The specter of defaulted student loan forgiveness looms large, casting a long shadow over the national economy and the lives of millions. This complex issue intertwines economic instability, social inequality, and legal complexities, demanding a thorough examination of its potential consequences. Understanding the ripple effects of widespread defaults—from impacting financial institutions to exacerbating existing social disparities—is crucial to developing effective solutions.

This exploration delves into the multifaceted nature of defaulted student loan forgiveness, analyzing its economic ramifications, societal implications, legal frameworks, and potential policy interventions. Through a blend of hypothetical scenarios, real-world case studies, and a comprehensive FAQ section, we aim to illuminate this critical issue and foster a more informed understanding of its far-reaching effects.

The Economic Impact of Student Loan Forgiveness Defaults

Widespread defaults on student loan forgiveness programs would create a significant ripple effect throughout the national economy, impacting various sectors and potentially triggering a substantial economic downturn. The consequences are complex and interconnected, extending far beyond the borrowers themselves.

Impact on Banks and Financial Institutions

Banks and other financial institutions hold a substantial portion of the outstanding student loan debt, either directly or through securitization. A mass default would lead to significant losses for these institutions, potentially impacting their capital reserves and lending capacity. This could trigger a credit crunch, making it harder for businesses and individuals to access loans, further hindering economic growth. The severity of the impact would depend on the extent of the defaults and the institutions’ preparedness for such an event. For example, a scenario similar to the 2008 subprime mortgage crisis, but focused on student loans, could unfold, with potentially devastating consequences for the financial system.

Consequences for Taxpayers

Should student loan forgiveness programs fail due to widespread defaults, taxpayers would likely bear a significant portion of the losses. The government might need to step in to cover losses incurred by banks or to fund new programs to address the resulting economic instability. This could lead to increased taxes, reduced government spending in other areas, or both. The exact cost to taxpayers would depend on the scale of the defaults and the government’s response. The 2008 bailout serves as a relevant example, where taxpayer money was used to stabilize the financial system after the mortgage crisis. A similar, albeit potentially smaller, scale bailout might be required in a scenario of widespread student loan defaults.

Economic Recovery or Further Downturn Scenarios

The economic consequences of mass student loan defaults depend heavily on the default rate. A relatively low default rate might lead to a manageable economic slowdown, with potential recovery through targeted government interventions and market adjustments. However, a high default rate could trigger a significant recession, similar to the Great Recession of 2008-2009. This could involve prolonged unemployment, decreased consumer spending, and a sharp decline in business investment. The severity of the downturn would depend on factors such as the speed and effectiveness of government response, the resilience of the financial system, and overall global economic conditions.

Hypothetical Economic Indicators Following a Mass Default

| Indicator | Pre-Default | During Default | Post-Default |

|---|---|---|---|

| GDP Growth Rate | 2.5% | -1.0% | 0.5% (after 2 years) |

| Unemployment Rate | 3.5% | 7.0% | 5.0% (after 2 years) |

| Consumer Spending | Stable | Decreased significantly | Slowly recovering |

| Inflation Rate | 2.0% | Potentially increased or decreased depending on government intervention | Returning to pre-default levels |

The Social Impact of Student Loan Forgiveness Defaults

The widespread defaulting on student loans carries significant societal consequences that extend far beyond the individual borrower. It impacts the overall economy, erodes public trust in financial institutions, and creates lasting inequalities within the population. Understanding these social ramifications is crucial for developing effective mitigation strategies.

The ramifications of student loan forgiveness defaults are far-reaching and deeply intertwined with various aspects of social well-being. This section will explore these consequences, focusing on the impact on credit scores, future financial opportunities, and the disproportionate effects on specific demographics. We will also illustrate the personal struggles of individuals affected and suggest potential social programs that can help alleviate the negative impacts.

Impact on Borrowers’ Credit Scores and Future Financial Opportunities

Defaulting on student loans has a devastating impact on a borrower’s credit score, severely limiting their access to future financial opportunities. A poor credit score makes it difficult to secure loans for a home, car, or even a credit card, effectively trapping individuals in a cycle of financial instability. This can lead to lower earning potential due to limited access to capital for business ventures or professional development. For example, someone hoping to start their own small business might be denied a loan, hindering their entrepreneurial aspirations and limiting their ability to climb the socioeconomic ladder. The long-term effects can be significant, affecting everything from renting an apartment to securing a mortgage, ultimately impacting their overall quality of life.

Disparities in Impact Based on Race, Ethnicity, or Socioeconomic Status

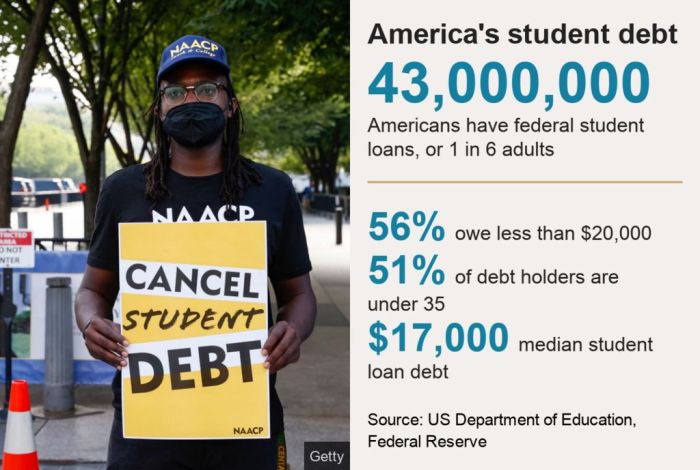

The impact of student loan defaults is not evenly distributed across the population. Studies have shown that borrowers from marginalized racial and ethnic groups, and those from lower socioeconomic backgrounds, are disproportionately affected by default. This disparity stems from a multitude of factors, including systemic inequalities in access to quality education, higher rates of unemployment, and limited access to financial literacy resources. For instance, students from low-income families may be more likely to attend less prestigious colleges with higher default rates, or they may be forced to take out larger loans to cover living expenses, making repayment more challenging. These existing inequalities are exacerbated by the consequences of default, creating a vicious cycle of disadvantage.

Illustrative Narrative of Personal Struggles

Maria, a single mother of two, worked tirelessly to complete her nursing degree, incurring significant student loan debt. After graduation, she secured a position with a low salary, making loan repayment difficult. Facing unexpected medical expenses for her child, she fell behind on her payments. The resulting default severely damaged her credit score, making it impossible to secure better employment opportunities or find affordable housing. Maria’s story highlights the vulnerability of borrowers facing unexpected life events and the devastating consequences of defaulting on student loans. It showcases how systemic issues can interact with individual circumstances to create insurmountable obstacles.

Potential Social Programs to Mitigate Negative Impacts

The negative societal impacts of widespread student loan defaults necessitate the implementation of comprehensive social programs. These programs should address both the immediate needs of borrowers and the underlying systemic issues contributing to defaults.

- Expanded financial literacy programs: Providing accessible and culturally relevant financial education can empower borrowers to make informed decisions about their debt and develop effective repayment strategies.

- Income-driven repayment plans: More flexible repayment plans that tie monthly payments to borrowers’ income can prevent defaults for those facing financial hardship.

- Targeted support for marginalized communities: Addressing systemic inequalities through targeted support programs can help reduce the disproportionate impact of defaults on specific demographics.

- Debt cancellation or reduction programs: Implementing programs that forgive or reduce student loan debt can alleviate the burden on struggling borrowers and stimulate the economy.

- Mental health support services: The stress and anxiety associated with student loan debt can have significant impacts on mental health. Providing access to mental health services can improve borrowers’ well-being and ability to manage their finances.

Legal and Regulatory Aspects of Student Loan Forgiveness Defaults

Navigating the legal landscape surrounding defaulted student loan forgiveness is complex, varying significantly based on the type of loan, the involved lender (federal or private), and the borrower’s location. This section will explore the key legal and regulatory aspects, focusing on the inconsistencies across states and the actions available to both lenders and borrowers.

Legal Ramifications of Student Loan Forgiveness Defaults Across States

While federal student loans are governed by federal law, the enforcement and collection practices can differ based on state-level regulations. Some states have stronger consumer protection laws impacting debt collection practices, potentially limiting the actions collection agencies can take. For example, some states may impose stricter limits on the frequency of contact by debt collectors or place restrictions on wage garnishment. Conversely, other states may have less stringent regulations, allowing for more aggressive collection methods. The specific legal ramifications, therefore, depend heavily on the borrower’s state of residence and the lender’s chosen collection strategy. This variation highlights the importance of understanding the specific laws applicable to a borrower’s situation.

Legal Processes Involved in Pursuing Defaulted Student Loan Debt

The legal process for pursuing defaulted student loans generally begins with attempts at amicable resolution, such as repayment plans or forbearance agreements. However, if these efforts fail, the lender can take several legal actions. This may involve wage garnishment, tax refund offset, or even legal action to seize assets. Federal student loans typically allow for the Department of Education to refer the debt to a collection agency or pursue legal action directly. Private loans often involve similar processes, though the specifics may vary based on the loan agreement and state law. The process generally involves formal legal notices, opportunities for the borrower to respond, and a potential court hearing if the matter is not resolved amicably.

Role of Collection Agencies and Legal Actions They Can Take

Collection agencies play a significant role in the pursuit of defaulted student loan debt. They are often hired by lenders to handle the collection process, employing various strategies to recover the outstanding debt. Legal actions collection agencies can take include contacting the borrower repeatedly, reporting the debt to credit bureaus, initiating wage garnishment, and filing lawsuits to obtain court judgments. The Fair Debt Collection Practices Act (FDCPA) sets limitations on the actions collection agencies can take, prohibiting harassment, misrepresentation, and unfair practices. However, borrowers should be aware that violations of the FDCPA must be actively reported to the relevant authorities to initiate legal recourse.

Summary of Existing Federal and State Laws Related to Student Loan Debt Collection

Federal laws, such as the Higher Education Act of 1965 and the FDCPA, govern many aspects of federal student loan debt collection. These laws Artikel the permissible collection methods, the rights of borrowers, and the responsibilities of lenders and collection agencies. State laws can supplement or, in some cases, restrict these federal regulations. For instance, state laws may impose additional limitations on wage garnishment or the types of assets that can be seized. The interaction between federal and state laws creates a complex legal framework that can vary significantly depending on the jurisdiction.

Impact of Legal Frameworks on Borrower Rights and Responsibilities

Different legal frameworks significantly impact borrowers’ rights and responsibilities. Stronger consumer protection laws in some states provide borrowers with more avenues for recourse against aggressive collection practices. Conversely, weaker regulatory environments may leave borrowers more vulnerable to aggressive debt collection tactics. Understanding the specific legal framework applicable to their situation is crucial for borrowers to protect their rights and understand their responsibilities in managing their defaulted student loan debt. This includes understanding the legal processes, deadlines, and potential consequences of non-compliance.

Policy Recommendations to Address Student Loan Forgiveness Defaults

The escalating rate of student loan defaults necessitates a multi-pronged approach involving proactive prevention strategies and robust support systems for borrowers facing financial hardship. Addressing this issue requires a careful balance between protecting borrowers and ensuring the financial stability of the lending system. The following policy recommendations aim to achieve this balance.

Income-Driven Repayment Plan Improvements

Income-driven repayment (IDR) plans are designed to make monthly payments more manageable based on a borrower’s income and family size. However, these plans often suffer from complexities and inconsistencies. Improvements should focus on simplifying the application process, standardizing calculations across different plans, and ensuring that borrowers are automatically enrolled in the most suitable plan based on their circumstances. This would reduce the administrative burden on borrowers and prevent them from falling behind on payments due to confusion or lack of awareness. Furthermore, regular reviews and adjustments to the plans based on economic indicators could ensure continued affordability. For example, automatic adjustments based on inflation could prevent payments from becoming unaffordable due to rising living costs.

Targeted Financial Literacy Programs

Many borrowers lack the financial literacy skills needed to effectively manage their student loans. Comprehensive financial literacy programs should be implemented, focusing on budgeting, debt management, and understanding loan repayment options. These programs could be integrated into high school curricula, offered at colleges and universities, and made readily accessible online. The programs should be tailored to the specific needs of different student demographics and incorporate interactive elements, such as workshops and online simulations, to enhance engagement and knowledge retention. A successful program would demonstrably increase borrowers’ understanding of their loan terms and their ability to make informed decisions about repayment.

Expanded Access to Loan Counseling and Rehabilitation

Effective loan counseling can help borrowers navigate the complexities of repayment and avoid default. Expanding access to free or low-cost counseling services, both pre- and post-loan disbursement, is crucial. This includes providing personalized guidance on choosing the right repayment plan, budgeting strategies, and options for managing financial difficulties. Loan rehabilitation programs, which allow borrowers to reinstate their loans after default, should be streamlined and made more accessible. Reducing the barriers to accessing these programs, such as lengthy application processes or stringent eligibility criteria, will encourage borrowers to seek help before their situation worsens. For example, a simplified application process with clear eligibility requirements could drastically increase participation.

Policy Options Comparison

| Policy Option | Cost | Benefits | Potential Challenges |

|---|---|---|---|

| Improved IDR Plans | Increased administrative costs; potential for increased government spending on subsidies | Reduced defaults, improved borrower affordability, simplified repayment | Complexity of implementation, potential for political opposition due to increased government spending |

| Expanded Financial Literacy Programs | Significant upfront investment in program development and implementation; ongoing operational costs | Reduced defaults through improved borrower knowledge and decision-making, improved long-term financial health of borrowers | Measuring program effectiveness, ensuring widespread access and engagement, overcoming skepticism about program value |

| Enhanced Loan Counseling and Rehabilitation | Increased costs for counseling services and program administration | Reduced defaults, improved borrower outcomes, increased loan recovery rates | Ensuring quality of counseling services, addressing potential for fraud, managing increased demand for services |

Political Challenges to Implementation

Implementing these policy recommendations will likely face significant political challenges. Increased government spending on student loan programs may face opposition from those advocating for fiscal responsibility. There may also be resistance to expanding government intervention in the student loan market, with some arguing for a more market-based approach. Furthermore, achieving consensus on the design and implementation of these programs will require navigating diverse perspectives and interests among policymakers, lenders, and borrowers. Building broad-based support through effective communication and collaboration with stakeholders will be essential to overcome these challenges.

Illustrative Case Studies of Student Loan Forgiveness Defaults

This section presents several case studies illustrating the diverse impacts of student loan forgiveness defaults, highlighting both individual struggles and broader societal consequences. These examples demonstrate the complexities of the issue and the need for comprehensive policy solutions.

The Long-Term Consequences of a Single Defaulted Loan: The Case of Sarah Miller

Sarah Miller, a graduate with a degree in art history, defaulted on her $40,000 student loan in 2015. Unable to find a job in her field that offered a livable wage, she fell behind on payments. The default resulted in a significant drop in her credit score, making it difficult to secure housing, a car loan, or even a credit card. This financial instability led to a cycle of debt and limited opportunities. She faced wage garnishment, impacting her already precarious financial situation. Even after finding a stable job, rebuilding her credit and financial stability proved a long and arduous process. This case illustrates how a single default can have far-reaching and long-lasting negative consequences, significantly impacting an individual’s life trajectory.

Policy Change Impact: The 2010 Amendments to the Higher Education Act

The 2010 amendments to the Higher Education Act introduced changes to the income-driven repayment plans for federal student loans. While intended to improve affordability, these changes, in some interpretations, led to a temporary increase in defaults, particularly among borrowers who misinterpreted the new plan options or faced difficulties navigating the complex application process. This increase was observed in the early years following the implementation, with a subsequent stabilization as borrowers became more familiar with the revised system. This highlights the importance of clear communication and accessible resources in supporting borrowers with new policy implementations. Further research into the specific demographics affected would be necessary to draw more precise conclusions.

Hypothetical Case Study: A Large-Scale Default in a Rural Community

Imagine a scenario where a significant percentage of student loan borrowers in a small, rural community default on their loans simultaneously. This could be triggered by a sudden economic downturn impacting local industries, such as a factory closure or a prolonged agricultural crisis. The resulting economic fallout would be severe. Local businesses reliant on consumer spending could experience a significant decline in revenue, potentially leading to closures and job losses. The community’s overall economic health would suffer, with reduced tax revenue impacting public services like schools and healthcare. This hypothetical scenario underscores the interconnectedness between individual financial struggles and the broader economic well-being of a community.

Successful Navigation of the Default Process: The Story of David Chen

David Chen defaulted on his student loans after losing his job. However, unlike many, he proactively engaged with his loan servicer. He participated in income-driven repayment plan counseling, explored options like loan rehabilitation, and successfully negotiated a repayment plan tailored to his current financial situation. His proactive approach prevented further negative impacts on his credit score and ultimately allowed him to regain control of his finances. This case demonstrates the importance of seeking help early and engaging with available resources.

Resources for Borrowers Struggling with Student Loan Debt

The following resources are available to assist borrowers struggling with student loan debt:

- National Student Loan Data System (NSLDS): Provides access to your federal student loan information.

- StudentAid.gov: The official U.S. Department of Education website for student financial aid.

- Your Loan Servicer: Contact your loan servicer directly to discuss repayment options.

- Nonprofit Credit Counseling Agencies: Offer free or low-cost financial counseling services.

- Legal Aid Organizations: Provide legal assistance to borrowers facing student loan issues.

Closing Summary

Ultimately, the challenge of defaulted student loan forgiveness requires a multi-pronged approach. Addressing the economic vulnerabilities of both borrowers and lenders, while simultaneously acknowledging and mitigating the social inequities inherent in the system, is paramount. Proactive policy interventions, coupled with accessible resources and support programs, are essential to navigate this complex landscape and prevent a future crisis. The path forward demands a collaborative effort, balancing the needs of individuals with the stability of the financial system.

FAQ Insights

What happens if I default on my student loans?

Defaulting on student loans can severely damage your credit score, leading to difficulty obtaining loans, credit cards, or even renting an apartment. Wage garnishment, tax refund offset, and lawsuits are also possible.

Are there any programs to help avoid default?

Yes, several programs offer income-driven repayment plans, which adjust your monthly payments based on your income and family size. Deferment or forbearance may also be options in certain circumstances. Contact your loan servicer to explore these possibilities.

Can my student loan debt be forgiven?

Loan forgiveness programs exist, but eligibility requirements vary. Some programs target specific professions (e.g., public service) or borrowers with disabilities. The specifics of any forgiveness program are subject to change.

What are the consequences for lenders if many borrowers default?

High default rates can lead to significant financial losses for lenders, potentially impacting their stability and ability to provide future loans. This could also lead to increased interest rates for future borrowers.