Understanding the history of student loan interest rates is crucial for navigating the complexities of higher education financing. This exploration delves into the fluctuating trends of these rates, examining their relationship with broader economic factors and government policies. From the impact of inflation and federal funds rates to the nuances of subsidized versus unsubsidized loans and the differences between federal and private options, we’ll uncover the key drivers shaping the cost of borrowing for students over the decades.

We will analyze the historical data, highlighting significant legislative changes and their effects on student loan interest rates. This analysis will shed light on how these rates have impacted students’ ability to access higher education and the long-term financial implications for borrowers. By understanding the past, we can better anticipate future trends and make informed decisions about managing student loan debt.

Historical Trends in Student Loan Interest Rates

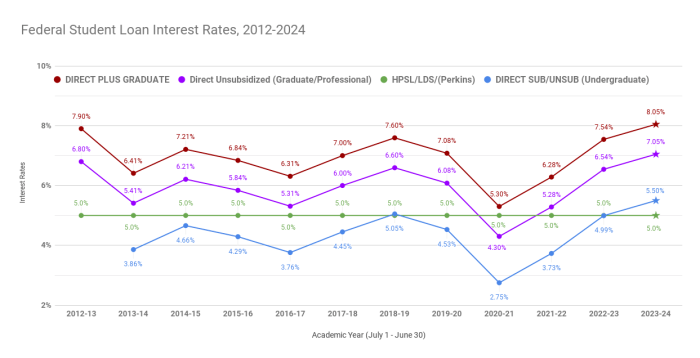

Student loan interest rates have fluctuated significantly over the past few decades, impacting millions of borrowers. These fluctuations are largely driven by government policy, economic conditions, and market forces. Understanding these historical trends is crucial for prospective and current borrowers to make informed financial decisions.

A Timeline of Major Changes in Federal Student Loan Interest Rates Since 1970

Federal student loan interest rates have not always been a fixed or predictable number. Early legislation set rates differently than they are set today. The following timeline highlights key legislative changes and their impact on interest rates:

Prior to 1970, the system was less formalized, with varying rates and terms. The Higher Education Act of 1965 laid the groundwork for federal student aid, but significant changes came later. The 1970s saw the expansion of federal student loan programs, with rates often tied to the Treasury bill rate plus a margin. Throughout the 1980s and 1990s, rates continued to fluctuate, influenced by prevailing economic conditions. The 2000s saw increasing concern about student loan debt, leading to some legislative changes aimed at controlling costs, but the Great Recession significantly impacted borrowing. The Health Care and Education Reconciliation Act of 2010 established a new system where interest rates were set annually based on market-based indexes. Subsequent legislation, such as the Affordable Care Act and various appropriations bills, further refined the process. The most recent changes have seen a move toward more fixed rates in some programs, but the overall trend remains subject to adjustments based on economic factors.

Comparison of Subsidized and Unsubsidized Loan Interest Rates Across Different Decades

Subsidized and unsubsidized federal student loans have always had different interest rate structures. Subsidized loans are need-based and the government pays the interest while the student is enrolled at least half-time, during a grace period, and during periods of deferment. Unsubsidized loans accrue interest from the time the loan is disbursed, regardless of the borrower’s enrollment status. The interest rate differential between these two loan types has varied over time. Generally, subsidized loans have had lower interest rates than unsubsidized loans in any given year, reflecting the government’s risk assessment and support for needy students. The magnitude of this difference has varied, with wider gaps in some decades than in others. For example, in the 1980s and 1990s, the difference might have been relatively small, while in more recent years, the gap may have been more pronounced due to economic shifts and government policy changes. Detailed data for specific decades would be needed for a precise comparison.

Average Interest Rates for Undergraduate and Graduate Loans Over Time

The following table provides a simplified overview of average interest rates for undergraduate and graduate federal student loans over selected years. It is important to note that these are averages and actual rates varied based on loan type, year of disbursement, and other factors. Precise data requires consulting official government sources for each loan program.

| Year | Undergraduate Rate (Approximate Average) | Graduate Rate (Approximate Average) | Significant Events |

|---|---|---|---|

| 1980 | 7-9% | 8-10% | High inflation, variable rates prevalent |

| 1990 | 7-9% | 8-10% | Continued fluctuation, some fixed rate options emerging |

| 2000 | 6-8% | 7-9% | Increased borrowing, market-based rate setting starting to take hold |

| 2010 | 6-7% (variable, dependent on index) | 7-8% (variable, dependent on index) | Health Care and Education Reconciliation Act changes rate setting |

| 2020 | 2.75-5.3% (depending on loan type and year of disbursement) | 4.3-7% (depending on loan type and year of disbursement) | COVID-19 pandemic impacts, periods of 0% interest |

Impact of Economic Factors on Interest Rates

Student loan interest rates, like other borrowing costs, are significantly influenced by broader economic conditions. Understanding these connections is crucial for both borrowers and policymakers, as they directly impact the affordability and accessibility of higher education. Fluctuations in key economic indicators create a ripple effect, affecting the overall cost of borrowing for students.

The relationship between economic factors and student loan interest rates is complex and multifaceted, involving a dynamic interplay of various forces. These factors can independently influence rates, or act in concert to create significant shifts in borrowing costs. For instance, periods of high inflation often lead to higher interest rates, while periods of economic recession can have the opposite effect. The Federal Reserve’s actions, specifically changes in the federal funds rate, also play a crucial role.

Inflation’s Influence on Student Loan Interest Rates

Inflation, a general increase in the prices of goods and services in an economy, directly impacts interest rates. When inflation rises, lenders demand higher interest rates to compensate for the decreased purchasing power of future repayments. This is because the money they receive back in the future will be worth less than the money they lent out today. For example, during periods of high inflation, such as the late 1970s and early 1980s, student loan interest rates were considerably higher than during periods of low inflation. Conversely, during periods of low or negative inflation (deflation), lenders may be willing to accept lower interest rates. The relationship isn’t always perfectly linear, however, as other economic factors can also influence the rates.

Federal Funds Rate and Student Loan Interest Rates

The federal funds rate, the target rate that the Federal Reserve (the central bank of the United States) sets for overnight lending between banks, acts as a benchmark for other interest rates in the economy. When the Federal Reserve raises the federal funds rate to combat inflation, it typically leads to an increase in other interest rates, including student loan interest rates. Conversely, a decrease in the federal funds rate, often implemented during economic downturns to stimulate borrowing and spending, usually results in lower student loan interest rates. This is because the cost of borrowing for banks decreases, and this reduction is often passed on to consumers, including students. The impact isn’t immediate or always proportional, as other factors and market forces play a role.

Other Macroeconomic Factors Influencing Student Loan Interest Rates

Beyond inflation and the federal funds rate, several other macroeconomic factors influence the cost of borrowing for students. These include government fiscal policy (e.g., government spending and taxation), overall economic growth, investor confidence, and global economic conditions. For instance, a strong economy with robust job growth can lead to lower interest rates as lenders feel more confident in borrowers’ ability to repay their loans. Conversely, a global economic crisis can increase risk aversion among lenders, potentially leading to higher interest rates for all borrowers, including students. Additionally, changes in government regulations and policies regarding student loans can also significantly affect interest rates. The government’s role in subsidizing or guaranteeing student loans can influence the overall risk profile and, consequently, the interest rates charged.

Types of Student Loans and Their Interest Rates

Understanding the different types of student loans and their associated interest rates is crucial for effective financial planning during and after your education. Interest rates significantly impact the total cost of borrowing, so a clear grasp of these variations is essential for making informed decisions. This section will detail the key differences between federal and private student loans, outlining the factors that influence their respective interest rates.

Federal and private student loans differ significantly in their interest rate structures and the factors influencing those rates. Federal loans, offered by the U.S. government, generally offer fixed interest rates and various income-driven repayment plans. Private loans, on the other hand, are provided by banks and other private lenders, and their interest rates are variable and typically higher than federal loan rates. These rates are influenced by a multitude of factors related to the borrower’s creditworthiness.

Federal Student Loan Interest Rates

Federal student loans, such as Stafford and PLUS loans, typically have lower interest rates than private loans. These rates are set by the government and are subject to change annually. The interest rate for a federal loan depends on factors such as the loan type (subsidized vs. unsubsidized), the borrower’s credit history (in the case of PLUS loans), and the loan disbursement year. While subsidized Stafford loans may not accrue interest while the student is enrolled at least half-time, unsubsidized Stafford loans and PLUS loans accrue interest throughout the loan’s life.

- Subsidized Stafford Loans: These loans are need-based and do not accrue interest while the borrower is enrolled at least half-time in an eligible degree program. The interest rate is set annually by the government.

- Unsubsidized Stafford Loans: These loans are available to both undergraduate and graduate students, regardless of financial need. Interest begins accruing immediately, even while the borrower is still in school.

- PLUS Loans: These loans are available to parents of dependent undergraduate students and to graduate students. Interest rates are generally higher than Stafford loan rates and are subject to a credit check.

Private Student Loan Interest Rates

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike federal loans, the interest rates on private loans are variable and are influenced by several factors. Borrowers with strong credit scores and a co-signer are more likely to secure lower interest rates.

The following factors play a crucial role in determining the interest rate a borrower receives on a private student loan:

- Credit Score: A higher credit score typically results in a lower interest rate. Lenders consider credit history as an indicator of the borrower’s ability to repay the loan.

- Co-signer: Having a co-signer with a strong credit history can significantly improve the chances of securing a lower interest rate. The co-signer assumes responsibility for repayment if the borrower defaults.

- Loan Amount: Larger loan amounts may be associated with higher interest rates, as they represent a greater risk to the lender.

- Repayment Term: Shorter repayment terms may result in higher monthly payments but lower overall interest costs, while longer repayment terms may lower monthly payments but result in higher overall interest costs.

- School Type and Program: The lender may consider the reputation and accreditation of the school and the specific program of study when determining the interest rate. Programs with high graduate employment rates may be associated with lower rates.

Comparison of Typical Interest Rate Ranges

It’s important to note that these are typical ranges and actual interest rates can vary depending on the specific lender, borrower’s creditworthiness, and other factors. Always compare offers from multiple lenders before selecting a private student loan.

| Loan Type | Typical Interest Rate Range (Example – subject to change) |

|---|---|

| Federal Subsidized Stafford Loan | 0% – 5% |

| Federal Unsubsidized Stafford Loan | 1% – 6% |

| Federal PLUS Loan | 6% – 8% |

| Private Student Loan | 4% – 15% (or higher) |

Interest Rate Calculation and Capitalization

Understanding how interest is calculated and capitalized on student loans is crucial for effectively managing repayment and minimizing overall costs. The method used significantly impacts the total amount you’ll ultimately pay back. This section will clarify the differences between simple and compound interest calculations and explain the process of interest capitalization.

Student loan interest accrues over time, meaning interest is added to the principal loan amount. There are two primary methods for calculating this interest: simple interest and compound interest. Simple interest is calculated only on the principal balance, while compound interest is calculated on both the principal and accumulated interest. The type of interest applied varies depending on the loan type and lender.

Simple Interest Calculation

Simple interest is calculated only on the original principal amount of the loan. The formula for calculating simple interest is:

Simple Interest = Principal x Interest Rate x Time

where the time is typically expressed in years. For example, a $10,000 loan with a 5% annual interest rate over one year would accrue $500 in simple interest ($10,000 x 0.05 x 1 = $500). This interest is added to the principal at the end of the year, resulting in a new balance of $10,500. This process would repeat each year if the loan wasn’t paid off. Note that this calculation is simplified; in reality, student loan interest is typically calculated daily and then added monthly.

Compound Interest Calculation

Compound interest is calculated on the principal amount plus any accumulated interest. Unlike simple interest, the interest earned in one period becomes part of the principal for the next period. This means that interest earns interest, leading to faster growth of the total loan balance. The formula for compound interest is more complex and typically involves exponential growth. However, a simplified understanding is that the interest is calculated and added to the principal balance periodically (daily, monthly, etc.). The new balance then becomes the basis for calculating interest in the next period. This results in a significantly larger total amount owed over time compared to simple interest.

Interest Capitalization

Interest capitalization occurs when unpaid interest is added to the principal loan balance. This typically happens when a borrower is in deferment or forbearance, periods where loan payments are temporarily suspended. Once the deferment or forbearance ends, the capitalized interest increases the principal balance, leading to higher future payments and a larger total loan cost. For example, if $1,000 of interest is capitalized, the borrower’s principal balance increases by $1,000, and future interest calculations will be based on this larger amount. This compounding effect can substantially increase the total cost of the loan over its lifetime.

Sample Calculation: Simple vs. Compound Interest

Let’s compare a $10,000 loan with a 5% annual interest rate over a 10-year repayment period, assuming simple versus compound interest. For simplicity, we will use annual compounding for the compound interest example. In reality, compounding would occur more frequently.

Simple Interest: Each year, $500 in interest would be added. After 10 years, the total interest paid would be $5,000 ($500/year * 10 years), resulting in a total repayment of $15,000.

Compound Interest: The calculation is more complex. In the first year, the interest would be $500, bringing the balance to $10,500. In the second year, interest is calculated on $10,500, and so on. After 10 years, the total interest paid would be significantly higher than $5,000, resulting in a total repayment substantially exceeding $15,000. The precise amount would require a more detailed compound interest calculation using the formula, which is beyond the scope of this simplified example. However, it is important to recognize the significantly higher total cost associated with compound interest.

Visual Representation of Interest Rate Data

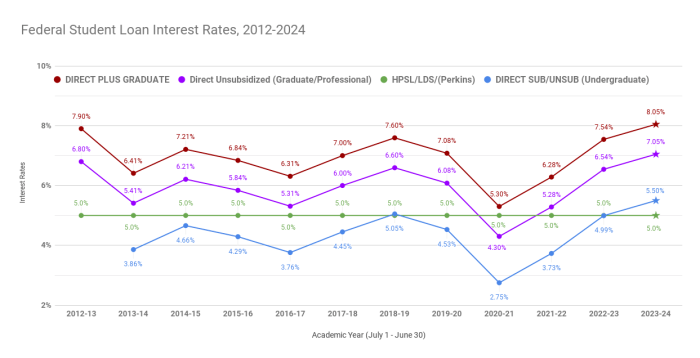

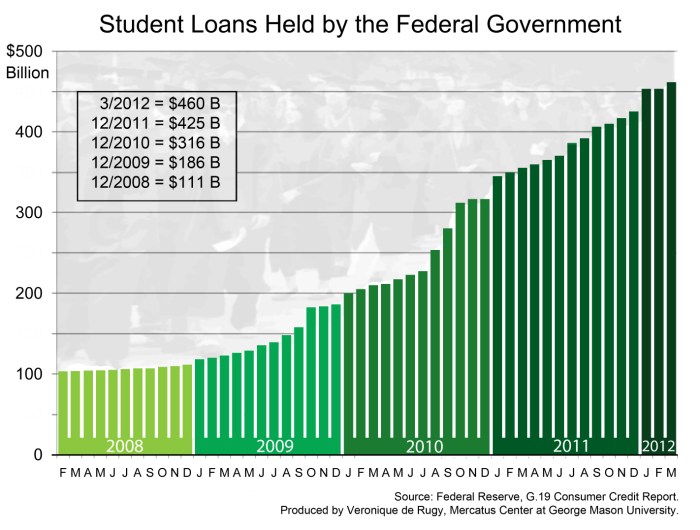

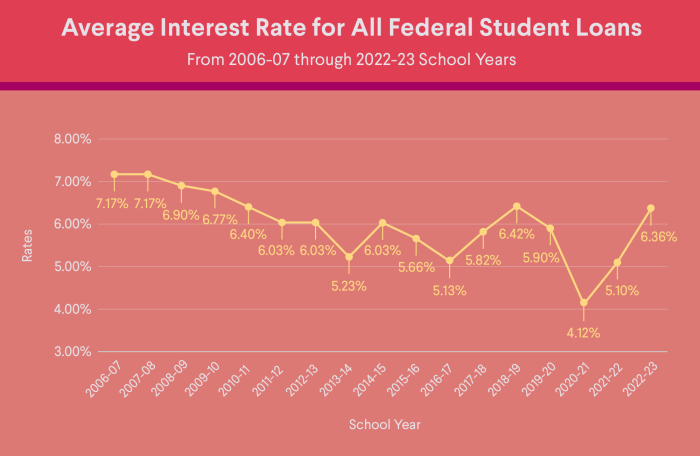

Understanding the historical trends and current state of student loan interest rates is crucial for prospective and current borrowers. Visual representations offer a clear and concise way to grasp this complex data, allowing for easier comparison and analysis. The following sections detail two different graphical representations illustrating key aspects of student loan interest rates.

Line Graph of Average Student Loan Interest Rates (1975-2025)

This line graph depicts the fluctuation of average student loan interest rates over the past 50 years (1975-2025, projected). The horizontal (x) axis represents the year, ranging from 1975 to 2025. The vertical (y) axis represents the average annual interest rate, expressed as a percentage. The line itself illustrates the change in average interest rates over time. Key trends would include periods of significant increase or decrease, reflecting economic conditions and government policies. For example, a noticeable spike might be observed during periods of high inflation or economic recession. Conversely, periods of low interest rates might coincide with government initiatives aimed at making higher education more accessible. The graph would visually demonstrate the overall upward or downward trends, as well as any significant volatility. Note that data for years beyond 2023 would be projections based on current trends and economic forecasts.

Bar Chart Comparing Average Interest Rates of Different Student Loan Types (2024)

This bar chart compares the average interest rates of various student loan types in the current year (2024). The horizontal (x) axis displays the different types of student loans, such as Federal Subsidized Loans, Federal Unsubsidized Loans, Federal PLUS Loans (for parents and graduate students), and Private Student Loans. The vertical (y) axis represents the average annual interest rate, again expressed as a percentage. Each bar represents a specific loan type, with its height corresponding to the average interest rate. This allows for a direct visual comparison of the relative costs of borrowing through different loan programs.

| Loan Type | Average Interest Rate (2024) |

|---|---|

| Federal Subsidized Loans | 5.0% (Example) |

| Federal Unsubsidized Loans | 6.5% (Example) |

| Federal PLUS Loans | 7.5% (Example) |

| Private Student Loans | 8.0% – 12.0% (Variable Range Example) |

The chart clearly shows that interest rates vary significantly depending on the type of loan. Private loans, for example, typically carry higher interest rates than federal loans, reflecting the higher risk associated with private lending. The chart also highlights the differences between subsidized and unsubsidized federal loans, with subsidized loans generally having lower interest rates due to government interest subsidies during periods of deferment. These visual aids provide a comprehensive overview of student loan interest rate trends and comparisons, making the information more accessible and understandable.

Government Policies and Their Influence

Government policies significantly influence student loan interest rates, impacting both the accessibility and affordability of higher education. These policies operate through direct regulation of interest rates, indirect influence on market conditions, and the implementation of loan forgiveness and repayment assistance programs. Understanding these governmental actions is crucial to comprehending the historical trends and current state of student loan interest rates.

Government interventions in the student loan market have evolved over time, reflecting shifting political priorities and economic realities. Early policies focused primarily on expanding access to higher education, often with less emphasis on the long-term implications of accumulating student loan debt. More recent policies have incorporated a greater focus on affordability and debt management, though the balance between access and affordability remains a subject of ongoing debate.

The Impact of Direct Rate Setting and Subsidies

The federal government directly sets interest rates for many federal student loans. These rates are often tied to market indices, but the government also has the power to cap or otherwise influence these rates. For example, Congress periodically adjusts the interest rates charged on subsidized and unsubsidized Stafford loans, directly impacting the cost of borrowing for students. Additionally, government subsidies reduce the overall cost of borrowing by covering a portion of the interest accrued on certain loans while students are in school or during grace periods. These subsidies effectively lower the overall interest rate burden on borrowers.

Effects of Loan Forgiveness Programs on Borrowing Costs

Loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program and income-driven repayment plans, can indirectly influence borrowing costs. While these programs don’t directly lower interest rates, they reduce the perceived risk associated with borrowing large sums for education. Knowing that a portion of their debt may be forgiven after a certain period of qualifying employment or based on income levels, borrowers may be more willing to take on larger loans, potentially driving up demand and indirectly impacting interest rates. The effect of loan forgiveness on the overall cost of borrowing is complex and a subject of ongoing economic research, with studies showing varying results depending on the program design and participation rates.

Government Interventions Aimed at Affordability

Several government initiatives aim to make student loans more affordable. These include initiatives that focus on increasing financial aid and grants, lowering interest rates on federal loans, and expanding income-driven repayment plans. The expansion of income-driven repayment plans, for example, allows borrowers to make monthly payments based on their income and family size, potentially reducing the burden of monthly payments and the total interest paid over the life of the loan. Furthermore, government programs promoting financial literacy and responsible borrowing practices aim to equip students with the knowledge to make informed decisions about their educational financing, ultimately leading to more sustainable debt management strategies.

Last Point

The journey through student loan interest rate history reveals a complex interplay of economic forces, government policies, and individual borrowing choices. While the fluctuations in rates can seem daunting, understanding the underlying factors—from inflation and macroeconomic conditions to legislative changes and loan types—empowers borrowers to make more informed decisions. By analyzing historical trends and understanding the mechanics of interest calculation and capitalization, students and graduates can better manage their debt and plan for a financially secure future.

Essential FAQs

What is the difference between subsidized and unsubsidized student loans?

Subsidized loans do not accrue interest while the borrower is in school, during grace periods, or during deferment. Unsubsidized loans accrue interest throughout the loan’s life.

How does my credit score affect my private student loan interest rate?

A higher credit score typically results in a lower interest rate on private student loans, as lenders perceive lower risk.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it may involve switching from federal to private loans, which could impact benefits like income-driven repayment plans.

What is interest capitalization?

Interest capitalization is the process of adding accrued but unpaid interest to the principal loan balance, increasing the total amount owed.