Navigating the world of student loans can feel overwhelming, but understanding the basics is crucial for a financially sound future. This guide breaks down the complexities of federal and private student loans, from application processes and repayment options to interest rates and potential forgiveness programs. We’ll explore the various factors to consider, empowering you to make informed decisions about financing your education.

From the initial application to long-term repayment strategies, we aim to demystify the student loan process, offering practical advice and clear explanations to help you manage your debt effectively. Whether you’re a prospective student or already managing loans, this resource provides valuable insights to guide you toward financial success.

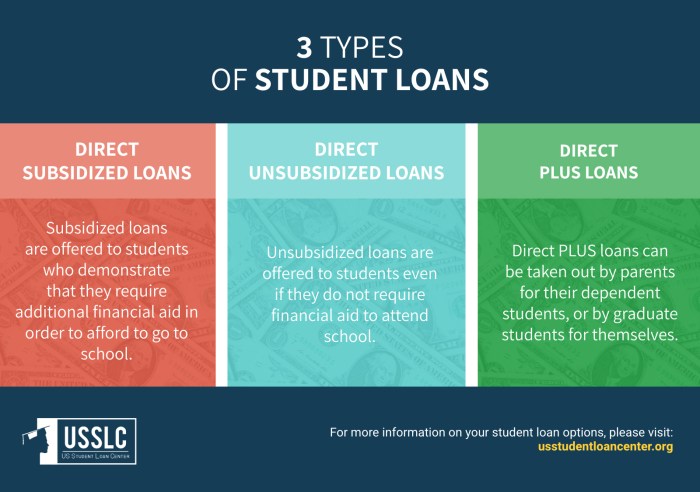

Types of Student Loans

Navigating the world of student loans can feel overwhelming, but understanding the fundamental differences between the main types—federal and private—is crucial for making informed financial decisions. This section will clarify these distinctions and explore the various repayment options available.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government, while private student loans come from banks, credit unions, or other private lenders. This key difference impacts numerous aspects of the loan, from interest rates and repayment options to eligibility requirements and borrower protections. Federal loans generally offer more favorable terms and greater borrower protections than private loans.

Federal Student Loan Repayment Plans

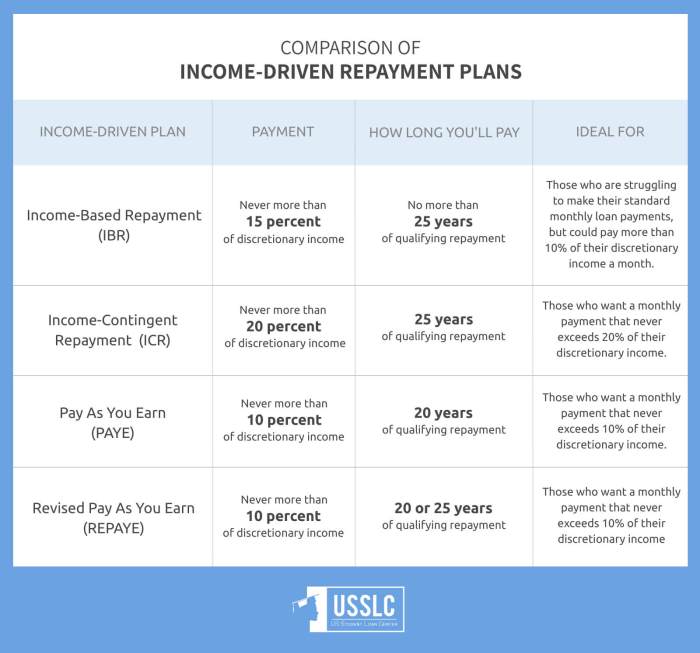

Several repayment plans are available for federal student loans, allowing borrowers to tailor their monthly payments to their financial circumstances. These plans vary in terms of payment amounts, loan forgiveness opportunities, and the length of the repayment period.

The Standard Repayment Plan involves fixed monthly payments over 10 years. The Graduated Repayment Plan starts with lower payments that gradually increase over time. The Extended Repayment Plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but higher overall interest paid. Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, base monthly payments on your income and family size. These plans may lead to loan forgiveness after 20 or 25 years, depending on the plan and your income.

Situations Requiring Private Student Loans

While federal loans are often the preferred choice due to their benefits, there are situations where private loans might become necessary. For example, if a student’s financial need exceeds the amount they can borrow through federal loans, they may need to supplement their funding with a private loan. Similarly, students who don’t qualify for federal loans due to credit history or other factors might rely on private loans. International students often find private loans a necessary option.

Comparison of Federal and Private Student Loans

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower and fixed | Generally higher and may be variable or fixed |

| Repayment Plans | Multiple options, including income-driven plans | Fewer repayment options, typically standard amortization |

| Borrower Protections | Stronger protections, including deferment and forbearance options | Fewer borrower protections |

| Eligibility | Based on financial need and enrollment status | Based on creditworthiness and income |

Interest Rates and Fees

Understanding interest rates and fees is crucial for responsible student loan management. These factors significantly impact the total cost of your education and your long-term financial health. Borrowers should carefully consider these aspects before accepting any loan.

Student loan interest rates are determined by several factors. For federal loans, the interest rate is typically set by Congress and can vary depending on the loan type (e.g., subsidized, unsubsidized), the loan’s disbursement date, and the borrower’s creditworthiness (although creditworthiness plays a less significant role in federal loans compared to private loans). Private student loans, on the other hand, are offered by banks and credit unions and their interest rates are largely based on market conditions, the borrower’s credit history, credit score, and the loan’s terms. Generally, borrowers with higher credit scores and strong credit histories qualify for lower interest rates.

Types of Student Loan Fees

Several fees can be associated with student loans. Origination fees are charged by the lender when the loan is disbursed. These fees can be deducted from the loan amount upfront, reducing the total amount received by the borrower. Late payment fees are assessed if a borrower fails to make a payment by the due date. These fees can vary depending on the lender and the severity of the delinquency. Other potential fees include prepayment penalties (though these are less common with federal student loans), default fees (incurred after defaulting on the loan), and potentially fees for specific services like loan consolidation or deferment.

Comparison of Federal and Private Student Loan Interest Rates

Federal student loans generally offer lower interest rates than private student loans. This is because federal loans carry less risk for the lender. However, the specific interest rates for both federal and private loans can fluctuate. For example, subsidized federal Stafford loans may have lower interest rates than unsubsidized Stafford loans because the government subsidizes the interest during periods of deferment. Private loan interest rates are more variable and depend heavily on the borrower’s creditworthiness. A borrower with excellent credit may secure a lower interest rate on a private loan than a borrower with poor credit might receive on a federal loan.

Sample Interest Rate Calculations

The following table illustrates how interest accrues on a sample loan amount over different repayment periods. Note that these are simplified examples and do not account for potential changes in interest rates or other fees. Actual calculations will be more complex and depend on the specific loan terms.

| Loan Amount | Interest Rate | Repayment Period (Years) | Approximate Total Interest Paid |

|---|---|---|---|

| $10,000 | 5% | 10 | $2,500 (approx.) |

| $10,000 | 7% | 10 | $3,500 (approx.) |

| $20,000 | 5% | 5 | $5,000 (approx.) |

| $20,000 | 7% | 5 | $7,000 (approx.) |

Repayment Options and Strategies

Navigating student loan repayment can feel overwhelming, but understanding the available options and developing a sound strategy is crucial for successful repayment and minimizing long-term financial burden. Choosing the right repayment plan depends on your individual financial circumstances, loan amount, and long-term goals.

Federal student loans offer several repayment plans, each with its own set of advantages and disadvantages. Careful consideration of these factors is essential to selecting a plan that aligns with your current financial situation and future aspirations.

Federal Student Loan Repayment Plans

The federal government provides several repayment plans designed to cater to diverse financial situations. These plans differ significantly in their monthly payment amounts, loan repayment periods, and overall cost.

- Standard Repayment Plan: This is the default plan for most federal student loans. It involves fixed monthly payments over a 10-year period. While payments are typically higher than other plans, it leads to the quickest repayment and the lowest overall interest paid. For example, a $30,000 loan at 5% interest would have a monthly payment of approximately $330 and total interest paid of around $10,000.

- Extended Repayment Plan: This plan extends the repayment period, lowering monthly payments. It offers repayment periods of 12, 15, or 25 years, depending on the loan amount. Longer repayment periods mean lower monthly payments, but significantly higher overall interest costs. Using the same $30,000 loan example at 5% interest, a 25-year plan would result in a monthly payment of approximately $180, but total interest paid would exceed $20,000.

- Income-Driven Repayment (IDR) Plans: These plans tie monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Payments are typically lower than under standard or extended plans, but repayment periods can extend to 20 or 25 years, leading to higher total interest paid. For instance, someone earning $40,000 annually with a $30,000 loan might see a monthly payment as low as $150 under an IDR plan, but the total repayment could take significantly longer.

Repayment Strategies

Effective repayment strategies involve careful planning and consideration of various factors.

- Prioritize High-Interest Loans: Focus on repaying loans with the highest interest rates first to minimize overall interest paid. This is often referred to as the avalanche method.

- Consolidate Loans: Combining multiple loans into a single loan can simplify repayment and potentially lower your monthly payment (though this isn’t always the case). However, it might extend the repayment period.

- Budgeting and Financial Planning: Creating a realistic budget and allocating funds specifically for loan repayment is crucial. This involves tracking income and expenses, identifying areas for savings, and prioritizing loan payments.

- Explore Refinancing Options: Refinancing can lower your interest rate, leading to lower monthly payments and faster repayment. However, this typically requires good credit and might involve switching from federal to private loans, losing some federal protections.

Choosing a Repayment Plan: A Decision-Making Flowchart

A flowchart would visually represent the decision-making process. The flowchart would start with assessing your current financial situation (income, expenses, debt). Based on this assessment, it would guide you through different options, considering factors like loan amount, interest rate, and risk tolerance. The flowchart would then lead to a recommendation for a specific repayment plan (Standard, Extended, or IDR), taking into account the pros and cons of each. Finally, it would highlight the importance of regular review and adjustment of the repayment plan as your financial circumstances change.

Default and its Consequences

Student loan default is a serious matter with significant financial repercussions. It occurs when a borrower fails to make payments on their student loans for a specific period, typically 270 days or nine months, after entering repayment. This can have a devastating impact on a borrower’s credit and overall financial well-being. Understanding the definition and consequences of default is crucial for responsible loan management.

Defaulting on student loans triggers a cascade of negative consequences. These consequences extend far beyond simply impacting your credit score. The ramifications are wide-reaching and can significantly hinder your future financial opportunities.

Consequences of Student Loan Default

Defaulting on your student loans leads to several severe consequences. These consequences are designed to incentivize repayment but can be extremely damaging to a borrower’s financial health. The government and lenders employ various methods to recover the outstanding debt.

- Wage Garnishment: The government can legally seize a portion of your wages to repay the defaulted loan. This means a significant reduction in your monthly take-home pay, making it difficult to meet other financial obligations.

- Tax Refund Offset: The government can intercept and apply your federal tax refund towards your defaulted student loan debt. This means you receive no refund, even if you’re expecting a significant amount.

- Negative Impact on Credit Score: Defaulting will severely damage your credit score, making it harder to obtain loans, credit cards, rent an apartment, or even get certain jobs. This negative impact can last for years, significantly hindering future financial opportunities.

- Difficulty Obtaining Future Loans: A defaulted loan makes it extremely difficult to obtain any future loans, including mortgages, auto loans, and even personal loans. Lenders will view you as a high-risk borrower.

- Legal Action: In some cases, the government may pursue legal action to recover the debt, which can involve lawsuits and potential wage garnishment or asset seizure.

Resources for Borrowers Facing Repayment Difficulties

Facing challenges in repaying your student loans doesn’t mean you’re doomed to default. Several resources are available to help borrowers navigate difficult financial situations and avoid default.

- Contact your loan servicer: Your loan servicer is your first point of contact. They can explain your repayment options, including income-driven repayment plans, deferment, or forbearance. Open communication is key.

- Explore income-driven repayment plans: These plans base your monthly payments on your income and family size, making them more manageable for those with lower incomes.

- Consider deferment or forbearance: These options temporarily postpone your payments, providing breathing room during periods of financial hardship. However, interest may still accrue during these periods.

- Seek professional financial counseling: A non-profit credit counseling agency can provide guidance on managing your debt and creating a budget. They can also help you negotiate with your lenders.

- StudentAid.gov: The official website for the U.S. Department of Education’s Federal Student Aid program offers comprehensive information on repayment options and resources.

Illustrative Representation of Default’s Impact

Imagine a graph with two lines. The “Credit Score” line starts high, representing a good credit score before default. Upon default, this line sharply drops, indicating a significant and lasting negative impact. The “Financial Well-being” line, initially stable, also plummets after default, reflecting the financial difficulties caused by wage garnishment, tax refund offsets, and difficulty accessing credit. The graph visually demonstrates the long-term negative consequences of defaulting on student loans, highlighting the importance of proactive debt management and seeking help when needed. A second, parallel graph could show a borrower who successfully manages their loans, demonstrating a steady credit score and improved financial well-being over time. This contrast would visually underscore the importance of responsible loan management.

Loan Forgiveness and Cancellation Programs

Navigating the complexities of student loan repayment can be daunting. Fortunately, several programs exist to offer relief through loan forgiveness or cancellation, providing opportunities for borrowers to reduce or eliminate their debt under specific circumstances. These programs generally target individuals pursuing careers in public service or those facing extenuating financial hardships. Understanding the eligibility requirements and limitations of each program is crucial for borrowers seeking this type of assistance.

Several federal and state programs offer student loan forgiveness or cancellation. Eligibility criteria vary significantly depending on the program, encompassing factors like the type of loan, the borrower’s profession, and their income level. The amount of loan forgiveness also differs considerably.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program is a federal initiative designed to forgive the remaining balance on Direct Loans after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. To qualify, borrowers must work for a qualifying employer, make 120 qualifying payments, and have Direct Loans. This program offers complete loan forgiveness.

Teacher Loan Forgiveness Program

This program provides forgiveness of up to $17,500 on federal student loans for qualified teachers who have completed five years of full-time teaching in a low-income school or educational service agency. Eligibility requires teaching in a low-income school or educational service agency and having federal student loans. The amount forgiven can be up to $17,500.

Income-Driven Repayment (IDR) Plans

While not strictly forgiveness programs, Income-Driven Repayment (IDR) plans significantly reduce monthly payments based on income and family size. After a set number of years (usually 20 or 25), any remaining balance may be forgiven. Eligibility is based on income and family size; the amount forgiven depends on the specific plan and remaining balance after the repayment period.

Other Forgiveness and Cancellation Programs

Several other programs exist, often at the state level or for specific professions (like nurses or doctors in underserved areas), offering varying degrees of loan forgiveness. Eligibility requirements and forgiveness amounts are specific to each program and often require extensive research to determine eligibility.

| Program Name | Eligibility Criteria | Forgiveness Amount | Notes |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | 120 qualifying payments under an income-driven repayment plan while employed full-time by a qualifying government or non-profit organization; Direct Loans | Full loan forgiveness | Requires specific employment and loan types. |

| Teacher Loan Forgiveness | Five years of full-time teaching in a low-income school or educational service agency; federal student loans | Up to $17,500 | Specific employment and loan types are required. |

| Income-Driven Repayment (IDR) Plans | Based on income and family size | Varies; remaining balance after 20 or 25 years | Not direct forgiveness, but leads to potential forgiveness after a set period. |

Understanding Loan Terms and Conditions

Navigating the world of student loans requires a thorough understanding of the terms and conditions associated with your loan agreement. Failing to grasp these crucial details can lead to unexpected costs and financial difficulties down the line. This section clarifies key terminology and highlights the importance of careful review before signing any loan documents.

Understanding your student loan terms is paramount to responsible borrowing and repayment. Key terms like principal, interest, amortization, and grace period significantly impact your overall loan experience and financial obligations. Moreover, misconceptions surrounding these terms are common, potentially leading to financial hardship. Therefore, a clear understanding of these concepts is essential for effective financial planning.

Key Loan Terms Defined

Several key terms are central to understanding your student loan. A clear grasp of these will empower you to make informed decisions and avoid potential pitfalls.

- Principal: This is the original amount of money you borrowed. It’s the base amount upon which interest is calculated.

- Interest: This is the cost of borrowing money. Lenders charge interest as a percentage of your principal balance. The interest rate determines how much interest you’ll accrue over time. Higher interest rates mean higher costs.

- Amortization: This refers to the process of paying off a loan through regular payments over a set period. Each payment typically covers both principal and interest. An amortization schedule Artikels the breakdown of each payment.

- Grace Period: This is a period after you graduate or leave school before you are required to begin making loan repayments. The length of the grace period varies depending on the loan type and lender.

The Importance of Reading Loan Documents

Before signing any student loan documents, carefully read and understand every clause. Don’t hesitate to ask questions if anything is unclear. This proactive approach can prevent future misunderstandings and financial burdens.

It is crucial to understand the implications of your loan agreement before committing to it. Ignoring the fine print can have significant financial consequences.

Common Misconceptions about Student Loan Terms

Several misconceptions surround student loan terms. Clarifying these can prevent costly mistakes.

- Misconception 1: “Interest only starts accruing after the grace period.” Reality: Interest often begins accruing from the moment the loan is disbursed, even during the grace period. This means the principal balance grows even before repayment begins.

- Misconception 2: “My loan payments will always remain the same.” Reality: While some repayment plans offer fixed payments, others, such as income-driven repayment plans, can adjust based on your income. Understanding how your payments might change is crucial.

- Misconception 3: “I can always refinance my loans to get a lower interest rate.” Reality: Refinancing options depend on your credit score and the prevailing interest rates. It’s not always guaranteed that you’ll qualify for a lower rate.

Glossary of Common Student Loan Terminology

Familiarizing yourself with common terminology is key to navigating the student loan process effectively.

| Term | Definition |

|---|---|

| Deferment | A temporary postponement of loan payments. |

| Forbearance | A temporary reduction or suspension of loan payments. |

| Default | Failure to make loan payments as agreed. |

| Capitalization | Adding unpaid interest to the principal balance, increasing the total amount owed. |

| Subsidized Loan | The government pays the interest while you’re in school. |

| Unsubsidized Loan | Interest accrues from the time the loan is disbursed. |

Epilogue

Securing your education through student loans requires careful planning and understanding. By weighing the advantages and disadvantages of different loan types and repayment strategies, you can create a sustainable financial path. Remember to proactively manage your loans, explore available resources, and seek professional guidance when needed to ensure a smooth journey towards debt repayment and financial well-being.

Questions and Answers

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into a single loan with one monthly payment. This can simplify repayment, but it may not always lower your interest rate.

How does my credit score affect my student loan interest rate?

Private student loans often consider your credit score when determining interest rates. A higher credit score generally leads to lower interest rates.

What is a grace period?

A grace period is a temporary period after graduation (usually six months) before you’re required to start making loan repayments.