Navigating the complex landscape of student loan repayment can feel overwhelming. The duration of your repayment journey hinges on several interconnected factors, from the type of repayment plan you choose to your income and the initial loan amount. Understanding these variables is crucial for developing a realistic repayment strategy and avoiding potential pitfalls. This guide provides a comprehensive overview of the key elements influencing student loan repayment timelines, empowering you to make informed decisions and achieve financial freedom.

We’ll explore various repayment plans, including standard, extended, and income-driven options, examining their respective timelines, minimum payments, and loan forgiveness possibilities. We will also delve into strategies for accelerating repayment, such as refinancing and debt consolidation, and discuss the potential consequences of loan default. Ultimately, the goal is to equip you with the knowledge necessary to confidently manage your student loans and plan for a debt-free future.

Understanding Student Loan Repayment Plans

Choosing the right student loan repayment plan is crucial for managing your debt effectively and minimizing the overall cost. Several factors influence this decision, including your income, the amount of your loan, the interest rate, and your long-term financial goals. Understanding the differences between the available plans is key to making an informed choice.

Student Loan Repayment Plan Comparison

Selecting a suitable repayment plan depends on your individual circumstances and financial priorities. The following table compares three common repayment plans, highlighting key differences to aid in your decision-making process. Note that specific details and availability may vary depending on your lender and loan type.

| Plan Name | Minimum Monthly Payment | Loan Forgiveness Eligibility | Repayment Period |

|---|---|---|---|

| Standard Repayment Plan | Fixed amount, typically higher than income-driven plans | No | 10 years |

| Extended Repayment Plan | Lower than Standard, but still fixed | No | Up to 25 years |

| Income-Driven Repayment Plan (IDR) | Based on your income and family size; typically lower than Standard or Extended | Yes, after a certain number of qualifying payments (specifics vary by plan) | 20-25 years (potential for loan forgiveness) |

Factors Influencing Repayment Plan Selection

Several key factors significantly impact the selection of a student loan repayment plan. Income plays a crucial role, as lower-income borrowers might find income-driven plans more manageable. The total loan amount also influences the choice; larger loans may necessitate a longer repayment period. The interest rate is another critical consideration; higher interest rates increase the total cost of borrowing, making it beneficial to choose a plan that minimizes the total interest paid over the loan’s life.

Implications of Repayment Plan Choice on Total Interest Paid

The repayment plan you choose directly impacts the total amount of interest you’ll pay over the life of your loan. Standard repayment plans, while shorter, typically result in higher total interest paid due to the higher monthly payments. Extended repayment plans reduce monthly payments but extend the repayment period, leading to a greater accumulation of interest. Income-driven repayment plans often result in the lowest monthly payments, but the longer repayment period and potential for loan forgiveness come at the cost of paying significantly more interest overall. For example, a borrower with a $50,000 loan at 6% interest could pay significantly more over 25 years under an IDR plan compared to a 10-year standard plan, even with potential loan forgiveness. However, the lower monthly payments may be essential for maintaining financial stability. Careful consideration of your individual financial situation and long-term goals is crucial in this decision.

Factors Affecting Student Loan Repayment Duration

The length of time it takes to repay student loans is influenced by a complex interplay of factors. Understanding these variables is crucial for effective financial planning and minimizing the overall cost of borrowing. This section will explore the key elements that determine your repayment timeline.

Interest Rates

Interest rates significantly impact the total repayment time. Higher interest rates mean a larger portion of your monthly payment goes towards interest, leaving less to reduce the principal loan amount. This extends the repayment period and increases the total amount you pay over the life of the loan. For example, a loan with a 7% interest rate will take longer to repay than an identical loan with a 5% interest rate, even with the same monthly payment amount. The compounding effect of interest can be substantial over the loan’s lifespan. Borrowers should actively seek out loans with the lowest possible interest rates to minimize the overall repayment time and cost.

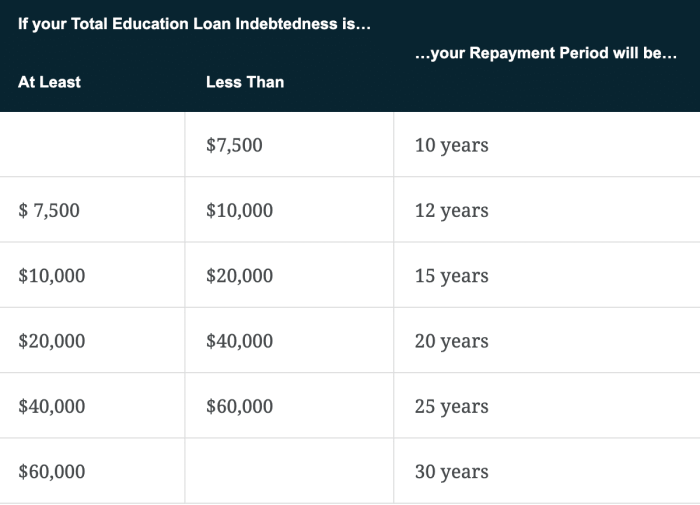

Initial Loan Amount

The principal loan amount directly correlates with repayment duration. Larger loan balances naturally require longer repayment periods, even with consistent monthly payments. A larger loan balance requires a higher monthly payment to pay it off in the same timeframe as a smaller loan, or it will take longer to repay if the monthly payment remains the same. For instance, a $50,000 loan will require a longer repayment period than a $25,000 loan, assuming all other factors remain constant. Careful budgeting and limiting borrowing to essential educational expenses can significantly reduce the initial loan amount and, consequently, the repayment period.

Impact of Extra Payments

Making extra payments on your student loans can substantially shorten the repayment timeline and reduce the total interest paid. Even small additional payments each month or year can accelerate the repayment process. Consider this scenario: Suppose you have a $30,000 student loan with a 6% interest rate and a 10-year repayment plan. Your monthly payment might be approximately $330. If you were to add just $50 to your monthly payment, you could potentially pay off the loan several years earlier and save thousands of dollars in interest. The earlier you start making extra payments, the greater the impact on reducing the overall repayment time and interest costs. This demonstrates the power of consistent extra payments in significantly impacting the loan repayment duration.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer a lifeline to student loan borrowers struggling to manage their monthly payments. These plans tie your monthly payment amount to your discretionary income, making them significantly more manageable than standard repayment plans, particularly during periods of lower earnings or unexpected financial hardship. They often lead to longer repayment periods, but the reduced monthly payments can prevent default and allow borrowers to stay afloat financially.

IDR plans work by calculating your monthly payment based on a formula that considers your income, family size, and loan amount. The payment is typically a percentage of your discretionary income, which is your income above a certain poverty guideline. Because this amount is recalculated periodically (usually annually), your payment may adjust over time as your income changes. This flexibility makes them a valuable tool for borrowers whose financial situations are not static. Importantly, after a specific number of qualifying payments (usually 20-25 years), the remaining loan balance may be forgiven. However, it’s crucial to understand that forgiven amounts are often considered taxable income.

Income-Driven Repayment Plan Application

Applying for an income-driven repayment plan involves several steps. First, you’ll need to gather your financial information, including tax returns and proof of income. Next, you’ll need to determine which IDR plan best suits your needs and complete the application for that specific plan through the student loan servicer managing your loans. This often involves completing an online form and providing the necessary documentation. The servicer will then review your application and determine your eligible payment amount. Finally, you’ll need to recertify your income annually to maintain your eligibility for the plan. Failure to recertify could result in your plan being cancelled or your payments being adjusted.

Hypothetical Example: Income-Driven vs. Standard Repayment

Let’s consider a hypothetical borrower, Sarah, who has $50,000 in student loans with a 6% interest rate. Under a standard 10-year repayment plan, her monthly payment would be approximately $550, and she’d pay a total of approximately $66,000 over the life of the loan. However, if Sarah qualifies for an income-driven repayment plan and her calculated monthly payment is $200 based on her income, her repayment period could extend to 25 years or more. While the total amount paid could be significantly higher than the standard plan, the reduced monthly payment would alleviate financial stress. In this scenario, her total payments might reach $60,000 over 25 years, but the lower monthly payments would be far more manageable, potentially avoiding default.

Comparison of Income-Driven Repayment Plans

Several types of income-driven repayment plans exist, each with slightly different eligibility requirements and payment calculation formulas. These include the Income-Driven Repayment (IDR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Based Repayment (IBR) plans. The specific terms and conditions, including the percentage of discretionary income used for payment calculation and the length of the repayment period, vary among these plans. For instance, PAYE and REPAYE generally offer lower monthly payments than IBR for borrowers with lower incomes, but the qualifying criteria may differ. It’s essential to compare these plans based on your individual financial situation to determine which one offers the most suitable balance between affordability and total repayment cost. The best plan for one borrower might not be the best for another.

Strategies for Faster Repayment

Paying off student loans faster can significantly reduce the overall cost and free up your finances sooner. Several strategies can help you achieve this goal, each with its own set of advantages and disadvantages. Careful planning and consistent effort are key to success.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can substantially reduce your monthly payments and shorten your repayment timeline. However, refinancing might not be suitable for everyone. For example, borrowers with federal loans may lose access to income-driven repayment plans or forgiveness programs if they refinance into a private loan. Additionally, the new loan terms might not be as favorable as initially anticipated, particularly if interest rates rise unexpectedly. It’s crucial to compare offers from multiple lenders and carefully consider the long-term implications before refinancing.

Debt Consolidation

Debt consolidation involves combining multiple student loans into a single loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering your interest rate, though this isn’t guaranteed. The impact on your repayment timeline depends on the interest rate of the consolidation loan. If the new interest rate is lower than the weighted average of your existing loans, you’ll save money and potentially pay off the debt faster. Conversely, a higher interest rate could lengthen your repayment period. Careful consideration of the new loan’s terms is crucial to determine if consolidation will benefit your repayment timeline.

Budgeting Tips to Accelerate Student Loan Repayment

Effective budgeting is essential for faster loan repayment. Creating a realistic budget and sticking to it can make a significant difference.

- Track your spending: Use budgeting apps or spreadsheets to monitor where your money goes. This awareness helps identify areas where you can cut back.

- Create a realistic budget: Allocate funds for necessities, student loan payments, and savings. Avoid overspending by sticking to your budget.

- Reduce unnecessary expenses: Identify non-essential spending habits (e.g., eating out frequently, subscription services you don’t use) and cut back.

- Increase your income: Explore opportunities to earn extra money through side hustles, part-time jobs, or freelance work. This allows you to allocate more funds toward loan repayment.

- Make extra payments: Even small extra payments can significantly reduce your loan’s principal and shorten the repayment period. Consider making bi-weekly payments instead of monthly to make more frequent payments.

- Automate payments: Set up automatic payments to ensure consistent, on-time payments and avoid late fees. This also helps you maintain financial discipline.

- Negotiate lower interest rates: Contact your lender to inquire about options to lower your interest rate. Even a small reduction can make a significant difference over the life of the loan.

Potential Consequences of Loan Default

Defaulting on your student loans can have severe and long-lasting consequences that significantly impact your financial well-being. Understanding these potential repercussions is crucial for responsible loan management and proactive planning. Failure to make timely payments can lead to a cascade of negative effects, from damaged credit to legal action.

Defaulting on student loans triggers a series of events that can dramatically alter your financial future. The immediate consequence is the reporting of the delinquency to credit bureaus, leading to a significant drop in your credit score. This can make it incredibly difficult to secure loans, rent an apartment, or even get a job in the future. Beyond the credit impact, the government can take aggressive collection actions, including wage garnishment and the seizure of tax refunds.

Impact on Credit Score

A student loan default will severely damage your credit score. The negative impact can persist for seven years or more, making it challenging to obtain credit cards, mortgages, auto loans, and other forms of financing. A lower credit score translates to higher interest rates on future loans, meaning you’ll pay significantly more over the life of any loan you manage to secure. For example, a borrower with a severely damaged credit score might face interest rates on a car loan that are 5-10 percentage points higher than someone with excellent credit, adding thousands of dollars to the total cost of the vehicle. This impact extends beyond simply borrowing money; it can also affect your ability to secure insurance policies at competitive rates.

Wage Garnishment and Tax Refund Offset

The Department of Education has the authority to garnish your wages to recover defaulted student loan debt. This means a portion of your paycheck will be directly sent to the government to repay your loans. The amount garnished is typically a significant percentage of your disposable income, potentially leaving you with insufficient funds to meet your essential living expenses. Furthermore, the government can seize your federal tax refund to apply towards your outstanding debt. This can leave you with little or no refund, further exacerbating your financial difficulties. For instance, a borrower with a significant tax refund might find the entire amount, or a substantial portion, confiscated to settle their defaulted student loan.

Resources for Borrowers Facing Financial Hardship

If you are struggling to repay your student loans, several resources are available to help. The Department of Education offers various income-driven repayment plans that can adjust your monthly payments based on your income and family size. You can also explore options such as loan consolidation or deferment to temporarily postpone payments. Additionally, non-profit credit counseling agencies can provide guidance and support in navigating your financial challenges and developing a repayment plan tailored to your specific circumstances. These agencies can help you understand your options, negotiate with your loan servicer, and create a budget to manage your finances effectively. Contacting your loan servicer directly to discuss your situation is also crucial; they may be able to offer forbearance or other temporary solutions to alleviate immediate financial pressure.

Visual Representation of Repayment Timelines

Understanding the repayment timeline for student loans is crucial for effective financial planning. Visual representations can significantly clarify the complex interplay between principal, interest, and repayment duration under different repayment plans. The following illustrations provide a simplified, yet informative, overview.

Standard Repayment Plan Timeline

Imagine a bar graph. The horizontal axis represents time, measured in years, stretching from zero to, say, ten years. The vertical axis represents the loan balance, starting at the initial loan amount (let’s say $30,000) at year zero. A steadily declining line represents the principal balance over the ten-year period. This line slopes downward, indicating consistent principal repayment. However, superimposed on this line is a shaded area representing the accumulated interest. This shaded area is initially small but gradually grows larger, especially in the early years, because a larger portion of the monthly payment goes towards interest at the beginning of the repayment period. The area’s growth slows as the principal balance decreases. At year ten, the line intersects the horizontal axis, indicating the loan is fully repaid. The total area under the line represents the total amount paid (principal + interest). This visual clearly demonstrates how a larger portion of early payments goes towards interest, and the decreasing balance over time.

Income-Driven Repayment Plan Timeline

This illustration is similar to the standard plan graph but shows key differences. The horizontal axis, again, represents time, but this time, the repayment period might extend to 20 or even 25 years. The vertical axis remains the same, starting with the initial loan amount ($30,000). The line representing the principal balance declines much more gradually than in the standard plan. This reflects the lower monthly payments characteristic of income-driven plans. The shaded area representing accumulated interest is significantly larger than in the standard plan due to the extended repayment period. The line intersects the horizontal axis at a much later point, reflecting the longer repayment duration. To further illustrate, let’s say the total interest paid under the standard plan was $10,000. The income-driven plan might show a total interest paid of $25,000, highlighting the trade-off between lower monthly payments and significantly higher total interest paid over the longer repayment term. This visual effectively compares the longer repayment period and the substantially higher total cost of the income-driven plan. A key difference to note visually would be the much shallower slope of the principal repayment line and the considerably larger area representing accumulated interest.

Conclusive Thoughts

Successfully managing student loan repayment requires careful planning and a proactive approach. By understanding the different repayment options, factors influencing repayment duration, and strategies for faster repayment, you can create a personalized plan that aligns with your financial circumstances and goals. Remember to explore all available resources and seek professional guidance when needed to navigate this crucial financial journey. Taking control of your student loan repayment is an investment in your long-term financial well-being.

FAQ Section

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, triggering serious consequences like wage garnishment.

Can I pay off my student loans early without penalty?

Generally, you can pay off student loans early without penalty. In fact, doing so can save you money on interest.

How often should I check my student loan balance?

It’s recommended to check your loan balance and payment history at least once a month to monitor progress and identify any discrepancies.

What are the tax implications of student loan interest?

You may be able to deduct student loan interest from your federal taxes, depending on your income and other factors. Consult a tax professional for personalized advice.