The crushing weight of credit card debt is a common struggle, leading many to explore unconventional solutions. One question frequently arises: can student loans be used to alleviate this burden? While seemingly a simple fix, using student loans to pay off credit cards involves complex financial considerations, potential pitfalls, and long-term implications that demand careful evaluation. This exploration delves into the intricacies of this approach, weighing the potential benefits against the significant risks.

This guide examines various debt management strategies, including student loan consolidation and refinancing, highlighting their suitability (or lack thereof) for tackling credit card debt. We’ll also discuss alternative methods such as debt management plans and budgeting techniques, ultimately empowering you to make informed decisions about your financial future.

Understanding Student Loan Consolidation

Student loan consolidation is the process of combining multiple federal student loans into a single loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering your overall monthly payment amount. While it doesn’t directly address credit card debt, it can indirectly impact your financial situation and, in some cases, free up funds to tackle that debt.

Student loan consolidation doesn’t change the total amount you owe; it simply changes how you pay it back. Understanding the nuances of consolidation is crucial before making a decision, especially if you’re hoping to use the freed-up cash flow to pay down credit card debt.

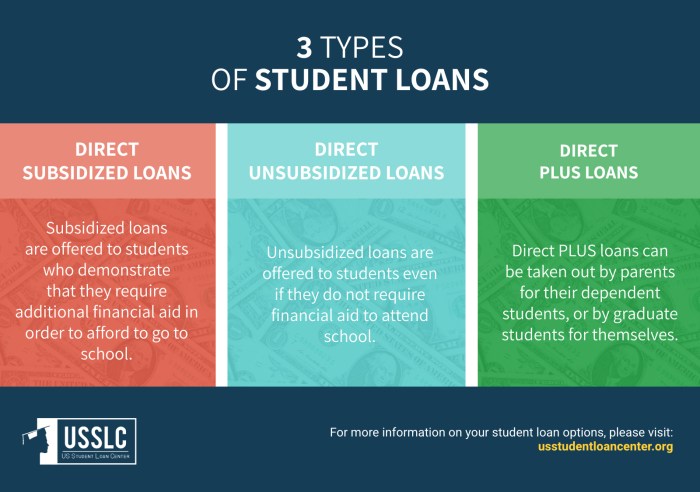

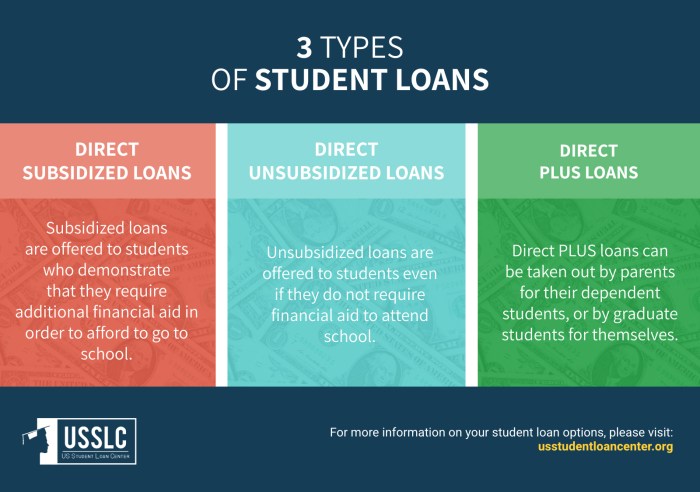

Types of Student Loan Consolidation Programs

The primary type of student loan consolidation is through the federal government’s Direct Consolidation Loan program. This program allows you to combine eligible federal student loans (Direct Loans, Federal Family Education Loans, and Federal Perkins Loans) into a single Direct Consolidation Loan. There are no private options for consolidating federal student loans. Private lenders may offer consolidation options for private student loans, but these are often less beneficial and should be carefully considered.

Scenarios Where Consolidation Might Be Beneficial or Detrimental

Consolidation can be beneficial if you’re struggling to manage multiple loan payments with varying interest rates and due dates. A single, lower monthly payment can improve your cash flow, potentially allowing you to allocate more funds toward credit card debt repayment. For example, someone with five different student loans, each with a different interest rate and due date, might find it easier to manage their finances after consolidating into one loan with a fixed interest rate and a single payment date. This simplified repayment schedule could allow them to focus on reducing their high-interest credit card debt.

However, consolidation can be detrimental if it results in a higher overall interest rate than your current weighted average interest rate across all loans. This is because consolidation often results in a weighted average interest rate of your existing loans. If you have loans with low interest rates, consolidating could increase your overall interest paid. For instance, if you have several loans with low interest rates and consolidate them into a loan with a higher rate, you will end up paying more in interest over the life of the loan, potentially hindering your ability to pay down credit card debt. It’s crucial to carefully compare the interest rate offered on the consolidated loan with your current interest rates.

Comparison of Student Loan Consolidation Options

| Feature | Federal Direct Consolidation Loan | Private Loan Consolidation |

|---|---|---|

| Loan Types Eligible | Federal student loans (Direct, FFEL, Perkins) | Typically only private student loans |

| Interest Rate | Weighted average of existing loans, fixed | Variable or fixed, potentially higher than existing rates |

| Repayment Options | Standard, graduated, extended, income-driven | Varies by lender |

| Fees | Typically none | May include origination fees |

Student Loan Refinancing for Debt Management

Refinancing student loans is a strategy some borrowers employ to manage their debt, potentially lowering their monthly payments or shortening the repayment term. It differs significantly from consolidation, and understanding these differences is crucial before making a decision. This section will explore refinancing’s potential benefits and drawbacks, eligibility requirements, and illustrate its financial implications with a hypothetical scenario.

Refinancing differs from consolidation in its fundamental approach. Consolidation combines multiple student loans into a single loan, often with a new servicer. The interest rate on a consolidated loan is typically a weighted average of the original loan rates. Refinancing, however, involves replacing your existing student loans with a completely new loan from a different lender, usually at a lower interest rate. This new loan effectively replaces your old loans, and the original loans are paid off with the proceeds of the refinanced loan.

Differences Between Consolidation and Refinancing

Consolidation simplifies repayment by combining multiple loans into one, potentially streamlining the payment process. However, it doesn’t necessarily lower your interest rate. Refinancing, conversely, aims to secure a lower interest rate, reducing the overall cost of borrowing. This can lead to lower monthly payments or a shorter repayment period, but it also involves a new application process and may not be suitable for everyone.

Potential Benefits and Drawbacks of Refinancing to Address Credit Card Debt

Refinancing can be beneficial for managing credit card debt if the refinancing interest rate is significantly lower than the credit card interest rate. By refinancing student loans at a lower rate and using the freed-up funds to pay off high-interest credit card debt, borrowers can save money on interest charges over the life of the loans. However, refinancing student loans to pay off credit card debt might extend the repayment period for the student loans, resulting in paying more interest overall than if the student loans were paid off more quickly. Additionally, refinancing might lock in a fixed interest rate, eliminating the possibility of benefiting from future interest rate decreases on the student loans.

Eligibility Requirements for Student Loan Refinancing Programs

Eligibility criteria for student loan refinancing programs vary among lenders. Generally, lenders consider credit score, debt-to-income ratio, and income stability. A higher credit score typically improves the chances of securing a favorable interest rate. A strong debt-to-income ratio, indicating a comfortable ability to manage debt, is also important. Lenders often prefer applicants with a stable income history. Some lenders may also require a minimum loan amount or specific types of student loans to be eligible for refinancing. Finally, citizenship or residency status may also play a role in eligibility.

Hypothetical Scenario Illustrating Refinancing Implications

Let’s imagine Sarah has $50,000 in federal student loans with an average interest rate of 6%. She also has $10,000 in credit card debt with a 19% interest rate. She finds a refinancing option with a 4% interest rate. By refinancing her student loans, she can potentially save approximately $1000 per year in interest alone, and then use that savings to aggressively pay down her credit card debt, eliminating the high-interest payments. However, if the refinancing lengthens her repayment period from 10 years to 15, she might end up paying more interest on her student loans over the lifetime of the loan. The overall savings would depend on the specific terms of the refinancing agreement and her ability to manage her finances effectively.

The Risks of Using Student Loans for Credit Card Debt

Using student loans to pay off credit card debt might seem like a quick fix, but it’s a strategy fraught with potential long-term financial consequences. While it can temporarily alleviate the stress of high-interest credit card balances, it often leads to a larger, more intractable debt burden. Understanding these risks is crucial before considering this approach.

Student loans and credit cards typically carry vastly different interest rates. Credit card interest rates are notoriously high, often exceeding 20%, and are variable, meaning they can fluctuate based on market conditions. This makes it difficult to accurately predict the total amount you will end up paying. In contrast, federal student loans generally have lower, fixed interest rates, making them more predictable in the long run. However, even though the rate might be lower, the overall amount of debt increases significantly when you consolidate higher-interest debt into a lower-interest loan with a longer repayment period.

Interest Rate Comparison

The core issue lies in the comparison of interest rates. A typical credit card interest rate might be 18-25%, while a federal student loan might have a rate of 5-10%. While the student loan rate seems lower, the total interest paid over the life of the loan could be significantly higher if the credit card debt was large and you now have to repay it over a much longer period (10+ years versus 2-3 years for a credit card). For example, a $10,000 credit card debt at 20% APR paid off over 3 years would result in significantly less interest paid than that same $10,000 consolidated into a student loan at 7% APR repaid over 10 years. The longer repayment period on the student loan allows the interest to accumulate substantially.

Alternative Strategies for Managing Credit Card Debt

Before resorting to student loans, explore alternative strategies for managing credit card debt. These strategies can often provide a more sustainable and less financially damaging solution.

It’s crucial to develop a plan to address credit card debt strategically. Several options exist, and the best choice depends on your individual circumstances. These include:

- Debt Consolidation Loan: A personal loan with a lower interest rate than your credit cards can help consolidate your debt into one manageable payment.

- Balance Transfer Credit Card: Transferring your balance to a card offering a 0% introductory APR can give you time to pay down your debt interest-free, but be aware of balance transfer fees and the high interest rate that will kick in after the introductory period ends.

- Debt Management Plan (DMP): A credit counseling agency can help negotiate lower interest rates and create a manageable repayment plan with your creditors.

- Debt Avalanche or Debt Snowball Method: These are repayment strategies that prioritize paying off either the highest-interest debt first (avalanche) or the smallest debt first (snowball), respectively, to motivate progress.

Impact of Interest Capitalization

Interest capitalization is the process of adding accrued but unpaid interest to the principal balance of a loan. This significantly increases the overall debt burden over time. With student loans, interest capitalization can occur during periods of deferment or forbearance, meaning that even while you are not making payments, your debt is growing. This effect compounds the problem of using student loans to pay off credit card debt, as the initial amount borrowed might quickly balloon into a much larger figure. For example, if you defer payments on a $10,000 student loan for two years, the accumulated interest could add several hundred or even thousands of dollars to your principal balance, leading to higher monthly payments and a much longer repayment period. This ultimately means paying substantially more in interest over the life of the loan.

Alternative Debt Management Strategies

Managing credit card debt effectively requires exploring various strategies beyond using student loans. Several viable options exist, each with its own set of advantages and disadvantages, allowing individuals to tailor their approach to their specific financial situation. Understanding these alternatives empowers individuals to make informed decisions and work towards financial stability.

Debt Management Plans (DMPs)

Debt management plans (DMPs) are structured programs offered by credit counseling agencies. These agencies negotiate with your creditors to lower your interest rates, consolidate your payments into one monthly payment, and often stop late fees and collection calls. The agency typically receives a fee for their services, often paid through your monthly payment. A DMP can simplify your finances and improve your credit score over time, but it’s important to understand the limitations and potential impact on your credit report. The process typically involves completing a budget analysis, creating a payment plan, and consistently making payments through the agency. Creditors might report the DMP to credit bureaus, which may temporarily impact your credit score, but responsible use of the DMP can lead to credit score improvement once debts are paid off.

Debt Consolidation Loans from Banks or Credit Unions

Debt consolidation loans involve taking out a single loan to pay off multiple debts. Banks and credit unions often offer these loans at lower interest rates than credit cards, potentially saving you money on interest payments over time. A lower interest rate can significantly reduce the total amount you pay over the life of the loan. However, securing a consolidation loan requires good credit, and it’s crucial to compare interest rates and fees from multiple lenders to find the most favorable terms. It’s also important to consider the loan term; a shorter term means higher monthly payments but less interest paid overall. A longer term means lower monthly payments but higher total interest paid. For example, consolidating $10,000 of credit card debt at 18% APR into a 5-year loan at 8% APR will significantly reduce the total interest paid and the overall cost of repayment.

Debt Snowball and Debt Avalanche Methods

The debt snowball and debt avalanche methods are two popular strategies for prioritizing debt repayment. The debt snowball method involves paying off the smallest debt first, regardless of interest rate, to build momentum and motivation. This approach focuses on psychological wins to maintain consistency. The debt avalanche method, conversely, prioritizes paying off the debt with the highest interest rate first, to minimize the total interest paid over time. This is a more mathematically efficient strategy but can be less motivating in the early stages. For instance, if you have debts of $500 at 20% APR, $1000 at 10% APR, and $2000 at 5% APR, the debt avalanche method would focus on the $500 debt first, while the debt snowball would start with the $500 debt. Both methods require discipline and consistent effort.

Creating a Personal Budget to Manage Debt

A well-structured personal budget is fundamental to effective debt management. This step-by-step guide Artikels the process:

- Track your income and expenses: Record every dollar earned and spent for at least one month to gain a clear picture of your financial situation. Use budgeting apps or spreadsheets to simplify this process.

- Categorize your expenses: Group your expenses into categories like housing, transportation, food, entertainment, and debt payments. This allows for better analysis and identification of areas for potential savings.

- Identify areas for reduction: Analyze your spending patterns and identify areas where you can cut back on expenses. Consider reducing discretionary spending or finding more cost-effective alternatives.

- Allocate funds for debt repayment: Determine how much you can realistically allocate towards debt repayment each month. This amount should be sustainable and integrated into your overall budget.

- Create a realistic budget: Based on your income and adjusted expenses, create a budget that allocates funds for essential expenses, debt repayment, and savings. Regularly review and adjust your budget as needed.

- Monitor your progress: Track your progress regularly to ensure you are sticking to your budget and making progress on your debt repayment goals. Adjust your budget as necessary to address any unforeseen circumstances.

Seeking Professional Financial Advice

Navigating significant debt can be overwhelming, making professional guidance invaluable. A well-structured debt management plan, tailored to your specific circumstances, can significantly improve your financial outlook and reduce stress. Seeking expert help is a proactive step towards achieving long-term financial stability.

A financial advisor plays a crucial role in developing a personalized debt management strategy. They provide objective analysis of your financial situation, identifying areas for improvement and recommending tailored solutions. This might involve creating a budget, negotiating with creditors, or exploring debt consolidation or refinancing options. Their expertise helps you understand the complexities of debt management and make informed decisions.

Types of Professionals Offering Debt Management Assistance

Several types of professionals can assist with debt management. Credit counselors, often affiliated with non-profit organizations, provide guidance on budgeting, debt negotiation, and developing a debt management plan. They typically work with individuals struggling with overwhelming credit card debt and offer education on responsible financial practices. Financial planners, on the other hand, take a broader perspective, considering your overall financial goals, including retirement planning and investment strategies, alongside debt management. They can help integrate debt reduction into a comprehensive financial plan. Attorneys specializing in bankruptcy can also provide valuable assistance if other debt management strategies prove unsuccessful.

Available Resources for Individuals with Credit Card Debt

Numerous resources exist to support individuals struggling with credit card debt. Non-profit credit counseling agencies, like the National Foundation for Credit Counseling (NFCC), offer free or low-cost services, including budgeting workshops and debt management plans. Many government agencies also provide resources and educational materials on debt management. Online tools and calculators can help individuals track their spending, create budgets, and estimate the impact of different debt repayment strategies. Remember to thoroughly research any organization before engaging their services, verifying their legitimacy and reputation.

Questions to Ask a Financial Advisor

Before engaging a financial advisor, it’s essential to be prepared with thoughtful questions. Asking about their experience with debt management, their fee structure, and their approach to developing a personalized plan is crucial. Inquiring about the potential risks and benefits of various debt management strategies will ensure you are making informed decisions. Understanding their communication style and availability is also important for building a productive working relationship. A clear understanding of their qualifications and professional affiliations will ensure you are working with a reputable and qualified professional. Finally, asking for references or testimonials from past clients can help you gauge their effectiveness and client satisfaction.

Visual Representation of Debt Management

Understanding the impact of different debt repayment strategies is crucial for effective financial planning. Visual aids can significantly clarify the complex interplay between interest payments, principal reduction, and overall debt reduction time. The following examples illustrate how different approaches affect the total cost of borrowing.

Comparison of Debt Repayment Strategies

A bar chart would effectively compare three common debt repayment strategies: the avalanche method (prioritizing high-interest debts), the snowball method (prioritizing small debts), and a minimum payment strategy. The horizontal axis would represent the three strategies, and the vertical axis would show the total interest paid over the repayment period. For example, let’s assume a total debt of $10,000, consisting of a $5,000 credit card debt at 18% APR and a $5,000 student loan at 6% APR. The chart would visually demonstrate that the avalanche method, by targeting the high-interest credit card debt first, would result in significantly lower total interest paid compared to the snowball method or the minimum payment strategy. The minimum payment strategy would show the highest bar, representing substantially more interest paid over time due to prolonged debt repayment. The chart would use different colored bars to clearly distinguish each strategy, with a legend indicating which color represents which strategy. Numerical values for total interest paid under each strategy would be displayed above each bar for clarity.

Growth of Credit Card Debt versus Student Loan Debt

A line graph would effectively illustrate the growth of credit card debt versus student loan debt over a specified period, for instance, 10 years. The horizontal axis would represent time (in years), and the vertical axis would represent the debt amount (in dollars). Two distinct lines would represent credit card debt and student loan debt. Let’s assume that initially, both debts start at $5,000. The credit card debt line would likely show a steeper upward trend than the student loan debt line, reflecting the higher interest rates typically associated with credit cards. This visual representation would highlight the potential for credit card debt to accumulate rapidly compared to student loan debt, even if the initial amounts are similar. The graph would use different colors for each line (e.g., red for credit card debt and blue for student loan debt), with a legend clearly identifying each line. Specific data points (e.g., debt amounts at the end of year 3, 5, and 10) could be labeled on the graph for precise comparison. A hypothetical scenario showing consistent minimum payments on both could also be added as a third line, demonstrating how even with payments, the credit card debt continues to outpace the student loan debt.

Concluding Remarks

Ultimately, the decision of whether to use student loans to pay off credit card debt is deeply personal and hinges on a thorough understanding of your individual financial situation. While it might seem like a quick solution, the long-term consequences of higher interest rates and extended repayment periods must be carefully considered. Exploring alternative debt management strategies and seeking professional financial advice are crucial steps in navigating this complex landscape and charting a path toward responsible debt resolution. Remember, informed choices lead to better financial outcomes.

FAQ Compilation

What are the interest rates typically like for student loans compared to credit cards?

Student loan interest rates vary, but they are generally lower than credit card interest rates. However, the total interest paid over the life of a student loan can still be substantial.

Can I consolidate my student loans and credit card debt together?

Typically, you cannot directly consolidate student loans and credit card debt into a single loan. Consolidation primarily applies to federal or private student loans. However, you could use a personal loan to consolidate credit card debt, though this requires good credit.

What is debt snowballing, and how does it differ from the debt avalanche method?

The debt snowball method focuses on paying off the smallest debt first for motivation, regardless of interest rate. The debt avalanche method prioritizes paying off the debt with the highest interest rate first to save money in the long run.

Where can I find free resources to help manage my debt?

Many non-profit credit counseling agencies offer free or low-cost debt management services and resources. Check with the National Foundation for Credit Counseling (NFCC) for referrals.