Navigating the complexities of higher education financing often leaves students and their families seeking clarity on available options. One frequently asked question revolves around the participation of major financial institutions in student lending. This exploration delves into whether Wells Fargo offers student loans, examining their current offerings, historical involvement, and a comparison with other financial institutions. Understanding the landscape of student loans is crucial for making informed decisions about financing your education.

We’ll analyze Wells Fargo’s current student loan portfolio (if any), investigate their past involvement in the student loan market, and compare their offerings (or lack thereof) to those of competing banks. We’ll also look at alternative financial products Wells Fargo provides to students, such as savings and checking accounts, and discuss the importance of financial literacy in managing student loan debt. Finally, we’ll examine customer experiences and feedback to paint a complete picture.

Wells Fargo’s Current Student Loan Offerings

Wells Fargo no longer originates new student loans. This means they do not offer new federal or private student loan products to borrowers. However, they may still service existing student loans for borrowers who obtained them through Wells Fargo before they ceased offering these products. It’s crucial to understand that any information regarding loan types, eligibility, and rates pertains solely to those pre-existing loans and not to any currently available options.

Student Loan Servicing by Wells Fargo

Wells Fargo continues to service existing student loans. This involves managing payments, providing customer support, and handling other administrative tasks associated with the loans. Borrowers with pre-existing Wells Fargo student loans should contact the bank directly for information specific to their loan terms and servicing options. It’s important to note that Wells Fargo’s role is limited to servicing; they are not involved in originating new loans.

Eligibility Requirements for Pre-Existing Wells Fargo Student Loans

Eligibility for pre-existing Wells Fargo student loans varied depending on the specific loan program and the borrower’s circumstances at the time of application. Factors such as credit history, income, enrollment status, and co-signer availability likely played a significant role in the approval process. Since Wells Fargo no longer offers these loans, specific eligibility requirements are not publicly available for new applicants. Individuals interested in student loans should explore options with other lenders.

Comparison of Interest Rates and Fees (Pre-Existing Wells Fargo Loans vs. Competitors)

Direct comparison of interest rates and fees between pre-existing Wells Fargo student loans and current competitor offerings is challenging due to the lack of publicly available data on the former. Wells Fargo does not release historical interest rates and fee structures for discontinued loan products. Therefore, a direct comparison table cannot be accurately constructed. However, prospective borrowers should compare current offerings from various lenders to find the best fit for their financial situation. These current offerings typically vary significantly based on creditworthiness, loan type (federal vs. private), and the lender’s current policies.

| Loan Type | Interest Rate | Fees | Eligibility Requirements |

|---|---|---|---|

| Pre-Existing Wells Fargo Student Loan (Example) | (Data unavailable – varied based on individual loan agreements) | (Data unavailable – varied based on individual loan agreements) | (Data unavailable – varied based on individual loan agreements and applicant’s circumstances at time of application) |

| Current Private Loan (Example – Competitor A) | Variable, starting at 6.5% APR | Origination fee, late payment fees | Good to excellent credit, co-signer may be required |

| Current Federal Subsidized Loan (Example) | Fixed, determined by the federal government | No origination fee for direct subsidized loans | US citizenship or eligible non-citizen status, enrollment in an eligible educational program |

Wells Fargo’s Past Involvement in Student Lending

Wells Fargo has a long, albeit evolving, history in the student loan market. While they are not currently a major player in originating new student loans for undergraduates, their past participation significantly shaped the landscape of student lending in the United States, influencing both borrowers and the overall market dynamics. Understanding this history provides context for their current absence from this sector.

Wells Fargo’s involvement in student lending spanned several decades, encompassing various types of loans and programs. Initially, their focus likely mirrored the broader industry trend, with a concentration on federal student loan programs. Over time, they also offered private student loans, often targeting graduate students and those pursuing professional degrees due to the higher loan amounts involved. These loans often came with varying interest rates and repayment terms depending on the borrower’s creditworthiness and the specific loan program. The bank’s participation in the student loan market was interwoven with the broader financial industry’s practices, reacting to shifts in government regulations and market conditions.

Changes in Wells Fargo’s Student Loan Policies

Significant shifts in Wells Fargo’s student loan policies were largely driven by changes in the broader economic and regulatory environment. The 2008 financial crisis, for instance, had a profound impact on the private student loan market, leading many lenders, including Wells Fargo, to become more cautious in their lending practices. Increased scrutiny of lending practices and tighter regulations led to stricter eligibility criteria and a more conservative approach to risk assessment. This resulted in a decrease in the number of private student loans offered and a shift in focus towards other financial products. Furthermore, changes in government policies regarding federal student loans also influenced Wells Fargo’s strategy, potentially reducing the bank’s incentive to participate actively in the private student loan market.

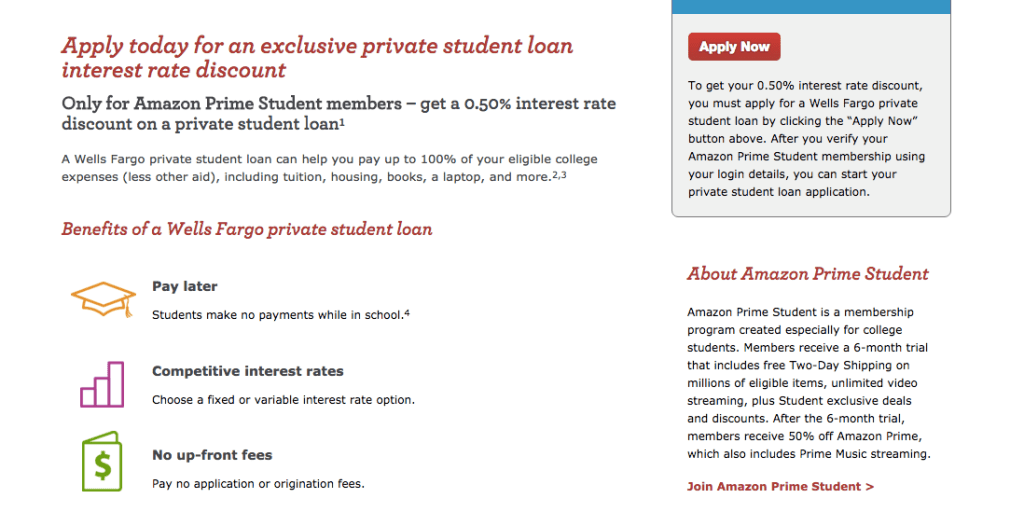

Examples of Past Marketing Materials

While specific examples of past Wells Fargo student loan marketing materials are not readily available publicly, it is reasonable to assume their marketing strategies mirrored industry trends. Likely, they utilized a mix of print advertising (brochures, newspaper ads), online advertising (website banners, search engine marketing), and possibly direct mail campaigns targeting prospective students and their families. The messaging likely emphasized the benefits of their loans, such as competitive interest rates, flexible repayment options, and potentially the convenience of integrating student loan services with other Wells Fargo banking products. The visual style would have been consistent with the bank’s overall branding at the time, featuring their logo and a professional, trustworthy aesthetic. These campaigns likely targeted specific student demographics based on their educational goals and financial needs.

Alternative Financial Products for Students

While Wells Fargo may not currently offer student loans directly, they provide a range of other financial products that can significantly benefit students navigating the complexities of higher education and beyond. These tools can help manage finances, build credit, and prepare for future financial responsibilities. Understanding these alternatives is crucial for students seeking responsible financial management.

Understanding the differences between these products and traditional student loans is essential for making informed financial decisions. Student loans typically involve borrowing large sums of money with interest accruing over time, requiring repayment after graduation. In contrast, the products discussed below offer various ways to manage and grow your own funds.

Wells Fargo Student Checking and Savings Accounts

Wells Fargo offers various checking and savings accounts designed for different needs and financial goals. Student checking accounts often come with perks like reduced or waived fees, making them a cost-effective way to manage daily expenses. Savings accounts, on the other hand, allow students to save money and earn interest, building a financial foundation for the future. Many accounts offer online banking features, making it convenient to monitor balances and manage transactions. The benefits of these accounts lie in their accessibility, ease of use, and ability to foster responsible saving and spending habits. For example, a student could use a checking account to manage tuition payments and everyday expenses, while simultaneously building an emergency fund in a savings account.

Wells Fargo Debit Cards and Credit Cards

Responsible use of debit and credit cards can be valuable tools for students. Debit cards provide direct access to funds in a checking account, promoting mindful spending. Credit cards, when used responsibly, can help build credit history—a crucial factor for future financial endeavors such as securing loans, renting an apartment, or even getting a job. However, it’s critical to understand and manage credit responsibly, avoiding high balances and late payments to prevent negative impacts on credit scores. A good example would be using a credit card for smaller, recurring expenses like textbooks or groceries, paying the balance in full each month to avoid interest charges. This strategy helps build a positive credit history without incurring debt.

Wells Fargo’s Financial Planning Resources

Beyond specific accounts, Wells Fargo provides various educational resources and tools to help students understand personal finance. These resources often include budgeting tools, financial literacy guides, and educational materials on topics such as saving, investing, and debt management. Utilizing these resources can equip students with the knowledge and skills to make informed financial decisions throughout their academic journey and beyond. Accessing these free resources empowers students to proactively manage their finances and build a strong financial future.

A Short Guide for Students Selecting Financial Products

Before selecting any financial product, students should carefully consider their individual needs and financial goals. Factors to consider include monthly expenses, savings goals, and the need for credit building. By understanding these factors, students can choose the most appropriate accounts and services to support their financial well-being. For example, a student with a part-time job and consistent income might benefit from both a checking and savings account, along with a credit card used responsibly to build credit. Conversely, a student relying solely on loans and financial aid might prioritize a simple checking account and focus on debt management strategies.

Customer Experiences with Wells Fargo and Student Loans

Understanding customer experiences is crucial for assessing the overall quality of Wells Fargo’s student loan services. Direct feedback from borrowers provides valuable insights into the effectiveness of the loan process, customer service responsiveness, and overall satisfaction. While Wells Fargo no longer originates new student loans, analyzing past customer experiences sheds light on the potential challenges and benefits associated with their previous offerings.

Analyzing publicly available information regarding Wells Fargo’s past student loan services reveals a mixed bag of customer experiences. While some borrowers reported positive interactions, others encountered significant difficulties. The following sections detail these experiences and highlight key trends.

Customer Reviews and Testimonials

It’s important to note that finding readily available, consolidated customer reviews specifically for Wells Fargo’s student loan services is challenging due to the cessation of their new loan origination. Many review sites focus on current services. However, based on scattered online comments and forum discussions from past borrowers, some common themes emerge.

- Positive experiences often centered around straightforward loan applications and relatively clear communication during the initial stages of the loan process. Some borrowers praised the ease of online account management.

- Negative experiences frequently highlighted difficulties in contacting customer service representatives, long wait times for resolutions to issues, and challenges in navigating repayment options or modifications. Complaints about confusing paperwork and lack of personalized support were also prevalent.

- Several instances of borrowers reporting problems with inaccurate account information or billing discrepancies were noted. These issues often resulted in extended periods of frustration and difficulty in resolving the problems.

Common Themes in Customer Feedback

Several key themes consistently emerged from the limited available customer feedback concerning Wells Fargo’s student loan services:

* Customer Service Responsiveness: A significant recurring concern involved the difficulty in reaching customer service representatives and the length of time required to resolve issues. This suggests a potential deficiency in staffing or efficiency within their customer support structure.

* Account Management and Transparency: Confusion surrounding account information, billing, and repayment options was another prominent theme. This points to a possible lack of clarity in communication and user-friendly account management tools.

* Loan Modification and Repayment Processes: Several accounts highlighted difficulties in modifying loan terms or navigating repayment plans. This indicates potential shortcomings in the flexibility and support offered to borrowers facing financial hardship.

Impact of Customer Service Practices

Wells Fargo’s customer service practices, or lack thereof, directly impacted the student loan experience. The difficulties in contacting representatives, lengthy wait times, and inconsistent responses created significant stress and frustration for borrowers. Inefficient processes and a lack of personalized support exacerbated problems and negatively affected borrowers’ overall satisfaction. This highlights the importance of robust and responsive customer service in mitigating negative experiences and maintaining positive customer relationships within the financial services sector. A responsive and efficient customer service system could have significantly improved the overall experience for many borrowers.

The Role of Student Loans in Personal Finance

Student loans can be a crucial stepping stone to higher education, but they also represent a significant financial commitment that extends far beyond graduation. Understanding the implications of student loan debt and developing strong personal finance skills are essential for navigating this responsibility successfully. Effective financial planning from the outset can mitigate potential stress and ensure a smoother transition into post-graduate life.

Financial literacy is paramount for students considering loans. It equips individuals with the knowledge and skills to make informed decisions about borrowing, budgeting, and repayment. Without a solid understanding of personal finance, students may underestimate the long-term costs of borrowing, leading to financial strain and difficulty managing debt. A strong foundation in budgeting, saving, and understanding interest rates is critical for responsible loan management.

Creating a Personal Budget that Includes Student Loan Debt

Developing a comprehensive personal budget is a fundamental step in managing student loan debt. This process involves carefully tracking income and expenses to create a realistic financial picture. A well-structured budget helps students allocate funds effectively, ensuring loan payments are met consistently while still allowing for essential living expenses and other financial goals.

A step-by-step guide to creating a personal budget that accounts for student loan debt includes:

1. Calculate your monthly income: This includes any income from employment, scholarships, grants, or part-time jobs.

2. List your monthly expenses: Categorize your expenses (housing, food, transportation, utilities, entertainment, etc.). Be thorough and include all regular outgoings.

3. Determine your monthly student loan payment: Use your loan documents to ascertain the precise amount due each month.

4. Subtract expenses from income: This reveals your monthly surplus or deficit. A deficit indicates that expenses exceed income, requiring adjustments to the budget.

5. Adjust your budget: If there’s a deficit, identify areas where expenses can be reduced. Prioritize essential expenses and consider reducing discretionary spending.

6. Track your spending: Regularly monitor your spending against your budget to ensure you’re staying on track. Adjustments may be necessary as circumstances change.

7. Review and revise: Periodically review and update your budget to reflect changes in income or expenses.

Example of a Student’s Monthly Budget

The following table illustrates a sample monthly budget for a student incorporating student loan payments. Remember that this is just an example, and individual budgets will vary based on income, expenses, and loan amounts.

| Category | Budget Amount | Actual Spending | Notes |

|---|---|---|---|

| Housing (Rent/Mortgage) | $800 | $780 | Slightly under budget this month. |

| Food | $300 | $350 | Over budget; needs adjustment next month. |

| Transportation | $150 | $150 | On budget. |

| Utilities | $100 | $95 | Under budget. |

| Student Loan Payment | $250 | $250 | Payment made on time. |

| Books/Supplies | $50 | $60 | Slightly over budget due to unexpected textbook purchase. |

| Entertainment | $100 | $80 | Under budget; saved some money. |

| Savings | $50 | $50 | On track with savings goal. |

| Total | $1800 | $1765 | Overall, slightly under budget. |

Comparison with Other Financial Institutions

Wells Fargo’s approach to student lending, while once a significant player in the market, has shifted considerably in recent years. Understanding its current position requires comparing it to other major banks and financial institutions that actively participate in the student loan landscape. This comparison will focus on key aspects like loan product offerings, interest rates, and customer service experiences.

A direct comparison reveals significant differences in the strategies employed by various lenders. While some institutions maintain a broad portfolio of federal and private student loans, others might specialize in specific loan types or cater to particular student demographics. Variations in interest rates, repayment options, and customer support further distinguish these institutions.

Student Loan Product Comparison: Wells Fargo, Bank of America, and Sallie Mae

The following comparative table illustrates key differences in student loan products offered by Wells Fargo, Bank of America, and Sallie Mae. Note that offerings and terms can change, so it’s crucial to check directly with each institution for the most up-to-date information. This comparison is for illustrative purposes only and does not constitute financial advice.

| Feature | Wells Fargo | Bank of America | Sallie Mae |

|---|---|---|---|

| Loan Types Offered | Currently offers limited private student loans, primarily through partnerships; previously offered federal loans. | Offers a range of private student loans, including those for undergraduate and graduate studies. | Primarily focuses on private student loans, offering various options for undergraduate and graduate students, as well as parent loans. |

| Interest Rates | Rates vary based on creditworthiness and other factors; generally competitive with other private lenders but subject to change. | Rates are variable and dependent on credit history and market conditions; generally competitive with other major banks. | Rates are competitive and often vary depending on the borrower’s creditworthiness and loan terms. |

| Repayment Options | Standard repayment plans are generally offered, though specifics may vary depending on the loan terms. | Offers a variety of repayment plans, including graduated and extended repayment options. | Provides a range of repayment plans, including options to defer payments under certain circumstances. |

| Customer Service | Customer service experiences vary widely based on individual reports; access to support channels is generally available. | Generally receives mixed reviews regarding customer service, with some citing positive experiences and others expressing dissatisfaction. | Customer service is a key focus for Sallie Mae, and they generally receive higher ratings than many other lenders in this area. |

Interest Rate Variations and Their Impact

Interest rates are a critical factor influencing the overall cost of a student loan. Variations between institutions often reflect differences in risk assessment, operating costs, and market conditions. For example, a borrower with a strong credit history might qualify for a lower interest rate than a borrower with a limited credit history. This difference can significantly impact the total amount repaid over the loan’s lifetime. A lower interest rate will result in lower total interest paid. For instance, a 1% difference in interest rates over a 10-year loan period of $20,000 could result in hundreds, or even thousands, of dollars in savings.

Customer Service and Support Mechanisms

Customer service is another area where lenders differ significantly. Some institutions offer extensive support channels, including online portals, phone support, and in-person assistance. Others might rely primarily on online resources or have limited phone support availability. The quality of customer service can significantly impact a borrower’s experience, particularly during challenging times such as loan application, repayment, or hardship situations. For example, prompt and helpful responses to inquiries can alleviate stress and prevent potential problems. Conversely, inadequate customer support can lead to frustration and financial difficulties.

Wrap-Up

Ultimately, the question of whether Wells Fargo offers student loans requires a nuanced understanding of their current offerings and historical participation in the market. While they may not directly provide student loans, the bank offers alternative financial products beneficial to students. Careful consideration of these options, alongside a strong understanding of personal finance principles, empowers students to make well-informed decisions about funding their education and managing their financial future responsibly. Remember to thoroughly research all available options and compare offerings from various financial institutions before committing to any financial product.

Question & Answer Hub

What alternative financial products does Wells Fargo offer students?

Wells Fargo offers various products like savings accounts, checking accounts, and potentially debit cards, which can assist students in managing their finances.

Does Wells Fargo offer any student loan refinancing options?

This would need to be verified directly with Wells Fargo, as their offerings change. Check their website for the most up-to-date information.

Are there any Wells Fargo scholarships or grants available for students?

Wells Fargo may offer various scholarships and grant programs; however, information on specific programs should be sought directly through their website or by contacting them.