilization low can help improve your overall credit score, reducing the relative impact of any negative marks from student loans. Additionally, the type of loan (federal vs. private) and the lender’s reporting practices play a role in how the information is reflected on your credit report.

Visual Representation of Loan Repayment Impact on Credit Scores

Imagine a line graph with two lines, one representing federal student loans and the other representing private student loans. The x-axis represents repayment history (from consistently on-time payments to consistent late payments and defaults). The y-axis represents credit score. Both lines start at a similar point, representing a good credit score with no loan activity. As repayment history moves towards consistently on-time payments, both lines increase, showing a positive impact on the credit score. However, the federal loan line shows a gentler decrease in credit score with late payments, reflecting the availability of repayment plans and hardship programs. In contrast, the private loan line shows a steeper decline with late payments and a more significant drop in credit score upon default, representing the stricter policies and potentially more aggressive collection practices of private lenders. The gap between the two lines widens as repayment history worsens, highlighting the differing impacts of federal and private loan defaults on credit scores.

End of Discussion

Choosing between federal and private student loans requires careful consideration of individual circumstances. While federal loans often provide greater borrower protections and flexible repayment options, private loans may offer higher borrowing limits for those who qualify. Ultimately, the best choice depends on factors like credit history, income, and the overall cost of your education. By weighing the advantages and disadvantages of each, and understanding the implications of your choice, you can make a well-informed decision that sets you up for success.

Quick FAQs

What happens if I default on a federal student loan?

Defaulting on a federal student loan can have serious consequences, including wage garnishment, tax refund offset, and damage to your credit score. It can also impact your ability to obtain future federal loans or other financial assistance.

Can I refinance my federal student loans into a private loan?

Yes, you can refinance federal student loans into a private loan, but this often forfeits certain borrower protections afforded by federal loans, such as income-driven repayment plans and loan forgiveness programs.

What is the difference in loan forgiveness programs between federal and private loans?

Federal student loans offer various loan forgiveness programs based on career paths (e.g., public service) or other qualifying factors. Private student loans generally do not offer such programs.

How does my credit score affect my chances of getting a private student loan?

Private student loan approval heavily relies on your credit score and history. A higher credit score increases your chances of approval and may result in a lower interest rate.