Navigating the complexities of student loan repayment can feel overwhelming, but understanding the Master Promissory Note (MPN) is crucial for responsible borrowing. This guide provides a clear and concise overview of the MPN, from its initial signing to long-term repayment strategies and the impact on your credit score. We’ll demystify the process, equipping you with the knowledge to make informed decisions about your student loan debt.

We will explore the various types of MPNs, the different repayment plans available, and the implications of defaulting on your loans. Furthermore, we will delve into loan forgiveness programs and how they interact with your MPN, providing practical tips for managing your student loans effectively and maintaining a healthy credit score throughout the repayment process. This guide aims to empower you with the understanding and tools needed to successfully navigate your student loan journey.

Understanding the Master Promissory Note (MPN)

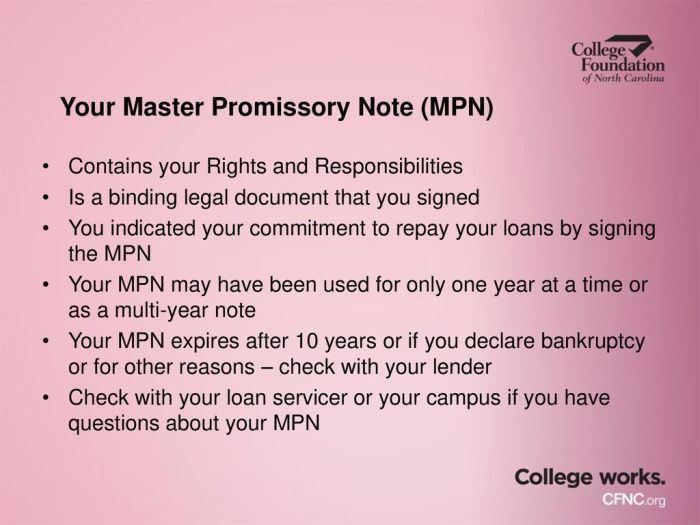

A Master Promissory Note (MPN) is a legally binding agreement you sign to receive federal student loans. It Artikels your responsibilities as a borrower and details the terms and conditions of your loan. Understanding its contents is crucial before accepting federal student aid.

The Purpose of a Student Loan MPN

The primary purpose of an MPN is to formalize the loan agreement between you, the borrower, and the U.S. Department of Education. It serves as a record of your commitment to repay the loan according to the terms specified. Signing an MPN signifies your understanding and acceptance of these terms, including the repayment schedule, interest rates, and potential consequences of default.

Key Components of a Standard MPN

A standard MPN includes several critical pieces of information. These typically include your personal details (name, address, social security number), the amount of the loan, the interest rate, the repayment plan options, the loan’s disbursement date, and details about loan forgiveness or cancellation programs (if applicable). It also clearly states the consequences of failing to make timely payments, including potential damage to your credit score and potential collection actions. The MPN will also specify the lender, which is typically a federal agency like the Department of Education.

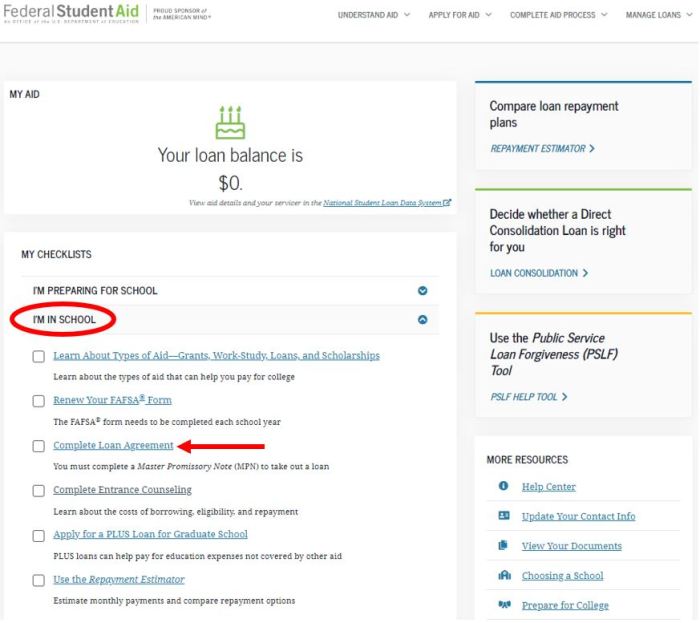

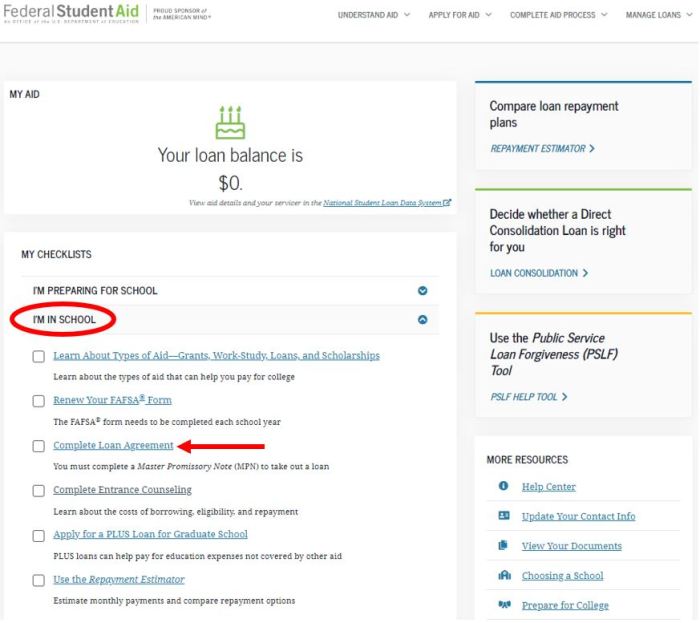

Completing an MPN: A Step-by-Step Guide

Completing an MPN is generally a straightforward online process. First, you’ll need to access the appropriate online portal, usually through the National Student Loan Data System (NSLDS) website or your school’s financial aid portal. You’ll then be required to log in using your Federal Student Aid ID (FSA ID). Next, you’ll review the loan terms and conditions carefully. Finally, you’ll electronically sign the MPN, signifying your acceptance of the loan terms. After signing, you will receive confirmation of your MPN completion.

Comparison of Different MPN Types

While there isn’t a significant variety of MPN types, there are variations based on the type of federal student loan you are receiving. For example, the process and terms might slightly differ between Direct Subsidized Loans and Direct Unsubsidized Loans, but the core principles remain the same across all federal student loan programs. The key differences usually relate to interest accrual while in school (subsidized loans have government-paid interest during certain periods) and eligibility requirements.

Comparison of Federal Direct Loan MPNs and Other Loan Types

| Feature | Federal Direct Loan MPN | Private Loan Agreement | Other Federal Loan Programs (e.g., Perkins) |

|---|---|---|---|

| Lender | U.S. Department of Education | Private financial institution | U.S. Department of Education or participating schools |

| Interest Rates | Fixed or variable, set by the government | Variable, set by the lender | Varies by program |

| Repayment Options | Standard, graduated, extended, income-driven | Varies by lender | Varies by program |

| Deferment/Forbearance | Available under specific circumstances | May be available, terms vary | May be available, terms vary |

MPN and Loan Repayment

Understanding your repayment options after signing a Master Promissory Note (MPN) is crucial for successfully managing your student loan debt. This section Artikels various repayment plans, the consequences of default, and provides examples to illustrate how interest and capitalization impact your total loan amount.

Available Repayment Plans

Several repayment plans are available to borrowers after signing an MPN, each with its own terms and conditions. The best plan for you will depend on your individual financial circumstances. Choosing the right plan can significantly impact your monthly payments and overall repayment period.

- Standard Repayment Plan: This is the most common plan, typically involving fixed monthly payments over a 10-year period. Payments are usually higher than other plans, but the total interest paid over the life of the loan is generally lower.

- Graduated Repayment Plan: Payments start low and gradually increase over time, usually over a 10-year period. This can be helpful for borrowers expecting their income to increase over time.

- Extended Repayment Plan: This plan extends the repayment period beyond 10 years, resulting in lower monthly payments but potentially higher total interest paid.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payment on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These are discussed in more detail below.

Consequences of Default

Defaulting on your student loans—failing to make payments according to your repayment plan—has severe consequences. These consequences can significantly impact your credit score, financial stability, and future opportunities.

- Damaged Credit Score: Defaulting will severely damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Wage Garnishment: The government can garnish your wages to collect the outstanding debt.

- Tax Refund Offset: Your federal tax refund can be seized to pay off your defaulted loans.

- Difficulty Obtaining Future Loans: Securing future loans, including mortgages, will become extremely challenging.

- Collection Agencies: Your debt may be sold to collection agencies, who will aggressively pursue repayment.

Sample Repayment Schedule

The following table illustrates a simplified example of different repayment options for a $20,000 loan with a 5% interest rate. Note that actual payments will vary based on the specific loan terms and chosen repayment plan.

| Repayment Plan | Monthly Payment (approx.) | Total Paid (approx.) | Repayment Period |

|---|---|---|---|

| Standard (10-year) | $212 | $25,440 | 10 years |

| Graduated (10-year) | Starts at $150, increases over time | $25,440 (approx.) | 10 years |

| Extended (20-year) | $127 | $30,480 (approx.) | 20 years |

Income-Driven Repayment Plans and their Impact on MPNs

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable for borrowers with lower incomes. These plans typically recalculate your monthly payment annually based on your income and family size. Signing an MPN is a prerequisite for enrolling in an IDR plan. The impact on your MPN is that your repayment terms are adjusted according to the IDR plan’s guidelines. After a certain period (usually 20-25 years), the remaining loan balance may be forgiven under some IDR plans; however, this forgiveness is considered taxable income.

Interest Accrual and Capitalization

* Interest Accrual: Interest begins to accrue on your loan balance from the date of disbursement. This means that interest is added to your principal loan amount over time. The higher your interest rate, the faster your debt grows. For example, a $10,000 loan with a 6% interest rate will accrue $600 in interest in the first year ($10,000 x 0.06 = $600).

* Capitalization: Capitalization occurs when unpaid interest is added to your principal loan balance. This increases the amount on which future interest is calculated, leading to a larger overall loan amount. For instance, if you don’t make payments for a period, the accumulated interest will be capitalized, increasing your principal balance and leading to higher future payments. This process can significantly accelerate debt growth over time.

Capitalization can substantially increase the total cost of your loan over its lifetime.

MPN and Loan Forgiveness Programs

Understanding your Master Promissory Note (MPN) is crucial, not only for managing your student loans but also for navigating potential loan forgiveness programs. These programs offer the possibility of eliminating your student loan debt under specific circumstances, significantly impacting your financial future. This section clarifies the relationship between your MPN and loan forgiveness opportunities.

Eligibility Requirements for Student Loan Forgiveness Programs

Eligibility for federal student loan forgiveness programs varies significantly depending on the specific program. Generally, borrowers must meet several criteria, including the type of loan (e.g., Direct Loans, Federal Family Education Loans), the type of employment (e.g., public service, teaching in a low-income school), and the length of employment. Some programs also have income limitations. For example, the Public Service Loan Forgiveness (PSLF) program requires 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying employer. The Teacher Loan Forgiveness program, on the other hand, has different requirements related to teaching in a low-income school for five complete and consecutive academic years. Specific requirements and income thresholds change periodically, so consulting the official government websites for the most up-to-date information is essential.

The MPN’s Impact on Loan Forgiveness Eligibility

Your MPN serves as a legal agreement outlining your responsibilities as a borrower. While the MPN itself doesn’t directly determine your eligibility for loan forgiveness, it’s a critical document because it identifies the loans included in the forgiveness program application. Accurately tracking your payments and loan details, as documented in your MPN, is essential for demonstrating your eligibility to the loan servicer. Any discrepancies between your MPN and your payment history can delay or even prevent loan forgiveness. Therefore, maintaining accurate records and keeping your contact information updated with your loan servicer is paramount.

Applying for Loan Forgiveness Programs

The application process for loan forgiveness varies by program but generally involves these steps: First, confirm your eligibility based on the program’s specific requirements. Next, gather all necessary documentation, including your MPN, employment verification, and tax returns. Then, complete the application form accurately and thoroughly, ensuring all information is consistent with your MPN and other supporting documents. Finally, submit the completed application along with all required documentation to the appropriate agency. It’s important to note that the processing time can vary significantly depending on the program and the volume of applications. Regularly checking the status of your application is advisable.

Comparison of Loan Forgiveness Programs

Several federal loan forgiveness programs exist, each with unique eligibility criteria and benefits. For instance, PSLF focuses on public service, while the Teacher Loan Forgiveness program targets educators in low-income schools. The income-driven repayment (IDR) plans, while not forgiveness programs themselves, can lead to loan forgiveness after a specified period of payments, often 20 or 25 years. The key differences lie in the type of employment required, the length of required payments, and the income thresholds. Some programs may offer partial forgiveness, while others may forgive the entire loan balance. A detailed comparison of these programs is best found on the official government websites dedicated to student aid.

Applying for Loan Forgiveness: A Flowchart

The following describes a generalized flowchart for applying for loan forgiveness. Remember, specific steps may vary depending on the program.

[Imagine a flowchart here. The flowchart would begin with a “Start” box. This would branch to a “Confirm Eligibility” box, which would then branch to “Gather Documentation” (MPN, employment verification, tax returns, etc.). This would lead to “Complete Application,” followed by “Submit Application and Documentation.” This would then branch to “Application Processing,” which would finally lead to “Loan Forgiveness Granted” or “Application Denied/Further Action Required”. The flowchart would clearly indicate the flow from one stage to the next using arrows.]

Managing Your Student Loans with an MPN

Successfully navigating your student loan journey requires proactive management. Understanding your Master Promissory Note (MPN) and employing effective strategies are crucial for responsible repayment and avoiding potential financial hardship. This section Artikels practical tips and resources to help you manage your student loans effectively.

Effective management of your student loans begins with a clear understanding of your repayment obligations. This includes knowing your loan amounts, interest rates, repayment plans, and due dates. Regularly reviewing your loan servicer’s statements is essential for staying informed about your account status. Proactive management reduces stress and minimizes the risk of default.

Strategies for Avoiding Student Loan Default

Preventing student loan default requires consistent effort and planning. Defaulting can have severe consequences, including damage to your credit score, wage garnishment, and tax refund offset. The following strategies can significantly reduce your risk:

- Choose a Repayment Plan that Fits Your Budget: Explore various repayment options offered by your loan servicer, such as standard, graduated, extended, or income-driven repayment plans. Selecting a plan aligned with your current financial capabilities is crucial for long-term success.

- Budgeting and Financial Planning: Create a realistic budget that incorporates your student loan payments. Track your income and expenses to ensure you have sufficient funds available each month. Consider using budgeting apps or spreadsheets to assist in this process.

- Automatic Payments: Set up automatic payments to avoid missed payments. This ensures consistent repayment and prevents late fees, which can accumulate quickly and negatively impact your credit score.

- Communicate with Your Loan Servicer: If you anticipate difficulties making payments, contact your loan servicer immediately. They may offer options such as forbearance or deferment to temporarily suspend or reduce your payments.

Resources for Borrowers Facing Financial Difficulties

Facing financial challenges doesn’t mean you’re destined for default. Numerous resources are available to assist borrowers experiencing hardship.

- Loan Servicer Contact: Your loan servicer is your primary point of contact for exploring repayment options and assistance programs. They can provide information about income-driven repayment plans, forbearance, and deferment.

- National Student Loan Data System (NSLDS): NSLDS provides a centralized database of your federal student loan information. This resource allows you to access your loan details and track your repayment progress.

- Student Loan Counseling Services: Non-profit organizations offer free student loan counseling services. These services provide guidance on repayment strategies, budgeting, and exploring available options for borrowers facing financial hardship.

- Government Websites: The U.S. Department of Education website offers comprehensive information on student loan repayment, assistance programs, and resources for borrowers.

Post-MPN Checklist

After signing your MPN, taking proactive steps ensures smooth loan management.

- Review Your Loan Details: Carefully review your MPN and all related loan documents to understand your repayment terms, interest rates, and payment schedule.

- Contact Your Loan Servicer: Verify your contact information with your loan servicer to ensure accurate communication regarding your account.

- Create a Repayment Plan: Develop a realistic repayment plan based on your budget and financial situation. Consider exploring different repayment options to find the most suitable one.

- Set Up Automatic Payments: Automate your loan payments to avoid missed payments and potential late fees.

- Monitor Your Account Regularly: Check your loan account statements regularly to track your payments and ensure accuracy.

Consolidating Multiple Student Loans

Consolidating multiple federal student loans into a single loan simplifies repayment. This process involves combining multiple loans under one MPN, resulting in a single monthly payment. Note that consolidation may not always be beneficial, depending on your individual circumstances and loan terms. It’s advisable to carefully consider the implications before proceeding.

- Eligibility Requirements: Determine your eligibility for loan consolidation by checking the requirements Artikeld by your loan servicer or the federal government.

- Application Process: Complete the necessary application forms and provide the required documentation to your loan servicer.

- New Loan Terms: Understand the terms of your consolidated loan, including the new interest rate, repayment schedule, and any potential changes to your loan forgiveness eligibility.

Understanding the Legal Aspects of the MPN

Signing a Master Promissory Note (MPN) for student loans is a legally binding contract. Understanding its implications is crucial for borrowers to protect their rights and avoid potential financial hardship. This section details the legal responsibilities associated with an MPN, clarifies common misunderstandings, and Artikels dispute resolution processes.

Legal Implications of Signing an MPN

The MPN constitutes a legally enforceable agreement between the borrower and the lender (typically the government or a private lender). By signing, the borrower legally commits to repaying the loan according to the terms Artikeld in the agreement. Failure to comply with these terms can lead to serious consequences, including damage to credit score, wage garnishment, and even legal action. The specific legal ramifications vary depending on the type of loan and the lender’s policies, but the core principle remains consistent: the MPN is a legally binding contract that must be honored.

Borrower Rights and Responsibilities Under an MPN

Borrowers have certain rights under the MPN, including the right to receive clear and accurate information about their loan terms, repayment options, and available deferment or forbearance programs. They also have the right to challenge inaccurate information on their loan records and to seek assistance if they experience financial hardship. Responsibilities include making timely payments according to the agreed-upon schedule, maintaining accurate contact information with the lender, and understanding the terms and conditions of their loan agreement. Failure to fulfill these responsibilities can result in negative consequences.

Common Misunderstandings Regarding MPNs and Their Legal Ramifications

A common misunderstanding is the belief that an MPN is simply a formality. Many borrowers underestimate the legal weight of the document and the serious consequences of default. Another misconception is that borrowers can simply ignore their loan obligations without repercussions. The reality is that lenders actively pursue repayment, and the legal consequences of default can be severe and long-lasting. Finally, some borrowers misunderstand the terms of their loan, leading to unintentional default due to lack of knowledge regarding repayment plans or available assistance programs.

Resolving Disputes Related to MPNs

Disputes regarding MPNs can arise from various issues, including inaccurate loan information, billing errors, or disagreements over repayment plans. The first step in resolving such disputes is typically to contact the lender directly and attempt to resolve the issue through informal channels. If this fails, borrowers may have recourse through formal complaint procedures with the lender or through the relevant government agency overseeing student loans. In some cases, legal action may be necessary. It is important to keep detailed records of all communication and documentation related to the dispute.

Hypothetical Scenario and Dispute Resolution

Imagine Sarah signed an MPN for a federal student loan. Due to unforeseen circumstances, she experienced significant financial hardship and was unable to make her loan payments. She contacted her lender to discuss options, but the lender did not offer any suitable solutions. Sarah then filed a formal complaint with the Department of Education, providing documentation of her financial hardship. After review, the Department of Education determined Sarah qualified for an income-driven repayment plan, reducing her monthly payments to a manageable level, resolving the dispute without further legal action. This scenario illustrates how proactive communication and utilization of available resources can effectively resolve MPN-related disputes.

MPN and the Impact on Credit Score

Your Master Promissory Note (MPN) and your subsequent student loan repayment behavior significantly influence your credit score. Understanding this connection is crucial for building and maintaining a strong financial future. Responsible loan management translates directly into improved creditworthiness, opening doors to better interest rates on future loans and other financial opportunities.

Student Loan Payments and Credit Scores

On-time student loan payments are reported to credit bureaus, such as Experian, Equifax, and TransUnion. These bureaus use this information, along with other factors, to calculate your credit score. Consistent, timely payments demonstrate responsible credit management, leading to a higher credit score. Conversely, late or missed payments negatively impact your credit score, potentially making it harder to obtain loans or credit cards in the future with favorable terms. The severity of the negative impact depends on the frequency and duration of late payments. For example, consistently missing payments could lead to a significant drop in your credit score, potentially hindering your ability to secure a mortgage or car loan.

The Effect of Loan Default on Credit History

Defaulting on your student loans—failing to make payments for an extended period—has severe consequences for your credit history. A default is reported to credit bureaus, resulting in a dramatic decrease in your credit score. This negative mark remains on your credit report for seven years, significantly impacting your ability to secure credit in the future. Furthermore, the government may take collection actions, such as wage garnishment or tax refund offset, to recover the defaulted loan amount. The long-term financial repercussions of a default can be substantial, making it crucial to prioritize timely payments.

Strategies for Maintaining a Good Credit Score While Repaying Student Loans

Maintaining a good credit score while repaying student loans requires careful planning and consistent effort. Budgeting effectively to ensure timely payments is paramount. Consider exploring different repayment plans offered by your loan servicer to find one that fits your budget. Automatic payments can help prevent missed payments. Monitoring your credit report regularly helps identify and address any inaccuracies promptly. Establishing a good credit history before taking out student loans, if possible, can provide a buffer against the impact of student loan repayment. For instance, having a credit card with a responsible payment history can mitigate the negative impact of student loans on the overall credit score.

Accessing and Understanding Credit Reports

You are entitled to a free credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) annually through AnnualCreditReport.com. Reviewing your credit report regularly allows you to identify and address any errors or discrepancies. Understanding the information presented on your credit report, including your payment history, credit utilization, and length of credit history, is essential for managing your credit effectively. If you discover inaccuracies, dispute them with the relevant credit bureau to correct your credit report.

Visual Representation of On-Time Payments and Credit Scores

Imagine a graph with two axes. The horizontal axis represents the percentage of on-time student loan payments, ranging from 0% (all payments missed) to 100% (all payments made on time). The vertical axis represents the credit score, ranging from a low score (e.g., 300) to a high score (e.g., 850). The graph would show a strong positive correlation: As the percentage of on-time payments increases, the credit score generally increases in a roughly linear fashion, starting at a low score at 0% and rising steadily towards a high score at 100%. The line representing this correlation wouldn’t be perfectly straight; individual factors will influence the exact score, but the overall trend would be clearly upward. For example, a point at 50% on-time payments might correspond to a credit score in the 600-700 range, while a point at 100% on-time payments could be associated with a score in the 750-850 range, depending on other factors in the credit report. The visualization emphasizes the direct relationship between responsible repayment and creditworthiness.

Conclusion

Successfully managing your student loans begins with a thorough understanding of the Master Promissory Note. This guide has provided a framework for navigating the intricacies of MPNs, from signing the note to exploring repayment options and loan forgiveness programs. By proactively managing your loans and utilizing available resources, you can minimize financial stress and build a strong financial future. Remember, informed action is key to responsible student loan repayment.

FAQ Explained

What happens if I lose my MPN?

Contact your loan servicer immediately. They can provide you with a replacement copy or access to your MPN online.

Can I make extra payments on my student loans?

Yes, making extra payments can significantly reduce the total interest paid and shorten the repayment period. Check with your servicer to ensure the extra payment is applied correctly.

What if I can’t afford my student loan payments?

Contact your loan servicer to explore options like income-driven repayment plans, deferment, or forbearance. They can help you create a manageable repayment plan.

How does my MPN affect my credit score?

On-time payments positively impact your credit score, while missed or late payments negatively affect it. Defaulting on your loan can severely damage your credit.