Navigating the complexities of student loan repayment can be daunting, especially when unexpected life events arise. Understanding the student loan deferment application process is crucial for borrowers facing financial hardship or temporary setbacks. This guide provides a comprehensive overview of eligibility, the application process itself, available deferment types, and the long-term financial implications of this option. We’ll also explore alternative solutions and equip you with the knowledge to confidently navigate this important decision.

From understanding eligibility requirements based on individual circumstances to mastering the application process and comparing various deferment options, this resource serves as your complete guide. We’ll delve into the impact of deferment on loan terms, including interest accrual and repayment schedules, and offer strategies for mitigating potential financial consequences. Finally, we’ll discuss alternative repayment plans and how to effectively communicate with your loan servicer.

Eligibility Criteria for Student Loan Deferment

Securing a student loan deferment can provide crucial financial relief during challenging times. Understanding the eligibility requirements is the first step in successfully applying for this assistance. This section details the various criteria and provides a clear guide to help you determine your eligibility.

Types of Federal Student Loans and Deferment Eligibility

Eligibility for deferment varies depending on the type of federal student loan you hold. Direct Subsidized and Unsubsidized Loans, along with Federal Stafford Loans (now consolidated into Direct Loans), generally offer similar deferment options, while other federal loan programs may have different rules. For instance, Perkins Loans often have more restrictive deferment criteria. It is crucial to check the specific terms and conditions of your individual loan agreement.

Qualifying Circumstances for Deferment

Several circumstances qualify borrowers for student loan deferment. These often involve periods of unemployment, economic hardship, or enrollment in further education. Specific examples include: unemployment for at least 90 days, documented economic hardship (such as a significant drop in income), enrollment in a graduate or professional program, or active-duty military service. The specific documentation required will vary depending on the qualifying circumstance.

Determining Eligibility: A Step-by-Step Guide

1. Identify your loan type: Determine the specific type(s) of federal student loan(s) you hold.

2. Review your current circumstances: Assess whether your current situation aligns with any of the qualifying circumstances for deferment (e.g., unemployment, economic hardship, or further education).

3. Gather necessary documentation: Collect supporting documentation to prove your eligibility. This may include unemployment verification, pay stubs showing income reduction, enrollment verification from an educational institution, or military orders.

4. Contact your loan servicer: Contact your loan servicer to discuss your eligibility and the application process. They can provide specific guidance and answer any questions you may have.

Comparison of Deferment Eligibility: Undergraduate vs. Graduate Loans

The eligibility criteria for deferment are generally similar for both undergraduate and graduate loans, focusing primarily on the qualifying event rather than the level of study. However, the specific documentation requirements might differ slightly. The length of deferment granted can also vary based on the circumstances.

| Loan Type | Qualifying Event | Documentation Required | Deferment Length |

|---|---|---|---|

| Direct Subsidized/Unsubsidized Loans | Unemployment, Economic Hardship, Graduate/Professional Study, Military Service | Unemployment verification, pay stubs, enrollment verification, military orders | Varies, up to 3 years total |

| Federal Perkins Loan | Unemployment, Economic Hardship, Graduate/Professional Study, Military Service | Unemployment verification, pay stubs, enrollment verification, military orders | Varies, generally shorter periods than Direct Loans |

| Graduate PLUS Loans | Unemployment, Economic Hardship, Graduate/Professional Study, Military Service | Unemployment verification, pay stubs, enrollment verification, military orders | Varies, up to 3 years total |

| Undergraduate PLUS Loans | Unemployment, Economic Hardship, Graduate/Professional Study, Military Service | Unemployment verification, pay stubs, enrollment verification, military orders | Varies, up to 3 years total |

The Application Process

Applying for a student loan deferment involves several key steps. Successfully navigating this process requires careful attention to detail and adherence to specific guidelines. Failure to do so can result in delays or rejection of your application.

The application process is generally straightforward, but understanding each step is crucial for a smooth experience. This section details the steps involved, common pitfalls, and how to avoid them. We’ll also provide a visual representation of the process and a checklist of required documentation.

Application Steps

The steps involved in applying for a student loan deferment vary slightly depending on your lender and the type of deferment you are seeking. However, the general process usually follows these steps:

- Gather Required Documentation: This is the foundational step. You’ll need proof of your eligibility for deferment (e.g., documentation of unemployment, enrollment in school, or medical hardship). Failure to provide complete documentation is a major reason for application delays.

- Complete the Application Form: Carefully fill out the application form provided by your lender. Ensure accuracy in all information provided, as inaccuracies can lead to rejection.

- Submit the Application: Submit your completed application form and supporting documentation. This might involve mailing physical documents, uploading them to an online portal, or submitting them through a dedicated fax line. Check your lender’s instructions carefully.

- Track Your Application: After submission, track the status of your application. Most lenders provide online portals or contact numbers to check on the progress.

- Receive Confirmation: Once approved, you’ll receive confirmation of your deferment. This confirmation will Artikel the terms and conditions of your deferment.

Common Application Mistakes

Several common mistakes can hinder the deferment application process. Understanding these errors helps applicants avoid delays and potential rejections.

- Incomplete Documentation: Failing to provide all necessary supporting documents is a frequent problem. Ensure you have gathered all required documents before starting the application.

- Inaccurate Information: Providing incorrect or misleading information on the application form can lead to immediate rejection. Double-check all information for accuracy.

- Late Submission: Missing deadlines can result in application rejection. Submit your application well in advance of the deadline to avoid any last-minute issues.

- Ignoring Lender Instructions: Each lender has specific requirements and instructions. Ignoring these instructions can lead to delays or rejection.

- Lack of Follow-up: Failing to track your application’s progress can leave you unaware of potential issues. Regularly check the status of your application.

Application Process Flowchart

The following describes a flowchart illustrating the student loan deferment application process. Imagine a diagram with rectangular boxes representing steps and diamond shapes representing decision points. The process begins with “Gather Required Documents.” This leads to “Complete Application Form.” After that, “Submit Application” is the next step. A diamond then appears: “Application Approved?”. If “Yes,” the process ends with “Deferment Granted.” If “No,” it branches back to “Review and Resubmit Application,” indicating the need to address any issues identified during the review process. This loop continues until approval or rejection.

Required Documentation Checklist

Having a checklist of required documents ensures you submit a complete application. This checklist is not exhaustive and may vary based on your lender and the type of deferment you seek.

| Document | Description |

|---|---|

| Proof of Income | Pay stubs, tax returns, or other income verification |

| Proof of Enrollment (if applicable) | Acceptance letter, enrollment verification form, or transcript |

| Medical Documentation (if applicable) | Doctor’s note or other medical evidence supporting your claim |

| Unemployment Documentation (if applicable) | Unemployment benefit statements or letter of unemployment |

| Completed Application Form | The official application form from your lender |

Types of Deferments Available

Student loan deferment offers temporary relief from loan payments, but the types available and their implications vary significantly. Understanding these differences is crucial for borrowers seeking to manage their student loan debt effectively. Choosing the right deferment option depends on your individual circumstances and the specific terms offered by your loan servicer.

Economic Hardship Deferment

Economic hardship deferments are typically granted to borrowers experiencing significant financial setbacks. This might include unemployment, a substantial reduction in income, or medical emergencies resulting in significant expenses. The benefits lie in the temporary pause on payments, preventing further damage to credit scores during a difficult period. However, interest usually continues to accrue during the deferment period, increasing the total loan amount owed upon repayment resumption. This deferment is best suited for borrowers facing unexpected and temporary financial crises that impact their ability to meet their loan obligations. For example, a borrower who loses their job due to company downsizing might qualify for this type of deferment.

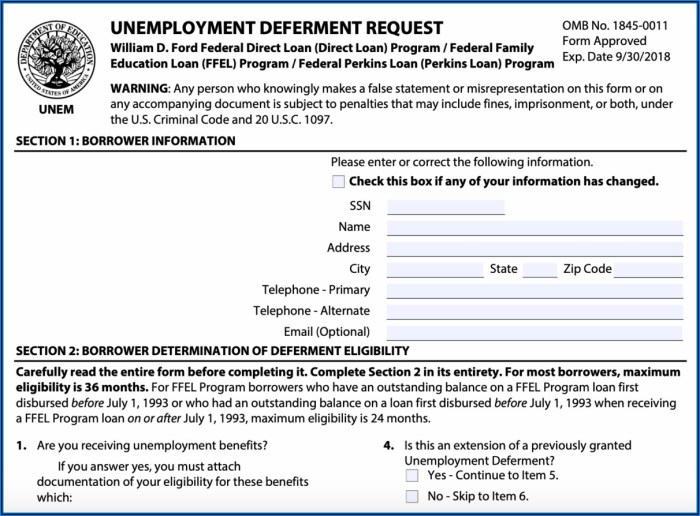

Unemployment Deferment

This type of deferment is specifically designed for borrowers who have become unemployed. The primary benefit is the temporary suspension of loan payments, providing some financial breathing room while actively seeking employment. The drawback, similar to economic hardship deferment, is the continued accrual of interest. This option is most appropriate for individuals who have lost their jobs and are actively searching for new employment. A recent college graduate struggling to find a job in a competitive market could utilize this deferment.

In-School Deferment

In-school deferment is available to students who are enrolled at least half-time in a degree or certificate program at an eligible educational institution. The key advantage is the suspension of payments while actively pursuing education. However, depending on the loan type, interest may still accrue. This deferment is specifically designed for students continuing their education after graduating high school or taking a break and returning to school. A student pursuing a master’s degree after completing their undergraduate studies would qualify for this deferment.

Military Deferment

Military deferment is specifically for borrowers serving in active duty in the military. The main benefit is the suspension of payments during active service, acknowledging the commitment and often challenging financial circumstances of military personnel. Interest accrual varies depending on the type of loan and the specific terms of service. This deferment is ideal for those serving in the armed forces. A soldier deployed overseas would be eligible for this type of deferment.

Comparison of Deferment Types

Understanding the differences between these deferment types is essential. The following bullet points summarize key aspects:

- Economic Hardship Deferment: Length varies by lender, typically up to 12 months; Requires documentation of financial hardship; Interest usually accrues.

- Unemployment Deferment: Length varies by lender, often up to 3 years; Requires documentation of unemployment; Interest usually accrues.

- In-School Deferment: Length depends on enrollment; Requires proof of enrollment; Interest may or may not accrue depending on the loan type.

- Military Deferment: Length depends on active duty service; Requires documentation of active duty status; Interest accrual varies depending on the loan type and terms of service.

Impact of Deferment on Loan Terms

Deferring your student loans offers temporary relief from repayment, but it’s crucial to understand the long-term financial implications. While pausing payments provides short-term breathing room, it doesn’t erase the debt; instead, it significantly impacts the total cost of your loan due to accruing interest. Understanding these impacts is key to making informed decisions about your financial future.

Deferment affects your loan’s total amount, interest accumulation, and repayment schedule. The primary impact is the accumulation of interest. While your payments are paused, interest continues to accrue on your principal loan balance, increasing the overall amount you eventually owe. This increased amount directly impacts your repayment schedule, potentially extending the length of your repayment period and leading to higher overall costs. The longer the deferment period, the greater the impact.

Interest Accrual During Deferment

During a deferment, interest typically continues to accrue on unsubsidized loans. This means that the interest charges are added to your principal balance, increasing the total amount you owe. For subsidized loans, the government may pay the interest during certain deferment periods, preventing it from capitalizing (being added to the principal). However, this is not always the case, and it’s crucial to understand the specifics of your loan type and deferment plan.

Let’s consider a hypothetical scenario: Suppose you have a $20,000 unsubsidized student loan with a 6% annual interest rate. If you defer your loan for one year, the interest accrued would be calculated as follows: $20,000 x 0.06 = $1200. After one year of deferment, your loan balance would be $21,200. If you defer for two years, the interest would compound, leading to an even higher balance. A longer deferment period exponentially increases the total interest paid.

Long-Term Financial Implications

Consider two borrowers, both with $30,000 in unsubsidized student loans at 7% interest. Borrower A repays their loan according to the standard repayment plan. Borrower B defers their loan for three years. After three years, Borrower B will owe significantly more than Borrower A due to accumulated interest. This difference could amount to thousands of dollars over the life of the loan, impacting their ability to save for a down payment on a house, invest in retirement, or meet other financial goals. The longer the deferment, the greater this financial disparity becomes.

Minimizing Negative Financial Impact

While deferment can provide short-term relief, proactive steps can mitigate the long-term financial consequences. Understanding your loan terms and exploring alternative options like income-driven repayment plans are crucial. Furthermore, during the deferment period, focusing on improving your financial situation by increasing income or reducing expenses can allow for extra payments upon resuming repayment, shortening the repayment term and reducing overall interest paid. Even small additional payments can significantly impact the total cost over the life of the loan.

Alternative Options to Deferment

Choosing to defer your student loan payments can provide temporary relief, but it’s crucial to understand that it’s not always the best option. Other strategies, each with its own set of advantages and disadvantages, might better suit your financial situation. Exploring these alternatives can help you make a more informed decision about managing your student loan debt.

Deferment, forbearance, and income-driven repayment plans all offer ways to temporarily reduce or modify your monthly student loan payments. However, they differ significantly in their eligibility requirements, impact on your loan balance, and long-term financial consequences. Understanding these differences is essential for selecting the most appropriate strategy.

Forbearance

Forbearance allows you to temporarily suspend or reduce your student loan payments for a specified period. Unlike deferment, forbearance doesn’t require you to meet specific criteria based on financial hardship. However, interest typically continues to accrue during forbearance, increasing your overall loan balance. This can lead to a larger debt burden in the long run. Forbearance might be a suitable option for borrowers facing short-term financial difficulties who anticipate being able to resume payments soon. Prolonged use of forbearance can negatively impact your credit score.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans calculate your monthly payment based on your income and family size. These plans are designed to make student loan repayment more manageable for borrowers with limited income. Eligibility typically requires demonstrating financial need and enrolling in an eligible repayment plan. IDR plans often extend the repayment period, leading to higher total interest paid over the life of the loan. However, they can prevent borrowers from falling behind on payments and potentially facing default. IDR plans are generally a better choice than deferment for borrowers who need long-term payment relief based on their income. After a set period of payments (usually 20 or 25 years), any remaining loan balance may be forgiven under certain IDR plans. However, this forgiven amount is typically considered taxable income.

Comparison of Options

The following table summarizes the key differences between deferment, forbearance, and income-driven repayment plans:

| Option | Eligibility | Interest Accrual | Impact on Credit Score |

|---|---|---|---|

| Deferment | Usually requires documented financial hardship or enrollment in specific programs. | May or may not accrue, depending on the type of deferment. | Generally minimal impact, but can vary depending on reporting practices. |

| Forbearance | Generally available to most borrowers; no specific hardship criteria. | Usually accrues, increasing the total loan amount. | Negative impact, especially with extended periods of forbearance. |

| Income-Driven Repayment (IDR) | Based on income and family size; requires enrollment in a specific plan. | Accrues, but payments are adjusted to income, potentially leading to lower monthly payments but higher total interest paid. | Generally minimal impact if payments are made as agreed. |

Contacting the Loan Servicer

Maintaining effective communication with your student loan servicer is crucial throughout the deferment process. They are your primary point of contact for application submission, status updates, and addressing any questions or concerns you may have. Understanding their contact methods and knowing what information to provide will streamline the process and ensure a smoother experience.

Your loan servicer’s contact information will be readily available on your loan documents or through the National Student Loan Data System (NSLDS). This information typically includes multiple avenues for communication, ensuring accessibility for borrowers with varying preferences.

Contact Methods

Several methods are generally available for contacting your student loan servicer. These options allow for flexibility and convenience, depending on your needs and the urgency of your inquiry.

- Phone: Most servicers provide a dedicated phone number for customer service. Expect to be asked for your loan information to verify your identity before assistance is provided. Phone calls are often the most efficient method for addressing immediate concerns or complex issues.

- Email: Many servicers offer email support. This method is useful for less urgent inquiries or for providing supporting documentation. Remember to include your loan identification number and a clear description of your request in your email.

- Online Portal: Most servicers maintain secure online portals where borrowers can access their account information, submit documents, and communicate directly through a messaging system. This method offers a convenient way to track your application status and manage your account details.

Common Questions for the Loan Servicer

Preparing a list of questions beforehand can make your interaction with the servicer more efficient. Clear and concise questions will lead to quicker resolution of your inquiries.

- What is the current status of my deferment application?

- What documents are required to support my deferment request?

- What is the expected processing time for my application?

- What are my options if my deferment application is denied?

- What are the specific terms and conditions of my deferment, including interest accrual?

Appealing a Denied Deferment Application

If your deferment application is denied, you typically have the right to appeal the decision. Understanding the appeals process and the necessary steps will increase your chances of a successful appeal.

The appeals process usually involves submitting additional documentation or providing further clarification to support your eligibility. This may include medical documentation, proof of unemployment, or other evidence relevant to your specific circumstances. The specific requirements and procedures for appealing a denied application will be Artikeld in your loan servicer’s communication regarding the denial. Contacting the servicer directly to discuss the reasons for denial and inquire about the appeals process is essential.

Typical Response Time for Deferment Applications

The processing time for a deferment application can vary depending on the servicer and the complexity of the application. While some applications may be processed within a few weeks, others may take longer, particularly if additional documentation is required. It’s advisable to contact your loan servicer for an estimated timeframe after submitting your application.

For example, one servicer may process straightforward applications within 10-14 business days, while a more complex case involving extensive documentation could take up to 30 business days. Always allow sufficient time for processing, and proactively follow up if you haven’t received an update within the expected timeframe.

Closing Summary

Successfully navigating a student loan deferment application requires careful planning and a thorough understanding of the process. By understanding your eligibility, choosing the right deferment type, and proactively managing communication with your loan servicer, you can effectively address temporary financial challenges while safeguarding your long-term financial well-being. Remember to explore all available options and weigh the potential benefits and drawbacks before making a decision. Proactive financial planning and informed choices are key to successfully managing your student loan debt.

Key Questions Answered

What happens to my interest during a deferment?

Interest typically continues to accrue on most federal student loans during a deferment, though the exact rules vary by loan type. This means your total loan balance will increase even while payments are paused.

How long can I defer my student loans?

The length of a deferment depends on the type of deferment and the reason for requesting it. Some deferments have time limits, while others may be extended under certain circumstances. Check with your loan servicer for specifics.

Can I defer my private student loans?

Deferment options for private student loans are determined by your lender, and are not guaranteed. Contact your private loan servicer to inquire about their policies.

What if my deferment application is denied?

If your application is denied, you should contact your loan servicer to understand the reasons for the denial and explore potential options for appeal or alternative repayment plans.