Securing funding for higher education is a significant undertaking for many students. The question of whether student loans hinge on creditworthiness is paramount, impacting both eligibility and the terms of repayment. This exploration delves into the intricacies of how credit history influences access to student loans, examining both federal and private loan options and offering strategies for navigating this crucial aspect of financing your education.

We will dissect the relationship between credit scores and interest rates, the role of co-signers, and effective methods for building credit while in school. Furthermore, we’ll discuss alternative funding sources available to students who may not qualify for credit-based loans, ensuring a comprehensive understanding of the financial landscape surrounding higher education.

The Impact of Credit Score on Interest Rates

Securing a private student loan often hinges on your creditworthiness, primarily assessed through your credit score. Lenders use this score to gauge the risk of lending you money; a higher score indicates a lower risk, leading to more favorable loan terms. Conversely, a lower score or lack of credit history can significantly impact the interest rate you’ll receive.

A student’s credit score, or lack thereof, significantly influences the interest rates offered on private student loans. Lenders view a strong credit history as a positive indicator of responsible financial behavior, making them more willing to offer lower interest rates. Conversely, a poor credit score or a limited credit history signals higher risk, resulting in higher interest rates or even loan denial. The impact is substantial; the difference between a high and low credit score can translate into thousands of dollars in extra interest paid over the life of the loan.

Interest Rate Ranges Based on Credit Score

Private student loan interest rates vary widely depending on the borrower’s credit score. Generally, borrowers with excellent credit scores (750 and above) qualify for the lowest interest rates, while those with poor credit (below 600) face significantly higher rates, or may be ineligible for a loan altogether. For example, a borrower with an excellent credit score might secure a rate around 6%, while a borrower with a fair credit score might face a rate closer to 12% or even higher. These rates are illustrative and can vary based on the lender, loan term, and other factors.

Factors Beyond Credit Score Affecting Interest Rates

While credit score is a major determinant, other factors influence private student loan interest rates. These include the type of loan, the loan amount, the repayment term, the presence of a co-signer, and the borrower’s income and debt-to-income ratio. For instance, a longer repayment term might lead to a slightly lower monthly payment but a higher overall interest cost. Similarly, having a co-signer with good credit can improve your chances of securing a lower interest rate, even if your own credit history is limited. The lender’s current lending standards and market conditions also play a role.

Credit Score and Interest Rate Relationship

| Credit Score Range | Approximate Interest Rate Range (%) | Loan Approval Likelihood | Comments |

|---|---|---|---|

| 750+ (Excellent) | 6-8 | High | Best rates, favorable terms. |

| 700-749 (Good) | 8-10 | High | Competitive rates, good terms. |

| 650-699 (Fair) | 10-14 | Moderate | Higher rates, may require a co-signer. |

| Below 650 (Poor) | 14%+ or Loan Denial | Low | Significant difficulty securing a loan. |

Co-signers and Creditworthiness

Securing student loans can be challenging for applicants with limited or poor credit histories. A co-signer, an individual with strong credit, can significantly improve the chances of loan approval and potentially secure more favorable interest rates. Understanding the roles, responsibilities, and implications for both the student and the co-signer is crucial before entering into such an agreement.

Co-signers act as guarantors, essentially pledging their own creditworthiness to back the student loan. Their excellent credit history mitigates the risk for the lender, making the student a more attractive borrower. This allows students who might otherwise be ineligible for a loan to access the funds needed for their education.

Co-signer Responsibilities

A co-signer’s responsibilities are significant and should not be undertaken lightly. They are legally obligated to repay the loan if the student defaults. This means that if the student fails to make payments, the lender will pursue the co-signer for the outstanding balance. This responsibility extends beyond the loan’s term, and any negative impact on the co-signer’s credit score will persist even after the loan is paid off. Understanding the implications of this shared financial responsibility is paramount.

Finding and Securing a Co-signer

The process of finding a suitable co-signer often involves approaching close family members or friends with excellent credit histories. Open and honest communication is key. It’s vital to discuss the financial implications and responsibilities involved in co-signing a student loan. Once a willing co-signer is identified, they will typically need to complete a co-signer application, providing their personal and financial information for credit checks and verification. The lender will then assess both the student’s and the co-signer’s creditworthiness before making a final decision.

Risks and Benefits for Students and Co-signers

For students, the primary benefit is access to student loans that might otherwise be unavailable. However, the risk lies in the potential strain on their future finances if they struggle to repay the loan. For co-signers, the benefits include helping a loved one achieve their educational goals. However, the risks are substantial, as they assume full responsibility for repayment in case of default. This could severely impact their credit score and financial stability. A detailed discussion about the financial implications is necessary before entering into this agreement.

Key Considerations When Choosing a Co-signer

Before selecting a co-signer, several factors warrant careful consideration. The decision should not be taken lightly, as it involves significant financial responsibility for both parties.

- Credit Score: A high credit score is essential to minimize the risk for both the student and the lender.

- Financial Stability: The co-signer should demonstrate a consistent income and responsible financial management.

- Relationship Strength: A strong and trusting relationship is crucial to ensure open communication and shared responsibility.

- Understanding of Responsibilities: Both parties must fully comprehend the co-signer’s legal obligations.

- Alternative Options: Explore all available options, including government-backed loans, before resorting to a co-signer.

Building Credit While in School

Building a strong credit history is crucial for future financial success, and starting this process while in school offers significant advantages. A good credit score can unlock better interest rates on loans, credit cards, and even car insurance, saving you substantial amounts of money over time. While the temptation to focus solely on academics is understandable, dedicating some effort to establishing credit responsibly during your college years can pay off handsomely in the long run.

Establishing credit responsibly involves demonstrating a consistent history of borrowing and repaying debts on time. This doesn’t require taking on significant debt; rather, it’s about demonstrating responsible financial behavior.

Secured Credit Cards

Secured credit cards are a great entry point for students looking to build credit. These cards require a security deposit, typically equal to your credit limit, which minimizes the lender’s risk. This makes approval easier, even for those with limited or no credit history. By using the card responsibly and paying your balance in full and on time each month, you’ll start building a positive credit history. For example, if a student secures a $500 credit card and consistently pays their balance on time, they’ll start to establish a positive payment history which is a key factor in credit scoring. The security deposit acts as a buffer, protecting the lender and giving you a chance to demonstrate your creditworthiness.

Responsible Credit Card Usage

Utilizing a credit card responsibly is paramount to building a strong credit score. This involves keeping your credit utilization ratio low – ideally below 30% of your available credit. This means if you have a $500 credit limit, aiming to keep your balance below $150 at any given time. Paying your balance in full and on time each month is crucial, as this shows lenders that you’re capable of managing debt effectively. Late payments severely damage your credit score. Making even one late payment can negatively impact your credit score for several years. Therefore, setting up automatic payments or reminders can be extremely beneficial.

The Importance of Timely Bill Payments

Paying all your bills, not just credit card bills, on time is essential for building good credit. This includes utility bills, student loans, and any other recurring payments. Your payment history accounts for a significant portion of your credit score. Even small debts, like a library fine, can negatively affect your credit report if left unpaid. Setting up automatic payments or using online bill pay systems can help ensure timely payments and prevent late fees. Consistent on-time payments demonstrate financial responsibility and contribute to a higher credit score.

Resources and Tools for Credit Monitoring

Several resources are available to help students monitor and improve their credit. AnnualCreditReport.com provides free access to your credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. Many credit card companies also offer free credit score monitoring services. These services often provide insights into your credit score and offer tips for improvement. Utilizing these free resources allows for regular monitoring of your credit health and allows you to identify and address any potential issues promptly. Regularly reviewing your credit report helps detect errors and identify potential fraudulent activity.

A Step-by-Step Guide to Establishing Good Credit While in School

- Obtain a secured credit card: Apply for a secured credit card with a small credit limit.

- Use your card responsibly: Keep your credit utilization low (below 30%).

- Pay your balance in full and on time: Set up automatic payments to avoid late fees.

- Monitor your credit score: Regularly check your credit report for errors and track your progress.

- Pay all bills on time: This includes utilities, student loans, and other recurring payments.

- Consider a student credit builder loan: These are specifically designed to help students build credit.

Alternatives to Credit-Based Student Loans

Securing funding for higher education can be challenging, especially for students who lack a robust credit history or find themselves ineligible for credit-based student loans. Fortunately, several alternative financing options exist, offering pathways to afford college without relying solely on creditworthiness. Understanding these alternatives and their nuances is crucial for navigating the financial complexities of higher education.

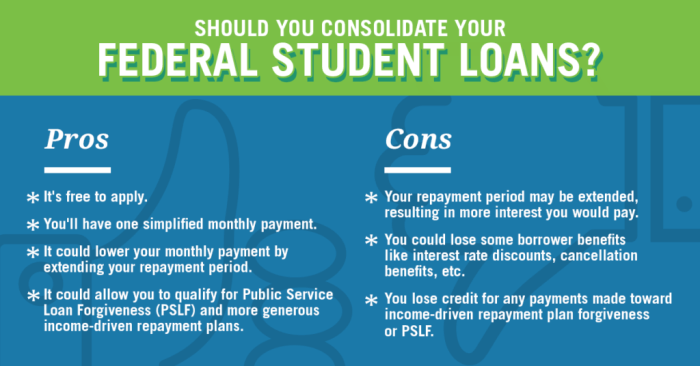

Federal Student Loans versus Private Student Loans

Federal student loans and private student loans represent two distinct avenues for financing education. Federal loans, offered by the U.S. Department of Education, generally offer more favorable terms, including lower interest rates, flexible repayment plans, and various borrower protections like deferment options during periods of financial hardship. In contrast, private student loans are offered by banks and other financial institutions and are typically subject to credit checks and higher interest rates, potentially leading to a larger overall debt burden. The eligibility requirements for federal loans are often less stringent than those for private loans, making them a more accessible option for many students. The selection between federal and private loans depends largely on individual financial circumstances and credit history.

Grants, Scholarships, and Work-Study Programs

These three options represent forms of financial aid that do not require repayment. Grants are typically awarded based on financial need, while scholarships are often merit-based, recognizing academic achievement, talent, or other exceptional qualities. Work-study programs provide part-time employment opportunities, allowing students to earn money to contribute towards their educational expenses. These options can significantly reduce the need to borrow, minimizing future debt. Many institutions and organizations offer grants and scholarships, requiring students to complete applications and demonstrate eligibility. Work-study programs are usually coordinated through the student’s college or university. A comprehensive search for available grants and scholarships is recommended.

Federal Student Aid Application Process

The primary gateway to federal student aid is the Free Application for Federal Student Aid (FAFSA). This application collects information about the student’s financial background and is used to determine eligibility for federal grants, loans, and work-study programs. The FAFSA is submitted annually and requires accurate and complete information to ensure an accurate assessment of financial need. After submission, students will receive a Student Aid Report (SAR) summarizing their eligibility for various forms of federal aid. The SAR will Artikel the types and amounts of aid for which the student qualifies, guiding them in making informed decisions about financing their education. Many colleges and universities have dedicated financial aid offices that can assist students with completing the FAFSA and navigating the application process.

Decision-Making Flowchart for Choosing a Student Funding Option

A flowchart visually representing the decision-making process for selecting a student funding option would begin with assessing the student’s financial need and creditworthiness. If creditworthy, the flowchart would branch to consider federal and private loan options, highlighting the advantages and disadvantages of each. If not creditworthy, the flowchart would lead to exploring grants, scholarships, and work-study programs. The flowchart would incorporate considerations like interest rates, repayment terms, and the total cost of borrowing. Each branch would ultimately lead to a decision regarding the most suitable funding strategy, considering factors such as long-term financial implications and the student’s overall financial situation. The flowchart would also include a path to seeking professional financial guidance if needed.

Final Thoughts

Ultimately, the question of whether student loans are based on credit has a nuanced answer. While federal student loans generally don’t require a strong credit history, private loans often do. Understanding this distinction, along with the strategies for building credit and exploring alternative funding options, empowers students to make informed decisions about financing their education. Proactive planning and responsible financial management are key to navigating the complexities of student loan debt and achieving academic success.

Quick FAQs

What happens if I have no credit history?

Students with no credit history may still qualify for federal student loans, but may need a co-signer for private loans.

Can I get a student loan with bad credit?

Securing a private student loan with bad credit is difficult but possible; you’ll likely need a co-signer or face significantly higher interest rates.

How does a co-signer affect my loan?

A co-signer shares responsibility for repayment. If you default, the lender can pursue the co-signer for the outstanding balance.

What are the best ways to build credit while in school?

Use a credit card responsibly (paying on time and keeping balances low), and consider a secured credit card if necessary.