Navigating the complexities of student loan repayment can feel overwhelming, especially when grappling with the often-misunderstood concept of capitalized interest. This seemingly innocuous term can significantly impact your overall loan burden, potentially adding thousands of dollars to your total repayment. Understanding how capitalized interest works is crucial for effective financial planning and responsible debt management.

This guide provides a comprehensive overview of capitalized interest on student loans, explaining its mechanics, implications, and strategies for mitigation. We’ll explore various scenarios, compare it to simple interest, and offer practical steps to minimize its impact on your financial future. By the end, you’ll be equipped with the knowledge to make informed decisions regarding your student loan repayment journey.

Definition of Capitalized Interest on Student Loans

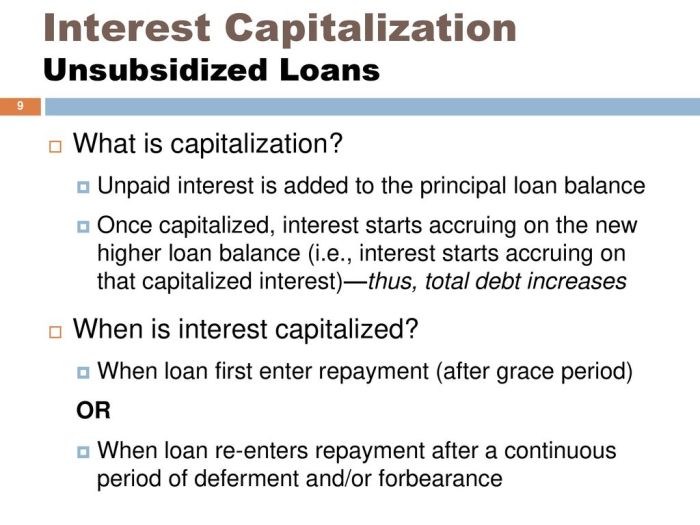

Capitalized interest on student loans refers to the process of adding unpaid interest to your principal loan balance. Essentially, the interest that accrues while your loan is in deferment or forbearance (periods where you don’t have to make payments) isn’t paid off separately; instead, it gets added to the original amount you borrowed, increasing your total loan amount. This means you’ll end up paying interest on that accumulated interest in the future, leading to a larger overall debt.

Capitalized interest can significantly increase the total cost of your student loans over time. Understanding how it works is crucial for effectively managing your student loan debt.

Capitalized Interest Calculation

Let’s say you have a $10,000 student loan with a 5% annual interest rate. Your loan enters a deferment period for one year. During this year, you don’t make any payments. At a 5% annual interest rate, the interest accrued during this year would be $500 ($10,000 x 0.05). When the deferment period ends, this $500 in interest is capitalized. Your new principal balance is now $10,500 ($10,000 + $500). Future interest calculations will now be based on this higher principal amount, meaning you’ll pay interest not only on the original $10,000 but also on the $500 in capitalized interest.

Impact of Capitalized Interest on Loan Repayment

Imagine a student with a $20,000 loan at 6% interest, who takes a 2-year deferment period after graduation. During those two years, significant interest accrues. Let’s assume $2,400 accrues in total interest over those two years. This interest is then capitalized, increasing the principal to $22,400. If the student then begins repayment with a standard 10-year repayment plan, the monthly payments will be noticeably higher compared to a scenario where the interest wasn’t capitalized. The higher principal balance directly translates to larger monthly payments and significantly more interest paid over the life of the loan. This scenario highlights the substantial long-term financial implications of capitalized interest. The longer the deferment period, the more significant the impact.

Circumstances Leading to Capitalized Interest

Capitalized interest on federal student loans occurs when unpaid interest is added to the principal loan balance. This increases the total amount you owe and, consequently, the amount of interest accruing in the future. Several circumstances can trigger this capitalization. Understanding these situations is crucial for effective loan management and minimizing long-term borrowing costs.

Capitalization generally happens when your student loan enters a period of deferment or forbearance, or if you have an unpaid balance after a period of grace. During these periods, interest continues to accrue, but you aren’t required to make payments. If this accrued interest remains unpaid, it’s added to your principal loan amount, thus becoming capitalized interest. This process effectively increases the overall loan balance and, subsequently, the future interest payments. The amount capitalized depends on the length of the deferment or forbearance period and the interest rate applicable to your loan.

Loan Deferment and Forbearance

Deferment and forbearance are both periods where you temporarily don’t have to make loan payments. However, interest usually still accrues during these periods. If you don’t pay this interest, it will be capitalized at the end of the deferment or forbearance period. Different types of deferments and forbearances exist, each with its own eligibility requirements and potential for interest capitalization. For example, economic hardship deferment or unemployment deferment can lead to interest capitalization if the accrued interest is not paid during the deferment period. Similarly, forbearance granted due to financial difficulties may also result in capitalized interest if not addressed promptly. The length of the deferment or forbearance significantly impacts the amount capitalized; a longer period means more interest accumulating and, therefore, a larger increase in your loan principal.

Specific Repayment Plans and Capitalization

While most repayment plans require monthly payments, some circumstances can lead to interest capitalization even within a standard repayment plan. For instance, if a borrower fails to make timely payments and their loan enters default, the unpaid interest can be capitalized upon rehabilitation of the loan. This means that the unpaid interest during the default period is added to the principal, resulting in a larger loan balance. The specific terms and conditions of each repayment plan vary, so it is crucial to review the details of your repayment plan carefully.

Factors Influencing the Amount of Capitalized Interest

Several factors influence the amount of interest capitalized. The most significant is the length of the period during which interest accrues but is not paid. A longer period results in a larger amount of capitalized interest. The interest rate applicable to the loan also plays a crucial role; higher interest rates lead to faster accumulation of interest, which, when capitalized, results in a larger increase in the principal. Finally, the initial loan amount also matters; a larger loan balance means more interest will accrue, and consequently, more interest will be capitalized. For example, a loan with a higher initial balance will have a larger amount of capitalized interest compared to a smaller loan balance, assuming all other factors remain the same.

Impact of Capitalized Interest on Loan Repayment

Capitalizing interest on student loans significantly impacts the total amount borrowers ultimately repay. This process essentially adds unpaid interest to the principal loan balance, increasing the amount on which future interest is calculated. Understanding this effect is crucial for effective financial planning and avoiding unexpected debt burdens.

Capitalization affects the total loan amount owed by increasing the principal balance. When interest is capitalized, it’s no longer a separate amount due; it becomes part of the new, larger principal. This means you’ll be paying interest on a higher amount, leading to a larger overall repayment cost. The longer the period of capitalization (e.g., during grace periods or deferments), the more substantial this effect becomes. The impact is compounded over time, resulting in a much higher total repayment amount compared to a scenario where interest is paid regularly.

Long-Term Financial Consequences of Capitalized Interest

The long-term financial consequences of capitalized interest can be substantial. A seemingly small amount of capitalized interest can dramatically increase the total loan repayment cost over the life of the loan. This can lead to difficulties in budgeting, delayed financial goals (such as homeownership or starting a family), and potentially even long-term financial stress. For example, a borrower who capitalizes $1000 in interest might find their total repayment amount increased by several thousand dollars over the loan’s lifespan, depending on the interest rate and repayment period. This extra cost could significantly impact their ability to save for retirement or other important financial goals.

Comparison of Total Repayment Costs

The following table compares the total repayment cost with and without capitalized interest, illustrating the significant difference capitalization can make. These figures are for illustrative purposes and will vary depending on the loan terms, interest rate, and capitalization period. It’s crucial to consult individual loan documents for precise calculations.

| Scenario | Initial Loan Amount | Capitalized Interest | Total Repayment Amount |

|---|---|---|---|

| Without Capitalization (Interest Paid Regularly) | $20,000 | $0 | $25,000 (Example – assuming $5,000 in interest accrued over the repayment period) |

| With Capitalization ($1,000 Capitalized) | $20,000 | $1,000 | $28,000 (Example – assuming the $1,000 capitalization significantly increases the total interest accrued) |

Strategies to Minimize Capitalized Interest

Minimizing capitalized interest on student loans requires a proactive approach to loan management. By understanding how capitalized interest works and implementing effective strategies, borrowers can significantly reduce the overall cost of their education loans. This involves both anticipating potential capitalization events and actively managing your loans to prevent or mitigate their impact.

Proactive Measures to Prevent Capitalization

Preventing capitalized interest is far more effective than dealing with it after the fact. These strategies focus on avoiding situations that trigger capitalization in the first place.

- Maintain Consistent Payments: The most crucial step is to consistently make on-time payments on all your student loans. This prevents deferment or forbearance periods, which are common triggers for capitalization. Even small, consistent payments demonstrate commitment and prevent default. For example, if you have a $10,000 loan and consistently make payments, even if they are only the minimum, you prevent the accumulation of unpaid interest that could later be capitalized.

- Explore Income-Driven Repayment Plans: Income-driven repayment (IDR) plans adjust your monthly payment based on your income and family size. While they may extend your repayment period, they can help you avoid missing payments, thus reducing the risk of capitalization. For instance, if you experience a period of lower income after graduation, an IDR plan can lower your payments to an affordable amount, preventing missed payments and subsequent capitalization.

- Consider Loan Consolidation: Consolidating multiple federal student loans into a single loan can simplify repayment and potentially lower your monthly payment. This can make it easier to stay current on your payments and avoid capitalization. A single, lower monthly payment might be more manageable, reducing the risk of default and subsequent interest capitalization. However, be aware that consolidation can sometimes lead to a higher overall interest rate over the life of the loan.

Reactive Measures to Mitigate Capitalization

If capitalization has already occurred, or if you anticipate it, these strategies can help minimize its impact.

- Accelerated Repayment: If you’ve experienced a period of deferment or forbearance and your interest has capitalized, aggressively paying down your principal balance can lessen the long-term impact. The faster you pay down the principal, the less interest will accrue in the future, and the less will be capitalized if another deferment is needed. For example, making extra payments each month, even a small amount, will significantly reduce the principal faster than scheduled payments.

- Refinance Your Loans (If Eligible): Refinancing your student loans with a private lender might offer a lower interest rate, potentially saving money over the life of the loan. This is particularly helpful if you’ve had interest capitalized, as it can lower your overall debt burden. However, refinancing federal loans means losing access to federal repayment plans and protections, so carefully consider the trade-offs.

Capitalized Interest vs. Simple Interest on Student Loans

Understanding the difference between capitalized and simple interest is crucial for effective student loan management. While both involve accruing interest charges, the way that interest is calculated and its ultimate impact on the total loan amount differ significantly. This section will clarify these differences and highlight the advantages and disadvantages of each approach.

Capitalized interest and simple interest represent two distinct methods of calculating interest on student loans. Simple interest is calculated only on the principal loan amount, while capitalized interest adds accumulated interest to the principal, increasing the base upon which future interest is calculated. This compounding effect can significantly increase the total cost of the loan over time.

Comparison of Capitalized and Simple Interest Calculation Methods

The following table illustrates the key differences between capitalized and simple interest calculations for student loans. Understanding these differences is essential for borrowers to make informed decisions about loan repayment strategies.

| Feature | Capitalized Interest | Simple Interest | Key Differences |

|---|---|---|---|

| Interest Calculation | Calculated on the principal balance plus any accumulated unpaid interest. | Calculated only on the original principal balance. | Capitalized interest compounds, increasing the loan balance faster than simple interest. |

| Impact on Loan Balance | Leads to a larger total loan amount over time due to compounding. | Results in a smaller total loan amount compared to capitalized interest for the same loan term and interest rate. | The difference can be substantial, especially over longer repayment periods. |

| Repayment Amount | Higher monthly payments or longer repayment periods are usually required. | Generally results in lower monthly payments or shorter repayment periods. | The difference in repayment amounts can significantly affect a borrower’s budget. |

| Example | Imagine a $10,000 loan with 5% interest. If interest is capitalized annually, and no payments are made, after one year the balance becomes $10,500 ($10,000 + $500 interest). The next year’s interest is calculated on $10,500, not $10,000. | With simple interest, the annual interest remains a constant $500, regardless of how long the loan remains unpaid. The total amount owed would increase linearly. | The compounded interest in the capitalized example leads to a faster growth in the total amount owed. |

Advantages and Disadvantages of Each Interest Calculation Method

Each interest calculation method presents its own set of advantages and disadvantages for borrowers.

Capitalized Interest: While there are no inherent advantages to capitalized interest from the borrower’s perspective, it simplifies administrative processes for lenders. The main disadvantage is the significantly higher total cost of the loan due to compounding. This can make repayment more challenging and increase the overall debt burden.

Simple Interest: The primary advantage of simple interest is that it results in a lower total loan cost. Borrowers pay less overall and may have lower monthly payments. The disadvantage is that this method might not be as widely offered by lenders.

Resources and Further Information

Understanding capitalized interest on student loans requires access to reliable information. Several government agencies and private organizations offer resources to help borrowers navigate this complex aspect of loan repayment. The following sections Artikel key resources categorized for easier access.

Federal Student Aid Resources

The U.S. Department of Education’s Federal Student Aid website (studentaid.gov) is the primary source for information on federal student loans. This site provides comprehensive details on various loan programs, repayment plans, and interest calculations, including explanations of capitalized interest. You can find detailed information on loan consolidation, deferment, and forbearance options, all of which impact capitalized interest accumulation. The site also offers interactive tools and calculators to estimate loan repayment amounts and the potential impact of capitalized interest. Furthermore, it provides contact information for federal loan servicers.

Loan Servicer Websites

Each federal student loan borrower is assigned a loan servicer, a company responsible for managing their loan account. These servicers (e.g., Nelnet, Navient, Great Lakes) maintain individual borrower accounts and provide personalized information regarding loan balances, payment schedules, and interest accrual. Their websites typically offer online account access, allowing borrowers to track their loan details, make payments, and view their amortization schedules, clearly showing the impact of capitalized interest. Contact information for individual servicers is usually available on the Federal Student Aid website.

Consumer Financial Protection Bureau (CFPB) Resources

The CFPB (consumerfinance.gov) is an independent agency that works to protect consumers’ financial interests. Their website offers resources on various financial topics, including student loans. They provide information on avoiding student loan scams, understanding loan terms, and navigating the repayment process. While they may not specifically detail the intricacies of capitalized interest calculations, their materials provide valuable context within the broader landscape of student loan management, empowering borrowers to make informed decisions. They also offer tools and resources to help borrowers understand their rights and resolve disputes with loan servicers.

Illustrative Example

Understanding the impact of capitalized interest can be challenging. A visual representation helps clarify how this compounding effect accumulates over time, especially during periods of deferment or forbearance. The following description details a chart that illustrates this process.

The chart would be a line graph, with the horizontal (x) axis representing time, measured in years. The vertical (y) axis represents the total loan balance, including the principal and accumulated capitalized interest. Data points would be plotted at yearly intervals, showing the loan balance at the end of each year. The line itself would demonstrate the growth of the loan balance over time. Ideally, multiple lines could be included: one showing the growth with no deferment or forbearance, and others demonstrating scenarios with different periods of deferment or forbearance.

Capitalized Interest Growth Over Time

The chart’s title would be “Growth of Loan Balance with Capitalized Interest.” The x-axis label would be “Years,” and the y-axis label would be “Loan Balance ($).” For a concrete example, let’s assume a starting loan balance of $10,000 with an interest rate of 5%. If no deferment or forbearance is utilized, the line would show a steady, upward curve reflecting the compounding effect of interest. Let’s say, for instance, that after 1 year, the balance is $10,500; after 2 years, $11,025; and so on. This line represents a typical loan repayment without interruptions.

A second line could represent a scenario with a two-year deferment period. During the deferment, the interest would accrue but not be paid, and then it would be capitalized at the end of the deferment period. This would result in a steeper upward curve after year two, reflecting the sudden jump in the principal due to capitalization. The total loan balance at the end of year 2 would be higher than in the scenario without deferment, demonstrating the impact of deferment. The subsequent years would also show a higher loan balance compared to the scenario without deferment. Similarly, a third line could illustrate a scenario with a forbearance period, potentially showing a different pattern of growth depending on the terms of the forbearance.

Impact of Deferment or Forbearance

The visual comparison of these lines clearly illustrates how deferment or forbearance periods significantly increase the total loan amount owed. The sudden jump in the loan balance after a deferment or forbearance period is visually striking, highlighting the negative impact of capitalized interest. The difference between the loan balance in the scenario without deferment/forbearance and those with deferment/forbearance becomes progressively larger over time, underscoring the long-term financial consequences. The chart effectively demonstrates that while deferment or forbearance might offer temporary relief, they ultimately lead to a higher total loan cost and longer repayment periods.

Summary

In conclusion, understanding capitalized interest is paramount for responsible student loan management. While it might seem like a technicality, its cumulative effect can dramatically increase your total repayment cost. By proactively employing the strategies Artikeld – from exploring repayment plans to consistently making payments – you can significantly reduce the impact of capitalized interest and pave the way for a more financially secure future. Remember, knowledge is power, and informed action is key to navigating the complexities of student loan debt.

Common Queries

What happens if I don’t make payments during a deferment period?

Interest continues to accrue during deferment periods, and it’s often capitalized at the end of the deferment.

Can I avoid capitalization altogether?

Yes, by consistently making on-time payments, you prevent interest from capitalizing.

How does capitalized interest affect my loan’s interest rate?

Capitalization increases the principal balance, potentially leading to higher total interest paid over the life of the loan, even if the interest rate remains the same.

Are there any penalties for not understanding capitalized interest?

There are no direct penalties for not understanding capitalized interest, but a lack of understanding can lead to significantly higher repayment costs.