Navigating the complex world of student loans can feel overwhelming, especially when faced with the sheer variety of loan types, repayment plans, and government programs available. Understanding which options are best suited to your individual circumstances is crucial to long-term financial health. This guide delves into the key aspects of student loan management, offering insights and strategies to help you make informed decisions and achieve your financial goals.

From federal versus private loans and the nuances of income-driven repayment to the potential pitfalls of predatory lending and the importance of proactive financial planning, we’ll explore the essential elements of effective student loan management. We aim to empower you with the knowledge and tools needed to confidently navigate this crucial financial journey.

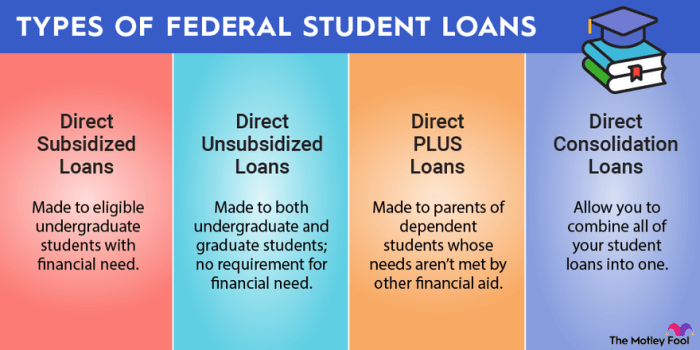

Understanding Student Loan Types

Navigating the world of student loans can be complex, but understanding the fundamental differences between loan types is crucial for responsible borrowing and repayment. This section will clarify the distinctions between federal and private student loans, outlining various repayment options and comparing interest rates and fees.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government and generally offer more borrower protections than private loans. These protections include flexible repayment plans, income-driven repayment options, and deferment or forbearance in times of financial hardship. Private student loans, on the other hand, are offered by banks, credit unions, and other private lenders. They typically have stricter eligibility requirements and may offer less flexibility in repayment. The interest rates and fees on private loans are often higher than those on federal loans, and they may lack the same borrower protections.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal student loans, allowing borrowers to tailor their payments to their financial circumstances. These plans include the Standard Repayment Plan, Graduated Repayment Plan, Extended Repayment Plan, and Income-Driven Repayment Plans (IDR). The Standard Repayment Plan involves fixed monthly payments over 10 years. The Graduated Repayment Plan starts with lower payments that gradually increase over time. The Extended Repayment Plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but higher overall interest paid. IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), calculate monthly payments based on your income and family size.

Interest Rates and Fees

Interest rates and fees vary significantly depending on the type of loan and the lender. Federal student loan interest rates are set by the government and are generally lower than those of private loans. Private loan interest rates are variable and depend on factors such as credit score, loan amount, and the lender’s current rates. Federal loans typically have lower fees than private loans, although some fees may apply depending on the loan type and program. For example, origination fees are common for federal loans, while private loans may charge application fees or prepayment penalties.

Comparison of Federal Student Loan Programs

| Feature | Subsidized Loan | Unsubsidized Loan | Direct PLUS Loan |

|---|---|---|---|

| Interest Accrual While in School | No | Yes | Yes |

| Credit Check Required | No | No | Yes |

| Eligibility | Undergraduate students demonstrating financial need | Undergraduate and graduate students | Graduate students and parents of undergraduate students |

| Interest Rate | Fixed rate set by the government | Fixed rate set by the government | Fixed rate set by the government |

Factors Affecting Student Loan Repayment

Successfully navigating student loan repayment hinges on understanding several key factors that significantly influence the process. These factors interact in complex ways, impacting the available repayment options, the overall cost of borrowing, and the length of time required to repay the debt. A thorough understanding of these elements is crucial for effective financial planning and minimizing long-term financial strain.

Income’s Impact on Repayment Options

Your income plays a pivotal role in determining which repayment plans are suitable and affordable. Federal student loan programs offer various income-driven repayment (IDR) plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans calculate your monthly payment based on your discretionary income and family size. Lower incomes typically result in lower monthly payments, potentially extending the repayment period but reducing the immediate financial burden. Conversely, higher incomes may allow for quicker repayment through standard repayment plans or higher payments under IDR plans, leading to less interest accruing over time. For example, a borrower earning $30,000 annually might qualify for a significantly lower monthly payment under an IDR plan than a borrower earning $80,000.

Credit Score’s Influence on Loan Terms

While federal student loans don’t directly require a credit check for eligibility, your credit score can significantly influence the terms you receive on private student loans. A higher credit score generally qualifies you for more favorable interest rates and loan terms. Lenders perceive borrowers with good credit as lower risk, thus offering them more competitive rates. A poor credit score, on the other hand, may result in higher interest rates, potentially leading to significantly increased overall borrowing costs. For instance, a borrower with a credit score of 750 might secure a private student loan with an interest rate of 6%, while a borrower with a score of 550 might face an interest rate of 12% or higher.

Challenges Faced by Borrowers with High Debt Loads

High student loan debt can present numerous challenges. Borrowers may struggle to meet their monthly payments, impacting their ability to save for other financial goals such as purchasing a home, investing, or building an emergency fund. High debt can also negatively affect credit scores if payments are missed or become delinquent. Furthermore, the weight of substantial debt can lead to significant financial stress and anxiety, impacting overall well-being. For example, a borrower with $100,000 in student loan debt might face monthly payments exceeding $1000, making it difficult to manage other expenses and save for the future. This situation could potentially lead to missed payments and a downward spiral impacting their credit score and overall financial health.

Choosing a Repayment Plan: A Flowchart

The process of selecting the best repayment plan requires careful consideration of individual circumstances. The following flowchart Artikels the key steps:

[Imagine a flowchart here. The flowchart would begin with a box labeled “Assess Your Income and Debt”. This would branch to two boxes: “High Income/Low Debt” and “Low Income/High Debt”. The “High Income/Low Debt” branch would lead to a box labeled “Standard Repayment Plan”. The “Low Income/High Debt” branch would lead to a box labeled “Explore Income-Driven Repayment (IDR) Plans”. The IDR box would branch to boxes representing the different IDR plans (IBR, PAYE, REPAYE). Each IDR plan box would lead to a final box labeled “Finalize Plan Selection”.]

Government Programs and Resources

Navigating the complexities of student loan repayment can be daunting, but various government programs and resources are available to help borrowers manage their debt and potentially reduce their overall burden. Understanding these options is crucial for effective financial planning. This section will Artikel key programs and provide information on eligibility and application processes.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer a flexible approach to student loan repayment by basing your monthly payments on your income and family size. Several plans exist, each with slightly different eligibility requirements and payment calculation methods. These plans typically involve lower monthly payments than standard repayment plans, but may extend the repayment period, potentially leading to higher total interest paid over the life of the loan. Examples include the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) plans. The specific plan that best suits an individual’s needs depends on their financial circumstances and loan types. It’s advisable to compare the various plans and their potential long-term implications before selecting one.

Applying for Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, offering the potential for partial or complete loan cancellation under specific circumstances. The application process varies depending on the program, but generally involves completing a detailed application form, providing supporting documentation (such as proof of employment in public service or verification of income), and undergoing a review process by the relevant agency. For instance, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal student loans after 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying employer. Careful review of program eligibility criteria is essential, as failing to meet all requirements can lead to application rejection.

Eligibility Criteria for Government Assistance Programs

Eligibility for government student loan assistance programs depends on several factors, including the type of loan, income level, employment status, and the specific program being considered. For example, IDR plans typically require borrowers to have federal student loans and meet certain income thresholds. Programs like PSLF have additional requirements related to employment in public service. It’s crucial to check the specific eligibility requirements for each program on the official government website to ensure you qualify before applying. Failure to meet these requirements will result in ineligibility for assistance.

Reputable Websites Offering Student Loan Advice and Resources

Accessing reliable information is key to effectively managing student loan debt. Several reputable websites provide comprehensive resources and guidance.

- Federal Student Aid (FSA): The official website of the U.S. Department of Education, offering detailed information on all federal student loan programs.

- StudentAid.gov: A comprehensive resource for understanding federal student aid, including loan repayment options and forgiveness programs.

- National Foundation for Credit Counseling (NFCC): A non-profit organization providing free and low-cost credit counseling services, including assistance with student loan management.

- Consumer Financial Protection Bureau (CFPB): Offers resources and tools to help consumers understand their rights and options regarding student loans.

Strategies for Managing Student Loan Debt

Successfully navigating student loan debt requires a proactive and strategic approach. Understanding your repayment options and developing a personalized plan are crucial steps towards financial freedom. This section Artikels key strategies to effectively manage your student loan debt and minimize its long-term impact.

Creating a Realistic Student Loan Repayment Budget

A realistic budget is the cornerstone of effective student loan repayment. Begin by meticulously tracking your monthly income and expenses. Categorize your spending to identify areas where you can reduce costs. Then, allocate a specific amount each month towards your student loan payments, ensuring it’s an amount you can consistently afford without compromising essential needs. Consider using budgeting apps or spreadsheets to simplify this process. Remember to factor in unexpected expenses and build a small emergency fund to avoid falling behind on payments. For example, if your monthly income is $3,000 and your essential expenses (rent, food, transportation) total $2,000, you might allocate $500 towards student loan payments, leaving $500 for savings and other discretionary spending. Adjusting this allocation requires careful consideration of your financial situation and priorities.

Benefits of Refinancing Student Loans

Refinancing student loans involves replacing your existing loans with a new loan from a private lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total interest paid over the life of the loan. However, refinancing might not be suitable for everyone. For instance, refinancing federal loans into private loans means losing access to federal repayment plans and protections, such as income-driven repayment options or deferment in case of financial hardship. Before refinancing, carefully compare interest rates, fees, and terms from different lenders to ensure you’re getting the best deal. Consider your credit score and overall financial situation, as a higher credit score generally qualifies you for more favorable interest rates. A hypothetical example: Let’s say you have $50,000 in federal student loans at 6% interest. Refinancing to a private loan at 4% interest could save you thousands of dollars in interest over the repayment period, while shortening the repayment term further accelerates savings, though increases monthly payments.

Implications of Loan Consolidation

Consolidating student loans combines multiple loans into a single loan with a new interest rate and repayment schedule. This simplifies the repayment process by reducing the number of payments you need to track. Federal loan consolidation, through the Department of Education, maintains access to federal repayment plans and protections. Private loan consolidation, however, carries similar risks to refinancing, such as loss of access to federal benefits. It’s crucial to understand the implications of each type of consolidation before making a decision. For example, while consolidation simplifies payment management, the new interest rate may be a weighted average of your existing rates, potentially resulting in a higher overall interest paid if your existing rates varied significantly.

Calculating Monthly Student Loan Payments

Calculating monthly payments involves considering the loan principal, interest rate, and repayment period. While many online calculators exist, the basic formula provides a foundation for understanding the calculation:

Monthly Payment = [P x (r(1+r)^n)] / [(1+r)^n – 1]

Where: P = Principal loan amount, r = Monthly interest rate (annual interest rate divided by 12), n = Number of months in the repayment period.

For example, a $20,000 loan at 5% annual interest over 10 years (120 months) would result in a monthly payment of approximately $212. This calculation demonstrates the significant impact of interest rates and repayment periods on monthly payments. A shorter repayment period leads to higher monthly payments but reduces total interest paid. Conversely, a longer repayment period lowers monthly payments but increases total interest paid.

Potential Pitfalls and Avoiding Them

Navigating the world of student loans can be challenging, and many students unintentionally fall into traps that can significantly impact their financial future. Understanding common mistakes and employing preventative strategies is crucial for responsible borrowing and successful repayment. This section will highlight potential pitfalls and offer practical advice for avoiding them.

Common Student Loan Mistakes

Borrowing more than necessary is a frequent error. Students may overestimate their need or underestimate their ability to cover expenses through part-time work, scholarships, or grants. This leads to higher debt burdens and longer repayment periods. Another common mistake is failing to shop around for the best loan terms and interest rates. Different lenders offer varying rates and repayment options, and choosing the first option presented can result in paying significantly more over the life of the loan. Finally, neglecting to understand the terms and conditions of the loan agreement is a serious oversight. Students should carefully review all paperwork before signing, ensuring they fully comprehend the repayment schedule, interest rates, and any associated fees.

Consequences of Student Loan Default

Defaulting on student loans has severe repercussions. Your credit score will take a substantial hit, making it difficult to secure loans for a car, mortgage, or even a credit card in the future. Wage garnishment is a possibility, where a portion of your earnings is automatically deducted to repay the debt. The government may also seize tax refunds or withhold Social Security benefits. Furthermore, defaulting can impact your ability to obtain certain professional licenses or security clearances. The long-term financial and personal consequences of defaulting can be devastating and far-reaching. For example, someone defaulting on a $50,000 loan could face years of financial hardship, impacting their ability to buy a home, save for retirement, or even afford unexpected expenses.

Avoiding Predatory Lending Practices

Predatory lenders target vulnerable borrowers with high-interest rates, hidden fees, and confusing terms. To avoid these practices, thoroughly research lenders before borrowing. Check their reputation with the Better Business Bureau and read online reviews. Compare loan offers from multiple lenders to identify the most favorable terms. Be wary of lenders who pressure you into making quick decisions or who are unwilling to answer your questions clearly. If something feels too good to be true, it probably is. Always prioritize transparency and clear communication with your lender. For example, a lender offering exceptionally low interest rates without clear terms or hidden fees should be approached with caution. A responsible lender will provide all the necessary information upfront and answer your questions thoroughly.

Warning Signs of Problematic Student Loan Servicers

It’s crucial to be aware of potential problems with your student loan servicer. Here are some warning signs:

- Difficulty contacting the servicer or receiving timely responses to inquiries.

- Inaccurate information on your loan account statement.

- Unexpected or unexplained fees or charges.

- Aggressive or harassing collection tactics.

- Failure to process payments correctly or apply payments to your account.

- Difficulty obtaining necessary documentation or information about your loan.

If you encounter any of these warning signs, immediately contact the servicer to resolve the issue. If the problem persists, consider filing a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general’s office.

Long-Term Financial Planning with Student Loans

Student loan debt can significantly impact long-term financial goals, potentially delaying major life milestones like homeownership, starting a family, or retirement. However, with careful planning and proactive strategies, it’s possible to mitigate the effects of this debt and still achieve financial security. Understanding how student loans fit into your overall financial picture is crucial for long-term success.

Impact of Student Loan Debt on Long-Term Financial Goals

Student loan payments represent a recurring monthly expense that reduces disposable income. This can limit the amount available for saving, investing, and other crucial financial goals. For example, a significant portion of a graduate’s income might be allocated to loan repayment, leaving less for contributions to retirement accounts or down payments on a house. The interest accrued on student loans also compounds over time, increasing the total amount owed and potentially delaying the achievement of financial independence. The longer it takes to repay loans, the more interest accumulates, making it harder to reach other financial milestones. This can create a cycle where high debt burdens limit future income-generating opportunities.

Incorporating Student Loan Repayment into a Comprehensive Financial Plan

Integrating student loan repayment into a comprehensive financial plan requires a holistic approach. This involves carefully assessing your income, expenses, and loan details. First, create a detailed budget outlining all income sources and expenses. Then, allocate a specific amount each month towards student loan repayment, ensuring it aligns with your budget and repayment plan. Consider using budgeting apps or spreadsheets to track progress and maintain financial transparency. Prioritize high-interest loans to minimize the overall cost of borrowing. Regularly review and adjust the plan as your income and financial circumstances change. Consider consulting with a financial advisor for personalized guidance.

Strategies for Building Wealth Despite Existing Student Loan Debt

Building wealth while managing student loan debt necessitates disciplined saving and investing. Prioritize high-yield savings accounts or certificates of deposit (CDs) to earn interest on your savings. Once you’ve established an emergency fund, allocate funds to investments such as index funds or exchange-traded funds (ETFs) to benefit from long-term market growth. Explore options for accelerating loan repayment, such as making extra payments when possible. Consider refinancing your loans if interest rates are lower, reducing the total amount paid over the life of the loan. Continuously monitor your progress and make adjustments to your financial plan as needed. Remember, consistent effort and strategic planning are key to building wealth even with student loan debt.

Sample Financial Plan Incorporating Student Loan Repayment and Other Financial Objectives

Let’s assume a recent graduate with a $50,000 student loan balance at a 6% interest rate, a monthly income of $4,000, and monthly expenses of $2,000.

| Category | Monthly Allocation | Rationale |

|---|---|---|

| Student Loan Repayment | $800 | Aggressive repayment strategy to minimize interest payments |

| Emergency Fund | $200 | Building a 3-6 month emergency fund |

| Retirement Savings | $500 | Contributing to a 401(k) or IRA |

| Investment Account | $300 | Investing in low-cost index funds |

| Other Expenses | $1200 | Housing, transportation, food, etc. |

This sample plan demonstrates how to allocate funds towards different financial goals while prioritizing student loan repayment. The specific amounts can be adjusted based on individual circumstances and financial priorities. The key is to create a plan that is realistic, sustainable, and aligned with long-term objectives. Remember to regularly review and adjust this plan as your financial situation evolves.

Visual Representation of Key Concepts

Visual aids can significantly enhance understanding of complex financial concepts like student loan debt. Graphs and charts provide a clear and concise way to illustrate the accumulation of debt over time and the impact of various repayment strategies. This section will describe how such visuals can effectively communicate key information about student loan management.

Average Student Loan Debt Accumulation Over Time

A typical visual representation of average student loan debt accumulation over time would utilize a line graph. The horizontal axis (x-axis) would represent time, typically in years, starting from the point of loan disbursement. The vertical axis (y-axis) would represent the total accumulated debt, expressed in dollars. The line itself would show the growth of the debt over time, reflecting both the initial loan amount and the accruing interest. The slope of the line would be steeper during periods of higher interest accrual and less steep during periods of repayment. Ideally, the graph would include different lines representing various loan amounts or interest rates to show the variations in debt growth based on these factors. For example, one line might represent a student with a $20,000 loan at 5% interest, while another could show a $40,000 loan at 7% interest, clearly demonstrating the significant difference in debt accumulation.

Impact of Different Repayment Strategies on Total Interest Paid

A bar chart would effectively illustrate the impact of different repayment strategies on the total interest paid. Each bar would represent a specific repayment plan (e.g., standard repayment, extended repayment, income-driven repayment). The height of each bar would correspond to the total interest paid over the life of the loan under that particular plan. This visual comparison immediately highlights the significant differences in total interest paid across various repayment strategies. For instance, a bar representing an income-driven repayment plan might be considerably shorter than a bar representing a standard repayment plan, showcasing the potential savings in interest through choosing a different repayment approach. This visual would clearly demonstrate how choosing a repayment strategy can dramatically impact the overall cost of the loan. A supplementary table could provide the exact dollar amounts of principal and interest paid under each plan, offering additional quantitative support for the visual representation.

Final Summary

Successfully managing student loan debt requires a proactive and informed approach. By understanding the different loan types, exploring available repayment options, and utilizing government resources, you can create a sustainable repayment plan that aligns with your financial goals. Remember, proactive planning, careful budgeting, and a commitment to responsible financial management are key to achieving long-term financial well-being despite the challenges of student loan debt.

FAQ Overview

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, which has severe financial consequences.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it typically involves a new loan from a private lender and may not be suitable for all borrowers.

What are income-driven repayment plans?

These plans base your monthly payments on your income and family size, potentially lowering your payments but extending your repayment period.

How can I find a reputable student loan counselor?

Look for counselors who are certified or affiliated with non-profit organizations. Beware of those who charge upfront fees for services.