Navigating the world of student loans can feel overwhelming, a complex maze of federal programs, private lenders, and repayment options. Understanding the nuances of each loan type is crucial for making informed decisions that align with your financial goals and long-term well-being. This guide will illuminate the different paths available, helping you choose the best fit for your educational journey.

From the readily available federal loans with their various subsidies and repayment plans to the more variable landscape of private loans, we’ll explore the key distinctions, advantages, and potential drawbacks of each. We’ll also delve into crucial aspects like interest rates, fees, and loan forgiveness programs, equipping you with the knowledge to confidently manage your student debt.

Federal Student Loans

Federal student loans are a significant source of funding for higher education in the United States, offering various programs designed to meet diverse student needs and financial situations. Understanding the different types, eligibility criteria, and repayment options is crucial for prospective and current borrowers to make informed decisions about financing their education.

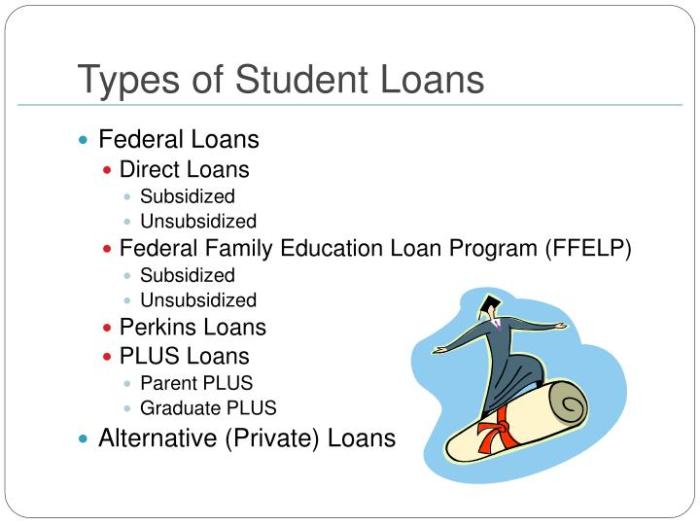

Types of Federal Student Loans

The federal government offers several types of student loans, each with its own eligibility requirements and terms. These loans are generally categorized as either subsidized or unsubsidized, and further differentiated by loan type.

Eligibility Requirements for Federal Student Loans

Eligibility for federal student loans hinges on several factors. Applicants must be enrolled or accepted for enrollment at least half-time in an eligible degree or certificate program at a participating institution. They must also be a U.S. citizen or eligible non-citizen, demonstrate financial need (for subsidized loans), and maintain satisfactory academic progress. Specific requirements may vary slightly depending on the loan type.

Interest Rates and Repayment Options for Federal Student Loans

Interest rates for federal student loans are set annually by the government and are generally lower than private loan interest rates. Subsidized loans do not accrue interest while the borrower is in school at least half-time, during grace periods, and in certain deferment periods. Unsubsidized loans, however, accrue interest from the time the loan is disbursed. Repayment options include standard plans, graduated plans, extended plans, and income-driven repayment plans, allowing borrowers to choose a plan that aligns with their financial circumstances.

Comparison of Federal Loan Programs

The following table summarizes key features of common federal student loan programs. Note that interest rates are subject to change annually.

| Loan Program | Interest Rate (Example – Subject to Change) | Repayment Plans | Eligibility |

|---|---|---|---|

| Direct Subsidized Loan | Variable, lower than unsubsidized | Standard, Graduated, Extended, Income-Driven | Demonstrated financial need, enrolled at least half-time |

| Direct Unsubsidized Loan | Variable, higher than subsidized | Standard, Graduated, Extended, Income-Driven | Enrolled at least half-time |

| Direct PLUS Loan (Graduate/Parent) | Variable, typically higher than subsidized/unsubsidized | Standard, Graduated, Extended, Income-Driven | Credit check required, graduate student or parent of dependent undergraduate student |

| Direct Consolidation Loan | Weighted average of consolidated loans | Standard, Graduated, Extended, Income-Driven | Borrower with multiple federal student loans |

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders, unlike federal student loans which are backed by the government. Understanding the key differences between these two loan types is crucial for making informed borrowing decisions. This section will explore the advantages and disadvantages of private student loans, the application process, and examples of different loan types.

Private student loans differ significantly from federal student loans in several key aspects. Federal loans generally offer more borrower protections, including income-driven repayment plans and loan forgiveness programs, which are typically unavailable with private loans. Furthermore, federal loan interest rates are usually fixed and often lower than private loan rates, especially for borrowers with less-than-perfect credit. Eligibility for federal loans is based on financial need and enrollment status, while private loan eligibility depends primarily on creditworthiness.

Key Differences Between Federal and Private Student Loans

Federal student loans offer various repayment plans, including income-driven repayment, which adjusts payments based on income and family size. They also often include deferment and forbearance options, allowing temporary pauses in payments during financial hardship. In contrast, private loans typically offer fewer repayment options and less flexibility in managing payments. Federal loans may also have loan forgiveness programs available depending on the type of loan and borrower’s occupation. Private loans usually lack these programs. Finally, the interest rates on federal loans are typically lower and fixed, whereas private loan interest rates are often variable and can be significantly higher, especially for borrowers with poor credit.

Advantages and Disadvantages of Private Student Loans

Private student loans can offer higher loan amounts than federal loans, potentially covering the full cost of tuition and living expenses. They might also have more flexible repayment terms in some cases. However, private loans generally come with higher interest rates and fewer borrower protections. The lack of government backing means that borrowers with poor credit may struggle to qualify or face higher interest rates. Missed payments can severely impact credit scores, leading to additional financial difficulties. The application process can also be more complex and time-consuming than for federal loans.

The Private Student Loan Application Process

Applying for a private student loan typically involves completing an online application and providing personal and financial information. A crucial aspect of the application process is the credit check. Lenders will review the applicant’s credit history to assess their creditworthiness and determine the interest rate and loan terms. A strong credit history is essential for securing favorable loan terms. If an applicant has limited or poor credit, they may need a co-signer—an individual with good credit who agrees to repay the loan if the borrower defaults. The co-signer’s creditworthiness significantly impacts the loan approval and interest rate. Lenders will also review the applicant’s income, debt, and overall financial situation.

Examples of Private Student Loan Types

Various lenders offer different types of private student loans, each with its own terms and conditions. For instance, some lenders offer variable-rate loans, where the interest rate fluctuates based on market conditions, while others offer fixed-rate loans, where the interest rate remains constant throughout the loan term. Some private loans may have specific requirements, such as being enrolled in a certain program or meeting specific academic criteria. Examples of lenders include Sallie Mae, Discover, and Citizens Bank, each offering a range of private student loan options with varying interest rates, fees, and repayment terms. It’s important to compare offers from multiple lenders to find the most suitable loan.

Subsidized vs. Unsubsidized Loans

Federal student loans come in two main flavors: subsidized and unsubsidized. Understanding the key differences between these loan types is crucial for responsible financial planning during and after your education. The primary distinction lies in how interest is handled while you’re still in school.

Choosing between subsidized and unsubsidized federal student loans depends heavily on your financial need and ability to manage debt. Both offer several benefits over private loans, including fixed interest rates and flexible repayment plans. However, the interest accrual differences significantly impact the total amount you’ll ultimately repay.

Interest Accrual During the In-School Period

Subsidized loans are need-based and the government pays the interest on your loan while you are enrolled at least half-time in an eligible degree program. This means that your loan balance doesn’t increase while you’re studying. Unsubsidized loans, on the other hand, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. This interest can be capitalized, meaning it’s added to your principal loan balance, increasing the total amount you owe. The longer you delay repayment, the more significant this capitalization effect becomes. For example, a student with a $10,000 unsubsidized loan accruing 5% interest annually could owe significantly more than $10,000 by the time they graduate, even if they haven’t made any payments.

Scenarios Favoring Subsidized Loans

A subsidized loan is generally preferable if you demonstrate financial need and qualify for them. This is because you avoid accumulating interest during your studies, leading to lower overall loan costs. Students with limited financial resources, those pursuing longer degree programs, or those anticipating difficulty finding employment immediately after graduation may benefit most from subsidized loans. The lower total debt burden upon graduation can ease the transition into repayment and potentially lead to quicker debt elimination. For instance, a student pursuing a six-year medical degree would significantly benefit from subsidized loans, as the interest savings over six years would be substantial compared to an unsubsidized loan.

Key Differences Between Subsidized and Unsubsidized Loans

Understanding the core differences between these loan types is essential for making informed borrowing decisions. Here’s a summary:

- Need-Based: Subsidized loans are need-based; unsubsidized loans are not.

- Interest Accrual (In-School): The government pays the interest on subsidized loans while you’re enrolled at least half-time; interest accrues on unsubsidized loans regardless of enrollment status.

- Interest Accrual (Grace Period): Interest accrues on both subsidized and unsubsidized loans during the grace period (typically six months after graduation).

- Loan Amount: The amount you can borrow is determined by your financial need for subsidized loans, whereas unsubsidized loans have higher borrowing limits.

- Overall Cost: Subsidized loans generally result in lower overall loan costs due to the absence of interest accrual during the in-school period.

Loan Repayment Plans

Choosing the right repayment plan for your federal student loans is crucial for managing your debt effectively and avoiding delinquency. The plan you select will significantly impact your monthly payments and the total amount you pay over the life of your loan. Several factors, including your income, loan amount, and financial goals, should be considered when making this decision.

Understanding the various repayment options available is the first step towards responsible debt management. The federal government offers several standardized plans, each with its own set of terms and conditions. Choosing the wrong plan can lead to unnecessary stress and financial hardship, while the right plan can provide much-needed flexibility and affordability.

Federal Student Loan Repayment Plan Options

The federal government offers several repayment plans designed to cater to different financial situations. These plans vary in terms of monthly payment amounts, loan repayment periods, and overall interest paid.

| Repayment Plan | Payment Calculation | Loan Term | Advantages |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payment over 10 years | 10 years | Predictable payments, shortest repayment period |

| Graduated Repayment Plan | Payments start low and gradually increase over 10 years | 10 years | Lower initial payments, helpful for those anticipating income increases |

| Extended Repayment Plan | Fixed monthly payment over 25 years (or longer for larger loan amounts) | Up to 25 years | Lower monthly payments |

| Income-Driven Repayment (IDR) Plans | Payment based on income and family size; various plans exist (IBR, PAYE, REPAYE, ICR) | 20-25 years; remaining balance forgiven after | Affordable monthly payments, potential for loan forgiveness |

Factors Influencing Repayment Plan Selection

Several key factors influence the optimal choice of a repayment plan. These factors need careful consideration to ensure the selected plan aligns with the borrower’s current financial situation and long-term goals.

The most important factors include the borrower’s current income, the total amount of student loan debt, and their anticipated future income. For instance, a borrower with a high income and a relatively small loan balance might prefer the Standard Repayment Plan to pay off the debt quickly. Conversely, a borrower with a low income and a large loan balance might benefit from an Income-Driven Repayment plan to keep monthly payments manageable.

Decision-Making Flowchart for Repayment Plan Selection

The following flowchart Artikels a simplified decision-making process for selecting a federal student loan repayment plan.

[Imagine a flowchart here. The flowchart would start with a question: “What is your current income and loan amount?” If income is high and loan amount is low, it points to “Standard Repayment Plan.” If income is low and loan amount is high, it points to “Income-Driven Repayment Plan.” If income is moderate and loan amount is moderate, it points to a decision point: “Do you anticipate significant income increase?” Yes leads to “Graduated Repayment Plan,” No leads to “Extended Repayment Plan.”]

Loan Forgiveness Programs

Student loan forgiveness programs offer the potential to eliminate or significantly reduce the burden of student loan debt. These programs are generally targeted towards individuals pursuing specific careers in public service or those working in areas of national need. While offering significant relief, it’s crucial to understand their eligibility requirements, limitations, and potential drawbacks before relying on them as a primary repayment strategy.

Federal Student Loan Forgiveness Program Overview

Several federal loan forgiveness programs exist, each with its own eligibility criteria and limitations. These programs are designed to incentivize individuals to pursue careers in public service, teaching, or other critical fields. Understanding the nuances of each program is essential for borrowers to determine if they qualify and what benefits they can expect.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

- Eligibility: Borrowers must have Direct Loans, work full-time for a qualifying government or non-profit organization, and make 120 qualifying monthly payments under an income-driven repayment plan.

- Limitations: The program has strict requirements for both employment and repayment plan type. Many borrowers have been denied forgiveness due to inconsistencies in their employment history or repayment plan. The process can be lengthy and complex.

- Drawbacks: The stringent requirements and complex application process can make it difficult to qualify. Even with careful planning, unforeseen circumstances could impact eligibility.

Teacher Loan Forgiveness Program

This program offers forgiveness of up to $17,500 on your federal student loans if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency.

- Eligibility: Borrowers must teach full-time for five consecutive academic years in a qualifying school, and meet specific income requirements.

- Limitations: The program is limited to teachers in low-income schools and educational service agencies. The definition of “low-income” can vary.

- Drawbacks: The program only forgives a portion of the loan balance, and eligibility requires meeting specific teaching requirements for a sustained period.

Other Federal Loan Forgiveness Programs

Several other federal loan forgiveness programs exist, often tailored to specific professions or situations. These programs may include forgiveness for those working in specific areas of national need, such as healthcare or law enforcement. The specifics of eligibility and forgiveness amounts vary significantly by program. It’s crucial to research individual programs thoroughly to understand the specific requirements and limitations.

Loan Forgiveness Programs by Profession or Service

- Public Service: Public Service Loan Forgiveness (PSLF)

- Teaching: Teacher Loan Forgiveness Program

- Healthcare: Several programs exist offering loan forgiveness for healthcare professionals working in underserved areas or specific specialties. Eligibility varies greatly depending on the program and location.

- Law Enforcement/Military: Some programs may offer loan forgiveness or repayment assistance for individuals serving in these fields. Specific requirements vary significantly.

Student Loan Consolidation

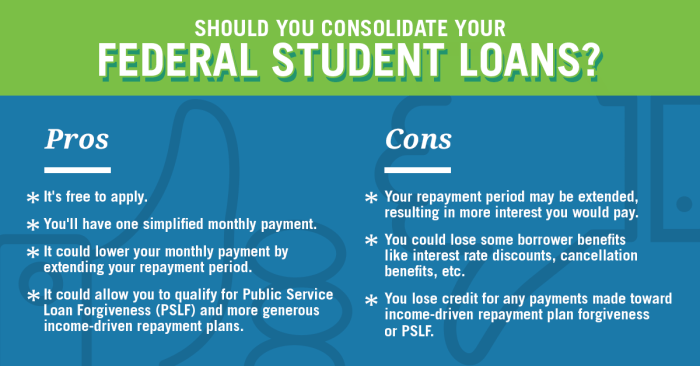

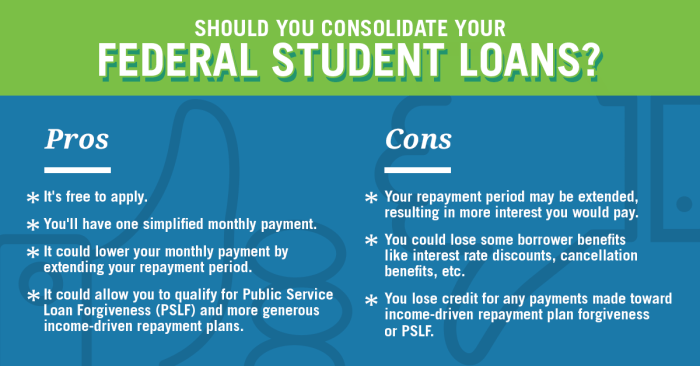

Consolidating your student loans means combining multiple federal or private student loans into a single, new loan. This simplifies repayment by reducing the number of monthly payments you need to track and potentially lowering your monthly payment amount. However, it’s crucial to carefully weigh the potential benefits against any drawbacks before making a decision.

Student loan consolidation involves applying for a new loan that pays off your existing loans. The lender then makes payments on your behalf, and you only make one payment to them each month. The terms of the consolidated loan, including the interest rate and repayment period, will depend on several factors, including your credit history and the types of loans being consolidated.

Benefits of Student Loan Consolidation

Consolidation can offer several advantages. A lower monthly payment can make repayment more manageable, particularly if you’re struggling to keep up with multiple payments. A fixed interest rate can provide predictability, eliminating the uncertainty associated with variable interest rates on some loans. Simplifying your repayment process by having only one loan to manage reduces administrative burden and the risk of missed payments. Finally, consolidating federal loans can potentially qualify you for income-driven repayment plans that are not available for certain loan types.

Drawbacks of Student Loan Consolidation

While consolidation simplifies payments, it’s not always the best option. A longer repayment term, often a feature of consolidated loans, can lead to paying significantly more interest over the life of the loan, increasing your overall cost. Consolidating federal loans into a private loan will mean losing access to federal repayment programs, such as income-driven repayment plans and loan forgiveness programs. Your new interest rate might be higher than the weighted average of your existing loans, negating some potential benefits. Additionally, if you have federal loans with subsidized interest, consolidating into an unsubsidized loan will mean accruing interest while in school or during grace periods.

Factors to Consider Before Consolidating

Before applying, carefully compare the interest rates of your current loans to the offered rate on the consolidated loan. Analyze the total cost of repayment, including interest, over the life of the loan, both with and without consolidation. Consider your eligibility for income-driven repayment plans and loan forgiveness programs, and whether consolidation will affect your access to these benefits. Assess your current repayment plan and determine whether consolidation would improve your financial situation. Finally, understand the terms and conditions of the consolidated loan thoroughly before signing any agreements.

Applying for Student Loan Consolidation

The process for consolidating federal student loans differs from that of private student loans. For federal loans, you typically apply online through the Federal Student Aid website. This involves gathering information about your existing loans, completing an application, and providing necessary documentation. The application process may require several weeks for approval. For private loan consolidation, you’ll need to contact private lenders directly to explore consolidation options and apply for a new loan. Each lender will have its own application process and requirements. Thorough research is essential to compare different lenders and find the best terms.

Understanding Interest Rates and Fees

Student loan interest rates and fees significantly impact the overall cost of your education. Understanding how these are determined and calculated is crucial for responsible borrowing and financial planning. This section will clarify the complexities of interest rates and fees associated with student loans, enabling you to make informed decisions.

Student Loan Interest Rate Determination

Several factors influence student loan interest rates. For federal loans, the interest rate is typically fixed and determined by Congress each year, based on economic indicators such as the 10-year Treasury note. The rate can vary slightly depending on the loan type (e.g., subsidized vs. unsubsidized) and the loan disbursement date. Private student loans, on the other hand, have variable or fixed interest rates set by the lender. These rates are influenced by factors such as the borrower’s creditworthiness, the loan term, and prevailing market interest rates. A borrower with a strong credit history might secure a lower interest rate compared to someone with a weaker credit profile. Generally, private loan rates are higher than federal loan rates because they carry a greater risk for the lender.

Types of Student Loan Fees

Various fees can be associated with student loans. Origination fees are charged by the lender to cover the administrative costs of processing the loan application. These fees are typically a percentage of the loan amount and are deducted from the total loan disbursement. Late payment fees are assessed if a borrower fails to make timely payments on their loan. These fees can vary significantly depending on the lender and the terms of the loan agreement. Some lenders may also charge prepayment penalties if a borrower pays off their loan early. However, federal student loans typically do not have prepayment penalties. Finally, there may be additional fees associated with loan consolidation or refinancing.

Calculating the Total Cost of a Student Loan

Calculating the total cost of a student loan requires considering the principal loan amount, the interest rate, the loan term, and any applicable fees. A simple formula to estimate the total cost is:

Total Cost = Principal + (Principal x Interest Rate x Loan Term) + Fees

. For example, a $10,000 loan with a 5% interest rate over 10 years would have an estimated interest cost of $6,289, assuming simple interest calculation. Adding a $100 origination fee, the total cost would be approximately $16,389. Note that this is a simplified calculation; more precise calculations will use compound interest and consider the specific repayment schedule.

Impact of Different Interest Rates on Loan Repayment

Imagine two bar graphs representing loan repayment schedules. The first bar graph displays a loan with a low interest rate (e.g., 4%). The bars representing monthly payments are relatively short and consistent over the loan term, indicating a faster payoff. The second bar graph depicts a loan with a high interest rate (e.g., 8%). Here, the bars are taller and the overall repayment period is significantly longer. The difference in height between the bars visually demonstrates how a higher interest rate leads to significantly higher total interest paid and a longer repayment timeline. The total area under the graph represents the total repayment cost, with the high-interest loan showing a much larger area, highlighting the substantial financial impact of higher interest rates.

Final Summary

Securing funding for higher education is a significant step, and choosing the right student loan is paramount. By carefully weighing the benefits and drawbacks of federal versus private loans, understanding repayment options, and exploring potential forgiveness programs, you can create a manageable financial plan. Remember to thoroughly research each option and seek professional advice if needed to ensure a smooth and successful path towards your academic aspirations.

Detailed FAQs

What is the difference between a grace period and deferment?

A grace period is a temporary period after graduation where you don’t have to make loan payments. Deferment is a postponement of payments due to specific circumstances like unemployment or further education.

Can I refinance my student loans?

Yes, refinancing can lower your interest rate or monthly payment, but it often involves switching from federal to private loans, potentially losing federal protections.

What happens if I default on my student loans?

Defaulting can severely damage your credit score, lead to wage garnishment, and even tax refund offset. It’s crucial to contact your lender if you’re struggling to make payments.

How do I apply for student loan forgiveness programs?

Eligibility requirements vary widely depending on the program. You’ll typically need to meet specific employment criteria and often complete a lengthy application process.