Navigating the complexities of student loan repayment can feel overwhelming, especially when dealing with loans backed by FNMA (Fannie Mae). Understanding the various loan types, repayment plans, and the factors influencing your monthly payments is crucial for effective financial planning. This guide provides a comprehensive overview of FNMA student loan calculations, empowering you to make informed decisions about your financial future.

We will explore the different components of FNMA student loans, including interest rates, fees, and repayment options. We’ll delve into the mechanics of calculating monthly payments using standard amortization formulas and demonstrate how different factors, such as interest capitalization and repayment plans, impact your overall loan cost. Through clear explanations and practical examples, this guide aims to demystify the process of calculating your FNMA student loan payments.

Understanding FNMA Student Loan Components

Fannie Mae (FNMA) doesn’t directly originate student loans; instead, it purchases them from lenders, thereby providing a secondary market and influencing the terms available to borrowers. Understanding the components of these loans is crucial for responsible borrowing and repayment. This section details the types of student loans backed by FNMA, their key features, and the calculation of payments.

Types of FNMA-Backed Student Loans

FNMA primarily backs two main types of federal student loans: Direct Subsidized Loans and Direct Unsubsidized Loans. These loans are offered through the federal government’s Direct Loan program. While FNMA doesn’t directly issue them, their involvement in the secondary market significantly impacts the overall availability and terms of these loans. Private student loans, while not directly backed by FNMA, may also be influenced by the secondary market dynamics.

Direct Subsidized Loans

Direct Subsidized Loans are need-based loans offered to undergraduate students demonstrating financial need. A key feature is that the government pays the interest during periods of deferment (postponement of payments) and grace periods (time before repayment begins). Interest rates are set annually by the government and are generally lower than unsubsidized loans. Repayment typically begins six months after graduation or leaving school. Calculation of monthly payments involves factors like loan amount, interest rate, and repayment term. The total payment consists of principal and interest. Fees are typically minimal or nonexistent.

Direct Unsubsidized Loans

Direct Unsubsidized Loans are available to both undergraduate and graduate students, regardless of financial need. Unlike subsidized loans, interest accrues (adds up) from the time the loan is disbursed, even during deferment periods. Borrowers are responsible for paying this accrued interest. Interest rates are typically slightly higher than subsidized loans. Repayment terms are similar to subsidized loans, generally starting six months after graduation or leaving school. The monthly payment calculation includes principal, interest accrued during the loan’s life, and any applicable fees.

Private Student Loans

Private student loans are offered by banks and other financial institutions. While not directly backed by FNMA, they operate within a market influenced by FNMA’s activities. Interest rates, repayment terms, and fees vary widely depending on the lender and the borrower’s creditworthiness. Payment calculation is similar to federal loans, incorporating principal, interest, and fees. However, private loans may have more variable interest rates and potentially higher fees than federal loans.

Comparison of FNMA-Influenced Student Loan Types

| Loan Type | Interest Rate | Repayment Terms | Fees |

|---|---|---|---|

| Direct Subsidized Loan | Government-set, typically lower | Variable, typically 10-20 years | Generally minimal or none |

| Direct Unsubsidized Loan | Government-set, typically slightly higher than subsidized | Variable, typically 10-20 years | Generally minimal or none |

| Private Student Loan | Variable, depends on creditworthiness | Variable, depends on lender | Variable, can be significant |

Calculating Monthly Payments

Understanding how to calculate your monthly student loan payment is crucial for effective financial planning. This section will guide you through the process using the standard amortization formula, demonstrating the impact of interest rates and providing practical examples. Accurate calculation ensures you understand your financial obligations and can budget accordingly.

The standard amortization formula is used to calculate the monthly payment for a fixed-rate loan, like a typical FNMA student loan. This formula takes into account the loan’s principal amount, the interest rate, and the loan term (in months). By understanding this formula, you gain control over your repayment strategy and can accurately project your future financial commitments.

The Amortization Formula

The formula to calculate the monthly payment (M) is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* M = Monthly payment

* P = Principal loan amount (the total amount borrowed)

* i = Monthly interest rate (annual interest rate divided by 12)

* n = Total number of payments (loan term in years multiplied by 12)

Impact of Interest Rates on Monthly Payments

The interest rate significantly impacts your monthly payment. A higher interest rate results in a larger monthly payment for the same loan amount and term. Conversely, a lower interest rate leads to smaller monthly payments. This is because a higher interest rate increases the overall cost of borrowing, requiring larger payments to cover both principal and interest over the loan’s lifespan.

For example, a $20,000 loan at 5% interest over 10 years will have a significantly lower monthly payment than the same loan at 7% interest.

Examples of Monthly Payment Calculations

Let’s illustrate with some examples:

| Loan Amount (P) | Annual Interest Rate | Loan Term (Years) | Monthly Interest Rate (i) | Number of Payments (n) | Calculated Monthly Payment (M) (Approximate) |

|---|---|---|---|---|---|

| $10,000 | 5% | 10 | 0.05/12 = 0.004167 | 120 | $106.07 |

| $20,000 | 7% | 5 | 0.07/12 = 0.005833 | 60 | $391.32 |

| $30,000 | 4% | 15 | 0.04/12 = 0.003333 | 180 | $220.13 |

*Note: These are approximate calculations. Actual payments may vary slightly due to rounding. Using a loan calculator is recommended for precise results.*

Step-by-Step Guide to Calculating Monthly Payments

Follow these steps to calculate your monthly payment:

1. Determine the principal loan amount (P): This is the total amount you borrowed.

2. Find the annual interest rate: This is stated in your loan documents.

3. Calculate the monthly interest rate (i): Divide the annual interest rate by 12.

4. Determine the loan term in years: This is the length of time you have to repay the loan.

5. Calculate the total number of payments (n): Multiply the loan term in years by 12.

6. Apply the amortization formula: Substitute the values of P, i, and n into the formula to calculate M.

Impact of Repayment Plans

Choosing the right repayment plan significantly impacts your monthly budget and the total cost of your FNMA student loan. Understanding the differences between available plans is crucial for effective financial planning. This section compares and contrasts several common repayment options, highlighting their advantages and disadvantages to help you make an informed decision.

The Federal Family Education Loan Program (FFELP), which included loans guaranteed by the FNMA (Federal National Mortgage Association), offered various repayment plans. While FFELP loans are no longer issued, understanding these plans remains relevant because many borrowers still have these loans. These plans provide a framework for understanding options available with other federal student loan programs, which often have similar structures.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It involves fixed monthly payments over a 10-year period. This plan minimizes the total interest paid compared to longer-term options.

- Monthly Payment: A fixed amount calculated based on the loan’s principal and interest rate.

- Loan Term: 10 years (120 months).

- Advantages: Shortest repayment period, lowest total interest paid.

- Disadvantages: Highest monthly payments, potentially challenging for borrowers with limited income.

Graduated Repayment Plan

Under the graduated repayment plan, monthly payments start low and gradually increase over time. This plan is designed to ease the financial burden in the early years of repayment, when income may be lower.

- Monthly Payment: Starts low and increases every two years, typically for 10 years.

- Loan Term: Typically 10 years (120 months).

- Advantages: Lower initial payments, easier to manage early in a career.

- Disadvantages: Higher payments later in the repayment period, higher total interest paid than standard plan.

Extended Repayment Plan

The extended repayment plan provides the longest repayment period, resulting in lower monthly payments but significantly higher total interest paid.

- Monthly Payment: Lower than standard and graduated plans.

- Loan Term: Up to 25 years, depending on the loan amount.

- Advantages: Lowest monthly payments, more manageable for borrowers with low income.

- Disadvantages: Longest repayment period, significantly higher total interest paid.

Income-Driven Repayment Plans (IDR)

While not directly part of the original FFELP program, it’s important to note that Income-Driven Repayment (IDR) plans are available for many federal student loans. These plans base monthly payments on your income and family size. While not specific to FNMA-guaranteed loans, understanding their existence is crucial as they are a common option for many borrowers.

- Monthly Payment: Calculated based on your income and family size; may be $0 in some cases.

- Loan Term: Typically 20-25 years, potentially leading to loan forgiveness after that time (forgiveness rules and eligibility vary depending on the plan).

- Advantages: Affordable monthly payments, potential for loan forgiveness.

- Disadvantages: Very high total interest paid over the life of the loan; potential tax implications on forgiven amounts.

Factors Affecting Loan Calculations

Several factors beyond the principal loan amount and interest rate significantly influence the overall cost and repayment schedule of a FNMA student loan. Understanding these factors is crucial for borrowers to make informed decisions and effectively manage their debt. This section will delve into the impact of loan origination fees, interest capitalization, and deferment or forbearance on your loan.

Loan Origination Fees

Loan origination fees are charges levied by the lender to cover the administrative costs associated with processing your loan application. These fees are typically a percentage of the loan amount and are added to the principal balance before the interest calculations begin. This means the borrower effectively pays interest on the origination fee, increasing the total cost of the loan over its lifetime. For example, a $10,000 loan with a 1% origination fee would result in an additional $100 added to the principal, meaning interest will accrue on $10,100 instead of $10,000. The higher the loan amount and the higher the origination fee percentage, the greater the impact on the overall cost.

Interest Capitalization

Interest capitalization occurs when accrued but unpaid interest is added to the principal loan balance. This typically happens during periods of deferment or forbearance, where payments are temporarily suspended. The capitalized interest then accrues interest itself, leading to a snowball effect that significantly increases the total amount owed and lengthens the repayment period. For instance, if $1,000 in interest capitalizes, that $1,000 becomes part of the principal balance, and future interest calculations will include this additional amount. This can dramatically increase the total interest paid over the life of the loan.

Impact of Deferment or Forbearance

Deferment and forbearance are temporary pauses in loan repayment, often granted due to financial hardship or specific circumstances like returning to school. While they provide short-term relief, they don’t eliminate the debt; instead, interest continues to accrue during these periods. Deferment often means that the government subsidizes the interest, while forbearance typically does not. The crucial difference is that unsubsidized loans accrue interest during deferment and forbearance periods, increasing the total loan amount owed at the end of the deferment or forbearance period. This increase in the loan balance due to accrued interest can substantially extend the repayment period and increase the total interest paid.

Interest Accrual During Deferment

Consider a simplified illustration: A student has a $20,000 unsubsidized loan with a 5% annual interest rate. They enter a 12-month deferment period. During this year, interest accrues on the $20,000 principal. At a 5% annual rate, the interest accrued in one year would be $1,000 ($20,000 x 0.05). At the end of the deferment, this $1,000 is capitalized, meaning it’s added to the principal balance, increasing the loan balance to $21,000. Now, interest will accrue on the higher $21,000 balance for the remainder of the loan term, resulting in a larger total repayment amount compared to a scenario without the deferment period. The longer the deferment period, the greater the impact on the total cost of the loan.

Scenarios and Examples

This section presents three distinct scenarios to illustrate the calculation of monthly payments for FNMA student loans. Each scenario demonstrates the impact of varying loan amounts, interest rates, and repayment plans on the overall cost and monthly payment obligation. Understanding these variations is crucial for effective financial planning.

Scenario 1: Standard Repayment Plan with Moderate Loan Amount

This scenario Artikels a typical student loan repayment situation. We will assume a loan amount of $30,000, a fixed interest rate of 6%, and a standard 10-year repayment plan. The calculation uses a standard amortization formula, widely used for calculating loan payments.

The monthly payment can be calculated using the following formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* M = Monthly Payment

* P = Principal Loan Amount ($30,000)

* i = Monthly Interest Rate (Annual Interest Rate / 12 = 0.06 / 12 = 0.005)

* n = Total Number of Payments (Loan Term in Years * 12 = 10 * 12 = 120)

Substituting the values into the formula:

M = 30000 [ 0.005(1 + 0.005)^120 ] / [ (1 + 0.005)^120 – 1]

Solving this equation yields a monthly payment of approximately $330.60. Over the 10-year period, the total amount repaid would be approximately $39,672, reflecting the accumulated interest.

Scenario 2: Extended Repayment Plan with Higher Loan Amount

This scenario considers a larger loan amount and a longer repayment period, which will impact both the monthly payment and the total interest paid. We’ll assume a loan amount of $60,000, a fixed interest rate of 7%, and a 20-year repayment plan (240 payments).

Using the same formula as above, with the adjusted values:

M = 60000 [ 0.00583(1 + 0.00583)^240 ] / [ (1 + 0.00583)^240 – 1]

(Note: 0.00583 is the monthly interest rate for a 7% annual rate).

The resulting monthly payment is approximately $492.20. The total repayment amount over 20 years would be approximately $118,128, demonstrating the significant impact of a longer repayment period on the overall cost.

Scenario 3: Income-Driven Repayment Plan

Income-driven repayment plans adjust monthly payments based on income and family size. These plans often extend the repayment period, leading to higher overall interest costs but lower monthly payments. Precise calculations for income-driven repayment plans require specific income and family size data and vary depending on the plan type. This scenario provides a conceptual illustration.

Let’s assume a loan amount of $40,000, an interest rate of 5%, and an income-driven repayment plan that results in a monthly payment of $250. The actual repayment term would be significantly longer than a standard plan, potentially exceeding 20 years, leading to substantially higher total interest payments. The exact length of the repayment period and total interest would depend on income fluctuations and the specific rules of the chosen income-driven repayment plan. It’s crucial to consult the loan servicer for accurate calculations.

| Scenario | Loan Amount | Interest Rate | Repayment Plan | Approximate Monthly Payment |

|---|---|---|---|---|

| 1 | $30,000 | 6% | 10-year Standard | $330.60 |

| 2 | $60,000 | 7% | 20-year Standard | $492.20 |

| 3 | $40,000 | 5% | Income-Driven (Illustrative) | $250 (Variable Repayment Term) |

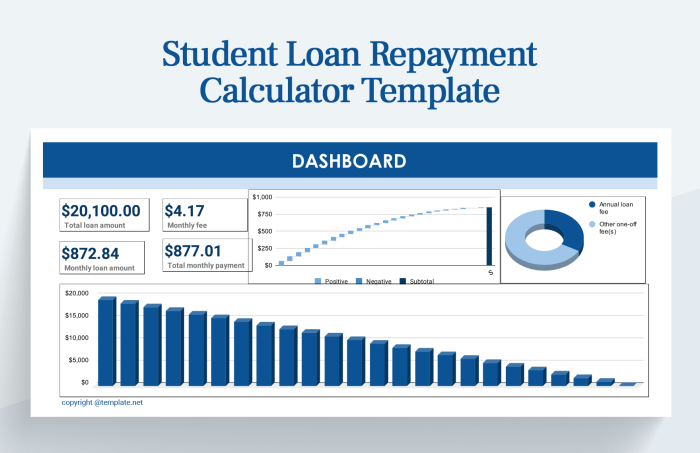

Tools and Resources for Calculation

Accurately calculating your FNMA student loan payments requires careful consideration of various factors. Fortunately, several online tools and resources are available to simplify this process, eliminating the need for manual calculations and reducing the risk of errors. These tools offer varying levels of complexity and features, allowing you to choose the best option based on your individual needs and technical proficiency.

Selecting the right tool depends on your comfort level with financial calculations and the level of detail you require. Simpler calculators offer quick estimates, while more sophisticated software provides in-depth analysis and personalized repayment scenarios. Understanding the pros and cons of each type is crucial for making an informed decision.

Available Online Calculators and Software

Numerous online calculators and software applications can assist with FNMA student loan calculations. These range from simple monthly payment calculators to comprehensive tools that incorporate various repayment plans and scenarios. Some popular choices include dedicated student loan calculators offered by financial websites, spreadsheet software with built-in financial functions, and specialized loan management applications.

- Simple Online Calculators: Many websites offer free, basic calculators that allow you to input loan amount, interest rate, and loan term to estimate monthly payments. These are user-friendly and require minimal input but often lack advanced features like variable interest rate calculations or different repayment plan options. Pros: Easy to use, quick results. Cons: Limited functionality, may not account for all factors.

- Spreadsheet Software (e.g., Microsoft Excel, Google Sheets): Spreadsheet software offers more flexibility. Users can create custom formulas to calculate payments, considering factors like capitalization of interest and different repayment schedules. Pros: Highly customizable, allows for complex scenarios. Cons: Requires some knowledge of spreadsheet formulas, more time-consuming to set up.

- Dedicated Student Loan Management Apps: Several mobile apps and online platforms are specifically designed to help manage student loans. These often include features like payment tracking, amortization schedules, and various repayment plan calculators. Pros: Comprehensive features, user-friendly interface, often include additional tools for loan management. Cons: May require subscription fees, data privacy concerns.

Features of Three Different Tools

To illustrate the range of available tools, let’s examine the features of three distinct examples. Note that specific features and interfaces may vary depending on the version and updates.

- Tool 1: A Basic Online Calculator (Example): This type of calculator typically requires the user to input the principal loan amount, the annual interest rate (expressed as a percentage), and the loan term (in months or years). The output is a simple monthly payment amount. It may also provide a total interest paid over the life of the loan. This tool lacks advanced features such as variable interest rate calculations or different repayment plan options.

- Tool 2: Microsoft Excel with PMT Function: Microsoft Excel’s built-in PMT function allows for more complex calculations. The formula

=PMT(rate, nper, pv, [fv], [type])calculates the payment for a loan based on constant payments and a constant interest rate. ‘rate’ is the interest rate per period, ‘nper’ is the total number of payment periods, ‘pv’ is the present value (loan amount), ‘fv’ is the future value (optional, defaults to 0), and ‘type’ specifies when payments are due (0 for end of period, 1 for beginning). This allows users to model various scenarios by changing input values. For example, you can model the impact of making extra payments or changing the loan term. - Tool 3: A Dedicated Student Loan Management App (Hypothetical Example): Imagine an app that allows users to input multiple loans with varying interest rates and terms. Beyond calculating individual loan payments, it could aggregate all payments into a single monthly amount. Furthermore, it might simulate different repayment plans (e.g., standard, extended, income-driven) and show the total interest paid under each scenario. The app could also offer features such as payment tracking and budgeting tools.

Ending Remarks

Successfully managing your FNMA student loans requires a clear understanding of the calculation process and the various factors that influence your repayment schedule. By utilizing the information and resources presented in this guide, you can confidently navigate the complexities of your student loan debt. Remember to explore the available repayment plans and tools to find the best strategy for your individual circumstances. Proactive financial planning and informed decision-making are key to achieving financial freedom.

FAQ Resource

What happens if I miss a payment on my FNMA student loan?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default. Contact your loan servicer immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I refinance my FNMA student loan?

Yes, refinancing options exist, potentially allowing you to lower your interest rate or consolidate multiple loans. However, carefully compare offers from different lenders to ensure you’re getting the best deal. Refinancing may alter your loan terms and impact your repayment schedule.

How do I find my FNMA student loan servicer?

Your loan servicer information should be available on your loan documents or through the National Student Loan Data System (NSLDS).

What is interest capitalization?

Interest capitalization is the process of adding accrued but unpaid interest to your principal loan balance. This increases the total amount you owe and can significantly impact your long-term repayment costs.