Navigating the world of student loans can feel like deciphering a complex financial code. From understanding the differences between federal and private loans to strategizing for repayment, the process can be daunting. But fear not! This guide unravels the intricacies of student loans, providing clear explanations and practical advice to help you make informed decisions about financing your education and managing your debt effectively. We’ll explore various loan types, eligibility criteria, repayment options, and even strategies for potential loan forgiveness.

This comprehensive overview aims to demystify the student loan landscape, equipping you with the knowledge to confidently navigate this crucial aspect of higher education. We will cover everything from the application process to long-term financial implications, ensuring you’re well-prepared for the journey ahead. Whether you’re a prospective student or already managing student loan debt, this resource offers valuable insights and actionable steps.

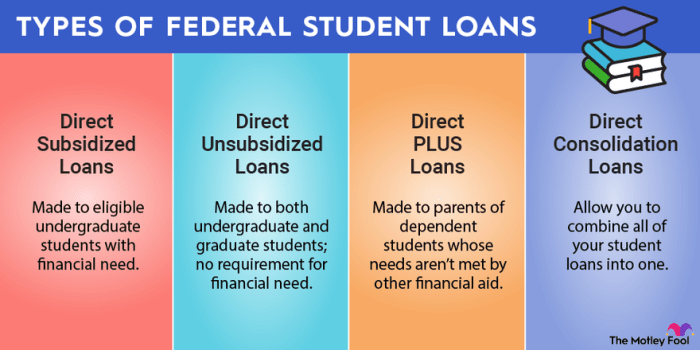

Types of Student Loans

Choosing the right student loan can significantly impact your financial future. Understanding the differences between federal and private loans, along with the various repayment options, is crucial for responsible borrowing. This section will clarify the key distinctions and help you navigate the complexities of student loan financing.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government and generally offer more borrower protections than private loans. These protections include flexible repayment plans, income-driven repayment options, and loan forgiveness programs under certain circumstances. Private student loans, on the other hand, are provided by banks, credit unions, and other private lenders. They often have stricter eligibility requirements and may come with higher interest rates and less flexible repayment options. The key difference lies in the source of the funds and the level of government oversight and borrower protections.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal student loans, each tailored to different financial situations. The Standard Repayment Plan involves fixed monthly payments over 10 years. The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, base monthly payments on your income and family size. Extended Repayment Plan allows for longer repayment periods, reducing monthly payments but increasing the total interest paid. Finally, the income-contingent repayment plan adjusts payments based on income and debt. Choosing the right plan depends on your individual financial circumstances and long-term goals.

Private Student Loan Lenders and Terms

Numerous private lenders offer student loans, including major banks like Sallie Mae, Discover, and Citizens Bank, as well as credit unions and online lenders. These lenders typically assess your creditworthiness, income, and co-signer availability when determining loan eligibility and interest rates. Private loan interest rates are often variable, meaning they can fluctuate over the life of the loan, unlike many federal loans which often have fixed rates. Repayment terms vary depending on the lender and the borrower’s profile, but they generally range from 5 to 20 years. It’s essential to compare offers from multiple lenders to secure the most favorable terms.

Comparison of Student Loan Types

| Loan Type | Interest Rate | Repayment Period | Eligibility Requirements |

|---|---|---|---|

| Federal Subsidized Loan | Variable; set by the government | 10-25 years (depending on repayment plan) | U.S. citizenship or eligible non-citizen; enrollment in eligible degree program |

| Federal Unsubsidized Loan | Variable; set by the government | 10-25 years (depending on repayment plan) | U.S. citizenship or eligible non-citizen; enrollment in eligible degree program |

| Federal PLUS Loan | Variable; set by the government | 10-25 years (depending on repayment plan) | U.S. citizenship or eligible non-citizen; credit check for parent PLUS loans |

| Private Student Loan | Variable or Fixed; set by the lender | 5-20 years (depending on lender and borrower) | Good credit history (or co-signer with good credit); enrollment in eligible degree program; income verification |

Interest Rates and Fees

Understanding the interest rates and fees associated with your student loans is crucial for effective financial planning and responsible repayment. These factors significantly impact the total cost of your education and the length of your repayment period. Failing to grasp these details can lead to unexpected expenses and prolonged debt.

Student loan interest rates are determined by a variety of factors, primarily the type of loan (federal or private), the interest rate index used (if variable), and the borrower’s creditworthiness (for private loans). Federal student loan interest rates are generally set by Congress annually and are often lower than private loan rates. Private loan interest rates are determined by the lender based on a credit check, assessing factors like credit score, income, and debt-to-income ratio. Variable interest rates fluctuate with market conditions, while fixed rates remain consistent throughout the loan term. This variability introduces an element of uncertainty into long-term repayment planning.

Interest Capitalization

Interest capitalization is the process of adding accrued but unpaid interest to the principal loan balance. This effectively increases the total amount you owe. It occurs when interest payments are not made, such as during periods of deferment or forbearance. For example, imagine a $10,000 loan with a 5% annual interest rate. If interest is not paid for a year, $500 in interest would capitalize, increasing the principal to $10,500. Subsequent interest calculations will then be based on this higher principal amount, resulting in a larger overall repayment burden. Understanding how and when interest capitalization occurs is critical to managing loan costs.

Common Student Loan Fees

Several fees can be associated with student loans, adding to the overall cost. These fees vary depending on the lender and loan type. It’s vital to understand these upfront to accurately budget for repayment.

- Origination Fees: These are one-time fees charged by the lender when the loan is disbursed. They are usually a percentage of the loan amount and are deducted from the loan proceeds before they are sent to the borrower. For example, a 1% origination fee on a $20,000 loan would result in a $200 fee.

- Late Payment Fees: These are penalties imposed for missed or late loan payments. The amount of the fee varies depending on the lender, but it can significantly impact your overall cost and credit score.

- Prepayment Penalties: While less common with federal student loans, some private lenders may charge a fee if you pay off your loan early. This is usually a percentage of the remaining loan balance.

- Returned Payment Fees: If a payment is returned due to insufficient funds, you will likely incur a fee from your lender. This is an additional cost on top of the late payment penalty.

Repayment Options and Strategies

Navigating student loan repayment can feel overwhelming, but understanding your options and developing a solid strategy is crucial for long-term financial health. Choosing the right repayment plan and employing effective management techniques can significantly impact the time it takes to pay off your loans and the total amount you pay in interest.

Choosing the right repayment plan depends on your individual financial situation and goals. There are several options available, each with its own advantages and disadvantages. Careful consideration of these factors is essential to avoid financial strain and ensure timely repayment.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. Borrowers make fixed monthly payments over a 10-year period. While this plan offers the shortest repayment timeline, resulting in less interest paid overall, the monthly payments can be substantial, potentially straining your budget, especially if you have a large loan balance.

Graduated Repayment Plan

A graduated repayment plan starts with lower monthly payments that gradually increase over time. This option can be beneficial in the early stages of your career when your income might be lower. However, it ultimately leads to higher total interest payments because of the extended repayment period. For example, a borrower might start with $200 monthly payments and see them rise to $500 or more over ten years.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) link your monthly payments to your income and family size. Several types of IDRs exist (e.g., ICR, PAYE, REPAYE,IBR), each with slightly different formulas for calculating payments. These plans typically offer lower monthly payments than standard or graduated plans, but they often extend the repayment period to 20 or 25 years, potentially leading to significantly higher total interest paid over the life of the loan. These plans are often advantageous for borrowers with lower incomes or high debt loads.

Strategies for Managing Student Loan Debt Effectively

Effective student loan management involves a multifaceted approach. Creating a realistic budget, prioritizing loan payments, and exploring options for reducing your loan balance are all crucial steps.

Consequences of Loan Default

Defaulting on your student loans has severe consequences. These include damage to your credit score, wage garnishment, tax refund offset, and potential difficulty obtaining future loans or credit. The impact on your financial future can be significant and long-lasting. It’s crucial to contact your loan servicer immediately if you’re facing difficulty making payments to explore available options before defaulting.

Comparison of Repayment Strategies

| Repayment Plan | Monthly Payment | Repayment Period | Total Interest Paid |

|---|---|---|---|

| Standard | High, fixed | 10 years | Lower |

| Graduated | Low initially, increasing | 10 years | Higher |

| Income-Driven | Based on income | 20-25 years | Highest |

Loan Forgiveness and Debt Relief Programs

Navigating the complexities of student loan repayment can be daunting, but understanding the various loan forgiveness and debt relief programs available can significantly alleviate financial burdens. These programs offer the possibility of partial or complete loan cancellation under specific circumstances, providing crucial relief for eligible borrowers. Eligibility criteria, application processes, and the potential impact on individual financial situations vary considerably depending on the specific program.

Public Service Loan Forgiveness (PSLF) Program Eligibility Requirements

The Public Service Loan Forgiveness (PSLF) program offers forgiveness of the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. Qualifying employers include government organizations (federal, state, local, or tribal) and not-for-profit organizations. Crucially, your employment must be continuous, and your loans must be Direct Loans. Borrowers must also be employed in a public service job continuously for 10 years and make 120 qualifying payments. Failure to meet these requirements will result in ineligibility for forgiveness. Furthermore, the type of loan, repayment plan, and employment status are rigorously vetted during the application process.

Teacher Loan Forgiveness Program Eligibility Requirements

The Teacher Loan Forgiveness program provides forgiveness of up to $17,500 on eligible federal student loans for teachers who complete five years of full-time teaching in a low-income school or educational service agency. To qualify, teachers must have received a TEACH Grant, and they must fulfill their service obligation. This includes teaching in a low-income school or educational service agency for at least five consecutive academic years. Forgiveness is granted only after the completion of the five-year teaching commitment and the submission of the necessary documentation. The program aims to incentivize individuals to pursue teaching careers in underserved communities.

Applying for Loan Forgiveness or Debt Relief

The application process for loan forgiveness programs generally involves submitting a comprehensive application form through the Federal Student Aid website (StudentAid.gov). This includes providing documentation to verify employment, income, loan type, and repayment history. The process can be time-consuming and requires meticulous attention to detail. Thorough preparation, including gathering all necessary documentation well in advance of the application deadline, is essential. Failure to provide complete and accurate information can significantly delay the processing of your application. Borrowers should anticipate a lengthy review period, and proactive follow-up with the relevant agency may be necessary.

Income-Driven Repayment Plans and Their Impact on Loan Forgiveness

Income-driven repayment (IDR) plans link your monthly student loan payments to your income and family size. Examples include the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) plans. These plans typically result in lower monthly payments than standard repayment plans, and under certain circumstances, any remaining balance after 20 or 25 years may be forgiven. The specific forgiveness period depends on the chosen IDR plan. However, it’s crucial to understand that forgiven amounts are considered taxable income. For example, a borrower on a REPAYE plan with a significant loan balance might see their monthly payment reduced substantially, potentially leading to loan forgiveness after 20 years, though the forgiven amount would be subject to taxation.

Calculating Potential Savings with Different Loan Forgiveness Programs

Calculating potential savings requires careful consideration of several factors, including the initial loan amount, interest rate, repayment plan, and the specific loan forgiveness program. For instance, a borrower with $50,000 in federal student loans might see significant savings under the PSLF program if they qualify. If their remaining balance after 10 years of qualifying payments is $30,000, the program would forgive $20,000. Conversely, the Teacher Loan Forgiveness program, with its maximum forgiveness of $17,500, would offer a smaller but still substantial reduction for eligible teachers. The potential savings are highly individual and depend on factors like loan balance, repayment history, and the program’s eligibility criteria. It is crucial to use online calculators or consult with a financial advisor to accurately assess potential savings for your specific circumstances. There are many online calculators available to help estimate potential savings.

Impact of Student Loans on Personal Finances

Student loan debt can significantly impact your financial well-being for years, even decades, after graduation. Understanding the long-term implications is crucial for responsible financial planning and making informed decisions about borrowing and repayment. Failing to account for this debt can lead to significant financial strain and limit future opportunities.

The weight of student loan debt extends far beyond the monthly payment. It influences major life decisions, from purchasing a home to investing in retirement, and can even affect your ability to secure other types of loans. A comprehensive understanding of these impacts allows for proactive planning and mitigation strategies.

Long-Term Financial Implications of Student Loan Debt

Student loan debt can dramatically affect long-term financial goals. For example, high monthly payments can reduce the amount available for saving and investing, potentially delaying retirement plans or limiting the ability to build wealth. The opportunity cost of using funds for loan repayment instead of investing them can be substantial over time, leading to a significantly smaller nest egg in the long run. Furthermore, the interest accrued on these loans can compound significantly, increasing the total amount owed and extending the repayment period. Consider a scenario where a graduate with $50,000 in student loan debt at a 7% interest rate makes only minimum payments. They might end up paying significantly more than the initial loan amount over a longer period, delaying their ability to save for a down payment on a house, starting a family, or investing in other ventures.

Impact of Student Loans on Credit Scores and Future Borrowing Capacity

Student loans, like all forms of credit, impact your credit score. Consistent on-time payments build a positive credit history, while missed or late payments negatively affect your score. A lower credit score can make it more difficult to obtain future loans, such as mortgages, auto loans, or even credit cards, at favorable interest rates. This is because lenders view individuals with lower credit scores as higher-risk borrowers, leading them to offer less favorable terms or even deny credit applications altogether. The higher interest rates associated with poor credit scores can further exacerbate financial challenges, creating a cycle of debt that is difficult to break. For instance, someone with a low credit score due to late student loan payments may face a significantly higher interest rate on a mortgage, increasing the overall cost of homeownership.

Budgeting Strategies for Managing Student Loan Payments

Effective budgeting is essential for managing student loan payments. Creating a detailed budget that tracks income and expenses can help identify areas where spending can be reduced to allocate more funds towards loan repayment. Prioritizing high-interest loans for repayment can save money on interest over the long term. Exploring options like income-driven repayment plans can adjust monthly payments based on income, making them more manageable. Additionally, actively seeking opportunities to increase income, such as a side hustle or a higher-paying job, can free up more resources for debt reduction. For example, a recent graduate could create a budget that allocates a specific percentage of their income to student loan payments, tracks their spending using budgeting apps, and explores options like refinancing to lower their interest rate.

Hypothetical Scenario Illustrating the Impact of Different Repayment Plans

Let’s consider two hypothetical graduates, both with $40,000 in student loans at a 6% interest rate. Graduate A chooses the standard 10-year repayment plan, while Graduate B opts for an income-driven repayment plan with a longer repayment period. Graduate A will have higher monthly payments but will pay off their loan faster, minimizing interest accumulation. Graduate B will have lower monthly payments initially, but they will likely pay significantly more in interest over the life of the loan and the repayment period will be much longer. This scenario highlights the trade-off between lower monthly payments and the total cost of the loan over time. The optimal repayment plan depends on individual financial circumstances and priorities.

Resources and Further Assistance

Navigating the complexities of student loans can be challenging, but numerous resources are available to help borrowers understand their options and manage their debt effectively. This section provides a comprehensive list of government websites, contact information for key organizations, and details on assistance programs for borrowers facing financial hardship. Utilizing these resources can significantly improve your ability to repay your loans and avoid potential financial distress.

Understanding where to turn for help is crucial for successful student loan management. Whether you need information on repayment plans, are seeking debt relief, or require assistance due to financial hardship, the resources Artikeld below can provide the guidance and support you need.

Government Websites and Organizations

Several government agencies offer valuable information and resources related to student loans. These websites provide comprehensive guides, tools, and calculators to help borrowers understand their loan terms, explore repayment options, and access available assistance programs.

- Federal Student Aid (FSA): This website, managed by the U.S. Department of Education, is the primary source of information on federal student loans. It offers detailed explanations of loan programs, repayment plans, and debt relief options. https://studentaid.gov/

- Consumer Financial Protection Bureau (CFPB): The CFPB provides resources to help consumers understand their rights and responsibilities regarding student loans, including information on avoiding scams and resolving disputes with lenders. https://www.consumerfinance.gov/

Student Loan Servicers and Counseling Agencies

Student loan servicers manage your loan payments and provide customer service. Independent counseling agencies offer unbiased advice and assistance in navigating student loan repayment. Contacting these organizations can help you understand your repayment options and develop a personalized repayment strategy.

- Your Student Loan Servicer: Your servicer’s contact information is typically found on your monthly statement or through the National Student Loan Data System (NSLDS). Contact them directly with any questions or concerns regarding your loans.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that provides financial counseling services, including assistance with student loan repayment. https://www.nfcc.org/

- United Way’s 211 Helpline: 211 is a free, confidential helpline that can connect you with local resources, including financial counseling services for student loan debt.

Assistance for Borrowers Experiencing Financial Hardship

Borrowers facing financial difficulties may be eligible for various assistance programs that can help them manage their student loan debt. These programs offer options such as income-driven repayment plans, deferment, and forbearance. It is crucial to explore these options early to prevent delinquency and potential negative consequences on your credit score.

- Income-Driven Repayment (IDR) Plans: IDR plans adjust your monthly payments based on your income and family size. Several IDR plans exist, each with different eligibility requirements and payment calculation methods. Details can be found on the Federal Student Aid website.

- Deferment and Forbearance: These programs temporarily postpone your loan payments under specific circumstances, such as unemployment or financial hardship. However, interest may still accrue during deferment or forbearance, depending on the loan type.

- Loan Forgiveness and Cancellation Programs: Certain professions, such as teaching and public service, may qualify for loan forgiveness programs that cancel a portion or all of your student loan debt after meeting specific requirements. These programs often have strict eligibility criteria and require sustained employment in qualifying roles for a set period.

Visual Representation of Loan Repayment

Understanding your student loan repayment journey is significantly easier with a visual aid. A well-constructed amortization schedule, presented graphically, provides a clear picture of how your loan balance decreases over time, illustrating the impact of each payment. This visual representation allows for a better understanding of the long-term implications of your repayment plan.

An effective visual representation of a student loan amortization schedule would typically be a line graph or a combination of a line graph and a bar chart.

Amortization Schedule Graph

The graph’s horizontal axis (x-axis) represents time, typically measured in months, spanning the entire repayment period of the loan. The vertical axis (y-axis) represents the loan balance, starting at the initial loan amount and decreasing to zero at the end of the repayment period. The line graph itself plots the remaining loan balance at the end of each month. Each data point on the line represents the loan balance after a monthly payment is made. The initial data point will be the original loan principal. Subsequent data points will show a gradual decrease in the principal balance. A steeper slope indicates a higher monthly payment, leading to faster principal reduction. A less steep slope shows a slower reduction, often reflecting a longer repayment period or a lower monthly payment. To further enhance understanding, a bar chart could be overlaid on the line graph, with each bar representing the amount of principal paid off during each month. This provides a clear visual representation of the principal reduction alongside the remaining balance. For example, a $30,000 loan with a 10-year repayment period at a 5% interest rate would show a steadily decreasing line, starting at $30,000 and ending at $0 after 120 months. The overlaid bar chart would show the monthly principal payments, increasing gradually as interest payments decrease over time.

End of Discussion

Securing a higher education is a significant investment, and understanding student loans is paramount to responsible financial planning. By carefully considering the various loan types, eligibility requirements, repayment options, and potential forgiveness programs, you can make informed choices that align with your financial goals. Remember to explore all available resources and seek professional guidance when needed. With careful planning and proactive management, you can successfully navigate the student loan landscape and achieve your educational and financial aspirations.

FAQ Compilation

What happens if I can’t repay my student loans?

Defaulting on your student loans has serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Explore options like deferment or forbearance before defaulting.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, it’s crucial to compare offers from different lenders and consider the long-term implications before refinancing.

How do I consolidate my student loans?

Loan consolidation combines multiple loans into a single loan, potentially simplifying repayment. Federal loan consolidation is often advantageous, but private loan consolidation options exist as well. Carefully weigh the pros and cons before consolidating.

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do. Subsidized loans typically have stricter eligibility requirements.