Securing a college education often involves navigating the complexities of student financing. Private student loans can play a crucial role, but understanding interest rates is paramount to making informed decisions. This guide explores the intricacies of private student loans with low interest rates, examining factors influencing rates, eligibility criteria, and strategies for securing the best possible terms. We’ll compare private loans with federal options and delve into repayment strategies to minimize long-term financial burdens.

From understanding the impact of credit scores and co-signers to exploring various repayment plans, this comprehensive resource aims to empower students and families to make sound financial choices regarding their educational funding. We will also address potential risks and highlight the importance of careful planning to avoid the pitfalls of high-interest debt.

Understanding Private Student Loan Interest Rates

Securing a private student loan involves careful consideration of interest rates, as they significantly impact the overall cost of your education. Understanding the factors that influence these rates and the differences between fixed and variable options is crucial for making informed borrowing decisions. This section will explore these key aspects to help you navigate the process effectively.

Factors Influencing Private Student Loan Interest Rates

Several factors contribute to the interest rate a lender offers on a private student loan. These factors are assessed during the application process and influence the final rate you receive. Lenders use a combination of these factors to determine your risk as a borrower. A higher perceived risk generally results in a higher interest rate.

Key factors include your credit score and history, the loan amount requested, the repayment term selected, the presence of a co-signer, and the lender’s own internal policies and market conditions. A strong credit history and a high credit score will typically result in a lower interest rate, reflecting a lower perceived risk to the lender. Conversely, a lower credit score or a history of missed payments might lead to a higher rate. The loan amount and repayment term also play a role; larger loans and longer repayment periods often carry higher rates due to increased risk for the lender. A co-signer with good credit can help mitigate this risk and potentially secure a lower rate.

Fixed Versus Variable Interest Rates

Private student loans typically offer two types of interest rates: fixed and variable. Understanding the differences between these two is essential for choosing the option that best suits your financial situation and risk tolerance.

A fixed interest rate remains constant throughout the life of the loan. This predictability makes budgeting and repayment planning easier. You know exactly how much you’ll be paying each month, regardless of market fluctuations. A variable interest rate, on the other hand, fluctuates based on an underlying index, such as the prime rate or LIBOR (though LIBOR is being phased out). This means your monthly payments could increase or decrease over time, depending on changes in the index rate. While variable rates may start lower than fixed rates, the potential for increases presents a higher degree of uncertainty.

Comparison of Interest Rates Offered by Various Private Lenders

Interest rates for private student loans vary considerably among different lenders. Factors such as lender policies, market conditions, and the borrower’s creditworthiness all influence the rates offered. It’s essential to compare offers from multiple lenders before choosing a loan to ensure you secure the most favorable terms.

It’s important to note that interest rates are subject to change and are only examples; always check directly with the lender for the most up-to-date information. It’s recommended to shop around and compare offers from several reputable lenders to find the best rate for your individual circumstances. Consider factors beyond just the interest rate, such as fees and repayment options.

Average Interest Rates Based on Credit Score

The following table provides a general overview of average interest rates for private student loans based on credit score. Remember that these are averages and actual rates will vary depending on the lender, loan terms, and other individual factors.

| Lender | Interest Rate (Example) | Loan Type | Credit Score Requirement (Example) |

|---|---|---|---|

| Lender A | 6.5% – 12% | Fixed | 680+ |

| Lender B | 7% – 13% | Variable | 660+ |

| Lender C | 5.5% – 11% | Fixed | 700+ |

| Lender D | 8% – 14% | Variable | 640+ |

Eligibility Criteria for Low-Interest Private Student Loans

Securing a private student loan with a low interest rate hinges on several key factors that lenders carefully assess. Understanding these eligibility criteria is crucial for prospective borrowers aiming to minimize their borrowing costs over the loan’s lifespan. Lenders analyze your financial profile to determine your creditworthiness and the likelihood of repayment.

Credit History and Credit Score Impact on Interest Rates

A strong credit history and a high credit score are paramount in obtaining favorable interest rates on private student loans. Lenders view a positive credit history, characterized by consistent on-time payments and responsible credit utilization, as an indicator of your reliability as a borrower. Conversely, a poor credit history, marked by late payments, defaults, or high credit utilization, significantly increases your perceived risk, leading to higher interest rates or even loan denial. A higher credit score generally translates to a lower interest rate, reflecting the lender’s assessment of lower risk. For instance, a borrower with a credit score above 750 might qualify for a significantly lower interest rate compared to a borrower with a score below 600. The specific impact of credit score varies among lenders, but the general trend remains consistent.

The Role of Co-signers in Securing Favorable Interest Rates

A co-signer is an individual who agrees to share responsibility for repaying the loan if the primary borrower defaults. The inclusion of a co-signer with a strong credit history and high credit score can dramatically improve your chances of securing a low-interest private student loan, even if your own credit history is limited or less than ideal. The lender considers the co-signer’s creditworthiness alongside the borrower’s, effectively mitigating the risk associated with the loan. This allows borrowers with less established credit to access more favorable terms. The co-signer’s credit score and payment history directly influence the interest rate offered.

Private Student Loan Application Process Flowchart

The following flowchart illustrates a typical application process for private student loans and the key factors influencing approval:

[Start] –> [Application Submission (including financial information, credit history, co-signer details)] –> [Credit Check and Financial Assessment] –> [Conditional Approval (interest rate offered based on assessment)] –> [Loan Documentation and Signing] –> [Funds Disbursement] –> [Loan Repayment] –> [End]

Factors influencing approval at each stage:

* Application Submission: Complete and accurate information is crucial.

* Credit Check and Financial Assessment: Credit score, credit history, debt-to-income ratio, income verification, co-signer’s creditworthiness.

* Conditional Approval: Interest rate offered depends on the risk assessment.

* Loan Documentation and Signing: Ensuring all legal requirements are met.

* Funds Disbursement: Funds are released based on the loan agreement.

* Loan Repayment: On-time payments are essential for maintaining a positive credit history.

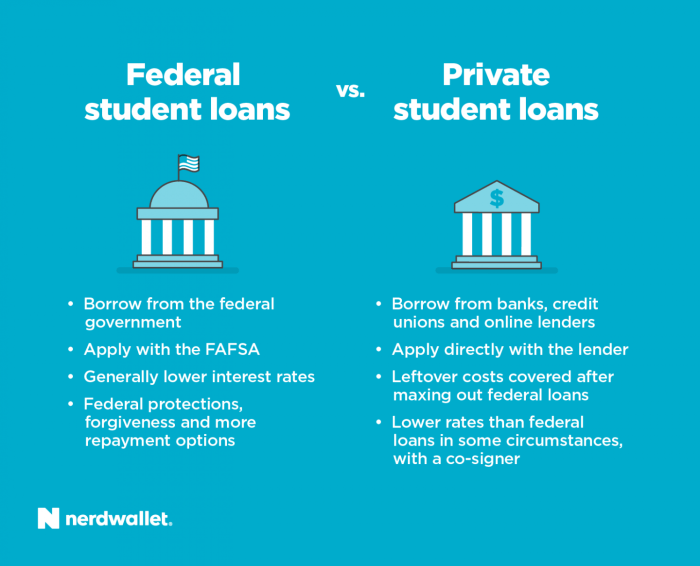

Comparing Private Student Loans with Federal Student Loans

Choosing between private and federal student loans is a crucial decision impacting your financial future. Understanding their key differences regarding interest rates, repayment terms, and benefits is essential for making an informed choice. This comparison will highlight the advantages and disadvantages of each loan type to help you navigate this important process.

Private and federal student loans differ significantly in several aspects. While both offer funding for higher education, their structures, benefits, and potential risks vary considerably. This section will delve into these differences, offering examples to illustrate when one loan type might be more suitable than the other.

Interest Rates and Repayment Terms

Private student loan interest rates are typically variable and often higher than federal loan rates. The interest rate you receive depends on your creditworthiness, the loan amount, and the lender. Federal student loans, on the other hand, generally offer fixed interest rates and are often more affordable. Repayment terms also differ; private loans may offer shorter repayment periods, potentially leading to higher monthly payments, while federal loans provide more flexible repayment plans, including income-driven repayment options. For example, a private loan might offer a 10-year repayment plan with a higher interest rate of 8%, whereas a federal loan might offer a 15-year repayment plan with a fixed interest rate of 5%. The choice depends on your financial situation and risk tolerance.

Benefits and Advantages of Each Loan Type

Federal student loans offer several advantages, including income-driven repayment plans, deferment and forbearance options during financial hardship, and loan forgiveness programs for certain professions (like teaching or public service). These features provide a safety net for borrowers who may face unexpected financial challenges. Private loans typically lack these borrower protections. However, private loans may offer larger loan amounts or more favorable terms for borrowers with excellent credit scores. For instance, a student pursuing a high-cost professional degree might find that a private loan can provide the necessary funding, whereas federal loans might not cover the entire cost of their education.

Key Differences Summarized

The following points summarize the key differences between private and federal student loans:

- Interest Rates: Federal loans usually have lower, fixed interest rates; private loans often have higher, variable rates.

- Repayment Terms: Federal loans offer more flexible repayment plans, including income-driven options; private loans may have shorter repayment periods.

- Borrower Protections: Federal loans provide borrower protections like deferment, forbearance, and loan forgiveness programs; private loans typically do not.

- Credit Requirements: Federal loans generally have less stringent credit requirements; private loans require good to excellent credit.

- Loan Amounts: Private loans may offer larger loan amounts than federal loans, but this depends on individual creditworthiness.

Strategies for Securing the Lowest Interest Rates

Securing the lowest possible interest rate on a private student loan is crucial for minimizing your overall borrowing costs. Several strategies can significantly impact the interest rate you receive, ultimately saving you thousands of dollars over the life of your loan. Understanding these strategies and actively employing them can make a substantial difference in your financial future.

Negotiating a lower interest rate isn’t always guaranteed, but it’s a worthwhile endeavor. The interest rate you’re offered is often based on your creditworthiness and the lender’s current risk assessment. However, proactive steps can improve your chances of securing a more favorable rate.

Negotiating Lower Interest Rates

While not all lenders are open to negotiation, it’s beneficial to explore this option. A strong credit history and a high credit score are your best bargaining chips. Presenting a compelling case, highlighting your academic achievements, future career prospects, and a solid repayment plan, can sometimes sway a lender to offer a lower rate. It’s important to be polite, professional, and prepared to present your financial situation clearly. Researching competing offers from other lenders can also strengthen your negotiating position. For example, you could say something like, “I’ve received an offer from another lender with a rate of X%, and I was hoping we could match or come close to that rate.”

Impact of Loan Amounts and Repayment Terms

The amount you borrow and the length of your repayment term directly influence your interest rate. Larger loan amounts generally carry higher interest rates because they represent a greater risk for the lender. Similarly, longer repayment terms often result in higher interest rates because the lender is exposed to the risk of the borrower defaulting for a longer period. For instance, a loan of $50,000 might have a higher interest rate than a loan of $25,000, even with the same credit score and repayment term. Extending the repayment period from 5 years to 10 years might also increase the interest rate due to increased risk for the lender.

Benefits of Shopping Around for the Best Rates

Comparing offers from multiple lenders is essential to securing the most favorable interest rate. Different lenders have different underwriting criteria and risk assessments, leading to variations in interest rates. By shopping around, you can identify the lender offering the lowest rate for your specific financial profile. This process can involve visiting multiple lender websites, comparing rates using online comparison tools, or contacting lenders directly. This proactive approach ensures you don’t settle for a higher rate than necessary.

Using Pre-qualification to Understand Interest Rate Options

Pre-qualification allows you to obtain an estimated interest rate without impacting your credit score. This process involves providing basic financial information to the lender, who then provides an estimate of the interest rate you’re likely to receive. This allows you to compare offers from different lenders and get a better understanding of your interest rate options before formally applying for a loan. Pre-qualification provides a valuable insight into your potential interest rate without committing to a loan and potentially affecting your credit score. This allows for a more informed decision-making process.

Repayment Options and Their Impact on Interest

Understanding your repayment options is crucial for minimizing the total interest paid on your private student loan. Different repayment plans offer varying monthly payments and loan terms, directly impacting the overall cost of borrowing. Choosing the right plan can significantly reduce your long-term debt burden.

Different repayment plans affect the total interest paid primarily through their impact on the loan’s amortization schedule. A longer repayment period means more time to pay back the principal, but also more time accumulating interest. Conversely, a shorter repayment period leads to higher monthly payments but significantly reduces the total interest paid over the life of the loan. Income-driven repayment plans offer flexibility but often extend the loan term, resulting in higher overall interest costs.

Standard Repayment Plans

Standard repayment plans typically involve fixed monthly payments over a set period, such as 5, 10, or 15 years. Shorter loan terms result in higher monthly payments but lower total interest costs. Longer loan terms reduce monthly payments but increase the total interest paid. For example, a $30,000 loan at 7% interest with a 10-year repayment plan would have significantly lower total interest paid than the same loan with a 15-year plan. The shorter term results in quicker principal reduction, minimizing the interest accrued over time.

Graduated Repayment Plans

Graduated repayment plans feature lower initial monthly payments that gradually increase over time. This option may be attractive to recent graduates anticipating higher income in the future. However, because the loan is outstanding for a longer period, the total interest paid will likely be higher compared to a standard fixed payment plan with the same loan term. For instance, a $25,000 loan with a 10-year graduated plan might have a lower starting payment but could ultimately result in several thousand dollars more in total interest compared to a fixed-payment 10-year plan.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRP) tie monthly payments to a borrower’s income and family size. While offering flexibility, these plans often extend the loan repayment period considerably, potentially leading to significantly higher total interest paid over the life of the loan. For example, a borrower with a low income might make minimal monthly payments under an IDRP, deferring a large portion of the principal repayment. This significantly extends the loan term, increasing the accumulated interest. However, the benefits of manageable monthly payments during periods of lower income should be carefully weighed against the increased long-term cost.

Comparison of Repayment Plans

| Repayment Plan | Monthly Payment (Example) | Total Interest Paid (Example) | Loan Term |

|---|---|---|---|

| Standard (10-year) | $350 | $8,000 | 10 years |

| Standard (15-year) | $250 | $14,000 | 15 years |

| Graduated (10-year) | $200 (initially), increasing gradually | $10,000 | 10 years |

| Income-Driven (Variable) | Variable, based on income | Potentially $15,000 or more | Variable, potentially 20+ years |

Potential Risks and Considerations

Private student loans, while offering access to education, come with inherent risks that borrowers must carefully consider before signing on the dotted line. Understanding these potential pitfalls is crucial for making informed decisions and avoiding potentially devastating financial consequences. Failing to do so can lead to significant long-term financial hardship.

While low interest rates can be attractive, it’s vital to remember that private loans often lack the same consumer protections as federal loans. This means that borrowers need to be particularly diligent in understanding the terms and conditions of their loan agreements.

High Interest Rates and Debt Accumulation

Private student loans can carry significantly higher interest rates than federal loans, especially for borrowers with less-than-perfect credit. This can lead to a rapid accumulation of debt, potentially exceeding the initial loan amount many times over by the time the loan is repaid. For example, a $20,000 loan with a 10% interest rate could easily balloon to over $40,000 over a 10-year repayment period, depending on the repayment plan chosen. This rapid growth in debt significantly impacts long-term financial stability.

Importance of Understanding Loan Terms and Conditions

Before accepting any private student loan, it is absolutely essential to thoroughly review and understand all terms and conditions. This includes the interest rate, repayment schedule, fees (origination fees, late payment fees, etc.), and any other stipulations. Failing to understand these details can lead to unexpected costs and financial difficulties down the line. For instance, some loans may have prepayment penalties, meaning you’ll pay extra if you try to pay off the loan early. Others may have variable interest rates, which can fluctuate, making budgeting more challenging.

Implications of Defaulting on a Private Student Loan

Defaulting on a private student loan can have severe consequences. Unlike federal loans, private student loans do not typically offer the same range of rehabilitation options. Defaulting can lead to damaged credit scores, wage garnishment, and even lawsuits to recover the debt. This can make it extremely difficult to obtain future loans, rent an apartment, or even secure certain jobs. The impact on one’s credit history can last for many years, severely limiting financial opportunities.

Long-Term Financial Consequences of High-Interest Private Student Loans

The following is a description of a visual representation:

The visual would be a line graph depicting the growth of a private student loan balance over time, comparing two scenarios: one with a low interest rate (e.g., 5%) and another with a high interest rate (e.g., 12%). The x-axis represents time in years (e.g., 0-10 years), and the y-axis represents the loan balance. The line representing the high-interest loan would show a much steeper upward curve compared to the low-interest loan. To further illustrate the impact, the graph could include annotations highlighting the difference in total interest paid between the two scenarios at various points in time (e.g., after 5 years and after 10 years). A clear legend would differentiate the lines representing the low and high-interest scenarios. Finally, a supplementary bar chart could be included showing the total amount paid in principal versus interest for each scenario, clearly demonstrating the disproportionately larger interest payments under the high-interest scenario. This would visually represent how a seemingly small difference in interest rates can lead to a significant difference in the total amount repaid over the life of the loan.

Outcome Summary

Successfully navigating the world of private student loans requires careful planning and a thorough understanding of interest rates, eligibility requirements, and repayment options. By leveraging the strategies discussed – such as improving credit scores, exploring co-signer options, and diligently shopping for the best rates – borrowers can significantly reduce their long-term financial burden. Remember, responsible borrowing and proactive financial management are key to achieving educational goals without unnecessary financial strain. Thorough research and careful consideration of all available options are crucial for a successful outcome.

Commonly Asked Questions

What is the difference between a fixed and variable interest rate on a private student loan?

A fixed interest rate remains constant throughout the loan’s term, while a variable interest rate fluctuates based on market conditions. Fixed rates offer predictability, while variable rates may initially be lower but carry the risk of increasing.

How can I improve my chances of getting a low interest rate?

Improve your credit score, secure a co-signer with good credit, apply with a co-borrower, and shop around for the best rates from multiple lenders. A larger down payment or shorter loan term may also help.

What happens if I default on a private student loan?

Defaulting on a private student loan can severely damage your credit score, potentially leading to wage garnishment, lawsuits, and difficulty obtaining future credit. It’s crucial to contact your lender immediately if you anticipate difficulties making payments.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and simplify payments, but it’s important to compare offers and understand the terms before refinancing. Be aware that refinancing may extend your repayment period.