Navigating the complexities of student loan financing can feel overwhelming, especially when understanding the nuances of direct student loan rates. This guide aims to demystify the process, providing clear explanations of interest rates, repayment options, and the application process. We’ll explore the differences between subsidized and unsubsidized loans, examine various repayment plans, and offer practical strategies for managing your student loan debt effectively.

From understanding the factors influencing interest rate calculations to comparing direct loans with private alternatives, we’ll equip you with the knowledge to make informed decisions about your financial future. This guide is designed to be both informative and accessible, providing a clear path to understanding and managing your student loan journey.

Understanding Direct Student Loan Rates

Navigating the world of student loans can be complex, but understanding the interest rates associated with Direct Student Loans is crucial for responsible financial planning. This section will clarify the nuances of these rates, helping you make informed decisions about your educational funding.

Subsidized and Unsubsidized Direct Student Loans

The key difference between subsidized and unsubsidized loans lies in whether the government pays the interest while you’re in school. Subsidized loans are need-based and the federal government covers the interest during periods of deferment (while you are enrolled at least half-time or during grace periods). Unsubsidized loans, on the other hand, accrue interest from the time the loan is disbursed, regardless of your enrollment status. This means you’ll owe more at the end of your loan term with an unsubsidized loan if you don’t make interest payments while in school.

Factors Influencing Direct Student Loan Interest Rates

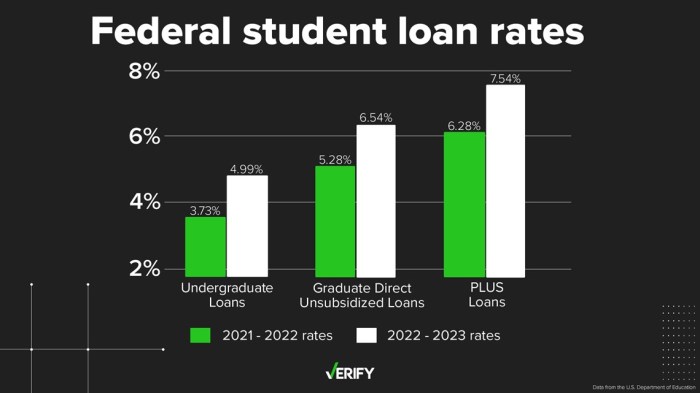

Several factors determine the interest rate you’ll receive on a Direct Student Loan. The most significant is the loan’s disbursement date. The interest rate is fixed for the life of the loan, determined by the federal government at the time you receive the loan. Your loan type (undergraduate, graduate, or professional) also plays a role, with graduate loans typically having higher rates. Finally, while your credit history isn’t directly considered, your financial need may influence eligibility for subsidized loans, which tend to have lower rates.

Historical Overview of Direct Student Loan Interest Rates

Direct student loan interest rates have fluctuated over time, generally reflecting broader economic conditions. For example, rates were significantly lower in the early 2000s than they were in the late 2010s and early 2020s. These changes reflect the government’s borrowing costs and overall economic policies. It’s important to note that while historical trends can offer some insight, they don’t predict future rates. Checking the current rates on the official Federal Student Aid website is crucial for the most up-to-date information.

Undergraduate and Graduate Loan Interest Rate Comparison

The following table compares typical interest rates for undergraduate and graduate Direct Student Loans. Remember that these are examples and actual rates can vary depending on the loan disbursement date.

| Loan Type | Interest Rate (Example) | Repayment Period (Example) | Notes |

|---|---|---|---|

| Undergraduate Subsidized | 4.5% | 10 years | Interest does not accrue while in school (at least half-time enrollment). |

| Undergraduate Unsubsidized | 5.0% | 10 years | Interest accrues from disbursement. |

| Graduate Unsubsidized | 6.5% | 10-25 years | Higher rate than undergraduate loans. |

| Graduate PLUS | 7.5% | 10-25 years | Higher rate; credit check required. |

Loan Repayment Plans

Choosing the right repayment plan for your federal student loans is crucial for managing your debt effectively and avoiding delinquency. The plan you select will significantly impact your monthly payments and the total amount you ultimately repay. Several options are available, each with its own advantages and disadvantages. Understanding these differences is key to making an informed decision.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loan borrowers. It involves fixed monthly payments over a 10-year period. This plan offers predictable payments, allowing for budgeting certainty. However, the fixed monthly payments can be relatively high, potentially straining borrowers’ budgets, especially in the early years of their careers. The total interest paid over the life of the loan is also generally higher compared to income-driven repayment plans.

Graduated Repayment Plan

The Graduated Repayment Plan offers lower payments in the early years, gradually increasing over time. This can be beneficial for borrowers anticipating increased income in the future. However, the initially low payments can lull borrowers into a false sense of security, and the escalating payments can become challenging to manage later. Furthermore, like the Standard plan, the total interest paid is generally higher than income-driven plans.

Extended Repayment Plan

This plan stretches payments over a longer period, typically up to 25 years, leading to lower monthly payments. It’s suitable for borrowers with significant loan balances who need lower monthly payments to manage their finances. However, the extended repayment period results in significantly higher total interest paid over the loan’s life. This plan should be carefully considered, as the long repayment timeline could lead to paying considerably more than the original loan amount.

Income-Driven Repayment Plans

Income-driven repayment plans link your monthly payment amount to your income and family size. This offers flexibility and affordability, especially for borrowers with lower incomes. There are several types, each with its own specifics: Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR).

Comparison of Income-Driven Repayment Plans

- Income-Based Repayment (IBR): Payments are calculated based on your discretionary income and loan amount. There are two versions of IBR: one for loans originated before July 1, 2014, and one for loans originated after that date. The calculation method differs slightly between these two versions.

- Pay As You Earn (PAYE): Payments are capped at 10% of your discretionary income. This plan is generally more generous than IBR for many borrowers.

- Revised Pay As You Earn (REPAYE): This plan is similar to PAYE but includes both subsidized and unsubsidized loans in the calculation. It also offers a potential for loan forgiveness after 20 or 25 years of payments.

- Income-Contingent Repayment (ICR): Payments are based on your income and family size, and the repayment period can be up to 25 years. This plan may result in higher monthly payments compared to PAYE or REPAYE.

Choosing among these plans often depends on individual circumstances and the specific features of each plan. Factors such as income, family size, and loan amount all play a significant role in determining which plan offers the most suitable balance of affordability and long-term repayment cost. It’s recommended to use the federal student aid website’s repayment estimator to compare the options.

The Application Process

Securing federal student loans involves a straightforward process, but careful attention to detail is crucial for a smooth application and disbursement. Understanding the steps involved, from completing the FAFSA to receiving your loan funds, will significantly reduce stress and ensure you receive the financial aid you need.

The application process for Direct Student Loans primarily revolves around completing the Free Application for Federal Student Aid (FAFSA). This form collects essential information about your financial situation and educational goals, enabling the government to determine your eligibility for federal student aid, including Direct Loans. The information you provide is used to calculate your Expected Family Contribution (EFC), a key factor in determining your financial need and the amount of aid you may receive.

Completing the FAFSA

Accurate and efficient completion of the FAFSA is paramount. Gather all necessary tax information, including your and your parents’ (if applicable) federal income tax returns, W-2s, and other relevant financial documents. Double-check all entries for accuracy, as errors can delay processing. Utilize the FAFSA website’s help resources and consider seeking assistance from your school’s financial aid office if needed. Remember to electronically sign the FAFSA to submit it. The IRS Data Retrieval Tool can help pre-populate your tax information, saving time and reducing errors. Submitting the FAFSA early is advisable, as processing times can vary.

The Loan Application and Award Process

After your FAFSA is processed, your school will notify you of your eligibility for federal student aid. If you are eligible for Direct Loans, you will need to complete a loan application through your school’s financial aid portal. This usually involves accepting or declining your offered loan amount. Be sure to carefully review the loan terms, including the interest rate, repayment options, and total loan amount before accepting. Once you’ve accepted your loan, your school will certify your enrollment and forward the information to the Department of Education.

Loan Disbursement

Once your loan is approved and your school has certified your enrollment, the loan funds will be disbursed. The disbursement schedule varies by school and the type of loan, but it usually occurs in installments. For example, a student might receive half of their loan at the beginning of the fall semester and the other half at the beginning of the spring semester. The funds are typically credited to your student account to cover tuition, fees, and other educational expenses. Any remaining funds may be disbursed to you directly, often via check or direct deposit. It’s important to monitor your student account regularly to track the disbursement process. Contact your school’s financial aid office if you have any questions or concerns.

Managing Student Loan Debt

Successfully navigating student loan repayment requires proactive planning and a clear understanding of your options. Failing to manage your loans effectively can lead to significant financial hardship, impacting your credit score and future financial opportunities. This section Artikels strategies for effective budgeting, the consequences of default, available resources, and methods for calculating your monthly payments.

Budgeting and Managing Student Loan Payments

Creating a realistic budget is crucial for successful student loan repayment. This involves tracking your income and expenses to identify areas where you can reduce spending and allocate funds towards your loan payments. Consider using budgeting apps or spreadsheets to monitor your financial health. Prioritize essential expenses (housing, food, transportation) and then allocate as much as possible towards your student loans. Explore different repayment plans (discussed earlier) to find one that fits your current financial situation. Automate your payments to avoid late fees and ensure consistent repayment. Regularly review your budget and adjust as needed to maintain a balance between your financial needs and loan repayment.

Consequences of Defaulting on Student Loans

Defaulting on your student loans has severe consequences. This occurs when you fail to make payments for a specified period (typically 9 months). The immediate consequences include damage to your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Your wages may be garnished, and the government may seize a portion of your tax refund. Furthermore, you may face lawsuits and collection actions, adding additional fees and legal costs to your debt. The long-term implications can significantly hinder your financial stability and limit your opportunities. For example, a defaulted loan could prevent you from buying a house or obtaining a car loan for many years.

Resources for Borrowers Struggling with Repayment

Several resources are available to assist borrowers facing repayment difficulties. The Federal Student Aid website (studentaid.gov) provides comprehensive information on repayment plans, deferment, and forbearance options. You can explore income-driven repayment plans that adjust your monthly payments based on your income and family size. Contacting your loan servicer directly is crucial; they can explain your options and potentially help you create a manageable repayment plan. Nonprofit credit counseling agencies can also offer guidance and support in developing a budget and negotiating with your lenders. These agencies often provide free or low-cost services to help you manage your debt effectively.

Calculating Monthly Loan Payments

Several methods exist for calculating monthly loan payments. The most common method utilizes a formula that incorporates the loan principal, interest rate, and loan term. While complex calculators are readily available online, understanding the basic principles is beneficial. A simplified formula (ignoring compounding for simplicity) is:

Monthly Payment ≈ (Principal + (Principal * Interest Rate * Loan Term))/Loan Term in Months

For example, a $10,000 loan at a 5% annual interest rate over 10 years (120 months) would yield an approximate monthly payment of:

Monthly Payment ≈ ($10,000 + ($10,000 * 0.05 * 10))/120 ≈ $104.17

Note: This is a simplified calculation and doesn’t account for compounding interest, which will result in a slightly higher actual monthly payment. More accurate calculations are available through online loan calculators that factor in compounding interest and other fees. It is crucial to use an accurate calculator provided by your lender or a reputable financial website to get a precise estimate of your monthly payment.

Interest Rate Changes and Their Impact

Understanding how interest rates fluctuate is crucial for managing student loan debt effectively. Changes in interest rates directly impact the total amount borrowers repay over the life of their loan, affecting their monthly payments and overall financial health. This section will explore the relationship between interest rate changes and student loan repayment, the government’s role in setting these rates, and provide historical examples to illustrate their impact.

Interest rate changes affect student loan borrowers by altering the amount of interest accrued on their outstanding loan balance. A higher interest rate means more interest is added to the principal balance each month, leading to larger monthly payments and a greater total repayment amount over the life of the loan. Conversely, lower interest rates result in smaller monthly payments and less overall interest paid. This dynamic significantly impacts borrowers’ long-term financial planning and ability to manage their debt.

The Federal Government’s Role in Setting Interest Rates

The federal government plays a significant role in determining interest rates for federal student loans. While the rates aren’t directly controlled by the government in the same way as the federal funds rate, they are heavily influenced by market conditions and government policy. The interest rate for each loan is typically set annually, based on a formula that often incorporates the 10-year Treasury note yield, plus a fixed margin. This ensures that rates are somewhat reflective of broader economic trends. Changes in government policy, such as adjustments to the fixed margin, can directly impact the final interest rate borrowers face.

Historical Examples of Interest Rate Fluctuations and Their Impact

Historically, interest rates for federal student loans have fluctuated considerably. For instance, rates were significantly lower in the early 2000s compared to the rates seen in the late 2000s and early 2010s. Borrowers who took out loans during periods of lower interest rates benefited from smaller monthly payments and lower overall interest costs. Conversely, those who borrowed during periods of higher rates faced substantially higher monthly payments and significantly increased overall costs. This illustrates how timing can drastically impact the overall financial burden of student loan debt.

Visual Representation of Interest Rates and Loan Repayment

Imagine a graph with two lines. The horizontal axis represents the loan repayment period (in years), and the vertical axis represents the cumulative amount repaid (including principal and interest). One line represents a loan with a lower interest rate; it shows a gentler upward slope, indicating slower growth in the cumulative amount repaid. The other line, representing a higher interest rate, displays a steeper upward slope, clearly showing a much faster accumulation of total repayment costs. The difference between the two lines visually represents the substantial impact that even small changes in interest rates can have on the total cost of a student loan over its lifetime. The area between the two lines visually represents the additional cost incurred due to the higher interest rate.

Comparison with Private Student Loans

Choosing between federal direct student loans and private student loans is a crucial decision impacting your financial future. Understanding the key differences in terms of interest rates, repayment options, and eligibility criteria is essential for making an informed choice that aligns with your individual circumstances. This comparison will highlight the advantages and disadvantages of each loan type to aid in your decision-making process.

Both direct student loans and private student loans offer funding for higher education, but they differ significantly in their structure and terms. Direct student loans are offered by the federal government, while private student loans are provided by banks, credit unions, and other private lenders. These differences translate into distinct advantages and disadvantages for borrowers.

Interest Rates and Repayment Terms

Interest rates are a major point of divergence. Direct student loans typically offer lower, fixed interest rates, especially for undergraduate students. These rates are set by the government and remain consistent throughout the loan’s life. Private student loans, on the other hand, usually have variable interest rates that fluctuate with market conditions. This variability can lead to unpredictable monthly payments and potentially higher overall costs. Repayment terms also vary. Direct loans often provide a range of repayment plans, including income-driven repayment options that adjust payments based on your income and family size. Private loan repayment plans are generally less flexible, often requiring a fixed monthly payment over a shorter period.

Eligibility Requirements

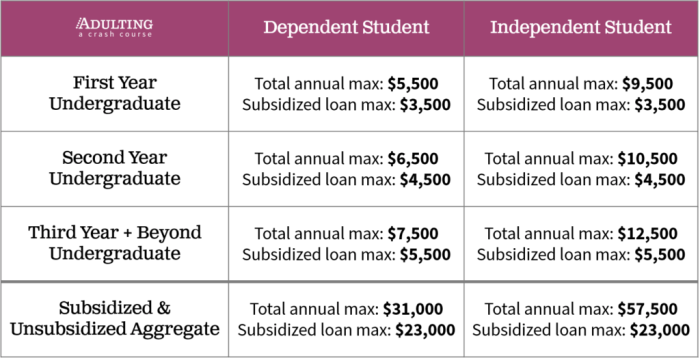

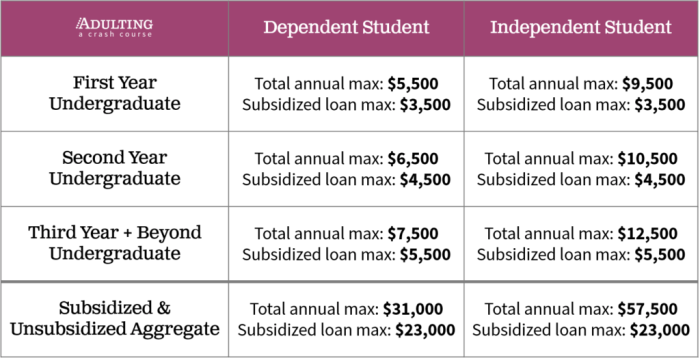

Eligibility for direct student loans is primarily based on enrollment status in an eligible educational program. Credit history is not a factor in determining eligibility. Private student loans, conversely, typically require a credit check and often favor borrowers with strong credit scores and co-signers. This makes securing private loans challenging for students with limited or no credit history. The amount you can borrow is also different; federal loans have borrowing limits based on factors such as your year in school and dependency status. Private loans are subject to the lender’s assessment of your creditworthiness and ability to repay.

Advantages and Disadvantages

The decision of which loan type to choose depends on your individual financial situation and risk tolerance. Weighing the advantages and disadvantages of each option is crucial.

| Feature | Direct Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower, fixed rates | Often higher, variable rates |

| Repayment Plans | More flexible options, including income-driven repayment | Less flexible, typically fixed payment amounts |

| Eligibility | Based on enrollment; no credit check required | Credit check required; credit history and co-signer may be necessary |

| Borrowing Limits | Set by the government | Determined by lender’s assessment of creditworthiness |

| Default Protections | Government protections, such as deferment and forbearance options | Fewer default protections; consequences can be severe |

| Advantages | Lower interest rates, flexible repayment, government protections | Potentially higher loan amounts, potentially faster repayment |

| Disadvantages | Lower borrowing limits | Higher interest rates, less flexible repayment, credit check required |

Summary

Successfully managing student loan debt requires a proactive approach and a thorough understanding of the available resources. By carefully considering your repayment options, budgeting effectively, and seeking assistance when needed, you can navigate the complexities of loan repayment and achieve long-term financial stability. Remember, knowledge is power, and this guide provides the tools you need to confidently manage your student loan debt and plan for a secure financial future.

FAQ Section

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and during certain deferment periods. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my direct student loans?

Yes, you can refinance your federal student loans with a private lender. However, this may mean losing federal protections and benefits.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially default on your loan, resulting in serious consequences like wage garnishment.

Where can I find more information about my loan servicer?

Your loan servicer’s contact information is typically available on your student loan account statements or the National Student Loan Data System (NSLDS) website.