Navigating the complexities of higher education often involves the crucial decision of securing student financing. Understanding the nuances of student loan programs is paramount to making informed choices that align with individual financial circumstances and long-term goals. This guide delves into the specifics of Modped student loans, offering a clear and concise overview of the application process, repayment options, potential risks and benefits, and relevant legal protections.

From exploring the various types of Modped student loan programs available and their eligibility criteria to outlining effective repayment strategies and addressing potential challenges, this resource aims to empower students and prospective borrowers with the knowledge necessary to make well-informed decisions about their educational funding. We will examine the financial implications of borrowing, comparing it to alternative funding sources and highlighting the importance of responsible borrowing habits.

Understanding Modped Student Loan Programs

Navigating the world of student loans can be daunting, especially when faced with a variety of options. This section provides a clear understanding of Modped student loan programs, outlining their types, eligibility requirements, and key features to help you make informed decisions. We will focus on providing factual information to aid in your comparison and selection process.

Types of Modped Student Loan Programs

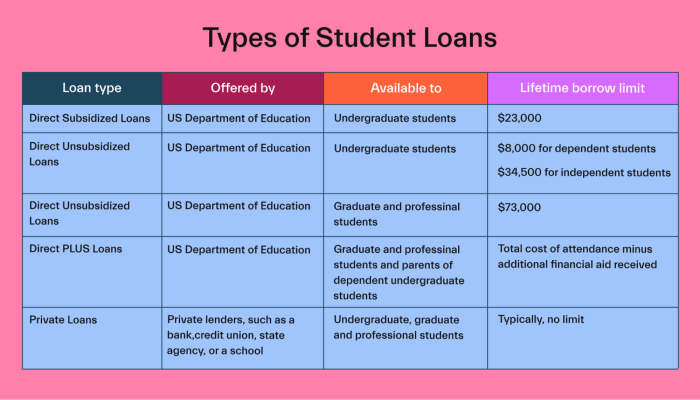

Modped offers several student loan programs tailored to different needs and circumstances. These programs typically fall under categories such as federal loans (if applicable in your region), private loans, and potentially specialized programs for specific fields of study or demographics. The exact programs offered might vary depending on your location and the current Modped offerings. It’s crucial to check the official Modped website for the most up-to-date information.

Eligibility Criteria for Modped Student Loan Programs

Eligibility for Modped student loan programs varies depending on the specific program. Generally, factors considered include your enrollment status (full-time or part-time), academic standing (GPA requirements may apply), credit history (for private loans), and citizenship or residency status. Some programs may also have specific requirements related to your field of study or financial need. For federal loan programs, specific income thresholds and family size may be considered as part of the eligibility assessment. Private loan eligibility often hinges on a credit check and a co-signer might be required if your credit history is limited.

Comparison of Interest Rates and Repayment Terms

Interest rates and repayment terms for Modped student loans vary significantly across different programs. Federal loans often have lower, fixed interest rates compared to private loans, which may have variable rates that fluctuate with market conditions. Repayment terms can range from several years to over a decade, with options for different repayment plans (e.g., standard, graduated, income-driven). The length of the repayment period impacts the total interest paid over the life of the loan. Longer repayment periods result in lower monthly payments but higher overall interest costs. Shorter repayment periods lead to higher monthly payments but lower overall interest costs. It is important to carefully consider your financial situation and repayment capacity when choosing a repayment plan.

Comparison of Key Features of Modped Student Loan Programs

The following table compares three hypothetical Modped student loan programs. Note that these are examples and actual programs and their features may differ. Always refer to the official Modped website for the most current information.

| Program Name | Interest Rate | Repayment Term (Years) | Eligibility Requirements |

|---|---|---|---|

| Modped Standard Loan | Variable, 5-8% | 5-10 | US Citizen, enrolled in accredited institution |

| Modped Graduate Loan | Fixed, 6% | 10-15 | Enrolled in graduate program, good credit history |

| Modped Federal Loan (Example) | Fixed, 4% | 10 | US Citizen, meets federal financial aid requirements |

The Application Process for Modped Student Loans

Applying for a Modped student loan involves several key steps designed to ensure a smooth and efficient process for borrowers. This section Artikels the application procedure, required documentation, the verification process, and provides a step-by-step guide to successfully complete your application. Remember to carefully review all instructions and gather the necessary materials beforehand to streamline the application process.

The application process for Modped student loans begins with the completion of a comprehensive application form. This form requests detailed personal and financial information necessary to assess your eligibility for a loan and determine the appropriate loan amount. The application is typically submitted online through a secure portal, ensuring the privacy and security of your information.

Required Documentation

Supporting documentation is crucial for a successful Modped student loan application. This evidence helps verify the information provided in your application and strengthens your eligibility. Incomplete applications may lead to delays or rejection.

- Proof of Identity: A government-issued photo ID, such as a driver’s license or passport, is required to verify your identity.

- Proof of Enrollment: Official acceptance letter from your chosen educational institution, confirming your enrollment in an eligible program.

- Financial Aid Information: Details of any other financial aid received, such as grants or scholarships, to determine your overall financial need.

- Tax Information: Tax returns (or equivalent documentation for non-tax filers) to demonstrate your income and financial situation. This helps assess your repayment capacity.

- Bank Statements: Recent bank statements showcasing your financial activity, demonstrating account stability and access to funds.

The Verification Process

After submitting your application and supporting documentation, Modped initiates a verification process. This involves checking the accuracy and validity of the information you have provided. This step is essential to ensure responsible lending practices and prevent fraudulent applications.

The verification process may include contacting your educational institution to confirm your enrollment and verifying your financial information with relevant institutions. Borrowers should expect this process to take several business days. You may be contacted by Modped to provide additional information or clarification if necessary. Prompt responses to any requests from Modped are crucial for a timely processing of your application.

Step-by-Step Application Guide

Following these steps will help ensure a smooth application process:

- Create an Account: Visit the Modped website and create a secure online account.

- Complete the Application Form: Fill out the application form accurately and completely, providing all required information.

- Gather Supporting Documents: Collect all necessary documentation as listed above.

- Upload Documents: Upload all required documents through your online account.

- Review and Submit: Carefully review your application and uploaded documents before submitting.

- Await Verification: Allow time for Modped to verify your information.

- Respond to Requests: Respond promptly to any requests for additional information.

Repayment Options and Strategies for Modped Loans

Understanding your repayment options and developing a sound repayment strategy is crucial for successfully managing your Modped student loan debt. Choosing the right plan and actively managing your finances will significantly impact your long-term financial health. This section Artikels various repayment plans and provides strategies to help you navigate the repayment process effectively.

Modped Loan Repayment Plans

Modped likely offers several repayment plans to accommodate varying financial situations. These typically include a standard repayment plan, a graduated repayment plan, and an extended repayment plan. The standard plan involves fixed monthly payments over a set period, usually 10 years. A graduated repayment plan starts with lower monthly payments that gradually increase over time, offering more flexibility initially. An extended repayment plan stretches payments over a longer period, resulting in lower monthly payments but higher overall interest paid. The specific terms and conditions of each plan, including interest rates and repayment periods, will be detailed in your loan agreement. It’s essential to carefully review these details before selecting a plan.

Challenges in Repayment

Borrowers often face challenges during the repayment process. Unexpected job loss, reduced income, or significant life events like illness or family emergencies can make meeting monthly payments difficult. Interest accrual can also lead to a snowball effect, increasing the total amount owed if payments are missed or delayed. Careful budgeting and financial planning are essential to mitigate these risks. Understanding the potential challenges beforehand allows for proactive strategies to minimize their impact.

Strategies for Effective Debt Management

Effective debt management requires a proactive and organized approach. This includes creating a realistic budget that accounts for all income and expenses, prioritizing loan repayment, and exploring options for reducing monthly payments if necessary. Regularly monitoring your loan balance and payment history is crucial for identifying potential issues early on. Seeking professional financial advice can also be beneficial, particularly if you are facing significant financial difficulties. Open communication with your lender is key to exploring potential solutions and avoiding delinquency.

Repayment Strategies Based on Risk Tolerance

Effective repayment strategies should align with your individual risk tolerance. Below are some examples categorized by risk tolerance level:

- Low Risk Tolerance: Prioritize consistent, on-time payments, even if it means a longer repayment period. This minimizes the risk of delinquency and potential damage to your credit score. Consider the standard repayment plan or an extended plan if necessary. Focus on building an emergency fund to handle unexpected expenses.

- Medium Risk Tolerance: Balance consistent payments with the potential for faster repayment. Consider a graduated repayment plan or explore options for making extra payments when financially feasible. Maintain a close eye on your budget and adjust as needed. Build an emergency fund to mitigate unexpected financial setbacks.

- High Risk Tolerance: Prioritize aggressive repayment to minimize overall interest paid. This may involve making extra payments consistently, potentially requiring sacrifices in other areas of your budget. Understand the risks associated with this approach and ensure you have a solid financial plan in place to manage potential setbacks.

Potential Risks and Benefits of Modped Student Loans

Choosing a Modped student loan, like any financial decision, involves weighing potential benefits against inherent risks. Understanding these aspects is crucial for making an informed choice that aligns with your long-term financial goals. This section will explore the advantages and disadvantages of utilizing Modped student loans to finance your education.

Benefits of Modped Student Loans

Modped student loans can offer several significant advantages, primarily enabling access to education that might otherwise be unattainable. These loans provide immediate funding, allowing students to focus on their studies without the immediate pressure of covering tuition fees and living expenses. Furthermore, depending on the loan terms and repayment plans, the manageable monthly payments can ease the financial burden during and after studies. Access to a higher education can lead to increased earning potential in the long run, making the investment worthwhile. Finally, some Modped loan programs may offer benefits such as flexible repayment schedules or grace periods, potentially mitigating short-term financial stress.

Risks Associated with Modped Student Loans

While Modped student loans offer crucial financial assistance, it’s essential to acknowledge the inherent risks. A primary concern is the accumulation of debt. High interest rates, particularly on unsecured loans, can significantly increase the total amount owed over the loan’s lifespan. This debt burden can extend well beyond graduation, impacting future financial decisions such as purchasing a home, investing, or starting a family. Unexpected life events, such as job loss or illness, can further complicate repayment, potentially leading to delinquency and negatively impacting credit scores. Moreover, the long-term financial implications of borrowing can be substantial, requiring careful budgeting and financial planning to manage effectively.

Long-Term Financial Implications: Borrowing vs. Alternative Funding

The long-term financial impact of choosing a Modped student loan differs significantly from alternative funding sources. For example, relying on savings or family contributions avoids accruing debt and its associated interest. Scholarships and grants, while often limited in availability, provide tuition assistance without repayment obligations. Part-time employment during studies can reduce the need for borrowing, minimizing long-term financial commitments. Conversely, while a Modped loan facilitates immediate access to education, the repayment schedule can extend for years, potentially delaying significant life milestones or impacting investment opportunities. The overall cost of education, including interest, needs to be carefully considered against the projected increase in future earnings resulting from the degree.

Visual Representation of Benefits and Risks

Imagine a balance scale. On one side, representing the benefits, we have images representing: a graduation cap (representing academic achievement), a rising graph (representing increased earning potential), and a relaxed smiling face (representing reduced financial stress during studies). On the other side, representing the risks, we have images depicting: a large stack of coins with a dollar sign (representing accumulating debt), a frowning face (representing financial stress post-graduation), and a downward-pointing graph (representing potential negative impact on credit score). The scale’s balance will depend on individual circumstances, loan terms, and ability to manage debt effectively. A well-informed decision involves carefully weighing the elements on both sides of the scale to make a balanced and responsible choice.

Government Regulations and Protections for Modped Student Loan Borrowers

Borrowing for education, even through less conventional avenues like Modped loans, is subject to a range of government regulations designed to protect borrowers from predatory lending practices and ensure fair treatment. These regulations vary depending on the country and specific loan program, but common themes revolve around transparency, responsible lending, and clear avenues for redress.

Government regulations aim to provide a safety net for student loan borrowers, ensuring they are not exploited by lenders. These regulations often dictate aspects of the loan agreement, including interest rates, fees, repayment terms, and the collection practices of the lender. They also establish clear processes for borrowers to resolve disputes and seek assistance if problems arise. This section will explore these regulations and the resulting protections afforded to Modped student loan borrowers.

Relevant Government Regulations

Specific regulations governing Modped loans will depend heavily on the jurisdiction where the loan is issued and the nature of the lending institution. However, several general areas of regulatory oversight are likely to apply. These might include laws pertaining to consumer credit protection, truth in lending acts, and regulations concerning debt collection practices. For instance, laws requiring clear disclosure of loan terms and fees would be crucial. Similarly, regulations limiting the interest rates charged and preventing unfair or deceptive practices are commonly in place. Finally, laws governing how lenders can collect on defaulted loans often dictate specific procedures to protect borrowers from harassment or abusive collection tactics. The exact specifics will need to be researched based on the individual loan and relevant jurisdiction.

Borrower Rights and Protections

Under these regulations, Modped student loan borrowers are typically afforded several key rights. These include the right to receive a clear and understandable loan agreement detailing all terms and conditions, including interest rates, fees, and repayment schedules. Borrowers also have the right to accurate information about their loan, including their balance, payment history, and any applicable fees. Importantly, borrowers have rights concerning how their debt is collected; lenders are typically prohibited from using abusive or harassing collection tactics. Finally, borrowers usually have the right to dispute errors or inaccuracies on their loan account and to seek redress through established channels.

Recourse for Borrowers Experiencing Issues

If a borrower experiences issues with their Modped loan provider, several avenues of recourse are typically available. These might include contacting the lender directly to attempt to resolve the issue informally. If this fails, borrowers can often escalate the matter to a consumer protection agency or regulatory body within their jurisdiction. In some cases, legal action may be necessary to protect their rights. Many jurisdictions offer free or low-cost legal assistance to consumers facing financial difficulties, which can be invaluable in navigating complex legal processes. Documentation of all communications with the lender is essential in these situations.

Examples of Scenarios Requiring Borrower Rights and Protections

Several scenarios might necessitate a borrower exercising their rights and protections. For example, if a lender fails to accurately reflect payments made by the borrower, leading to an inflated balance, the borrower can dispute the inaccuracy and demand correction. Another scenario might involve a lender employing harassing or abusive collection tactics, violating regulations protecting borrowers from such treatment. The borrower could then file a complaint with the relevant authorities. Finally, if the loan agreement contains terms that violate consumer protection laws, the borrower may be able to challenge the legality of those terms and seek redress. In all these scenarios, meticulous record-keeping is crucial for successful dispute resolution.

Impact of Modped Student Loans on Students’ Financial Well-being

Student loan debt, including that from Modped programs, significantly impacts a student’s financial well-being, extending far beyond graduation. The amount borrowed, interest rates, and repayment terms all play a crucial role in shaping a graduate’s financial future, influencing major life decisions and potentially hindering long-term financial stability. Understanding these potential impacts is essential for responsible borrowing and effective financial planning.

The weight of student loan debt can significantly alter post-graduation financial decisions. Graduates may postpone major purchases like a home or car, delay starting a family, or choose a lower-paying job with better work-life balance over a higher-paying, but more demanding, position. These choices, while often necessary to manage debt, can have lasting implications for career progression and overall financial security. For example, delaying homeownership could mean missing out on potential property value appreciation, while choosing a lower-paying job might limit long-term earning potential and retirement savings.

Post-Graduation Financial Decisions and Debt Management

Managing student loan debt effectively requires careful budgeting and financial planning. Creating a realistic budget that accounts for loan repayments alongside living expenses is crucial. This budget should prioritize essential expenses such as housing, food, and transportation, while allocating a portion of income towards loan repayment. Exploring different repayment plans offered by Modped, such as income-driven repayment options, can help tailor repayments to individual financial circumstances. Furthermore, actively monitoring loan balances and interest accrual ensures informed decision-making and proactive debt management. Consider using budgeting apps or seeking guidance from a financial advisor to develop a personalized financial plan.

Long-Term Financial Consequences of Default

Defaulting on a Modped student loan has severe long-term financial consequences. It can lead to damaged credit scores, making it difficult to secure loans, rent an apartment, or even obtain certain jobs. Wage garnishment, tax refund offset, and even legal action are potential outcomes. The accumulation of late fees and penalties can significantly increase the total debt owed, making repayment even more challenging. For instance, a default could lead to a significant reduction in credit score, making it challenging to secure a mortgage for a home purchase in the future. This could delay or prevent homeownership, impacting long-term wealth building.

Mitigating Negative Financial Impacts Through Responsible Borrowing

Responsible borrowing habits are crucial in mitigating the negative financial impacts of student loans. This includes borrowing only what is absolutely necessary for education, carefully comparing loan terms and interest rates from different lenders, including Modped, and creating a realistic repayment plan before taking out loans. Prioritizing academic success to maximize the return on investment of education and exploring scholarships and grants to reduce reliance on loans are also effective strategies. For example, meticulously researching the cost of education at different institutions and choosing a program that aligns with career goals can significantly reduce the overall loan amount needed. This proactive approach can lead to a more manageable debt burden post-graduation.

Final Thoughts

Securing a Modped student loan can be a significant step towards achieving higher education goals. However, careful consideration of the associated risks and benefits, alongside a thorough understanding of repayment options and legal protections, is essential for responsible financial management. By employing effective budgeting strategies and proactively addressing potential challenges, borrowers can navigate the complexities of student loan repayment and build a solid financial foundation for the future. Remember, informed decision-making is key to maximizing the positive impact of a Modped student loan while mitigating potential long-term financial burdens.

User Queries

What happens if I miss a Modped student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, impacting your future borrowing ability.

Can I refinance my Modped student loan?

Refinancing options may be available depending on your creditworthiness and the terms of your existing loan. Explore options with various lenders to compare rates and terms.

What types of income are considered when determining eligibility for a Modped student loan?

Eligibility criteria typically consider various income sources, including employment income, self-employment income, and possibly spousal income. Specific requirements vary depending on the loan program.

Are there any government programs that can help with Modped student loan repayment?

Depending on your country of residence and specific circumstances, various government programs may offer assistance with student loan repayment, such as income-driven repayment plans or loan forgiveness programs. Research relevant programs in your area.