Navigating the world of student loans can feel overwhelming, but understanding your options is key to financial success. This guide delves into Discover Student Loans, providing a detailed look at their various products, application processes, repayment strategies, and overall benefits and drawbacks. We aim to equip you with the knowledge needed to make informed decisions about your student loan journey.

From exploring different loan types and eligibility requirements to mastering repayment plans and budgeting effectively, we cover all the essential aspects of managing Discover student loans. We’ll also compare Discover’s offerings to those of other major lenders, helping you identify the best fit for your individual circumstances. This comprehensive guide aims to demystify the process and empower you to take control of your student loan debt.

Application and Approval Process

Applying for a Discover student loan is a straightforward process designed to be accessible to students and their families. The application itself is completed online, requiring you to provide accurate and complete information to ensure a smooth and timely approval. The entire process, from initial application to loan disbursement, is typically managed through the Discover Student Loans website and may involve interaction with a Discover representative if needed.

The application process involves several key steps and requires specific documentation to verify your eligibility and financial information. Failing to provide the necessary documents can delay the approval process. Therefore, it is crucial to gather all required documents before beginning the application. The time it takes to process your application will vary depending on several factors, including the completeness of your application and the verification of your provided information.

Required Documentation for Loan Application

To ensure a prompt application review, prospective borrowers should gather the following documents before starting the application: A valid Social Security number, your federal tax return (or your parent’s if you are a dependent student), proof of enrollment at your chosen educational institution, and your current bank account information. Additional documents might be requested depending on your individual circumstances. For instance, if you are a dependent student, your parents’ financial information may be required. If you have co-signers, you will need their financial information as well. Failure to provide complete documentation will likely result in delays.

Steps in the Discover Student Loan Application Process

The application process is designed to be user-friendly. Following these steps will help ensure a smooth and efficient experience.

- Create an Account: Begin by creating an online account on the Discover Student Loans website. This will allow you to track your application’s progress and access your loan details.

- Complete the Application: Carefully fill out the online application form, providing accurate information about yourself, your education, and your financial situation. Double-check all entries for accuracy before submitting.

- Upload Required Documents: Upload all the necessary supporting documents, such as tax returns, proof of enrollment, and bank statements. Ensure all documents are clear and legible.

- Review and Submit: Before submitting your application, thoroughly review all the information provided to ensure its accuracy. Once you are satisfied, submit your application.

- Await Processing and Approval: After submitting your application, Discover will review your information. The processing time varies, but you can typically expect an update within a few weeks. You will receive notifications via email and/or your online account.

- Loan Disbursement: Upon approval, your loan funds will be disbursed directly to your educational institution according to their schedule. You will receive notification when the funds have been released.

Typical Processing Time for Loan Applications

While Discover aims for efficient processing, the timeframe for loan application approval can vary. Several factors influence processing time, including the completeness of the application, the verification of provided information, and the overall volume of applications. Generally, applicants can expect a decision within several weeks, though some applications may take longer depending on individual circumstances. For example, an application submitted during peak periods, such as the beginning of a semester, may experience a slight delay compared to one submitted during a less busy time. Prospective borrowers should be prepared for a processing time that could range from a few weeks to a couple of months.

Repayment Options and Strategies

Understanding your repayment options is crucial for effectively managing your Discover student loan. Choosing the right plan can significantly impact your monthly payments and the total interest you pay over the life of the loan. Discover offers several repayment plans designed to cater to different financial situations and goals. Let’s explore these options and how to select the best fit for you.

Discover Student Loan Repayment Plans

Discover typically offers a range of standard repayment plans, including a graduated repayment plan, an extended repayment plan, and potentially an income-driven repayment plan (IDR). The specifics of these plans, including interest rates and available options, are subject to change and should be verified directly with Discover. It’s important to carefully review your loan agreement for the most up-to-date information.

Repayment Scenario Examples

Let’s consider hypothetical scenarios to illustrate the impact of different repayment plans. Assume a $30,000 loan with a 6% fixed interest rate.

| Repayment Plan | Monthly Payment (Estimate) | Loan Term (Years) | Total Interest Paid (Estimate) |

|---|---|---|---|

| Standard Repayment (10-year) | $330 | 10 | $9,800 |

| Graduated Repayment (10-year) | Starts lower, increases over time | 10 | $9,800 (approximately, total interest will vary slightly) |

| Extended Repayment (20-year) | $180 | 20 | $21,600 (approximately, total interest will be significantly higher) |

*Note: These are simplified examples. Actual payments and interest amounts will vary based on the specific loan terms and individual circumstances. Contact Discover for precise calculations.*

Choosing the Right Repayment Plan: A Flowchart

This flowchart provides a visual guide to help you determine the most suitable repayment plan.

[Imagine a flowchart here. The flowchart would start with a question like “What is your current financial situation?” with branches leading to different options based on income, expenses, and debt. Each branch would eventually lead to a recommended repayment plan (Standard, Graduated, Extended, etc.). The flowchart would visually represent the decision-making process based on individual circumstances.]

Pros and Cons of Repayment Options

| Repayment Plan | Pros | Cons | Best For |

|---|---|---|---|

| Standard Repayment | Lower total interest paid, shorter loan term | Higher monthly payments | Borrowers with higher incomes and comfortable monthly budgets |

| Graduated Repayment | Lower initial payments, manageable early on | Payments increase over time, potentially becoming difficult later | Borrowers expecting income growth |

| Extended Repayment | Lower monthly payments | Higher total interest paid, longer loan term | Borrowers with limited current income |

Managing and Monitoring Discover Student Loans

Effectively managing your Discover student loans is crucial for maintaining a good credit score and avoiding financial difficulties. This involves understanding your payment options, regularly monitoring your account, and developing a budget that incorporates your loan payments. Let’s explore the key aspects of managing your Discover student loans.

Making Loan Payments

Discover offers several convenient methods for making your student loan payments. You can easily make payments online through your Discover student loan account, a process that typically involves logging in, selecting the payment option, and providing your banking information. Alternatively, you can mail a check or money order to the address provided on your monthly statement. For those who prefer automated payments, Discover also allows you to set up automatic payments from your checking or savings account, ensuring timely payments without manual intervention. This automated payment option provides the added benefit of avoiding late fees.

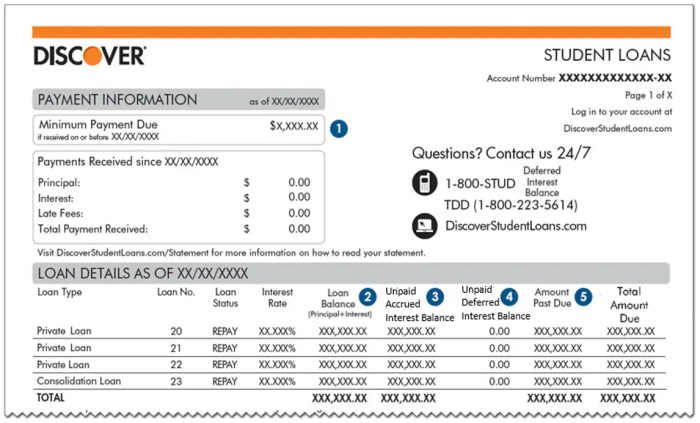

Accessing and Interpreting Online Account Statements

Your Discover student loan online account provides a comprehensive overview of your loan details. By logging in, you can access your account statement, which will clearly display your current loan balance, payment history, minimum payment due, and the due date. The statement will also show any interest accrued, fees applied, and the loan’s amortization schedule, which details how your payments are allocated toward principal and interest over the loan’s lifespan. Understanding this information allows for proactive loan management. Familiarizing yourself with the statement’s layout and terminology will empower you to track your progress and make informed decisions regarding your repayment strategy.

Strategies for Staying on Track with Loan Payments and Avoiding Delinquency

Staying on track with your student loan payments requires planning and discipline. One effective strategy is to set up automatic payments to ensure timely payments and avoid late fees. Another crucial step is to budget your loan payments carefully, incorporating them into your monthly expenses. Consider creating a reminder system, such as calendar alerts or using budgeting apps, to keep you informed of upcoming payment deadlines. If you anticipate difficulty making a payment, contacting Discover proactively to discuss possible options, such as deferment or forbearance, is advisable before falling behind. Open communication with your lender can often prevent delinquency and its associated negative consequences.

Sample Monthly Budget Incorporating Student Loan Payments

Creating a realistic monthly budget is essential for successfully managing your student loan payments. This budget should account for all your income and expenses, ensuring that your loan payments are prioritized. Here’s a sample budget:

- Income: $3,000 (This will vary depending on your income)

- Expenses:

- Housing: $1,000 (Rent or mortgage)

- Student Loan Payment: $300

- Transportation: $300 (Car payment, gas, public transportation)

- Groceries: $200

- Utilities: $150 (Electricity, water, internet)

- Insurance: $100 (Health, car, renters)

- Savings: $200 (Emergency fund, investments)

- Other Expenses: $150 (Entertainment, dining out, personal care)

Note: This is a sample budget, and your actual expenses may differ. Adjust the categories and amounts to reflect your individual circumstances.

Discover Student Loan Benefits and Drawbacks

Choosing a student loan provider requires careful consideration of both advantages and disadvantages. Discover Student Loans, while a popular option, presents a unique set of benefits and drawbacks that prospective borrowers should weigh against their individual financial circumstances and needs. This section will Artikel these key aspects to aid in your decision-making process.

Discover Student Loans offer several attractive features, but it’s crucial to understand their limitations to make an informed choice.

Discover Student Loan Advantages

Discover student loans are known for their competitive interest rates and flexible repayment options. Many borrowers appreciate the straightforward application process and the availability of online tools for managing their loans. The Discover student loan program also frequently offers features such as cash back rewards programs, which can provide financial incentives during repayment. This can significantly offset the overall cost of borrowing, making them a potentially attractive option for financially savvy students. These advantages contribute to a positive borrowing experience for many students.

Discover Student Loan Disadvantages

While Discover offers competitive rates, they might not always be the absolute lowest available. Furthermore, the availability of certain features, such as cash back rewards, may be subject to change based on promotional periods. The specific terms and conditions of the loan, including interest rates and fees, can vary depending on factors like creditworthiness and the type of loan. Borrowers should carefully review the loan agreement before signing to fully understand their financial obligations. Additionally, Discover may not offer the same breadth of loan options as some larger competitors.

Discover Customer Service Compared to Competitors

Discover’s customer service is generally well-regarded, with many borrowers praising the accessibility of their customer support channels, including phone, email, and online chat. However, customer service experiences can be subjective and vary. Compared to competitors such as Sallie Mae or Nelnet, Discover’s customer service is considered comparable in terms of responsiveness and helpfulness, though individual experiences will naturally differ. It’s essential to research reviews from various sources to gain a comprehensive understanding of customer service across different lenders.

Impact of Interest Rates on Total Repayment Cost

The interest rate significantly influences the total cost of a student loan. A higher interest rate leads to a larger overall repayment amount. Let’s illustrate this with hypothetical scenarios:

Understanding the impact of interest rates is critical for planning responsible repayment.

- Scenario 1: A $20,000 loan at 5% interest over 10 years results in a total repayment cost of approximately $25,000 (including principal and interest).

- Scenario 2: The same $20,000 loan at 7% interest over 10 years results in a total repayment cost of approximately $27,000.

- Scenario 3: A $30,000 loan at 6% interest over 15 years results in a total repayment cost of approximately $45,000. This longer repayment term increases the total cost despite a lower interest rate compared to Scenario 2.

Note: These are simplified examples and do not account for potential fees or changes in interest rates. Actual repayment costs may vary. Using a student loan repayment calculator can provide more precise estimates based on individual loan terms.

Illustrative Scenarios of Student Loan Repayment

Understanding how student loan repayment works is crucial for successful financial planning. This section provides visual and textual examples to illustrate typical repayment journeys, showcasing both positive and challenging scenarios. These examples are for illustrative purposes only and individual experiences may vary.

Visual Representation of a Typical Student Loan Repayment Journey

Imagine a line graph. The horizontal (x) axis represents time, measured in years, from loan origination to full repayment. The vertical (y) axis represents the dollar amount, showing both the principal (the original loan amount) and the interest paid cumulatively over time. Initially, a larger portion of each monthly payment goes towards interest, represented by a steeper curve for interest. As the loan term progresses, the proportion shifts, with a greater portion of the payment going towards principal, depicted by a gradually flattening interest curve and a steeper principal repayment curve. The lines would eventually intersect, showing the point where the principal paid surpasses the interest paid. Key data points to include would be the starting loan balance, the monthly payment amount, and the total interest paid over the loan’s lifetime. The graph would clearly label each axis and the lines representing principal and interest payments, showing their gradual convergence toward the point of full repayment.

Successful Student Loan Repayment Scenario

Sarah graduated with $30,000 in student loans and a 6% interest rate. She secured a job offering a comfortable salary and immediately began aggressively paying down her loans. She opted for a standard repayment plan, aiming to make extra payments whenever possible. By prioritizing her loan payments and maintaining a disciplined budget, Sarah consistently paid more than the minimum amount each month. This strategy allowed her to pay off her loans within five years, significantly reducing the total interest paid compared to the standard ten-year repayment plan. Her proactive approach and consistent efforts resulted in significant savings on interest and allowed her to achieve financial freedom sooner.

Challenging Student Loan Repayment Scenario and Strategies for Overcoming Challenges

Mark graduated with $45,000 in student loan debt and a 7% interest rate. He faced unexpected job loss shortly after graduation, leading to significant financial difficulties. He fell behind on his loan payments, resulting in late fees and increased interest accrual. Mark proactively contacted his loan servicer to explore options such as forbearance or deferment, temporarily suspending his payments. During this period, he actively sought employment, attended job training workshops, and built an emergency fund. Once he secured a new position, he worked with his loan servicer to create a manageable repayment plan, possibly opting for an income-driven repayment plan to align his monthly payments with his income. He also began budgeting meticulously, tracking his expenses and identifying areas to reduce spending. By actively managing his situation, seeking support, and developing a realistic financial plan, Mark was able to regain control of his finances and work towards successful loan repayment.

Wrap-Up

Securing a student loan is a significant financial commitment, and choosing the right lender is crucial. This guide has explored the ins and outs of Discover Student Loans, providing a thorough analysis of their features, benefits, and potential drawbacks. By understanding the application process, repayment options, and available resources, you can make informed decisions that align with your financial goals. Remember to carefully compare Discover’s offerings with those of other lenders to find the best fit for your specific needs and circumstances. Effective financial planning and proactive loan management are key to successful repayment.

Top FAQs

What credit score is needed for a Discover student loan?

Discover doesn’t publicly state a minimum credit score requirement, but a good credit history generally improves your chances of approval and securing favorable interest rates.

Can I refinance my existing student loans with Discover?

Discover offers student loan refinancing options, allowing you to potentially lower your interest rate and consolidate multiple loans into a single payment. Eligibility criteria apply.

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score and may lead to late fees and collection actions. Contact Discover immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Does Discover offer any student loan forgiveness programs?

Discover does not offer its own loan forgiveness programs, but borrowers may be eligible for government programs based on their employment or field of study (e.g., Public Service Loan Forgiveness).