Navigating the world of student loans can feel overwhelming, especially when considering private options. Federal loans often offer government-backed benefits, but private loans can provide alternatives when federal aid falls short. Understanding the nuances of interest rates, repayment terms, and lender comparisons is crucial for making informed decisions and securing the best possible financing for your education. This guide explores the key factors to consider when choosing a private student loan, empowering you to make a confident and financially responsible choice.

This exploration delves into the complexities of private student loans, examining various lender options, eligibility requirements, and the importance of credit scores and co-signers. We’ll also cover critical aspects such as variable versus fixed interest rates, repayment strategies, and the potential risks associated with private borrowing. Ultimately, the goal is to equip you with the knowledge needed to select a loan that aligns with your financial situation and long-term goals.

Understanding Private Student Loan Basics

Private student loans can be a crucial funding source for higher education, but understanding their intricacies is vital before committing. Unlike federal loans, private loans are offered by banks, credit unions, and other financial institutions, each with its own terms and conditions. This section clarifies the key differences and considerations involved in navigating the world of private student loans.

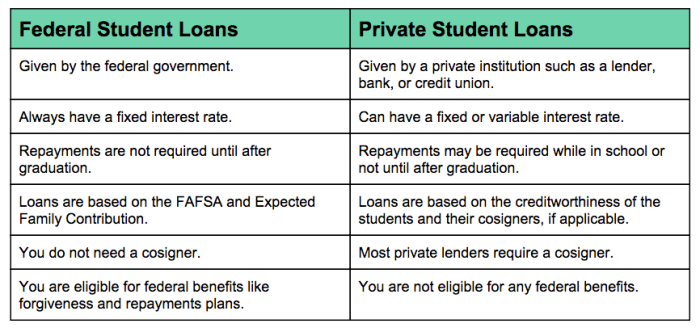

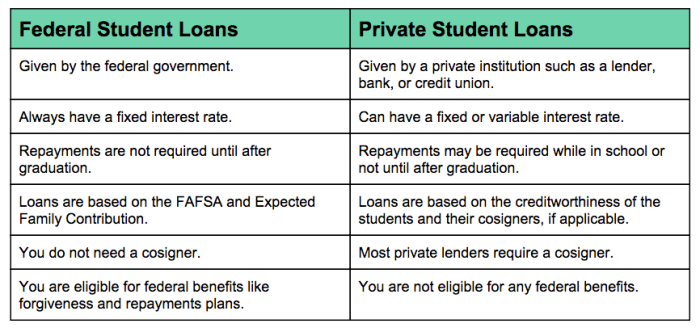

Federal vs. Private Student Loans

Federal student loans, offered by the government, generally come with more borrower protections, such as income-driven repayment plans and loan forgiveness programs. These programs are designed to make repayment more manageable. In contrast, private student loans are governed by the individual lender’s policies, often lacking these safety nets. Federal loans typically have lower interest rates than private loans, particularly for undergraduate students. Eligibility for federal loans is based on financial need and enrollment status, while private loan eligibility hinges more on creditworthiness and co-signer availability.

Private Student Loan Eligibility Requirements

Securing a private student loan typically requires a strong credit history, or a creditworthy co-signer. Lenders assess credit scores, debt-to-income ratios, and overall financial stability to determine eligibility. Applicants usually need to provide proof of enrollment in an eligible educational program. Some lenders may also require a minimum GPA or specific academic standing. The specific requirements vary significantly across lenders. A co-signer, usually a parent or family member with good credit, can significantly improve the chances of approval, especially for students with limited or no credit history.

Interest Rates and Repayment Terms

Private student loan interest rates are variable and depend on several factors, including the applicant’s creditworthiness, the loan amount, the repayment term, and the prevailing market interest rates. Rates can fluctuate throughout the loan term, potentially increasing the overall cost of borrowing. Repayment terms vary as well, ranging from short-term loans with higher monthly payments to longer-term loans with lower monthly payments. Longer terms generally result in higher overall interest paid. Borrowers should carefully compare interest rates and repayment terms from multiple lenders to find the most suitable option. It is crucial to understand the total cost of the loan over its lifetime, including interest and fees.

Comparison of Private Student Loan Lenders

The following table compares four hypothetical private student loan lenders. Note that actual rates and terms are subject to change and vary based on individual circumstances. It is crucial to check the latest information directly with the lender.

| Lender | Interest Rate (Variable) | Fees | Repayment Options |

|---|---|---|---|

| Lender A | 6.5% – 12% | Origination fee: 1% | Standard, Graduated, Extended |

| Lender B | 7% – 13% | Origination fee: 2%, Late payment fee: $25 | Standard, Income-Based (limited eligibility) |

| Lender C | 5.5% – 11% | No origination fee, Late payment fee: $30 | Standard, Extended |

| Lender D | 8% – 14% | Origination fee: 0.5%, Prepayment penalty: None | Standard, Accelerated |

Factors Influencing Loan Selection

Choosing the right private student loan involves careful consideration of several key factors. Understanding these factors will help you secure the most favorable terms and minimize the long-term financial burden of your student debt. The process involves assessing your creditworthiness, exploring co-signer options, and comparing interest rate structures.

Credit Score’s Impact on Loan Approval and Interest Rates

Your credit score significantly influences your eligibility for a private student loan and the interest rate you’ll receive. Lenders use credit scores to assess your creditworthiness – your ability to repay borrowed money. A higher credit score generally indicates a lower risk to the lender, resulting in a higher likelihood of loan approval and a lower interest rate. Conversely, a lower credit score might lead to loan rejection or higher interest rates, increasing the overall cost of borrowing. For example, a borrower with a credit score above 750 might qualify for a loan with an interest rate of 6%, while a borrower with a score below 600 might face an interest rate of 10% or higher, or even be denied altogether. This difference in interest rates can significantly impact the total amount repaid over the loan’s life.

The Role of Co-signers in Securing a Loan

A co-signer is an individual with a strong credit history who agrees to share responsibility for repaying the loan if the primary borrower defaults. Their excellent credit score can significantly improve the chances of loan approval, especially for borrowers with limited or damaged credit. While co-signing offers a clear advantage in securing a loan, it also carries significant risk for the co-signer. If the borrower fails to make payments, the co-signer becomes fully responsible for the remaining debt. Therefore, it’s crucial for both the borrower and the co-signer to carefully consider the implications before entering into such an agreement. Choosing a reliable co-signer who understands their financial obligations is paramount.

Variable vs. Fixed Interest Rates

Private student loans typically offer two types of interest rates: fixed and variable. A fixed interest rate remains constant throughout the loan’s term, providing predictability in monthly payments. A variable interest rate fluctuates based on market conditions, potentially leading to lower initial payments but also the risk of higher payments later if interest rates rise. The choice between a fixed and variable rate depends on individual risk tolerance and financial projections. A borrower who prefers stability and predictability might opt for a fixed rate, while a borrower comfortable with some risk might choose a variable rate, hoping for lower payments initially. However, it’s important to remember that variable rates can increase significantly, making repayment more challenging.

Suitable and Unsuitable Situations for Private Student Loans

Private student loans can be a suitable option when federal student loan options are insufficient to cover educational expenses. This might occur when a student’s federal loan limits have been reached, or if they require additional funds beyond what federal loans provide. However, private student loans might not be suitable if a borrower has poor credit and cannot secure a co-signer, resulting in high interest rates and unfavorable repayment terms. Furthermore, private student loans generally lack the same borrower protections as federal loans, such as income-driven repayment plans and loan forgiveness programs. Therefore, careful consideration of the borrower’s financial situation and risk tolerance is crucial before opting for a private student loan.

Navigating the Application Process

Securing a private student loan involves a multi-step process that requires careful planning and attention to detail. Understanding each step and the necessary documentation will streamline the application and increase your chances of approval. This section Artikels the typical steps, required documents, and the crucial process of comparing loan offers.

The application process for a private student loan generally follows a predictable pattern. However, specific requirements may vary slightly between lenders. It’s essential to thoroughly review each lender’s guidelines before submitting your application.

Required Documents for Private Student Loan Applications

Gathering the necessary documentation beforehand significantly expedites the application process. Missing documents can delay approval or even lead to rejection. Lenders typically require verification of your identity, financial stability, and academic enrollment.

- Government-issued photo ID: This confirms your identity and is a standard requirement for most financial transactions.

- Social Security number: Used for credit checks and loan processing.

- Proof of enrollment: An acceptance letter or enrollment verification from your chosen institution demonstrating your current student status.

- Bank statements: These demonstrate your financial history and stability, helping lenders assess your ability to repay the loan.

- Tax returns (or parent’s tax returns, if applicable): Provide evidence of income and financial standing, particularly important for co-signed loans.

- Credit report: Lenders use credit reports to assess creditworthiness. A good credit score can lead to more favorable loan terms.

Comparing Loan Offers from Multiple Lenders

Comparing loan offers is critical to securing the most favorable terms. Different lenders offer varying interest rates, fees, repayment options, and other features. Failing to compare can result in paying significantly more over the life of the loan.

Step-by-Step Guide to Comparing Loan Offers

A systematic approach to comparing loan offers ensures you don’t overlook crucial details. Focus on these key features and costs:

- Interest Rate: This is the cost of borrowing money, expressed as a percentage. A lower interest rate translates to lower overall borrowing costs. Compare both fixed and variable interest rates to see which best suits your needs and risk tolerance.

- Fees: Origination fees, late payment fees, and prepayment penalties can significantly impact the total cost of the loan. Carefully review all fees associated with each loan offer.

- Repayment Terms: Consider the loan’s repayment period (e.g., 5, 10, or 15 years). Longer repayment terms result in lower monthly payments but higher overall interest costs. Shorter terms mean higher monthly payments but lower total interest.

- Deferment and Forbearance Options: These options allow temporary pauses in payments under specific circumstances, such as unemployment or financial hardship. Understanding the availability and terms of these options is crucial.

- Co-signer Requirements: Some lenders may require a co-signer, someone who agrees to repay the loan if you default. Consider the implications for both you and your co-signer.

For example, let’s say Lender A offers a loan with a 7% fixed interest rate, a $200 origination fee, and a 10-year repayment term, while Lender B offers a loan with a 6.5% fixed interest rate, a $100 origination fee, and a 10-year repayment term. While Lender B has a slightly lower interest rate, the difference in origination fees needs to be considered to determine which loan is ultimately more cost-effective. Using a loan comparison calculator can simplify this process. Many reputable financial websites offer free tools to help compare loan offers side-by-side.

Repayment Strategies and Options

Successfully navigating private student loan repayment requires understanding the available options and developing a strategic plan. Choosing the right repayment strategy can significantly impact your financial well-being and minimize the overall cost of your loan. This section explores various repayment plans and effective debt management strategies.

Private Student Loan Repayment Plans

Private student loan lenders offer a range of repayment plans, often more flexible than federal loan options. These plans typically include options designed to fit different budgets and financial situations. Understanding the nuances of each plan is crucial for effective debt management. Common options include:

- Standard Repayment: This plan typically involves fixed monthly payments over a set period (e.g., 10-15 years). The monthly payment remains consistent throughout the repayment term.

- Graduated Repayment: Payments start low and gradually increase over time, often aligning with the expectation of increased income as borrowers progress in their careers. This can provide relief in the early years but results in higher payments later.

- Extended Repayment: This option extends the loan repayment period, leading to lower monthly payments but higher overall interest costs due to the longer repayment timeframe. It’s a trade-off between affordability and total cost.

- Income-Driven Repayment (IDR): While less common with private loans than federal loans, some lenders may offer plans where monthly payments are tied to a percentage of your income. This can provide flexibility during periods of lower income, but the repayment period may be longer.

Strategies for Effective Student Loan Debt Management

Effective management of student loan debt requires proactive planning and consistent effort. Several strategies can significantly improve your ability to repay your loans efficiently and minimize the long-term financial burden.

- Budgeting and Prioritization: Creating a detailed budget to track income and expenses is fundamental. Prioritizing loan repayment within your budget ensures consistent payments and avoids delinquency.

- High-Interest Loan Prioritization: Focus on repaying loans with the highest interest rates first to minimize the overall interest paid. This strategy can save substantial money over the long run. The snowball or avalanche methods are commonly used strategies here.

- Refinancing: Refinancing can lower your interest rate if rates have fallen since you initially took out your loans. This can lead to significant savings over the life of the loan, but be aware of potential fees and changes in loan terms.

- Seeking Professional Advice: Consulting with a financial advisor can provide personalized guidance on debt management strategies tailored to your specific circumstances. They can help you navigate complex financial decisions and create a comprehensive repayment plan.

Consequences of Defaulting on a Private Student Loan

Defaulting on a private student loan can have severe financial consequences. Unlike federal loans, private loans generally don’t offer the same government-backed protections and rehabilitation programs. The consequences can include:

- Damage to Credit Score: A default significantly lowers your credit score, making it difficult to obtain future loans, credit cards, or even rent an apartment. This negative impact can persist for years.

- Wage Garnishment: Lenders can legally garnish your wages to recover the debt, leaving you with significantly reduced income.

- Legal Action: Lenders can pursue legal action to recover the debt, including lawsuits and judgments that can lead to further financial penalties.

- Collection Agency Involvement: Your debt may be sold to a collection agency, which will aggressively pursue repayment, often with additional fees and charges.

Sample Repayment Plan

Let’s assume a total private student loan debt of $50,000 with a 7% interest rate, spread across two loans: $30,000 with a 7.5% interest rate and $20,000 with a 6.5% interest rate. We’ll use a combination of strategies to minimize interest payments.

| Loan Amount | Interest Rate | Repayment Strategy | Monthly Payment (approx.) |

|---|---|---|---|

| $30,000 | 7.5% | Avalanche (High-Interest First) – 10-year repayment | $345 |

| $20,000 | 6.5% | Avalanche (High-Interest First) – 10-year repayment | $225 |

Note: These are approximate monthly payments. Actual payments may vary slightly depending on the lender’s calculation methods. A longer repayment term would lower the monthly payment but increase the total interest paid.

Potential Risks and Considerations

Private student loans, while offering a crucial funding source for higher education, come with inherent risks that borrowers must carefully consider. Understanding these potential pitfalls is essential to making informed decisions and avoiding financial hardship down the line. Failing to thoroughly research and understand the terms of a loan can lead to unexpected costs and difficulties in repayment.

High interest rates and fees are significant concerns. Unlike federal student loans, which often have lower, fixed interest rates, private loans can carry significantly higher variable rates, meaning your monthly payments could fluctuate. Additionally, private lenders frequently charge origination fees, late payment fees, and other charges that can add substantially to the overall cost of borrowing. These added expenses can quickly escalate the total amount you owe, making repayment a more challenging endeavor.

Understanding Loan Agreements

Before signing any loan agreement, meticulously review all terms and conditions. Pay close attention to the interest rate (both fixed and variable options), fees, repayment terms, and any potential penalties for late or missed payments. Understanding the loan’s amortization schedule—a detailed breakdown of how your payments will be applied to principal and interest over the life of the loan—is crucial for managing your debt effectively. Don’t hesitate to ask the lender for clarification on any points you don’t understand; it’s far better to be certain than to face unexpected financial burdens later. Consider seeking advice from a financial advisor before committing to a loan.

Avoiding Predatory Lending Practices

Predatory lenders target vulnerable borrowers with misleading terms and high fees. These practices often involve aggressive sales tactics, hidden fees, and confusing contract language designed to trap borrowers in a cycle of debt. To avoid such practices, always compare offers from multiple lenders, scrutinize the fine print of loan agreements, and be wary of lenders who pressure you into making quick decisions. Legitimate lenders will be transparent about their fees and terms, readily answering your questions and providing clear explanations. If a lender seems overly aggressive or unwilling to provide clear information, it’s a significant red flag.

Red Flags to Watch For

It’s crucial to be aware of warning signs that might indicate a predatory loan. Understanding these red flags can help you protect yourself from exploitative lending practices.

- Extremely high interest rates significantly above market averages.

- Hidden fees or unclear fee structures.

- Aggressive sales tactics or high-pressure sales techniques.

- Difficulty obtaining clear and concise information about loan terms.

- Lack of transparency regarding fees and repayment options.

- Requirement to sign documents without fully understanding the terms.

- Loan terms that seem too good to be true.

Alternatives to Private Student Loans

Securing funding for higher education shouldn’t solely rely on private student loans. Numerous alternative financing options exist, offering potentially more favorable terms and reducing the overall debt burden. Exploring these alternatives is crucial for making informed decisions about financing your education.

Before diving into specifics, it’s helpful to understand the core differences between private student loans and other financing methods. Private loans typically come with higher interest rates and less flexible repayment options compared to federal student loans or grants. The lack of government oversight also means fewer consumer protections. Conversely, grants and scholarships represent “free money” that doesn’t need to be repaid, significantly reducing the overall cost of education.

Scholarships and Grants

Scholarships and grants are financial aid awards based on merit, need, or specific criteria. They are generally awarded by colleges, universities, foundations, corporations, and government agencies. Unlike loans, these funds do not need to be repaid. Securing these awards can substantially reduce or even eliminate the need for borrowing.

Federal Student Loans

Federal student loans, unlike private loans, offer several advantages. They often have lower interest rates, flexible repayment plans (including income-driven repayment), and government-provided protections against default. The federal government provides various loan types catering to different needs and financial situations. For example, subsidized loans do not accrue interest while the student is enrolled at least half-time, whereas unsubsidized loans accrue interest immediately.

Comparison of Borrowing Options

The following table illustrates a comparison of different borrowing options, highlighting key differences in interest rates, repayment terms, and eligibility criteria. Note that interest rates and terms are subject to change and vary based on individual circumstances. This table uses hypothetical examples for illustrative purposes only.

| Financing Option | Interest Rate (Example) | Repayment Terms (Example) | Eligibility |

|---|---|---|---|

| Private Student Loan | 7-12% | Variable, typically 10-20 years | Credit history, co-signer often required |

| Federal Subsidized Loan | Currently around 5% | Standard 10-year repayment, but income-driven plans available | US citizenship or eligible non-citizen status, enrollment in eligible program |

| Federal Unsubsidized Loan | Currently around 5% | Standard 10-year repayment, but income-driven plans available | US citizenship or eligible non-citizen status, enrollment in eligible program |

Calculating Total Borrowing Costs

Accurately calculating the total cost of borrowing is essential for informed decision-making. This involves considering not only the principal loan amount but also the accumulated interest over the repayment period. The following formula can help:

Total Cost = Principal + (Principal x Interest Rate x Number of Years)

For example, a $10,000 loan with a 7% interest rate over 10 years would cost: $10,000 + ($10,000 x 0.07 x 10) = $17,000. This demonstrates the significant impact of interest accumulation over time.

Resources for Finding Scholarships and Grants

Numerous resources can assist in locating scholarships and grants. These include:

* The Federal Student Aid website (studentaid.gov): This is the official website for federal student aid, offering information on grants, loans, and scholarships.

* Fastweb: A popular online scholarship search engine that matches students with potential opportunities based on their profile.

* Scholarships.com: Another comprehensive scholarship search website with a large database of awards.

* Your college or university’s financial aid office: Your institution’s financial aid office is an invaluable resource for information on scholarships and grants specific to your school.

Last Word

Securing a private student loan requires careful consideration and a thorough understanding of the available options. By comparing lenders, understanding your creditworthiness, and developing a sound repayment strategy, you can navigate the process effectively. Remember to always read the fine print, be wary of predatory lending practices, and explore alternative funding sources before committing to a loan. Making an informed decision ensures you can focus on your education without the added burden of excessive debt.

Essential Questionnaire

What is the difference between a co-signer and an endorser?

A co-signer shares responsibility for the loan repayment, while an endorser typically only guarantees the loan in case of default.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it depends on your credit score and current financial situation.

What happens if I default on a private student loan?

Defaulting can severely damage your credit score, leading to difficulty securing future loans and impacting other financial opportunities. Collection agencies may pursue legal action.

Are there any tax benefits associated with private student loans?

Generally, no. Unlike some federal loan programs, there are usually no tax deductions or credits specifically for private student loans.