Navigating the complexities of higher education often involves the crucial step of securing student financing. Federal subsidized student loans represent a significant pathway for many students, offering financial assistance to pursue their academic goals. Understanding the intricacies of eligibility, repayment options, and potential forgiveness programs is paramount to making informed decisions about this substantial financial commitment. This guide delves into the key aspects of federal subsidized student loans, providing clarity and empowering students to confidently manage their educational funding.

From understanding eligibility requirements and interest rates to exploring repayment plans and loan forgiveness opportunities, this resource aims to equip you with the knowledge needed to make informed choices about your student loan journey. We’ll also compare subsidized loans to their unsubsidized counterparts, highlighting key differences and their long-term financial implications. By the end, you’ll have a clearer understanding of how these loans work and how to best utilize them to achieve your educational aspirations.

Interest Rates and Repayment Plans

Understanding the interest rates and repayment options for your federal subsidized student loans is crucial for effective financial planning after graduation. This section will detail the current interest rate landscape and explore the various repayment plans available to borrowers, allowing you to make informed decisions about managing your student loan debt.

Current Federal Subsidized Student Loan Interest Rates

Federal subsidized student loan interest rates are not fixed and change periodically. They are determined by the U.S. Department of Education and are usually set annually. To find the most up-to-date information, it is essential to check the official website of the Federal Student Aid (FSA) or contact your loan servicer. The interest rate will depend on the loan type (e.g., undergraduate, graduate) and the year the loan was disbursed. Keep in mind that these rates are subject to change, and any information presented here should be considered a snapshot in time and not a guaranteed future rate. For example, a 2023 undergraduate subsidized loan might have had a rate of X%, while a 2024 graduate subsidized loan might have a different rate of Y%. Always confirm the exact rate applicable to your specific loan.

Factors Influencing Interest Rate Changes

Several factors influence the fluctuation of federal subsidized student loan interest rates. These include prevailing market interest rates, economic conditions, and government policy. When overall interest rates rise in the economy, it typically leads to an increase in student loan interest rates. Conversely, periods of low economic activity may result in lower rates. Government policy also plays a significant role, as the Department of Education can adjust rates based on budgetary considerations and the broader economic climate. These changes are announced publicly and typically take effect for new loans disbursed after a specified date.

Federal Student Loan Repayment Plan Options

Borrowers have several repayment plan options to choose from, each with its own set of features and implications for monthly payments, loan term, and total interest paid. Selecting the right plan is a critical decision that can significantly impact your long-term financial health. The four main categories are Standard, Extended, Graduated, and Income-Driven Repayment (IDR) plans.

Comparison of Federal Student Loan Repayment Plans

The following table compares the key features of different repayment plans. Remember that specific details, such as monthly payment amounts, can vary based on the principal loan balance and interest rate. This table provides a general overview and should not be used for precise calculations; you should use the official FSA repayment calculators for personalized estimates.

| Repayment Plan | Monthly Payment | Loan Term | Total Interest Paid |

|---|---|---|---|

| Standard | Fixed, typically higher | 10 years | Lower than other plans with longer terms |

| Extended | Fixed, lower than Standard | Up to 25 years | Higher than Standard due to longer repayment period |

| Graduated | Starts low, increases over time | 10 years | Potentially higher than Standard due to increasing payments |

| Income-Driven (e.g., ICR, PAYE, REPAYE,IBR) | Based on income and family size | Up to 20-25 years | Potentially highest due to long repayment periods, but payments are more manageable |

Loan Forgiveness and Cancellation Programs

Federal student loan forgiveness and cancellation programs offer borrowers the opportunity to have all or part of their loan balances eliminated under specific circumstances. These programs are designed to incentivize certain professions and address specific financial hardships. Understanding the eligibility requirements and application processes is crucial for those seeking relief.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Eligibility criteria include:

- Employment by a qualifying government or non-profit organization.

- Possession of Direct Loans (Federal Family Education Loans are not eligible).

- Consistent employment for 10 years.

- Making 120 qualifying monthly payments under an income-driven repayment plan.

Applying for PSLF involves:

- Confirming your loans are Direct Loans.

- Ensuring you are employed by a qualifying employer.

- Certifying your employment through the PSLF Help Tool.

- Submitting the PSLF Employment Certification Form annually.

- Monitoring your progress toward forgiveness.

Teacher Loan Forgiveness Program

This program provides forgiveness of up to $17,500 on certain federal student loans for qualified teachers who have completed five years of full-time teaching in a low-income school or educational service agency.

Eligibility requirements include:

- Teaching full-time for at least five consecutive academic years in a low-income school or educational service agency.

- Holding a qualifying federal student loan.

- Meeting specific teaching requirements as defined by the program.

The application process generally involves:

- Verifying employment at a qualifying school or agency.

- Gathering documentation to prove teaching experience and loan details.

- Completing and submitting the Teacher Loan Forgiveness application.

- Following up on the application status.

Income-Driven Repayment (IDR) Plans and Forgiveness

While not strictly “forgiveness” programs, Income-Driven Repayment (IDR) plans can lead to loan forgiveness after a set period (typically 20 or 25 years) if the remaining loan balance isn’t paid off. These plans adjust monthly payments based on your income and family size.

Eligibility criteria typically include:

- Having federal student loans.

- Meeting the income requirements for the specific IDR plan chosen.

Applying for an IDR plan usually involves:

- Selecting an IDR plan that best suits your financial situation (REPAYE, IBR, PAYE, ICR).

- Completing the application process through the student loan servicer.

- Regularly updating your income and family size information.

The Impact of Subsidized Loans on Student Debt

Subsidized federal student loans, while intended to make higher education more accessible, have played a significant role in the overall growth of student loan debt in the United States. Understanding their impact requires examining their contribution to the debt crisis, comparing debt burdens across borrower groups, and analyzing the long-term financial implications for individuals and the economy.

The availability of subsidized loans, which defer interest accrual while the student is enrolled at least half-time, has undoubtedly increased the number of students pursuing higher education. This increased access, however, has also contributed to a rise in overall borrowing and, consequently, a larger student loan debt burden for many. While subsidized loans offer a crucial benefit—the absence of interest during the grace period—the overall impact on the debt crisis is complex and multifaceted, influenced by factors such as rising tuition costs and changes in repayment plans.

Subsidized Loan Contribution to the Student Debt Crisis

The expansion of subsidized loan programs coincided with a period of significant tuition inflation. As college costs increased, students relied more heavily on loans to cover expenses, leading to a larger average loan amount per borrower. While subsidized loans offer a crucial advantage during the study period, the eventual need to repay the principal plus any accrued interest after graduation contributes significantly to the overall student debt crisis. The ease of accessing these loans, combined with often-unrealistic expectations about post-graduation earnings, has fueled this growth.

Comparison of Debt Burdens

Borrowers with subsidized loans generally have a higher average debt burden than those without. This is because subsidized loans often form a significant portion of the total loan amount, allowing students to borrow more. While the exact figures vary depending on the year and specific data source, studies consistently show that borrowers who utilized subsidized loans alongside unsubsidized loans or other loan types often carry substantially higher debt loads upon graduation. This difference is even more pronounced for those pursuing longer, more expensive programs like graduate or professional degrees.

Long-Term Financial Implications of Subsidized Student Loan Debt

High levels of student loan debt can have profound long-term financial implications. Borrowers may face difficulties in saving for retirement, purchasing a home, or starting a family. The weight of loan repayments can restrict career choices, as individuals might prioritize higher-paying jobs over those aligned with their passions or personal values. Furthermore, extended periods of repayment can negatively impact credit scores, affecting future borrowing opportunities. Delinquency or default can have devastating consequences, including wage garnishment and damage to credit history. The long-term financial burden extends beyond the individual, potentially impacting economic growth by hindering consumer spending and investment.

Visual Representation of Student Loan Debt Growth

Imagine a line graph charting the total amount of outstanding student loan debt in the United States over time, beginning around the year 1980 and extending to the present day. The y-axis represents the total debt in trillions of dollars, and the x-axis represents the year. The line starts relatively low in the early 1980s, then gradually rises over the decades, showing a period of slower growth, followed by a sharp and accelerating upward trend starting in the late 1990s and continuing through the 2000s and 2010s. The line would demonstrate a dramatic increase in the total amount of student loan debt over this period, visually representing the significant expansion of the student loan market and the increasing reliance on loans to finance higher education. The graph would clearly illustrate the substantial growth of student loan debt, emphasizing the magnitude of the current crisis.

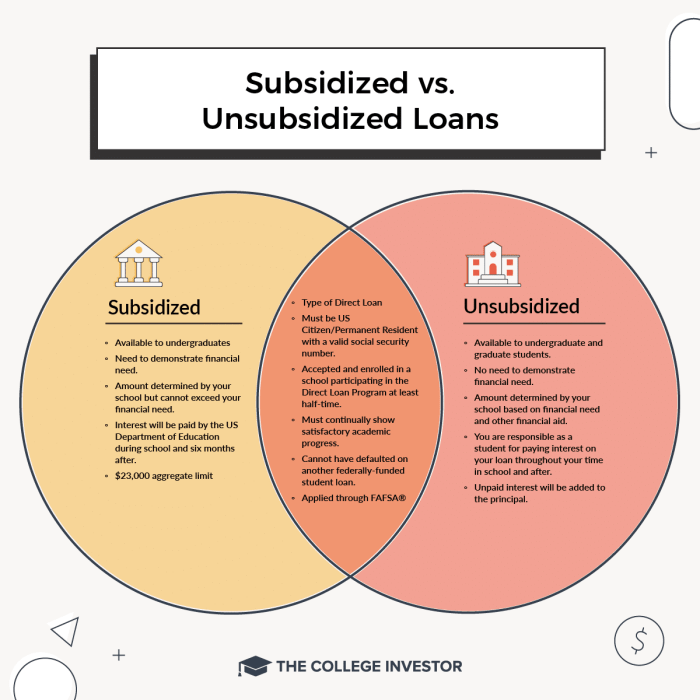

Comparison with Unsubsidized Federal Student Loans

Understanding the differences between subsidized and unsubsidized federal student loans is crucial for effective financial planning during and after college. While both help finance education, key distinctions exist regarding interest accrual and repayment, significantly impacting the overall cost of borrowing. This comparison highlights these differences to aid in informed decision-making.

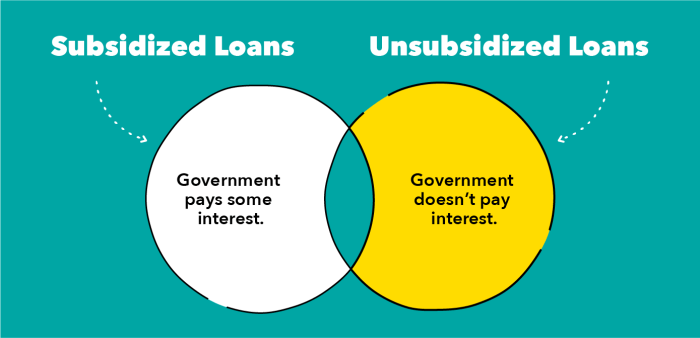

Interest Accrual During School

Subsidized and unsubsidized loans diverge significantly in how interest accumulates while you’re still a student. With subsidized loans, the government pays the interest while you’re enrolled at least half-time and during certain grace periods. This means your loan balance doesn’t grow during these periods. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. This interest is either capitalized (added to your principal balance) at the end of your grace period or can be paid during school to prevent the principal balance from increasing.

Financial Impact of Interest Accrual

The difference in interest accrual can lead to substantial variations in the total amount you repay. Consider two students, both borrowing $10,000 for four years. Student A has a subsidized loan, and Student B has an unsubsidized loan with a 5% annual interest rate. Assuming no payments are made during school, Student A’s loan balance remains $10,000 at graduation. However, Student B’s loan balance will be significantly higher due to accumulated interest. Using a simple interest calculation, Student B would owe approximately $12,155 at graduation, a difference of $2,155. This gap widens further if the interest is capitalized, as the accumulated interest then earns additional interest.

Comparison Table: Subsidized vs. Unsubsidized Federal Student Loans

| Subsidized Loans | Unsubsidized Loans |

|---|---|

| Government pays interest while enrolled at least half-time (and during certain grace periods). | Interest accrues from disbursement, regardless of enrollment status. |

| Loan balance doesn’t increase while interest is subsidized. | Loan balance increases due to accruing interest. Interest can be capitalized. |

| Generally lower overall cost due to no interest accrual during school. | Higher overall cost due to interest accruing during school. |

| Typically requires demonstrating financial need. | No financial need demonstration required. |

| May have lower interest rates than unsubsidized loans. | May have higher interest rates than subsidized loans. |

Defaulting on Federal Subsidized Student Loans

Defaulting on federal subsidized student loans carries significant and long-lasting negative consequences. It’s a serious matter that can severely impact your financial future and creditworthiness. Understanding these consequences is crucial to avoiding default and taking proactive steps if you’re struggling with repayment.

Consequences of Default

Defaulting on a federal student loan means you have failed to make payments for 270 days or more. This triggers a series of severe repercussions. Your loan will be considered in default, and the full balance becomes immediately due. The government will pursue collection efforts, which may include wage garnishment, tax refund offset, and even legal action. Furthermore, your credit score will suffer significantly, making it extremely difficult to obtain credit in the future, such as mortgages, auto loans, or even credit cards. This can have a ripple effect on other aspects of your life, potentially impacting your ability to rent an apartment or secure certain jobs. The negative impact on your credit report will remain for seven years, and even after that, the default will still be visible to lenders for a considerable period.

Government Actions to Recover Defaulted Loans

The Department of Education employs various methods to recover defaulted federal student loans. These methods are designed to ensure repayment and recoup the government’s investment. These methods can include wage garnishment (a portion of your paycheck is automatically deducted), tax refund offset (your tax refund is applied to your loan debt), and the offset of federal benefits such as Social Security payments. The government may also refer the debt to a collection agency, which will aggressively pursue repayment. In extreme cases, legal action, including lawsuits and wage garnishment, may be initiated. These actions can be financially devastating, potentially leading to further debt and financial instability.

Impact on Credit Scores and Future Borrowing

Defaulting on federal student loans has a profoundly negative impact on your credit score. This significantly reduces your creditworthiness, making it difficult to secure loans or credit in the future. Lenders view defaults as a major red flag, indicating a high risk of non-payment. The lower credit score resulting from default will likely lead to higher interest rates on future loans, if you are even approved. This can create a vicious cycle of debt, making it harder to manage finances and improve your credit standing. Securing a mortgage, auto loan, or even a credit card becomes a much more challenging, if not impossible, task.

Resources for Borrowers Facing Financial Hardship

It’s crucial to understand that there are resources available to help borrowers avoid default. Seeking help early is vital. If you’re facing financial difficulties, several options can help you manage your student loan debt and avoid default.

- Deferment or Forbearance: These programs temporarily postpone your loan payments, giving you time to get back on your feet financially. Eligibility requirements vary depending on your situation.

- Income-Driven Repayment Plans: These plans adjust your monthly payments based on your income and family size, making them more manageable for those facing financial hardship.

- Student Loan Rehabilitation: This program allows you to reinstate your defaulted loans by making nine on-time payments within 20 days of the due date. Once rehabilitated, your loans are no longer considered in default, and you can resume normal repayment.

- Contacting Your Loan Servicer: Your loan servicer is your first point of contact. They can explain your options and help you navigate the available repayment assistance programs. It’s important to proactively communicate with them about your financial challenges.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that provides free and low-cost credit counseling services. They can help you create a budget, manage your debt, and explore options for repayment.

Closure

Securing a federal subsidized student loan can be a pivotal step towards achieving higher education. This guide has explored the key facets of these loans, from eligibility and interest rates to repayment options and forgiveness programs. By understanding the nuances of subsidized loans and comparing them to unsubsidized options, you can make informed financial decisions that align with your long-term goals. Remember to proactively manage your loan, explore available resources, and seek assistance when needed to navigate this significant financial undertaking successfully.

Questions and Answers

What happens if I graduate and can’t find a job?

Several income-driven repayment plans adjust your monthly payments based on your income and family size, potentially lowering payments or extending the repayment period.

Can I refinance my subsidized student loans?

Yes, but refinancing federal student loans with a private lender will lose the benefits of federal loan programs, including income-driven repayment plans and loan forgiveness programs. Carefully weigh the pros and cons before refinancing.

What if I am unable to make my loan payments?

Contact your loan servicer immediately to discuss options like deferment, forbearance, or an income-driven repayment plan. Failing to make payments can lead to default, negatively impacting your credit score and future borrowing ability.

Are there any tax benefits associated with student loan interest?

You may be able to deduct the amount you paid in student loan interest on your federal income tax return, up to a certain limit. Consult a tax professional or the IRS website for the most current information.