Navigating the complex world of student loan debt can feel overwhelming, especially when grappling with fluctuating interest rates. Understanding these rates is crucial for effective financial planning and minimizing long-term costs. This guide provides a clear overview of current rates, historical trends, and strategies for managing your student loan debt effectively, empowering you to make informed decisions about your financial future.

From the impact of economic shifts on interest rate fluctuations to the various repayment plans available, we explore the intricacies of federal and private student loans. We’ll examine how government policies influence rates and offer practical advice for borrowers seeking to minimize their debt burden. Whether you’re a current student or already repaying loans, this comprehensive resource will equip you with the knowledge you need to successfully manage your student loan debt.

Current Student Loan Interest Rates

Understanding current student loan interest rates is crucial for prospective and current borrowers. These rates significantly impact the total cost of a student loan, affecting repayment schedules and overall financial burden. The rates vary depending on several factors, including the type of loan, the lender, and the borrower’s creditworthiness.

Federal and private student loans have distinct interest rate structures. Federal loans generally offer more favorable terms, especially for eligible borrowers, while private loans are subject to market fluctuations and individual borrower profiles.

Federal Student Loan Interest Rates

Interest rates for federal student loans are set annually by the government and are generally lower than those offered by private lenders. The specific rate depends on the loan type and the loan disbursement date. These rates are fixed for the life of the loan, offering predictability in repayment planning.

| Loan Type | Interest Rate (Example – rates change annually) | Subsidized/Unsubsidized | Notes |

|---|---|---|---|

| Subsidized Federal Stafford Loan (Undergraduate) | 4.99% (Example) | Subsidized | Interest does not accrue while the borrower is in school at least half-time. |

| Unsubsidized Federal Stafford Loan (Undergraduate) | 4.99% (Example) | Unsubsidized | Interest accrues while the borrower is in school. |

| Subsidized Federal Stafford Loan (Graduate) | 6.54% (Example) | Subsidized | Interest does not accrue while the borrower is in school at least half-time. |

| Unsubsidized Federal Stafford Loan (Graduate) | 6.54% (Example) | Unsubsidized | Interest accrues while the borrower is in school. |

| Federal Grad PLUS Loan | 7.54% (Example) | Unsubsidized | Available to graduate and professional students. Credit check required. |

| Federal Parent PLUS Loan | 7.54% (Example) | Unsubsidized | Available to parents of dependent undergraduate students. Credit check required. |

The factors influencing federal student loan interest rates include the prevailing market interest rates, the government’s fiscal policy, and the overall economic climate. For example, during periods of low inflation, the government may set lower interest rates to stimulate borrowing and economic growth. Conversely, during periods of high inflation, rates might be increased to control inflation.

Private Student Loan Interest Rates

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike federal loans, private loan interest rates are variable and depend heavily on the borrower’s creditworthiness and the lender’s risk assessment.

Credit scores play a significant role in determining interest rates on private student loans. Borrowers with high credit scores are considered less risky and therefore qualify for lower interest rates. Other factors considered include income, debt-to-income ratio, co-signer availability, and the loan amount. A borrower with a strong credit history and a low debt-to-income ratio will likely receive a more favorable interest rate compared to a borrower with a poor credit history and high debt.

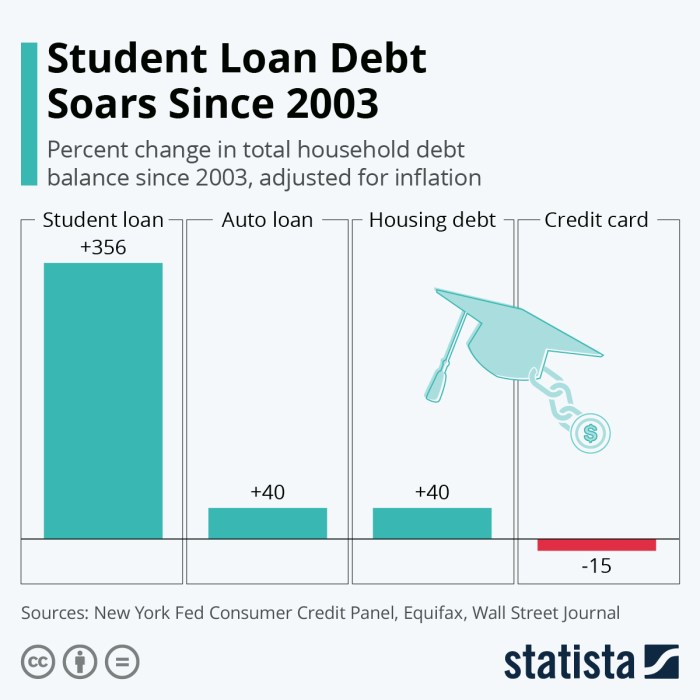

Historical Trends in Student Loan Interest Rates

Understanding the historical fluctuations in student loan interest rates provides valuable context for current borrowers and policymakers alike. These rates haven’t remained static; they’ve been influenced by a complex interplay of economic factors and legislative decisions. Examining these trends helps illustrate the financial burden faced by students across different generations.

The following analysis explores the historical trends in average student loan interest rates over the past two decades, considering the impact of economic shifts and significant policy changes.

Average Student Loan Interest Rate Fluctuations (2004-2024)

Imagine a line graph depicting the average annual interest rate for federal student loans from 2004 to 2024. The graph’s x-axis represents the year, and the y-axis shows the interest rate percentage. The line would generally show an upward trend from 2004 to approximately 2007, followed by a slight dip. A significant increase would be observed between 2008 and 2011, correlating with the Great Recession. After 2011, the line would demonstrate a period of relative stability with some minor fluctuations, before another period of change influenced by more recent economic and legislative factors. Specific numerical data would be needed to accurately depict the peaks and valleys, but the overall pattern would clearly illustrate the dynamic nature of these rates. For example, a peak might be observed around 2011, reflecting the economic instability of the time, while a valley might be seen in the years following the implementation of specific legislative changes designed to lower interest rates.

Impact of Economic Conditions on Student Loan Interest Rates

Economic conditions, particularly inflation and recession, significantly influence student loan interest rates. During periods of high inflation, the Federal Reserve often raises interest rates to curb inflation. This directly impacts the cost of borrowing, including student loans. Conversely, during recessions, the Federal Reserve typically lowers interest rates to stimulate economic activity. This can lead to lower student loan interest rates, making borrowing more affordable. The Great Recession of 2008-2009 provides a clear example. The Federal Reserve drastically lowered interest rates to combat the economic downturn, which initially resulted in lower student loan rates. However, the subsequent economic recovery and increased inflation have led to increases in student loan interest rates in later years.

Key Legislative Changes Affecting Student Loan Interest Rates

Several legislative changes and policy decisions have profoundly impacted student loan interest rates. For instance, the 2007 College Cost Reduction and Access Act introduced variable interest rates for subsidized Stafford loans. Later legislation, like the Health Care and Education Reconciliation Act of 2010, aimed to stabilize and potentially reduce interest rates. More recently, policy changes relating to loan forgiveness programs and interest rate caps have significantly affected the overall cost of borrowing for students. These legislative actions highlight the government’s role in shaping the affordability and accessibility of higher education. The impact of these changes can be seen in the line graph mentioned previously – periods of significant legislative action often correspond to noticeable shifts in the trend line.

Impact of Interest Rates on Student Loan Repayment

Understanding how interest rates affect your student loan repayment is crucial for long-term financial planning. The interest rate directly impacts the total amount you’ll pay back, and the repayment plan you choose significantly influences this cost. Choosing wisely can save you thousands of dollars over the life of your loan.

The interest rate determines how much interest accrues on your principal loan balance each month. A higher interest rate means more interest accumulates, leading to a larger total repayment amount. Conversely, a lower interest rate reduces the total interest paid over the life of the loan. This effect is compounded by the repayment plan chosen and the presence of interest capitalization.

Comparison of Student Loan Repayment Plans

Several repayment plans are available, each impacting the total interest paid differently. The best choice depends on individual financial circumstances and goals. Let’s examine three common plans:

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s the simplest plan but often results in higher monthly payments and potentially the least amount of total interest paid due to the shorter repayment period. However, this higher payment may not be feasible for all borrowers.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time. While initially more manageable, the longer repayment period generally leads to higher total interest paid compared to the standard plan. This option is beneficial for borrowers who anticipate increased income in the future.

- Income-Driven Repayment Plan (IDR): These plans (such as ICR, PAYE, REPAYE) base monthly payments on your income and family size. Payments are typically lower, potentially resulting in a longer repayment period (often 20-25 years) and consequently, higher total interest paid over the loan’s lifetime. However, IDR plans offer forgiveness options after a certain number of years of on-time payments, potentially wiping out remaining balances.

Effect of Interest Capitalization

Interest capitalization occurs when unpaid interest is added to your principal loan balance. This increases the amount on which future interest is calculated, effectively accelerating interest growth and increasing your overall debt. For example, if you miss payments or defer your loans, accrued interest will be capitalized, leading to a significantly larger final loan amount.

Interest capitalization can dramatically increase the total cost of your loan. It’s crucial to make payments consistently to avoid this.

Hypothetical Scenario: Long-Term Cost Differences

Consider two borrowers, each with a $30,000 loan. Borrower A has a 5% interest rate, while Borrower B has a 7% interest rate. Both choose a standard 10-year repayment plan. Over the 10 years, Borrower A would pay approximately $38,000 in total (including principal and interest), while Borrower B would pay approximately $41,500. This represents a difference of approximately $3,500, solely due to the 2% difference in interest rates. The longer the repayment period, or the presence of interest capitalization, would further amplify this difference.

Strategies for Managing Student Loan Debt and Interest

Managing student loan debt effectively requires a proactive approach to minimize the long-term financial impact of interest accumulation. Understanding available strategies and resources is crucial for borrowers to navigate their repayment journey successfully and avoid potential pitfalls. This section explores practical methods for managing student loan debt and interest, highlighting resources and outlining various repayment strategies.

High interest rates can significantly increase the total cost of your student loans. Several strategies can help mitigate this impact, allowing borrowers to pay off their debt faster and save money. These strategies involve careful planning, informed decision-making, and potentially seeking external assistance.

Refinancing and Consolidation Options

Refinancing and consolidation are two common strategies employed to manage student loan debt. Refinancing involves replacing your existing loans with a new loan at a potentially lower interest rate. This can be particularly beneficial if interest rates have fallen since you initially borrowed. Consolidation, on the other hand, combines multiple loans into a single loan, simplifying repayment and potentially lowering monthly payments (though the overall interest paid might be higher depending on the terms). However, refinancing often requires good credit, and borrowers should carefully compare offers from multiple lenders to secure the best terms. Consolidation may not always result in lower interest rates, but it simplifies the repayment process. The choice between refinancing and consolidation depends on individual circumstances and financial goals. Careful consideration of the terms and conditions of each option is essential before making a decision.

Available Resources for Student Loan Debt Management

Numerous resources are available to assist students and borrowers in managing their student loan debt. These resources offer guidance, support, and tools to help borrowers navigate the complexities of repayment.

These resources can be invaluable in helping borrowers understand their repayment options, develop a repayment plan that fits their budget, and access potential assistance programs.

- The National Student Loan Data System (NSLDS): This system provides a centralized location to access information about your federal student loans.

- Your Loan Servicer: Your loan servicer is responsible for managing your student loan payments. They can provide information about your loan terms, repayment options, and available assistance programs.

- The Federal Student Aid website (studentaid.gov): This website provides comprehensive information about federal student loans, repayment plans, and other relevant resources.

- Nonprofit credit counseling agencies: These agencies offer free or low-cost credit counseling services, including assistance with student loan debt management.

Student Loan Repayment Strategies: Benefits and Drawbacks

Several repayment strategies exist, each with its own benefits and drawbacks. The optimal strategy depends on individual financial circumstances, risk tolerance, and long-term financial goals.

Understanding the nuances of each approach is crucial for making an informed decision and achieving efficient debt repayment.

| Repayment Strategy | Benefits | Drawbacks |

|---|---|---|

| Standard Repayment | Simple and straightforward | Higher monthly payments, potentially longer repayment period |

| Graduated Repayment | Lower initial payments | Payments increase over time, potentially leading to higher overall interest paid |

| Extended Repayment | Lower monthly payments | Longer repayment period, potentially leading to higher overall interest paid |

| Income-Driven Repayment (IDR) Plans | Payments based on income and family size | Potentially longer repayment period, may result in loan forgiveness after 20-25 years, but forgiven amount is considered taxable income |

The Role of Government in Student Loan Interest Rates

The United States government plays a significant role in shaping the student loan interest rate landscape, impacting both federal and, indirectly, private student loan markets. Its influence stems from its substantial involvement in the federal student loan program and its broader economic policies.

The government directly sets interest rates for federal student loans. These rates are often tied to market indices, such as the 10-year Treasury note, but with adjustments based on Congressional legislation and budgetary considerations. This means that fluctuations in the broader financial market can affect the cost of borrowing for federal student loans, although the government retains considerable control over the ultimate rate offered to borrowers. For instance, legislation might mandate a fixed interest rate for a specific period, or introduce temporary subsidies to lower the cost of borrowing.

Federal Student Loan Interest Rate Setting

The government’s influence on federal student loan interest rates is primarily achieved through legislation and regulatory actions. Congress sets the overall framework for federal student loan programs, including the types of loans offered, eligibility criteria, and the methods used to determine interest rates. The Department of Education, specifically, is responsible for the day-to-day administration of these programs, including the calculation and dissemination of interest rates to borrowers. These rates are usually announced annually and apply to new loans disbursed during a specific academic year. Changes to the rate are often influenced by economic factors and political considerations, balancing the need to support students with the government’s fiscal responsibilities.

Government Influence on Private Student Loan Interest Rates

While the government does not directly set interest rates for private student loans, its policies and actions significantly influence the market. Factors like the overall economic climate (influenced by government monetary policy), the availability of federal student loans (affecting the demand for private loans), and regulations concerning lending practices all contribute to the interest rates charged by private lenders. For example, a period of low interest rates set by the Federal Reserve can lead to lower borrowing costs for private lenders, potentially resulting in lower interest rates on private student loans. Conversely, increased regulatory scrutiny on private lenders might lead to higher costs associated with lending, which could translate to higher interest rates for borrowers.

Implications of Government Policies on Student Loan Interest Rates

Government policies aimed at lowering or controlling student loan interest rates can have far-reaching consequences. Lowering interest rates can make higher education more accessible and affordable, potentially leading to increased enrollment and improved educational attainment. However, this can also increase the overall cost to taxpayers if the government subsidizes the difference between market rates and the lower rates offered to borrowers. Furthermore, prolonged periods of artificially low interest rates might encourage excessive borrowing, potentially leading to increased student loan debt burdens for individuals and a larger overall national debt. Conversely, policies that fail to address affordability issues or maintain high interest rates could restrict access to higher education for many students, exacerbating existing inequalities. The optimal balance between affordability and fiscal responsibility is a complex issue requiring careful consideration of numerous factors.

Summary

Successfully managing student loan debt requires a proactive approach and a thorough understanding of the factors influencing interest rates. By analyzing current rates, historical trends, and available repayment options, borrowers can develop effective strategies to minimize their financial burden. Remember to utilize available resources and explore options like refinancing or consolidation to potentially lower your overall interest payments. Proactive planning and informed decision-making are key to navigating the complexities of student loan repayment and achieving long-term financial well-being.

User Queries

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or while in deferment. Unsubsidized loans accrue interest throughout these periods.

Can I refinance my federal student loans with a private lender?

Yes, but be aware that refinancing federal loans means losing federal protections like income-driven repayment plans.

What is interest capitalization?

Interest capitalization is when unpaid interest is added to your principal loan balance, increasing the amount you owe.

How often are federal student loan interest rates adjusted?

Federal student loan interest rates are typically set annually and may vary depending on the loan type and the market.

What factors affect my eligibility for student loan refinancing?

Factors include credit score, debt-to-income ratio, and income stability. Private lenders have varying eligibility requirements.