Navigating the world of higher education financing can be daunting, especially for students lacking a cosigner for private loans. Securing funds for tuition, fees, and living expenses without a cosigner requires careful planning and a thorough understanding of lender requirements. This guide explores the landscape of private student loans designed specifically for students who don’t have access to a cosigner, outlining eligibility criteria, loan types, interest rates, repayment options, and potential risks.

Understanding the intricacies of cosigner-less student loans empowers students to make informed decisions about their financial future. We’ll delve into the specific factors lenders consider, comparing different loan options to help you find the best fit for your individual circumstances. The information presented aims to equip you with the knowledge necessary to navigate this complex process successfully.

Eligibility Criteria for Student Loans Without Cosigners

Securing a student loan without a cosigner can be challenging, but it’s achievable for students who meet specific criteria. Lenders assess applicants based on several factors, prioritizing those demonstrating a strong capacity to repay the loan. This often means a robust credit history and a sufficient income stream.

Lenders carefully evaluate several key aspects of an applicant’s financial profile to determine their eligibility for a cosigner-less student loan. The absence of a cosigner increases the risk for the lender, so they need greater assurance of repayment. This leads to more stringent requirements than loans with cosigners.

Credit History’s Impact on Loan Approval

A strong credit history is paramount for securing a student loan without a cosigner. Lenders use credit reports to gauge an applicant’s responsible borrowing behavior in the past. A higher credit score significantly improves the chances of approval, as it signals a lower risk of default. Conversely, a poor credit history or lack of credit history can lead to rejection or higher interest rates. Applicants with limited or no credit history may need to demonstrate other forms of financial responsibility, such as consistent income from employment. The specific credit score requirements vary between lenders.

Comparison of Eligibility Requirements Across Lenders

Different lenders have varying eligibility criteria for cosigner-less student loans. These differences reflect their individual risk assessments and target markets. Some lenders may focus on borrowers with strong credit profiles, while others might offer programs catering to those with less established credit. It’s crucial to compare offers from multiple lenders to find the most suitable option. This comparison should include factors like interest rates, repayment terms, and fees, in addition to eligibility requirements.

Eligibility Requirements Comparison Table

The following table provides a general comparison of eligibility requirements across different hypothetical lenders. Actual requirements may vary, so it’s essential to check directly with each lender for the most up-to-date information. These are examples and do not represent any specific lender.

| Lender | Minimum Credit Score | Minimum Annual Income | Maximum Debt-to-Income Ratio |

|---|---|---|---|

| Lender A | 700 | $25,000 | 40% |

| Lender B | 680 | $30,000 | 35% |

| Lender C | 650 | $20,000 | 45% |

| Lender D | 720 | $35,000 | 30% |

Types of Private Student Loans Without Cosigners

Securing a private student loan without a cosigner can be challenging, but several options exist catering to different financial situations and risk profiles. Understanding the distinctions between loan types is crucial for making an informed borrowing decision. This section Artikels the primary types of private student loans available without a cosigner, highlighting their respective advantages and disadvantages.

Private student loans without cosigners typically fall into two main categories: fixed-rate and variable-rate loans. The choice between these significantly impacts your monthly payments and overall loan cost.

Fixed-Rate Private Student Loans Without Cosigners

Fixed-rate loans offer predictable monthly payments throughout the loan term. The interest rate remains constant, providing borrowers with financial stability and allowing for easier budgeting. However, fixed-rate loans may come with slightly higher interest rates compared to variable-rate loans, particularly in a low-interest-rate environment. Several lenders, including Sallie Mae and Discover, offer fixed-rate private student loans without cosigners, though approval is contingent upon strong credit history and income.

The advantage of a predictable monthly payment is substantial for long-term financial planning. Knowing the exact amount due each month simplifies budgeting and reduces the risk of missed payments, which can negatively impact credit scores. However, if interest rates decline significantly after you’ve secured a fixed-rate loan, you might miss out on potential savings.

Variable-Rate Private Student Loans Without Cosigners

Variable-rate loans offer the potential for lower initial interest rates compared to fixed-rate loans. These rates fluctuate based on market indices, such as the prime rate or LIBOR. While this can lead to lower payments initially, it also introduces uncertainty. If market interest rates rise, your monthly payments could increase substantially, making budgeting more challenging. Lenders like Citizens Bank and PNC Bank sometimes offer variable-rate options, although their availability for cosigner-less borrowers is less common than fixed-rate loans.

The potential for lower initial payments is attractive, especially for borrowers with limited funds. However, the risk of unpredictable increases in monthly payments due to fluctuating interest rates can be significant. This uncertainty makes long-term financial planning more difficult and increases the risk of default if income doesn’t keep pace with rising payments.

Comparison of Fixed-Rate and Variable-Rate Private Student Loans

The following table summarizes key differences between fixed-rate and variable-rate private student loans without cosigners. Note that specific interest rates, repayment terms, and fees vary significantly depending on the lender, borrower’s creditworthiness, and market conditions. These are illustrative examples and should not be considered definitive offers.

| Feature | Fixed-Rate Loan (Example) | Variable-Rate Loan (Example) |

|---|---|---|

| Interest Rate | 7.5% (Illustrative Example from Sallie Mae) | 6.0% – 9.0% (Illustrative Range from Citizens Bank) |

| Repayment Terms | 5-15 years (Typical Range) | 5-15 years (Typical Range) |

| Fees | Origination fee (potential 1-3% of loan amount) | Origination fee (potential 1-3% of loan amount) |

Disclaimer: Interest rates and fees are subject to change. The examples provided are for illustrative purposes only and do not represent specific offers from any particular lender. Always check with individual lenders for the most up-to-date information.

Interest Rates and Fees for Cosigner-less Student Loans

Securing a private student loan without a cosigner can be challenging, as lenders perceive a higher risk. This increased risk directly impacts the interest rates and fees borrowers face. Understanding these financial implications is crucial for responsible borrowing. This section details the factors influencing interest rates, compares rates across lenders, and Artikels common associated fees.

Factors Influencing Interest Rates

Several factors contribute to the interest rate a lender offers on a private student loan without a cosigner. Credit history is paramount; a strong credit score typically translates to a lower interest rate. The loan amount also plays a significant role; larger loan amounts often command higher rates due to increased lender risk. The loan term (length of repayment) can influence rates; longer repayment periods might result in higher rates to compensate for the extended risk. Finally, the borrower’s educational background and intended field of study may also factor into the lender’s assessment of risk and, consequently, the interest rate. A student pursuing a high-demand field might receive a slightly more favorable rate than one in a less lucrative field, though this is not always the case.

Comparison of Interest Rates Across Lenders

Direct comparison of interest rates across various lenders for cosigner-less loans is difficult due to the dynamic nature of rates and the individual assessment of each borrower’s risk profile. However, a general observation is that interest rates for cosigner-less loans tend to be significantly higher than those with a cosigner. While some lenders may advertise competitive rates, the final rate offered to a specific borrower will depend on their individual circumstances. It’s crucial to shop around and compare offers from multiple lenders to find the most favorable terms. Remember that advertised rates are often “starting rates” and may not reflect the rate you qualify for.

Associated Fees

Private student loans without cosigners often involve several fees. Origination fees are common and are typically a percentage of the loan amount, deducted upfront. Prepayment penalties might be imposed if the borrower pays off the loan early, though these are becoming less common. Late payment fees are charged for missed or late payments, adding to the overall cost of the loan. Some lenders may also charge fees for specific services, such as application processing or account maintenance. It’s essential to carefully review the loan agreement to understand all associated fees before accepting the loan.

Interest Rate Ranges and Associated Fees

The following table provides illustrative examples of interest rate ranges and potential fees. These are hypothetical examples and actual rates and fees will vary significantly based on lender, borrower creditworthiness, and loan terms. Always check with individual lenders for their current offerings.

| Lender | Interest Rate Range (APR) | Origination Fee | Prepayment Penalty | Late Payment Fee |

|---|---|---|---|---|

| Lender A | 7.00% – 15.00% | 1.00% – 4.00% | None | $25 – $50 |

| Lender B | 8.00% – 17.00% | 0.50% – 3.00% | Variable | $30 |

| Lender C | 6.50% – 16.00% | 2.00% | None | $35 – $75 |

Repayment Options and Strategies

Securing a private student loan without a cosigner is a significant achievement, but responsible repayment is crucial. Understanding your repayment options and developing a robust repayment strategy are key to avoiding financial hardship and maintaining a healthy credit score. This section Artikels various repayment plans and offers practical advice for managing your debt effectively.

Private Student Loan Repayment Options

Several repayment plans are typically available for private student loans, each with its own advantages and disadvantages. The specific options offered will vary depending on your lender. Choosing the right plan depends on your individual financial circumstances and repayment goals. Common options include standard, graduated, and extended repayment plans. A standard repayment plan involves fixed monthly payments over a set period (typically 5-10 years). Graduated repayment plans start with lower monthly payments that gradually increase over time. Extended repayment plans spread payments over a longer period, resulting in lower monthly payments but higher overall interest paid. It’s important to carefully compare the total interest paid under each plan to make an informed decision.

Strategies for Managing Student Loan Debt Without a Cosigner

Managing student loan debt without a cosigner requires discipline and proactive financial planning. One key strategy is creating a realistic budget that prioritizes loan repayment. This involves tracking income and expenses meticulously to identify areas where you can reduce spending and allocate more funds towards loan payments. Another effective strategy is exploring options for income maximization, such as seeking a higher-paying job or taking on a part-time role. Additionally, consistently making on-time payments is crucial for maintaining a good credit score, which can be beneficial if you need to borrow money in the future. Finally, staying in regular communication with your lender can help you address any potential issues promptly and avoid delinquency.

Budgeting and Financial Planning for Repayment

Effective budgeting is fundamental to successful student loan repayment. Start by creating a detailed budget that Artikels your monthly income and expenses. Categorize your expenses to identify areas where you can cut back. Prioritize essential expenses like housing, food, and transportation, and then allocate as much as possible towards your student loan payments. Consider using budgeting apps or spreadsheets to track your spending and progress. Regularly review and adjust your budget as your income or expenses change. Building an emergency fund is also crucial; having savings to cover unexpected expenses prevents you from falling behind on your loan payments. Consider setting financial goals, such as becoming debt-free within a specific timeframe, to stay motivated and focused.

Sample Repayment Schedule (Standard Repayment)

Let’s illustrate a sample repayment schedule using a standard repayment plan. Assume a hypothetical loan amount of $30,000 with a fixed interest rate of 7% over a 10-year repayment period. Using a standard amortization calculator (widely available online), the monthly payment would be approximately $350. This would result in a total repayment of approximately $42,000, with the difference representing the accumulated interest.

| Month | Starting Balance | Payment | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $30,000.00 | $350.00 | $175.00 | $175.00 | $29,825.00 |

| 2 | $29,825.00 | $350.00 | $174.21 | $175.79 | $29,649.21 |

| … | … | … | … | … | … |

| 120 | $175.79 | $350.00 | $1.04 | $348.96 | $0.00 |

Note: This is a simplified example. Actual repayment schedules may vary depending on the lender and loan terms. Always consult your loan agreement for precise details.

Alternatives to Cosigner-less Student Loans

Securing a private student loan without a cosigner can be challenging. Fortunately, several alternative financing options exist to help students fund their education. These alternatives offer varying degrees of accessibility and financial benefits, and understanding their nuances is crucial for making informed decisions. Careful consideration of eligibility requirements, interest rates, and repayment terms is essential to choosing the best path for your individual circumstances.

Federal Student Loans

Federal student loans are a strong alternative to private loans, especially for students who struggle to qualify for private options without a cosigner. These loans are offered by the U.S. government and generally come with more favorable terms than private loans, including lower interest rates and flexible repayment options. Furthermore, federal loans often offer income-driven repayment plans and loan forgiveness programs, providing significant financial relief for borrowers facing hardship.

- Application Process: Students apply through the Free Application for Federal Student Aid (FAFSA) website. The process involves providing personal and financial information to determine eligibility.

- Eligibility Requirements: Eligibility is based on factors such as financial need, enrollment status, and citizenship. Specific requirements vary depending on the type of federal loan (e.g., subsidized vs. unsubsidized).

- Interest Rates and Repayment Terms: Interest rates are set by the government and are typically lower than those of private loans. Repayment terms are flexible, with various plans available to suit different financial situations.

Scholarships and Grants

Scholarships and grants represent non-repayable forms of financial aid, offering significant advantages over loans. They don’t require repayment, reducing the overall debt burden after graduation. Many scholarships and grants are merit-based, rewarding academic achievement, talent, or community involvement, while others are need-based, assisting students from low-income families.

- Application Process: The application process varies widely depending on the specific scholarship or grant. Some require essays, letters of recommendation, and transcripts, while others have simpler application forms.

- Eligibility Requirements: Eligibility criteria differ greatly. Some scholarships target specific demographics, majors, or extracurricular activities, while others have broader eligibility requirements.

- Interest Rates and Repayment Terms: Since scholarships and grants are not loans, there are no interest rates or repayment terms.

Work-Study Programs

Federal Work-Study programs provide part-time employment opportunities for students, allowing them to earn money to contribute towards their educational expenses. This option helps reduce reliance on loans and offers valuable work experience. The earnings can be used for tuition, fees, books, and living expenses.

- Application Process: Students apply through the FAFSA. The program’s availability and funding are dependent on the student’s financial need and the participating institution’s resources.

- Eligibility Requirements: Eligibility is determined by financial need as assessed through the FAFSA. Students must be enrolled at least half-time in an eligible program of study at a participating institution.

- Interest Rates and Repayment Terms: Work-study is not a loan; therefore, no interest rates or repayment terms apply. Earnings are received directly as wages.

Impact of Credit Scores and Building Credit

Securing a private student loan without a cosigner hinges significantly on your creditworthiness, primarily assessed through your credit score. Lenders view a strong credit score as an indicator of your ability to manage debt responsibly, making you a less risky borrower. A higher credit score often translates to more favorable loan terms, including lower interest rates and potentially higher loan amounts. Conversely, a poor or nonexistent credit history can severely limit your loan options or even lead to rejection.

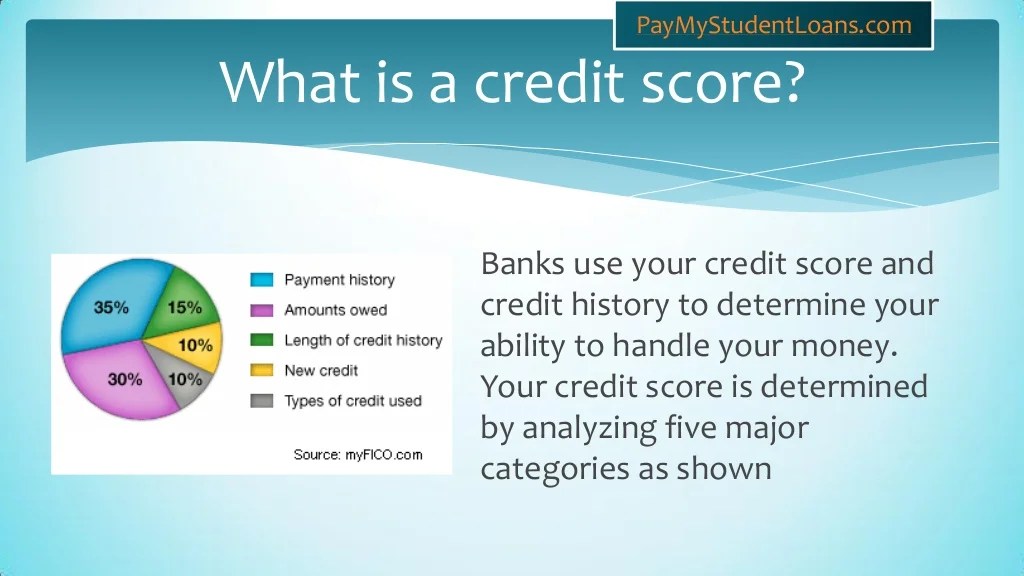

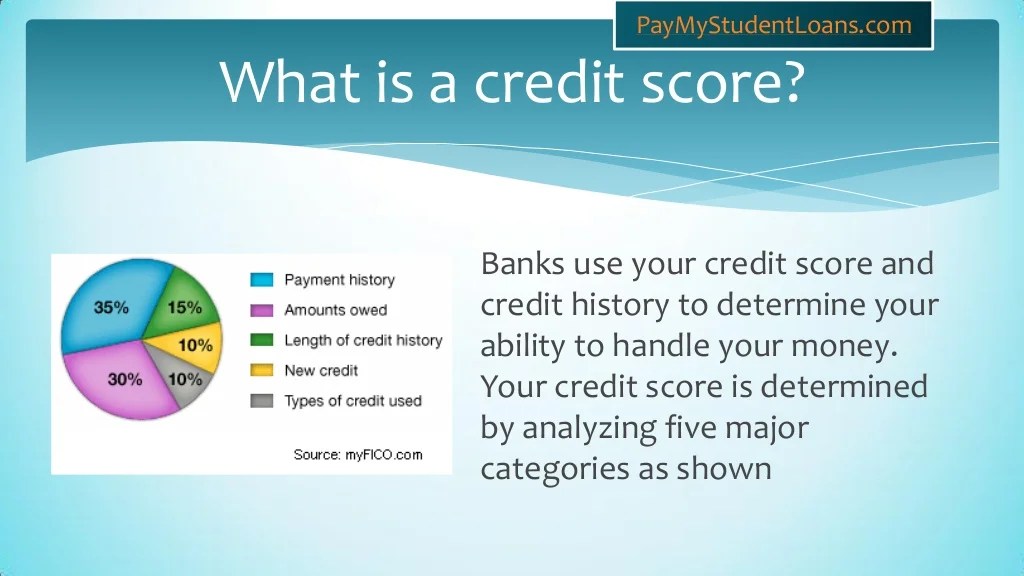

Your credit score is a numerical representation of your credit history, reflecting your past borrowing and repayment behavior. Lenders use various credit scoring models, with FICO and VantageScore being the most common. These models consider factors such as payment history, amounts owed, length of credit history, new credit, and credit mix. A higher score (generally above 670) indicates a lower risk to the lender, while a lower score suggests a higher risk. Understanding this scoring system is crucial for students seeking loans without a cosigner.

Credit Score Improvement Methods for Students

Improving your credit score requires proactive steps and consistent responsible financial behavior. Building a positive credit history takes time, but the effort pays off in the long run. Even small, consistent improvements can significantly impact your loan application. Focusing on timely payments and keeping credit utilization low are fundamental strategies.

Responsible Credit Management for Enhanced Loan Approval

Responsible credit management involves more than just making payments on time. It encompasses a holistic approach to borrowing and spending. This includes monitoring your credit reports regularly for errors, understanding your credit utilization ratio (the percentage of available credit you’re using), and avoiding excessive applications for new credit. Each credit application creates a hard inquiry on your credit report, which can temporarily lower your score. Therefore, it’s advisable to limit credit applications to only those truly needed. Responsible credit behavior demonstrates your financial maturity and significantly improves your chances of loan approval.

Steps to Build Credit History Before Applying for a Loan

Building a strong credit history before applying for a student loan is a strategic move that can significantly enhance your chances of approval and securing better terms. Here are key steps to take:

- Become an authorized user on a trusted individual’s credit card: This allows you to benefit from their positive payment history, provided they maintain a good credit record. The credit history is added to your credit report, contributing to the length of your credit history and potentially boosting your score.

- Obtain a secured credit card: These cards require a security deposit, which serves as your credit limit. Responsible use of a secured credit card demonstrates creditworthiness and helps establish a positive credit history.

- Pay all bills on time: Consistent on-time payments are the most significant factor influencing your credit score. Set up automatic payments to avoid missed deadlines.

- Keep credit utilization low: Aim to keep your credit utilization ratio below 30%. This shows lenders you are managing your debt effectively.

- Monitor your credit reports regularly: Check your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) annually for errors or fraudulent activity. Dispute any inaccuracies immediately.

Potential Risks and Considerations

Securing a private student loan without a cosigner can offer financial independence, but it also presents significant risks. Understanding these risks and implementing effective mitigation strategies is crucial for responsible borrowing and avoiding potential financial hardship. Careful consideration of loan terms, potential consequences of default, and proactive credit management are essential for navigating this path successfully.

Risks of Private Student Loans Without a Cosigner

Borrowing without a cosigner significantly increases the lender’s risk, leading to stricter eligibility requirements and potentially less favorable loan terms. Lenders will scrutinize your credit history, income, and debt-to-income ratio more intensely. A poor credit score or limited income could result in loan denial or higher interest rates. Furthermore, the absence of a cosigner means you bear the entire responsibility for repayment, increasing the financial burden if unexpected circumstances arise. For example, job loss or a medical emergency could make repayment challenging, potentially leading to delinquency and further damage to your credit score.

Understanding Loan Terms and Conditions

Before signing any loan agreement, thoroughly review all terms and conditions. Pay close attention to the interest rate (both fixed and variable), fees (origination fees, late payment fees, prepayment penalties), repayment schedule, and any potential penalties for default. Understanding these aspects allows for informed decision-making and helps you avoid unforeseen financial difficulties. For instance, a variable interest rate could increase significantly over the life of the loan, leading to a higher total repayment amount than initially anticipated. Similarly, overlooking prepayment penalties could discourage you from making extra payments to reduce the loan balance quicker.

Consequences of Defaulting on a Private Student Loan

Defaulting on a private student loan has severe consequences. Your credit score will suffer significantly, making it difficult to obtain future loans, credit cards, or even rent an apartment. Collection agencies may pursue aggressive debt collection methods, including wage garnishment or bank levy. Furthermore, defaulting on a private student loan does not typically offer the same federal protections as defaulting on a federal student loan, limiting options for rehabilitation or forgiveness. The negative impact on your credit report could last for seven years or more, severely hindering your financial prospects.

Risk, Consequence, and Mitigation Table

| Risk | Potential Consequences | Mitigation Strategies |

|---|---|---|

| Higher interest rates and fees due to lack of cosigner | Increased total loan cost; difficulty managing repayments | Shop around for the best rates and terms; explore loan refinancing options once credit improves; create a detailed repayment budget. |

| Loan denial due to insufficient credit history or income | Inability to finance education; potential impact on future career prospects | Build credit responsibly before applying; explore alternative funding options; improve income stability. |

| Difficulty managing repayments due to unforeseen circumstances (job loss, illness) | Default; damaged credit score; debt collection actions; potential legal repercussions | Create an emergency fund; explore income protection insurance; communicate with lender about potential hardship; consider income-driven repayment plans if available. |

| Overlooking crucial loan terms and conditions | Unforeseen costs; inability to meet repayment obligations; financial distress | Read the loan agreement carefully; ask clarifying questions; seek independent financial advice. |

Concluding Remarks

Securing a private student loan without a cosigner presents both opportunities and challenges. While it offers financial independence, it necessitates a strong understanding of your creditworthiness and a commitment to responsible repayment. By carefully evaluating your eligibility, comparing loan options, and implementing sound financial strategies, you can successfully manage your student loan debt and achieve your educational goals. Remember to thoroughly research lenders, understand the terms and conditions of any loan you consider, and prioritize responsible borrowing practices.

FAQ Overview

What is the minimum credit score typically required for a cosigner-less student loan?

Minimum credit scores vary widely among lenders, but generally, a score above 670 is often preferred. However, some lenders may consider applicants with lower scores, potentially with higher interest rates.

Can I refinance my cosigner-less student loan later?

Yes, refinancing is a possibility once you’ve established a better credit history and income. Refinancing might lower your interest rate and consolidate your debt.

What happens if I default on a cosigner-less student loan?

Defaulting can severely damage your credit score, impacting your ability to obtain loans or credit in the future. It can also lead to wage garnishment or legal action.

Are there any government programs to help students without cosigners?

While private loans require cosigners more often, federal student loans are generally available without one. Exploring federal loan options is always advisable before considering private loans.