Navigating the complex world of student loans can feel overwhelming, especially when considering taking out additional funds. This guide provides a clear and concise path to understanding your eligibility, exploring your financial needs, and ultimately making informed decisions about increasing your student loan debt. We’ll cover everything from understanding different loan types and their associated costs to developing effective repayment strategies and exploring alternative financing options. The goal is to empower you with the knowledge needed to manage your finances responsibly while pursuing your educational goals.

Successfully securing additional student loans requires careful planning and a thorough understanding of your financial situation. This involves assessing your current debt, evaluating your future earning potential, and exploring all available resources. We’ll delve into the application process, highlighting potential pitfalls and offering practical tips to increase your chances of approval. Remember, responsible borrowing is crucial; this guide aims to help you make informed decisions that align with your long-term financial well-being.

Understanding Your Eligibility for Additional Student Loans

Securing additional student loans requires a thorough understanding of eligibility criteria and the various loan options available. Factors influencing your eligibility are carefully assessed by lenders, impacting the loan amount you can receive and the terms offered. Understanding these factors will empower you to make informed decisions about your financing options.

Factors Determining Student Loan Eligibility

Several key factors determine your eligibility for additional student loans. These include your credit history (for private loans), your current debt load, your enrollment status (full-time or part-time), your academic standing (GPA for some private lenders), and your anticipated future income. Federal loans often have less stringent credit requirements than private loans, but they still assess your overall financial situation. Lenders also consider your ability to repay the loan, which is often determined by your income and employment history. A strong credit score and a demonstrable ability to manage debt will significantly improve your chances of approval.

Types of Federal and Private Student Loans

Federal student loans are offered by the U.S. government and typically have more favorable terms than private loans. These include subsidized and unsubsidized Stafford Loans (for undergraduate and graduate students), PLUS Loans (for graduate students and parents of undergraduates), and Perkins Loans (for undergraduate students with exceptional financial need). Private student loans, on the other hand, are offered by banks, credit unions, and other financial institutions. They often require a creditworthy co-signer, especially for students with limited or no credit history. The interest rates and repayment terms vary significantly depending on the lender and the borrower’s creditworthiness.

Interest Rates and Repayment Terms

Interest rates and repayment terms for student loans vary widely depending on the type of loan and the lender. Federal student loans generally offer lower interest rates than private loans, especially for subsidized loans where the government pays the interest while the student is enrolled at least half-time. However, private loan interest rates can fluctuate based on market conditions and the borrower’s creditworthiness. Repayment terms for federal loans often include options such as standard repayment (10 years), extended repayment, graduated repayment, and income-driven repayment plans. Private loans typically offer fixed or variable interest rates and repayment terms ranging from 5 to 20 years, though this can vary greatly. It’s crucial to compare offers from multiple lenders before choosing a private loan.

Comparison of Federal and Private Loan Options

| Feature | Federal Loans | Private Loans |

|---|---|---|

| Interest Rates | Generally lower, fixed for the life of the loan | Generally higher, can be fixed or variable |

| Repayment Periods | Various options, including income-driven plans | Typically 5-20 years |

| Eligibility Requirements | Based on financial need and enrollment status | Based on creditworthiness, income, and co-signer availability |

| Loan Fees | Origination fees may apply | Origination fees and other fees may apply |

Determining Your Need for Additional Funding

Before considering additional student loans, carefully weigh the potential benefits against the long-term financial implications. Taking on more debt requires a thorough understanding of your current financial situation and a realistic plan for repayment. This involves assessing your educational goals, exploring alternative funding options, and developing a robust budget.

The consequences of accumulating substantial student loan debt can be significant. High monthly payments can strain your finances after graduation, potentially delaying major life milestones such as buying a home, starting a family, or investing in retirement. Defaulting on loans can severely damage your credit score, limiting access to credit cards, mortgages, and even employment opportunities. Therefore, a well-considered approach to borrowing is crucial.

Potential Consequences of Additional Debt

Taking on additional student loan debt necessitates a comprehensive understanding of the potential repercussions. These can range from the immediate impact on monthly cash flow to long-term effects on creditworthiness and financial stability. For instance, a larger loan balance translates to higher monthly payments, reducing disposable income and potentially limiting your ability to save or invest. Furthermore, prolonged periods of high debt can negatively affect credit scores, hindering access to future financial opportunities. In extreme cases, defaulting on loans can lead to wage garnishment and damage your credit report for years. A thorough assessment of the potential risks is vital before committing to additional borrowing.

Strategies for Budgeting and Managing Student Loan Debt

Effective budgeting and debt management are paramount when dealing with student loans. Creating a detailed budget that tracks income and expenses is the first step. This budget should incorporate estimated loan payments, living expenses (rent, utilities, food), educational costs (books, supplies), and personal expenses (entertainment, transportation). Prioritizing essential expenses and minimizing non-essential spending can significantly improve your financial health. Exploring different repayment plans offered by lenders, such as income-driven repayment, can help manage monthly payments. Regularly reviewing and adjusting your budget based on your income and expenses is also essential.

Alternative Funding Sources

Before resorting to additional loans, explore alternative funding sources. Scholarships and grants offer non-repayable financial aid. Many organizations, universities, and private companies offer scholarships based on academic merit, extracurricular activities, or demonstrated financial need. Grants, typically awarded based on financial need, can significantly reduce the reliance on loans. Actively searching for and applying for scholarships and grants is crucial. Part-time jobs can supplement your income, reducing the need for additional borrowing. Balancing work and studies requires careful time management, but it can alleviate the financial burden.

Sample Budget Incorporating Additional Loan Funds

A sample budget for a student considering additional loan funds might look like this:

| Income | Amount |

|---|---|

| Part-time Job | $500 |

| Additional Loan Funds (Monthly) | $750 |

| Total Income | $1250 |

| Expenses | Amount |

| Rent | $600 |

| Utilities | $100 |

| Groceries | $200 |

| Transportation | $100 |

| Books & Supplies | $50 |

| Loan Payment (Existing Loans) | $100 |

| Savings | $100 |

| Total Expenses | $1250 |

This budget demonstrates how additional loan funds can be allocated to cover essential expenses while still allowing for some savings. Remember that this is a sample; your individual budget will vary based on your specific circumstances and location. It’s crucial to create a personalized budget that accurately reflects your income and expenses.

The Application Process for Additional Student Loans

Applying for additional student loans, whether federal or private, involves a series of steps and requires specific documentation. Understanding this process is crucial to ensuring a smooth and successful application. This section Artikels the necessary steps and provides guidance on avoiding common pitfalls.

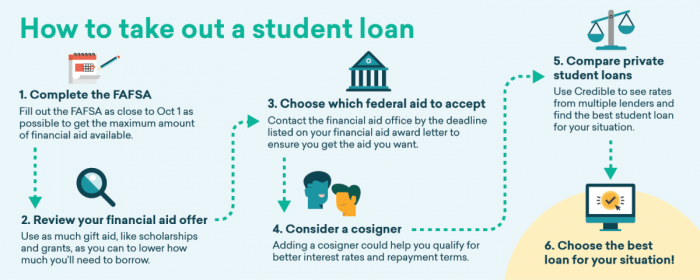

Federal Student Loan Application Process

The application process for federal student loans primarily involves completing the Free Application for Federal Student Aid (FAFSA). This form collects information about your financial situation and academic goals to determine your eligibility for federal aid. Submitting a complete and accurate FAFSA is paramount to receiving the maximum amount of financial aid you are eligible for.

Here’s a step-by-step guide:

- Complete the FAFSA: Gather your tax information, social security number, and driver’s license. Accurately complete all sections of the FAFSA form online at studentaid.gov. Any discrepancies can delay or prevent the processing of your application.

- Review your Student Aid Report (SAR): After submitting the FAFSA, you’ll receive a SAR which summarizes your information and eligibility. Carefully review this report for any errors. Correct any mistakes promptly.

- Accept your loan offer: Once your school receives your FAFSA information, they will determine your eligibility for federal student loans. You will then receive a loan offer outlining the terms and conditions. Carefully review the terms before accepting the loan.

- Complete Master Promissory Note (MPN): You’ll need to sign a Master Promissory Note (MPN) to legally agree to repay the loan. This is a legally binding agreement.

- Loan disbursement: Once all requirements are met, the funds will be disbursed to your school.

Required Documentation for Federal Student Loans

Accurate and complete documentation is essential for a successful federal student loan application. Missing or incorrect documentation can significantly delay the process.

Commonly required documents include:

- Completed FAFSA form: This is the cornerstone of your application.

- Tax returns (yours and your parents’, if applicable): These are used to determine your financial need.

- Social Security number: This is essential for verifying your identity.

- Driver’s license or other government-issued ID: This provides additional identity verification.

- Proof of enrollment: This confirms your enrollment status at an eligible institution.

Common Mistakes to Avoid During Federal Student Loan Application

Several common mistakes can hinder the application process. Avoiding these errors ensures a smoother experience.

Examples of common mistakes include:

- Inaccuracies on the FAFSA: Providing incorrect information can lead to delays or denial of your application. Double-check all information before submitting.

- Missing deadlines: Be aware of all application deadlines and submit your FAFSA and other required documents on time.

- Failing to review the SAR: Carefully review your Student Aid Report for any errors and correct them promptly.

- Not understanding loan terms: Before accepting a loan, thoroughly understand the interest rate, repayment terms, and any fees associated with the loan.

Private Student Loan Application Process

Applying for private student loans generally involves a more complex process than federal loans. These loans are offered by banks and other financial institutions and often have higher interest rates and stricter requirements.

The process typically includes these steps:

- Research lenders: Compare interest rates, fees, and repayment options from various private lenders.

- Pre-qualify: Many lenders offer pre-qualification options, which allow you to check your eligibility without impacting your credit score.

- Complete the application: Provide the required personal and financial information, including your credit history (if applicable).

- Provide documentation: This may include tax returns, bank statements, proof of enrollment, and co-signer information (if required).

- Review loan terms: Carefully review the loan terms and conditions before accepting the loan.

- Loan disbursement: Once approved, the funds will be disbursed according to the lender’s terms.

Repayment Strategies for Increased Student Loan Debt

Taking on additional student loans significantly impacts your financial future. Understanding and implementing effective repayment strategies is crucial to manage this increased debt responsibly and avoid long-term financial strain. Choosing the right repayment plan and diligently managing your payments are key factors in minimizing the overall cost of your loans.

Student Loan Repayment Plan Comparison

Several repayment plans are available, each with its own advantages and disadvantages. The Standard Repayment Plan involves fixed monthly payments over 10 years. The Graduated Repayment Plan offers lower initial payments that gradually increase over time, often appealing to recent graduates with lower initial incomes. Extended Repayment Plans stretch payments over a longer period (up to 25 years), resulting in lower monthly payments but higher overall interest costs. Income-Driven Repayment (IDR) plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base monthly payments on your income and family size. These plans often lead to loan forgiveness after 20 or 25 years, but the total interest paid can be substantial.

Calculating Monthly Payments

Calculating monthly payments involves understanding the loan amount, interest rate, and loan term. A common formula used is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

where: M = Monthly Payment, P = Principal Loan Amount, i = Monthly Interest Rate (Annual Interest Rate / 12), and n = Number of Months (Loan Term in Years * 12). For example, a $20,000 loan at 5% annual interest over 10 years would result in a monthly payment of approximately $212. A longer repayment period will reduce the monthly payment but increase the total interest paid. Online loan calculators can simplify this process.

Implications of Loan Deferment and Forbearance

Loan deferment and forbearance temporarily postpone your loan payments. Deferment is typically granted due to specific circumstances like unemployment or enrollment in school, and interest may or may not accrue depending on the loan type. Forbearance is granted when you experience temporary financial hardship, and interest usually accrues, increasing your overall loan balance. Both options provide temporary relief but can lead to increased long-term costs if not managed carefully. It’s essential to understand the terms and conditions before utilizing either option, as they can impact your credit score and ultimately the total cost of your loans.

Long-Term Cost Implications of Different Repayment Plans

The following table illustrates the long-term cost implications of different repayment plans on a $30,000 loan with a 6% annual interest rate. Note that these are estimations and actual costs may vary based on individual circumstances and loan terms.

| Repayment Plan | Loan Term (Years) | Approximate Monthly Payment | Total Interest Paid (Approximate) |

|---|---|---|---|

| Standard | 10 | $328 | $9,900 |

| Graduated | 10 | Starts lower, ends higher | $9,900 (approximately) |

| Extended | 25 | $168 | $25,000 (approximately) |

| Income-Driven (Example) | 20-25 | Varies based on income | Potentially high, but with potential forgiveness |

The Impact of Additional Debt on Future Financial Planning

Taking on additional student loan debt significantly impacts your long-term financial health. Understanding these implications is crucial for making informed decisions and developing a robust financial plan that accounts for the increased financial burden. Careful consideration of your future earning potential, coupled with a realistic repayment strategy, is essential to navigate this added responsibility successfully.

The long-term implications of increased student loan debt extend far beyond the immediate cost of tuition. The monthly payments can significantly reduce your disposable income, limiting your ability to save for other important financial goals. This added debt can also affect your credit score, potentially impacting your ability to secure loans for major purchases like a home or a car in the future. Furthermore, the interest accrued over the life of the loan can substantially increase the total amount you ultimately repay, potentially delaying or hindering the achievement of long-term financial aspirations.

Building Good Credit After Graduation

Establishing good credit is paramount after graduation, particularly when carrying a substantial student loan debt. Consistent on-time payments on your student loans are the foundation of a strong credit history. Supplementing this with a credit card used responsibly (keeping balances low and paying on time) can further enhance your credit score. Regularly monitoring your credit report for accuracy and identifying any potential issues is also a proactive measure. A high credit score opens doors to better interest rates on future loans and can even influence your eligibility for certain jobs or rental properties. For example, someone with a 750+ credit score might qualify for a mortgage with a significantly lower interest rate compared to someone with a lower score, potentially saving tens of thousands of dollars over the life of the loan.

Impact on Future Financial Goals

Increased student loan debt can significantly affect major financial goals such as homeownership and investments. A larger monthly loan payment directly reduces the amount available for saving for a down payment on a house. Similarly, the reduced disposable income limits the capacity for investing in retirement accounts or other investment vehicles. For instance, someone with a $500 monthly student loan payment might have to delay purchasing a home by several years compared to someone without this financial burden. Furthermore, the inability to contribute meaningfully to retirement savings can lead to a significantly smaller nest egg in retirement, potentially impacting the quality of life in later years. Similarly, the inability to invest in a diversified portfolio may result in missed opportunities for capital appreciation and wealth building.

Financial Plan Incorporating Increased Loan Burden

A comprehensive financial plan is crucial to manage increased student loan debt effectively. This plan should include a realistic budget that accounts for all expenses, including the monthly loan payments. Prioritizing high-interest debt repayment is a smart strategy to minimize the overall interest paid. Exploring income-driven repayment plans may offer more manageable monthly payments, although this might extend the repayment period and increase the total interest paid over time. Simultaneously, developing a savings plan for both short-term and long-term goals, including emergency funds, is essential. This might involve adjusting lifestyle choices to create more room in the budget for savings. For example, someone could create a detailed budget that allocates specific amounts for loan repayments, essential expenses, savings, and entertainment. They could also explore options like refinancing their loans at a lower interest rate to reduce the overall cost of borrowing.

Exploring Alternative Financing Options

Securing funding for higher education often extends beyond traditional student loans. Numerous alternative financing options exist, each with its own set of advantages and disadvantages. Carefully considering these alternatives can lead to a more financially responsible path towards achieving your educational goals. Understanding the nuances of each option is crucial for making informed decisions.

Exploring alternative financing options can significantly impact your overall financial well-being during and after your education. By diversifying your funding sources, you can potentially reduce your reliance on high-interest student loans and improve your long-term financial health.

Types of Alternative Financing Options

Several alternative financing methods can help fund higher education. The suitability of each option depends on individual circumstances, including credit history, income, and available assets.

- Scholarships and Grants: These are forms of financial aid that do not require repayment. Scholarships are typically merit-based, awarded for academic achievement, athletic prowess, or other talents. Grants are often need-based, awarded to students demonstrating financial hardship. Many scholarships and grants are offered by colleges, universities, private organizations, and government agencies.

- Federal and State Grants: Government-sponsored grants, such as the Pell Grant in the US, provide need-based funding for higher education. Eligibility criteria vary depending on the specific grant program and the student’s financial situation. These grants are often a significant source of funding for many students.

- Work-Study Programs: These programs provide part-time employment opportunities to students, allowing them to earn money while attending college. Earnings can be used to cover tuition, fees, and living expenses. Work-study jobs are often on campus, providing flexibility for students to balance their studies with work.

- Personal Savings and Family Contributions: Utilizing personal savings or receiving financial support from family members is a common way to fund higher education. This method reduces reliance on loans and minimizes future debt burden. Early planning and saving are essential for maximizing the impact of this approach.

- Private Loans: Unlike federal student loans, private loans are offered by banks and credit unions. Interest rates and repayment terms can vary widely, and creditworthiness is a major factor in loan approval. It’s crucial to compare rates and terms from multiple lenders before selecting a private loan.

- Income Share Agreements (ISAs): ISAs are a relatively new type of funding where investors provide upfront capital in exchange for a percentage of the student’s future income for a set period. The repayment amount is tied to income, potentially reducing the burden on lower-earning graduates. However, higher-earning graduates may end up paying more overall.

Examples of Successful Alternative Funding Strategies

Successful alternative funding strategies often involve a combination of approaches. For instance, a student might combine a merit-based scholarship, a need-based grant, and part-time work to minimize their reliance on loans.

A successful example might be a student who secured a significant scholarship from their university based on their academic record, supplemented this with a federal Pell Grant, and worked part-time on campus. This strategy allowed them to graduate with minimal student loan debt.

Another example could involve a student who received significant financial support from their family, combined with a work-study program to cover additional expenses, thus avoiding the need for any student loans whatsoever.

Visual Representation of Loan Accumulation and Repayment

Understanding the growth of student loan debt and the impact of different repayment strategies is crucial for effective financial planning. Visual aids can significantly improve comprehension of these complex financial concepts. The following descriptions Artikel two helpful visualizations.

Loan Accumulation Over Time with Varying Interest Rates

Imagine a line graph. The horizontal axis represents time, perhaps in years, starting from the moment the loan is taken out. The vertical axis represents the total loan balance. Multiple lines are plotted on the graph, each representing a different interest rate. For example, one line might show the growth of a $10,000 loan with a 5% interest rate, another with a 7% rate, and a third with a 10% rate. The steeper the line’s slope, the higher the interest rate and the faster the loan balance grows. This clearly illustrates the significant impact even small differences in interest rates can have on the total debt accumulated over time. For instance, the difference between the 5% and 10% line would dramatically increase as the years progress, showcasing the compounding effect of interest.

Repayment Scenarios and Long-Term Cost Implications

This visualization could be a bar chart. Each bar represents a different repayment scenario, such as a standard 10-year repayment plan, an extended 20-year plan, or an aggressive early repayment plan. The height of each bar represents the total amount repaid over the life of the loan, including principal and interest. A second set of bars could be added to the chart, showing the total interest paid for each scenario. This allows for a direct comparison of the total cost of each repayment strategy. For example, a bar representing a standard 10-year plan might show a significantly lower total repayment amount than a 20-year plan, but the interest paid would be less than the interest paid under a 20-year plan. This visualization clearly demonstrates the trade-off between longer repayment periods and increased interest costs. For instance, one could show a 10-year plan resulting in $20,000 in total interest paid, versus a 20-year plan resulting in $40,000, despite both starting with the same loan principal. The visual difference in bar height would be striking.

Outcome Summary

Securing additional student loans is a significant financial decision requiring careful consideration of your current financial situation and future goals. While additional funding can provide access to crucial educational opportunities, it’s vital to approach this process with a well-defined plan for repayment and a realistic understanding of the long-term implications. By thoughtfully weighing the pros and cons, understanding your eligibility, and exploring alternative financing options, you can make informed choices that support your educational aspirations without jeopardizing your future financial stability. Remember, responsible borrowing practices are key to navigating the complexities of student loan debt successfully.

Question Bank

What is the difference between federal and private student loans?

Federal loans are offered by the government and typically have more favorable terms and repayment options. Private loans are from banks and credit unions, often with higher interest rates and stricter eligibility requirements.

How can I improve my chances of getting approved for a private student loan?

A strong credit history, a co-signer with good credit, and a demonstrated ability to repay the loan are key factors in improving your chances of approval.

What happens if I can’t repay my student loans?

Failure to repay can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Explore repayment options like income-driven repayment plans if you face difficulties.

Are there any resources available to help me manage my student loan debt?

Yes, many non-profit organizations and government agencies offer free counseling and resources to help manage student loan debt. Contact the National Foundation for Credit Counseling or the U.S. Department of Education for assistance.