Navigating the complexities of student loan repayment can feel overwhelming, especially after consolidating multiple loans into a single payment. While consolidation often simplifies the process, circumstances may arise where borrowers wish to reverse this decision. This exploration delves into the possibility of unconsolidating student loans, examining the challenges, potential scenarios where it might be considered, and alternative strategies for managing consolidated debt effectively.

The process of consolidating student loans involves combining multiple federal or private loans into one, often resulting in a simplified repayment schedule and potentially a lower monthly payment. However, this simplification comes with potential drawbacks, such as a higher overall interest rate or the loss of certain benefits associated with individual loans. Understanding these trade-offs is crucial before making a consolidation decision, and even more so if considering the possibility of reversal.

Understanding Student Loan Consolidation

Student loan consolidation is the process of combining multiple federal student loans into a single loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering your overall monthly payment amount. However, it’s crucial to understand the implications before making a decision, as consolidation isn’t always the best option.

The Process of Student Loan Consolidation

The process generally involves applying through the Federal Student Aid website. You’ll need to provide information about your existing loans, including loan numbers and lenders. Once your application is approved, your existing loans are paid off, and a new consolidated loan is created. The terms of your new loan, such as the interest rate and repayment plan, will depend on several factors, including your existing loan types and credit history. The entire process can take several weeks or even months to complete.

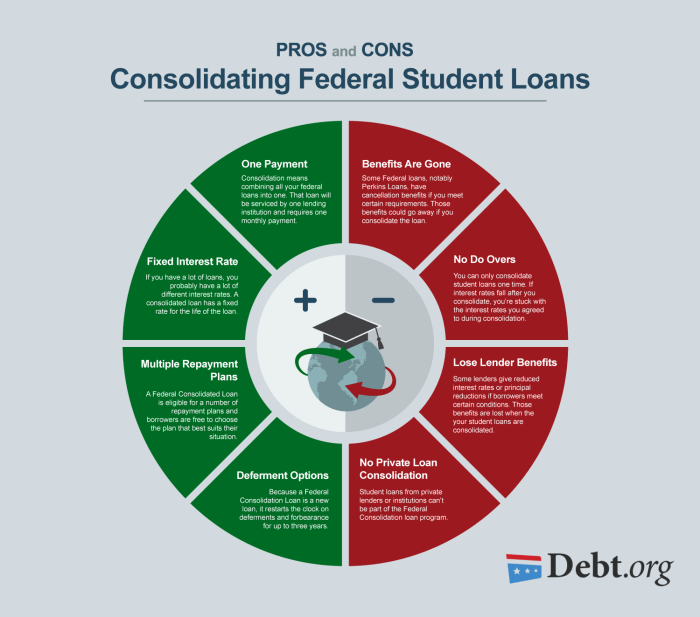

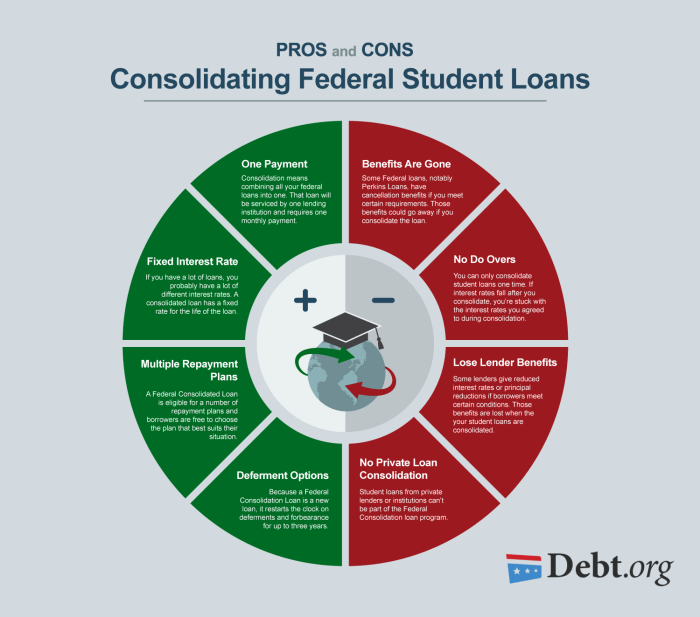

Benefits and Drawbacks of Consolidating Federal Student Loans

Consolidating federal student loans offers several potential benefits. A simplified repayment process with a single monthly payment is a major advantage. Additionally, depending on your circumstances, you may qualify for income-driven repayment plans that are only available after consolidation. However, consolidation also has drawbacks. Consolidation often results in a higher overall interest paid over the life of the loan, especially if you have loans with lower interest rates. Furthermore, consolidating may cause you to lose certain benefits associated with your original loans, such as loan forgiveness programs specific to certain professions.

Comparison of Different Consolidation Loan Programs

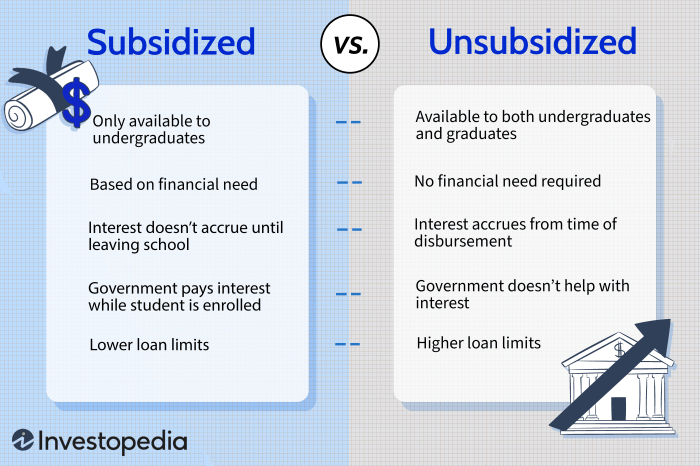

While the federal government primarily offers one consolidation program, the Direct Consolidation Loan, variations exist based on your eligibility and the types of loans you’re consolidating. The differences primarily lie in the eligibility requirements and the available repayment plans. For example, some programs may be restricted to federal student loans, while others might accommodate certain private loans under specific conditions. The interest rate is also a key factor that varies based on the weighted average of the interest rates of the loans being consolidated.

Examples of When Consolidation Is Beneficial and When It Is Not

Consolidation is beneficial for borrowers struggling to manage multiple loan payments. For example, a borrower with five different loans, each with a different due date and interest rate, might find consolidation simplifies their finances significantly. However, consolidation is not beneficial if you have loans with low interest rates that you are already managing effectively. Consolidating these loans would likely result in a higher interest rate and increased overall cost.

Comparison of Federal Student Loan Consolidation Programs

| Program Name | Interest Rate | Loan Forgiveness Options | Eligibility Requirements |

|---|---|---|---|

| Direct Consolidation Loan | Weighted average of the interest rates of the loans being consolidated (fixed) | Dependent on the underlying loan types; some forgiveness programs may be lost. Public Service Loan Forgiveness (PSLF) may be possible if eligible before consolidation. | Must have eligible federal student loans. |

Circumstances Leading to Unconsolidation

Student loan consolidation, while often beneficial, isn’t always the best long-term strategy. Several circumstances can lead borrowers to seek unconsolidation, a process to reverse the consolidation and reinstate their original loans. Understanding these situations is crucial for making informed decisions about your student loan debt.

Borrowers may desire to reverse a consolidation for a variety of reasons, primarily financial or related to specific loan features. The legal process, while not always straightforward, is achievable with the right approach and documentation.

Financial Reasons for Unconsolidation

Several financial factors can make unconsolidation a worthwhile pursuit. For example, a borrower might have consolidated loans with varying interest rates, some significantly lower than others. After consolidation, they may find themselves with a higher overall interest rate, increasing their total repayment cost. Similarly, a borrower might have lost access to income-driven repayment plans or other benefits available only on certain types of federal student loans that were lost during the consolidation process. Unconsolidating allows them to regain access to these potentially advantageous repayment options. Another factor could be the loss of a favorable loan forgiveness program, such as Public Service Loan Forgiveness (PSLF), which might be available for certain loan types but not applicable to consolidated loans.

Legal Aspects of Unconsolidating Student Loans

The legal landscape surrounding unconsolidation is complex and depends largely on the type of loans involved and the terms of the consolidation agreement. There isn’t a straightforward legal right to unconsolidate; it’s more a matter of negotiating with the loan servicer and demonstrating a valid reason for the reversal. Generally, the servicer will only consider unconsolidation in exceptional circumstances, such as demonstrable errors in the consolidation process or unforeseen financial hardship directly resulting from the consolidation itself. Thorough documentation is essential to support any claim for unconsolidation. It’s advisable to consult with a student loan attorney or financial advisor specializing in student loan debt to navigate the legal complexities.

Examples of Viable Unconsolidation Cases

Consider a scenario where a borrower consolidated federal and private student loans. Later, they discovered that the consolidation resulted in the loss of eligibility for income-driven repayment on their federal loans. This could significantly increase their monthly payments and extend their repayment period. Unconsolidation in this case would be a reasonable option to restore access to income-driven repayment. Another example could involve a borrower who consolidated loans with different interest rates, only to find the weighted average interest rate after consolidation was substantially higher than the rate on their lowest-interest loan. This increased cost could justify seeking unconsolidation to revert to the original, more favorable interest rates. A final example might involve a technical error during the consolidation process, such as the incorrect calculation of the loan balance or the omission of a loan from the consolidation agreement.

Steps Involved in Unconsolidation

The following flowchart illustrates the process of attempting to unconsolidate student loans. It is important to note that this is a general representation and the specific steps and outcomes may vary based on the lender and individual circumstances.

[Flowchart Description: The flowchart would begin with a “Start” box. It would then branch into a decision box: “Valid reason for unconsolidation?”. A “Yes” branch would lead to a box: “Gather supporting documentation (loan agreements, financial statements, etc.)”. This would then lead to a box: “Contact loan servicer and request unconsolidation”. This box would branch into a decision box: “Servicer approves unconsolidation?”. A “Yes” branch would lead to a box: “Unconsolidation process initiated”. A “No” branch would lead to a box: “Explore alternative options or legal counsel”. Both the “Unconsolidation process initiated” and “Explore alternative options or legal counsel” boxes would lead to an “End” box. A “No” branch from the initial decision box (“Valid reason for unconsolidation?”) would lead directly to the “Explore alternative options or legal counsel” box and then to the “End” box.]

The Feasibility of Unconsolidation

Unconsolidating student loans is a process rarely achievable, primarily due to the fundamental nature of loan consolidation itself. Consolidation combines multiple loans into a single, new loan with a potentially revised interest rate and repayment schedule. This process fundamentally alters the legal and financial structure of the original loans, making separation exceedingly difficult. The administrative burden and cost involved in reversing the consolidation process far outweigh the potential benefits for both lenders and borrowers.

The inherent difficulty stems from the legal and administrative complexities involved. Once loans are consolidated, the original loan agreements are essentially dissolved, replaced by a single, overarching agreement. Re-establishing the individual loans requires recreating the original contractual terms, which are often unavailable or incomplete after consolidation. Furthermore, the administrative task of disentangling the financial records associated with the consolidated loan would be immense.

Student Loan Servicer Policies on Loan Separation

Major student loan servicers, such as Nelnet, Navient, and FedLoan Servicing (now Aidvantage), generally do not offer loan unconsolidation services. Their policies reflect the practical and logistical impossibilities of separating consolidated loans. While they may handle modifications to existing consolidated loans, such as changing repayment plans, the option to revert to the pre-consolidated state is almost universally unavailable. These servicers prioritize the streamlined management of consolidated loans, which simplifies their administrative processes and reduces potential errors. Attempts to unconsolidate are typically met with rejections, directing borrowers towards alternative solutions like refinancing or seeking hardship programs.

Federal vs. Private Student Loan Unconsolidation

The challenges of unconsolidating federal student loans mirror those of private loans. Federal loan consolidation is managed through the Department of Education, and their policies strictly limit the possibility of separating consolidated loans. The administrative complexity involved in reversing the consolidation and re-establishing individual loan accounts within the federal system is prohibitive. Similarly, private lenders generally do not provide unconsolidation options, as the process would be both costly and logistically challenging. The terms of the original private loans might be difficult to recover, further complicating any attempt at reconstituting them. Private lenders, focusing on managing their current loan portfolios, have little incentive to reverse consolidations.

Situations Where Unconsolidation Might Be Considered

While extremely rare, there might be exceptional circumstances where a lender might consider unconsolidation. For instance, if a significant error occurred during the consolidation process, leading to inaccurate interest rates or loan terms, a lender might be willing to investigate a reversal to correct the mistake. Another potential scenario could involve a severe legal challenge to the consolidation itself, revealing a violation of lending regulations or borrower rights. However, these situations are exceptional, and the burden of proof would rest heavily on the borrower. Even in these circumstances, a complete unconsolidation is not guaranteed.

Reasons for Denial of Unconsolidation Requests

The vast majority of unconsolidation requests are denied due to the following reasons:

- Logistical Impracticability: The administrative and financial complexities of reversing the consolidation process are significant.

- Missing Documentation: Original loan documents may be lost or unavailable after consolidation, making reconstruction impossible.

- Lack of Legal Precedent: There is no established legal framework or process for unconsolidating federal or private student loans.

- Cost-Ineffectiveness: The cost of reversing the consolidation would likely outweigh any potential benefits for the lender.

- Policy Restrictions: Student loan servicers and lenders have clear policies against unconsolidation.

Alternative Strategies to Manage Consolidated Loans

Consolidating your student loans can simplify repayment, but it doesn’t automatically solve all your financial challenges. High interest rates, substantial monthly payments, and the overall debt burden can still be significant. Fortunately, several strategies can help you manage your consolidated loans more effectively. This section Artikels options for addressing high interest rates, reducing monthly payments, exploring income-driven repayment plans, and investigating loan forgiveness programs.

Strategies for Managing High Interest Rates on Consolidated Loans

High interest rates significantly impact the total cost of your loans. One approach to mitigate this is to make extra payments whenever possible. Even small additional payments can reduce the principal balance faster, leading to lower interest charges over the life of the loan. Another strategy is to refinance your consolidated loan with a lender offering a lower interest rate. This requires a credit check and meeting the lender’s eligibility criteria, but it can potentially save you a considerable amount of money. Remember to carefully compare offers from multiple lenders before refinancing.

Options for Reducing Monthly Payments on Consolidated Loans

Lowering your monthly payment can improve your short-term cash flow. Extending the loan term is one way to achieve this, but it’s crucial to understand that this increases the total interest paid over the life of the loan. Another approach is to explore income-driven repayment (IDR) plans, which base your monthly payments on your income and family size. These plans are discussed in more detail in the following section. Finally, consider exploring options for forbearance or deferment, although these temporarily suspend payments and can lead to accrued interest. These options should be used cautiously and only as a short-term solution.

Income-Driven Repayment Plans for Consolidated Loans

Income-driven repayment (IDR) plans offer a flexible approach to managing student loan debt. These plans calculate your monthly payments based on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has specific eligibility requirements and payment calculation methods. After a specific period of qualifying payments (typically 20 or 25 years), the remaining loan balance may be forgiven under certain circumstances. However, this forgiven amount is typically considered taxable income.

Loan Forgiveness Programs that Might Apply to Consolidated Loans

Several loan forgiveness programs exist, but eligibility criteria are often stringent. Public Service Loan Forgiveness (PSLF) is one example; it forgives the remaining balance of federal student loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Teacher Loan Forgiveness programs offer partial loan forgiveness to eligible teachers who meet specific requirements, including teaching in low-income schools. It’s crucial to carefully research the specific requirements and eligibility criteria for each program before relying on them for debt relief. The details and availability of these programs can change, so checking the official government websites is recommended.

Resources for Borrowers Struggling with Consolidated Student Loan Debt

Managing consolidated student loans can be challenging. Several resources are available to assist borrowers:

- The Federal Student Aid website: This website provides comprehensive information on federal student loans, repayment plans, and loan forgiveness programs.

- Your loan servicer: Your loan servicer can answer questions about your specific loan terms, repayment options, and available assistance programs.

- National Foundation for Credit Counseling (NFCC): The NFCC offers free and low-cost credit counseling services, including assistance with student loan debt management.

- Student Loan Borrower Assistance (SLBA): SLBA provides assistance to borrowers facing financial hardship and offers guidance on various repayment options.

Legal and Regulatory Aspects

Student loan consolidation, while seemingly straightforward, operates within a complex legal and regulatory framework. Understanding these aspects is crucial for borrowers to protect their rights and navigate potential challenges. The primary governing body and the source of most relevant information is the U.S. Department of Education.

Federal Regulations Governing Student Loan Consolidation

The primary federal regulations governing student loan consolidation are found within the Higher Education Act of 1965 (HEA) and subsequent amendments, as well as regulations promulgated by the Department of Education. These regulations detail the eligibility criteria for consolidation, the terms and conditions of consolidated loans, and the rights and responsibilities of borrowers. Specific regulations address issues such as the calculation of interest rates, the types of loans eligible for consolidation, and the processes for appealing adverse decisions. The exact regulations are subject to change, so it’s vital to consult the most current versions available on the Department of Education’s website.

The Department of Education’s Role in Student Loan Consolidation

The Department of Education (ED) plays a central role in the student loan consolidation process. It oversees the federal student loan programs, establishes the rules and regulations governing consolidation, and works through its various agencies (like the Federal Student Aid office) to process consolidation applications. The ED is responsible for ensuring that lenders comply with applicable regulations, addressing borrower complaints, and providing information and resources to borrowers about their rights and responsibilities. The ED also manages the Direct Loan program, the primary source of federal student loans that are eligible for consolidation. Borrowers who believe their consolidation was handled improperly should contact the ED directly.

Potential Legal Recourse for Borrowers

Borrowers facing challenges with their consolidated loans may have several avenues for legal recourse. These options might include contacting the Federal Student Aid Ombudsman group within the Department of Education to resolve disputes informally. If informal methods fail, borrowers may consider filing a formal complaint with the ED or pursuing legal action through the courts. Legal action might be pursued if the ED or a lender has violated the terms of the loan agreement or applicable federal regulations. For example, a borrower might sue if they were improperly denied consolidation or if the lender applied incorrect interest rates. Legal representation may be necessary for complex cases.

Locating Relevant Legal Documents and Resources

Finding relevant legal documents and resources regarding student loan consolidation primarily involves utilizing the Department of Education’s website (studentaid.gov). This site contains numerous publications, fact sheets, and regulations related to federal student loans, including those pertaining to consolidation. The website also offers a search function to help locate specific documents. Additionally, legal aid organizations and consumer advocacy groups often provide resources and information on student loan issues, including consolidation. These organizations can offer guidance on navigating the legal system and understanding borrower rights.

Filing a Complaint Regarding Student Loan Consolidation

The process for filing a complaint regarding student loan consolidation typically begins with contacting the lender or servicer directly to attempt to resolve the issue informally. If this attempt is unsuccessful, a formal complaint can be filed with the Department of Education’s Federal Student Aid office. The ED’s website provides detailed instructions on how to file a complaint, including the required information and documentation. Borrowers should maintain detailed records of all communications and documentation related to their loan and the complaint process. The ED will investigate the complaint and take appropriate action, which may include mediating a resolution between the borrower and the lender or taking enforcement action against the lender if a violation of regulations is found.

Summary

Ultimately, unconsolidating student loans is rarely a straightforward process. While the desire to separate loans might stem from legitimate financial needs or unforeseen circumstances, the reality is that the ability to reverse a consolidation is highly limited. This exploration has highlighted the complexities involved, emphasizing the importance of careful consideration before consolidating and exploring alternative strategies for managing consolidated debt, such as income-driven repayment plans or exploring loan forgiveness options. Proactive planning and understanding your loan options are key to navigating the student loan repayment journey successfully.

FAQ Insights

Can I unconsolidate private student loans?

Unconsolidating private student loans is generally more difficult than with federal loans, and often depends entirely on the lender’s policies. Contact your lender directly to inquire about their specific procedures and policies.

What are the fees associated with trying to unconsolidate?

There are typically no direct fees associated with *requesting* unconsolidation. However, if you incur additional fees due to a change in your repayment plan or other actions taken as a result of your request, those would be your responsibility.

What if I made a mistake consolidating?

Contact your loan servicer immediately to explain the situation. While unconsolidation might not be possible, they may be able to offer alternative solutions, such as a different repayment plan.

Does unconsolidation affect my credit score?

The impact on your credit score depends on the actions taken during and after the unconsolidation attempt. Frequent changes to your loan status could negatively affect your score.