Navigating the world of student loans can feel overwhelming, but understanding the Sallie Mae application process is key to securing the financial support you need for your education. This guide provides a comprehensive overview, walking you through each step, from eligibility requirements to repayment options, ensuring a smoother application experience.

We’ll explore the various types of Sallie Mae loans available, comparing interest rates, fees, and repayment plans to help you make informed decisions. We’ll also address common challenges and offer solutions to potential roadblocks, empowering you to confidently manage your student loan journey.

Sallie Mae Student Loan Application Process Overview

Applying for a Sallie Mae student loan involves several key steps, from initial eligibility checks to final loan disbursement. Understanding this process ensures a smoother application and a quicker path to securing the funding you need for your education. This guide provides a comprehensive overview of the steps involved.

The Sallie Mae student loan application process is generally straightforward, but requires careful attention to detail and accurate information. Applicants should familiarize themselves with the requirements and gather all necessary documentation beforehand to expedite the process. This will minimize delays and ensure a timely approval.

Sallie Mae Student Loan Application Steps

The application process can be broken down into distinct stages, each requiring specific actions and documentation. Following these steps diligently will increase your chances of a successful application.

| Step | Action | Required Documents | Time Estimate |

|---|---|---|---|

| 1 | Pre-qualification: Check your eligibility and get a personalized loan estimate. | Social Security number, date of birth, school information. | 15-30 minutes |

| 2 | Complete the application: Fill out the online application form accurately and completely. | Driver’s license or state ID, address verification, school information (including acceptance letter or enrollment details). | 30-45 minutes |

| 3 | Provide financial information: Submit necessary financial documentation. | Tax returns (if applicable), bank statements (if applicable), proof of income (if applicable). Specific requirements vary depending on the applicant’s financial situation. | 30-60 minutes (depending on document availability) |

| 4 | Review and submit: Double-check all information for accuracy before submitting. | All completed application forms and supporting documentation. | 15 minutes |

| 5 | Await approval: Sallie Mae will review your application and notify you of the decision. | None (at this stage) | 7-14 business days (processing times may vary) |

| 6 | Loan disbursement: Once approved, funds are disbursed directly to your school. | None (at this stage) | Varies depending on school’s processing time |

Required Documentation for Sallie Mae Student Loan Application

Having the necessary documents readily available significantly streamlines the application process. Failing to provide complete and accurate documentation can lead to delays or rejection of your application. It is crucial to gather all required documents before beginning the application.

Types of Sallie Mae Student Loans

Sallie Mae offers a range of student loan products designed to meet diverse financial needs. Understanding the distinctions between these loan types is crucial for borrowers to select the most suitable option for their circumstances. This section will detail the various Sallie Mae student loan offerings, highlighting their key features and benefits.

While Sallie Mae no longer originates federal student loans, they offer a variety of private student loans. These loans are not backed by the government, meaning the terms and conditions can vary significantly from federal loan programs. It’s essential to carefully compare options before committing to a private loan.

Sallie Mae Smart Option Student Loan

This loan is designed for undergraduate and graduate students, and often parents borrowing on behalf of their children. It provides a flexible repayment option and potentially lower interest rates for borrowers who maintain a good credit history and meet specific eligibility criteria. The application process is generally straightforward, and borrowers can often receive a quick decision.

Sallie Mae Private Student Loan for Undergraduate Students

This loan is specifically tailored to undergraduates pursuing a degree. It often offers competitive interest rates and flexible repayment terms. Borrowers may be able to choose from various repayment plans, potentially including options designed to align with their post-graduation income.

Sallie Mae Private Student Loan for Graduate Students and Professionals

This loan caters to the specific needs of graduate students and professionals pursuing advanced degrees or continuing education. It often considers factors such as graduate-level programs, professional experience, and future earning potential when assessing interest rates. It may offer higher loan amounts than undergraduate loans.

Comparison of Sallie Mae Student Loan Types

The following bullet points offer a comparison of key features. Note that specific rates and fees are subject to change and depend on individual creditworthiness and other factors. Always check Sallie Mae’s website for the most up-to-date information.

- Interest Rates: Rates vary depending on creditworthiness, loan amount, and loan type. Generally, borrowers with higher credit scores qualify for lower rates. Graduate student loans may have slightly higher rates than undergraduate loans due to increased risk.

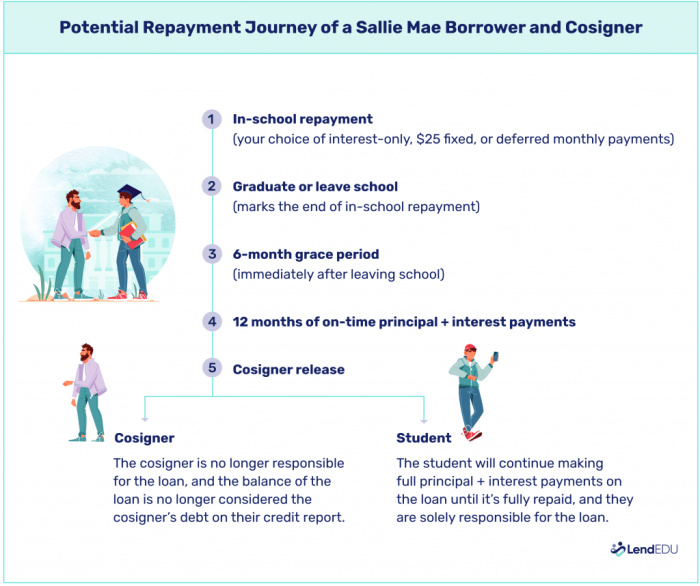

- Repayment Options: Sallie Mae typically offers various repayment plans, including fixed-rate and variable-rate options, as well as options to defer payments during certain periods (e.g., grace period after graduation).

- Fees: Fees can include origination fees and late payment penalties. These fees can vary based on the loan type and the borrower’s credit profile. It’s important to review the loan agreement carefully to understand all associated costs.

Loan Type Comparison Table

The table below summarizes key differences. Remember that these are examples and actual rates and fees are subject to change.

| Loan Type | Repayment Plans | Potential Penalties | Typical Interest Rate Range (Example – Subject to Change) |

|---|---|---|---|

| Smart Option Student Loan | Fixed, Variable, Deferred | Late payment fees, default fees | 5% – 12% |

| Undergraduate Private Loan | Fixed, Variable | Late payment fees, default fees | 6% – 13% |

| Graduate Private Loan | Fixed, Variable | Late payment fees, default fees | 7% – 14% |

Repayment Options and Plans

Understanding your repayment options is crucial for successfully managing your Sallie Mae student loans. Choosing the right plan depends on your financial situation and repayment goals. Several options are available, each with its own terms and conditions, designed to provide flexibility and affordability. Let’s explore the key features of each.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans, including those offered by Sallie Mae. Under this plan, you’ll make fixed monthly payments over a 10-year period. The monthly payment amount is calculated based on your loan balance, interest rate, and loan term. This plan is straightforward and predictable, allowing for consistent budgeting. For example, a $30,000 loan at a 5% interest rate would result in an approximate monthly payment of $316. However, it’s important to note that actual payments may vary slightly based on the specific loan terms.

Extended Repayment Plan

This plan extends the repayment period, lowering your monthly payments. While this offers short-term financial relief, it typically leads to paying more interest over the life of the loan. Sallie Mae offers extended repayment plans with longer terms, often up to 25 years. For the same $30,000 loan at 5% interest, a 25-year repayment plan would result in a lower monthly payment of approximately $180, but the total interest paid would be significantly higher.

Graduated Repayment Plan

With a Graduated Repayment Plan, your monthly payments start low and gradually increase over time, typically every two years. This option can be beneficial for borrowers who anticipate increased income in the future. However, it’s important to understand that the later payments will be substantially higher than the initial payments. The increase in payments is designed to align with potential income growth. An example using the same $30,000 loan at 5% interest might show an initial payment around $150, gradually increasing to over $300 in later years. Precise figures would depend on the specific schedule implemented by Sallie Mae.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) tie your monthly payments to your income and family size. These plans are designed to make repayment more manageable, especially during periods of lower income. Sallie Mae may offer various IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). The calculation for monthly payments under IDRs involves a complex formula that considers your adjusted gross income (AGI), family size, and loan balance. For instance, a borrower with a low income and a significant loan balance might see monthly payments significantly reduced compared to a standard repayment plan. However, remaining loan balances after the repayment period may be forgiven under certain circumstances, but this forgiveness may be considered taxable income.

Calculating Monthly Payments

Calculating monthly payments accurately requires using a loan amortization formula. While this can be done manually, many online calculators are available. These calculators typically require the loan amount, interest rate, and loan term as inputs. The formula itself is relatively complex, often involving exponential functions. A simplified illustration might show that a higher interest rate leads to higher monthly payments, all else being equal. Similarly, a longer loan term leads to lower monthly payments, but increased total interest paid. Using a reliable online calculator is strongly recommended for accurate estimations.

Understanding Interest Rates and Fees

Understanding the interest rates and fees associated with your Sallie Mae student loan is crucial for effective financial planning. Knowing how these are determined and what factors influence them allows you to make informed decisions about your borrowing and repayment strategy. This section will clarify the key aspects of Sallie Mae’s interest rate and fee structure.

Sallie Mae determines interest rates for student loans based on a variety of factors, primarily your creditworthiness and the type of loan you’re applying for. These rates are not fixed and can vary depending on market conditions and your individual profile. The interest rate is presented as an annual percentage rate (APR), reflecting the cost of borrowing over a year. This rate is applied to your outstanding loan balance, accumulating interest charges over the life of the loan.

Interest Rate Determination

Sallie Mae uses a complex formula to calculate interest rates, considering factors such as your credit history, credit score, loan type (e.g., subsidized, unsubsidized, parent PLUS), loan amount, and the prevailing market interest rates. A higher credit score and a strong credit history generally result in lower interest rates. The type of loan also significantly impacts the interest rate; subsidized loans often have lower rates than unsubsidized loans because the government subsidizes the interest during certain periods. Market conditions, including the overall economic climate and the federal funds rate, influence the base rates used in the calculation. The process is not transparent to the borrower, but the final interest rate is communicated in the loan offer.

Associated Fees

Several fees might be associated with Sallie Mae student loans. These fees are typically disclosed upfront in the loan documents. Common fees may include origination fees, which are a percentage of the loan amount, charged to cover the administrative costs of processing the loan. Late payment fees can be incurred if payments are not made on time, and returned payment fees may apply if a payment is returned due to insufficient funds. It’s crucial to review all loan documents carefully to understand the potential fees and their implications.

Factors Influencing Interest Rates

Several key factors influence the interest rate you’ll receive on your Sallie Mae student loan. These include:

| Factor | Impact on Interest Rate | Example |

|---|---|---|

| Credit Score | Higher credit score generally leads to lower interest rates. | A borrower with a credit score of 750 might receive a lower rate than a borrower with a score of 650. |

| Credit History | A longer and positive credit history tends to result in lower rates. | A borrower with a 10-year history of responsible credit use may qualify for a lower rate than someone with limited or negative credit history. |

| Loan Type | Subsidized loans often have lower rates than unsubsidized loans. | A subsidized federal loan might have a 4% interest rate, while an unsubsidized private loan from Sallie Mae might have a 6% interest rate. |

| Loan Amount | Larger loan amounts might be associated with slightly higher rates in some cases. | Borrowing $20,000 might result in a slightly lower rate than borrowing $40,000, although this is not always consistent. |

| Market Interest Rates | Prevailing market interest rates influence the base rates used in the calculation. | If overall interest rates rise in the economy, the interest rates on student loans are likely to increase as well. |

Managing Your Sallie Mae Student Loan

Successfully managing your Sallie Mae student loan involves understanding and utilizing the various tools and resources available to ensure timely payments and maintain a positive account standing. This section will guide you through the key aspects of loan management, from making payments to accessing your account information and contacting customer support.

Making Payments on Your Sallie Mae Loan

Several convenient methods exist for making payments on your Sallie Mae student loan. You can choose the option that best suits your preferences and financial situation. These methods ensure flexibility and ease of payment.

- Online Payments: Log in to your Sallie Mae account online and make payments directly through their secure payment portal. This is often the quickest and most convenient method.

- Automatic Payments: Set up automatic payments from your checking or savings account to ensure on-time payments without manual intervention. This helps avoid late fees and simplifies your financial management.

- Mail Payments: You can mail a check or money order to the address provided on your monthly statement. Remember to include your loan account number for accurate processing. Allow sufficient time for the payment to reach Sallie Mae before the due date.

- Phone Payments: In some cases, Sallie Mae may offer the option to make payments over the phone. However, this method may involve additional fees, so it’s advisable to check their website for current information.

Accessing Your Sallie Mae Account Information Online

Accessing your account online provides a centralized location for managing your loan details. This convenient method allows for 24/7 access to your information.

- Navigate to the Sallie Mae website.

- Locate the “Sign In” or “My Account” button and click it.

- Enter your username and password. If you’ve forgotten your credentials, follow the password recovery instructions provided on the login page.

- Once logged in, you’ll have access to your loan balance, payment history, upcoming payments, and other pertinent information.

Contacting Sallie Mae Customer Service

Sallie Mae offers multiple channels for contacting customer service if you need assistance or have questions. These options ensure accessibility for various communication preferences.

- Phone: Call their customer service number, which is readily available on their website.

- Email: Many lenders offer email support; check the Sallie Mae website for their email address or an online contact form.

- Mail: You can send a letter to their customer service address, though this is generally the slowest method.

- Live Chat (if available): Some websites offer live chat support for immediate assistance.

Managing Your Loan Account Online: A Step-by-Step Guide

Effectively managing your Sallie Mae loan online requires understanding the features and tools available. This step-by-step guide simplifies the process.

- Log in: Access your Sallie Mae account using your username and password.

- Review Account Summary: Check your current loan balance, payment due date, and any upcoming payments.

- Make a Payment: Utilize the online payment system to make a payment using your preferred method (e.g., checking account, savings account, debit card).

- View Payment History: Review your past payment activity to ensure accuracy and track your payment progress.

- Update Contact Information: Ensure your contact information (address, phone number, email) is up-to-date to receive important notifications.

- Explore Additional Features: Familiarize yourself with other features, such as repayment plan options or deferment/forbearance applications, as needed.

Potential Challenges and Solutions

Securing student loans can sometimes present unexpected hurdles. Understanding these potential challenges and having solutions in place can significantly ease the application process and improve your chances of a successful outcome. Proactive planning and preparation are key to navigating these potential difficulties.

Applying for a Sallie Mae student loan, while generally straightforward, can encounter several obstacles. These challenges often stem from incomplete applications, discrepancies in provided information, or unforeseen circumstances impacting your financial standing. Addressing these issues promptly and effectively is crucial for a smooth application process.

Incomplete or Inaccurate Application Information

Incomplete or inaccurate application information is a frequent cause of delays. Sallie Mae requires comprehensive and precise details to process your application efficiently. Missing documents, errors in personal information, or inconsistencies in financial data can lead to delays or even rejection. To mitigate this, meticulously review your application before submission, ensuring all fields are accurately completed and all necessary supporting documentation is included. Double-checking your contact information and financial details is crucial.

Credit History and Financial Factors

Your credit history and current financial situation play a significant role in Sallie Mae’s loan approval process. A poor credit history or limited credit history can negatively impact your eligibility or result in less favorable loan terms. Similarly, inconsistent income or high debt-to-income ratios can also pose challenges. To address these, strive to improve your credit score before applying by paying bills on time and reducing existing debt. If your credit history is limited, consider having a co-signer with a strong credit history.

Verification of Information

Sallie Mae may require additional verification of your information, such as income verification or proof of enrollment. This verification process can add time to the application process. To streamline this, keep readily available documentation such as tax returns, pay stubs, and enrollment verification forms. Responding promptly to Sallie Mae’s requests for information is essential.

Examples of Situations Leading to Delays

Several situations can complicate the application process. For instance, a change in your enrollment status during the application period might necessitate updating your application, leading to a delay. Similarly, discrepancies between the information provided on your application and information obtained by Sallie Mae through verification processes can cause delays while these discrepancies are resolved. Finally, submitting an incomplete application lacking required documentation will undoubtedly delay the process.

| Common Problem | Solution |

|---|---|

| Incomplete Application | Carefully review the application and ensure all sections are completed accurately. Gather all required documentation before submitting. |

| Inaccurate Information | Double-check all personal and financial information for accuracy. Correct any errors promptly. |

| Missing Documentation | Maintain organized records of all necessary documents. Submit all required documents with your application. |

| Poor Credit History | Work on improving your credit score before applying. Consider having a co-signer. |

| Delayed Verification | Respond promptly to Sallie Mae’s requests for information and provide all necessary documentation immediately. |

Comparison with Other Student Loan Providers

Choosing a student loan provider involves careful consideration of various factors beyond just the interest rate. Understanding the differences between lenders like Sallie Mae and others is crucial for making an informed decision that aligns with your financial situation and repayment capabilities. This section will compare Sallie Mae with other prominent student loan providers, highlighting key differences in their terms and conditions.

Several major lenders compete with Sallie Mae in the student loan market, each offering varying loan types, interest rates, and repayment options. These differences can significantly impact the overall cost of borrowing and your long-term financial health. Direct comparison is essential to ensure you select the loan best suited to your individual needs and circumstances.

Key Differences in Terms and Conditions Across Lenders

Comparing student loan providers requires analyzing several key aspects. These include interest rates (both fixed and variable), fees (origination fees, late payment fees, etc.), repayment options (standard, graduated, income-driven), and eligibility requirements. Lenders may also offer different benefits, such as grace periods or deferment options. It’s vital to carefully review the terms and conditions of each loan before making a decision.

Comparison of Key Features Across Different Lenders

The following table summarizes key features of student loans offered by Sallie Mae and several other prominent lenders. Note that interest rates and fees are subject to change and can vary based on creditworthiness and other factors. This data is for illustrative purposes and should not be considered exhaustive or definitive. Always consult the lender directly for the most up-to-date information.

| Lender | Loan Type | Interest Rate (Example) | Fees (Example) | Repayment Options |

|---|---|---|---|---|

| Sallie Mae | Federal & Private | Variable: 6.5% – 10.5%; Fixed: 7% – 11% | Origination fee: 0-4%; Late payment fee: $25-$35 | Standard, Graduated, Income-Driven |

| Discover | Private | Variable: 6% – 12%; Fixed: 7.5% – 13% | Origination fee: 0-2%; Late payment fee: $25 | Standard, Graduated |

| Wells Fargo | Private | Variable: 6.25% – 11.75%; Fixed: 7.75% – 12.75% | Origination fee: 1-3%; Late payment fee: $35 | Standard, Extended |

| Navient | Federal & Private | Variable: 6.75% – 11%; Fixed: 8% – 12% | Origination fee: Varies; Late payment fee: $25 | Standard, Graduated, Income-Driven |

Visual Representation of Interest Rates, Fees, and Repayment Options

Imagine a bar graph. The horizontal axis represents the different lenders (Sallie Mae, Discover, Wells Fargo, Navient, etc.). The vertical axis represents the percentage for interest rates and the dollar amount for fees. Three separate bars for each lender would illustrate the average interest rate (separately for fixed and variable), the average origination fee, and a representation of repayment options (e.g., the number of repayment plans offered). For example, a longer bar for Sallie Mae in the “repayment options” category would indicate a wider range of plans available compared to other lenders. A higher bar for a specific lender in the “interest rate” category would visually represent a higher interest rate. Similarly, higher bars for fees would indicate higher associated costs.

Conclusion

Securing a Sallie Mae student loan is a significant step towards achieving your educational goals. By understanding the application process, eligibility criteria, and repayment options, you can navigate this process with confidence and plan effectively for your financial future. Remember to carefully review all terms and conditions and don’t hesitate to contact Sallie Mae directly with any questions.

Top FAQs

What is the minimum credit score required for a Sallie Mae loan?

Sallie Mae doesn’t have a publicly stated minimum credit score. Eligibility depends on various factors including credit history, income, and co-signer availability.

Can I apply for a Sallie Mae loan if I’m an international student?

Sallie Mae loan eligibility varies based on residency status. International students may have limited options or need a co-signer.

What happens if I miss a Sallie Mae loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially default on the loan. Contact Sallie Mae immediately if you anticipate difficulty making a payment.

How long does the Sallie Mae application process take?

The application process timeframe varies depending on individual circumstances and required documentation. Allow sufficient time for processing.