Navigating the complexities of higher education often involves the significant financial hurdle of student loans. Understanding the intricacies of government student loan programs is crucial for prospective and current students alike. This guide delves into the various types of federal student loans available, the application process, repayment options, and potential forgiveness programs, equipping you with the knowledge to make informed decisions about your educational funding.

From the initial FAFSA application to the long-term implications of repayment strategies, this guide provides a clear and concise overview of the entire student loan journey. We will explore the benefits and drawbacks of different loan types, helping you to choose the best option for your individual circumstances. Furthermore, we will address common concerns regarding loan forgiveness, default prevention, and effective debt management techniques.

Types of Government Student Loans

Navigating the world of federal student loans can feel overwhelming, but understanding the different types available is crucial for responsible borrowing. This section details the key federal student loan programs in the United States, highlighting their differences and eligibility criteria. Careful consideration of these factors will help students make informed decisions about financing their education.

Federal Student Loan Types

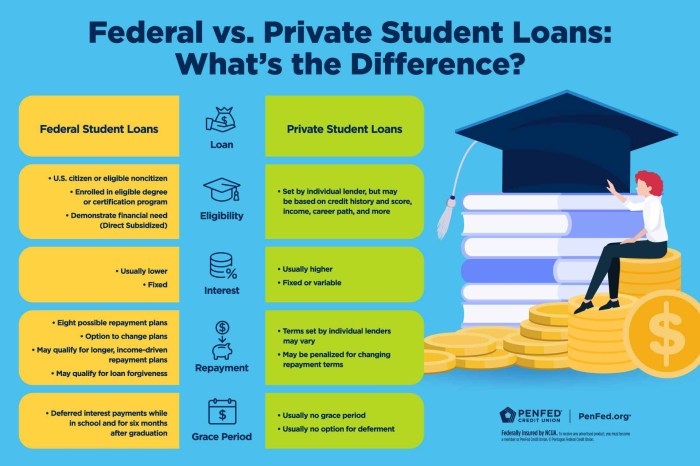

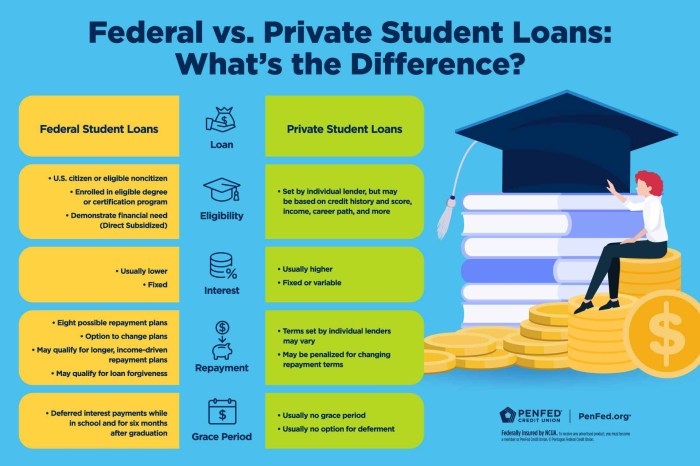

The federal government offers several types of student loans, each with its own set of terms and conditions. The primary distinctions lie in whether the loan is subsidized or unsubsidized, and the type of institution attended. These loans are generally more affordable than private loans, offering lower interest rates and flexible repayment options.

Subsidized vs. Unsubsidized Loans

The core difference between subsidized and unsubsidized loans lies in interest accrual. With subsidized loans, the government pays the interest while you’re in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. This means that you’ll owe more at the end of your loan term if you don’t pay the accruing interest.

Eligibility Requirements for Federal Student Loans

To be eligible for federal student loans, applicants must generally meet several criteria. These include:

- Being a U.S. citizen or eligible non-citizen.

- Having a valid Social Security number.

- Enrolling or enrolled at least half-time in an eligible degree or certificate program at a participating institution.

- Maintaining satisfactory academic progress.

- Completing the Free Application for Federal Student Aid (FAFSA).

Specific eligibility requirements may vary depending on the type of loan and the individual’s financial situation. It’s crucial to carefully review the requirements on the official Federal Student Aid website.

Comparison of Federal Student Loan Types

The following table compares key features of different federal student loan types. Note that interest rates are subject to change annually and these figures are for illustrative purposes only. Always refer to the official Federal Student Aid website for the most up-to-date information.

| Loan Type | Interest Rate (Example) | Repayment Options | Forgiveness Programs |

|---|---|---|---|

| Subsidized Stafford Loan | Variable, set annually (e.g., 4.99%) | Standard, graduated, extended, income-driven | Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness |

| Unsubsidized Stafford Loan | Variable, set annually (e.g., 5.99%) | Standard, graduated, extended, income-driven | Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness |

| Direct PLUS Loan (Graduate/Parent) | Variable, set annually (e.g., 7.54%) | Standard, graduated, extended | Limited forgiveness programs |

| Direct Consolidation Loan | Fixed, weighted average of consolidated loans | Standard, graduated, extended, income-driven | Same forgiveness programs as original loans |

Loan Application and Approval Process

Securing a federal student loan involves a multi-step process, primarily centered around the completion and submission of the Free Application for Federal Student Aid (FAFSA). Understanding this process is crucial for prospective students aiming to finance their education. The application process itself is relatively straightforward, but careful attention to detail is essential to ensure a smooth and timely approval.

The Free Application for Federal Student Aid (FAFSA) is the cornerstone of the federal student loan application process. It’s a standardized form used by the U.S. Department of Education to determine a student’s eligibility for federal financial aid, including grants, loans, and work-study programs. Completing the FAFSA accurately and completely is paramount, as it directly impacts the amount of financial aid a student may receive. The information provided on the FAFSA is used by both the federal government and participating educational institutions to assess the student’s financial need and determine the appropriate level of assistance.

FAFSA Completion and Submission

The FAFSA form requests detailed information about the student and their family’s financial circumstances. This includes income, assets, tax information, and household size. Accurate and complete information is vital for a successful application. The process generally involves creating an FSA ID, gathering necessary financial documents, and carefully inputting all requested data into the online FAFSA form. Submitting the completed FAFSA initiates the processing of the application. Students should allow sufficient time for processing, as this can take several weeks.

Factors Considered in Loan Application Evaluation

Lenders, primarily the federal government through its various loan programs, evaluate loan applications based on several key factors. Credit history, while not always a primary factor for undergraduate students, may be considered for graduate loans. The student’s academic record and enrollment status are also assessed, as lenders want assurance that the student is making progress toward degree completion. The student’s demonstrated financial need, as determined by the FAFSA, plays a significant role in determining eligibility and loan amounts. Finally, the program of study and the cost of attendance are considered to ensure the loan amount is reasonable and aligned with the student’s educational goals.

Step-by-Step Guide to Completing the FAFSA Form

- Create an FSA ID: Both the student and a parent (if the student is a dependent) need to create a unique FSA ID, which serves as a digital signature for the FAFSA.

- Gather Necessary Documents: Collect tax returns (IRS Form 1040), W-2s, and other relevant financial documents for both the student and their parents (if applicable).

- Complete the FAFSA Online: Access the FAFSA website and carefully fill out all required fields. Double-check for accuracy before submission.

- Review and Submit: Thoroughly review the completed FAFSA form to ensure accuracy. Submit the form electronically.

- Track Your Application: Monitor the status of your application online to track its progress.

Repayment Plans and Options

Understanding your repayment options is crucial for successfully managing your government student loans. Choosing the right plan can significantly impact your monthly payments and the total amount of interest you pay over the life of your loan. Several plans cater to different financial situations and priorities.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. While this plan offers the shortest repayment timeframe, resulting in less interest paid overall, the monthly payments can be higher than other options. This plan is suitable for borrowers who can comfortably afford higher monthly payments and want to pay off their loans quickly.

Graduated Repayment Plan

The Graduated Repayment Plan offers lower initial monthly payments that gradually increase over time. This can be helpful for borrowers who anticipate an increase in income in the future. However, it results in a longer repayment period and higher total interest paid compared to the Standard Repayment Plan. The payments increase every two years for the life of the loan.

Extended Repayment Plan

For borrowers with high loan balances, the Extended Repayment Plan offers longer repayment terms, resulting in lower monthly payments. Repayment periods can extend to up to 25 years, depending on the loan balance. While the lower monthly payments are beneficial for managing immediate finances, this plan significantly increases the total interest paid over the loan’s lifetime.

Income-Driven Repayment Plans

Income-driven repayment plans link your monthly payments to your income and family size. These plans offer lower monthly payments than other plans, making them particularly beneficial for borrowers with lower incomes or high debt loads. They generally offer a repayment period of 20 or 25 years, after which any remaining loan balance may be forgiven under specific circumstances.

Income-Driven Repayment Plan Benefits

Income-driven repayment plans offer several key advantages. Lower monthly payments ease the financial burden, allowing borrowers to manage their finances more effectively. The potential for loan forgiveness after a set period further reduces the long-term financial strain. These plans are designed to be more manageable for borrowers facing financial challenges. However, it’s important to understand that the longer repayment period leads to significantly higher total interest paid over the life of the loan.

Applying for Loan Deferment or Forbearance

Loan deferment and forbearance temporarily postpone your loan payments. Deferment is typically granted for specific reasons like returning to school or experiencing unemployment. Forbearance is usually granted for temporary financial hardship. The application process typically involves contacting your loan servicer and providing documentation supporting your request. It’s crucial to understand that interest may still accrue during deferment or forbearance, potentially increasing the total amount owed. The specific requirements and processes for deferment and forbearance vary depending on the loan type and servicer.

Repayment Plan Comparison

| Repayment Plan | Monthly Payment (Example) | Repayment Period | Total Interest Paid (Example) |

|---|---|---|---|

| Standard | $500 | 10 years | $10,000 |

| Graduated | $300 (initially) | 10 years | $15,000 |

| Extended | $200 | 25 years | $25,000 |

| Income-Driven (Example) | $250 | 20 years | $20,000 |

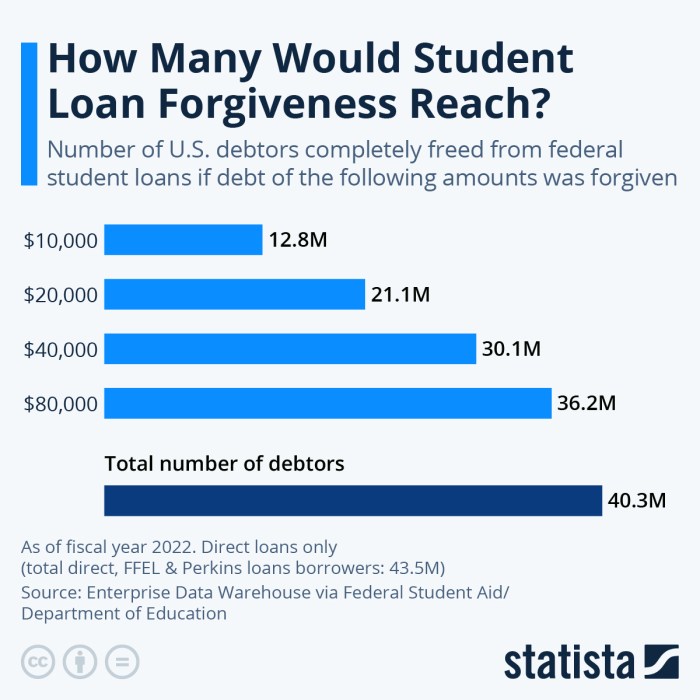

Loan Forgiveness and Cancellation Programs

Navigating the complexities of student loan repayment can be daunting. Fortunately, several federal programs offer loan forgiveness or cancellation options, providing relief to borrowers who meet specific criteria. These programs are designed to incentivize public service, address economic hardship, or correct errors in loan processing. Understanding these programs is crucial for borrowers seeking to reduce or eliminate their student loan debt.

Federal Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, each with its own eligibility requirements and application process. These programs offer varying degrees of loan forgiveness, depending on factors such as employment, income, and loan type. It’s important to carefully review the details of each program to determine eligibility.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. A qualifying employer includes government organizations or tax-exempt 501(c)(3) non-profits. To be eligible, borrowers must have Direct Loans and be employed full-time by a qualifying employer. The application process involves submitting an Employment Certification form annually, demonstrating continuous employment with a qualifying employer.

Teacher Loan Forgiveness Program

This program offers forgiveness of up to $17,500 on your federal student loans if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency. Eligibility requires teaching in a qualifying school, maintaining full-time employment, and having federal student loans. The application process involves submitting documentation proving employment and loan information to the Department of Education.

Income-Driven Repayment (IDR) Plans and Forgiveness

Several income-driven repayment (IDR) plans, such as ICR, PAYE, REPAYE, and IBR, offer loan forgiveness after a set number of years (typically 20-25 years). The amount forgiven depends on your income and loan balance. Eligibility requires having federal student loans and meeting the income requirements of the chosen IDR plan. Automatic forgiveness is typically granted after the qualifying repayment period; however, some plans require an application for forgiveness.

Examples of Professions Qualifying for Loan Forgiveness

Many professions qualify for loan forgiveness programs. Teachers in low-income schools, government employees at all levels (federal, state, and local), and employees of qualifying non-profit organizations are among those eligible. Specifically, social workers, nurses, and medical professionals working in underserved communities often qualify for loan forgiveness through various programs. Furthermore, members of the military and Peace Corps volunteers may also be eligible for specific loan forgiveness programs.

Loan Forgiveness Application Process

The application process varies depending on the specific program. Generally, it involves completing an application form, providing documentation to support your eligibility (such as employment verification and tax returns), and submitting the application to the Department of Education. Regular monitoring of the application status and prompt response to any requests for additional information is crucial. Failure to submit all required documentation can delay or even prevent loan forgiveness.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and consistent effort. Understanding your repayment options, budgeting effectively, and building good financial habits are crucial for avoiding the serious consequences of default. This section will provide practical strategies for managing your student loans and maintaining a healthy financial standing.

Budgeting and Managing Student Loan Payments

Creating a realistic budget is paramount to effectively managing student loan payments. This involves tracking your income and expenses to identify areas where you can reduce spending and allocate funds towards your loan repayments. Consider using budgeting apps or spreadsheets to monitor your finances. Prioritize your essential expenses (housing, food, transportation) and then allocate as much as possible towards your student loans. Remember that even small, consistent payments can make a significant difference over time. Consider exploring different repayment plans to find one that aligns with your current financial situation. For example, an income-driven repayment plan may lower your monthly payments, but it could extend your repayment period and increase the total interest paid.

Strategies for Avoiding Student Loan Default

Defaulting on your student loans can have severe repercussions, including damage to your credit score, wage garnishment, and difficulty obtaining future loans or credit. To avoid default, maintain open communication with your loan servicer. If you anticipate difficulty making payments, contact them immediately to explore options such as deferment, forbearance, or an income-driven repayment plan. Regularly review your loan terms and repayment schedule. Building an emergency fund can provide a financial cushion during unexpected expenses, preventing you from falling behind on your payments. Consider consolidating your loans into a single payment to simplify the process and potentially lower your interest rate. Finally, prioritizing your student loan payments alongside other essential expenses is vital.

Consequences of Student Loan Default

Defaulting on your student loans has significant and long-lasting negative consequences. Your credit score will be severely damaged, making it difficult to obtain credit cards, mortgages, or even rent an apartment. The government may garnish your wages or tax refunds to recover the debt. You may also face legal action, including lawsuits and wage garnishment. Furthermore, defaulting can impact your ability to secure future employment opportunities, as many employers conduct credit checks. The long-term financial implications of default are substantial, making it crucial to avoid this situation through proactive financial planning and communication with your loan servicer.

Sample Budget Incorporating Student Loan Payments

A sample budget can be designed to illustrate how to incorporate student loan payments. This budget assumes a monthly income of $3,000 after taxes. Remember, this is a sample, and your budget will need to reflect your specific income and expenses.

| Category | Amount |

|---|---|

| Housing | $1,000 |

| Food | $500 |

| Transportation | $300 |

| Utilities | $200 |

| Student Loan Payment | $500 |

| Other Expenses (Entertainment, Savings, etc.) | $500 |

| Total Expenses | $3,000 |

Note: This is a simplified example. Your actual budget will need to reflect your individual circumstances and expenses. It’s crucial to adjust this budget based on your personal financial situation and income. Consider using budgeting tools to track expenses and allocate funds effectively.

The Impact of Government Student Loans on Higher Education

Government student loan programs have profoundly reshaped the landscape of higher education, significantly influencing access, affordability, and the overall economic landscape. Their impact is multifaceted, encompassing both positive and negative consequences that warrant careful consideration. This section explores the key roles these loans play in shaping the higher education experience and the broader economy.

Government Student Loans and Increased Access to Higher Education

Government student loan programs have undeniably expanded access to higher education for millions. Prior to the widespread availability of federal student aid, higher education was largely restricted to those from affluent families. Loans provide financial assistance, enabling students from diverse socioeconomic backgrounds to pursue post-secondary education, thus increasing overall educational attainment and potentially boosting social mobility. This increased access has led to a more diverse student population in colleges and universities across the country, enriching the learning environment and fostering a wider range of perspectives. The Pell Grant program, for example, specifically targets low-income students, demonstrating a direct commitment to expanding access based on financial need.

The Impact of Changing Government Student Loan Policies on College Affordability

Changes in government student loan policies directly influence college affordability. Increases in loan limits can temporarily ease the financial burden, allowing students to borrow more to cover rising tuition costs. However, this can also contribute to a cycle of increasing tuition, as institutions may raise prices knowing students have access to greater loan amounts. Conversely, stricter eligibility criteria or reduced loan amounts can make college less accessible, potentially deterring prospective students from pursuing higher education. The recent pause on student loan repayments, for example, provided temporary relief but ultimately didn’t address the underlying issue of rising tuition costs. Conversely, policies promoting loan forgiveness programs can reduce the long-term financial burden on borrowers, but their impact on overall affordability depends on their scale and design.

The Relationship Between Student Loan Debt and the Overall Economy

The accumulation of student loan debt has significant implications for the overall economy. High levels of student loan debt can hinder economic growth by reducing consumer spending and delaying major life decisions such as homeownership and starting a family. This impact is particularly pronounced among younger generations, who may postpone investments in other areas due to loan repayment obligations. Conversely, a well-educated workforce, facilitated by accessible higher education, can lead to increased productivity and innovation, boosting economic growth in the long run. The economic consequences are complex, requiring a balanced approach that considers both the benefits of increased educational attainment and the potential drawbacks of high levels of student loan debt. For example, the impact of the 2008 financial crisis highlighted the interconnectedness of the student loan market and broader economic stability.

Key Arguments Summarized

The following points summarize the key arguments regarding the impact of government student loans on higher education and the economy:

- Government student loans have significantly increased access to higher education for students from various socioeconomic backgrounds.

- Changes in loan policies directly affect college affordability; increased loan limits may lead to tuition increases, while stricter eligibility can limit access.

- High levels of student loan debt can negatively impact consumer spending and economic growth, while a well-educated workforce can boost productivity and innovation.

- The relationship between student loan debt and the economy is complex and requires a balanced approach considering both the benefits and drawbacks.

Illustrative Example: A Student’s Loan Journey

This narrative follows Sarah, a bright and ambitious student navigating the complexities of government student loans throughout her college career and beyond. Her experience highlights the challenges and triumphs many students face when financing their education.

Sarah, a driven aspiring veterinarian, enrolled at State University. Her chosen major was demanding, requiring extensive laboratory work and clinical rotations. Tuition, fees, and living expenses were significant, far exceeding her family’s ability to contribute. To cover the costs, Sarah opted for a combination of federal student loans: subsidized and unsubsidized Stafford Loans, and a Perkins Loan.

Loan Application and Disbursement

Sarah diligently completed the Free Application for Federal Student Aid (FAFSA) form, providing accurate information about her family’s financial situation. The process was relatively straightforward, with online resources and campus financial aid advisors providing ample support. After acceptance into the university and her FAFSA processing, the loan funds were disbursed directly to the university to cover tuition and fees. She received separate disbursements for living expenses, which she carefully budgeted to cover rent, groceries, and textbooks. The total loan amount across her four years of study amounted to $75,000.

Repayment and Financial Challenges

Upon graduation, Sarah faced the daunting task of repaying her student loans. Initially, she entered the standard 10-year repayment plan, but quickly found the monthly payments ($800) to be a significant burden, especially considering her entry-level veterinary salary. She struggled to balance loan repayments with other essential expenses, like rent, car payments, and health insurance. This led to periods of financial stress and anxiety. The weight of the debt impacted her ability to save for a down payment on a house or invest in her future.

Impact of Financial Literacy

Recognizing the need for improved financial management, Sarah sought guidance from a financial advisor specializing in student loan debt. The advisor helped her explore different repayment options, such as income-driven repayment plans (IDR). She eventually switched to an IDR plan, significantly reducing her monthly payments based on her income and family size. The advisor also educated her on the importance of budgeting, saving, and building good credit. This newfound financial literacy significantly eased her financial burden and improved her overall financial well-being. Through careful budgeting and disciplined saving, she was able to make consistent payments and avoid delinquency.

Long-Term Financial Outlook

By proactively managing her debt and implementing sound financial practices, Sarah successfully navigated the challenges of student loan repayment. While the journey was challenging, her improved financial literacy empowered her to make informed decisions, ultimately leading to a more secure and stable financial future. The knowledge gained throughout the process equipped her to handle future financial decisions effectively, underscoring the importance of financial literacy in managing substantial debt.

Conclusion

Securing a higher education is a significant investment in your future, and understanding the landscape of government student loans is paramount. By carefully considering the various loan types, repayment plans, and available forgiveness programs, you can effectively manage your student loan debt and pave the way for a successful financial future. Remember, proactive planning and financial literacy are key to navigating this process successfully. This guide provides a foundation for your understanding, but seeking personalized advice from a financial advisor is always recommended.

FAQ Summary

What happens if I can’t repay my student loans?

Failure to repay your student loans can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Contact your loan servicer immediately if you anticipate difficulties in repayment to explore options like deferment, forbearance, or income-driven repayment plans.

Can I consolidate my student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new interest rate and repayment schedule. Consolidation simplifies repayment but may not always reduce your overall interest paid. Explore the benefits and drawbacks carefully before consolidating.

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or in deferment. Unsubsidized loans accrue interest throughout your entire loan term, regardless of your enrollment status.

How long does it take to get approved for a student loan?

The processing time varies, but generally, approval can take several weeks to a few months, depending on the completeness of your application and the lender’s processing times.