The crushing weight of student loan debt is a pervasive reality for millions, transforming dreams into nightmares. For many, the monthly payments become an insurmountable hurdle, leading to crippling financial stress and profound emotional distress. This exploration delves into the multifaceted challenges of unpayable student loans, examining the psychological impact, exploring practical financial strategies, and outlining available legal and governmental resources. We’ll navigate the complexities of debt management, highlighting pathways towards financial recovery and advocating for a more equitable system.

Understanding the student loan crisis requires a holistic approach. This includes acknowledging the emotional toll, strategizing effective financial management, and understanding the legal ramifications of default. This guide provides a comprehensive overview, aiming to empower individuals facing this daunting challenge with knowledge and actionable steps.

The Emotional Impact of Student Loan Debt

The crushing weight of student loan debt extends far beyond the financial burden; it significantly impacts the mental and emotional well-being of individuals. The constant pressure of looming payments and the uncertainty of the future can lead to a cascade of negative psychological effects, impacting daily life and long-term prospects. This pervasive stress is a growing concern, highlighting the need for understanding and support systems for those affected.

The pervasive financial stress associated with student loans significantly impacts mental health. Many individuals experience heightened anxiety and depression, often characterized by persistent worry, sleep disturbances, and difficulty concentrating. The feeling of being trapped in a cycle of debt can lead to feelings of hopelessness and helplessness, potentially contributing to more serious mental health conditions. The constant pressure to make ends meet while juggling loan repayments can strain relationships with family and friends, further isolating individuals and exacerbating feelings of stress and loneliness. This can manifest in various ways, from reduced productivity at work or school to difficulty maintaining healthy relationships. The long-term consequences can include chronic health problems exacerbated by prolonged stress.

Psychological Effects of Overwhelming Student Loan Debt

Overwhelming student loan debt can manifest in a variety of psychological symptoms. Anxiety is a common response, characterized by persistent worry, restlessness, and difficulty sleeping. Depression, with its feelings of sadness, hopelessness, and loss of interest in activities, is also prevalent. Individuals may experience reduced self-esteem and a diminished sense of control over their lives. The constant financial pressure can lead to feelings of guilt and shame, particularly if they feel they have let themselves or their family down. In severe cases, these feelings can contribute to suicidal ideation. The impact on daily functioning can be profound, affecting concentration, decision-making abilities, and overall productivity.

Impact of Financial Stress on Mental Health

Financial stress related to student loans is directly linked to a decline in mental health. Studies have shown a strong correlation between high levels of student loan debt and increased rates of depression and anxiety disorders. The constant worry about repayment can lead to chronic stress, which weakens the immune system and increases the risk of developing various physical health problems. The impact extends beyond the individual, affecting relationships with family and friends, as financial strain can create tension and conflict. For example, a young couple struggling to pay off student loans and save for a house may experience increased arguments and resentment. The pressure to maintain a certain lifestyle while managing debt can also lead to unhealthy coping mechanisms, such as overspending or substance abuse. This can further complicate the situation and worsen mental health outcomes.

Common Coping Mechanisms

Individuals facing insurmountable student loan payments often employ various coping mechanisms, some healthy and others potentially harmful. Healthy coping mechanisms might include seeking professional counseling or joining support groups to share experiences and strategies. Others might prioritize budgeting and financial planning to gain a sense of control over their finances. Unfortunately, some individuals resort to unhealthy coping mechanisms, such as avoidance, denial, or substance abuse. These can provide temporary relief but ultimately exacerbate the problem and negatively impact mental health. For instance, someone might avoid opening their mail or checking their bank accounts to avoid confronting the reality of their debt. Another individual might turn to alcohol or drugs to numb the emotional pain associated with financial stress. It is crucial to recognize these unhealthy coping mechanisms and seek help to develop healthier strategies.

Support Systems for Individuals Struggling with Student Loan Debt

Several support systems are available to individuals struggling with student loan debt. National and local non-profit organizations often offer free financial counseling and guidance on debt management strategies. These organizations can provide personalized advice on repayment plans, debt consolidation options, and other resources. Many universities and colleges also have career services departments that can offer assistance with job searching and financial planning. Additionally, mental health professionals can provide support and therapy to address the emotional and psychological impact of student loan debt. Online forums and support groups offer a platform for individuals to share their experiences and connect with others facing similar challenges. Seeking help from these resources is a crucial step towards managing debt and improving mental well-being.

Financial Strategies for Managing Unpayable Loans

Facing overwhelming student loan debt can feel incredibly daunting, but proactive financial strategies can significantly improve your situation. Understanding your options and taking decisive action is crucial to regaining control of your finances. This section Artikels several approaches to managing unpayable loans, emphasizing realistic solutions and responsible financial planning.

Budgeting and Expense Tracking

Creating a detailed budget is the cornerstone of effective debt management. This involves meticulously tracking all income and expenses to identify areas where spending can be reduced. A comprehensive budget should categorize expenses (housing, transportation, food, entertainment, etc.) and highlight areas for potential savings. For example, reducing dining out expenses, negotiating lower utility bills, or exploring cheaper transportation options can free up significant funds to allocate towards loan repayment. A realistic budget accounts for all necessities while strategically minimizing non-essential spending.

Debt Consolidation

Debt consolidation involves combining multiple loans into a single, larger loan, often with a lower interest rate. This simplifies repayment by reducing the number of monthly payments and potentially lowering the overall interest paid. Several options exist, including personal loans, balance transfer credit cards, and government-sponsored consolidation programs. Careful consideration of the terms and conditions of each option is vital, as some may come with fees or require excellent credit scores.

Negotiating with Lenders

Direct communication with your lenders is crucial. Many lenders are willing to work with borrowers facing financial hardship. Negotiating a modified repayment plan, such as extending the repayment term or reducing the monthly payment amount, can provide much-needed financial relief. Documenting your financial situation clearly and professionally, including proof of income and expenses, strengthens your negotiating position. It’s essential to maintain open and respectful communication throughout the negotiation process.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. These plans are offered by the federal government and can significantly lower monthly payments, potentially making loans more manageable. However, IDR plans often extend the repayment period, leading to potentially higher overall interest paid. Specific plans, such as ICR, PAYE, REPAYE, andIBR, have different eligibility criteria and calculation methods. Choosing the right IDR plan requires careful consideration of your individual financial circumstances and long-term goals.

Sample Budget for Managing Student Loan Debt

| Category | Monthly Allocation | Notes |

|---|---|---|

| Housing | $800 | Rent or mortgage payment |

| Transportation | $200 | Car payment, gas, public transportation |

| Food | $400 | Groceries, dining out (minimized) |

| Student Loan Payment | $500 | Minimum payment or negotiated amount |

| Utilities | $150 | Electricity, water, internet |

| Other Expenses | $150 | Health insurance, phone, personal care |

| Emergency Fund | $100 | Savings for unexpected expenses |

Debt Consolidation Options Comparison

| Option | Pros | Cons | Considerations |

|---|---|---|---|

| Personal Loan | Lower interest rate, single monthly payment | Credit check required, potential fees | Shop around for best rates; consider your credit score. |

| Balance Transfer Credit Card | 0% introductory APR, potential rewards | High interest rate after introductory period, balance transfer fees | Pay off balance before introductory period ends; manage spending carefully. |

| Federal Consolidation Loan | Simplified repayment, potential for income-driven repayment | May not lower interest rate, extended repayment period | Eligibility requirements; consider long-term implications. |

Legal and Regulatory Aspects of Student Loan Default

Defaulting on student loans carries significant legal and financial consequences. Understanding these ramifications is crucial for borrowers facing difficulties in repayment. The legal processes involved vary depending on the type of loan and the lender, but generally involve a series of actions designed to recover the outstanding debt.

Legal Ramifications of Student Loan Default

Defaulting on a federal student loan triggers a series of actions by the Department of Education or its contracted collection agencies. These actions can significantly impact a borrower’s financial life and credit history. The most immediate consequence is the reporting of the default to credit bureaus, resulting in a substantial drop in credit score. This negatively affects the ability to obtain future loans, rent an apartment, or even secure employment in certain fields. Further actions can include wage garnishment, tax refund offset, and even legal action to seize assets. Private student loans may involve similar actions, though the specific legal processes may differ based on the lender’s policies and state laws. For example, a lender might pursue a lawsuit to obtain a judgment against the borrower, which could lead to the seizure of assets such as bank accounts or property.

Lender Actions Following Student Loan Default

Lenders employ various methods to recover defaulted student loan debt. These actions are generally progressive, starting with attempts to contact the borrower to arrange repayment plans. If these attempts fail, more aggressive measures are implemented. These may include referring the debt to collections agencies, which will intensify collection efforts through phone calls, letters, and potentially legal action. The government can garnish wages, meaning a portion of a borrower’s paycheck is directly seized to repay the debt. Tax refund offset allows the government to intercept a borrower’s tax refund to apply it towards the outstanding loan balance. In extreme cases, the government may initiate legal proceedings to seize assets. Private lenders may utilize similar tactics, although their collection practices are subject to state laws and regulations.

Impact on Credit Scores and Future Borrowing

Student loan default has a severely detrimental effect on credit scores. A default is reported to credit bureaus, significantly lowering a borrower’s credit rating, which remains on their credit report for seven years. This severely impacts the ability to obtain credit in the future. Securing loans (auto, mortgage, personal) becomes significantly more difficult, often resulting in higher interest rates or loan denials. Even obtaining a credit card can be challenging. The negative impact extends beyond financial matters; it can affect opportunities for renting an apartment, obtaining certain jobs, and even qualifying for insurance. Rebuilding credit after a default requires significant time and effort, often involving responsible financial behavior and diligent credit repair strategies. For instance, a borrower with a defaulted student loan may struggle to buy a house, as mortgage lenders heavily weigh credit scores in their lending decisions.

Legal Resources and Protections for Borrowers

Several legal resources and protections exist for borrowers facing student loan default. The Department of Education offers various repayment options, including income-driven repayment plans, which adjust monthly payments based on income and family size. Borrowers can explore options like loan consolidation or rehabilitation programs to improve their repayment situation. They can also seek guidance from non-profit credit counseling agencies that offer free or low-cost financial advice. Legal aid organizations can provide assistance to borrowers facing legal action from lenders. Understanding and utilizing these resources can significantly mitigate the negative impact of student loan default. For example, a borrower facing wage garnishment might seek legal counsel to challenge the garnishment or negotiate a more manageable repayment plan.

Government Programs and Assistance for Student Loan Borrowers

Navigating the complexities of student loan debt can be overwhelming, but various government programs offer crucial assistance to borrowers facing repayment challenges. Understanding these programs and their eligibility criteria is essential for securing the financial relief you need. This section Artikels key federal programs designed to help borrowers manage and potentially reduce their student loan burden.

The federal government offers a range of programs aimed at alleviating the financial strain of student loan debt. These programs vary in their eligibility requirements, application processes, and the type of assistance provided, ranging from income-driven repayment plans to loan forgiveness programs. Careful consideration of individual circumstances is crucial to determine the most appropriate program.

Income-Driven Repayment (IDR) Plans

Income-Driven Repayment plans adjust your monthly student loan payments based on your income and family size. Several IDR plans exist, including the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) plans. Eligibility generally requires federal student loans and meeting specific income thresholds. The application process involves completing a form online through the student loan servicer’s website, providing income documentation, and potentially updating information annually. These plans can significantly lower monthly payments, but it’s important to understand that extending the repayment period may result in paying more interest over the loan’s lifetime.

Public Service Loan Forgiveness (PSLF) Program

The PSLF program offers complete forgiveness of federal student loans after 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization. Eligibility requires employment by a qualifying employer and consistent payments under an IDR plan. The application process involves submitting an Employment Certification Form annually to your loan servicer. It’s crucial to carefully document employment and payments to ensure eligibility for forgiveness. For example, a teacher working for a public school qualifies, whereas a teacher at a private school generally does not.

Teacher Loan Forgiveness Program

This program provides forgiveness for up to $17,500 of federal student loan debt for qualified teachers who have completed five years of full-time teaching in a low-income school or educational service agency. Eligibility requirements include teaching in a qualifying school and completing the required years of service. The application process involves submitting an application to your loan servicer with documentation verifying employment and teaching experience. The program is designed to incentivize individuals to pursue careers in education within underserved communities.

Other Federal Student Loan Repayment Assistance Programs

Beyond the programs described above, the federal government offers additional resources and assistance for borrowers struggling with student loan repayments. These may include deferment or forbearance options, which temporarily postpone payments, or loan consolidation, which combines multiple loans into a single loan with a potentially lower interest rate. It is important to explore all available options to find the best solution for your individual circumstances.

- Deferment: Postpones payments temporarily due to specific circumstances, such as unemployment or enrollment in school.

- Forbearance: Allows for temporary suspension of payments, but interest may still accrue.

- Loan Consolidation: Combines multiple federal student loans into a single loan, potentially simplifying repayment.

The Broader Societal Impact of Student Loan Debt Crisis

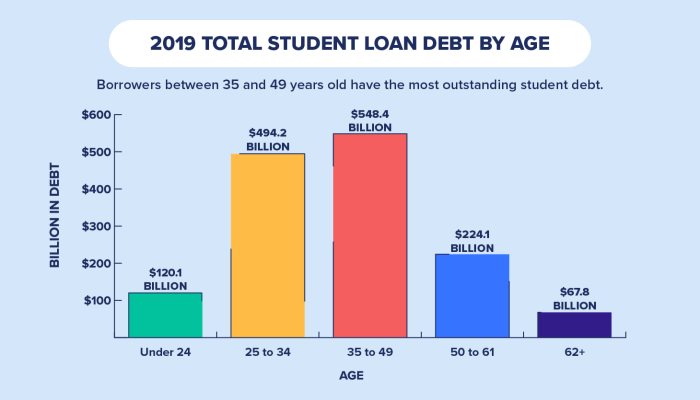

The crippling weight of student loan debt extends far beyond the individual borrower, significantly impacting the overall health and dynamism of the American economy and its social fabric. The sheer scale of this debt acts as a drag on economic growth, affecting consumer spending, investment, and ultimately, the nation’s long-term prosperity.

The pervasive nature of student loan debt restricts economic mobility and opportunities for young adults. This impacts not only their immediate financial well-being but also their ability to contribute fully to the economy. The burden of repayment often delays major life decisions such as homeownership, starting a family, and pursuing entrepreneurial ventures.

Impact on the Overall Economy

Widespread student loan debt reduces aggregate demand. Borrowers facing substantial monthly payments are less likely to spend money on other goods and services, thus dampening economic activity. This reduced consumer spending can lead to slower economic growth and fewer job creation opportunities. Furthermore, the high levels of debt can discourage entrepreneurship, as young adults may be hesitant to take the financial risks associated with starting a business when already burdened with significant loan repayments. The resulting impact on innovation and economic productivity is substantial. For example, a recent study showed a significant correlation between high student loan debt levels in a region and lower rates of new business formation.

Student Loan Debt and Economic Mobility

Student loan debt significantly impedes economic mobility, particularly for low- and middle-income individuals. The expectation of repaying substantial loans can influence career choices, often pushing graduates towards higher-paying but potentially less fulfilling jobs. This can limit their opportunities for professional growth and advancement, trapping them in a cycle of debt and limiting their upward mobility. Moreover, the weight of debt can make it difficult for young adults to save for retirement, further exacerbating their long-term financial insecurity and hindering their ability to achieve financial independence. This disparity in economic opportunities based on debt levels exacerbates existing inequalities.

Implications for Higher Education Affordability and Accessibility

The student loan crisis directly contributes to the escalating cost of higher education. As universities and colleges see a consistent stream of federal loan funding, they may be less incentivized to control costs, leading to a vicious cycle of rising tuition fees and increasing student loan burdens. This makes higher education less accessible to students from lower socioeconomic backgrounds, perpetuating inequalities in educational attainment and future earning potential. The rising cost of tuition coupled with the rising cost of living further exacerbates the challenges of affording higher education. This makes it more difficult for students to pursue their chosen field of study, potentially limiting their career options.

Interconnectedness of Student Loan Debt and Other Societal Issues

Imagine a complex web. At the center is a large, heavy node representing “Student Loan Debt.” Radiating outwards are interconnected nodes representing various societal issues. These include “Reduced Consumer Spending,” leading to a smaller node labeled “Slower Economic Growth.” Another node connects to “Increased Income Inequality,” which branches further to “Limited Social Mobility” and “Political Polarization.” Another strand connects to “Mental Health Issues,” stemming from the stress and anxiety associated with overwhelming debt. Finally, a node representing “Decreased Homeownership Rates” is linked to the central node, illustrating the impact on major life milestones. This visual representation highlights how the student loan crisis is not an isolated problem but rather a key driver of broader societal challenges.

Last Word

The journey through unpayable student loan debt is arduous, but not insurmountable. While the emotional and financial burdens are significant, effective strategies, available resources, and a proactive approach can significantly improve outcomes. By understanding the options available—from debt consolidation and income-driven repayment plans to government assistance programs and legal protections—individuals can navigate this complex situation with greater confidence and hope. Ultimately, addressing the broader societal issues surrounding student loan debt requires systemic change, ensuring equitable access to higher education and sustainable financial solutions for all.

FAQ Resource

What happens if I can’t make my student loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in wage garnishment or tax refund offset. Contact your lender immediately to explore options like deferment, forbearance, or income-driven repayment plans.

Can I negotiate my student loan payments?

Yes, you can often negotiate with your lender. Explain your financial situation and explore options like a modified repayment plan or a temporary reduction in payments. Documentation supporting your hardship is crucial.

What is income-driven repayment?

Income-driven repayment plans base your monthly payments on your income and family size. These plans can lead to loan forgiveness after a set number of payments, but they often extend the repayment period.

Where can I find free financial counseling?

Many non-profit organizations offer free or low-cost credit counseling. The National Foundation for Credit Counseling (NFCC) is a good resource to find reputable counselors in your area.