Navigating the complexities of student loan repayment in 2023 can feel overwhelming. From understanding forgiveness programs and interest rates to managing debt amidst inflation, the journey requires careful planning and informed decision-making. This guide provides a clear overview of the key aspects of student loans in 2023, equipping you with the knowledge to navigate this crucial financial landscape effectively.

This year presents unique challenges and opportunities for student loan borrowers. We will explore the current state of forgiveness programs, analyze various repayment plans, and discuss strategies for mitigating the impact of inflation on your debt. We’ll also delve into the long-term financial implications of student loans and offer practical advice for managing your debt successfully.

Student Loan Forgiveness Programs in 2023

The landscape of student loan forgiveness in the United States is constantly evolving, making it crucial to understand the current options available to borrowers. Several programs offer varying degrees of debt relief, each with its own set of eligibility criteria and application processes. Navigating these programs can be complex, but understanding the key features of each can empower borrowers to make informed decisions.

Current Status of Student Loan Forgiveness Programs

As of late 2023, the future of broad-based student loan forgiveness remains uncertain following legal challenges. While some programs, such as those for public service and specific professions, continue to operate, the large-scale forgiveness plans previously proposed are currently paused or in legal limbo. This uncertainty necessitates a careful review of the programs that are still active and accessible. Borrowers should regularly check for updates from the Department of Education and their loan servicers.

Eligibility Requirements for Student Loan Forgiveness Programs

Eligibility requirements vary significantly across different forgiveness programs. Factors considered include the type of loan (federal or private), the borrower’s occupation, income level, and the type of repayment plan utilized. Some programs require a specific number of qualifying payments, while others focus on the borrower’s employment in a public service role. Careful examination of the specific requirements for each program is vital before applying.

Comparison of Student Loan Forgiveness Program Options

Several federal student loan forgiveness programs exist, each with its own advantages and disadvantages. Some programs offer complete loan forgiveness after a certain number of years of qualifying payments, while others provide partial forgiveness based on income or employment. The application processes also differ, with some requiring extensive documentation and others being relatively straightforward. Understanding these nuances is key to selecting the most suitable program.

Student Loan Forgiveness Programs: A Summary Table

| Program Name | Eligibility | Forgiveness Amount | Application Process |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Working for a qualifying government or non-profit organization; making 120 qualifying monthly payments under an income-driven repayment plan. | Remaining balance of federal Direct Loans. | Apply through your loan servicer; requires documentation of employment and loan payments. |

| Teacher Loan Forgiveness | Full-time employment as an elementary or secondary school teacher in a low-income school for five complete and consecutive academic years. | Up to $17,500 in federal student loans. | Apply through the Department of Education; requires documentation of employment and loan payments. |

| Income-Driven Repayment (IDR) Plans | Available to most federal student loan borrowers; monthly payments are based on income and family size. | Remaining balance forgiven after 20 or 25 years of payments (depending on the plan). | Select an IDR plan through your loan servicer. Forgiveness is automatic after the qualifying period. |

| Perkins Loan Cancellation | For borrowers who worked in specific public service roles (teaching, etc.). This program is no longer available for new borrowers. | Partial or full cancellation based on years of service. | The application process varied depending on the lender. |

Interest Rates and Repayment Plans for Student Loans in 2023

Navigating the complexities of student loan repayment can feel daunting, but understanding the interest rates and available repayment plans is crucial for long-term financial well-being. This section provides a clear overview of these key aspects, empowering you to make informed decisions about your repayment strategy.

Current student loan interest rates vary depending on the type of loan (federal or private), the loan’s origination date, and the borrower’s creditworthiness. Federal student loans generally have lower interest rates than private loans. The interest rate for a particular loan is fixed for the life of the loan, meaning it won’t change. For 2023, federal student loan interest rates are set by the government and are subject to change annually. It is advisable to check the official Federal Student Aid website for the most up-to-date information on current rates. Private student loan interest rates, on the other hand, are determined by the lender and are based on factors like your credit score, income, and the loan’s term. These rates can be fixed or variable, meaning they can fluctuate over time.

Federal Student Loan Repayment Plan Options

Several repayment plans are available for federal student loans, each with its own set of advantages and disadvantages. Choosing the right plan significantly impacts the total amount paid over the life of the loan. Understanding the nuances of each plan is essential for effective debt management.

The following are three common repayment plans:

- Standard Repayment Plan: This is the default plan for most federal student loans. Payments are typically made over 10 years, and the monthly payment amount is fixed. While this plan offers a shorter repayment period, resulting in less interest paid overall, the monthly payments might be higher than other plans.

- Extended Repayment Plan: This plan allows borrowers to extend their repayment period to up to 25 years. This lowers the monthly payment amount, making it more manageable for borrowers with lower incomes. However, the total interest paid over the life of the loan will be significantly higher compared to the Standard Repayment Plan.

- Income-Driven Repayment (IDR) Plans: These plans, such as the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR) plans, base your monthly payment on your income and family size. Monthly payments are typically lower than other plans, and any remaining balance may be forgiven after 20 or 25 years, depending on the plan. However, the total interest paid can be substantially higher, and forgiveness may be subject to taxation.

Comparison of Key Repayment Plan Features

The table below summarizes the key features of the three repayment plans discussed above. Careful consideration of these factors is essential in selecting the most suitable plan for individual circumstances.

| Feature | Standard Repayment | Extended Repayment | Income-Driven Repayment (IDR) |

|---|---|---|---|

| Repayment Period | 10 years | Up to 25 years | 20 or 25 years (depending on the plan) |

| Monthly Payment | Higher | Lower | Lowest |

| Total Interest Paid | Lower | Higher | Highest |

| Loan Forgiveness | No | No | Possible after 20 or 25 years (tax implications may apply) |

The Impact of Inflation on Student Loan Debt in 2023

Inflation significantly impacts the real value of student loan debt. As prices rise, the purchasing power of your money decreases, meaning the same amount of debt represents a larger portion of your income. This effect is particularly pronounced during periods of high inflation, like those experienced in 2023, potentially making repayment more challenging.

Inflation’s Effect on the Real Value of Student Loan Debt

Inflation erodes the purchasing power of money over time. A $50,000 student loan today will have a lower real value in the future if inflation increases. For example, if inflation averages 5% annually, that $50,000 loan will effectively be worth less in five years. This is because the same amount of money will buy fewer goods and services. The borrower still owes the same nominal amount, but its real value decreases. This means that while the monthly payment remains constant, the borrower’s ability to pay it may decrease due to the increased cost of living. This increased cost of living, coupled with stagnant or slow wage growth, can exacerbate the burden of student loan debt.

Strategies for Managing Student Loan Debt During High Inflation

Borrowers can employ several strategies to mitigate the impact of inflation on their student loans. Careful budgeting and prioritizing essential expenses are crucial. Exploring options like income-driven repayment plans, which tie monthly payments to income, can provide temporary relief. Increasing income through a higher-paying job or additional income streams can also help manage debt. Furthermore, actively seeking ways to reduce overall expenses, such as consolidating loans to potentially lower interest rates, can also improve the borrower’s financial situation.

Inflation’s Impact on Different Repayment Plan Options

Different repayment plans are affected differently by inflation. Standard repayment plans have fixed monthly payments, but the real value of those payments decreases with inflation. Income-driven repayment plans, however, adjust payments based on income, offering some protection against inflation’s effects. However, even with income-driven plans, inflation can still impact the overall repayment period and the total interest paid. For instance, if income growth doesn’t keep pace with inflation, the monthly payment might not increase sufficiently to offset the decreasing purchasing power of the dollar. This could lead to a longer repayment period and a larger total interest payment over time.

Infographic: Inflation and Student Loan Debt

The infographic would visually depict the relationship between inflation and student loan debt. It would use a simple line graph, showing one line representing the nominal value of a student loan (remaining constant) and another line representing the real value of the loan, decreasing over time due to inflation. A third line could represent the borrower’s income, potentially showing a slower growth rate than inflation, highlighting the increasing burden of the debt. The graph would use clear labels and annotations to explain the impact of inflation on the real value of the debt and the borrower’s ability to repay. A simple table could also compare the nominal and real values of the loan over a few years, assuming different inflation rates, to further illustrate the impact.

Student Loan Debt and its Effect on Personal Finance in 2023

Student loan debt significantly impacts personal finances, creating numerous challenges for borrowers navigating adulthood. The sheer weight of repayment obligations can restrict financial flexibility and delay major life milestones, affecting everything from saving for retirement to achieving homeownership. Understanding these impacts and implementing effective management strategies is crucial for navigating this significant financial hurdle.

Major Financial Challenges Faced by Individuals with Student Loan Debt

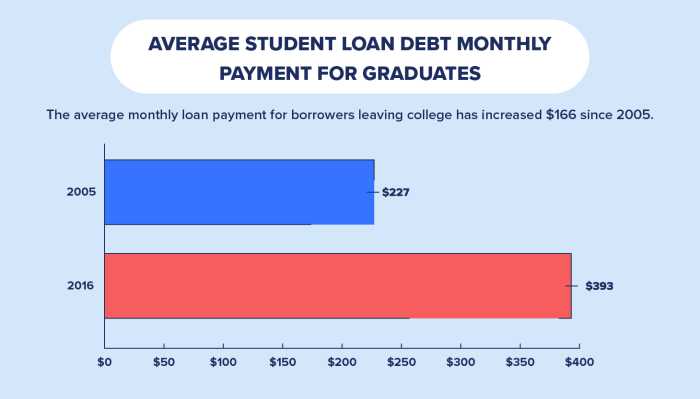

The primary challenge is the significant monthly payment burden. These payments often compete directly with essential expenses like rent, groceries, and utilities, leaving little room for savings or investments. This can lead to a cycle of debt, where borrowers struggle to make ends meet and find it difficult to reduce their principal balance. Further complicating matters are variable interest rates, which can increase monthly payments unexpectedly, exacerbating financial strain. The inability to access credit due to high debt-to-income ratios is another common issue, limiting opportunities for further education, business ventures, or even securing favorable interest rates on mortgages. Finally, the psychological burden of substantial debt can lead to significant stress and anxiety, negatively impacting overall well-being.

Impact of Student Loan Debt on Major Life Decisions

Student loan debt frequently delays or prevents major life decisions. Homeownership becomes significantly more challenging, as lenders often consider student loan payments when assessing mortgage applications. A large student loan balance can reduce borrowing power and increase the likelihood of being denied a mortgage, or necessitate a smaller, less desirable home. Similarly, starting a family can be postponed due to the financial constraints imposed by loan repayments. The costs associated with raising children, including childcare, education, and healthcare, add considerable financial pressure on individuals already burdened with student loan debt. This can lead to delayed family planning or difficult choices about family size.

Strategies for Budgeting and Financial Planning with Student Loan Debt

Effective budgeting and financial planning are essential for managing student loan debt. Creating a realistic budget that prioritizes loan payments is crucial. This involves tracking income and expenses meticulously to identify areas for potential savings. Exploring options for income augmentation, such as a part-time job or freelance work, can provide additional funds to allocate towards loan repayment. Consolidating multiple loans into a single loan with a potentially lower interest rate can simplify repayment and potentially reduce the overall cost of borrowing. Regularly reviewing and adjusting the budget as financial circumstances change ensures that the plan remains effective and sustainable. Finally, seeking professional financial advice from a certified financial planner can provide valuable guidance and support in developing a personalized financial strategy.

Practical Tips for Managing Student Loan Debt Effectively

Effective management of student loan debt requires proactive strategies.

- Prioritize Loan Payments: Treat student loan payments as a non-negotiable expense, prioritizing them above other discretionary spending.

- Explore Repayment Plans: Investigate income-driven repayment plans, which can adjust monthly payments based on income and family size.

- Automate Payments: Set up automatic payments to avoid late fees and ensure consistent repayment.

- Increase Payments When Possible: Make extra payments whenever feasible to reduce the principal balance and shorten the repayment period.

- Seek Professional Advice: Consult with a financial advisor to develop a comprehensive debt management strategy tailored to your individual circumstances.

Navigating the Student Loan Repayment Process in 2023

Successfully managing your student loan repayment requires understanding the process and available resources. This guide provides a step-by-step approach to help you navigate this crucial phase of your financial life. Effective management can significantly impact your financial well-being and future prospects.

Understanding the Repayment Process

The student loan repayment process generally begins after your grace period ends (typically six months after graduation or leaving school). This involves understanding your loan type(s), interest rates, and repayment plan options. The first step is to gather all your loan information, including the servicer’s contact details and your loan balance. This information is typically available through the National Student Loan Data System (NSLDS).

Contacting Your Loan Servicer and Resolving Issues

Your loan servicer is your primary point of contact for all repayment-related matters. They manage your account, process payments, and answer your questions. If you encounter any issues, such as payment processing delays, incorrect account information, or difficulty understanding your repayment plan, contact your servicer immediately. Most servicers offer multiple communication channels, including phone, email, and online portals. Persistently follow up on any unresolved issues, keeping records of all communication.

Utilizing Available Resources and Tools

Several resources are available to assist borrowers in managing their student loans. These include online loan management portals provided by your servicer, allowing you to track payments, view statements, and make payments online. Federal government websites, such as StudentAid.gov, offer comprehensive information on repayment plans, income-driven repayment options, and loan forgiveness programs. Additionally, many non-profit organizations and financial advisors provide free or low-cost guidance on student loan repayment strategies. Utilizing these resources can help borrowers make informed decisions and optimize their repayment plans.

A Step-by-Step Guide to Student Loan Repayment

- Gather your loan information: Obtain details on your loan amount, interest rate, repayment plan, and servicer contact information from the NSLDS.

- Understand your repayment plan: Familiarize yourself with the terms of your repayment plan, including the monthly payment amount, repayment period, and total interest accrued.

- Set up automatic payments: Automating payments helps avoid late fees and ensures consistent repayment.

- Monitor your account regularly: Log into your online account regularly to track your progress and identify any discrepancies.

- Contact your servicer if needed: Don’t hesitate to contact your servicer for clarification or assistance with any issues.

- Explore repayment options: Research and consider alternative repayment plans, such as income-driven repayment, if your current plan presents financial hardship.

- Budget effectively: Integrate your student loan payments into your monthly budget to ensure timely payments.

The Future of Student Loan Debt in 2023 and Beyond

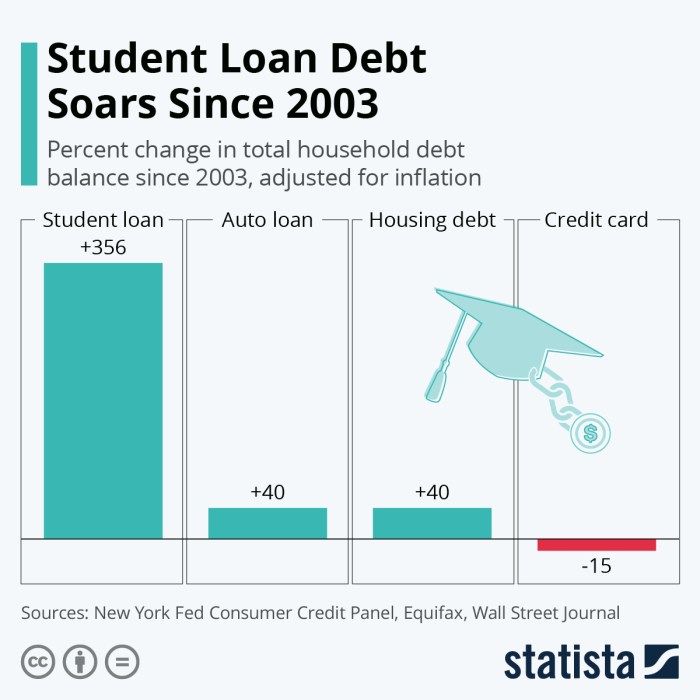

The current state of student loan debt in the United States presents a significant challenge with far-reaching consequences. Understanding the potential trajectory of this debt, including policy changes, long-term implications, and potential solutions, is crucial for individuals and the economy as a whole. The future of student loan debt is uncertain, shaped by a complex interplay of economic factors, political decisions, and evolving societal needs.

The long-term implications of the current high levels of student loan debt are multifaceted and potentially severe. The weight of repayment can significantly hinder borrowers’ ability to save for retirement, purchase homes, and start families, impacting overall economic growth. Furthermore, prolonged periods of debt can negatively affect mental health and well-being.

Potential Changes to Student Loan Policies and Programs

Several potential changes to student loan policies and programs could significantly alter the landscape of student loan debt in the coming years. These changes could include adjustments to interest rates, the introduction of income-driven repayment plans with more generous terms, or even the expansion of loan forgiveness programs. For example, the Biden administration’s proposed income-driven repayment plan changes, while currently facing legal challenges, illustrate the potential for significant shifts in repayment terms. Alternatively, future administrations may focus on preventative measures such as increased funding for Pell Grants or tuition reform. These policy shifts could dramatically impact the overall burden of student loan debt on borrowers.

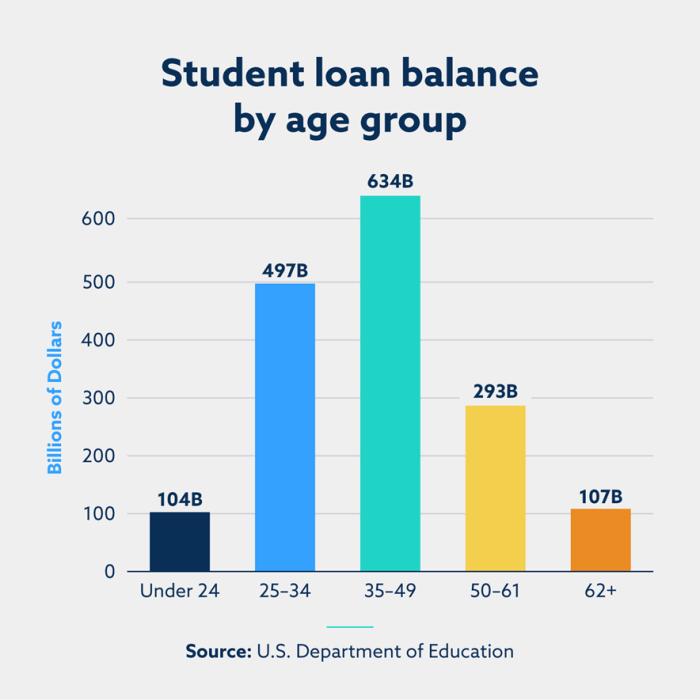

Long-Term Implications of Current Student Loan Debt Levels

The persistently high levels of student loan debt carry significant long-term risks for both individuals and the broader economy. For individuals, this debt can delay major life milestones like homeownership and retirement planning, leading to reduced financial security in later life. Economically, high levels of student loan debt can dampen consumer spending and overall economic growth. Furthermore, a large portion of the population burdened by debt might limit their entrepreneurial endeavors due to financial constraints. This could stifle innovation and economic dynamism. The impact could be particularly acute for lower-income borrowers, potentially exacerbating existing inequalities.

Potential Solutions to Address the Growing Student Loan Debt Crisis

Addressing the student loan debt crisis requires a multi-pronged approach. One key strategy involves expanding access to affordable higher education through increased funding for need-based financial aid programs like Pell Grants and exploring options for tuition control or reform. Additionally, streamlining and improving the existing income-driven repayment plans, ensuring they are truly accessible and beneficial to borrowers, is vital. Finally, targeted debt relief programs for specific demographics or fields of study could provide crucial support to those most burdened by student loan debt. The combination of these solutions could potentially mitigate the crisis more effectively than any single approach.

Forecast of Student Loan Debt’s Impact on the Economy

The continuing impact of student loan debt on the economy is likely to be significant. Reduced consumer spending due to debt repayment obligations could slow economic growth. Furthermore, the concentration of debt among younger generations might delay major purchases like houses and cars, impacting related industries. Conversely, increased government spending on debt relief or expanded aid programs could stimulate the economy in the short term, but potentially strain the federal budget in the long term. The long-term economic effects are complex and depend heavily on future policy decisions and broader economic trends. For instance, a scenario where a significant portion of student loan debt is forgiven could lead to a short-term boost in consumer spending, but potentially increase the national debt.

Final Wrap-Up

Successfully managing student loan debt requires proactive planning and a comprehensive understanding of available resources. By carefully considering the information presented—from forgiveness programs and repayment options to inflation’s impact and long-term financial strategies—you can develop a personalized approach to debt management. Remember to utilize available resources and seek professional advice when needed to ensure a smooth and successful repayment journey.

Helpful Answers

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default. Contact your loan servicer immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into a single loan with a new interest rate and repayment plan. This can simplify repayment, but it might not always reduce your overall cost.

Are there income-driven repayment plans available?

Yes, several income-driven repayment plans adjust your monthly payments based on your income and family size. These plans can make repayment more manageable but may extend the repayment period.

What resources are available to help me manage my student loans?

The Federal Student Aid website (studentaid.gov) offers valuable resources, including repayment calculators, information on repayment plans, and contact information for loan servicers. You can also seek guidance from financial advisors or credit counselors.