Navigating the world of private student loans can feel overwhelming. With a myriad of lenders offering diverse terms and conditions, choosing the right loan can significantly impact your financial future. This guide provides a comprehensive comparison of private student loans, helping you make informed decisions and avoid potential pitfalls. We’ll explore key factors like interest rates, repayment options, and hidden fees, empowering you to secure the best possible financing for your education.

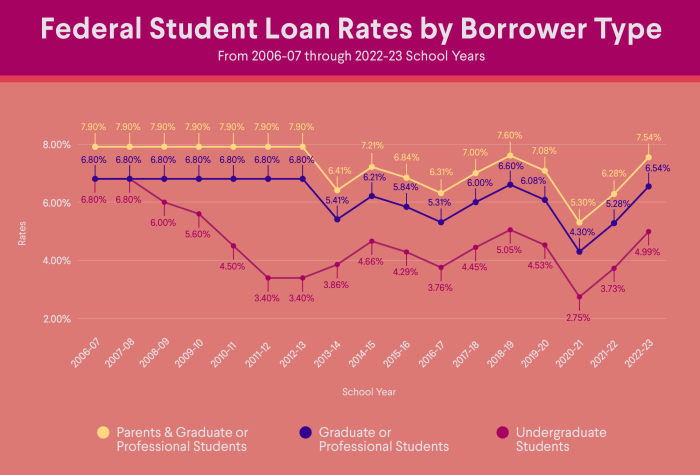

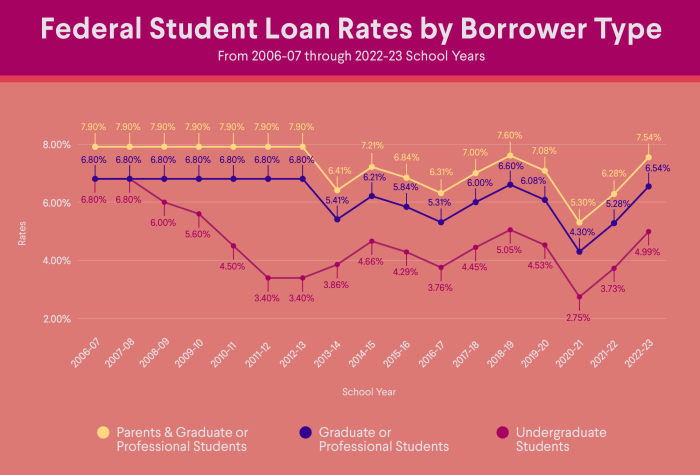

Understanding the differences between federal and private loans is crucial. Federal loans often offer more flexible repayment plans and borrower protections, while private loans may have higher interest rates and stricter eligibility requirements. This comparison will delve into these nuances, examining the pros and cons of each to help you determine which loan type aligns best with your individual circumstances and financial goals.

Understanding Private Student Loan Basics

Private student loans can be a crucial funding source for higher education, but understanding their nuances is vital before borrowing. They differ significantly from federal loans, impacting your repayment and overall financial health. This section clarifies the key distinctions and provides a comparison to help you make informed decisions.

Private student loans are offered by banks, credit unions, and other private financial institutions, unlike federal student loans which are backed by the government. They often come with varying interest rates, repayment terms, and fees, making direct comparison crucial for finding the best option for your circumstances.

Types of Private Student Loans

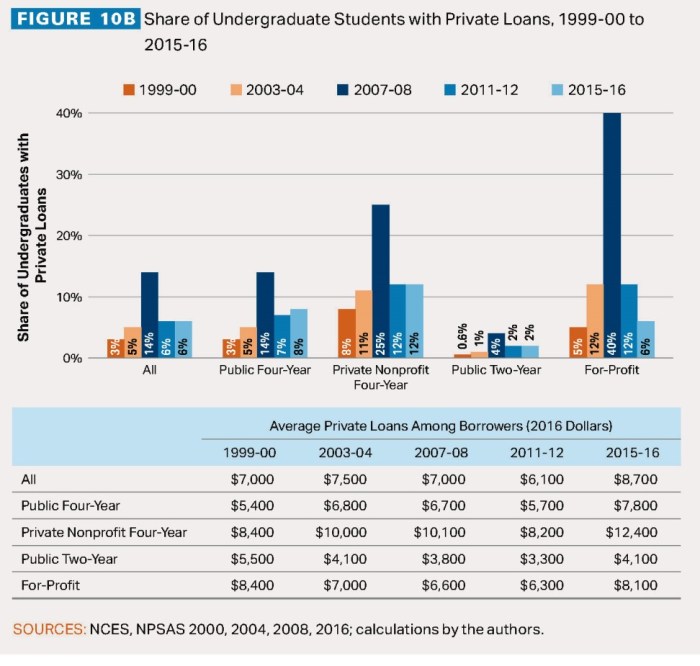

Private student loans generally fall into two main categories: undergraduate and graduate loans. Undergraduate loans are designed to help students finance their bachelor’s degrees, while graduate loans are specifically for those pursuing master’s, doctoral, or professional degrees. Some lenders also offer loans for specific programs or fields of study. It’s important to note that eligibility criteria, interest rates, and repayment terms can vary depending on the type of loan. Additionally, some lenders may offer loans for specific educational expenses, such as tuition, fees, room and board, or books.

Key Features of Federal vs. Private Student Loans

Federal student loans generally offer more borrower protections than private loans. Federal loans often have fixed interest rates, income-driven repayment plans, and deferment options in case of financial hardship. Private loans, conversely, usually have variable interest rates, which can fluctuate over time, making repayment less predictable. Furthermore, private lenders typically require a creditworthy co-signer, particularly for students with limited or no credit history. Federal loans, however, often have more flexible eligibility requirements.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally fixed; lower than private loans | Variable or fixed; typically higher than federal loans |

| Repayment Terms | Standard 10-year repayment, but income-driven repayment plans are available | Vary by lender; typically 10-15 years, but can be longer |

| Fees | Generally lower or no origination fees | Origination fees, late payment fees, and other fees may apply |

| Credit Check | Usually not required for subsidized loans; credit check may be required for unsubsidized loans | Credit check is typically required; a co-signer may be needed |

| Deferment/Forbearance | Options available under specific circumstances | Limited or no options; depends on the lender |

| Borrower Protections | Strong borrower protections and government oversight | Fewer borrower protections; relies on lender policies |

Private Lender Comparison Table

This table provides a simplified comparison and should not be considered exhaustive. Actual rates and terms are subject to change based on individual creditworthiness and lender policies. Always check with the lender directly for the most up-to-date information.

| Lender | Interest Rate (Example – Variable) | Repayment Terms (Example) | Fees (Example) |

|---|---|---|---|

| Lender A | 7.5% – 12% | 5-15 years | Origination fee: 1-3% |

| Lender B | 6.0% – 10% | 10-20 years | Origination fee: 0-2% |

| Lender C | 8.0% – 13% | 7-12 years | Origination fee: 2-4% |

Factors Influencing Loan Selection

Choosing the right private student loan involves careful consideration of several key factors. Understanding these elements will help you secure the most favorable loan terms and minimize potential financial burdens. This section explores the critical aspects influencing your loan selection process.

Credit Score’s Impact on Loan Eligibility and Interest Rates

Your credit score plays a pivotal role in determining your eligibility for a private student loan and the interest rate you’ll receive. Lenders use your credit score to assess your creditworthiness – essentially, your ability to repay the loan. A higher credit score generally indicates lower risk to the lender, resulting in more favorable loan terms, including lower interest rates and potentially higher loan amounts. Conversely, a lower credit score may lead to loan denial or significantly higher interest rates, making repayment more expensive. For example, a borrower with a credit score above 750 might qualify for an interest rate of 6%, while a borrower with a score below 600 might face an interest rate exceeding 10%, significantly increasing the total cost of the loan over its lifetime.

The Importance of Co-signers in Securing a Loan

If you lack a strong credit history or have a low credit score, a co-signer can be instrumental in securing a private student loan. A co-signer is an individual with good credit who agrees to share responsibility for repaying the loan. Their excellent credit history essentially guarantees the lender that the loan will be repaid, even if the primary borrower (the student) encounters difficulties. This significantly increases the chances of loan approval and can often lead to more favorable interest rates. However, it’s crucial to remember that a co-signer assumes significant financial risk, so this decision should be made carefully and with open communication between the student and the co-signer.

Key Factors to Consider When Choosing a Private Student Loan Lender

Selecting the right lender is crucial. Students should compare offers from multiple lenders, focusing on factors like interest rates, fees, repayment terms, and customer service. Consider lenders’ reputation and customer reviews before committing to a loan. A lower interest rate might seem appealing, but high fees or inflexible repayment options could negate the initial savings. Additionally, researching lenders’ customer service reputation is vital; a responsive and helpful lender can make navigating the loan process significantly smoother. It’s advisable to compare offers side-by-side using a loan comparison tool or spreadsheet to ensure a thorough evaluation.

Potential Hidden Fees Associated with Private Student Loans

It’s essential to be aware of potential hidden fees that can significantly impact the overall cost of your loan. These fees can vary among lenders, so careful review of the loan terms is crucial.

- Origination Fees: A one-time fee charged by the lender for processing the loan application.

- Late Payment Fees: Penalties imposed for missed or late loan payments.

- Prepayment Penalties: Fees charged for paying off the loan early.

- Returned Payment Fees: Fees assessed if a payment is returned due to insufficient funds.

- Default Fees: Significant penalties incurred if the loan goes into default.

Comparison of Major Lenders

Choosing a private student loan requires careful consideration of various factors. Understanding the offerings of different lenders is crucial to making an informed decision that aligns with your financial needs and repayment capabilities. This section compares three major private student loan providers, focusing on their loan features, customer service, and complaint resolution processes. Remember to always research independently and compare multiple lenders before committing to a loan.

Loan Offerings of Three Major Private Lenders

This section details the loan offerings of Discover, Sallie Mae, and Citizens Bank, three prominent private student loan providers. Each lender offers a range of loan products with varying features and benefits. It is essential to understand these differences to select the most suitable option.

| Lender | Interest Rates | Repayment Options | Customer Service |

|---|---|---|---|

| Discover | Variable and fixed rates available; rates vary based on creditworthiness and other factors. Competitive rates often advertised. | Standard repayment plans, as well as options for deferment and forbearance in certain circumstances. | Generally positive reviews; known for its user-friendly online platform and responsive customer service team. Complaint resolution processes are typically handled efficiently. |

| Sallie Mae | Offers both variable and fixed interest rates. Rates depend on creditworthiness, co-signer availability, and loan amount. | Provides a variety of repayment options, including graduated repayment, extended repayment, and income-driven repayment plans in certain situations. | Customer service experiences vary. While many report positive interactions, others have noted challenges in reaching representatives or resolving issues. Complaint resolution can sometimes be lengthy. |

| Citizens Bank | Interest rates are determined based on credit history and other factors. Rates are generally competitive with other major lenders. | Offers standard repayment plans, with the possibility of deferment and forbearance under specific conditions. | Customer service reviews are mixed. While some praise the bank’s accessibility and responsiveness, others have reported difficulties navigating the loan process or resolving complaints. |

Customer Service and Complaint Resolution

Effective customer service and a robust complaint resolution process are vital aspects of choosing a private student loan lender. A positive experience during the loan application, disbursement, and repayment phases can significantly reduce stress and uncertainty. Conversely, difficulties in accessing support or resolving complaints can create significant financial and emotional hardship.

The three lenders discussed above—Discover, Sallie Mae, and Citizens Bank—vary in their customer service reputation and complaint resolution procedures. While Discover generally receives positive feedback for its responsive customer service and efficient complaint resolution, Sallie Mae and Citizens Bank have experienced more mixed reviews. It’s important to research each lender’s specific policies and customer reviews before making a decision. Consider checking independent review sites and the Better Business Bureau for additional insights.

Repayment Options and Strategies

Understanding your repayment options is crucial for successfully managing your private student loans. Choosing the right plan can significantly impact your monthly payments and the total interest you pay over the life of the loan. This section will explore various repayment options and strategies to help you navigate this important process.

Private student loans typically offer a range of repayment options, differing primarily in interest rate type and payment schedule. Fixed interest rates remain constant throughout the loan term, providing predictable monthly payments. Variable interest rates, on the other hand, fluctuate based on market indices, leading to potentially lower initial payments but exposing borrowers to the risk of increased payments if interest rates rise. The choice between fixed and variable rates depends on individual risk tolerance and financial projections.

Fixed vs. Variable Interest Rates

A fixed interest rate provides stability and predictability. Your monthly payment will remain the same for the life of the loan, making budgeting easier. However, you may pay more in total interest compared to a variable rate loan, especially if interest rates decline during the repayment period. A variable interest rate offers the potential for lower initial payments, but your monthly payment can increase or decrease depending on market fluctuations. This uncertainty can make budgeting more challenging. For example, a borrower with a $50,000 loan at a 7% fixed rate will have a different monthly payment than a borrower with the same loan amount at a 5% variable rate that could increase to 7% in the future.

Repayment Plan Examples and Their Impact

Different repayment plans significantly affect the total cost of your loan. Standard repayment plans typically involve fixed monthly payments over a set period (e.g., 10-15 years). Extended repayment plans stretch the repayment period, lowering monthly payments but increasing the total interest paid. Interest-only repayment plans allow borrowers to pay only the interest for a specific period, deferring principal repayment. However, this strategy ultimately leads to a larger principal balance and higher overall interest costs. For instance, a 10-year repayment plan will result in higher monthly payments but lower total interest compared to a 20-year plan for the same loan amount.

Strategies for Effective Student Loan Debt Management

Effective student loan debt management requires a proactive approach. Creating a detailed budget is crucial to track income and expenses, ensuring sufficient funds for loan payments. Prioritizing high-interest loans for repayment can save money on interest charges over time. Exploring options like refinancing or debt consolidation can potentially lower interest rates and simplify payments. Additionally, maintaining a good credit score can improve your chances of securing favorable loan terms in the future.

Resources for Borrowers Facing Financial Hardship

Borrowers facing financial difficulties can access various resources to manage their student loan debt. These resources can provide guidance, assistance, and potentially modify repayment plans to ease financial burdens.

- Your loan servicer: Contact your loan servicer to discuss options such as forbearance, deferment, or income-driven repayment plans.

- National Foundation for Credit Counseling (NFCC): The NFCC offers free and low-cost credit counseling services, including guidance on managing student loan debt.

- The U.S. Department of Education: The Department of Education provides information and resources on federal student loan programs and repayment options.

- Student Loan Ombudsman Group: This group assists borrowers with complaints and disputes related to their student loans.

Potential Risks and Considerations

Private student loans, while offering access to vital funds for education, carry inherent risks that prospective borrowers must carefully consider. Understanding these risks and their potential impact is crucial for making informed borrowing decisions and avoiding future financial hardship. Failing to do so can lead to significant financial burdens and long-term consequences.

High interest rates and the potential for substantial debt accumulation are primary concerns. Unlike federal student loans, private loan interest rates are often variable and can fluctuate significantly, leading to unpredictable repayment amounts. Furthermore, the absence of robust federal protections means borrowers may face more aggressive collection practices in case of default.

High Interest Rates and Debt Accumulation

Private student loans frequently carry higher interest rates than federal loans. This can dramatically increase the total cost of borrowing over the loan’s lifetime. For example, a $20,000 loan with a 7% interest rate will cost significantly more than the same loan with a 4% interest rate. The longer it takes to repay the loan, the more interest will accrue, leading to a larger overall debt burden. Careful budgeting and diligent repayment planning are essential to minimize the impact of these high interest rates. Borrowers should also explore options for refinancing their loans if interest rates fall after they’ve already taken out their loans.

Consequences of Defaulting on a Private Student Loan

Defaulting on a private student loan has severe repercussions. Unlike federal loans, which offer various rehabilitation programs, private loan defaults typically result in immediate and aggressive collection actions. These can include wage garnishment, bank levy, and damage to credit scores. The impact on credit scores can significantly hinder future financial opportunities, such as securing a mortgage or obtaining car loans. It is therefore imperative that borrowers prioritize repayment even if facing financial difficulties. Exploring options like forbearance or deferment with the lender should be considered before defaulting.

Appealing Loan Denial or Challenging Interest Rate Increases

The process for appealing a loan denial or challenging interest rate increases varies depending on the lender. Borrowers should carefully review the lender’s policies and procedures, typically Artikeld in the loan agreement. Generally, an appeal involves submitting a written request, providing supporting documentation to justify the appeal, and clearly outlining the reasons for the challenge. For example, a borrower might appeal a loan denial by demonstrating improved creditworthiness or providing evidence of increased income. Similarly, challenging an interest rate increase may involve citing contractual discrepancies or demonstrating the increase is not in line with market standards. It is crucial to maintain thorough documentation throughout the appeal process.

Calculating the Total Cost of a Loan

Calculating the total cost of a private student loan involves considering several factors. The most important factors include the principal loan amount, the interest rate (both fixed and variable), loan fees, and the repayment period. A simple calculation to estimate the total cost is to use an online loan amortization calculator, readily available through many financial websites. These calculators typically require the loan amount, interest rate, and loan term as input, and they will then calculate the total interest paid over the life of the loan. For example, a $30,000 loan with a 6% fixed interest rate over 10 years will result in a significantly higher total cost than the same loan repaid over 5 years, due to less accumulated interest.

Total Cost = Principal + Total Interest + Fees

Remember that this is an estimate, and actual costs may vary slightly depending on the lender’s specific calculation methods.

Illustrative Examples

Understanding when a private student loan is beneficial and when it poses risks is crucial for informed decision-making. The following examples illustrate scenarios where private student loans can be helpful financial tools and situations where they may lead to financial difficulties.

Private student loans, while carrying inherent risks, can be a valuable asset under specific circumstances. Careful consideration of your financial situation and loan terms is paramount.

Beneficial Use of Private Student Loans

Imagine a high-achieving student, Sarah, who has exhausted all federal loan options but has been accepted into a prestigious medical school with high tuition costs. Federal loans alone do not cover her expenses. A private student loan with a competitive interest rate, perhaps secured by a co-signer with excellent credit, bridges the funding gap, enabling Sarah to pursue her education and ultimately a higher-earning career that allows her to comfortably repay the loan. This scenario demonstrates a responsible use of private loans where the potential future earnings justify the debt.

Financial Hardship from Private Student Loans

Conversely, consider Mark, a student who takes out multiple private student loans with high interest rates to fund a less lucrative degree program without a clear career path. He struggles to find employment after graduation, leaving him with significant debt and limited income to make repayments. The high interest rates accumulate, increasing the overall debt burden, and he faces financial hardship due to the inability to manage his loan repayments. This illustrates the potential for private student loans to lead to significant financial difficulties without careful planning and consideration of future earning potential.

Comparison of Repayment Schedules

A visual representation comparing repayment schedules could be a table. The table would show three loan types: a federal subsidized loan (with in-school deferment), a federal unsubsidized loan (interest accrues during school), and a private student loan. Each row would represent a different year (e.g., Year 1, Year 2, Year 3, Year 4, and then several post-graduation years). The columns would display the loan balance at the beginning of each year, interest accrued during the year, principal repayment during the year, and the loan balance at the end of the year. The table would visually demonstrate how the in-school deferment affects the subsidized loan, how interest accrues on the unsubsidized loan even during school, and how the repayment schedule for a private loan might differ depending on the interest rate and repayment plan chosen. For example, the private loan might show a significantly higher interest accumulation and a longer repayment period compared to the federal loans, highlighting the importance of comparing loan terms.

Epilogue

Securing a private student loan is a significant financial undertaking. By carefully considering the factors Artikeld in this guide—from credit scores and co-signers to repayment strategies and potential risks—you can make a well-informed decision that minimizes financial burden and maximizes your chances of success. Remember, responsible borrowing and proactive financial planning are key to managing student loan debt effectively and achieving your educational and career aspirations.

Key Questions Answered

What is the impact of a late payment on a private student loan?

Late payments can significantly damage your credit score and lead to increased interest charges and fees. It can also negatively affect your ability to secure future loans.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, carefully compare offers from different lenders before refinancing to ensure you’re getting the best deal.

What happens if I default on my private student loan?

Defaulting on a private student loan can severely damage your credit, leading to wage garnishment, lawsuits, and difficulty obtaining future credit.

How do I choose a co-signer for my private student loan?

Choose a co-signer with excellent credit history and a stable income. This will increase your chances of loan approval and potentially secure a lower interest rate.