Navigating the complex world of student loans can be daunting, especially understanding the limitations on how much you can borrow. Lifetime student loan limits significantly impact educational choices and long-term financial planning. This guide explores federal and state loan programs, highlighting the maximum borrowing amounts, eligibility criteria, and the consequences of reaching these limits. We’ll also examine alternative financing options and strategies for managing substantial loan debt.

Understanding these limits is crucial for prospective and current students to make informed decisions about their education and future financial well-being. Failure to plan for the eventual repayment can lead to significant financial hardship. This guide aims to provide a clear and comprehensive overview of the entire process, empowering readers to make responsible borrowing choices.

Federal Student Loan Limits

Understanding federal student loan limits is crucial for prospective students and their families, as these limits directly impact borrowing capacity and long-term financial planning. This section details the current limits, historical changes, and distinctions between dependent and independent students. Accurate information is essential to make informed decisions about financing higher education.

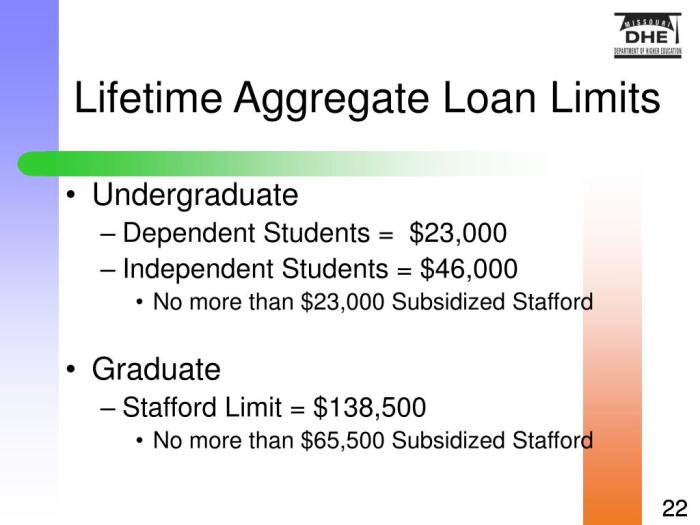

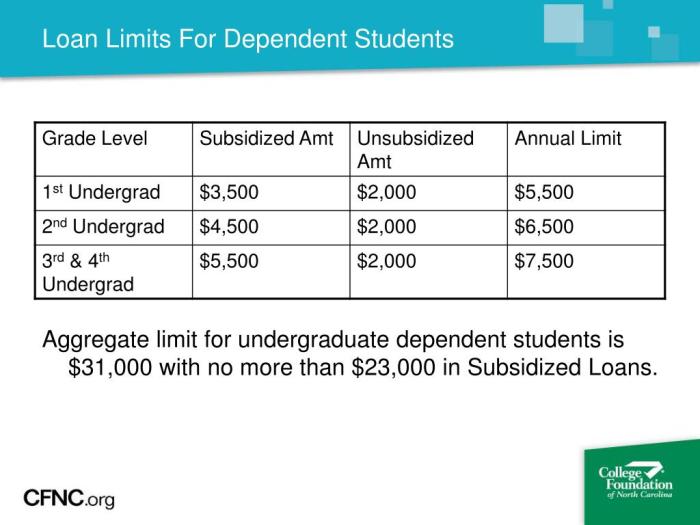

Current Federal Student Loan Limits for Undergraduate and Graduate Students

The maximum amount a student can borrow in federal student loans varies depending on several factors, including their dependency status (dependent or independent), year in school, and whether they are pursuing an undergraduate or graduate degree. These limits are set annually by the federal government and are subject to change. For the most up-to-date information, it is always recommended to consult the official website of the Federal Student Aid (FSA) office. Generally, undergraduate students can borrow more each year than in previous years, while graduate students have different, and often higher, borrowing limits.

History of Changes in Federal Student Loan Limits Over the Past 20 Years

Federal student loan limits have not remained static over the past two decades. Increases have generally tracked with inflation and the rising costs of higher education. However, the rate of increase hasn’t always kept pace with tuition increases, leading to ongoing debates about student loan debt and affordability. For example, the maximum amount available for undergraduate students has seen a steady, though not always consistent, upward trend since 2003. Significant changes have also occurred in the eligibility criteria and types of loans available. Analyzing historical data reveals fluctuating policies reflecting shifts in national economic priorities and political considerations. Detailed historical data can be found on the Federal Student Aid website.

Comparison of Loan Limits for Dependent and Independent Students

Independent students generally have higher borrowing limits than dependent students. This difference reflects the assumption that independent students have greater financial responsibility and may need more assistance to cover educational expenses. Dependency status is determined by factors such as marital status, age, and financial dependence on parents. The increased borrowing capacity for independent students acknowledges their greater financial burden. The difference in limits can be substantial, potentially influencing a student’s choice of college and overall financial strategy.

Maximum Loan Amounts by Loan Type and Academic Year

The following table summarizes the maximum loan amounts for different loan types (Subsidized, Unsubsidized, and PLUS loans) for both undergraduate and graduate students. These figures are illustrative and may vary based on the specific academic year and individual circumstances. It is crucial to consult official sources for the most current and accurate information.

| Loan Type | Undergraduate Year 1 | Undergraduate Year 2-4 | Graduate/Professional |

|---|---|---|---|

| Subsidized Direct Loan | $3,500 | $4,500-$5,500 | $20,500 |

| Unsubsidized Direct Loan | $2,000-$9,500 | $9,500-$12,500 | $20,500 |

| Parent PLUS Loan | N/A | Up to the cost of attendance minus other financial aid | Up to the cost of attendance minus other financial aid |

*Note: These are simplified examples and actual limits can vary. Always refer to the official Federal Student Aid website for the most current information.*

State-Based Student Loan Programs and Limits

Many states offer their own student loan programs to supplement federal aid, providing additional financial assistance to students pursuing higher education within their borders. These programs often have varying eligibility criteria, loan limits, and interest rates, making it crucial for students to understand the options available in their state. Understanding these state-level programs can significantly impact a student’s overall borrowing strategy and long-term financial planning.

State-based student loan programs are designed to address the unique needs of their residents and often focus on specific demographics or educational goals. They may offer lower interest rates, more flexible repayment options, or additional grants, making them attractive alternatives or supplements to federal loans. The availability and specifics of these programs vary considerably, highlighting the importance of researching the options available in your specific state.

Eligibility Criteria for State Student Loan Programs

Eligibility for state-based student loan programs typically involves meeting residency requirements, demonstrating financial need, and maintaining satisfactory academic progress. Residency requirements usually necessitate being a resident of the state for a specified period before and during the academic year. Financial need is often assessed through the Free Application for Federal Student Aid (FAFSA), with lower income students often prioritized. Maintaining satisfactory academic progress typically requires students to meet a minimum GPA and credit completion rate. Specific requirements vary widely among states.

Examples of State Programs Offering Supplemental Loans or Grants

Several states offer programs that provide supplemental funding alongside federal programs. For example, the California Student Aid Commission offers various grants and loan programs, including the Cal Grant program, which provides need-based grants to eligible California residents. Similarly, New York offers the Tuition Assistance Program (TAP), a need-based grant program that helps cover tuition costs at eligible colleges and universities within the state. These supplemental programs can significantly reduce the overall borrowing needs of students.

Variations in Loan Limits and Interest Rates Across State Programs

Loan limits and interest rates vary significantly among state programs. Some states may offer lower interest rates than federal loans, while others might have higher limits, allowing students to borrow more. These variations often depend on the specific program, the student’s financial need, and the type of institution attended. It’s vital to compare the terms and conditions of different state programs before making borrowing decisions.

Comparison of Five State Student Loan Programs

The following table compares five different state student loan programs. Note that the information provided is for illustrative purposes and should not be considered exhaustive. Always consult the official program websites for the most up-to-date and accurate information.

| State | Program Name | Loan Type | Eligibility Criteria (Summary) | Approximate Interest Rate (Example) | Approximate Loan Limit (Example) |

|---|---|---|---|---|---|

| California | Cal Grant | Grant (Not a loan) | California residency, financial need, academic progress | N/A (Grant) | Varies based on need and program |

| New York | Tuition Assistance Program (TAP) | Grant (Not a loan) | New York residency, financial need, enrollment in eligible institution | N/A (Grant) | Varies based on need and enrollment |

| Florida | Florida Student Assistance Grant (FSAG) | Grant (Not a loan) | Florida residency, financial need, enrollment in eligible institution | N/A (Grant) | Varies based on need and enrollment |

| Texas | Texas Grant Program | Grant (Not a loan) | Texas residency, financial need, enrollment in eligible institution | N/A (Grant) | Varies based on need and enrollment |

| Pennsylvania | Pennsylvania State Grant | Grant (Not a loan) | Pennsylvania residency, financial need, enrollment in eligible institution | N/A (Grant) | Varies based on need and enrollment |

Impact of Lifetime Loan Limits on Borrowing Decisions

Lifetime limits on federal student loans significantly impact borrowing decisions, potentially altering educational paths and long-term financial stability. Understanding these limitations and exploring alternative financing options is crucial for students aiming for higher education. Reaching these limits can create considerable financial strain and necessitate careful planning.

Reaching lifetime loan limits presents several challenges for students. The most immediate consequence is the inability to borrow additional funds to cover educational expenses, potentially forcing students to curtail their studies, change their educational plans, or take on a heavier burden of personal savings and alternative financing. This can lead to increased stress and uncertainty regarding their future career prospects. Delayed graduation or an inability to complete a chosen program are also real possibilities.

Consequences of Reaching Lifetime Loan Limits

Reaching the maximum loan amount can lead to a variety of negative consequences. Students might be forced to reduce their course load, extend their time to graduation, or even withdraw from their program entirely. This can result in lost income potential and increased overall costs due to prolonged education. Furthermore, students might be forced to accept less desirable employment opportunities to manage their debt burden immediately after graduation. The inability to pursue further education, such as graduate studies, is another potential long-term consequence. For example, a student aiming for a medical degree might find their career aspirations significantly hampered by insufficient funding after exhausting their undergraduate loan limits.

Alternative Financing Options

Students who have reached their federal loan limits need to explore alternative financing options. These include private student loans, which often come with higher interest rates and less favorable repayment terms. Scholarships and grants, awarded based on merit or financial need, can significantly reduce reliance on loans. Part-time employment during the academic year and full-time employment during breaks can supplement income and lessen the borrowing requirement. Family contributions, if available, can also alleviate the financial burden. Finally, exploring income share agreements, where investors provide funding in exchange for a percentage of future earnings, represents a relatively new but potentially viable alternative.

Hypothetical Scenario: Impact on Financial Planning

Consider Sarah, a student pursuing a four-year degree in engineering. She diligently planned her finances and maximized her federal student loan eligibility each year. However, after three years, she discovers that her projected costs for her final year, including tuition, fees, and living expenses, exceed her remaining federal loan eligibility. Sarah faces a difficult choice. She could: 1) reduce her course load, extending her graduation date; 2) take on a part-time job, impacting her academic performance; 3) seek private loans, increasing her debt burden; or 4) consider a less expensive educational path. Each option presents significant trade-offs, highlighting the impact of reaching lifetime loan limits on financial planning. This situation underscores the importance of careful budgeting and proactive financial planning throughout one’s educational journey.

Impact on Students in Different Fields of Study

The impact of lifetime loan limits varies depending on the field of study. Students pursuing expensive programs like medicine, law, or dentistry, which often require extensive schooling and higher tuition fees, are disproportionately affected. These programs often necessitate significant borrowing, and reaching the lifetime limit can severely hinder their ability to complete their education. Conversely, students in less expensive fields might find that their loan limits are sufficient, although careful budgeting remains crucial. The cost of education in a specific field, combined with the student’s individual circumstances and financial planning, will determine the overall impact of the lifetime loan limits.

Factors Affecting Student Loan Eligibility and Amounts

Securing student loans involves a multifaceted process where lenders assess various factors to determine eligibility and loan amounts. Understanding these factors is crucial for prospective borrowers to navigate the application process effectively and increase their chances of approval. This section will detail the key elements lenders consider, highlighting the roles of credit history, co-signers, and income in shaping loan outcomes.

Credit History’s Influence on Loan Approval

A strong credit history significantly impacts loan eligibility and the interest rates offered. Lenders view a positive credit history – characterized by consistent on-time payments and low credit utilization – as an indicator of responsible financial behavior. Individuals with limited or damaged credit histories may find it more challenging to secure loans, potentially facing higher interest rates or needing a co-signer. Conversely, a good credit score can lead to more favorable loan terms, including lower interest rates and potentially higher loan amounts. For example, a student with an excellent credit score might qualify for a lower interest rate on a private loan compared to a student with a fair credit score. This difference can translate into substantial savings over the loan repayment period.

The Role of Co-signers in Loan Applications

Co-signers act as guarantors, sharing responsibility for loan repayment. Their creditworthiness becomes a crucial factor in the loan approval process. If the primary borrower (the student) lacks a sufficient credit history or has a low credit score, a co-signer with a strong credit history can significantly improve the chances of loan approval and potentially secure better interest rates. The lender assesses the co-signer’s creditworthiness alongside the borrower’s, considering their income and debt-to-income ratio. However, it is important to remember that co-signing involves a significant commitment for the co-signer, as they become liable for the loan’s repayment if the borrower defaults.

Income’s Impact on Loan Approval and Amounts

Lenders consider the borrower’s and co-signer’s income to assess their ability to repay the loan. A stable income demonstrates a capacity to manage monthly payments, increasing the likelihood of approval. Higher income generally allows for larger loan amounts, as lenders feel more confident in the borrower’s ability to handle the debt. The debt-to-income ratio (DTI), which compares total debt to gross income, is a key metric used in this assessment. A lower DTI suggests a greater capacity to manage additional debt, making the borrower a more attractive candidate for a larger loan. Conversely, a high DTI might limit the loan amount or even lead to rejection.

Federal vs. Private Student Loan Application Processes

The application processes for federal and private student loans differ significantly. Federal student loans are typically processed through the Free Application for Federal Student Aid (FAFSA), requiring the completion of a standardized application form providing information about the student’s financial situation and academic plans. This process involves a review of the student’s eligibility based on their financial need and enrollment status. Private student loans, on the other hand, involve a more direct application to a private lender, often requiring a credit check, verification of income, and sometimes a co-signer. Private lenders assess the borrower’s creditworthiness and financial capacity independently, resulting in a more individualized assessment process.

Federal Student Loan Application Flowchart

The steps involved in applying for federal student loans can be visualized in a flowchart:

[Imagine a flowchart here. The flowchart would begin with “Complete the FAFSA,” branching to “FAFSA processed,” then to “Financial aid offer received,” with further branches showing options like “Accept offer,” “Appeal decision,” “Reject offer,” and finally leading to “Loan disbursement.”] The flowchart visually depicts the sequential steps, from completing the FAFSA to receiving loan disbursement. Each step requires specific actions and documentation, and the entire process can take several weeks.

Repayment Options and Strategies for High Loan Balances

Managing significant student loan debt requires a proactive approach and a thorough understanding of available repayment options. Choosing the right strategy can significantly impact your long-term financial health, affecting everything from your ability to save for a down payment on a house to your retirement planning. This section Artikels various repayment plans and strategies to help navigate the complexities of high student loan balances.

Available Student Loan Repayment Plans

Several repayment plans cater to different financial situations and income levels. Understanding these options is crucial for selecting the most suitable plan based on individual circumstances. The most common plans include Standard Repayment, Extended Repayment, Graduated Repayment, and Income-Driven Repayment (IDR) plans. Each plan differs in its monthly payment amount, loan term, and overall repayment cost.

Strategies for Managing High Student Loan Debt

Effective management of high student loan debt necessitates a multifaceted approach. This includes creating a detailed budget to track income and expenses, identifying areas for potential savings, and exploring debt consolidation options. Budgeting allows for a clear picture of available funds for loan repayment, while debt consolidation can simplify repayment by combining multiple loans into a single, potentially lower-interest loan.

Impact of Repayment Plans on Long-Term Financial Health

The choice of repayment plan directly influences long-term financial well-being. Income-Driven Repayment plans, for instance, offer lower monthly payments but may extend the repayment period, leading to higher overall interest costs. Conversely, Standard Repayment plans involve higher monthly payments but a shorter repayment period, resulting in less interest paid over the loan’s lifetime. Careful consideration of these trade-offs is essential for making informed decisions.

Impact of Interest Rates and Loan Terms on Total Repayment Costs

Interest rates and loan terms significantly affect the total cost of repayment. A higher interest rate increases the overall amount paid over the life of the loan, even with the same principal amount. Longer loan terms result in lower monthly payments but increase the total interest paid due to the extended repayment period. For example, consider two loans of $30,000: one with a 5% interest rate and a 10-year term, and another with a 7% interest rate and a 15-year term. The lower interest rate and shorter term loan will have a significantly lower total repayment cost despite higher monthly payments. A sample calculation using a loan amortization calculator (easily found online) would clearly demonstrate this difference. For instance, the 5% loan would result in approximately $34,000 total repayment, while the 7% loan could reach almost $45,000. This illustrates the considerable impact of interest rates and loan terms on the overall cost.

The Role of Financial Aid and Scholarships in Reducing Loan Burdens

Securing financial aid and scholarships is crucial for mitigating the need to borrow heavily for higher education. These funds can significantly reduce or even eliminate student loan debt, easing the financial burden on students and their families throughout and after their college years. By strategically pursuing these opportunities, students can pave the way for a more financially stable future.

Financial aid and scholarships provide essential support to students pursuing higher education, enabling them to focus on their studies rather than solely on financing their education. They offer a range of funding options, including need-based and merit-based awards, grants, and scholarships from various sources, ultimately reducing reliance on loans and minimizing long-term debt. This access to financial support directly impacts affordability and accessibility to higher education, opening doors to opportunities that might otherwise be unattainable.

Resources for Finding and Applying for Financial Aid and Scholarships

Numerous resources exist to assist students in locating and applying for financial aid and scholarships. The Free Application for Federal Student Aid (FAFSA) is a primary gateway, providing access to federal grants, loans, and work-study programs. State-level financial aid programs also offer valuable funding opportunities, often with specific eligibility requirements. Colleges and universities themselves typically provide significant financial aid packages, combining grants, scholarships, and loans tailored to individual student needs. Beyond institutional aid, private organizations, corporations, and community groups offer a wide array of scholarships based on various criteria, such as academic merit, extracurricular achievements, and demonstrated financial need. Online scholarship search engines can help students efficiently navigate these diverse resources. Utilizing these resources effectively can significantly improve a student’s chances of securing substantial financial support.

Benefits of Need-Based and Merit-Based Financial Assistance

Need-based financial aid is awarded based on a student’s demonstrated financial need, as determined through the FAFSA or similar applications. This type of aid helps ensure that students from low-income backgrounds have access to higher education. The benefits are significant, as it directly addresses financial barriers and promotes educational equity. Conversely, merit-based financial aid recognizes academic achievement, talent, or other exceptional qualities. These awards incentivize academic excellence and can provide significant financial support, often supplementing need-based aid or reducing loan amounts. Both need-based and merit-based aid play crucial roles in making higher education more accessible and affordable. For example, a Pell Grant is a need-based grant, while a scholarship awarded for academic excellence is merit-based.

Types of Financial Aid

The following table summarizes different types of financial aid available to students:

| Type of Aid | Source | Basis for Award | Example |

|---|---|---|---|

| Grants | Federal, State, Institutional | Financial need, merit, or specific criteria | Pell Grant, institutional grants |

| Scholarships | Private organizations, corporations, institutions | Merit, talent, demographics, or specific criteria | Academic scholarships, athletic scholarships |

| Loans | Federal, private | Creditworthiness (often co-signed), financial need (for some federal loans) | Federal Stafford Loan, private student loan |

| Work-Study | Federal program | Financial need | Part-time job on campus or related to field of study |

Final Review

Successfully managing student loan debt requires proactive planning and a thorough understanding of available resources. By carefully considering lifetime borrowing limits, exploring alternative funding options, and implementing effective repayment strategies, students can mitigate financial risk and pave the way for a secure financial future. Remember, responsible borrowing and diligent financial planning are essential components of a successful educational journey.

FAQ Insights

What happens if I exceed my lifetime loan limit?

You will be unable to borrow additional federal student loans. You may need to explore alternative financing options, such as private loans (though these often come with higher interest rates), scholarships, or grants.

Are there exceptions to lifetime loan limits?

While exceptions are rare, certain extenuating circumstances might allow for increased borrowing. Contact your loan servicer or the relevant federal agency to inquire about potential exceptions.

How are lifetime loan limits calculated?

The calculation depends on the type of loan (undergraduate, graduate, PLUS), your dependency status, and the loan program. The total amount borrowed across all eligible loan programs throughout your education is considered.

Can I refinance my student loans to lower my monthly payments?

Yes, refinancing can potentially lower your monthly payments and interest rate, but it often involves private lenders and may eliminate federal protections.