Navigating the complexities of higher education often involves grappling with the financial burden of tuition fees. Direct PLUS loans offer a crucial lifeline for many students and their families, providing access to funds that might otherwise be unattainable. Understanding the intricacies of these loans—from eligibility requirements and repayment options to potential long-term financial implications—is paramount to making informed decisions about financing your education.

This guide delves into the essential aspects of Direct PLUS loans, offering a clear and concise overview of the application process, repayment plans, and potential financial impacts. We’ll explore various scenarios, compare them to alternative financing options, and equip you with the knowledge to manage your debt effectively and responsibly. By the end, you’ll have a comprehensive understanding of Direct PLUS loans and how they can fit into your financial strategy.

Understanding Direct Plus Loans

Direct PLUS loans are a federal student loan program designed to help parents of dependent undergraduate students and graduate students pay for college expenses. They offer a crucial funding option when other financial aid sources fall short. Understanding the eligibility requirements, interest rates, application process, and comparison to other loan programs is key to making informed financial decisions.

Eligibility Criteria for Direct PLUS Loans

To be eligible for a Direct PLUS loan, parents of dependent undergraduate students must meet specific criteria. They must be a U.S. citizen or eligible non-citizen, have a Social Security number, and not have an adverse credit history. Graduate students applying for Direct PLUS loans must meet similar requirements, though parental status is not a factor. The lender will conduct a credit check to assess creditworthiness. Applicants with adverse credit history may still be eligible by obtaining an endorser or demonstrating extenuating circumstances. It’s important to note that the lender’s creditworthiness assessment is not the only factor; the applicant must also meet the general eligibility requirements set by the Department of Education.

Interest Rates and Fees Associated with Direct PLUS Loans

Direct PLUS loans carry a fixed interest rate that is determined by the U.S. Department of Education. This rate changes periodically and is usually higher than the interest rates on subsidized or unsubsidized federal student loans. Additionally, a loan fee is charged upon disbursement of the loan. This fee is a percentage of the loan amount and is deducted from the loan disbursement, meaning the borrower receives less than the total loan amount. For example, if the loan fee is 4%, and the loan amount is $10,000, the borrower would receive $9,600. The specific interest rate and loan fee will vary depending on when the loan is disbursed. It is advisable to check the official Department of Education website for the most current information.

Applying for a Direct PLUS Loan

Applying for a Direct PLUS loan is a relatively straightforward process. First, the parent or graduate student must complete the Free Application for Federal Student Aid (FAFSA). Next, the applicant must complete a Direct PLUS Loan Master Promissory Note (MPN). This MPN is an agreement outlining the terms and conditions of the loan. After the MPN is signed, the loan is processed, and the funds are disbursed to the student’s educational institution. The entire process usually takes several weeks. It’s recommended to apply well in advance of the start of the academic term to ensure timely disbursement of funds.

Comparison of Direct PLUS Loans to Other Federal Student Loan Programs

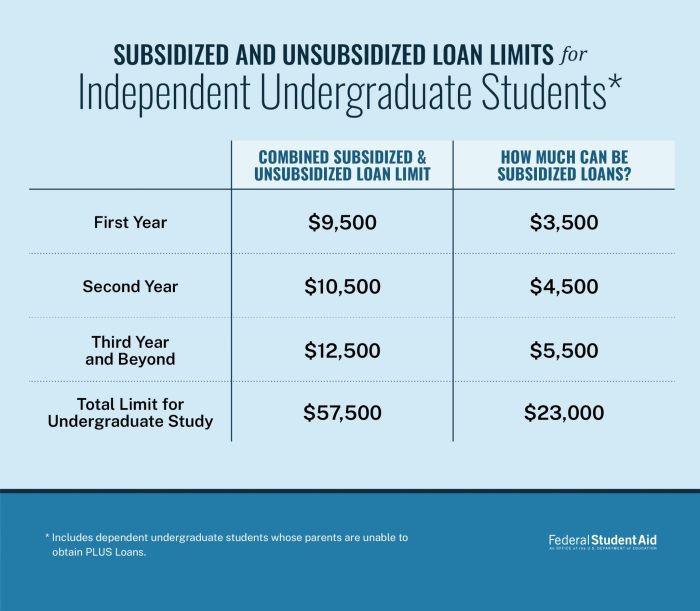

Direct PLUS loans differ from other federal student loan programs in several key ways. Unlike subsidized and unsubsidized Stafford Loans, which are available to undergraduate and graduate students directly, PLUS loans are for parents or graduate students. Interest begins accruing immediately on Direct PLUS loans, unlike subsidized Stafford Loans where interest does not accrue while the student is enrolled at least half-time. Additionally, the interest rate on Direct PLUS loans is typically higher than the interest rates on Stafford Loans. Finally, eligibility for Direct PLUS loans is based on creditworthiness, whereas eligibility for Stafford Loans is based primarily on financial need and enrollment status. Choosing the appropriate loan type depends on the borrower’s individual circumstances and financial situation.

Repayment Options for Direct PLUS Loans

Choosing the right repayment plan for your Direct PLUS loan is crucial for managing your debt effectively and avoiding financial strain. Several options exist, each with its own advantages and disadvantages, depending on your individual financial circumstances and long-term goals. Understanding these options will allow you to make an informed decision that best suits your needs.

Different repayment plans offer varying monthly payments, loan terms, and overall repayment costs. The plan you select will significantly impact your budget and your overall interest payments. Careful consideration of your income, expenses, and long-term financial projections is essential before committing to a specific plan.

Standard Repayment Plan

The Standard Repayment Plan is the most common option. It involves fixed monthly payments over a 10-year period. This plan offers predictable payments but may result in higher total interest paid compared to income-driven repayment plans, especially if your income is relatively low. A longer repayment period, while reducing monthly payments, typically increases the total interest paid over the life of the loan.

Extended Repayment Plan

This plan stretches payments over a longer period, up to 25 years, reducing monthly payments. However, the extended repayment period will result in a significantly higher total interest paid over the life of the loan. This plan is suitable for borrowers who need lower monthly payments but are willing to pay more in interest over the long term.

Graduated Repayment Plan

Under the Graduated Repayment Plan, monthly payments start low and gradually increase over time. This can be beneficial in the early years after graduation when income is typically lower. However, the increasing payments can become challenging to manage as they rise. The total interest paid will also be higher than under the standard plan, but potentially lower than the extended plan.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) link your monthly payments to your income and family size. These plans include the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans.

Benefits and Drawbacks of Income-Driven Repayment Plans

Income-driven repayment plans offer the advantage of lower monthly payments, making them more manageable for borrowers with lower incomes. They also potentially lead to loan forgiveness after a certain number of qualifying payments, often 20 or 25 years, depending on the plan. However, the lower monthly payments often result in a longer repayment period and significantly higher total interest paid over the loan’s life. Additionally, the income verification process can be somewhat complex and require regular updates.

Sample Repayment Schedule: Standard Repayment Plan ($10,000 Loan)

This example assumes a 10-year repayment period at a fixed interest rate of 7% (Note: Interest rates fluctuate, and this is a hypothetical example. Always check the current interest rate on your loan).

| Year | Beginning Balance | Annual Payment | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $10,000.00 | $1,220.47 | $700.00 | $520.47 | $9,479.53 |

| 2 | $9,479.53 | $1,220.47 | $663.57 | $556.90 | $8,922.63 |

| 3 | $8,922.63 | $1,220.47 | $625.58 | $594.89 | $8,327.74 |

| … | … | … | … | … | … |

| 10 | $1,268.02 | $1,220.47 | $88.34 | $1,132.13 | $0.00 |

*(Note: This is a simplified example and does not include any potential fees. Actual payment amounts may vary slightly.)*

Managing Direct PLUS Loan Debt

Successfully navigating Direct PLUS loan debt requires proactive strategies and diligent financial management. Understanding your repayment options and actively minimizing interest costs are crucial steps towards becoming debt-free. This section Artikels practical strategies and resources to help you manage your PLUS loan debt effectively and avoid potential pitfalls.

Strategies for Minimizing Interest Payments on Direct PLUS Loans

Lowering your interest payments can significantly reduce the overall cost of your loan. Several strategies can help achieve this goal. One key strategy is to make extra payments whenever possible. Even small additional payments can accelerate your repayment timeline and save you money on interest in the long run. Consider exploring refinancing options if interest rates have dropped since you initially took out the loan. Refinancing could potentially lower your monthly payment and reduce the total interest paid. Finally, selecting a repayment plan that aligns with your financial situation can also help. While some plans may have higher monthly payments, they can lead to lower overall interest costs over the life of the loan. For example, choosing a shorter repayment term will increase your monthly payments, but it will significantly reduce the total interest accrued.

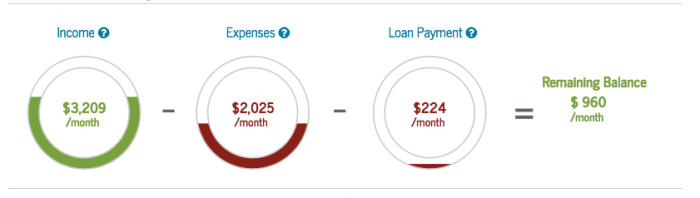

Budget Template to Manage Student Loan Debt

A well-structured budget is essential for effective student loan management. The following template can be adapted to your specific circumstances:

| Income | Amount |

|---|---|

| Monthly Salary/Income | $_____ |

| Other Income (e.g., part-time job) | $_____ |

| Expenses | Amount |

| Housing (Rent/Mortgage) | $_____ |

| Utilities (Electricity, Water, Gas) | $_____ |

| Food | $_____ |

| Transportation | $_____ |

| Student Loan Payment | $_____ |

| Other Expenses (e.g., insurance, entertainment) | $_____ |

| Net Income (Income – Expenses) | $_____ |

By meticulously tracking your income and expenses, you can identify areas where you can reduce spending and allocate more funds towards your student loan payments. This process provides a clear picture of your financial situation and helps you prioritize loan repayment.

Tips for Avoiding Default on Direct PLUS Loans

Defaulting on your Direct PLUS loan can have severe consequences, including damage to your credit score and potential wage garnishment. To avoid default, consistent communication with your loan servicer is vital. If you anticipate difficulty making payments, contact your servicer immediately to explore options like deferment or forbearance. Creating a realistic budget and sticking to it is also crucial. Consider exploring income-driven repayment plans if your income is low relative to your debt. These plans adjust your monthly payments based on your income and family size, making them more manageable for borrowers facing financial hardship.

Resources for Borrowers Facing Financial Hardship

Several resources are available to assist borrowers facing financial difficulties. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services, helping borrowers create a budget and negotiate with creditors. Your loan servicer can also provide information on repayment assistance programs and hardship options. Additionally, the U.S. Department of Education’s website offers a wealth of information on student loan repayment and available assistance programs. Contacting these organizations can provide valuable support and guidance during challenging financial times.

The Impact of Direct PLUS Loans on Borrowers

Direct PLUS loans can significantly impact a borrower’s financial future, both positively and negatively. Understanding these implications is crucial before taking on this type of debt to finance education. Careful consideration of the long-term costs and potential effects on creditworthiness is essential for responsible borrowing.

Long-Term Financial Implications of Direct PLUS Loans

Borrowing through the Direct PLUS loan program involves taking on significant debt that extends beyond the immediate educational period. Repayment schedules can span many years, potentially impacting future financial goals like homeownership, investing, or starting a family. The longer the repayment period, the more interest accrues, increasing the overall cost of the loan. For example, a $20,000 PLUS loan at a 7.5% interest rate over 10 years will result in significantly higher total payments compared to a 5-year repayment plan. The added financial burden can restrict opportunities and necessitate careful budgeting and financial planning throughout the repayment period. It is important to realistically assess one’s future earning potential to ensure manageable monthly payments.

Benefits and Drawbacks of Using Direct PLUS Loans

Direct PLUS loans offer the advantage of potentially covering the full cost of education, allowing students to pursue higher education without relying solely on other funding sources. However, this convenience comes with the considerable drawback of accumulating substantial debt, which can strain finances for years to come. The high interest rates compared to other loan options can lead to a larger total repayment amount. Careful consideration of alternative funding sources, such as scholarships, grants, and other loan types with lower interest rates, should be undertaken before relying solely on PLUS loans. A balanced approach, combining various funding methods, can help mitigate the risk of overwhelming debt.

Effects of Direct PLUS Loan Debt on Credit Scores

Direct PLUS loan debt can impact credit scores in several ways. Missed or late payments significantly lower credit scores, making it harder to secure future loans or credit at favorable rates. On the other hand, consistent and timely payments demonstrate responsible credit management, potentially improving credit scores over time. Therefore, meticulous repayment planning and adherence to the repayment schedule are crucial for maintaining a healthy credit profile. Defaulting on a PLUS loan can have severe consequences, including damage to credit history and potential wage garnishment.

Calculating the Total Cost of a Direct PLUS Loan

Calculating the total cost of a Direct PLUS loan requires understanding the loan amount, interest rate, and repayment period. The total cost includes the principal (the original loan amount) and the accumulated interest over the repayment term. The following table illustrates a sample calculation:

| Year | Beginning Balance | Principal Paid | Interest Paid | Ending Balance |

|---|---|---|---|---|

| 1 | $10,000 | $800 | $750 | $9,950 |

| 2 | $9,950 | $850 | $700 | $9,800 |

| 3 | $9,800 | $900 | $650 | $9,550 |

| 4 | $9,550 | $950 | $600 | $9,200 |

Note: This is a simplified example and does not account for potential changes in interest rates or variations in repayment schedules. Accurate calculations should be performed using official loan amortization calculators provided by your lender.

Alternatives to Direct PLUS Loans

Securing funding for graduate education can often feel overwhelming, but Direct PLUS loans aren’t the only avenue. Exploring alternative financing options can lead to a more manageable debt burden and potentially better terms. This section examines viable alternatives, comparing their advantages and disadvantages against Direct PLUS loans and highlighting strategies to minimize loan dependence.

Direct PLUS loans, while accessible, come with their own set of drawbacks. High interest rates and the potential for significant long-term debt are major considerations. Therefore, exploring alternatives, such as private loans, scholarships, grants, and institutional aid, is crucial for a comprehensive financial plan.

Private Student Loans

Private student loans offer an alternative funding source for graduate studies. However, they differ significantly from federal Direct PLUS loans in terms of interest rates, repayment options, and eligibility requirements. Unlike Direct PLUS loans, private loans are offered by banks and other financial institutions, often with variable interest rates that can fluctuate based on market conditions. Eligibility depends on creditworthiness, which may be a barrier for some students.

A comparison reveals that Direct PLUS loans generally offer more favorable repayment options, including income-driven repayment plans, deferment, and forbearance, which are less commonly available with private loans. While private loans may offer higher loan amounts, the higher interest rates can quickly increase the total cost of borrowing. Therefore, careful consideration of interest rates, fees, and repayment terms is crucial before opting for a private loan. For example, a student might find a private loan offering a lower initial interest rate, but the lack of flexible repayment options could lead to significantly higher overall repayment costs compared to a Direct PLUS loan with a slightly higher initial rate and flexible repayment plan.

Scholarships and Grants

Scholarships and grants represent a significant opportunity to reduce or eliminate the need for loans. These funds typically don’t require repayment and can significantly alleviate the financial burden of graduate school. Many organizations, including professional associations, foundations, and individual universities, offer scholarships and grants based on merit, academic achievement, or financial need.

Finding these opportunities requires proactive research. Online databases like Fastweb and Scholarships.com are valuable resources. Additionally, networking with faculty members and career services offices at your institution can provide valuable leads on lesser-known scholarships and grants specific to your field of study. For example, the National Science Foundation offers grants for graduate students pursuing research in science and engineering, while the American Association of University Women provides scholarships for women pursuing higher education.

Institutional Financial Aid

Universities and colleges often provide their own financial aid packages to graduate students, including scholarships, grants, and assistantships. These funds can supplement or replace the need for loans. Applying for institutional aid is often part of the overall financial aid application process, but it’s important to inquire directly with the financial aid office at your institution to explore all available options.

Graduate assistantships, for instance, offer students the opportunity to work part-time in exchange for tuition remission and a stipend. These positions can significantly reduce the cost of education while providing valuable professional experience. The availability of institutional aid varies widely depending on the institution and the specific program, but exploring these options should be a high priority in the financial planning process. For example, a student accepted into a highly competitive program at a prestigious university may be offered a full tuition scholarship and a generous stipend, eliminating the need for any loans.

Understanding the Loan Application Process

Applying for a Direct PLUS loan involves several key steps, from initial application to loan disbursement. A thorough understanding of this process will help ensure a smooth and successful application. This section details the necessary steps, required documentation, credit check procedures, and helpful tips to maximize your chances of approval.

The Direct PLUS Loan Application Process

The application process for a Direct PLUS loan can be visualized using a flowchart. Imagine a flowchart with the following steps:

1. Complete the PLUS Loan Application: This involves filling out the online application form through the National Student Loan Data System (NSLDS) website. This step requires providing accurate personal and financial information.

2. Credit Check: The Department of Education will conduct a credit check to assess the applicant’s creditworthiness. This is a crucial step in determining eligibility.

3. Notification of Approval or Denial: The applicant will receive notification of their application status – approved, denied, or requiring additional documentation.

4. Acceptance of Loan Terms: If approved, the applicant must review and accept the loan terms, including the interest rate and repayment schedule.

5. Loan Disbursement: Once the terms are accepted, the loan funds are disbursed to the educational institution.

Required Documentation for Direct PLUS Loan Applications

Applicants should gather necessary documentation before beginning the application process to streamline the procedure. This reduces delays and ensures a timely application review. This documentation typically includes:

- Social Security Number (SSN): This is essential for verifying identity and accessing credit reports.

- Driver’s License or State-Issued ID: This provides further verification of identity.

- Tax Information (Tax Returns or W-2 Forms): This helps determine the applicant’s financial stability.

- Bank Account Information: This is required for loan disbursement.

- Student’s Information (if applicable): This may include the student’s name and school information.

Credit Checks for Direct PLUS Loan Applications

A credit check is a standard part of the Direct PLUS loan application process. The Department of Education utilizes credit reports to assess the applicant’s credit history and determine their creditworthiness. Adverse credit history, such as bankruptcies or defaults, may impact the approval process or lead to higher interest rates. A credit check is conducted to mitigate the risk to the federal government. It is important to note that the credit check is a factor in the approval decision, but not the sole determinant.

Tips for a Successful Direct PLUS Loan Application

To increase the likelihood of a successful application, applicants should:

- Ensure Accuracy of Information: Double-check all provided information for accuracy to avoid delays or denials.

- Address any Credit Issues Proactively: If there are concerns about credit history, address them before applying. This may involve contacting creditors to resolve outstanding issues.

- Complete the Application Thoroughly: Leaving any fields incomplete can delay processing.

- Maintain a Good Credit Score: A good credit score significantly improves the chances of approval.

- Review Loan Terms Carefully: Understand the interest rate, repayment schedule, and other terms before accepting the loan.

Illustrative Scenarios of Direct PLUS Loan Usage

Direct PLUS loans offer a valuable financial tool for both parents and graduate students navigating the complexities of higher education funding. Understanding how these loans function in different contexts is crucial for responsible borrowing and financial planning. The following scenarios illustrate the practical application of Direct PLUS loans and their potential impact.

Parent Utilizing a Direct PLUS Loan

Maria and David are the parents of Sarah, a bright and ambitious student accepted into a prestigious private university. Their combined annual income is $75,000, but the university’s tuition, fees, and room and board total $60,000 per year. After exhausting savings and scholarships, they still face a significant funding gap. To bridge this gap, they decide to take out a Direct PLUS loan. The loan covers the remaining cost of Sarah’s first year of tuition. While the loan adds to their existing debt, they believe the investment in Sarah’s education is worthwhile, anticipating a higher earning potential for her in the future. The manageable monthly payments, combined with their responsible budgeting, allow them to handle the additional financial burden. This scenario highlights how Direct PLUS loans can provide critical financial support for parents committed to their children’s education, even when faced with considerable expenses.

Graduate Student Using a Direct PLUS Loan

Rajesh, a recent engineering graduate, is pursuing a Master’s degree in Robotics. His goal is to secure a high-paying position in the rapidly growing field of automation. While he received some financial aid, it does not fully cover his tuition and living expenses. He opts for a Direct PLUS loan to cover the remaining costs. He carefully considers the loan’s terms and repayment options, creating a realistic budget that includes loan payments after graduation. Rajesh anticipates that his advanced degree will lead to a significantly higher salary, enabling him to comfortably repay the loan within a reasonable timeframe. This scenario demonstrates how Direct PLUS loans can facilitate access to advanced education and future career opportunities, even with a pre-existing debt burden.

Case Study: Comparing Financial Outcomes

Two graduate students, Anya and Ben, both pursued Master’s degrees in Business Administration. Anya relied solely on savings and scholarships, while Ben utilized Direct PLUS loans to supplement his financial aid. Anya graduated with no debt but also had limited funds for professional development and networking opportunities after graduation. Ben, while graduating with loan debt, used some of his loan funds to attend career fairs and join professional organizations, resulting in a more competitive job search. Within two years of graduation, Anya secured a job with a slightly lower starting salary, while Ben secured a higher-paying position due to his enhanced networking and experience. While Anya’s debt-free status initially seemed advantageous, Ben’s investment in his career through strategic use of the Direct PLUS loan ultimately led to higher long-term earnings and quicker debt repayment. This comparison emphasizes the importance of considering the total cost of education, including the potential impact of loan debt on career trajectory and post-graduation financial planning.

Final Wrap-Up

Securing a higher education often necessitates careful financial planning. Direct PLUS loans represent a significant tool, but their effective utilization hinges on a thorough understanding of their terms and conditions. By carefully weighing the benefits and drawbacks, exploring alternative funding sources, and implementing responsible repayment strategies, borrowers can leverage Direct PLUS loans to achieve their educational goals while mitigating potential long-term financial risks. Remember, informed decision-making is key to successfully navigating the complexities of student loan debt.

FAQ

What happens if I can’t repay my Direct PLUS loan?

Defaulting on your loan can severely damage your credit score, impacting your ability to secure loans, mortgages, or even rent an apartment in the future. The government may also take collection actions, including wage garnishment and tax refund offset.

Can I consolidate my Direct PLUS loan with other federal loans?

Yes, you can consolidate your Direct PLUS loan with other federal student loans through the Direct Consolidation Loan program. This might simplify repayment by combining multiple loans into a single monthly payment.

What is the difference between a Direct PLUS loan and a private student loan?

Direct PLUS loans are offered by the federal government and typically offer more borrower protections, such as income-driven repayment plans and deferment options. Private loans are offered by banks and other lenders and often have higher interest rates and less flexible repayment options.

Are there any penalties for early repayment of a Direct PLUS loan?

No, there are generally no penalties for making early payments on your Direct PLUS loan. In fact, doing so can save you money on interest in the long run.