Securing a low interest rate on student loans can significantly impact a borrower’s financial future. This impacts not only immediate repayment costs but also long-term financial stability. Understanding the factors influencing these rates—government policies, lender practices, and available repayment strategies—is crucial for navigating the complexities of student loan debt.

This exploration delves into the multifaceted world of low-interest student loans, examining the interplay between government regulations, private sector involvement, and the various repayment options available to borrowers. We’ll analyze how these factors combine to shape both the immediate and long-term financial consequences for students and graduates.

Impact of Low Student Loan Interest Rates on Borrowers

Low student loan interest rates offer significant financial advantages to borrowers, impacting both their immediate finances and their long-term debt repayment strategies. Understanding these impacts is crucial for effective financial planning and maximizing the benefits of a favorable interest rate environment.

Immediate Financial Benefits

Lower interest rates translate directly into lower monthly payments. This immediate reduction in the amount owed each month frees up cash flow for other essential expenses like housing, food, transportation, and even savings. Borrowers can allocate these savings towards reducing other debts, building an emergency fund, or investing for the future. The immediate relief provided by lower payments can significantly reduce financial stress and improve overall financial well-being.

Long-Term Implications of Lower Interest Payments

The long-term impact of lower interest rates is a substantial reduction in the total amount of interest paid over the life of the loan. This means borrowers pay less in interest charges, resulting in a lower overall cost of borrowing. This significant savings can have a profound effect on a borrower’s long-term financial health, allowing for earlier debt repayment, increased savings, and greater financial flexibility in the future. For example, a borrower with a $50,000 loan at 5% interest will pay significantly less in total interest than a borrower with the same loan amount at 7% interest.

Comparison of Total Interest Paid Under Various Low-Interest Scenarios

The total interest paid is heavily influenced by the interest rate. Consider three scenarios for a $30,000 loan over a 10-year repayment period: a 3% interest rate, a 4% interest rate, and a 5% interest rate. While a seemingly small difference in interest rates might appear insignificant, the cumulative effect over the loan’s lifespan is considerable. At 3%, the total interest paid might be approximately $4,000; at 4%, it might rise to around $6,000; and at 5%, it could exceed $8,000. These figures are illustrative and will vary based on loan terms and repayment plans. The crucial takeaway is that even small reductions in interest rates can result in substantial savings over the long term.

Budgeting Strategies Leveraging Low-Interest Rates

Borrowers should actively utilize the extra cash flow provided by lower monthly payments. A practical approach is to create a detailed budget, allocating a portion of the savings towards accelerated loan repayment to further reduce the total interest paid. Another effective strategy is to allocate a portion of the savings to build an emergency fund, creating a financial safety net for unexpected expenses. Finally, investing a portion of the savings can help build long-term wealth.

Comparison of Repayment Plans and Their Impact Under Low-Interest Conditions

| Repayment Plan | Monthly Payment (Example: $30,000 loan) | Total Interest Paid (Example) | Loan Repayment Time |

|---|---|---|---|

| Standard Repayment | $300 (Illustrative) | $4,000 (Illustrative at 3% interest) | 10 years |

| Graduated Repayment | Starts low, increases gradually (Illustrative) | $4,500 (Illustrative at 3% interest) | 10 years |

| Income-Driven Repayment (IBR) | Based on income (Illustrative) | $5,000 (Illustrative at 3% interest) | 20-25 years |

| Accelerated Repayment | Higher monthly payments (Illustrative) | $3,000 (Illustrative at 3% interest) | 5 years |

*Note: These figures are for illustrative purposes only and actual amounts will vary based on individual loan terms, interest rates, and income levels.*

Government Policies and Low Interest Rates for Student Loans

Government intervention in student loan interest rates stems from a multifaceted rationale focused on ensuring access to higher education and promoting economic growth. Lowering interest rates makes borrowing more affordable, thereby increasing the number of students pursuing higher education and potentially boosting the skilled workforce. This, in turn, can lead to greater economic productivity and innovation.

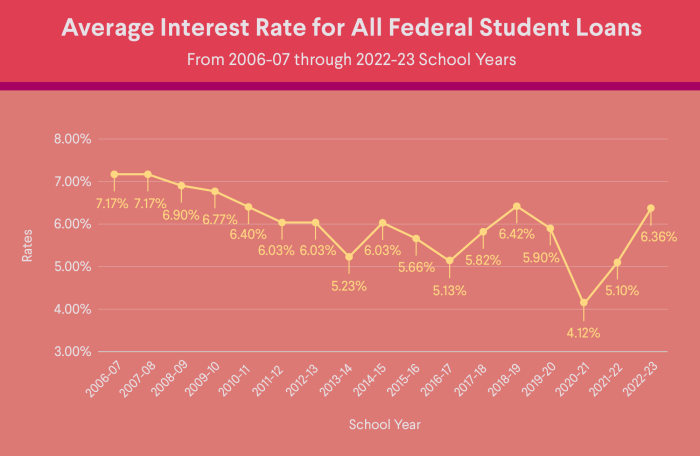

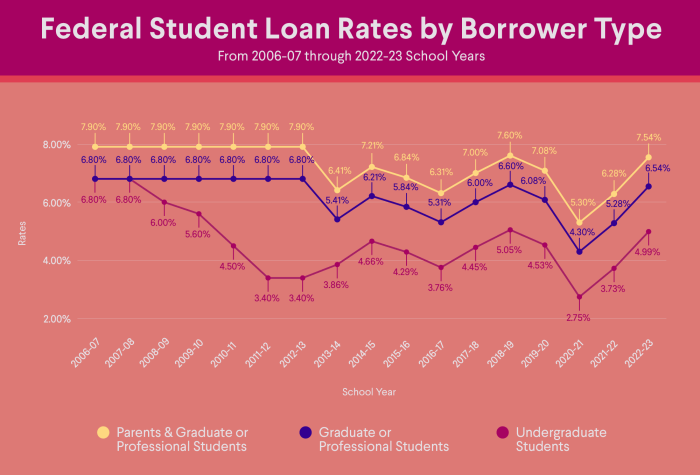

The decision-making process regarding student loan interest rate adjustments is influenced by a complex interplay of economic factors. Inflation rates, overall economic growth, the federal budget deficit, and the prevailing market interest rates all play a significant role. For example, during periods of high inflation, the government might be hesitant to lower interest rates on student loans, as it could exacerbate inflationary pressures. Conversely, during economic downturns, lowering rates can stimulate demand and support economic recovery.

Economic Factors Influencing Interest Rate Adjustments

Several key economic indicators shape government decisions. The unemployment rate, for instance, is closely monitored. High unemployment might lead to policies favoring lower interest rates to encourage education and workforce development. Similarly, projections for future economic growth are crucial. A forecast of strong growth might allow for less aggressive interest rate reductions, while a pessimistic outlook could justify more substantial interventions. Furthermore, the overall health of the federal budget directly impacts the government’s ability and willingness to subsidize student loan interest rates. Large budget deficits might constrain the government’s capacity to implement expansive loan programs with low interest rates.

Historical Examples of Government Policy Impact

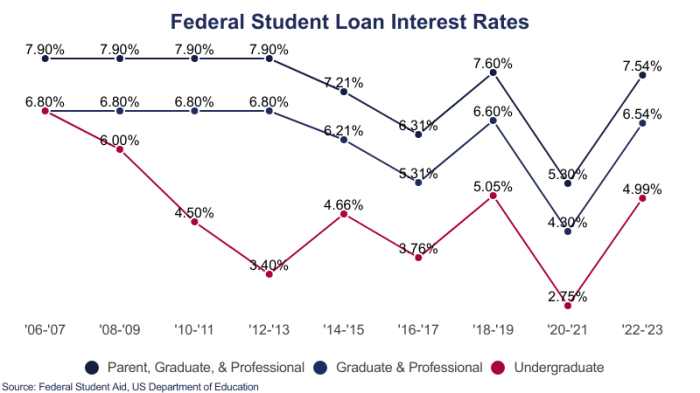

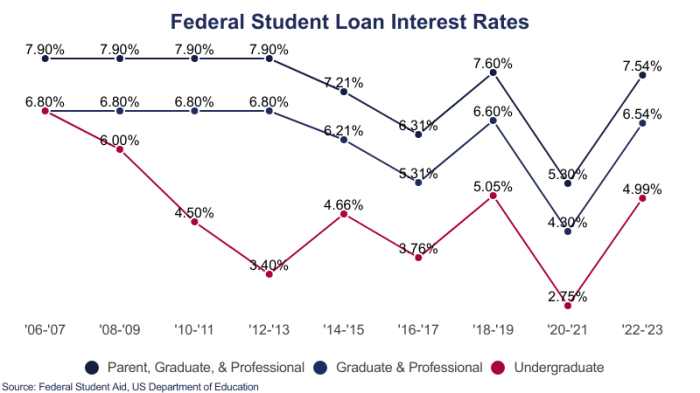

The history of US student loan interest rates reveals several instances of significant policy shifts. For example, the creation of the Federal Family Education Loan Program (FFELP) in the 1960s represented a major expansion of government involvement in student lending. While FFELP initially relied on private lenders, the government played a significant role in setting interest rate guidelines and providing loan guarantees. The subsequent shift towards the Direct Loan program, which eliminated the involvement of private lenders, significantly altered the government’s control over interest rates. More recently, the various temporary interest rate freezes and reductions implemented in response to economic crises, such as the Great Recession, showcase the government’s willingness to use student loan interest rates as a tool for economic stimulus.

Political Considerations Affecting Interest Rate Changes

Political considerations significantly influence student loan interest rate decisions. Interest rates are often a subject of partisan debate, with differing views on the appropriate level of government intervention. The perceived impact on student voters and the broader electorate plays a crucial role. For example, lowering interest rates might be politically advantageous during election cycles, while raising them could be a necessary but unpopular fiscal measure. The influence of lobbying groups representing students, higher education institutions, and lenders also shapes the political landscape surrounding these policies. Furthermore, the overall political climate and the prevailing priorities of the administration in power can dramatically influence the approach to student loan interest rate policies.

Timeline of Significant Policy Shifts

A timeline illustrating key policy shifts would highlight specific legislative actions and their impact. For example, the year 2007 saw the implementation of several reforms aimed at simplifying the student loan system and increasing access. The subsequent years witnessed several instances of interest rate adjustments, both increases and decreases, often reflecting the fluctuating economic conditions. The passage of the Health Care and Education Reconciliation Act of 2010 marked a significant shift towards the direct lending program, granting the government more direct control over interest rates. Subsequent years have seen periods of fixed interest rates, temporary rate reductions, and periods of fluctuating rates influenced by market conditions and economic policy. This timeline would also incorporate the various legislative attempts to address the growing student loan debt crisis, highlighting the ongoing interplay between economic and political factors in shaping student loan interest rate policies.

The Role of Lenders and the Private Sector

The private sector plays a significant, albeit often smaller, role in the student loan market, particularly when it comes to offering low-interest options. While government-backed loans dominate the landscape, private lenders offer a competitive alternative for some borrowers, influencing overall market dynamics and interest rate trends. Understanding their involvement is crucial to comprehending the full picture of student loan financing.

Private sector participation in student loan markets involves various financial institutions, including banks, credit unions, and specialized student loan providers. These entities offer loans directly to students, often with interest rates that fluctuate based on market conditions and the borrower’s creditworthiness. Unlike government loans, which often have fixed interest rates or rates capped at a certain level for a specified time, private loans tend to be more dynamic.

Private and Government Lender Terms and Conditions

Government and private student loan programs differ substantially in their terms and conditions. Government loans, such as those offered through the Federal Student Aid program in the United States, typically feature more favorable terms for borrowers, including lower interest rates, flexible repayment options, and various deferment and forbearance programs designed to accommodate financial hardship. Private loans, on the other hand, often demand higher credit scores, require co-signers in many cases, and may carry higher interest rates and less flexible repayment plans. The repayment terms, including the loan term length and associated monthly payments, will also vary significantly depending on the lender and the borrower’s profile. For example, a government loan might offer a longer repayment period at a lower interest rate than a comparable private loan, leading to lower overall payments but potentially a higher total interest paid over the life of the loan.

Lender Risk Assessment Methods for Low-Interest Loans

Private lenders employ rigorous risk assessment methods to determine eligibility for low-interest student loans. These methods typically involve a thorough review of the applicant’s credit history, credit score, debt-to-income ratio, and educational background. Lenders assess the likelihood of loan repayment based on these factors. A higher credit score and a lower debt-to-income ratio generally indicate a lower risk of default, potentially qualifying the borrower for a lower interest rate. Additionally, the applicant’s chosen field of study and projected earning potential might also influence the lender’s decision and the offered interest rate. For example, a student pursuing a high-demand profession might receive a more favorable interest rate than a student in a field with lower earning potential.

Impact of Low Interest Rates on Lender Profitability

Lower interest rates directly impact lender profitability. While a high volume of loans at low interest rates can generate substantial revenue, the reduced interest margin per loan decreases the overall profit margin for each individual loan. Lenders compensate for this by increasing loan volume or by adjusting other fees associated with the loan, such as origination fees or late payment penalties. The challenge for lenders lies in balancing the need to attract borrowers with the need to maintain a profitable business model. A strategy might involve offering tiered interest rates based on risk assessment, allowing the lender to balance risk and return.

Hypothetical Scenario: Government Policy and Private Lending Interaction

Imagine a scenario where the government implements a new program offering substantial loan forgiveness for borrowers in specific high-demand fields after a certain number of years of repayment. This policy would incentivize private lenders to offer more competitive interest rates to attract borrowers in those fields, as the risk of default is mitigated by the government’s loan forgiveness program. This would lead to a decrease in the interest rates offered by private lenders for those students, creating a more favorable lending environment for borrowers while potentially increasing the overall volume of private student loans in those specific fields. This demonstrates the interplay between government policies and the behavior of private sector lenders in the student loan market. Conversely, a policy that reduces government subsidies or increases regulations could cause private lenders to increase interest rates or become more selective in their lending practices.

Student Loan Repayment Strategies in a Low-Interest Environment

Low interest rates on student loans present a significant opportunity to accelerate repayment and minimize overall interest paid. However, navigating the various repayment options and strategies requires careful planning and understanding of your individual financial situation. This section Artikels several strategies to effectively manage your student loan debt in a low-interest rate environment.

Standard Repayment Strategies for Low-Interest Loans

A low interest rate allows for aggressive repayment strategies. The standard repayment plan, typically a 10-year plan, is often the most straightforward approach. However, with low interest, consider increasing your monthly payment beyond the minimum. This will significantly reduce the total interest paid and shorten the loan repayment period. For example, a $30,000 loan at 3% interest with a 10-year repayment plan would have a monthly payment of approximately $300. Increasing that payment by even $50 a month would save thousands of dollars in interest and pay off the loan several years earlier.

Loan Refinancing Options: A Step-by-Step Guide

Refinancing your student loans can potentially lower your interest rate even further, saving you money over the life of the loan. However, it’s crucial to compare offers from multiple lenders before making a decision.

- Check your credit score: Lenders use credit scores to determine your eligibility and interest rate. A higher credit score typically leads to better terms.

- Gather your loan information: Collect details on your existing loans, including balances, interest rates, and lenders.

- Compare refinancing offers: Shop around and compare rates, fees, and repayment terms from different lenders. Consider both fixed and variable rate options, weighing the stability of a fixed rate against the potential savings of a variable rate in a low-interest environment.

- Read the fine print carefully: Pay close attention to any fees associated with refinancing, such as origination fees or prepayment penalties.

- Choose the best option: Select the refinance loan that offers the lowest interest rate and most favorable terms.

- Complete the application process: Follow the lender’s instructions to finalize the refinancing process.

Managing Multiple Student Loans with Varying Interest Rates

Borrowers often have multiple student loans with different interest rates. Prioritize paying down loans with the highest interest rates first, even if the balance is smaller. This strategy, known as the avalanche method, minimizes the total interest paid over the life of the loans. For example, aggressively paying down a high-interest private loan before focusing on a lower-interest federal loan will yield significant savings.

Income-Driven Repayment Plans: Benefits and Drawbacks

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. While they offer lower monthly payments, they may extend the repayment period, leading to potentially higher total interest paid over time. The benefit is affordability in the short term, while the drawback is potentially paying more overall. For instance, a borrower with a low income might find an IDR plan manageable, but the longer repayment period could result in paying significantly more in interest compared to a standard repayment plan.

Key Considerations for Choosing a Repayment Plan

Before selecting a repayment plan, carefully consider the following:

- Your current income and expenses

- Your long-term financial goals

- The interest rates on your loans

- The total amount of interest you’ll pay under different plans

- The length of the repayment period

- The potential impact on your credit score

Illustrative Scenarios

Understanding the impact of low interest rates on student loan borrowers requires examining various scenarios. The effect isn’t uniform; it depends heavily on individual circumstances, loan amounts, repayment plans, and financial discipline.

Unexpectedly Low Interest Rates Benefitting a Borrower

Consider Sarah, a recent graduate with $50,000 in federal student loans. She initially anticipated a 6% interest rate, budgeting accordingly. However, due to unforeseen economic shifts, the interest rate dropped to 2%. This unexpected decrease significantly reduced her monthly payments and total interest paid over the life of the loan. The lower interest rate allowed her to accelerate her repayment or allocate more funds towards other financial goals like saving for a down payment on a house or investing. The reduced financial burden significantly improved her overall financial well-being.

Strategic Decision-Making Based on Low Interest Rates

John, also a recent graduate, had $75,000 in student loan debt. Faced with low interest rates, he strategically chose to consolidate his various loans into a single federal loan with the lowest possible interest rate. This simplified his repayment process, providing a clearer picture of his debt and allowing him to focus his repayment efforts on a single payment. He also opted for an income-driven repayment plan, minimizing his monthly payments while taking advantage of the lower interest rate to reduce the total interest accrued over time. His proactive approach minimized his financial risk and maximized the benefits of the low-interest environment.

Struggling with Repayment Despite Low Interest Rates

Despite historically low interest rates, Maria, burdened with $100,000 in student loan debt from a private lender and facing unexpected job loss, struggled with repayment. While the lower interest rate reduced her monthly payment somewhat, it was not enough to offset her reduced income. She fell behind on payments, accumulating late fees and potentially impacting her credit score. This scenario highlights that low interest rates alone cannot solve the challenges faced by borrowers with high debt burdens or unexpected life events. Access to financial aid, hardship programs, or effective budgeting strategies become critical for such borrowers.

Impact of Fluctuating Interest Rates on Total Loan Repayment

Imagine a bar graph representing total loan repayment over time. The horizontal axis represents the years of repayment, and the vertical axis represents the total amount repaid (principal + interest). One bar shows repayment under a consistently low 3% interest rate. This bar shows a relatively lower total repayment amount. A second bar represents repayment under a scenario with fluctuating interest rates—starting low at 3%, rising to 5% mid-repayment, and then dropping back to 4% in the final years. This bar is noticeably taller, reflecting a significantly higher total repayment due to the periods of higher interest. A third bar illustrates a scenario with consistently high interest rates (e.g., 7%), demonstrating the highest total repayment amount. The visual difference between the bars clearly illustrates how even seemingly small fluctuations in interest rates can significantly impact the overall cost of borrowing.

Final Review

Ultimately, securing and managing low-interest student loans requires a proactive and informed approach. By understanding the government’s role, lender practices, and available repayment strategies, borrowers can navigate the complexities of student loan debt and pave the way for a more financially secure future. Careful planning and a strategic approach to repayment are essential to maximizing the benefits of low interest rates and minimizing long-term financial burden.

FAQ Section

What is the difference between subsidized and unsubsidized student loans?

Subsidized loans don’t accrue interest while you’re in school (under certain conditions), whereas unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it often involves consolidating multiple loans into a new one with a private lender. Carefully compare offers and consider the implications before refinancing.

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score and lead to late fees, collection efforts, and potentially even default on the loan.

Are there any programs to help with student loan repayment?

Yes, several income-driven repayment plans adjust your monthly payments based on your income and family size. Explore options like ICR, PAYE, REPAYE, andIBR to determine what best suits your situation.