Navigating the complexities of student loan debt can feel overwhelming, but understanding how to lower your interest rate is a crucial step towards financial freedom. This guide explores various strategies, from leveraging federal repayment plans to refinancing your loans, empowering you to take control of your debt and minimize long-term costs. We’ll delve into the intricacies of different loan types, interest calculations, and the impact of credit scores, providing practical advice and actionable steps to achieve significant savings.

By understanding the factors influencing your interest rate and exploring the available options, you can develop a personalized repayment strategy that aligns with your financial goals. Whether you’re aiming to reduce your monthly payments, accelerate repayment, or simply gain a clearer understanding of your loan terms, this comprehensive guide provides the knowledge and tools you need to make informed decisions about your student loan debt.

Understanding Your Student Loan Interest Rate

Understanding your student loan interest rate is crucial for effectively managing your debt. The interest rate dictates how much your loan will cost you over time, significantly impacting your overall repayment burden. Factors influencing this rate are complex, involving both your personal circumstances and the type of loan you receive.

Factors Determining Student Loan Interest Rates

Several factors contribute to the interest rate assigned to your student loan. These include your creditworthiness (for private loans), the type of loan, the loan’s disbursement date, and prevailing market interest rates. For federal student loans, your credit history typically doesn’t directly influence the rate, unlike private loans where a strong credit score can lead to a lower rate. The specific interest rate for federal loans is often determined by the loan program and the year the loan was disbursed. Market interest rates also play a role in the overall cost of borrowing, with higher rates leading to higher loan costs.

Types of Student Loans and Their Interest Rates

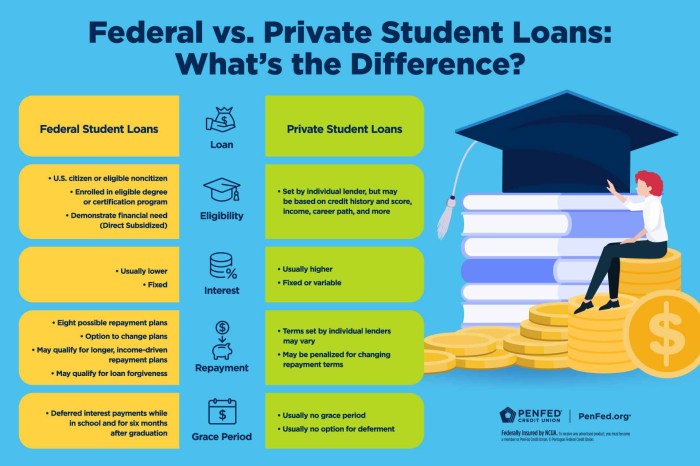

Student loans are broadly categorized into federal and private loans. Federal loans are offered by the government and generally come with more favorable terms and lower interest rates compared to private loans. Private loans, offered by banks and credit unions, often have higher interest rates and stricter eligibility criteria.

Federal student loans include subsidized and unsubsidized Stafford Loans, PLUS Loans (for parents and graduate students), and Perkins Loans. Subsidized Stafford Loans have the lowest interest rates and don’t accrue interest while the borrower is enrolled at least half-time. Unsubsidized Stafford Loans accrue interest from the time of disbursement. PLUS loans generally have slightly higher interest rates than Stafford Loans. Perkins Loans are available to students with exceptional financial need and historically have had very low interest rates. Private loan interest rates vary significantly depending on the lender, the borrower’s creditworthiness, and market conditions.

Impact of Loan Terms on Total Interest Paid

The total interest paid over the life of a loan is heavily influenced by the loan’s term (repayment period) and interest rate. A longer repayment period lowers your monthly payment, but significantly increases the total interest you pay. Conversely, a shorter repayment period increases monthly payments but reduces the overall interest paid.

For example, consider two loans of $10,000, one with a 5% interest rate and a 10-year repayment term, and another with the same principal but a 7% interest rate and a 15-year repayment term. The first loan will likely have a higher monthly payment but will result in substantially less total interest paid compared to the second loan, even though the second loan has a lower monthly payment.

Comparison of Student Loan Interest Rates

| Loan Type | Interest Rate (Example – Rates vary) | Repayment Term (Example) | Total Interest Paid (Example) |

|---|---|---|---|

| Federal Subsidized Stafford Loan | 4.5% | 10 years | $2,250 (approx.) |

| Federal Unsubsidized Stafford Loan | 5.5% | 10 years | $2,750 (approx.) |

| Federal PLUS Loan | 7% | 10 years | $3,500 (approx.) |

| Private Student Loan | 8-12% | 10 years | $4,000 – $6,000 (approx.) |

*Note: These are example rates and total interest paid, and actual rates and payments will vary based on the loan amount, repayment plan, and lender. These figures are for illustrative purposes only.

Federal Student Loan Repayment Plans

Navigating the complexities of federal student loan repayment can feel daunting, but understanding the available repayment plans is crucial for managing your debt effectively. Income-driven repayment (IDR) plans offer a pathway to more manageable monthly payments based on your income and family size. These plans can significantly reduce your monthly burden and, in some cases, lead to loan forgiveness after a specified period of time. Let’s explore the different IDR plans and how they work.

Income-Driven Repayment (IDR) Plan Options

Several income-driven repayment plans are available for federal student loans, each with its own calculation method and eligibility requirements. Choosing the right plan depends on your individual financial situation and long-term goals. Understanding the nuances of each plan is key to making an informed decision.

- Income-Driven Repayment (IDR): This is a general term encompassing several specific plans. It’s important to understand that the specific plan you’re enrolled in will determine your payment calculation.

- Income-Based Repayment (IBR): This plan calculates your monthly payment based on your discretionary income (income minus 150% of the poverty guideline for your family size) and the total amount of your eligible federal student loans. Payments are generally lower than standard repayment plans.

- Pay As You Earn (PAYE): Similar to IBR, PAYE bases your monthly payment on your discretionary income (income minus 150% of the poverty guideline for your family size). However, PAYE caps your monthly payment at 10% of your discretionary income. This can result in even lower payments than IBR for some borrowers.

- Revised Pay As You Earn (REPAYE): REPAYE is similar to PAYE, but it includes both undergraduate and graduate loans in the calculation. It also considers your total loan amount, and the monthly payment is capped at 10% of discretionary income. A key difference is that unpaid interest can be capitalized at the end of the repayment period if the borrower doesn’t make payments that cover all the interest.

- Income-Contingent Repayment (ICR): This plan calculates your monthly payment based on your annual gross income, family size, and the total amount of your loan. The payment is calculated as the lesser of 20% of your discretionary income or a fixed payment amount over 12 years. The length of the repayment period under ICR can be longer than other IDR plans.

IDR Plan Payment Calculation Examples

The calculation for each IDR plan is complex and involves several factors. Let’s illustrate with simplified examples. Remember, these are simplified examples and the actual calculations are performed by the loan servicer using official government guidelines and data.

Suppose a borrower has $50,000 in federal student loans and a discretionary income of $20,000 per year (after accounting for 150% of the poverty guideline for their family size).

- IBR: The calculation would consider the $20,000 discretionary income and the $50,000 loan balance. The resulting monthly payment would be significantly lower than a standard repayment plan.

- PAYE: The calculation would also use the $20,000 discretionary income. However, the maximum payment would be capped at 10% of that income, leading to a potentially even lower monthly payment than IBR.

- REPAYE: The calculation would incorporate the $20,000 discretionary income and the $50,000 loan balance, but the interest capitalization factor is crucial to consider. This might lead to a slightly higher payment than PAYE, especially if the borrower does not make payments that fully cover the interest.

- ICR: The calculation would use the gross income (not just discretionary income), family size, and the loan amount. This could result in a higher payment than other IDR plans, depending on the gross income and family size.

These examples highlight the variability in monthly payments across different IDR plans. The specific payment amount will depend on individual circumstances. It’s crucial to contact your loan servicer for a personalized payment calculation.

Key Differences Between IDR Plans

The table below summarizes the key differences between the main IDR plans. Note that eligibility requirements and specific calculation formulas can change, so always check the official government website for the most up-to-date information.

| Plan | Payment Calculation Based On | Payment Cap | Potential for Loan Forgiveness |

|---|---|---|---|

| IBR | Discretionary Income & Loan Amount | None | Yes, after 25 years |

| PAYE | Discretionary Income & Loan Amount | 10% of Discretionary Income | Yes, after 20 years |

| REPAYE | Discretionary Income & Loan Amount | 10% of Discretionary Income | Yes, after 20 or 25 years (depending on loan type) |

| ICR | Gross Income, Family Size, & Loan Amount | 20% of Discretionary Income or Fixed Payment over 12 years | Yes, after 25 years |

Refinancing Your Student Loans

Refinancing your student loans involves replacing your existing federal or private student loans with a new loan from a private lender. This can be a strategic move to potentially lower your monthly payments and overall interest costs, but it’s crucial to understand the implications before making a decision. This process offers the potential for significant savings, but also carries risks that need careful consideration.

The refinancing process typically involves applying to a private lender, providing documentation like your credit score, income, and existing loan details. The lender will then assess your application and offer a new loan with a potentially lower interest rate and possibly a different repayment term. It’s important to shop around and compare offers from multiple lenders before accepting any refinancing deal.

Benefits and Drawbacks of Refinancing Student Loans

Refinancing can offer several advantages, primarily the potential for a lower interest rate, leading to reduced monthly payments and less interest paid over the life of the loan. A longer repayment term might also lower monthly payments, though it will increase the total interest paid. However, refinancing also comes with disadvantages. The most significant is the loss of federal student loan benefits, such as income-driven repayment plans, deferment options, and potential forgiveness programs. This means you’ll lose the safety net provided by federal loan protections. Additionally, if your credit score isn’t strong, you might not qualify for a favorable interest rate, or even be approved for refinancing at all.

Comparison of Interest Rates Offered by Private Lenders

Interest rates offered by private lenders vary considerably based on factors such as your credit score, income, loan amount, and the type of loan being refinanced. It’s essential to compare offers from multiple lenders to find the best possible rate. The following table provides a hypothetical example to illustrate the potential range of rates. Note that these are examples only, and actual rates will vary depending on individual circumstances.

| Lender | Interest Rate (Fixed) | Interest Rate (Variable) | Additional Fees |

|---|---|---|---|

| Lender A | 6.5% | 5.5% – 7.5% | $0 |

| Lender B | 7.0% | 6.0% – 8.0% | $200 |

| Lender C | 6.0% | 5.0% – 7.0% | $100 |

| Lender D | 7.5% | N/A | $0 |

Step-by-Step Guide to Finding and Applying for Student Loan Refinancing

Before beginning the refinancing process, it is crucial to gather all necessary documentation, including your credit report, income statements, and student loan details.

- Check your credit report: Review your credit report for accuracy and identify any areas for improvement. A higher credit score will generally lead to better interest rates.

- Compare lenders: Research and compare offers from multiple private lenders, considering interest rates, fees, and repayment terms.

- Pre-qualify: Use pre-qualification tools offered by lenders to get an estimate of your potential interest rate without impacting your credit score.

- Gather documentation: Collect necessary documents, such as your credit report, income statements, and student loan details.

- Complete the application: Submit a complete application to your chosen lender.

- Review the loan offer: Carefully review the loan terms and conditions before accepting the offer.

- Sign the loan documents: Once you’re satisfied with the terms, sign the loan documents and submit them to the lender.

Strategies for Managing Student Loan Debt

Effectively managing student loan debt requires a proactive and organized approach. This involves creating a realistic budget, exploring strategies to accelerate repayment, and understanding how to improve your creditworthiness to potentially secure better loan terms in the future. Ignoring these aspects can lead to increased financial stress and long-term consequences.

Budgeting for Student Loan Repayment

Prioritizing student loan repayment within your budget is crucial for timely repayment and minimizing interest accrual. Begin by tracking all income and expenses to create a clear picture of your financial situation. Categorize your expenses to identify areas where you can reduce spending and allocate more funds towards your loan payments. Consider using budgeting apps or spreadsheets to streamline this process. Allocate a specific amount each month towards your student loans, treating this payment as a non-negotiable expense similar to rent or utilities. This disciplined approach will help ensure consistent repayment and avoid falling behind. Remember to adjust your budget periodically as your income or expenses change.

Accelerating Loan Repayment

Several strategies can help you pay off your student loans faster and save money on interest. Making extra payments, even small ones, can significantly reduce your loan’s lifespan. For instance, if your monthly payment is $500, an extra $100 per month will substantially shorten the repayment period. Another effective strategy is bi-weekly payments. By making half your monthly payment every two weeks, you effectively make 13 monthly payments annually instead of 12, leading to faster repayment. Consider automating these extra payments to ensure consistency. Additionally, explore the possibility of refinancing your loans to a lower interest rate, potentially lowering your monthly payments and reducing the overall cost. Remember to carefully compare offers before refinancing.

Improving Credit Score for Refinancing

A higher credit score can significantly impact your ability to refinance your student loans at a more favorable interest rate. Improving your credit score involves several key steps. First, pay all your bills on time, consistently. Late payments severely impact your credit score. Second, keep your credit utilization low. This means using only a small percentage of your available credit. Aim to keep your credit utilization below 30%. Third, maintain a diverse credit history, including a mix of credit cards and loans. Finally, avoid opening multiple new credit accounts within a short period, as this can negatively affect your score. Regularly monitoring your credit report and addressing any errors can also improve your score.

Avoiding Pitfalls in Student Loan Management

Several pitfalls can hinder your progress in managing student loan debt. Ignoring your loans or making minimum payments only will lead to accumulating significant interest over time, extending the repayment period and increasing the total cost. Failing to budget effectively can result in missed payments and damage your credit score. Rushing into refinancing without comparing offers thoroughly can lead to higher interest rates or unfavorable terms. Finally, consolidating loans without understanding the implications can inadvertently increase your overall interest payments. Proactive planning, diligent tracking, and informed decision-making are essential to avoid these potential problems.

The Impact of Interest Rate Changes

Fluctuations in interest rates, particularly the federal funds rate set by the Federal Reserve, significantly influence the cost of borrowing money, including student loan interest rates. While the connection isn’t always direct and immediate, changes in the broader economic landscape affect the rates lenders offer. Understanding this relationship is crucial for borrowers to anticipate potential costs and plan accordingly.

Changes in interest rates, even seemingly small ones, have a substantial long-term impact on the total amount repaid over the life of a student loan. The compounding effect of interest means that a higher rate dramatically increases the total interest paid, extending repayment periods and increasing the overall debt burden. Conversely, lower rates can lead to significant savings over time. This is particularly true for loans with longer repayment terms.

The Long-Term Effects of Interest Rate Changes on Total Repayment

A seemingly insignificant change in the interest rate can translate into a substantial difference in the total amount paid over the loan’s lifespan. Consider the cumulative effect of interest over a decade or more: a higher interest rate increases the principal balance, meaning more interest is calculated on a larger amount each month. This snowball effect can significantly increase the overall cost. Conversely, a lower rate reduces the interest accrued each month, leading to substantial savings over the long term.

Illustrative Example of Interest Rate Impact

Let’s imagine a hypothetical $20,000 student loan with a 10-year repayment period. If the interest rate is 5%, the total interest paid over 10 years would be approximately $6,000. This means the total repayment would be approximately $26,000. However, if the interest rate increases by just one percentage point to 6%, the total interest paid increases significantly to approximately $7,200, resulting in a total repayment of approximately $27,200. This seemingly small one-percentage-point increase adds $1,200 to the total cost of the loan over 10 years. A decrease in the interest rate would have the opposite effect, resulting in significant savings. This simple example demonstrates how even minor interest rate changes can have a substantial impact on the borrower’s overall cost.

Epilogue

Successfully lowering your student loan interest rate requires a proactive and informed approach. By carefully considering the options Artikeld – from income-driven repayment plans and refinancing to strategic debt management and exploring government assistance programs – you can significantly reduce your overall loan burden and pave the way for a more secure financial future. Remember, consistent effort and a well-defined strategy are key to achieving long-term financial success in managing student loan debt.

Essential Questionnaire

What is the difference between federal and private student loans?

Federal loans are offered by the government and typically have more flexible repayment options and protections, while private loans are from banks or credit unions and often have higher interest rates and fewer protections.

Can I refinance my federal student loans?

Yes, but refinancing federal loans with a private lender means losing federal protections like income-driven repayment plans and potential forgiveness programs. Carefully weigh the pros and cons before refinancing.

How does my credit score affect my interest rate?

A higher credit score generally qualifies you for lower interest rates on both federal and private student loans. Improving your credit score before refinancing can lead to significant savings.

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They may offer options like deferment or forbearance, or you might qualify for an income-driven repayment plan.