The weight of student loan debt significantly impacts the financial well-being of millions. Lowering interest rates on these loans could offer substantial relief, impacting borrowers’ monthly payments, long-term debt burdens, and even the broader economy. This exploration delves into the multifaceted effects of reduced student loan interest rates, examining both the benefits and potential drawbacks for individuals and the nation.

We will examine government policies designed to lower these rates, exploring their effectiveness and the economic considerations involved. Furthermore, we will analyze how borrowers might respond to such changes and how they can best leverage these opportunities to improve their financial situations. The analysis includes a comparative look at various repayment strategies and the crucial role of financial literacy in navigating these changes.

Impact of Lower Interest Rates

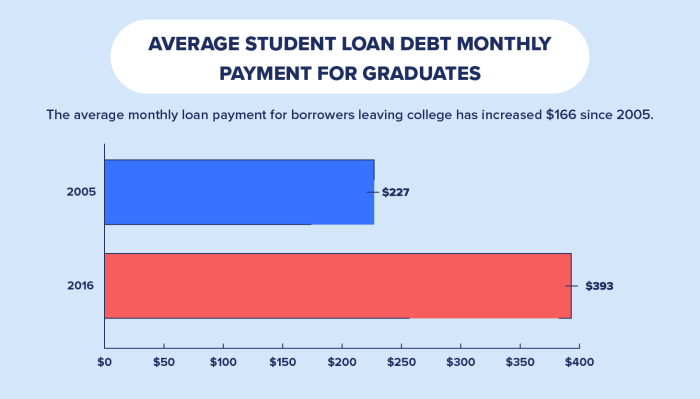

A reduction in student loan interest rates offers immediate and long-term financial benefits to borrowers. The lower rates translate directly into smaller monthly payments, freeing up funds for other financial priorities. This also significantly impacts the overall cost of borrowing and the time it takes to repay the loan.

Immediate Effects on Monthly Payments

Lower interest rates directly decrease the amount borrowers pay each month. For example, a borrower with a $50,000 loan at 7% interest might see their monthly payment drop by several hundred dollars if the rate decreases to 5%. This immediate relief can significantly improve a borrower’s cash flow and reduce financial stress. The exact reduction will depend on the loan’s original terms and the size of the interest rate cut.

Long-Term Financial Implications

The long-term impact of lower interest rates is equally substantial. Borrowers will pay significantly less in total interest over the life of the loan. This translates to thousands, or even tens of thousands, of dollars saved. Furthermore, the reduced monthly payments often allow borrowers to pay off their loans faster, potentially saving them years of repayment. This can have a significant positive impact on their overall financial health and future financial planning.

Savings Comparison for Different Loan Amounts and Interest Rates

The savings from lower interest rates vary considerably depending on the initial loan amount and the interest rate reduction. A borrower with a smaller loan will see less absolute savings compared to someone with a larger loan, even if the percentage reduction is the same. Similarly, a larger percentage decrease in interest rates will result in greater savings than a smaller reduction. For instance, a 2% decrease on a $100,000 loan will save far more than a 2% decrease on a $20,000 loan.

Monthly Payment Differences with Varying Loan Sizes and Interest Rate Reductions

| Loan Amount | Original Interest Rate | New Interest Rate | Monthly Payment Difference |

|---|---|---|---|

| $20,000 | 7% | 5% | ~$50 |

| $50,000 | 7% | 5% | ~$125 |

| $100,000 | 7% | 5% | ~$250 |

| $100,000 | 6% | 4% | ~$150 |

*Note: These figures are estimates and actual savings may vary based on loan terms and repayment plans.*

Government Policies and Lower Rates

Government intervention plays a significant role in shaping student loan interest rates, influencing both affordability and the overall economic landscape. Through various policy tools, governments can directly or indirectly impact the cost of borrowing for higher education. Understanding these mechanisms is crucial for assessing the effectiveness and potential consequences of such interventions.

Government intervention in student loan interest rates primarily manifests through legislative action and the implementation of refinancing programs. Legislative action involves direct changes to the statutory interest rates applied to federal student loans. This can be achieved through acts of Congress that either set fixed rates or establish formulas for determining rates based on market conditions. Refinancing programs, on the other hand, offer borrowers the opportunity to consolidate their existing loans at lower interest rates, typically through government-backed initiatives. These programs often aim to provide relief to borrowers burdened by high interest rates accumulated over time.

Legislative Actions to Reduce Student Loan Interest Rates

Legislative changes directly influence student loan interest rates. For example, the government could pass a law mandating a specific interest rate cap for federal student loans. Alternatively, legislation might adjust the index used to calculate interest rates, leading to a reduction in the overall cost of borrowing. Such actions often involve intricate negotiations and considerations of the broader economic environment. The impact of such legislative adjustments depends heavily on the specific details of the enacted law and the prevailing economic conditions.

Examples of Past Government Initiatives

Several past government initiatives aimed at lowering student loan interest rates provide valuable insights. For instance, the Obama administration implemented several programs to reduce interest rates, including lowering rates on subsidized Stafford loans. While these initiatives offered short-term relief to borrowers, the long-term impact varied depending on factors such as economic fluctuations and the overall student loan debt landscape. Another example is the temporary reduction of interest rates on federal student loans enacted in response to the 2008 financial crisis. This action aimed to stimulate the economy by providing financial relief to students and graduates. The effectiveness of such measures is a subject of ongoing debate, with some arguing that they provided crucial support while others point to potential unintended consequences.

Economic Considerations in Implementing Lower Interest Rate Policies

Lowering student loan interest rates involves complex economic trade-offs. A reduction in rates directly benefits borrowers by reducing their monthly payments and overall repayment costs. However, it also affects the federal budget, as the government may need to subsidize the difference between the lower rate and the market rate. This can lead to increased government spending and potentially contribute to the national debt. Furthermore, artificially low rates can potentially distort the market for student loans, potentially leading to increased demand and further escalating the overall cost of higher education. The government must carefully weigh these factors to ensure that any policy intervention is sustainable and does not create unintended negative consequences.

Comparison of Potential Benefits and Drawbacks of Government Approaches

The following points highlight the potential benefits and drawbacks of different government approaches to reducing student loan interest rates:

- Legislative Rate Caps:

- Benefit: Provides immediate and predictable cost savings for borrowers.

- Drawback: May increase government spending and potentially distort the market.

- Refinancing Programs:

- Benefit: Targets borrowers with high interest rates, offering targeted relief.

- Drawback: Can be administratively complex and may not reach all eligible borrowers.

- Index Adjustments:

- Benefit: Offers a more market-responsive approach, potentially mitigating risks associated with fixed rates.

- Drawback: May not provide sufficient relief during periods of high interest rates.

Impact on the Economy

Lowering student loan interest rates can have a significant ripple effect throughout the economy, influencing consumer behavior, economic growth, and the financial health of lending institutions. The magnitude of these effects depends on the extent of the rate reduction and the overall economic climate.

Lower interest rates directly impact borrowers by reducing their monthly payments. This frees up disposable income, potentially leading to increased consumer spending. Increased consumer spending, in turn, stimulates economic growth by boosting demand for goods and services. This increased demand can lead to job creation and further economic expansion, creating a positive feedback loop. However, this positive impact is not guaranteed and depends on various factors.

Consumer Spending and Economic Growth

Reduced student loan payments translate to more money available for other expenditures. Borrowers might use this extra cash to purchase durable goods like cars or appliances, invest in their education or businesses, or simply increase their savings. This increased spending can boost economic activity across various sectors. For example, a significant reduction in interest rates could mirror the effect seen after the 2008 financial crisis when government stimulus packages, including tax rebates, spurred consumer spending and aided economic recovery. However, the effect might be muted if borrowers prioritize debt repayment or if the overall economic climate remains uncertain.

Risks Associated with Widespread Student Loan Interest Rate Reductions

While lower rates stimulate the economy, they also present potential risks. A drastic reduction could lead to increased borrowing, potentially fueling inflation if demand significantly outpaces supply. Furthermore, it might incentivize excessive borrowing for education, potentially leading to unsustainable levels of student debt in the future. This could also strain the budgets of government entities involved in student loan programs, particularly if repayment rates decline. The experience of the subprime mortgage crisis serves as a cautionary tale, highlighting the dangers of excessive lending and unsustainable debt levels.

Impact on the Student Loan Market and Lending Institutions

Lower interest rates reduce the profitability of student loan lending for institutions. Banks and other lenders might respond by tightening lending standards, reducing the number of loans offered, or increasing fees to compensate for lower interest income. This could limit access to credit for some prospective students. The government, as a major player in the student loan market, would also need to consider the financial implications of lower interest rates on its own loan programs and budget. The shift in profitability could also lead to consolidation within the lending industry, as smaller institutions struggle to remain competitive.

Scenario: Significant Lowering of Interest Rates

Let’s imagine a scenario where student loan interest rates are significantly reduced, say, by 5 percentage points. In the short term, this could lead to a noticeable surge in consumer spending, boosting economic activity in various sectors. Retail sales might increase, housing markets might see a temporary uptick, and employment numbers could rise due to increased demand. However, in the long term, the potential risks become more prominent. Inflation could increase, potentially eroding the purchasing power of consumers. The government might face increased budget deficits due to lower returns on its loan portfolio. Furthermore, the increased borrowing could lead to a future where a larger percentage of the population carries significant student loan debt, potentially hindering long-term economic growth. This scenario necessitates careful monitoring and management to mitigate potential negative consequences.

Last Word

Reducing student loan interest rates presents a complex economic puzzle with significant implications for borrowers and the national economy. While the potential for financial relief and economic stimulus is substantial, careful consideration of potential risks and unintended consequences is vital. Ultimately, a well-informed approach, combining effective government policies with responsible borrower behavior and enhanced financial literacy, is key to maximizing the positive impacts of lower interest rates on student loans.

FAQ

What are the eligibility requirements for lower student loan interest rates?

Eligibility criteria vary depending on the specific program or initiative. Factors like loan type, income level, and credit history often play a role. It’s crucial to check the specific program guidelines for details.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing is an option for some borrowers. Private lenders offer refinancing options, but it’s essential to compare rates and terms carefully before refinancing, as it might impact federal loan benefits.

How long does it take to see the effects of a lower interest rate on my monthly payments?

The changes will usually reflect in your next monthly statement after the interest rate reduction is implemented. The exact timing depends on your loan servicer’s processing procedures.

What happens if I already have a low interest rate on my student loans?

If your current interest rate is already low, the benefits of further reduction might be minimal. However, exploring other repayment strategies, like accelerated repayment, can still yield savings even with low interest rates.