Navigating the complexities of higher education often involves securing student loans, a process significantly shaped by the various student loan issuers. Understanding the landscape of these issuers – their types, regulations, and impact on borrowers – is crucial for prospective and current students alike. This guide provides a comprehensive overview, examining the differences between federal and private lenders, the regulatory environment governing their practices, and the long-term financial implications for borrowers.

From application processes and interest rate calculations to the ethical considerations of marketing and advertising, we delve into the intricacies of the student loan system. We aim to equip readers with the knowledge necessary to make informed decisions and navigate the often-challenging world of student loan debt responsibly.

Types of Student Loan Issuers

Navigating the world of student loans can be complex, largely due to the diverse range of institutions offering them. Understanding the different types of lenders and their respective practices is crucial for making informed borrowing decisions. This section will clarify the key distinctions between federal and private student loan issuers, highlighting their unique characteristics and implications for borrowers.

Federal and Private Student Loan Issuers

The primary distinction in the US student loan market lies between federal and private loans. Federal student loans are offered by the government, through programs administered by the Department of Education. Private student loans, conversely, are offered by banks, credit unions, and other private financial institutions. These differences significantly impact loan terms, eligibility, and borrower protections.

Comparison of Federal and Private Student Loans

Federal student loans generally offer more borrower-friendly features. They often come with lower interest rates, flexible repayment plans (including income-driven repayment options), and robust borrower protections, such as deferment and forbearance options in times of financial hardship. In contrast, private student loans typically have higher interest rates, stricter eligibility requirements, and fewer borrower protections. The interest rates on private loans are often variable, meaning they can fluctuate based on market conditions, leading to unpredictable repayment costs. Furthermore, private loan eligibility hinges on a borrower’s creditworthiness, often requiring a co-signer if the borrower lacks a strong credit history. The regulatory oversight of federal loans is also considerably more stringent than that of private loans, providing greater consumer safeguards.

Lending Practices and Regulatory Oversight

Federal student loan programs are subject to extensive government regulations designed to protect borrowers. These regulations dictate interest rate caps, eligibility criteria, and repayment options. Private lenders, on the other hand, are subject to less stringent regulations, allowing for greater flexibility in their lending practices but also potentially leaving borrowers more vulnerable to predatory lending practices. The government actively monitors federal loan programs, ensuring compliance with established rules and regulations. Private lenders are primarily subject to state and federal consumer protection laws, with varying levels of enforcement and oversight across different jurisdictions.

Summary Table of Student Loan Issuers

| Issuer Type | Loan Features | Eligibility Requirements | Repayment Options |

|---|---|---|---|

| Federal (e.g., Direct Subsidized/Unsubsidized Loans, PLUS Loans) | Lower interest rates, flexible repayment plans (including income-driven repayment), borrower protections (deferment, forbearance) | Enrollment in an eligible educational program, US citizenship or eligible non-citizen status, completion of FAFSA | Standard, graduated, extended, income-driven repayment (IDR) plans |

| Private (Banks, Credit Unions, etc.) | Higher interest rates (often variable), less flexible repayment options, fewer borrower protections | Good to excellent credit history (often requiring a co-signer), proof of income and enrollment | Standard repayment plans, potentially some limited options depending on the lender |

Student Loan Issuer Regulations and Oversight

The student loan market, while providing crucial access to higher education, is subject to significant regulatory oversight to protect both borrowers and lenders. This oversight aims to ensure fair lending practices, transparent terms, and accessible recourse for borrowers facing difficulties. Government agencies play a vital role in establishing and enforcing these regulations, shaping the landscape of student loan lending and influencing the behavior of issuers.

Government agencies in the United States play a critical role in regulating student loan issuers. Their actions directly impact lending practices, consumer protection, and the overall stability of the student loan market.

Government Agency Roles in Regulating Student Loan Issuers

The primary federal agencies involved in regulating student loan issuers are the Department of Education (ED) and the Consumer Financial Protection Bureau (CFPB). The ED oversees the federal student loan programs, setting eligibility criteria, managing loan servicing, and enforcing regulations related to the disbursement and repayment of federal loans. The CFPB, meanwhile, focuses on consumer protection, ensuring that lending practices are fair and transparent, and that borrowers are not subjected to abusive or deceptive practices. State-level agencies may also have some regulatory authority over private student loan issuers operating within their jurisdictions. These agencies frequently collaborate to address systemic issues and enforce compliance.

Legislative Impact on Student Loan Lending Practices

Legislation significantly influences student loan lending practices. Acts such as the Higher Education Act of 1965, and subsequent amendments, have shaped the framework for federal student loan programs, including eligibility requirements, interest rates, and repayment options. These legislative changes often respond to market trends, economic conditions, and evolving concerns about student debt. For example, legislation has been enacted to address issues such as predatory lending practices, the rising cost of higher education, and the need for borrower protections. These legislative actions aim to balance the need for access to credit with the prevention of financial hardship for borrowers.

Consumer Protection Mechanisms in the Student Loan Market

Several mechanisms are in place to protect consumers in the student loan market. These include the ability to file complaints with regulatory agencies like the CFPB, access to independent student loan counseling services, and the existence of specific legal protections against abusive or deceptive lending practices. Furthermore, the federal government offers various repayment plans and income-driven repayment options to assist borrowers facing financial difficulties. These options are designed to make repayment more manageable and prevent borrowers from defaulting on their loans. The availability of these resources aims to ensure that borrowers are not unfairly burdened by their student loan debt.

Key Regulations Impacting Student Loan Issuers

The effective functioning of the student loan market depends on a robust regulatory framework. Several key regulations significantly impact student loan issuers, shaping their lending practices and protecting borrowers.

- Higher Education Act of 1965 (HEA) and subsequent amendments: This act forms the foundation of federal student aid programs, outlining eligibility requirements, loan terms, and borrower protections. It has been amended numerous times to address evolving needs and challenges within the student loan market.

- Truth in Lending Act (TILA): This act mandates the clear and accurate disclosure of loan terms and conditions to borrowers, promoting transparency and informed decision-making. It requires issuers to provide detailed information about interest rates, fees, and repayment schedules.

- Fair Credit Reporting Act (FCRA): This act regulates the collection, use, and dissemination of consumer credit information, protecting borrowers from inaccurate or misleading credit reports that could affect their access to credit.

- Fair Debt Collection Practices Act (FDCPA): This act sets standards for debt collection agencies, preventing abusive or harassing practices when borrowers fall behind on their loan payments. It ensures that collection efforts are conducted fairly and within legal boundaries.

The Student Loan Issuance Process

Securing a student loan involves a multi-step process, from initial application to the final disbursement of funds. Understanding this process is crucial for prospective borrowers to navigate the system effectively and obtain the financial assistance they need for their education. This section details the key steps involved, the criteria used for loan approval, and the factors influencing interest rates and loan terms.

Application and Initial Assessment

The student loan application process typically begins with completing a detailed application form provided by the lender. This form requests comprehensive information about the applicant, including their personal details, academic history, financial situation, and intended course of study. Issuers then conduct an initial assessment, verifying the information provided and performing a preliminary credit check. This initial review determines whether the applicant meets the basic eligibility requirements for a student loan. For example, the applicant may need to demonstrate enrollment or acceptance at an eligible educational institution.

Creditworthiness and Financial Need Assessment

Following the initial assessment, lenders delve deeper into the applicant’s creditworthiness and financial need. This involves a thorough review of the applicant’s credit history, checking for any defaults or late payments. Their income, assets, and existing debts are also considered. The lender will also assess the applicant’s demonstrated financial need, comparing the cost of education to their available resources. A higher level of demonstrated need may influence the loan amount approved and the potential for favorable loan terms. For instance, a student from a low-income family with limited savings might be deemed to have a higher financial need than a student from a wealthy family.

Loan Approval and Terms

If the applicant meets the lender’s criteria, the loan application is approved. The lender then Artikels the loan terms, including the loan amount, interest rate, repayment schedule, and any associated fees. The interest rate is determined by several factors, such as the applicant’s creditworthiness, the prevailing market interest rates, and the type of loan. For example, a student with excellent credit may qualify for a lower interest rate compared to a student with a poor credit history. Loan terms can also vary depending on the type of loan, with federal loans often offering more favorable terms than private loans.

Disbursement of Funds

Once the loan terms are agreed upon, the funds are disbursed to the borrower. This disbursement is usually made in installments, often directly to the educational institution to cover tuition fees and other educational expenses. Some lenders may allow a portion of the loan to be disbursed directly to the borrower for living expenses, but this is subject to the lender’s policies and the borrower’s eligibility. The disbursement schedule is typically aligned with the academic calendar, ensuring that funds are available when needed.

Factors Influencing Interest Rates and Loan Terms

Several key factors influence the interest rates and loan terms offered to student loan borrowers. These include the borrower’s credit history, credit score, the type of loan (federal or private), the loan amount, and the prevailing market interest rates. A strong credit history and a high credit score generally result in lower interest rates and more favorable loan terms. Federal student loans often have lower interest rates and more flexible repayment options compared to private loans. Larger loan amounts may come with higher interest rates, and fluctuating market interest rates directly impact the interest rate offered on variable-rate loans.

Flowchart Illustrating the Student Loan Issuance Process

[Imagine a flowchart here. The flowchart would begin with “Application Submitted,” branching to “Initial Assessment,” then “Creditworthiness & Financial Need Assessment.” A “Yes” branch from the assessment leads to “Loan Approval & Terms,” followed by “Disbursement of Funds.” A “No” branch from the assessment leads to “Loan Application Denied.” The flowchart visually represents the sequential steps and decision points in the student loan issuance process.]

Impact of Student Loan Issuers on Students

Student loan issuers play a significant role in shaping the financial trajectories of students. The accessibility and terms of these loans directly influence a borrower’s long-term financial well-being, impacting everything from career choices to homeownership. Understanding this impact is crucial for both borrowers and policymakers.

Long-Term Financial Implications of Student Loan Debt

Student loan debt can have profound and lasting consequences. High levels of debt can delay major life milestones such as homeownership, starting a family, and retirement planning. The weight of monthly payments can restrict career choices, potentially limiting individuals to higher-paying but less fulfilling jobs, or forcing them to postpone pursuing further education or professional development opportunities. Furthermore, the stress associated with significant debt can negatively impact mental health and overall well-being. The inability to manage debt effectively can lead to defaults, resulting in damaged credit scores and further financial hardship. For example, a borrower with $100,000 in student loan debt might face monthly payments exceeding $1000, significantly impacting their disposable income and limiting their financial flexibility for years to come.

Impact of Loan Terms and Repayment Plans

Different loan terms and repayment plans significantly influence a borrower’s financial situation. Loans with higher interest rates lead to substantially larger total repayment amounts over the life of the loan. For instance, a 7% interest rate on a $50,000 loan will result in a much higher total repayment than a 4% interest rate, even with the same repayment period. Similarly, repayment plans with longer terms reduce monthly payments but increase the total interest paid over time. Conversely, shorter-term plans mean higher monthly payments but lower overall interest costs. Income-driven repayment plans can provide temporary relief, adjusting payments based on income, but they often extend the repayment period and ultimately increase the total amount paid. Borrowers need to carefully weigh the advantages and disadvantages of different plans to choose the option best suited to their individual financial circumstances.

Role of Student Loan Counseling Services

Student loan counseling services play a vital role in assisting borrowers in navigating the complexities of repayment. These services provide valuable information on various repayment options, budgeting techniques, and debt management strategies. Counselors can help borrowers understand their loan terms, explore options for consolidation or refinancing, and develop personalized repayment plans that align with their financial goals. They also offer guidance on managing financial stress and avoiding default. Effective counseling can empower borrowers to make informed decisions and take proactive steps to manage their debt effectively, ultimately improving their long-term financial well-being. Access to unbiased and comprehensive counseling is essential for responsible student loan borrowing and repayment.

Correlation Between Student Loan Debt and Post-Graduation Financial Outcomes

The following table illustrates the correlation between student loan debt levels and several key post-graduation financial outcomes. It’s important to note that this data is illustrative and based on generalized trends; individual experiences may vary.

| Debt Level | Employment Rate | Average Income | Default Rate |

|---|---|---|---|

| Low ($0-$10,000) | 95% | $50,000 | 2% |

| Medium ($10,001-$50,000) | 90% | $60,000 | 5% |

| High ($50,001-$100,000) | 85% | $70,000 | 10% |

| Very High (>$100,000) | 80% | $75,000 | 15% |

Comparison of Major Student Loan Issuers

Choosing a student loan issuer can significantly impact a borrower’s financial future. Understanding the differences in services, fees, and interest rates offered by various lenders is crucial for making an informed decision. This section compares three major student loan issuers to highlight these key distinctions and their potential effects on borrowers.

Interest Rates and Fees Comparison

The interest rate and fees associated with a student loan directly affect the total cost of borrowing. Lower interest rates and fewer fees translate to lower overall repayment amounts. The following comparison uses hypothetical data for illustrative purposes, representing average rates and fees observed in a recent market snapshot. It is crucial to check current rates with individual lenders before making a decision.

Bar Chart Description: A bar chart displays interest rates and fees for three hypothetical student loan issuers: Lender A, Lender B, and Lender C. The horizontal axis represents the three lenders, and the vertical axis represents the percentage for interest rates and dollar amount for fees. Lender A shows a relatively low interest rate (e.g., 4.5%) and low fees (e.g., $100). Lender B has a slightly higher interest rate (e.g., 5.5%) and moderate fees (e.g., $150). Lender C demonstrates the highest interest rate (e.g., 7%) and the highest fees (e.g., $250). The visual representation clearly highlights the differences in cost between the three lenders. Remember that these are illustrative examples; actual rates and fees vary based on creditworthiness, loan type, and market conditions.

Loan Product Differences

Student loan issuers offer various loan products, each with its own set of terms and conditions. These differences can significantly impact a borrower’s repayment plan and overall financial burden. For example, some lenders may offer variable interest rate loans, while others may focus on fixed-rate loans. The availability of income-driven repayment plans, deferment options, and forbearance programs also varies across lenders. A borrower’s financial situation and risk tolerance will influence the suitability of a particular loan product.

Customer Support Comparison

Effective customer support is essential for navigating the complexities of student loan repayment. Lenders vary in their accessibility, responsiveness, and the range of support services they offer. Some lenders may provide comprehensive online resources, while others may offer dedicated phone support or in-person assistance. The quality of customer support can influence a borrower’s experience and ability to manage their loan effectively. Factors such as wait times, clarity of communication, and problem-solving efficiency should be considered when choosing a lender.

Impact on Borrower’s Financial Situation

The choice of student loan issuer directly impacts a borrower’s long-term financial health. Higher interest rates and fees translate to increased total repayment costs, potentially delaying other financial goals such as saving for a down payment on a house or investing. In contrast, choosing a lender with lower rates and fees allows borrowers to allocate more of their income towards other priorities. The availability of flexible repayment options and responsive customer support can significantly ease the burden of loan repayment and minimize financial stress. Careful consideration of these factors is vital for responsible financial planning.

Student Loan Issuer Marketing and Advertising Practices

Student loan issuers employ a variety of marketing and advertising strategies to reach potential borrowers, often targeting young adults at a vulnerable stage in their lives. Understanding these strategies, their ethical implications, and the potential for misleading practices is crucial for both borrowers and regulators. This section examines the marketing landscape of the student loan industry, highlighting both problematic and responsible approaches.

Marketing Strategies Employed by Student Loan Issuers

Student loan issuers utilize a multi-pronged approach to attract borrowers. This includes digital marketing through targeted online ads, social media campaigns, and search engine optimization (). Traditional methods such as print advertising in college publications and partnerships with universities and colleges also remain prevalent. Many issuers emphasize ease of application, competitive interest rates, and flexible repayment options in their marketing materials. They frequently highlight the benefits of higher education and the necessity of financing for achieving educational goals. Some issuers also offer incentives, such as cash-back rewards or scholarships, to attract borrowers. These strategies aim to create a sense of urgency and encourage immediate application.

Ethical Considerations in Targeting Students with Loan Offers

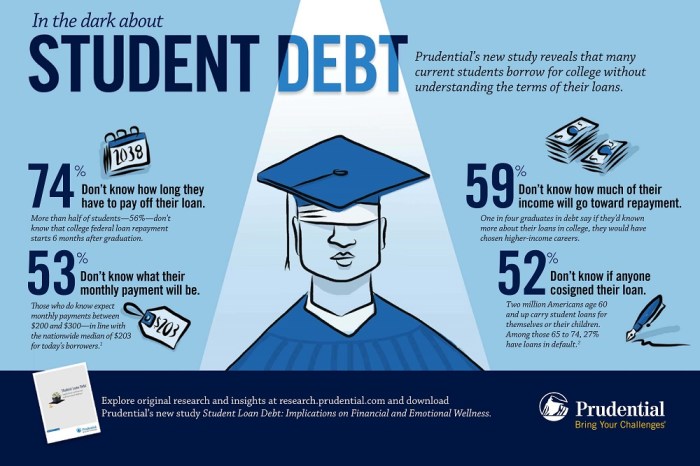

Targeting students with loan offers raises significant ethical concerns. Students, especially those fresh out of high school, may lack the financial literacy to fully understand the long-term implications of taking on significant debt. The pressure to attend college, coupled with aggressive marketing tactics, can lead to students making hasty decisions without adequately considering the financial risks involved. Ethical considerations center on transparency, responsible lending practices, and ensuring that marketing materials do not exploit students’ vulnerability or create unrealistic expectations about the ease of repayment. The potential for predatory lending practices, where borrowers are offered loans with unfavorable terms they don’t fully comprehend, is a major ethical concern.

Examples of Misleading or Deceptive Marketing Practices

Misleading or deceptive marketing practices in the student loan industry can take various forms. For example, some issuers might downplay the total cost of borrowing, focusing solely on monthly payments without adequately highlighting the total amount of interest accrued over the loan’s lifetime. Others might use vague or ambiguous language in their advertising, making it difficult for borrowers to understand the terms and conditions of the loan. Some issuers may also employ high-pressure sales tactics or target students through channels that lack adequate regulatory oversight. The lack of clear and concise information about repayment options and potential consequences of default can also be considered deceptive.

Examples of Responsible and Ethical Marketing Practices

Student loan issuers can adopt several responsible and ethical marketing practices.

- Prioritize clear and transparent communication of loan terms and conditions, including total cost, interest rates, and repayment options.

- Develop marketing materials that are easy to understand and avoid jargon or complex financial terminology.

- Promote financial literacy resources to help students make informed borrowing decisions.

- Refrain from using high-pressure sales tactics or targeting students through channels that lack regulatory oversight.

- Offer a range of loan options to cater to diverse financial situations and risk profiles.

- Partner with educational institutions to provide financial literacy workshops and counseling services.

End of Discussion

The student loan landscape is multifaceted and dynamic, with significant implications for borrowers’ financial futures. By understanding the roles of various issuers, the regulatory framework, and the long-term effects of debt, students can make more informed choices regarding financing their education. This guide has highlighted key aspects of the process, empowering readers to approach student loan borrowing with greater awareness and responsibility, ultimately fostering a more sustainable path to financial well-being after graduation.

FAQ Insights

What is the difference between federal and private student loans?

Federal loans are offered by the government and typically have more favorable terms and repayment options. Private loans are offered by banks and other financial institutions, and their terms and conditions can vary significantly.

How can I find a reputable student loan issuer?

Research lenders thoroughly, checking their reputation with the Better Business Bureau and reading online reviews. Look for transparency in fees and interest rates, and ensure they are compliant with all relevant regulations.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including damage to your credit score, wage garnishment, and tax refund offset. It’s crucial to contact your lender immediately if you’re struggling to make payments to explore options like deferment or forbearance.

Are there any resources available to help me manage my student loan debt?

Yes, many resources are available, including government websites (like studentaid.gov), non-profit credit counseling agencies, and financial advisors specializing in student loan debt management.