Navigating the world of student loans can feel overwhelming, especially when trying to understand the intricacies of interest rates. This guide delves into PNC student loan rates, providing a clear and concise overview to help you make informed decisions about your education financing. We’ll explore various loan types, repayment plans, associated fees, and eligibility criteria, empowering you to confidently manage your student loan journey.

Understanding your options is key to successful financial planning. We’ll compare PNC’s offerings to those of other lenders, analyze the factors influencing interest rates, and offer practical strategies for managing your loans effectively. Whether you’re a prospective borrower or already managing a PNC student loan, this resource will equip you with the knowledge to navigate the process with ease.

PNC Student Loan Interest Rates Overview

PNC offers a range of student loan options, each with its own interest rate structure. Understanding these rates is crucial for borrowers to make informed decisions about their financing. This overview will detail the various interest rate types, compare them to competitors, and explore the factors influencing these rates.

Types of PNC Student Loan Interest Rates

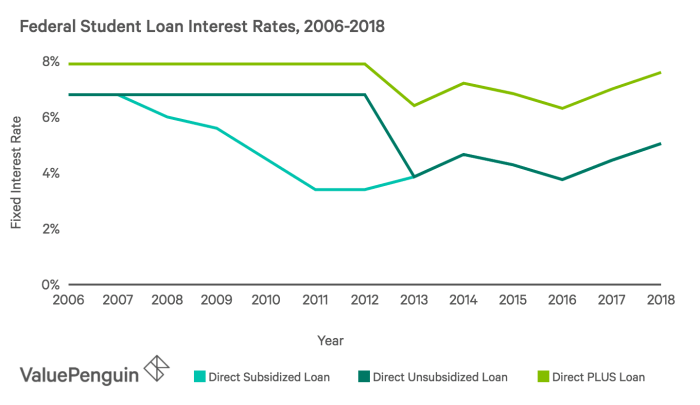

PNC’s student loan interest rates vary depending on the loan type (federal or private), the borrower’s creditworthiness, and the loan’s terms. Generally, private student loans tend to have higher interest rates than federal loans, reflecting the higher risk for the lender. Within private loans, rates can further fluctuate based on factors like the borrower’s credit history and co-signer involvement. PNC may offer fixed or variable interest rates for private loans, while federal loans typically have fixed rates. It’s important to note that specific rate information is subject to change and should be verified directly with PNC.

Comparison with Other Major Lenders

Direct comparison of PNC’s student loan interest rates with other major lenders requires accessing current rate information from each lender. This information is dynamic and changes frequently based on market conditions and lender policies. Generally, a borrower should compare offers from several lenders to identify the most competitive rates based on their individual circumstances. Factors like credit score, loan amount, and loan term all play a role in the final interest rate offered by any lender, making direct comparisons complex.

Factors Influencing PNC Student Loan Interest Rates

Several key factors determine the interest rate a borrower receives from PNC. A strong credit score is usually associated with lower interest rates, as it indicates lower risk to the lender. The type of loan (federal vs. private) significantly impacts the rate, with federal loans typically offering lower rates due to government backing. The loan term also plays a role; longer repayment periods may result in slightly higher interest rates. Finally, the presence of a co-signer with a good credit history can help secure a lower interest rate for the borrower.

Fixed vs. Variable Interest Rates

The following table compares fixed and variable interest rates offered by PNC (Note: These are illustrative examples and may not reflect current rates. Contact PNC for the most up-to-date information).

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Rate Type | Stays the same for the life of the loan | Fluctuates based on market index |

| Predictability | Highly predictable monthly payments | Monthly payments may change |

| Risk | Lower risk of unexpectedly higher payments | Higher risk of unexpectedly higher payments |

| Example Rate (Illustrative) | 7.00% | 5.50% – 8.00% (Index + Margin) |

Understanding PNC Student Loan Repayment Plans

Choosing the right repayment plan is crucial for managing your PNC student loans effectively. Different plans offer varying levels of flexibility and potential long-term cost savings, depending on your individual financial circumstances. Understanding the options available will empower you to make informed decisions that align with your budget and repayment goals.

PNC offers a range of repayment plans to accommodate diverse borrower needs and financial situations. The selection process should involve careful consideration of your current income, future earning potential, and overall financial goals. Failing to choose a suitable plan could lead to unnecessary stress and potentially higher overall loan costs.

Standard Repayment Plan

The Standard Repayment Plan is a fixed monthly payment plan spread over a 10-year period. This option provides a predictable payment schedule and is often the quickest route to paying off your loans. However, monthly payments may be higher than other options.

For example, a $30,000 loan at a 6% interest rate would result in an approximate monthly payment of $330.10. This is just an example, and actual payments may vary based on the loan amount, interest rate, and loan terms.

Extended Repayment Plan

The Extended Repayment Plan offers longer repayment terms, typically up to 25 years. This results in lower monthly payments compared to the Standard Repayment Plan. However, it’s important to note that you will pay significantly more in interest over the life of the loan.

Using the same $30,000 loan example at 6% interest, extending the repayment period to 25 years could lower the monthly payment to approximately $180, but the total interest paid would be substantially higher.

Income-Driven Repayment Plans

Income-driven repayment plans tie your monthly payment to your income and family size. These plans are designed to make student loan repayment more manageable, especially during periods of lower income. However, they typically extend the repayment period, leading to higher total interest paid over the life of the loan. Specific plans may include the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans.

Example: A borrower with an annual income of $40,000 and a $30,000 loan might see a significantly reduced monthly payment under an income-driven plan, potentially as low as $150, depending on the specific plan and other factors. However, this lower payment will extend the repayment period and increase the total interest paid over time. It is crucial to carefully review the terms and conditions of each plan to understand the long-term implications.

Deferment and Forbearance

Deferment and forbearance offer temporary pauses in your loan payments. Deferment is typically available under specific circumstances, such as returning to school or experiencing unemployment. Forbearance allows for a temporary suspension of payments due to financial hardship. Neither option eliminates interest; interest continues to accrue during both deferment and forbearance periods, potentially increasing your total loan balance.

PNC Student Loan Fees and Charges

Understanding the fees associated with your PNC student loan is crucial for accurate budgeting and financial planning. While PNC strives for transparency, it’s important to carefully review your loan documents to understand the specific fees that apply to your individual loan. These fees can significantly impact the total cost of your education, so awareness is key.

It’s important to note that PNC’s fee structure may change, so always refer to the most current information available on their website or loan documents. This information is for general understanding and shouldn’t be considered exhaustive or a substitute for official PNC documentation.

Late Payment Fees

Late payment fees are charged when a payment is not received by the due date. The amount of the late fee can vary depending on the loan agreement and the lender’s policies. These fees add to the principal balance of the loan, increasing the total amount you owe. For example, a consistent pattern of late payments could significantly increase the overall cost of your loan over its lifespan. Paying on time is crucial to avoid these added expenses.

Returned Payment Fees

Returned payment fees are applied when a payment is returned due to insufficient funds or incorrect account information. This fee adds to the total cost of borrowing and is usually a flat fee, but the exact amount is determined by PNC’s policies. To avoid these fees, ensure sufficient funds are available in your account and that the account information provided is accurate.

Other Potential Fees

While late payment and returned payment fees are the most common, there might be other less frequent fees depending on your specific loan agreement. These could include fees associated with loan consolidation, deferment requests, or other administrative actions. It’s advisable to review your loan documents thoroughly to understand all potential fees.

Summary of Potential Fees

Understanding the potential impact of these fees is crucial for responsible financial planning. The following list summarizes the potential fees associated with PNC student loans:

- Late Payment Fee: Charged when a payment is received after the due date. The amount varies depending on the loan agreement.

- Returned Payment Fee: Charged when a payment is returned due to insufficient funds or incorrect account information. The amount is typically a flat fee.

- Other Potential Fees: These could include fees for loan consolidation, deferment requests, or other administrative actions. Review your loan documents for specifics.

Impact on Overall Loan Cost

These fees, though seemingly small individually, can accumulate over the life of the loan, significantly increasing the total amount repaid. For instance, repeated late payment fees could add hundreds or even thousands of dollars to the final cost of your education. Careful budgeting and timely payments are essential to minimize the impact of these fees and keep your overall loan costs as low as possible.

Eligibility Criteria for PNC Student Loans

Securing a PNC student loan involves meeting specific eligibility requirements. These criteria ensure responsible lending and help determine an applicant’s ability to repay the loan. Understanding these requirements is crucial for a successful application.

Required Documentation for PNC Student Loan Application

Applicants must provide comprehensive documentation to support their application. This documentation verifies their identity, academic enrollment, and financial standing. Incomplete applications will likely be delayed or rejected. Generally, you will need to provide proof of enrollment, such as an acceptance letter or enrollment verification form from your chosen school. You’ll also need to provide personal identification, such as a driver’s license or passport. Finally, financial documentation, such as tax returns or bank statements, may be requested to assess your financial capacity.

Credit History Requirements for PNC Student Loan Approval

While PNC offers various student loan options, some may require a credit check. The specific credit requirements vary depending on the loan type and the applicant’s co-signer status. A strong credit history generally improves the chances of loan approval and may result in more favorable interest rates. For applicants with limited or poor credit history, having a co-signer with good credit can significantly increase the likelihood of approval. The credit check assesses the applicant’s creditworthiness and repayment ability.

Step-by-Step Guide to the PNC Student Loan Application Process

The application process for a PNC student loan generally follows a structured sequence. First, you will need to gather all the necessary documentation mentioned previously. Second, you will complete the online application form, providing accurate and complete information. Third, PNC will review your application, including your credit history (if applicable) and provided documentation. Fourth, if approved, you will receive a loan offer outlining the terms and conditions. Finally, you will need to accept the loan offer and complete any required paperwork to finalize the loan disbursement. Throughout this process, contacting PNC’s customer service for clarification or assistance is advisable.

Managing Your PNC Student Loans

Effective management of your PNC student loans is crucial for minimizing stress and ensuring timely repayment. This involves understanding your loan details, utilizing available online tools, and establishing a consistent payment strategy. Proactive management can significantly impact your financial well-being and credit score.

Accessing Your PNC Student Loan Account Information Online

Accessing your account online provides convenient and immediate access to your loan details. Through PNC’s online banking platform or dedicated student loan portal, you can view your loan balance, payment history, interest rate, and upcoming payment due dates. Registration typically involves providing your loan number and creating a secure online profile. The online portal often features tools to help you track your progress and plan for future payments. Remember to always use a secure internet connection and protect your login credentials.

Making Payments and Managing Your Account

PNC offers several convenient options for making student loan payments. You can make payments online through the PNC website or mobile app, by phone, by mail, or through automatic debit. Online payments are generally the most efficient and trackable method. Automatic debit ensures timely payments and avoids late fees. When making payments by mail, ensure you include your loan number and account information. For any payment method, always keep records of your transactions. Regularly reviewing your account online allows you to monitor your progress, identify any discrepancies, and address issues promptly.

Strategies for Effective Student Loan Management

Effective student loan management involves proactive planning and consistent effort. Creating a realistic budget that incorporates your loan payments is a crucial first step. Consider exploring different repayment plans offered by PNC to find one that aligns with your financial situation. Budgeting tools and financial planning resources can assist in creating and maintaining a manageable repayment schedule. Furthermore, staying informed about any changes in interest rates or repayment terms is vital. By proactively managing your loans, you can reduce stress and improve your long-term financial health.

PNC Student Loan Account Management Flowchart

The following describes a flowchart illustrating the steps involved in managing a PNC student loan account. Imagine a flowchart with distinct boxes and arrows connecting them.

* Start: The process begins with the borrower needing to access or manage their PNC student loan account.

* Login: The borrower logs into their PNC online banking account or the dedicated student loan portal using their credentials.

* View Account Information: The borrower accesses their loan details, including balance, payment history, interest rate, and due dates.

* Make Payment: The borrower chooses a payment method (online, phone, mail, or automatic debit) and submits their payment.

* Payment Confirmation: The system confirms the payment and updates the account balance.

* Monitor Account: The borrower regularly reviews their account activity and ensures payments are made on time.

* Contact Support (Optional): If the borrower encounters any issues or needs assistance, they can contact PNC customer support.

* End: The process concludes with the borrower successfully managing their student loan account.

PNC Student Loan Refinancing Options

Refinancing your PNC student loans might be a strategic move to potentially lower your monthly payments or reduce the overall interest you pay. However, it’s crucial to carefully weigh the potential benefits against the risks before making a decision. This section explores the process, advantages, and disadvantages of refinancing your PNC student loans.

Refinancing involves replacing your existing student loan with a new loan from a different lender, often at a lower interest rate. This can lead to significant savings over the life of the loan. However, refinancing might not always be the best option, depending on your individual financial situation and the terms of the new loan.

Benefits of Refinancing PNC Student Loans

Refinancing can offer several advantages. A lower interest rate is the most significant benefit, leading to lower monthly payments and reduced total interest paid over the loan’s lifespan. For example, someone with a $50,000 loan at 7% interest could save thousands of dollars by refinancing to a 4% rate. Additionally, refinancing can simplify loan management by consolidating multiple loans into a single payment, making budgeting easier. Some refinancing options also allow for the choice of a shorter repayment term, enabling faster debt payoff.

Risks of Refinancing PNC Student Loans

While refinancing offers potential benefits, there are also risks to consider. One major risk is losing access to federal student loan benefits, such as income-driven repayment plans or loan forgiveness programs. Refinancing typically converts federal loans into private loans, which often lack these protections. Another risk is the potential for higher interest rates if your credit score has worsened since you originally took out your loans. Finally, the application process itself can be time-consuming and may require a credit check, potentially impacting your credit score temporarily.

Scenarios Where Refinancing Might Be Beneficial

Refinancing can be particularly beneficial in certain situations. For instance, borrowers with excellent credit scores and high incomes may qualify for significantly lower interest rates, resulting in substantial savings. Borrowers with multiple student loans may find it advantageous to consolidate their debt into a single, more manageable payment. Individuals facing job changes or other life events that might temporarily impact their ability to make payments may consider refinancing to secure a lower monthly payment.

Comparison of Original Loan Terms and Refinancing Options

| Feature | Original PNC Student Loan | Potential Refinancing Option |

|---|---|---|

| Interest Rate | Variable or Fixed (depending on original loan terms) – Example: 6% | Fixed or Variable – Example: 4% |

| Loan Term (Years) | 10-20 years (depending on original loan terms) | 5-15 years (depending on lender and creditworthiness) |

| Monthly Payment | Calculated based on interest rate and loan term – Example: $500 | Lower if interest rate is lower – Example: $400 |

| Loan Forgiveness Programs | Potentially eligible if federal loan | Generally not eligible if private loan |

Illustrative Examples of Loan Scenarios

Understanding different loan scenarios helps prospective borrowers make informed decisions. The following examples illustrate the impact of interest rates, loan terms, and repayment plans on the overall cost of a student loan. These are simplified examples and actual loan terms may vary.

Fixed Interest Rate Loan Scenario

This example details a hypothetical student loan with a fixed interest rate. A student borrows $20,000 at a fixed annual interest rate of 5% over a 10-year repayment period. Using a standard amortization calculator (readily available online), the monthly payment would be approximately $212.47. Over the 10-year loan term, the total interest paid would be approximately $5,496.40. This means the total repayment amount would be $25,496.40. The calculation uses a standard amortization formula which distributes payments across the loan term to cover both principal and interest.

Variable Interest Rate Loan Scenario

Variable interest rate loans present a different dynamic. Let’s assume a student borrows the same $20,000 but with a variable interest rate that starts at 4% and increases to 6% after three years due to market fluctuations. The initial monthly payment would be lower than the fixed-rate example, but it would increase significantly after the rate adjustment. Precise calculations would require knowing the exact interest rate changes and their timing. However, it is crucial to understand that fluctuating interest rates introduce uncertainty into the monthly payment amount, potentially making budgeting more challenging. The total interest paid would likely be higher than in the fixed-rate scenario, though the precise amount is dependent on the variable rate’s behavior.

Income-Driven Repayment Plan Scenario

Income-driven repayment plans adjust monthly payments based on the borrower’s income. Imagine a student with a $20,000 loan and an initial annual income of $30,000. Under an income-driven plan, their initial monthly payment might be significantly lower than in the fixed-rate example, perhaps around $150. However, if their income increases to $60,000 five years later, their monthly payment would also increase, reflecting the higher earning capacity. The exact payment amount at each income level depends on the specific income-driven repayment plan selected (e.g., ICR, PAYE, REPAYE) and the associated formulas used to calculate payments. The total repayment time may be longer than a standard 10-year plan, potentially resulting in higher total interest paid over the life of the loan, although this is often offset by the lower initial payments during periods of lower income.

End of Discussion

Securing your financial future after graduation requires careful planning and understanding of your student loan options. By understanding PNC’s student loan rates, repayment plans, and associated fees, you can make informed decisions that align with your financial goals. Remember to utilize available resources, such as online account access and repayment plan options, to manage your loans effectively and minimize long-term costs. Proactive management now can lead to a more secure and stable financial future.

Q&A

What credit score is needed for a PNC student loan?

While PNC doesn’t publicly state a minimum credit score, a higher score generally leads to more favorable interest rates. Good credit history is beneficial.

Can I refinance my PNC student loan with another lender?

Yes, you can refinance your PNC student loan with another lender. This might offer lower interest rates or different repayment options, but carefully compare offers before refinancing.

What happens if I miss a payment on my PNC student loan?

Missing payments can negatively impact your credit score and may result in late fees. Contact PNC immediately if you anticipate difficulty making a payment to explore options.

Does PNC offer any student loan forgiveness programs?

PNC itself doesn’t offer loan forgiveness programs. Eligibility for government programs like Public Service Loan Forgiveness depends on the type of loan and your employment.