Navigating the world of higher education funding can feel overwhelming, especially when considering private student loans. Unlike federal loans backed by the government, private student loans are offered by banks, credit unions, and other financial institutions. Understanding the nuances of private student loans—their eligibility requirements, interest rates, repayment options, and potential risks—is crucial for making informed decisions about financing your education. This guide provides a clear and concise overview to help you navigate this complex landscape.

This exploration delves into the core characteristics of private student loans, highlighting key distinctions from their federal counterparts. We’ll examine the application process, interest rate calculations, and various repayment plans. Furthermore, we’ll discuss the potential risks and benefits, offering a balanced perspective to help you determine if a private student loan is the right choice for your financial situation. We’ll also explore alternative funding options to provide a holistic view of financing your education.

Defining Private Student Loans

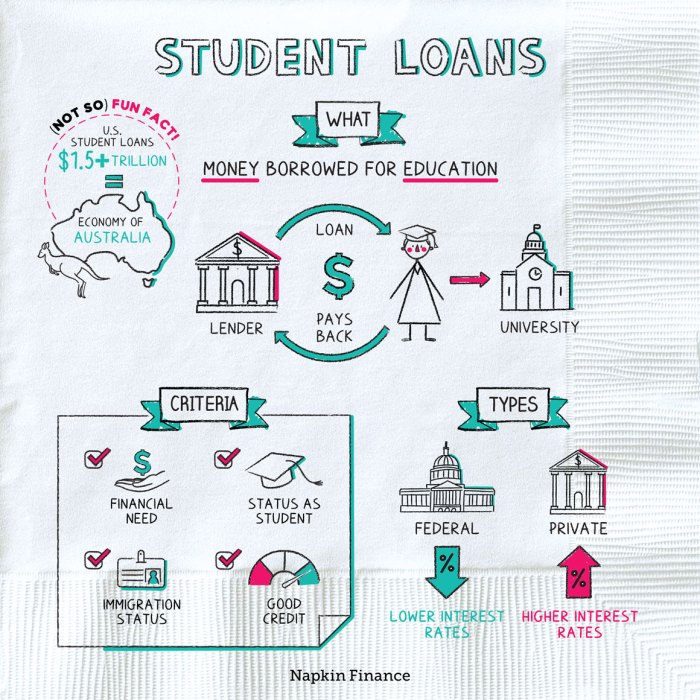

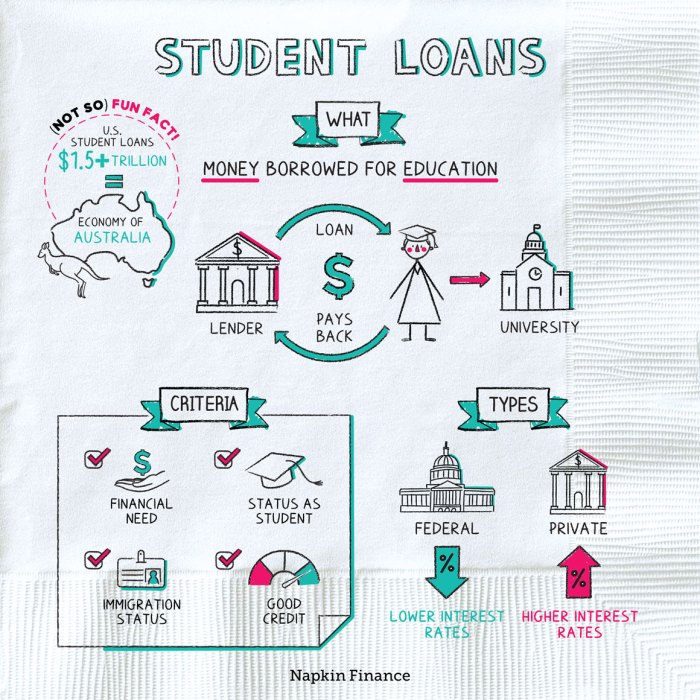

Private student loans are loans offered by private lenders, such as banks and credit unions, to help students finance their education. Unlike federal student loans, they are not backed by the government. This means the terms and conditions, including interest rates and repayment options, can vary significantly between lenders. Understanding the key differences between private and federal loans is crucial for making informed borrowing decisions.

Key Differences Between Private and Federal Student Loans

Federal student loans and private student loans differ significantly in several aspects. Federal loans generally offer more borrower protections and benefits, while private loans often have stricter eligibility requirements and less favorable terms. A key distinction lies in the availability of government-backed benefits such as income-driven repayment plans and loan forgiveness programs.

Comparison of Private and Federal Student Loans

The following table highlights the key advantages and disadvantages of private student loans compared to federal student loans.

| Loan Type | Interest Rates | Repayment Options | Eligibility Requirements | Loan Forgiveness Programs |

|---|---|---|---|---|

| Private Student Loan | Variable or fixed; generally higher than federal loans; can change over time. | Typically standard repayment plans; fewer options compared to federal loans; may include options like deferment or forbearance but with lender-specific criteria. | Credit history and co-signer often required; income verification may be necessary; strong creditworthiness usually needed. | Limited or no loan forgiveness programs available; exceptions may exist depending on specific lender programs, but generally less accessible than federal loan forgiveness options. |

| Federal Student Loan | Fixed; generally lower than private loans; set by the government. | Variety of repayment plans available, including income-driven repayment (IDR) plans; deferment and forbearance options generally more readily available. | Based on financial need and enrollment status; generally easier to qualify for than private loans. | Various loan forgiveness programs available depending on loan type and employment (e.g., Public Service Loan Forgiveness). |

Types of Private Student Loans

Private student loans are categorized based on the student’s educational level and the borrower’s relationship to the student. Common types include undergraduate loans, graduate loans, and parent loans. Undergraduate loans are for students pursuing a bachelor’s degree, graduate loans are for students in master’s, doctoral, or professional programs, and parent loans allow parents to borrow on behalf of their children. The specific terms and conditions for each type of loan can vary depending on the lender. For instance, graduate loans may require a higher credit score or co-signer due to the typically higher loan amounts involved. Parent loans often have eligibility criteria centered around the parent’s creditworthiness, as they are responsible for repayment.

Eligibility and Application Process

Securing a private student loan involves navigating specific eligibility requirements and a detailed application process. Understanding these aspects is crucial for prospective borrowers to successfully obtain the funding they need for their education. This section will Artikel the typical criteria lenders consider, the steps involved in the application, and the necessary documentation.

Private student loan eligibility hinges on several key factors. Lenders assess applicants based on creditworthiness, income, and the intended educational program. Generally, a higher credit score improves your chances of approval and can lead to more favorable interest rates. A stable income, demonstrating the ability to repay the loan, is also essential. Finally, the type of degree program and the institution’s accreditation can influence a lender’s decision. Some lenders may prioritize applicants pursuing specific high-demand fields, while others may have stricter requirements for non-accredited institutions.

Eligibility Criteria for Private Student Loans

While specific requirements vary among lenders, common eligibility criteria include a minimum credit score (often above 670), a demonstrable income stream sufficient to handle loan repayments, enrollment in an eligible degree program at an accredited institution, and a co-signer (often required for applicants with limited or no credit history). Some lenders may also consider factors such as debt-to-income ratio and the length of your credit history. Meeting these criteria significantly increases the likelihood of loan approval.

Application Steps for Private Student Loans

The application process for private student loans typically involves several key steps. These steps may vary slightly depending on the lender, but the overall process remains fairly consistent. It is important to carefully review each lender’s specific requirements before beginning the application process.

- Pre-qualification: Many lenders offer a pre-qualification process that allows you to check your eligibility without impacting your credit score. This step provides an estimate of how much you might be able to borrow and the potential interest rates.

- Application Submission: Once you’ve chosen a lender and understand the terms, you’ll need to complete a formal application. This typically involves providing personal information, educational details, and financial information.

- Documentation Submission: Supporting documentation is crucial at this stage. This might include tax returns, pay stubs, proof of enrollment, and possibly a co-signer’s financial information.

- Credit Check: The lender will perform a credit check to assess your creditworthiness. This is a standard part of the loan approval process.

- Loan Approval/Denial: Based on your application and credit check, the lender will either approve or deny your loan application. If approved, you’ll receive a loan offer outlining the terms and conditions.

- Loan Disbursement: Once you accept the loan offer, the funds will be disbursed according to the terms agreed upon, often directly to the educational institution.

Required Documentation for Private Student Loan Applications

Gathering the necessary documentation is a vital step in the application process. Failing to provide complete and accurate documentation can delay or even prevent loan approval. It’s best to organize these documents well in advance to streamline the process.

- Proof of Identity: Government-issued identification, such as a driver’s license or passport.

- Social Security Number (SSN): Required for verification and credit checks.

- Proof of Enrollment: Acceptance letter or enrollment confirmation from your educational institution.

- Financial Aid Award Letter (if applicable): Shows any federal or institutional aid you’ve received.

- Tax Returns (or W-2s): To verify income and financial stability.

- Pay Stubs (if applicable): Demonstrates current income.

- Bank Statements: Provides insight into your financial activity.

- Co-signer Information (if required): Similar documentation as above, but for your co-signer.

Interest Rates and Repayment

Understanding the interest rates and repayment options for private student loans is crucial for responsible borrowing and financial planning. These loans, unlike federal loans, vary significantly in terms of interest rates and repayment structures, impacting the overall cost and repayment timeline. Careful consideration of these factors is essential before committing to a private student loan.

Several factors influence the interest rate you’ll receive on a private student loan. Your creditworthiness plays a significant role; a higher credit score typically translates to a lower interest rate. The loan amount, the loan term (length of repayment), and the type of loan (fixed or variable rate) also affect the interest rate. Additionally, the lender’s current lending environment and market conditions influence interest rates. Co-signers, individuals who agree to repay the loan if you cannot, can also impact the interest rate, potentially securing a lower rate for the borrower.

Fixed Versus Variable Interest Rates

Private student loans typically offer either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, making budgeting and repayment planning easier. A variable interest rate fluctuates based on market indexes, potentially leading to lower initial payments but also increased payments if the index rises. Choosing between fixed and variable rates depends on individual risk tolerance and financial forecasting abilities. Individuals who prefer predictable payments generally opt for fixed rates, while those who anticipate lower rates in the future might consider variable rates, acknowledging the inherent risk of rate increases.

Repayment Plans and Scenarios

Understanding different repayment plans is vital for managing your private student loan debt effectively. Common options include standard repayment (fixed monthly payments over a set period), extended repayment (longer repayment term, leading to lower monthly payments but higher total interest paid), and graduated repayment (payments increase over time). The choice of repayment plan significantly affects the total interest paid and the overall repayment timeline.

Let’s consider some repayment scenarios:

- Scenario 1: $20,000 loan at 6% fixed interest, standard 10-year repayment. Monthly payment would be approximately $222. Total interest paid would be approximately $6,650.

- Scenario 2: $20,000 loan at 8% variable interest (starting at 7%, potentially increasing to 9%), standard 10-year repayment. The initial monthly payment would be approximately $244 (based on 7% interest), but could increase if the interest rate rises. Total interest paid would depend on interest rate fluctuations throughout the repayment period.

- Scenario 3: $30,000 loan at 7% fixed interest, extended 15-year repayment. Monthly payments would be approximately $260. Total interest paid would be significantly higher than Scenario 1 due to the longer repayment period.

Calculating Monthly Payments

The exact calculation of monthly payments involves several factors and is usually handled by the lender’s loan calculator. However, the basic formula involves the loan amount (P), the annual interest rate (r), and the number of months in the loan term (n). A common formula used is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where: M = Monthly Payment; P = Principal Loan Amount; i = Monthly Interest Rate (Annual Interest Rate / 12); n = Number of Months in Loan Term.

Using online loan calculators, borrowers can input their loan details to determine their monthly payment amount under different scenarios. This allows for a comparative analysis of repayment plans and helps in making informed decisions. It’s important to remember that these calculations are estimations, and the actual payments might slightly vary based on the lender’s specific calculation methods.

Risks and Considerations

Private student loans, while offering access to funds for higher education, come with inherent risks that borrowers must carefully consider before signing on the dotted line. Understanding these risks and weighing them against your financial situation is crucial to making an informed decision. Failure to do so can lead to significant financial hardship down the line.

Private student loans differ significantly from federal student loans in terms of protections and repayment options. This difference underscores the need for thorough research and a realistic assessment of your ability to manage the repayment obligations. It’s essential to remember that these loans are contracts, and failure to adhere to the terms can have serious consequences.

High Interest Rates and Lack of Government Protections

Unlike federal student loans, private student loans typically carry higher interest rates. These rates can fluctuate based on market conditions and your creditworthiness, potentially leading to a substantially larger total repayment amount than the initial loan principal. Furthermore, private student loans lack the same borrower protections as federal loans. For instance, there are no income-driven repayment plans or loan forgiveness programs generally available. This means that if you experience financial hardship, your options for managing your debt may be more limited. Defaulting on a private student loan can severely damage your credit score, making it difficult to obtain future loans or even rent an apartment.

Understanding Loan Terms and Conditions

Before accepting a private student loan, meticulously review the loan agreement. Pay close attention to the interest rate (both fixed and variable options), repayment terms, fees (origination fees, late payment fees, etc.), and any prepayment penalties. Understanding these terms will allow you to accurately project your total repayment costs and ensure that the loan aligns with your financial capabilities. Consider seeking independent financial advice to help you interpret the often complex loan documentation. Don’t hesitate to ask questions; if something is unclear, seek clarification from the lender.

Checklist for Considering a Private Student Loan

Before taking out a private student loan, it is imperative to conduct a thorough assessment of your financial situation and the loan terms. The following checklist can assist in this process:

- Have you exhausted all federal student loan options?

- Have you explored scholarships and grants?

- Have you compared interest rates and terms from multiple lenders?

- Can you comfortably afford the monthly payments, considering your current and anticipated income?

- Have you considered the potential impact on your credit score?

- Do you understand all the terms and conditions of the loan agreement?

- Have you factored in potential fees and charges?

- Have you developed a realistic repayment plan?

- Have you considered the implications of defaulting on the loan?

- Have you sought independent financial advice?

Suitable and Unsuitable Situations for Private Student Loans

It’s crucial to understand when a private student loan might be a viable option and when it might be best avoided.

- Suitable Situations:

- You’ve maximized federal student loan eligibility and still have a funding gap.

- You have excellent credit and can secure a favorable interest rate.

- You have a clear plan for repayment and a stable income source.

- Unsuitable Situations:

- You have poor credit and anticipate high interest rates.

- You lack a stable income or have significant financial obligations.

- You haven’t fully explored alternative funding sources, such as scholarships or grants.

- You don’t fully understand the loan terms and conditions.

Alternatives to Private Student Loans

Securing funding for higher education can be a significant challenge. While private student loans offer a potential solution, they often come with high interest rates and stringent repayment terms. Fortunately, several alternative funding options exist that may be more advantageous. Exploring these alternatives can help students and their families make informed decisions about financing their education.

Before committing to a private loan, thoroughly investigate other funding avenues. These alternatives can significantly reduce reliance on private loans, potentially saving you considerable money in the long run. A multifaceted approach, combining several funding sources, is often the most effective strategy.

Federal Student Loans

Federal student loans are a significantly different option compared to private loans. They offer several key advantages, including lower interest rates, flexible repayment plans, and robust borrower protections. Understanding the differences between these two loan types is crucial for making informed financial decisions.

| Loan Type | Interest Rate | Repayment Options | Default Consequences |

|---|---|---|---|

| Federal Student Loan | Generally lower than private loans; rates vary depending on the loan type and year. Often subsidized (interest may not accrue during certain periods). | Various income-driven repayment plans, extended repayment periods, deferment, and forbearance options available. | Negative impact on credit score, wage garnishment, tax refund offset, difficulty obtaining future federal loans. However, federal loan programs often offer rehabilitation and consolidation options. |

| Private Student Loan | Typically higher than federal loans, varying significantly depending on creditworthiness and market conditions. | Repayment options are usually less flexible than federal loans, with fewer opportunities for deferment or forbearance. | Severe negative impact on credit score, potential legal action by the lender, difficulty obtaining future loans (both private and federal). Limited options for rehabilitation. |

Alternative Funding Sources

Exploring diverse funding sources can significantly reduce the need for private student loans. Prioritizing these options before considering private loans is a financially responsible approach.

Several avenues can help alleviate the financial burden of higher education. These resources can provide significant financial assistance, often without the need for repayment.

- Scholarships: Merit-based or need-based awards from colleges, universities, foundations, and private organizations. These funds typically do not require repayment.

- Grants: Need-based financial aid provided by federal, state, or institutional programs. Similar to scholarships, these do not require repayment.

- Work-Study Programs: Part-time employment opportunities offered by colleges and universities to help students earn money to contribute towards their education expenses.

- Savings and Investments: Utilizing personal savings, family contributions, or investment accounts to cover educational costs.

- 529 Plans: Tax-advantaged savings plans specifically designed for educational expenses. Contributions grow tax-deferred, and withdrawals for qualified education expenses are tax-free.

Default and Consequences

Defaulting on a private student loan has serious and long-lasting repercussions. Unlike federal student loans, which offer various protections and rehabilitation options, private loans are governed by the lender’s policies and state laws. Failure to meet your repayment obligations can lead to a significant decline in your financial well-being and severely impact your future creditworthiness.

Defaulting on a private student loan triggers a cascade of negative consequences. Lenders may pursue aggressive collection tactics, including wage garnishment, bank levy, and even lawsuits. These actions can result in significant financial strain and legal complications. Furthermore, the negative impact extends far beyond the immediate financial losses.

Consequences of Private Student Loan Default

Defaulting on a private student loan results in a severely damaged credit score. This negative mark can make it extremely difficult to secure future loans, credit cards, mortgages, or even rent an apartment. The default will remain on your credit report for seven years, potentially hindering your ability to obtain favorable interest rates or even qualify for essential financial products. For instance, a person with a defaulted loan might be denied a mortgage, forcing them to delay homeownership indefinitely or settle for less favorable terms. Additionally, employers sometimes perform credit checks, and a poor credit history could negatively affect job prospects. The long-term financial consequences of default can be substantial, impacting major life decisions for years to come.

Options for Borrowers Facing Repayment Difficulties

Several options exist for borrowers struggling to repay their private student loans, though they are not guaranteed and depend entirely on the lender’s policies. These options may offer temporary relief but don’t erase the debt. It’s crucial to proactively contact your lender as soon as you anticipate difficulty, as waiting until default is almost always detrimental.

Borrowers may be able to negotiate a forbearance, which temporarily suspends or reduces payments for a specific period. Alternatively, a deferment may be available, postponing payments for a defined timeframe, often requiring documentation of specific hardships. However, interest may still accrue during both forbearance and deferment, increasing the total loan amount owed. Some lenders might offer loan modification, altering the repayment terms to make them more manageable, such as extending the loan term or lowering the monthly payments. This often results in paying more interest over the life of the loan. Finally, borrowers might explore loan consolidation, combining multiple loans into a single loan with potentially more favorable terms. However, this is not always available or beneficial. It is essential to carefully review the terms of any offered solution before agreeing to it.

Impact on Credit Scores and Future Borrowing

A private student loan default has a devastating impact on credit scores. The default will be reported to the major credit bureaus (Equifax, Experian, and TransUnion), resulting in a significant drop in your credit score. This negative mark can persist for seven years, making it significantly harder to obtain credit in the future. Higher interest rates on subsequent loans, if approved at all, will further compound the financial burden. The difficulty in securing favorable loan terms can affect major life decisions, such as purchasing a home or a car, or even obtaining a credit card. The impact extends beyond financial transactions, as potential employers may also review credit reports, potentially affecting job prospects. In essence, a private student loan default creates a long-term, negative financial cycle that is challenging to overcome.

Conclusion

Securing funding for higher education requires careful consideration and planning. While private student loans can be a valuable tool, it’s essential to approach them with a thorough understanding of their terms and conditions. By carefully weighing the advantages and disadvantages, exploring alternative funding options, and understanding the potential risks, you can make an informed decision that aligns with your financial goals and long-term well-being. Remember, responsible borrowing is key to a successful educational journey.

Popular Questions

What happens if I can’t repay my private student loan?

Defaulting on a private student loan can severely damage your credit score, impacting your ability to obtain loans or credit in the future. Lenders may pursue legal action to recover the debt.

Can I refinance my private student loan?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, carefully compare offers from different lenders before refinancing.

Are co-signers always required for private student loans?

Not always. Some lenders may require a co-signer, especially for students with limited or no credit history. A co-signer shares responsibility for repayment.

What is the difference between fixed and variable interest rates?

Fixed interest rates remain constant throughout the loan term, while variable rates fluctuate based on market conditions. Fixed rates offer predictability, while variable rates could potentially be lower initially.