Student loan debt significantly impacts employee well-being and productivity. Offering student loan repayment assistance as an employee benefit is emerging as a powerful tool for attracting, retaining, and motivating top talent. This guide explores the various facets of this increasingly popular employee perk, examining its design, implementation, financial implications, and overall impact on both employers and employees.

We will delve into the different types of student loan repayment assistance programs available, from direct contributions to loan forgiveness, and analyze their tax implications. Furthermore, we’ll investigate the strategic advantages of incorporating such programs into a comprehensive benefits package, considering recruitment, retention, and return on investment (ROI). The challenges and best practices associated with implementation will also be addressed, along with strategies for effective communication and integration into existing HR systems.

Employee Benefit Landscape

Student loan debt has become a significant financial burden for many Americans, impacting their ability to save for retirement, purchase homes, and build financial security. Recognizing this, an increasing number of employers are offering student loan repayment assistance as a valuable employee benefit. This program aims to attract and retain talent, improve employee morale and financial well-being, and foster a positive work environment.

Prevalence of Student Loan Repayment Assistance Programs

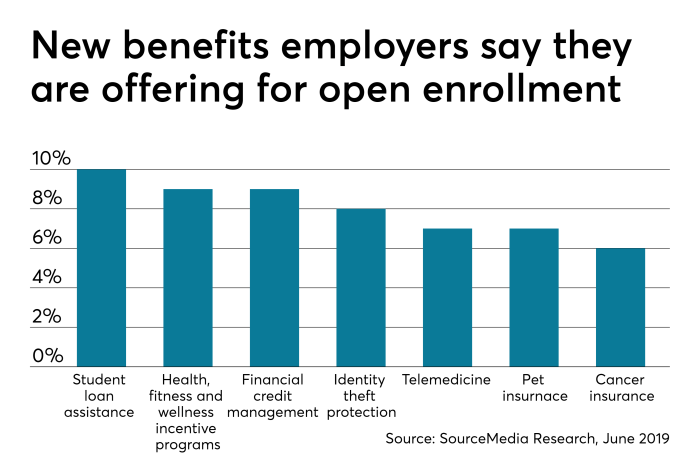

While precise data on the prevalence of student loan repayment assistance programs is difficult to obtain due to the variety of program structures and lack of centralized reporting, anecdotal evidence and surveys suggest a notable and growing trend. Many large companies, particularly in technology, finance, and higher education, are leading the way in offering these programs. Smaller companies are also beginning to adopt such benefits, recognizing their potential for attracting and retaining employees in a competitive job market. The growth is largely driven by the escalating student loan debt crisis and the competitive need to offer unique and appealing employee benefits packages.

Types of Student Loan Repayment Assistance Programs

Several types of student loan repayment assistance programs exist, each with varying levels of employer and employee contributions. Direct contribution programs involve the employer making direct payments towards the employee’s student loan debt. Matching contribution programs offer a contribution that matches a certain percentage of the employee’s own student loan payments. Loan forgiveness programs, less common, involve the employer agreeing to forgive a portion or all of the employee’s outstanding student loan debt after a specified period of employment. The choice of program type reflects an employer’s budget and strategic goals for employee benefits. For example, a company aiming for high employee retention might prefer a loan forgiveness program, while a company with a tighter budget might opt for a direct contribution program with a lower contribution amount.

Tax Implications of Student Loan Repayment Assistance

The tax implications of student loan repayment assistance programs vary depending on the program structure and applicable federal and state laws. For employers, payments made towards an employee’s student loan debt are generally considered taxable compensation to the employee. This means the employer must include the contribution as part of the employee’s W-2 income. However, there are some exceptions, for instance, some educational assistance programs may be excluded from income if they meet certain criteria. For employees, the employer’s contribution is considered taxable income and is subject to income tax withholding, Social Security, and Medicare taxes. This is consistent with the general taxation of employee compensation. Careful consideration of these tax implications is crucial for both employers and employees in structuring and utilizing these benefits effectively.

Summary of Student Loan Repayment Assistance Programs

| Program Type | Employer Contribution | Employee Eligibility | Tax Implications |

|---|---|---|---|

| Direct Contribution | Employer makes direct payments to the loan servicer. Amount varies widely. | Typically requires full-time employment and may include tenure requirements. Specific eligibility criteria vary by employer. | Employer: Taxable compensation for the employee. Employee: Taxable income, subject to income tax, Social Security, and Medicare taxes. |

| Matching Contribution | Employer matches a percentage of the employee’s student loan payments. Matching percentage varies widely. | Similar to direct contribution programs, requiring full-time employment and possibly tenure requirements. Specific eligibility criteria vary by employer. | Employer: Taxable compensation for the employee. Employee: Taxable income, subject to income tax, Social Security, and Medicare taxes. |

| Loan Forgiveness | Employer forgives a portion or all of the employee’s student loan debt after a specified period of employment. | Typically requires a significant tenure commitment and may have performance-based criteria. | Employer: Taxable compensation for the employee in the year of forgiveness. Employee: Taxable income in the year of forgiveness, subject to income tax, Social Security, and Medicare taxes. |

Impact on Employee Recruitment and Retention

Offering student loan repayment assistance is proving to be a powerful tool for companies seeking to attract and retain top talent in today’s competitive job market. The rising cost of higher education has left many graduates burdened with significant debt, impacting their financial well-being and career choices. By providing this benefit, companies demonstrate a commitment to employee financial health and overall well-being, creating a significant competitive advantage.

Student loan repayment assistance significantly improves a company’s ability to attract and retain skilled employees. Many job seekers, particularly millennials and Gen Z, actively seek employers who offer such benefits. This assistance alleviates a major financial stressor, allowing employees to focus on their work and contribute more effectively. Furthermore, reducing financial strain increases employee loyalty and reduces turnover, resulting in cost savings for the company in the long run. Retention rates improve because employees feel valued and appreciated, leading to increased productivity and a more positive work environment.

Successful Integration of Student Loan Repayment Assistance

Companies successfully integrate student loan repayment assistance into their overall employee benefits package by strategically positioning it within their broader compensation and benefits strategy. For example, some companies offer it as a supplemental benefit alongside traditional retirement plans and health insurance, highlighting its value as a significant financial advantage. Others integrate it into their onboarding process, showcasing it as a key employee perk alongside other attractive benefits. Effective communication is crucial, ensuring employees understand the program’s details, eligibility criteria, and the impact it can have on their financial future. A clear and concise explanation of the program’s mechanics and benefits can significantly improve employee engagement and utilization.

Case Studies Demonstrating Return on Investment

While precise ROI figures vary depending on the company size, industry, and program specifics, several case studies illustrate the positive impact of student loan repayment assistance. For instance, Fidelity Investments reported a significant increase in employee satisfaction and retention rates after implementing their student loan repayment program. Similarly, some tech companies, such as those in Silicon Valley, have reported reduced turnover and increased employee engagement as a direct result of offering such benefits. These improvements translate into lower recruitment costs, increased productivity, and a more stable workforce, all contributing to a positive ROI. The specific numbers are often proprietary and not publicly released, but qualitative data consistently points to positive impacts.

Benefits for Employees and Employers

The benefits of student loan repayment assistance are substantial for both employees and employers.

Offering this benefit demonstrates a clear commitment to employee well-being and financial stability, fostering a more positive and productive work environment.

- For Employees: Reduced financial stress, improved financial health, increased job satisfaction, enhanced loyalty to the employer, greater financial freedom to pursue personal goals, and improved work-life balance.

- For Employers: Improved employee recruitment and retention, increased employee morale and productivity, reduced turnover costs, enhanced employer branding and reputation, stronger employee loyalty and engagement, and a more competitive advantage in the talent market.

Program Design and Implementation

Designing and implementing a successful student loan repayment assistance program requires careful consideration of various factors, from eligibility criteria to communication strategies. A well-structured program can significantly boost employee morale and attract top talent, while a poorly designed one can lead to administrative headaches and financial strain.

A sample student loan repayment assistance program should be tailored to the specific needs and resources of the company. However, a common framework can be used as a starting point.

Sample Student Loan Repayment Assistance Program

This program offers a contribution towards eligible employees’ student loan payments. Eligibility is determined by factors such as tenure, employment status, and loan type. The contribution amount is calculated based on a percentage of the employee’s monthly student loan payment, up to a predetermined maximum. Administrative procedures involve verification of loan details, payment processing, and regular reporting.

Eligibility Criteria:

- Full-time employment for at least one year.

- Active student loan repayment in good standing.

- Submission of required documentation (loan statement, etc.).

Contribution Amounts:

- Company contributes 5% of the employee’s monthly student loan payment, up to a maximum of $100 per month.

- Contribution amount may increase with tenure (e.g., 7.5% after 3 years, 10% after 5 years).

Administrative Procedures:

- Employees submit a completed application form and supporting documentation.

- HR verifies eligibility and processes payments directly to the loan servicer.

- Annual review of program participation and performance.

Challenges in Implementing Student Loan Repayment Programs

Companies often face significant hurdles when implementing student loan repayment assistance programs. These challenges range from the financial burden of the program to the complexities of administration and tracking.

Cost Considerations:

The cost of the program can be substantial, particularly for larger companies with many eligible employees. Careful budgeting and forecasting are crucial to ensure the program’s long-term viability. For example, a company with 100 eligible employees contributing $100 per month would face a $120,000 annual cost.

Administrative Burden:

Managing the program requires significant administrative resources, including verification of eligibility, tracking payments, and addressing employee inquiries. Streamlining processes and leveraging technology can help mitigate this burden. For instance, automating eligibility checks and payment processing through HR software can reduce manual effort.

Tracking and Reporting:

Effective tracking and reporting are essential to assess the program’s effectiveness and make data-driven adjustments. This includes tracking participation rates, contribution amounts, and employee satisfaction. A dedicated reporting dashboard within the HR system can facilitate data analysis and inform future program refinements.

Effective Communication Strategies

Clear and consistent communication is essential for the success of any employee benefit program, especially one as complex as student loan repayment assistance. The communication strategy should cover program details, eligibility criteria, and application procedures.

Communication Channels:

- Company intranet and email announcements.

- Informative presentations and workshops.

- One-on-one meetings with HR representatives.

Messaging and Content:

The communication should highlight the program’s benefits, such as reduced financial stress and improved employee morale. It should also include simple, easy-to-understand instructions on how to apply. Using clear and concise language, avoiding jargon, and providing visual aids such as infographics can enhance understanding.

Integrating the Program into Existing HR Systems

Integrating the student loan repayment assistance program into existing HR systems can significantly streamline administration and improve efficiency. This integration can involve customizing existing HR software or implementing a dedicated module for the program.

System Integration Options:

- Integration with payroll systems for automated payments.

- Development of a dedicated online application portal.

- Use of HRIS (Human Resource Information System) to manage eligibility and track participation.

Data Security and Privacy:

Ensuring data security and employee privacy is paramount. All data collected and processed must comply with relevant regulations and internal policies. This includes secure storage of sensitive information and adherence to data privacy best practices.

Financial Implications for Employers

Offering student loan repayment assistance presents a multifaceted financial picture for employers. While it’s a valuable employee benefit attracting and retaining talent, it necessitates careful budgeting, cost analysis, and long-term financial planning. Understanding these implications is crucial for successful program implementation and sustainable growth.

Various Financial Considerations for Employers

Employers must consider several key financial aspects when implementing a student loan repayment assistance program. These include the direct program costs (employer contributions), administrative overhead (managing the program, tracking payments, etc.), potential tax implications (both for the employer and the employee), and the opportunity cost of allocating resources to this benefit versus other initiatives. A comprehensive cost-benefit analysis is essential before launching the program. For instance, a company might analyze the cost per employee versus the potential increase in employee retention rates and productivity gains. They might also need to consider whether the program will be offered to all employees or only specific roles or departments.

Cost-Effectiveness Compared to Other Employee Benefits

Comparing the cost-effectiveness of student loan repayment assistance with other benefits requires a nuanced approach. While the upfront cost might seem higher than some benefits like gym memberships or commuter subsidies, the potential return on investment (ROI) through improved employee retention, reduced turnover costs, and increased productivity can be significantly greater. A company could compare the cost of replacing an employee (including recruitment, training, and lost productivity) to the cost of contributing to their student loan repayment. If the cost of replacement is higher, the loan repayment assistance program becomes a more cost-effective solution. Furthermore, the impact on employee morale and engagement should also be factored into the cost-effectiveness analysis.

Budgeting Strategies and Forecasting Models

Effective budgeting and forecasting are vital for the long-term success of a student loan repayment program. Employers should develop a detailed budget that accounts for all anticipated expenses, including employer contributions, administrative costs, and potential increases in employee participation over time. A realistic forecasting model should incorporate factors like employee turnover rates, anticipated participation levels, and potential changes in interest rates or program parameters. For example, a company could start with a pilot program involving a smaller group of employees to gather data and refine their forecasting model before expanding the program company-wide. This approach allows for adjustments based on actual program performance.

Potential Long-Term Financial Impact on the Employer

A visual representation of the long-term financial impact could be a line graph. The X-axis would represent time (years), and the Y-axis would represent net financial impact (positive or negative). The graph would show an initial negative impact (investment in the program) followed by a gradual upward trend as the program’s benefits (reduced turnover, increased productivity, enhanced employee loyalty) outweigh the costs. The graph might show a comparison line representing the financial impact without the student loan repayment program, highlighting the positive difference resulting from the benefit. For example, a company might show a scenario where the cost of employee turnover is reduced by 15% within three years of program implementation, offsetting the initial investment and generating a positive ROI in the long term. This would be represented as a line crossing from negative to positive values over the three years. The comparison line would stay consistently negative, reflecting the continued high turnover cost without the program.

Employee Perspectives and Satisfaction

Student loan debt significantly impacts the financial well-being of many employees, often extending far beyond the repayment schedule itself. This financial stress can seep into the workplace, affecting job satisfaction, productivity, and overall morale. Understanding employee perspectives on this issue is crucial for employers seeking to create a supportive and productive work environment.

The weight of student loan debt can significantly impact an employee’s overall well-being and job performance. Employees struggling with repayments may experience increased stress and anxiety, leading to reduced focus, decreased productivity, and even absenteeism. Conversely, assistance with student loan repayment can foster a sense of loyalty and improved morale, ultimately benefiting the employer through increased retention and productivity.

Impact of Student Loan Debt on Job Satisfaction and Productivity

Studies have shown a strong correlation between high levels of student loan debt and lower job satisfaction. Employees burdened by debt often report feeling overwhelmed and stressed, leading to difficulty concentrating on work tasks and reduced overall productivity. This can manifest in various ways, including decreased engagement in team projects, missed deadlines, and increased errors. For example, a survey by [Fictional Survey Name] found that employees with over $50,000 in student loan debt reported significantly lower job satisfaction scores compared to their debt-free counterparts. The survey also indicated a correlation between the level of debt and reported instances of presenteeism (being physically present at work but not fully engaged).

Positive Impact of Student Loan Repayment Assistance on Employee Morale and Loyalty

Offering student loan repayment assistance can be a powerful tool for boosting employee morale and fostering loyalty. When employers demonstrate a commitment to their employees’ financial well-being, it fosters a sense of appreciation and trust. This can lead to increased job satisfaction, improved productivity, and reduced employee turnover. Anecdotal evidence from companies that have implemented such programs suggests that employees feel valued and supported, leading to a more positive and productive work environment. For instance, a case study of [Fictional Company Name] showed a significant increase in employee retention rates after introducing a student loan repayment assistance program. Employees reported feeling less stressed about their finances, allowing them to focus more on their work and contribute more effectively to the company’s success.

Illustrative Examples of Employee Satisfaction with Student Loan Repayment Programs

- A qualitative study involving interviews with employees participating in a student loan repayment program revealed overwhelmingly positive feedback. Participants frequently cited reduced stress and improved financial stability as key benefits. Many reported feeling more loyal to their employer as a result of the program.

- Another study using a quantitative approach measured employee satisfaction through surveys before and after the implementation of a student loan repayment program. The results showed a statistically significant increase in employee satisfaction scores post-implementation.

- Informal feedback gathered through employee focus groups indicated that the program was perceived as a valuable and highly appreciated employee benefit. Employees felt that the program demonstrated genuine care and concern from their employer, fostering a stronger sense of loyalty and commitment.

Impact on Employee Well-being

The positive impact of student loan repayment assistance on employee well-being is multifaceted:

- Reduced financial stress and anxiety.

- Improved mental and emotional health.

- Increased job satisfaction and engagement.

- Enhanced productivity and performance.

- Greater loyalty and reduced turnover.

- Improved overall work-life balance.

Summary

In conclusion, student loan repayment assistance offers a compelling value proposition for both employers and employees. By strategically designing and implementing such programs, companies can significantly enhance their employer branding, attract and retain skilled professionals, boost employee morale and productivity, and ultimately, achieve a strong return on their investment. Understanding the financial implications, navigating the administrative complexities, and effectively communicating the program’s benefits are crucial for successful implementation and achieving a positive impact on the organization’s overall success.

FAQ Explained

What are the potential downsides of offering a student loan repayment program?

Potential downsides include increased administrative costs, the possibility of attracting employees primarily for the benefit, and the need for careful budgeting and forecasting to ensure program sustainability.

Can employers discriminate in who they offer student loan repayment assistance to?

No. Programs must comply with anti-discrimination laws and be applied fairly to all eligible employees.

How do I choose the right type of student loan repayment assistance program for my company?

The best type depends on your budget, employee demographics, and strategic goals. Consider factors like your company size, financial resources, and the overall employee benefits package when making your decision.

Are there any legal considerations I should be aware of?

Yes, it is essential to consult with legal counsel to ensure compliance with all applicable federal, state, and local laws and regulations related to employee benefits and tax implications.