The crushing weight of student loan debt is a pervasive reality for millions, significantly impacting their financial futures. High interest rates exacerbate this burden, transforming manageable loans into long-term financial shackles. This exploration delves into the multifaceted challenges surrounding student loan interest, examining current rates, government interventions, and practical strategies for borrowers to navigate this complex landscape.

Understanding the intricacies of student loan interest is crucial for both current and prospective borrowers. From analyzing the various types of loans and their associated interest rates to exploring effective repayment strategies, this comprehensive overview equips individuals with the knowledge necessary to make informed decisions and mitigate the financial strain of student loan debt.

Current Student Loan Interest Rates

Understanding current student loan interest rates is crucial for borrowers, as these rates significantly impact the total cost of repayment. Interest rates vary depending on several factors, including the type of loan, the borrower’s creditworthiness, and prevailing economic conditions. This section will explore these variations and the factors that influence them.

Federal and private student loans differ significantly in their interest rate structures. Federal student loans generally offer lower, fixed interest rates, making them a more predictable and often more affordable option. These rates are set by the government and are typically tied to the 10-year Treasury note. Private student loans, on the other hand, are offered by banks and other financial institutions. Their interest rates are variable, meaning they can fluctuate over the life of the loan, and are often higher than federal loan rates. The interest rate on a private loan is determined by the lender’s assessment of the borrower’s creditworthiness and the prevailing market conditions. A borrower’s credit history, credit score, and co-signer availability all play a role in determining the interest rate offered.

Factors Influencing Student Loan Interest Rate Fluctuations

Several factors contribute to the variability of student loan interest rates. Market interest rates, specifically the 10-year Treasury note rate for federal loans, are a primary driver. When market rates rise, so do student loan interest rates, and vice versa. Economic conditions also play a significant role. During periods of economic uncertainty or inflation, lenders may increase interest rates to compensate for increased risk. The borrower’s creditworthiness, including credit score and history, is another critical factor, particularly for private loans. A higher credit score generally translates to a lower interest rate. Finally, the type of loan—federal subsidized, unsubsidized, or private—also influences the interest rate, with federal subsidized loans typically having the lowest rates.

Average Student Loan Interest Rates (Past Decade)

The following table provides an overview of average student loan interest rates over the past decade. It’s important to note that these are averages and actual rates may vary depending on the specific circumstances of each borrower and loan.

| Year | Federal Subsidized (Undergraduate) | Federal Unsubsidized (Undergraduate) | Private Loans (Average) |

|---|---|---|---|

| 2014 | 4.66% | 6.84% | 7.5% |

| 2015 | 4.29% | 6.44% | 7.0% |

| 2016 | 4.29% | 6.44% | 6.8% |

| 2017 | 4.45% | 6.61% | 7.2% |

| 2018 | 5.05% | 7.21% | 7.9% |

| 2019 | 4.53% | 6.61% | 7.6% |

| 2020 | 4.53% | 6.61% | 7.1% |

| 2021 | 2.75% | 4.3% | 6.5% |

| 2022 | 2.75% | 4.3% | 7.0% |

| 2023 | 5.0% | 6.5% | 8.0% |

Note: These figures are illustrative examples and are not intended to represent precise historical data. Actual rates varied and may differ from these average values. Data sources should be consulted for precise historical interest rate information.

Impact of High Interest Rates on Borrowers

High student loan interest rates significantly impact borrowers’ long-term financial health, potentially delaying major life milestones and creating substantial financial strain. The cumulative effect of interest accrual over the loan repayment period can dramatically increase the total amount owed, far exceeding the initial loan principal. This can lead to a cycle of debt that’s difficult to escape, hindering financial stability and future opportunities.

The consequences of high interest rates extend beyond simply paying more money. They influence crucial financial decisions, such as buying a home, starting a family, or investing in retirement. The weight of substantial monthly payments can restrict borrowers’ ability to save, build credit, and achieve their financial goals. This financial burden can also negatively impact mental well-being, leading to stress and anxiety.

Repayment Plan Challenges

High interest rates directly affect the feasibility and affordability of various repayment plans. For example, a standard 10-year repayment plan might seem manageable initially, but with high interest, the monthly payments can be significantly higher than anticipated, making it challenging to meet other financial obligations. Income-driven repayment plans, designed to make payments more manageable based on income, can still leave borrowers with substantial debt even after 20 or 25 years, due to the continuous accrual of interest. The extended repayment period, while offering lower monthly payments, ultimately results in paying significantly more in interest over the life of the loan.

Impact on Overall Financial Well-being

High student loan interest rates can severely restrict borrowers’ financial flexibility and future prospects. The large monthly payments consume a substantial portion of their income, limiting their ability to save for retirement, emergencies, or other investments. This can lead to a cycle of debt, where borrowers struggle to make ends meet and are less likely to build wealth. Furthermore, high debt levels can negatively impact credit scores, making it more difficult to obtain loans for a mortgage, car, or other significant purchases. The constant financial pressure can also lead to stress, anxiety, and even depression, affecting overall mental and physical health.

Hypothetical Repayment Scenario

Let’s consider two hypothetical scenarios to illustrate the impact of interest rates. Imagine two borrowers, both with a $50,000 student loan. Borrower A has a loan with a 5% interest rate, while Borrower B has a loan with a 10% interest rate. Both choose a standard 10-year repayment plan. Using a loan amortization calculator (easily found online), we can estimate that Borrower A would pay approximately $57,000 in total, including interest, while Borrower B would pay approximately $77,000. This shows that a seemingly small difference in interest rate (5%) can result in a significant difference in the total repayment amount ($20,000 in this example). This difference can significantly impact a borrower’s long-term financial stability.

Government Policies and Initiatives to Reduce Interest

Governments worldwide employ various strategies to alleviate the burden of student loan debt, primarily through policies influencing interest rates. These policies are often intertwined with broader economic goals and reflect differing philosophies on the role of higher education in national development. Understanding these approaches is crucial to evaluating their effectiveness and potential long-term impacts.

Existing government policies aimed at reducing student loan interest rates vary considerably. Many countries offer subsidized loans, where the government pays a portion of the interest while the student is in school or during a grace period. Others provide income-driven repayment plans, adjusting monthly payments based on the borrower’s income, effectively lowering the effective interest rate over the life of the loan. Some governments also offer loan forgiveness programs, particularly for borrowers working in public service or specific high-demand fields. These programs can be viewed as a form of indirect interest rate reduction, as they reduce the total amount repaid.

Subsidized Loan Programs and Their Impact

Subsidized loan programs, a common feature in many developed nations, directly lower the cost of borrowing for students. The government’s subsidy effectively reduces the interest rate charged to the borrower, making higher education more accessible. The economic impact includes increased enrollment in higher education, potentially leading to a more skilled workforce and increased economic productivity. However, the cost of these subsidies must be weighed against potential budget constraints and the need to balance other government priorities. For example, the United States’ federal student loan program includes subsidized loans, while the UK offers similar schemes through its Student Loan Company. These programs, however, are not without their criticisms, with concerns about escalating government debt and the potential for inequitable distribution of benefits.

Income-Driven Repayment Plans and Their Effectiveness

Income-driven repayment (IDR) plans offer an alternative approach to managing student loan debt. Instead of a fixed monthly payment, IDR plans calculate payments based on a borrower’s income and family size. While the total amount repaid over the loan’s life may remain the same, the lower monthly payments during periods of lower income can significantly reduce the financial strain on borrowers. This, in turn, can boost consumer spending and contribute to overall economic stability. The effectiveness of IDR plans depends on factors such as the income thresholds used in the calculation, the loan forgiveness provisions after a certain period, and the administrative costs associated with managing these complex repayment schedules. Countries like Canada and Australia have implemented variations of IDR plans with varying degrees of success.

International Comparisons of Government Approaches

A comparison of government approaches reveals diverse strategies. Some countries, like Germany, emphasize grants and scholarships over loans, minimizing the reliance on interest-bearing debt. Others, like the United States, have a more loan-centric system, with varying levels of government support. These differences reflect diverse educational philosophies, economic conditions, and political priorities. The effectiveness of each approach is subject to ongoing debate, with researchers examining factors such as access to higher education, student debt levels, and the long-term economic benefits of a more educated workforce. For instance, a comparison of the US and German systems would reveal stark differences in the reliance on loans versus grants, reflecting differing societal views on the financing of higher education.

Economic Impacts of Interest Rate Reduction Strategies

Implementing various interest rate reduction strategies has significant economic implications. While reducing interest rates makes higher education more affordable and increases access, it also increases the government’s financial burden. The potential increase in government spending needs to be balanced against the potential long-term economic benefits of a more skilled and productive workforce. Moreover, the impact on inflation needs careful consideration. A sudden influx of government spending could potentially fuel inflationary pressures, while a slower, more gradual approach might have less of an impact. Furthermore, the effectiveness of these strategies depends on the overall economic climate and the responsiveness of the higher education sector to changes in financing models. For example, a significant reduction in interest rates could lead to an increase in demand for higher education, but it might also lead to an increase in tuition fees if universities are not effectively regulated.

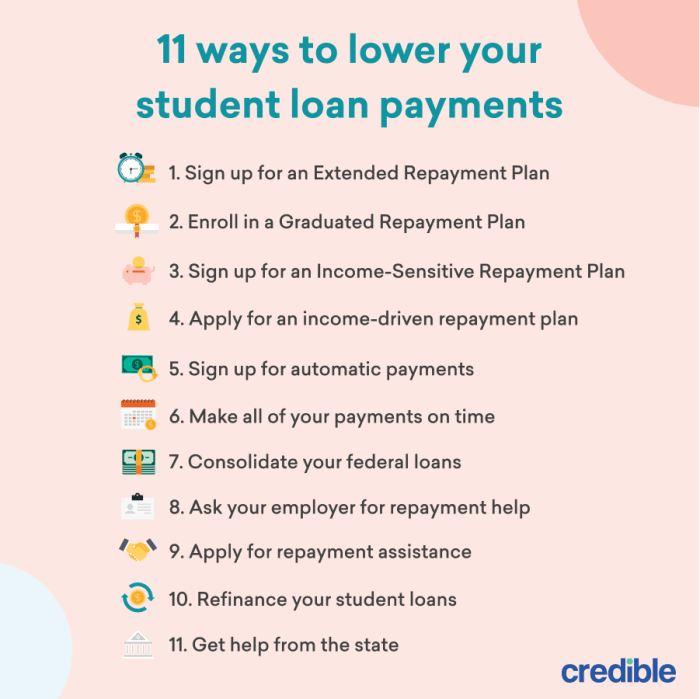

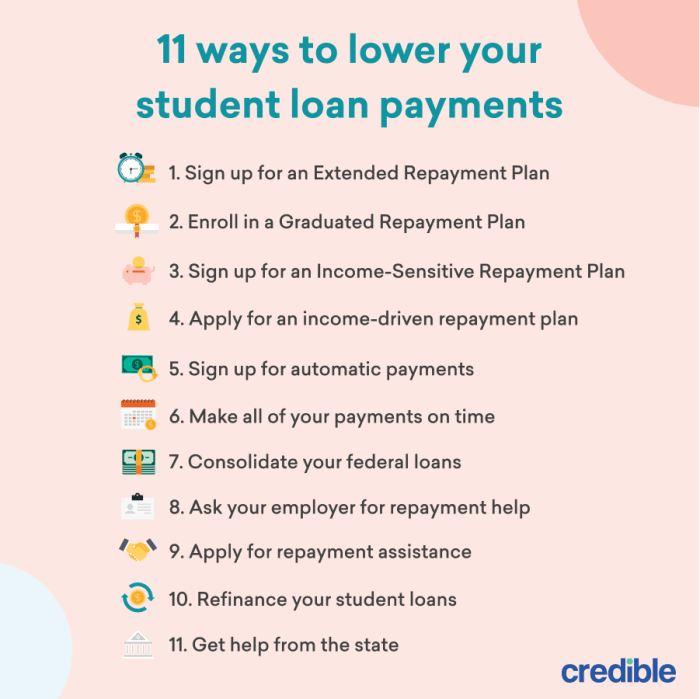

Repayment Strategies and Their Impact on Interest

Choosing the right repayment strategy for your student loans is crucial, as it significantly impacts the total amount of interest you’ll pay over the life of your loan. Different plans offer varying levels of flexibility and ultimately affect your monthly payments and the overall cost of borrowing. Understanding these differences is key to minimizing your debt burden.

Understanding the interplay between repayment plans and interest accumulation is essential for effective debt management. The longer it takes to repay your loans, the more interest accrues, increasing your total repayment cost. Conversely, aggressive repayment strategies, while requiring higher monthly payments, lead to significant long-term savings.

Standard Repayment Plans

Standard repayment plans typically involve fixed monthly payments over a 10-year period. This approach offers predictability and allows for consistent debt reduction. However, the fixed monthly payments can be substantial, particularly for borrowers with high loan balances. The benefit lies in the shorter repayment period, which minimizes overall interest paid compared to longer-term plans. For example, a $50,000 loan at 6% interest with a standard 10-year plan will result in significantly lower total interest paid compared to an income-driven plan stretching over 20 or even 25 years.

Income-Driven Repayment Plans

Income-driven repayment plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), adjust your monthly payments based on your income and family size. This flexibility makes them attractive to borrowers with fluctuating incomes or those facing financial hardship. However, because payments are lower, the repayment period extends considerably, often to 20 or 25 years, resulting in significantly higher total interest paid over the life of the loan. While the lower monthly payments offer immediate relief, the trade-off is a substantially larger total repayment amount. A $50,000 loan at 6% interest under an IBR plan could easily lead to a total repayment exceeding $70,000, a difference of $20,000+ in interest compared to a standard 10-year plan.

Aggressive Repayment Strategies

Aggressive repayment strategies prioritize rapid debt reduction by making payments that exceed the minimum required amount. This might involve making extra payments each month, paying bi-weekly instead of monthly (effectively making an extra monthly payment each year), or making lump-sum payments whenever possible. While demanding more financial discipline upfront, this approach drastically reduces the total interest paid and shortens the repayment period. For example, even an extra $100 per month on a $50,000 loan can significantly reduce the total interest and time to repayment. This strategy requires careful budgeting and prioritization, but the long-term financial benefits are considerable.

Choosing the Most Effective Repayment Plan

A step-by-step guide to selecting the most effective repayment plan involves careful consideration of several factors:

- Assess your current financial situation: Analyze your income, expenses, and savings to determine your realistic monthly payment capacity.

- Compare repayment plan options: Use online loan calculators or consult with a financial advisor to compare the total interest paid and repayment periods for different plans.

- Consider your long-term financial goals: Factor in future income projections and potential career changes when evaluating the long-term implications of each plan.

- Prioritize aggressive repayment where feasible: Explore strategies for increasing your monthly payments even if you choose an income-driven plan initially.

- Monitor and adjust as needed: Regularly review your repayment progress and make adjustments as your financial situation changes.

The Role of Financial Literacy in Managing Interest

Understanding your student loan debt and how interest accrues is crucial for effective management. Financial literacy empowers borrowers to make informed decisions, minimizing long-term costs and achieving faster debt repayment. A strong grasp of financial concepts allows for strategic planning and proactive steps to reduce the overall burden of student loans.

Effective student loan management hinges on a comprehensive understanding of interest rates, repayment plans, and budgeting strategies. Borrowers equipped with financial literacy skills are better positioned to navigate the complexities of loan repayment and avoid potential pitfalls like delinquency or default. This knowledge translates to significant savings over the life of the loan and improved overall financial well-being.

Resources and Educational Materials for Financial Literacy

Several organizations offer valuable resources to enhance financial literacy among student loan borrowers. These resources provide practical guidance, tools, and educational materials to help individuals understand their finances and make informed decisions.

- The National Foundation for Credit Counseling (NFCC): Offers free and low-cost credit counseling services, including debt management plans and financial education resources. They provide workshops and online materials covering budgeting, debt management, and credit repair.

- The Consumer Financial Protection Bureau (CFPB): A government agency dedicated to protecting consumers in the financial marketplace. The CFPB offers a wealth of information on student loans, including repayment options, interest rates, and consumer rights. Their website provides clear explanations and interactive tools.

- Federal Student Aid (FSA): The primary source of information on federal student loans. FSA’s website offers detailed information on loan repayment plans, interest rates, and other important aspects of loan management. They provide tools to track loan balances and make payments.

- Khan Academy: Offers free online courses on various financial topics, including budgeting, saving, investing, and debt management. Their comprehensive and easily accessible materials cater to different learning styles.

Practical Tips and Strategies for Managing Student Loan Debt

Active management of student loan debt requires a proactive approach. Combining financial literacy with practical strategies can significantly reduce interest payments and accelerate debt repayment.

- Create a Budget: Track income and expenses to identify areas for savings and allocate funds towards loan repayment.

- Prioritize High-Interest Loans: Focus on repaying loans with the highest interest rates first to minimize overall interest costs. This strategy can significantly reduce the total amount paid over the life of the loans.

- Explore Repayment Options: Investigate different repayment plans offered by your loan servicer, such as income-driven repayment (IDR) plans, to find one that aligns with your financial situation. IDR plans can lower monthly payments but may extend the repayment period.

- Make Extra Payments: Whenever possible, make extra payments towards your principal loan balance. Even small extra payments can significantly reduce the total interest paid and shorten the repayment period. For example, an extra $100 per month can save thousands of dollars in interest over the life of a loan.

- Consolidate Loans: Consider consolidating multiple loans into a single loan with a potentially lower interest rate. This can simplify repayment and potentially reduce the overall interest burden. However, be mindful of any potential fees associated with consolidation.

Decision-Making Flowchart for Selecting a Repayment Strategy

Choosing the right repayment strategy requires careful consideration of individual financial circumstances. The following flowchart Artikels a decision-making process to help borrowers select the most suitable option.

[Imagine a flowchart here. The flowchart would begin with a starting point: “Assess your financial situation.” Branches would lead to questions like: “Is your income low relative to your loan payments?”, “Do you have high-interest debt besides student loans?”, “Are you comfortable with potentially longer repayment periods?”. Each answer would lead to a different repayment strategy recommendation: Income-driven repayment, aggressive repayment focusing on high-interest debt, standard repayment, etc. The flowchart would end with “Selected repayment strategy”. This visual representation aids in decision making based on individual financial parameters. ]

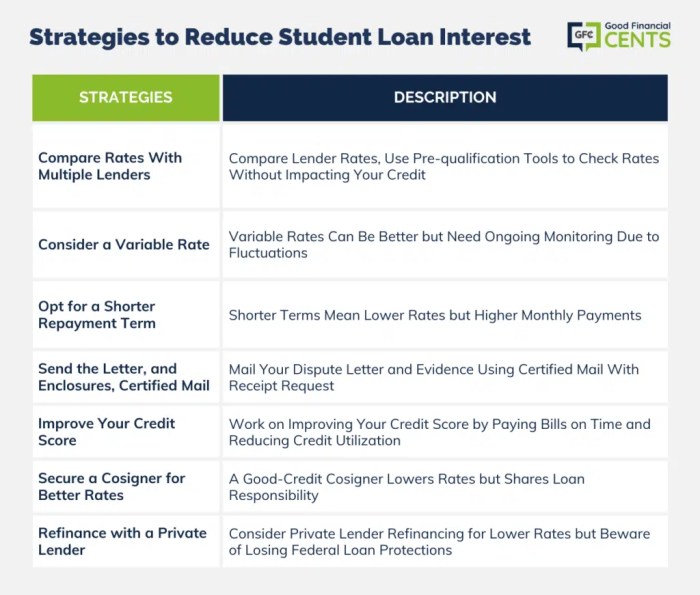

Potential Solutions for Lowering Interest Rates

Lowering student loan interest rates requires a multifaceted approach considering both the needs of borrowers struggling with debt and the financial stability of lending institutions. Several innovative solutions and policy recommendations exist, each with its own set of advantages and disadvantages. Exploring these options thoroughly is crucial for developing effective strategies to alleviate the burden of student loan debt.

The current high interest rates on student loans significantly impact borrowers’ ability to repay their debt, hindering their financial well-being and economic mobility. Therefore, finding sustainable solutions that address this issue is paramount for individual financial health and the overall economy. A balanced approach, involving government intervention, private sector participation, and responsible borrowing practices, is essential for long-term success.

Government Subsidies and Targeted Interest Rate Reductions

The government could directly subsidize a portion of student loan interest, effectively lowering the cost for borrowers. This could be targeted towards specific demographics, such as low-income borrowers or those pursuing high-need fields like education or healthcare. Alternatively, the government could implement a tiered interest rate system, with lower rates for borrowers meeting certain criteria, such as maintaining a high GPA or securing employment in a designated field after graduation. For example, the government could offer a 1% reduction in interest rates for borrowers who maintain a 3.5 GPA or higher throughout their studies. This approach balances the need for financial assistance with incentives for academic achievement.

Private Sector Partnerships and Alternative Lending Models

Private sector involvement can play a significant role in reducing interest rates. Partnerships between the government and private lenders could create innovative lending models, such as income-share agreements (ISAs), where repayment is tied to a percentage of the borrower’s future income. This shifts the risk from the borrower to the lender, potentially allowing for lower upfront interest rates. Another model could involve private companies offering loan refinancing options with lower interest rates based on creditworthiness and employment history. For instance, a successful tech company might partner with a lender to offer lower rates to graduates entering their industry. This creates a mutually beneficial relationship, attracting talent while providing accessible financing.

A Comparison of Proposed Solutions

The following table summarizes the pros and cons of different proposed solutions for lowering student loan interest rates:

| Solution | Pros | Cons |

|---|---|---|

| Government Subsidies | Directly reduces borrower costs; can be targeted to specific groups. | Increases government spending; potential for abuse or inefficiency. |

| Income-Share Agreements (ISAs) | Lower upfront interest rates; aligns repayment with earning potential. | Complexity in contract design and enforcement; potential for unfair outcomes. |

| Private Sector Refinancing | Increased competition among lenders; potentially lower rates for creditworthy borrowers. | May not benefit all borrowers; relies on a healthy private lending market. |

| Tiered Interest Rate System | Incentivizes academic achievement and career choices aligned with national needs; provides targeted relief. | Complexity in implementation and administration; potential for inequities if not carefully designed. |

The Effect of Inflation on Student Loan Interest

Inflation significantly impacts student loan interest rates and the real cost of borrowing. While the nominal interest rate on a loan might remain unchanged, inflation erodes the purchasing power of both the loan principal and the interest payments, effectively increasing the real cost of borrowing. This means that the same loan repayment amount buys less over time as prices rise due to inflation.

Inflation’s effect on student loan interest rates is complex and not always directly proportional. Lenders typically factor anticipated inflation into their interest rate calculations. Higher inflation generally leads to higher interest rates as lenders seek to protect their returns against the erosion of purchasing power. However, other economic factors, such as the overall supply and demand for credit and government policies, also play a role.

The Historical Relationship Between Inflation and Student Loan Interest Rates

Historically, there’s been a general correlation between inflation rates and adjustments in student loan interest rates, although the relationship is not perfectly linear. Periods of high inflation have often been accompanied by increases in student loan interest rates. For example, the high inflation of the 1970s and early 1980s coincided with relatively high student loan interest rates. Conversely, periods of lower inflation, such as those seen in the late 1990s and early 2000s, often saw lower student loan interest rates. However, it’s crucial to note that government intervention and policy changes regarding student loan interest rates can sometimes decouple the relationship, particularly with subsidized loans.

Visual Representation of Inflation and Student Loan Interest Rate Correlation

Imagine a scatter plot. The horizontal axis represents the annual inflation rate (measured using the Consumer Price Index, for example), while the vertical axis represents the average annual interest rate on federal student loans. Each point on the plot represents a specific year, with its coordinates indicating the inflation rate and the corresponding student loan interest rate for that year. The plot would generally show a positive correlation, meaning that higher inflation rates tend to be associated with higher student loan interest rates. The points would not fall perfectly on a straight line, reflecting the influence of other economic factors beyond inflation. A line of best fit could be drawn through the data points to visually represent the general trend. Outliers might exist due to government interventions, such as temporary interest rate caps or subsidies. The overall pattern would demonstrate a tendency for student loan interest rates to increase during periods of higher inflation, although the magnitude of the increase might vary depending on other economic conditions and government policies.

Ultimate Conclusion

Successfully navigating the complexities of student loan interest requires a proactive and informed approach. By understanding the factors influencing interest rates, exploring available government programs, and implementing effective repayment strategies, borrowers can significantly reduce their long-term financial burden. Empowering individuals with financial literacy and advocating for policy changes that promote affordability are crucial steps towards creating a more equitable and accessible higher education system.

FAQ Compilation

What is the difference between federal and private student loans?

Federal loans are offered by the government and typically have more favorable terms and repayment options than private loans, which are offered by banks and other financial institutions. Federal loans often have lower interest rates and income-driven repayment plans.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing can lower your interest rate, but it typically involves consolidating your loans into a new private loan. Carefully compare offers and ensure the new rate is significantly lower before refinancing, considering any potential loss of federal loan benefits.

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to temporarily lower your payments or extend your repayment period. Ignoring the problem will only worsen the situation.