The question of student loan repayment looms large for millions, casting a shadow over post-graduation plans and long-term financial stability. Understanding the intricacies of repayment options, from standard plans to income-driven approaches, is crucial for navigating this complex landscape. This guide will unravel the mysteries of student loan repayment, empowering you to make informed decisions and chart a course towards financial freedom.

This exploration delves into the various types of student loans, repayment plans, and the factors influencing your repayment journey. We’ll cover strategies for managing interest, exploring options like deferment and forbearance, and examining the potential for loan forgiveness programs. Ultimately, the goal is to equip you with the knowledge to effectively manage your student loan debt and plan for a secure financial future.

Loan Repayment Basics

Understanding student loan repayment is crucial for successfully managing your finances after graduation. This section will Artikel the different types of loans, repayment plans, and budgeting strategies to help you navigate this process effectively. Failure to understand these basics can lead to missed payments, penalties, and long-term financial difficulties.

Types of Student Loans and Repayment Terms

Student loans generally fall into two categories: federal and private. Federal loans are offered by the U.S. government and often come with more favorable repayment options and protections for borrowers. Private loans, on the other hand, are offered by banks and other private lenders, and their terms can vary significantly. Repayment terms, including interest rates, repayment periods, and deferment options, differ depending on the loan type and lender. Federal loans often have income-driven repayment plans unavailable with private loans.

Standard Repayment Plan Options

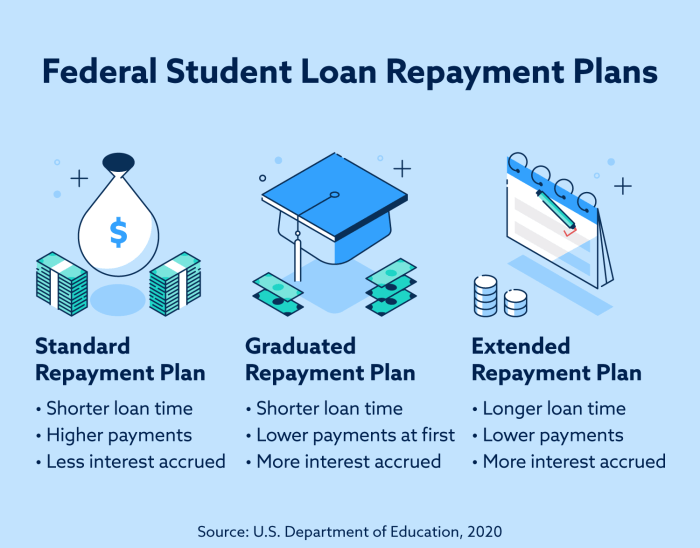

Several standard repayment plans are available for federal student loans. The most common is the Standard Repayment Plan, which typically involves fixed monthly payments over 10 years. Other options include Graduated Repayment Plans (payments increase over time), Extended Repayment Plans (longer repayment periods), and Income-Driven Repayment Plans (payments are based on your income and family size). Private loan repayment plans are determined by the lender and may offer fewer options than federal loans.

Creating a Student Loan Repayment Budget

Creating a comprehensive budget is essential for successful student loan repayment. Follow these steps:

- Calculate your total monthly loan payments: Sum the monthly payments for all your loans.

- Track your monthly income: Record all sources of income, including salary, side hustles, and any other earnings.

- List your monthly expenses: Categorize your expenses (housing, food, transportation, etc.) to identify areas for potential savings.

- Determine your disposable income: Subtract your total monthly expenses from your total monthly income. This is the amount available for loan repayment.

- Allocate funds for loan repayment: Ensure your disposable income comfortably covers your loan payments. If not, explore ways to reduce expenses or increase income.

- Build an emergency fund: Set aside a portion of your income for unexpected expenses to avoid falling behind on loan payments.

- Regularly review and adjust your budget: Life circumstances change, so regularly review your budget and make adjustments as needed.

Comparison of Repayment Plan Options

| Repayment Plan | Pros | Cons | Best For |

|---|---|---|---|

| Standard Repayment Plan | Fixed payments, shorter repayment period | Higher monthly payments | Borrowers with higher incomes and stable financial situations |

| Graduated Repayment Plan | Lower initial payments | Payments increase over time, potentially leading to higher total interest paid | Borrowers anticipating income increases |

| Extended Repayment Plan | Lower monthly payments | Longer repayment period, higher total interest paid | Borrowers with lower incomes or high debt |

| Income-Driven Repayment Plan | Payments based on income and family size, potential for loan forgiveness | Longer repayment period, may result in higher total interest paid | Borrowers with low incomes or significant financial hardship |

Factors Affecting Repayment

Understanding the various factors influencing student loan repayment is crucial for effective financial planning. Several key elements significantly impact the total cost and duration of repayment, necessitating careful consideration throughout the borrowing and repayment process. These factors can be broadly categorized into interest rates, repayment plan options, and the potential for loan default.

Interest Rates and Total Repayment Costs

Interest rates directly determine the overall cost of your student loans. A higher interest rate means you’ll pay more in interest over the life of the loan, significantly increasing your total repayment amount. For example, a $10,000 loan with a 5% interest rate will accrue less interest over 10 years than the same loan with a 7% interest rate. This difference can amount to thousands of dollars in additional costs. Understanding the interest rate on your loans and exploring options for refinancing to a lower rate, if available, can substantially reduce your long-term financial burden. Careful comparison shopping and consideration of loan terms are essential for minimizing interest-related expenses.

Loan Deferment and Forbearance

Loan deferment and forbearance are temporary pauses in your loan repayment schedule. Deferment typically applies to specific circumstances, such as returning to school or experiencing unemployment, and may involve suspending both principal and interest payments. Forbearance, on the other hand, allows for temporary reduction or suspension of payments, but interest usually continues to accrue. Both options can provide short-term relief, but they extend the loan repayment period, ultimately increasing the total cost due to accumulated interest. It’s crucial to understand the terms and conditions of each program before utilizing them, as they may have implications for your credit score and future repayment options. For example, a six-month deferment on a loan with accruing interest will lead to a larger balance needing to be repaid at the end of the deferment period.

Reasons for Loan Default and Consequences

Loan default occurs when a borrower fails to make payments for a specified period. Several factors can contribute to default, including job loss, unexpected medical expenses, or simply an inability to manage multiple financial obligations. The consequences of default are severe and can include damage to credit scores, wage garnishment, and tax refund offset. Furthermore, the lender may pursue legal action to recover the outstanding debt. Proactive financial planning, including budgeting and exploring repayment options, can help borrowers avoid default. Seeking guidance from financial aid offices or credit counseling agencies can also provide valuable support in managing student loan debt effectively. Understanding the potential repercussions of default is crucial for responsible loan management.

Applying for Loan Forgiveness Programs

The process for applying for loan forgiveness programs varies depending on the specific program and eligibility requirements. Many programs require borrowers to meet certain criteria, such as working in public service or teaching in low-income areas. The application process typically involves submitting documentation verifying employment, income, and loan details.

The flowchart below illustrates a generalized process, but specific steps may vary based on the program.

[A flowchart would be inserted here. It would visually represent the steps involved in applying for loan forgiveness, starting with checking eligibility criteria, gathering required documentation, submitting the application, undergoing review and approval processes, and finally, receiving notification of the outcome. Each step would be clearly labeled, creating a user-friendly guide to the process.]

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer a lifeline to student loan borrowers struggling with high monthly payments. These plans tie your monthly payment to your income and family size, making repayment more manageable, particularly during periods of lower earnings or unexpected financial hardship. Several different IDR plans exist, each with its own nuances and eligibility requirements. Understanding the differences between them is crucial for selecting the plan that best suits your individual circumstances.

IDR plans work by calculating your monthly payment based on a percentage of your discretionary income – the amount left after subtracting essential expenses from your gross income. This percentage varies depending on the specific plan chosen and your income level. The remaining balance is typically forgiven after a specified number of payments, often 20 or 25 years, though this forgiveness may be subject to taxation. The amount of forgiveness can vary greatly depending on the plan and your income throughout the repayment period.

Comparison of Income-Driven Repayment Plans

Several federal income-driven repayment plans are available. The key differences lie in the calculation of discretionary income, the repayment period, and the potential for loan forgiveness. Choosing the right plan requires careful consideration of your current financial situation and future income projections.

- Income-Based Repayment (IBR): IBR plans calculate your monthly payment based on your discretionary income and family size. There are two versions: one for loans originated before July 1, 2014, and one for loans originated after that date. The older version has a 15-year repayment period for loans before 7/1/2014 and a 25-year period for loans after. The newer version has a 20-year repayment period.

- Pay As You Earn (PAYE): PAYE calculates your monthly payment at 10% of your discretionary income. The repayment period is 20 years. This plan is generally more favorable to borrowers with lower incomes compared to IBR.

- Revised Pay As You Earn (REPAYE): REPAYE is similar to PAYE but includes both undergraduate and graduate loans in the calculation. The repayment period is 20 years, and it offers a lower payment amount for those with high loan balances relative to their income.

- Income-Contingent Repayment (ICR): ICR calculates your monthly payment based on your income, family size, and loan amount. The repayment period is either 12 or 25 years, depending on the loan type and origination date.

Examples of IDR Plan Payment Reductions

Let’s consider a borrower with $50,000 in student loan debt. Under a standard 10-year repayment plan, their monthly payment might be approximately $550. However, with an IDR plan, their monthly payment could be significantly lower, depending on their income and family size. For instance, if their discretionary income is low, their monthly payment under PAYE might be reduced to $200 or less. If their income increases over time, their monthly payment will also increase, reflecting the income-driven nature of the plan. These reductions provide immediate financial relief, allowing borrowers to manage other essential expenses while still making progress on their loan repayment.

Income Verification Process for IDR Plans

To qualify for an IDR plan, borrowers must provide documentation verifying their income and family size. This typically involves submitting tax returns, pay stubs, or other relevant financial documents. The specific documentation required varies depending on the lender and the chosen plan. The income verification process is usually completed annually or every two years to ensure the payment remains accurate based on the borrower’s current financial circumstances. Failure to provide accurate information can result in penalties, including increased payments or even loan default. Borrowers should be prepared to re-certify their income regularly, usually online through the student loan servicer’s website.

Loan Consolidation and Refinancing

Managing multiple student loans can be complex, often involving varying interest rates, repayment schedules, and lenders. Loan consolidation and refinancing offer potential solutions to simplify this process and potentially save money. However, it’s crucial to understand the benefits and drawbacks of each before making a decision.

Loan consolidation combines multiple federal student loans into a single loan with a new repayment plan. Refinancing, on the other hand, involves replacing your existing student loans (federal or private) with a new private loan from a different lender. Both options can streamline repayment, but they differ significantly in their implications.

Consolidation Benefits and Drawbacks

Consolidating federal student loans simplifies repayment by reducing the number of monthly payments and potentially offering a fixed interest rate. This can make budgeting easier and provide a clearer picture of your overall debt. However, consolidation may not always lower your overall interest rate, and it might extend your repayment period, leading to higher total interest paid over the life of the loan. Furthermore, consolidating federal loans into a new federal loan may mean losing access to certain repayment plans or forgiveness programs available for specific loan types.

Refinancing Student Loans with a Private Lender

Refinancing student loans with a private lender involves applying for a new loan to pay off your existing student loan debt. The process typically involves comparing offers from multiple lenders, providing documentation such as income verification and credit history, and undergoing a credit check. Once approved, the lender disburses the funds to pay off your previous loans, and you begin making payments on the new, refinanced loan. A key advantage is the potential for a lower interest rate than your existing loans, leading to lower monthly payments and reduced overall interest paid. However, refinancing federal loans with a private lender means losing access to federal student loan benefits like income-driven repayment plans and potential forgiveness programs.

Eligibility Requirements for Loan Consolidation and Refinancing

Eligibility for federal loan consolidation is generally straightforward; you must have eligible federal student loans. However, refinancing with a private lender has stricter requirements. Lenders typically assess credit scores, debt-to-income ratios, and income stability. A higher credit score and lower debt-to-income ratio generally improve your chances of approval and securing a favorable interest rate. Specific requirements vary depending on the lender.

Refinancing Interest Rates and Terms Comparison

It’s crucial to shop around and compare offers from multiple private lenders before refinancing. Interest rates and terms can vary significantly. The following table provides a hypothetical example; actual rates and terms will depend on individual circumstances and market conditions.

| Lender | Interest Rate (APR) | Loan Term (Years) | Fees |

|---|---|---|---|

| Lender A | 6.5% | 10 | $0 |

| Lender B | 7.0% | 15 | $200 |

| Lender C | 6.0% | 5 | $100 |

| Lender D | 7.5% | 12 | $0 |

Understanding Your Loan Documents

Navigating the world of student loans requires a thorough understanding of the associated paperwork. Carefully reviewing your loan documents is crucial to avoid unexpected fees, missed payments, and long-term financial difficulties. Understanding the terms and conditions will empower you to make informed decisions about your repayment strategy.

Your loan documents contain vital information governing your repayment responsibilities. Failure to understand these documents could lead to significant financial repercussions. Taking the time to carefully read and comprehend these agreements is a critical step in responsible loan management.

Key Terms and Conditions in Student Loan Agreements

Student loan agreements typically include several key terms and conditions. These are legally binding and dictate the borrower’s responsibilities and the lender’s obligations. Familiarizing yourself with these terms is essential for successful loan repayment.

- Principal: The original amount of money borrowed.

- Interest Rate: The percentage charged on the unpaid principal balance. This rate can be fixed or variable.

- Interest Capitalization: The process of adding accumulated interest to the principal balance, increasing the total amount owed.

- Repayment Schedule: The timeline outlining the monthly payments and their due dates.

- Grace Period: The period after graduation or leaving school before repayment begins.

- Default: Failure to make payments according to the agreed-upon schedule.

- Fees: Charges for late payments, returned payments, or other administrative actions.

- Forbearance and Deferment: Options that temporarily suspend or reduce payments under specific circumstances.

Understanding Your Loan Amortization Schedule

An amortization schedule details your loan repayment plan, outlining each payment’s allocation between principal and interest over the loan’s life. Understanding this schedule allows you to track your progress and anticipate future payments.

A step-by-step guide to understanding your amortization schedule:

- Locate your schedule: This is usually provided by your lender either online or in paper form.

- Identify key columns: Look for columns showing the payment number, payment date, payment amount, principal paid, interest paid, and remaining balance.

- Analyze the payment allocation: Observe how each payment is divided between principal and interest. In the early stages, a larger portion goes towards interest, while later payments allocate more to the principal.

- Track your progress: Regularly check your schedule to monitor your repayment progress and ensure payments are accurately applied.

- Plan for future payments: Use the schedule to budget and plan for upcoming payments.

Common Misunderstandings Regarding Loan Terms

Several common misunderstandings surround student loan terms, potentially leading to financial difficulties. Clear understanding prevents these issues.

- Misunderstanding Interest Capitalization: Many borrowers don’t realize that interest capitalization can significantly increase their total loan amount over time, especially if they have periods of deferment or forbearance.

- Ignoring Grace Periods: Failing to understand the length and implications of the grace period can lead to unexpected late payment fees and negative impacts on credit scores.

- Overlooking Fees: Unexpected fees for late payments, returned payments, or other administrative actions can quickly accumulate and add to the total repayment burden.

- Underestimating the Total Cost: Many borrowers underestimate the total cost of their loan, including interest, fees, and the total repayment period. This can lead to budget shortfalls and difficulty managing repayments.

Seeking Assistance with Repayment

Navigating student loan repayment can be challenging, and many borrowers find themselves needing assistance at some point. Fortunately, numerous resources are available to help manage debt and avoid delinquency. Understanding these resources and how to access them is crucial for successful repayment.

Borrowers facing difficulties should proactively seek help rather than waiting until their situation worsens. Ignoring the problem will only compound the challenges. Several avenues exist for obtaining support, ranging from contacting your loan servicer to utilizing free financial counseling services.

Contacting Your Loan Servicer

Your loan servicer is your primary point of contact for all matters related to your student loans. They are responsible for processing payments, answering questions about your loan terms, and offering assistance programs. When contacting your servicer, be prepared to provide your loan information, including your loan ID number and the type of loan. Clearly explain your financial situation and the type of assistance you require. Keep detailed records of all communication with your servicer, including dates, times, and the names of the individuals you spoke with. Many servicers offer online portals where you can manage your account, submit requests, and access important documents. Utilizing these online tools can streamline the process and provide a record of your interactions.

Options for Borrowers Facing Financial Hardship

Several options are available for borrowers experiencing financial hardship, preventing default and helping them manage their debt. These options may include forbearance, deferment, or income-driven repayment plans. Forbearance temporarily suspends or reduces your payments, while deferment postpones them. Income-driven repayment plans adjust your monthly payment based on your income and family size. The specific terms and eligibility requirements for each option vary depending on your loan type and servicer. It’s crucial to thoroughly research these options and understand their implications before making a decision. For example, while forbearance and deferment offer temporary relief, interest may still accrue on your loan, potentially increasing your total debt.

Organizations Offering Free Financial Counseling Services

Seeking guidance from a reputable financial counselor can be invaluable when navigating student loan repayment challenges. These professionals can provide personalized advice, help you explore available options, and develop a repayment strategy tailored to your circumstances. Many organizations offer free or low-cost financial counseling services.

- The National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that provides certified credit counselors who can help you create a budget, manage debt, and explore options for student loan repayment.

- The Consumer Credit Counseling Service (CCCS): CCCS offers similar services to the NFCC, including budgeting assistance and debt management plans.

- The United States Department of Education:

The Department of Education’s website provides valuable resources and information on student loan repayment, including contact information for loan servicers and details about income-driven repayment plans.

Long-Term Financial Planning After Repayment

Successfully navigating student loan repayment marks a significant financial milestone. However, the journey doesn’t end there. Strategic planning is crucial to build a secure financial future, leveraging the newfound freedom from loan payments to achieve long-term goals. This section Artikels key strategies for managing your finances post-repayment.

Managing Debt After Student Loan Repayment

Eliminating student loan debt significantly improves your financial health, but other debts may remain. Prioritize paying down any remaining high-interest debt, such as credit card balances, using methods like the debt snowball or avalanche method. The debt snowball method focuses on paying off the smallest debt first for motivation, while the debt avalanche method prioritizes the debt with the highest interest rate to save money on interest payments. Creating a realistic budget and tracking your spending will help manage existing debts effectively and prevent accumulating new ones. Regularly reviewing your credit report will help you identify and address any potential issues.

Building Savings and Investing After Loan Repayment

With the consistent outflow of student loan payments eliminated, you can now redirect those funds towards building a robust financial foundation. A crucial first step is establishing an emergency fund, ideally covering 3-6 months of living expenses. This fund acts as a safety net for unexpected events, preventing you from falling back into debt. Once an emergency fund is established, you can explore various investment options, such as retirement accounts (401(k)s and IRAs), index funds, or individual stocks. The specific investment strategy should align with your risk tolerance, time horizon, and financial goals. For example, a young individual with a long time horizon might choose a more aggressive investment strategy with a higher proportion of stocks, while someone closer to retirement might opt for a more conservative approach with a greater allocation to bonds.

Establishing Good Credit After Loan Repayment

Consistent on-time student loan payments contribute positively to your credit score. Maintaining this positive momentum after repayment is crucial. Continue paying all bills on time, keep credit utilization low (ideally below 30%), and monitor your credit report regularly for errors. Building and maintaining a good credit score opens doors to better interest rates on loans, mortgages, and credit cards, saving you significant money in the long run. Consider obtaining a secured credit card to further improve your credit score if you have limited credit history.

Sample Budget After Student Loan Repayment

A well-structured budget is essential for managing personal finances after loan repayment. The following is a sample budget; you should adjust it to reflect your individual income and expenses.

| Category | Percentage of Income | Example Amount (Monthly Income $4,000) |

|---|---|---|

| Housing | 30% | $1200 |

| Food | 15% | $600 |

| Transportation | 10% | $400 |

| Debt Payments (excluding student loans) | 5% | $200 |

| Savings (Emergency Fund & Investments) | 20% | $800 |

| Healthcare | 5% | $200 |

| Other Expenses (Entertainment, Clothing, etc.) | 15% | $600 |

Remember: This is a sample budget. Adjust the percentages to match your individual circumstances and financial goals. Regularly review and adjust your budget as needed.

Last Point

Successfully navigating student loan repayment requires careful planning, understanding of available options, and proactive engagement with your loan servicer. By carefully considering your individual financial situation, exploring different repayment plans, and utilizing available resources, you can create a manageable repayment strategy. Remember, seeking professional financial guidance can be invaluable in developing a long-term plan that ensures both responsible debt management and the achievement of your future financial goals.

Clarifying Questions

What happens if I don’t repay my student loans?

Failure to repay your student loans can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action.

Can I deduct student loan interest from my taxes?

The student loan interest deduction allows you to deduct the amount you paid in student loan interest during the tax year, up to a certain limit. Eligibility requirements apply.

What if I lose my job and can’t make my student loan payments?

Contact your loan servicer immediately. They may offer options such as deferment or forbearance to temporarily suspend or reduce your payments.

How long does it typically take to repay student loans?

The repayment timeline varies depending on the loan amount, interest rate, and repayment plan chosen. It can range from 10 to 20 years or longer.