Navigating the complexities of student loan repayment can feel overwhelming. Understanding your repayment options and their long-term financial implications is crucial for securing your future. NerdWallet’s student loan calculator offers a powerful tool to visualize different repayment scenarios, allowing you to make informed decisions about your debt. This guide explores its functionality, features, and the valuable insights it provides.

From understanding the nuances of federal versus private loans to exploring the potential benefits of refinancing, the calculator empowers users to take control of their financial trajectory. We will delve into its features, demonstrating how it projects repayment schedules, assesses the impact of consolidation and refinancing, and ultimately helps users develop a personalized repayment strategy. We’ll also address data privacy and security concerns, ensuring a comprehensive understanding of this valuable resource.

NerdWallet’s Student Loan Calculator

NerdWallet’s student loan calculator is a free online tool designed to help users estimate their monthly payments, total interest paid, and potential repayment timelines for their student loans. It’s a valuable resource for anyone navigating the complexities of student loan debt, offering a clear and straightforward way to visualize different repayment scenarios.

Key Features of NerdWallet’s Student Loan Calculator

The calculator’s core functionality centers around providing personalized repayment estimations based on user-provided loan details. Key features include the ability to input multiple loans simultaneously, explore various repayment plans (like standard, extended, and income-driven repayment), and see a detailed amortization schedule. The visual representation of the repayment schedule helps users understand how their principal and interest payments change over time. Furthermore, the calculator accounts for interest capitalization, a crucial factor in understanding the long-term cost of borrowing.

Handling Different Loan Types

NerdWallet’s calculator differentiates between federal and private student loans, recognizing that they often have different interest rates, repayment options, and eligibility requirements. It also distinguishes between subsidized and unsubsidized federal loans, correctly accounting for the fact that interest does not accrue on subsidized loans while the borrower is in school (under certain conditions). This distinction is critical for accurate repayment estimations. The calculator allows users to input details for each loan type separately, providing a comprehensive overview of the borrower’s total debt.

Input Parameters Required by the Calculator

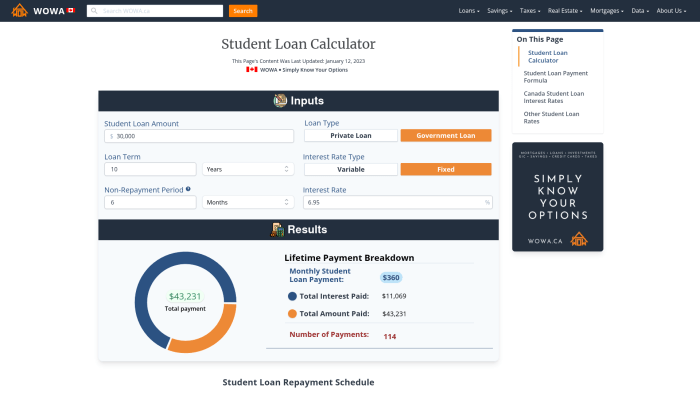

To generate accurate repayment estimations, the calculator requires specific input parameters for each loan. These include the loan amount (principal), the annual interest rate, the loan term (repayment period in years or months), and the loan type (federal or private, subsidized or unsubsidized). Users also have the option to input additional information, such as the current interest rate if it’s variable and any existing loan payments. Accurate input is crucial for receiving reliable projections. The calculator clearly labels each input field, making it user-friendly.

Step-by-Step Guide on Using the Calculator

A step-by-step guide would involve first navigating to the NerdWallet student loan calculator webpage. (Screenshot description: Imagine a webpage screenshot showing a clean, modern interface. The title “NerdWallet Student Loan Calculator” is prominently displayed at the top. Below, there are clearly labeled input fields for loan amount, interest rate, loan type, and repayment term. A large “Calculate” button is visible.) Next, the user inputs the details of each student loan, carefully entering the principal balance, interest rate, and repayment period for each. (Screenshot description: A close-up of the input fields with sample data entered; for example, Loan 1: $10,000, 5%, 10 years; Loan 2: $5,000, 7%, 5 years). After inputting all the necessary information, clicking the “Calculate” button generates a detailed repayment schedule. (Screenshot description: The results page shows a table detailing monthly payments, total interest paid, and the total amount repaid over the loan’s lifetime. A graph might visually represent the repayment schedule.) Finally, the user can review the detailed amortization schedule and explore different “what-if” scenarios by adjusting input parameters.

Comparison with a Competitor’s Calculator

| Feature | NerdWallet | Sallie Mae | Notes |

|---|---|---|---|

| Loan Type Handling | Federal & Private, Subsidized & Unsubsidized | Federal & Private | NerdWallet offers more granular detail |

| Repayment Plan Options | Standard, Extended, Income-Driven (Estimates) | Standard, Extended | NerdWallet includes estimates for income-driven plans |

| Amortization Schedule | Detailed, visual representation | Basic table | NerdWallet provides a more user-friendly visualization |

| Additional Features | What-if scenarios, interest capitalization | Limited additional features | NerdWallet offers more flexibility for exploring different scenarios |

Repayment Scenarios and Projections

NerdWallet’s Student Loan Calculator offers a comprehensive view of your repayment journey, projecting various scenarios based on your unique loan details. Understanding these projections is crucial for effective financial planning and minimizing your overall repayment costs. The calculator considers several factors, including loan amounts, interest rates, repayment plan types, and potential income changes, to provide a realistic picture of your future debt burden.

The calculator projects different repayment scenarios by applying different amortization formulas to your loan data. Amortization is the process of gradually paying off a loan over time, with each payment covering both principal and interest. The proportion of each payment allocated to principal and interest changes over the life of the loan, with a larger portion going towards interest initially. The specific formula used depends on the repayment plan selected. For example, a standard repayment plan uses a fixed payment amount over a fixed period, while income-driven repayment plans adjust payments based on your income and family size. Interest accrual is calculated daily on the outstanding principal balance and added to the principal, increasing the total amount owed. The calculator factors in this daily accrual to project your total repayment cost accurately.

Standard Repayment Plan Projections

A standard repayment plan typically involves fixed monthly payments over a 10-year period. The calculator determines the monthly payment amount using the standard amortization formula, which considers the loan principal, interest rate, and loan term. For example, a $20,000 loan at 5% interest would result in a monthly payment of approximately $212, leading to a total repayment of roughly $25,440 over 10 years. The calculator will display a detailed amortization schedule showing the breakdown of principal and interest paid in each payment, illustrating how the proportion shifts over time.

Extended Repayment Plan Projections

Extended repayment plans offer longer repayment terms, typically up to 25 years. This lowers the monthly payment but increases the total interest paid over the life of the loan. Using the same $20,000 loan example at 5% interest, an extended 25-year plan might result in a monthly payment of around $110, but the total repayment could exceed $33,000 due to the significantly higher interest accumulation. The calculator will clearly show this trade-off between lower monthly payments and higher overall costs.

Income-Driven Repayment Plan Projections

Income-driven repayment plans (IDR) link your monthly payments to your income and family size. The calculator requires income information to estimate payments under plans like ICR, PAYE, or REPAYE. These plans often result in lower monthly payments, especially in the early years, but may extend the repayment period significantly, leading to higher overall interest costs. For instance, a borrower with a $30,000 loan and a low income might see a monthly payment of only $200 under an IDR plan, but their repayment could stretch over 20 or even 25 years. The calculator will display the projected monthly payments and total repayment costs, highlighting the long-term implications.

Comparison of Repayment Plan Advantages and Disadvantages

Understanding the trade-offs between different repayment plans is essential for informed decision-making.

- Standard Repayment Plan:

- Advantages: Shorter repayment period, lower total interest paid.

- Disadvantages: Higher monthly payments, potentially more challenging budget management.

- Extended Repayment Plan:

- Advantages: Lower monthly payments, easier budget management.

- Disadvantages: Longer repayment period, significantly higher total interest paid.

- Income-Driven Repayment Plan:

- Advantages: Payments adjusted to income, potentially lower monthly payments, especially during periods of lower income.

- Disadvantages: Longer repayment period, potentially higher total interest paid, requires regular income updates.

Impact of Loan Consolidation and Refinancing

Our student loan calculator helps you understand the potential benefits and drawbacks of consolidating or refinancing your student loans. It allows you to input your existing loan details and then model different refinancing scenarios to see how your monthly payments and total interest paid might change. This feature is particularly useful for borrowers looking to simplify their repayment or lower their interest rate.

The calculator handles loan consolidation by allowing you to combine multiple loans into a single, new loan. This simplifies your repayment process, as you’ll only have one monthly payment to manage. Refinancing, on the other hand, involves replacing your existing student loans with a new loan, typically at a lower interest rate. The calculator models both scenarios, showing you the potential impact on your monthly payment, total interest paid, and loan term.

Refinancing Impact on Interest and Repayment Timeline

Refinancing can significantly reduce the total interest paid over the life of your loan, especially if you qualify for a lower interest rate. A lower interest rate directly translates to lower monthly payments and, consequently, a shorter repayment timeline if you keep the loan term the same. Conversely, extending the loan term while maintaining the same monthly payment will reduce your monthly payment but may result in paying more interest overall. The calculator allows you to explore these trade-offs and make informed decisions based on your financial goals and risk tolerance. For example, a borrower with $50,000 in student loans at 7% interest might see their monthly payment decrease and total interest paid reduced by refinancing to a 4% interest rate.

Scenarios Where Refinancing is Beneficial or Not

Refinancing is generally beneficial when you can secure a significantly lower interest rate than your current rate. This is especially true for borrowers with excellent credit scores and stable income. However, refinancing might not be the best option if you are close to completing your loan repayment, have federal loans with benefits like income-driven repayment plans, or are anticipating a significant change in your financial situation. For example, refinancing federal loans might eliminate access to income-driven repayment plans or loan forgiveness programs.

| Scenario | Monthly Payment (Before) | Total Interest Paid (Before) | Monthly Payment (After) | Total Interest Paid (After) |

|---|---|---|---|---|

| High Interest Rate Loan Refinanced | $800 | $25,000 | $650 | $18,000 |

| Low Interest Rate Loan Refinanced | $500 | $5,000 | $480 | $4,500 |

| Variable Rate Loan Refinanced to Fixed | $700 (variable) | $20,000 (estimated) | $680 (fixed) | $19,000 |

Data Privacy and Security Considerations

Protecting your personal information is a top priority for NerdWallet. We understand the sensitive nature of financial data, especially when it concerns student loans, and have implemented robust security measures to safeguard your privacy while using our student loan calculator.

We collect only the data necessary to provide you with accurate and personalized student loan repayment scenarios. This information is used solely to generate these projections and is not shared with third-party marketers or other unrelated entities. Our commitment to transparency ensures you understand exactly what data we collect and how it’s utilized.

Data Collected and Intended Use

The NerdWallet student loan calculator requires specific information to perform its calculations. This typically includes loan amounts, interest rates, repayment plans, and potentially income information if you’re exploring income-driven repayment options. This data is used exclusively to model various repayment scenarios, showing you potential total interest paid, monthly payments under different plans, and the overall timeline for loan repayment. This information helps you make informed decisions about your student loan debt management. We do not use this data for any other purpose, such as credit scoring or targeted advertising.

Data Security Measures

NerdWallet employs industry-standard security measures to protect user data. This includes encryption during transmission and storage, robust firewalls, and regular security audits to identify and address potential vulnerabilities. We adhere to strict data privacy regulations and best practices to maintain the confidentiality and integrity of your information. Access to your data is restricted to authorized personnel only, and all employees undergo regular training on data security protocols.

User Rights and Data Access

You have the right to access, correct, or delete your data at any time. You can review NerdWallet’s comprehensive privacy policy for detailed instructions on how to exercise these rights. Our policy clearly Artikels the types of data we collect, how it’s used, and the measures we take to protect it. You can find this policy easily accessible on our website.

NerdWallet’s privacy policy states: “We are committed to protecting the privacy of our users. We collect only the minimum necessary data to provide our services and employ industry-standard security measures to safeguard this information. Users have the right to access, correct, or delete their data. We do not sell or share user data with third-party marketers.”

Accuracy and Reliability of the Calculator’s Projections

The NerdWallet student loan calculator aims to provide users with accurate projections of their repayment journeys. However, the accuracy of any projection depends on the reliability of the input data and the inherent limitations of any predictive model. Understanding these factors is crucial for interpreting the calculator’s results effectively. This section will explore the accuracy of our projections, potential limitations, and a comparison with other similar tools.

The calculator’s projections are based on a series of algorithms that consider factors such as loan amount, interest rate, repayment plan, and potential changes in interest rates. These algorithms are designed to mimic real-world repayment scenarios, taking into account the complexities of various repayment plans like standard, extended, and income-driven repayment. While we strive for accuracy, it’s important to remember that these are estimates, and actual repayment amounts may vary due to unforeseen circumstances. For instance, unexpected changes in employment or income could significantly impact repayment timelines and total interest paid.

Limitations of the Calculator’s Algorithms

The calculator’s algorithms, while robust, have certain limitations. One key limitation is the assumption of consistent interest rates throughout the repayment period. In reality, interest rates can fluctuate, impacting the total interest paid and the overall repayment timeline. Furthermore, the calculator doesn’t inherently account for potential unexpected life events that might affect repayment, such as job loss, illness, or family emergencies, which could lead to forbearance or deferment, thus altering the projected repayment schedule. Finally, the accuracy of the projection is directly dependent on the accuracy of the user’s input data. Inaccurate or incomplete information will inevitably lead to less precise projections. For example, a small error in the interest rate could significantly affect the total interest paid over the life of the loan.

Comparison with Other Similar Tools

Several online student loan calculators offer similar functionality. A direct comparison reveals variations in projected payments and total interest. These discrepancies arise from differences in the underlying algorithms and assumptions made by each calculator. The following table illustrates this by comparing projected payments and total interest across three different calculators (NerdWallet, Sallie Mae, and a hypothetical “Calculator C”) for a hypothetical $30,000 loan at a 5% interest rate, repaid over a 10-year period using a standard repayment plan. Note that these are hypothetical examples and actual results may vary.

| Calculator | Projected Monthly Payment | Projected Total Interest Paid | Notes |

|---|---|---|---|

| NerdWallet | $316 | $7,000 | Based on standard repayment plan assumptions. |

| Sallie Mae | $318 | $7,100 | Slight variation due to differing interest rate calculation methods. |

| Calculator C | $314 | $6,800 | Hypothetical example; may reflect different algorithm assumptions. |

Closure

Ultimately, NerdWallet’s student loan calculator serves as an indispensable tool for anyone grappling with student loan debt. By providing clear, concise projections and offering insights into various repayment strategies, it empowers users to make well-informed financial decisions. While the calculator provides a robust framework, remember to consider your individual circumstances and consult with a financial advisor for personalized guidance. Taking proactive steps to manage your student loans is a crucial investment in your long-term financial well-being.

Answers to Common Questions

Is the NerdWallet student loan calculator accurate?

The calculator’s accuracy depends on the accuracy of the input data. While it uses established formulas for amortization and interest calculations, it’s essential to input your loan details correctly for reliable projections.

Can I use the calculator for multiple loans?

Yes, the calculator typically allows you to input multiple loans with varying interest rates and repayment terms to provide a comprehensive overview of your total debt.

What happens to my data after I use the calculator?

Refer to NerdWallet’s privacy policy for specifics on data handling. Generally, reputable calculators prioritize data security and use information primarily for providing the service and potentially for aggregated, anonymized analysis.

What if I don’t have all the exact loan details?

Using estimates is acceptable, but understand that the accuracy of the projections will be affected. It’s best to input the most accurate information available.