Navigating the complexities of student loan debt often begins with understanding current interest rates. These rates, which fluctuate based on various economic and individual factors, significantly impact the overall cost of higher education and the subsequent repayment burden. This exploration delves into the intricacies of federal student loan interest rates, examining the different loan types, influencing factors, and available repayment options to empower borrowers with informed decision-making.

From subsidized and unsubsidized loans to the impact of credit history and economic conditions, we’ll uncover the key elements that shape your interest rate. We’ll also explore strategies for minimizing interest payments, including exploring repayment plans and refinancing options, ultimately aiming to provide a comprehensive guide for managing student loan debt effectively.

Understanding Current Student Loan Interest Rates

Navigating the world of student loan interest rates can be complex. Understanding the different types of loans and how their interest rates are calculated is crucial for responsible borrowing and repayment planning. This section will clarify the key aspects of federal student loan interest rates.

Federal Student Loan Types and Interest Rates

Federal student loans are offered through various programs, each with its own interest rate structure. These rates are generally lower than those offered by private lenders. The specific interest rate for each loan type is determined annually and fixed for the life of the loan. This means the rate doesn’t change, unlike some variable-rate loans.

Interest Rate Determination for Federal Student Loans

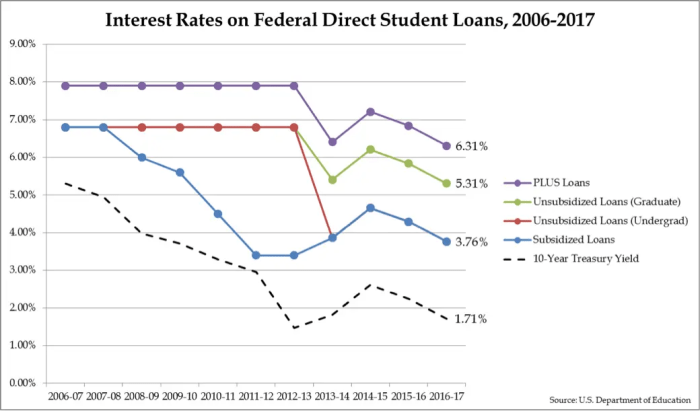

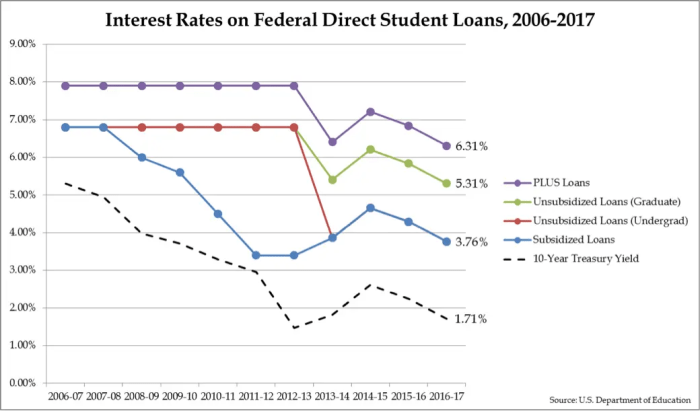

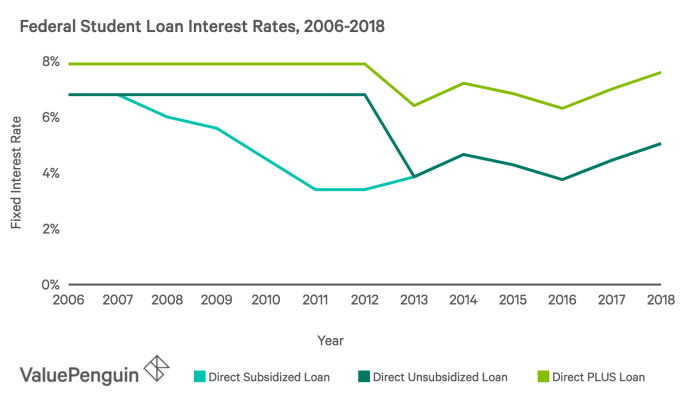

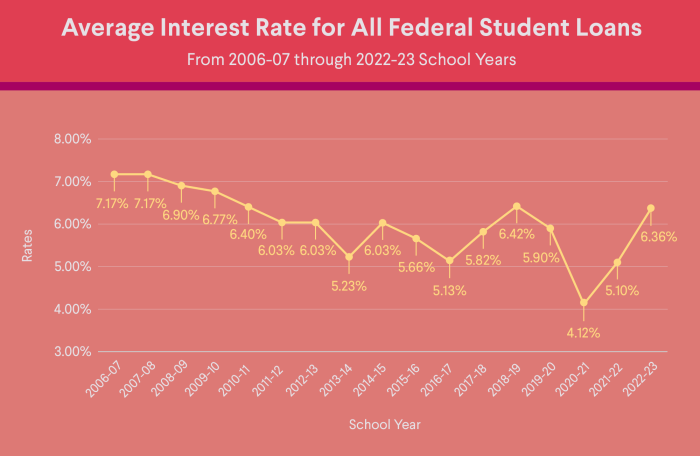

The interest rates for federal student loans are set by the government and are influenced by several factors. A primary factor is the 10-year Treasury note’s yield. This benchmark rate serves as a foundation for calculating the interest rate. Additionally, a fixed percentage is added to account for administrative costs and other factors. These rates are typically announced each year before the academic year begins. This ensures transparency and allows students to plan accordingly.

Subsidized vs. Unsubsidized Loan Interest Rates

Subsidized and unsubsidized federal student loans differ significantly in how interest accrues. Subsidized loans do not accrue interest while the borrower is in school at least half-time, during a grace period, or during periods of deferment. Unsubsidized loans, however, accrue interest throughout the entire loan term, even during periods of deferment or grace. Consequently, the total amount owed at the end of the loan term is typically higher for unsubsidized loans. The interest rate for both subsidized and unsubsidized loans is usually the same for a given loan year.

Current Federal Student Loan Interest Rates

The following table displays example interest rates. Remember that these rates are subject to change annually and should be verified with the official sources before making any financial decisions.

| Loan Type | Interest Rate (Example) | Repayment Plan (Example) | Grace Period (Example) |

|---|---|---|---|

| Direct Subsidized Loan | 4.99% | Standard 10-year | 6 months |

| Direct Unsubsidized Loan | 4.99% | Standard 10-year | 6 months |

| Direct PLUS Loan (Graduate/Parent) | 7.54% | Standard 10-year | 6 months |

| Direct Consolidation Loan | Weighted Average of Consolidated Loans | Variable | None (usually) |

Factors Influencing Student Loan Interest Rates

Understanding the factors that determine your student loan interest rate is crucial for managing your debt effectively. Several interconnected elements influence the final rate you’ll receive, impacting your monthly payments and overall repayment costs. These factors can be broadly categorized into your personal financial standing and the prevailing economic environment.

Credit History’s Impact on Student Loan Interest Rates

A strong credit history significantly impacts the interest rate offered on student loans. Lenders view a positive credit history – characterized by consistent on-time payments, low credit utilization, and a lack of negative marks like defaults or bankruptcies – as an indicator of responsible financial behavior. Borrowers with excellent credit scores typically qualify for lower interest rates, reflecting the reduced risk to the lender. Conversely, a poor credit history or a lack of credit history can result in higher interest rates or even loan denial. For example, a borrower with a FICO score above 750 might secure a significantly lower rate than a borrower with a score below 600. The difference can amount to several percentage points, leading to substantial savings or increased costs over the life of the loan.

The Influence of the Current Economic Climate on Interest Rates

The prevailing economic climate plays a significant role in shaping student loan interest rates. Factors like inflation, the federal funds rate set by the Federal Reserve, and overall economic growth all influence interest rates. When inflation is high, the Federal Reserve might raise interest rates to curb inflation. This increase in the federal funds rate often leads to higher interest rates across the board, including student loans. Conversely, during periods of low inflation and economic slowdown, interest rates may fall, resulting in more favorable loan terms for borrowers. For instance, during periods of economic uncertainty, like the 2008 financial crisis, we saw a decrease in student loan interest rates as the Federal Reserve lowered the federal funds rate to stimulate economic activity.

Other Factors Affecting Student Loan Interest Rates

Beyond credit history and the economic climate, several other factors can influence the interest rate you receive. These include the type of loan (federal versus private), the loan’s repayment plan, the lender’s policies, and the borrower’s co-signer (if applicable). Federal student loans generally offer fixed interest rates, while private loans may have variable rates subject to market fluctuations. Choosing a longer repayment plan might lower your monthly payments but could result in paying more interest overall. Different lenders have varying lending criteria and interest rate structures. Finally, having a co-signer with a strong credit history can significantly improve your chances of securing a lower interest rate, as the co-signer’s creditworthiness mitigates the lender’s risk.

Flowchart Illustrating Factors Influencing Student Loan Interest Rates

Imagine a flowchart. The central box would be labeled “Student Loan Interest Rate.” Branching out from this central box would be three main branches: “Borrower’s Credit History,” “Economic Conditions,” and “Other Factors.” The “Borrower’s Credit History” branch would lead to boxes illustrating the impact of credit score, payment history, and debt-to-income ratio. The “Economic Conditions” branch would lead to boxes representing inflation rates, the federal funds rate, and overall economic growth. Finally, the “Other Factors” branch would lead to boxes detailing the loan type, repayment plan, lender policies, and the presence of a co-signer. All these branches ultimately converge back to the central box, illustrating their combined effect on the final student loan interest rate. The flowchart visually demonstrates the interplay of these factors, highlighting their collective influence on the interest rate a borrower ultimately receives.

Repayment Options and Interest Rate Implications

Choosing the right student loan repayment plan significantly impacts the total cost of your education. Different plans offer varying repayment periods and monthly payments, directly affecting the amount of interest you accrue over the life of the loan. Understanding these differences is crucial for making informed financial decisions.

Understanding how repayment plans influence interest accumulation requires careful consideration of several factors. Longer repayment periods generally lead to higher total interest payments, as you’re paying interest on the principal balance for a longer duration. Conversely, shorter repayment periods, while resulting in higher monthly payments, reduce the overall interest paid. Income-driven repayment plans offer flexibility but may extend the repayment timeline, potentially increasing the total interest paid compared to standard plans.

Student Loan Repayment Plan Comparison

The following Artikels key differences between common student loan repayment plans and their impact on total interest paid. Remember that specific details may vary depending on your loan type and lender. These examples use hypothetical loan amounts and interest rates for illustrative purposes.

- Standard Repayment Plan: This plan typically involves fixed monthly payments over 10 years. It offers the shortest repayment period, minimizing total interest paid. Example: A $30,000 loan at 5% interest would have a monthly payment of approximately $330 and a total interest paid of roughly $10,000.

- Extended Repayment Plan: This plan extends the repayment period beyond 10 years, usually up to 25 years, resulting in lower monthly payments. However, the extended repayment period leads to significantly higher total interest paid. Example: The same $30,000 loan at 5% interest, spread over 25 years, would have a monthly payment of around $180, but the total interest paid would increase to approximately $23,000.

- Income-Driven Repayment (IDR) Plans: These plans base monthly payments on your income and family size. They offer lower monthly payments, particularly during periods of lower income. However, IDR plans typically extend the repayment period significantly, potentially leading to higher total interest paid over the life of the loan. Example: With an IDR plan, the monthly payment on the $30,000 loan might be significantly lower than the standard plan’s payment, but repayment could stretch to 20 or even 30 years, resulting in a total interest cost potentially exceeding $25,000. The exact amount will depend on income fluctuations throughout the repayment period.

Managing Student Loan Debt and Interest

Successfully navigating student loan debt requires a proactive approach to minimize interest accrual and protect your financial future. Understanding various strategies and their implications is crucial for responsible debt management. This section Artikels key methods for controlling interest payments and the potential consequences of neglecting your loans.

Minimizing the amount of interest paid on student loans involves a multi-pronged strategy focusing on proactive repayment and strategic financial planning. Effective management can significantly reduce the overall cost of borrowing and accelerate debt repayment.

Strategies for Minimizing Interest Payments

Several effective strategies can help borrowers reduce the total interest paid over the life of their loans. These strategies combine responsible repayment practices with careful financial planning.

- High-Interest Loan Prioritization: Focus extra payments on loans with the highest interest rates first. This approach maximizes savings by tackling the most expensive debt quickly. For example, if you have one loan at 7% and another at 4%, prioritizing the 7% loan will save you more money in the long run.

- Aggressive Repayment: Making even small extra payments each month can significantly reduce the loan’s lifespan and the total interest paid. A simple example: An extra $50 per month on a $30,000 loan at 6% could save thousands of dollars and shorten the repayment period by several years.

- Income-Driven Repayment Plans: Explore income-driven repayment (IDR) plans. These plans adjust monthly payments based on your income and family size, making them more manageable, although they often extend the repayment period and may result in paying more interest overall.

- Loan Consolidation: Consolidating multiple loans into a single loan with a lower interest rate can simplify repayment and potentially reduce monthly payments. However, carefully compare interest rates before consolidating, as it might not always lead to significant savings.

Benefits of Making Extra Payments

Making extra payments on student loans offers substantial financial advantages. These benefits directly impact both the short-term and long-term financial health of the borrower.

- Reduced Total Interest Paid: The most significant benefit is the reduction in total interest paid over the life of the loan. Each extra payment directly reduces the principal balance, leading to less interest accruing over time.

- Shorter Repayment Period: Extra payments accelerate the repayment process, allowing borrowers to become debt-free sooner. This frees up funds for other financial goals, such as saving for a down payment on a house or investing.

- Improved Financial Well-being: Faster debt repayment contributes to improved overall financial health and reduces financial stress. Knowing you’re making progress on your student loans can positively impact your overall financial outlook.

Consequences of Loan Default

Failing to make timely student loan payments can lead to serious consequences, impacting credit scores and overall financial stability. Defaulting on student loans has far-reaching and long-lasting implications.

- Damaged Credit Score: A default is reported to credit bureaus, significantly lowering your credit score. This makes it difficult to obtain loans, rent an apartment, or even secure certain jobs in the future.

- Wage Garnishment: The government can garnish a portion of your wages to recover the defaulted loan amount. This can severely impact your monthly income and financial stability.

- Tax Refund Offset: Your federal tax refund may be seized to repay the defaulted loan. This means you may not receive any of your refund until the debt is settled.

- Difficulty Obtaining Future Loans: A default makes it extremely challenging to obtain future loans, including mortgages, auto loans, and credit cards.

Exploring Student Loan Refinancing Options

Refinancing student loans involves replacing your existing loans with a new loan from a private lender, often at a lower interest rate. This process can lead to significant savings over the life of the loan, but careful consideration is essential.

- Check Your Credit Score: A higher credit score improves your chances of securing a favorable interest rate. Review your credit report and address any inaccuracies.

- Shop Around for Lenders: Compare interest rates and terms from multiple lenders. Don’t settle for the first offer you receive.

- Consider Loan Terms: Evaluate the loan terms carefully, including the interest rate, repayment period, and any associated fees.

- Compare Offers: Create a comparison table outlining the key features of each loan offer to help you make an informed decision.

- Understand the Implications: Refinancing can impact your repayment schedule and eligibility for certain federal loan benefits. Weigh the pros and cons carefully before proceeding.

Resources for Finding Current Interest Rate Information

Staying informed about current student loan interest rates is crucial for effective financial planning. Understanding where to find reliable and up-to-date information is the first step in making informed decisions about your loans. This section Artikels key resources and explains how to interpret the data provided.

Knowing where to look for accurate student loan interest rate information is essential for responsible financial management. Misinformation can lead to poor decisions, so relying on credible sources is paramount. The following resources offer comprehensive and reliable information.

Government Websites Providing Student Loan Interest Rate Information

The federal government is the primary source for information regarding federal student loans. Several websites provide detailed information on interest rates, repayment plans, and other relevant details. These sites are regularly updated to reflect current rates and policies.

- StudentAid.gov: This is the official website of the U.S. Department of Education’s Federal Student Aid office. It provides comprehensive information on all federal student loan programs, including current interest rates for each loan type (e.g., subsidized and unsubsidized Stafford Loans, PLUS Loans). The site often includes rate tables and calculators to help you estimate your monthly payments.

- Federal Student Aid’s Interest Rate Pages: Within StudentAid.gov, you’ll find dedicated pages specifically outlining current interest rates. These pages are updated annually and sometimes more frequently, reflecting changes in the federal interest rate index.

Other Reputable Organizations Offering Information on Student Loan Interest Rates

While government websites are the primary source, other reputable organizations offer valuable supplementary information and resources. These organizations often provide analysis and context that can be helpful in understanding the broader implications of interest rate changes.

- National Education Association (NEA): The NEA provides resources and information for educators, many of whom are borrowers of student loans. Their website may include summaries and analyses of federal student loan interest rate policies.

- The Institute for College Access & Success (TICAS): TICAS conducts research and advocacy on college affordability. Their publications often include analyses of student loan debt and interest rates, offering valuable context and perspective.

Interpreting Interest Rate Information from Official Sources

Understanding how interest rates are presented on official websites is crucial. Government websites typically present interest rates as fixed or variable rates, clearly specifying the type of loan. Fixed rates remain constant throughout the loan’s life, while variable rates fluctuate based on an index (often the 10-year Treasury note).

For example, a website might state: “The interest rate for Direct Subsidized Loans disbursed on or after July 1, 2024, is 5.0% fixed.” This means the interest rate for that specific loan type will remain 5.0% for the entire repayment period. In contrast, a variable rate might be described as “The interest rate for Direct Unsubsidized Loans is currently 4.5%, based on the 10-year Treasury note index.” This indicates the rate is subject to change based on market conditions. Always pay close attention to the effective date of the rates provided.

Outcome Summary

Understanding current student loan interest rates is crucial for responsible financial planning. By carefully considering the various loan types, influencing factors, and repayment options, borrowers can make informed decisions to minimize their long-term financial obligations. Proactive strategies, such as exploring refinancing opportunities and making extra payments, can significantly reduce the overall cost of borrowing and pave the way for a more secure financial future. Remember to utilize the resources provided to stay updated on the latest interest rate information and make the best choices for your individual circumstances.

FAQ Overview

What is the difference between subsidized and unsubsidized student loans?

Subsidized loans don’t accrue interest while you’re in school (at least half-time), during grace periods, and during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my federal student loans?

Yes, but refinancing federal loans with a private lender means losing federal protections like income-driven repayment plans and potential forgiveness programs. Carefully weigh the pros and cons before refinancing.

What happens if I default on my student loans?

Defaulting on student loans has serious consequences, including damage to your credit score, wage garnishment, and potential tax refund offset. It can also make it difficult to obtain future loans.

Where can I find the most up-to-date interest rate information?

The official source for federal student loan interest rates is the Federal Student Aid website (studentaid.gov).