Navigating the complexities of higher education financing can feel overwhelming, but understanding your options is key. Student loan lines of credit offer a flexible approach to funding your studies, allowing you to borrow only what you need, when you need it. This guide will delve into the intricacies of these loans, comparing them to other financing options and equipping you with the knowledge to make informed decisions.

From eligibility requirements and the application process to effective management strategies and repayment plans, we’ll cover all aspects of student loan lines of credit. We’ll explore the advantages and disadvantages, discuss potential challenges, and offer practical advice to help you successfully navigate this important financial journey.

Understanding Student Loan Lines of Credit

A student loan line of credit (LOC) is a flexible borrowing option designed to help students finance their education. Unlike traditional student loans, which provide a fixed amount upfront, a LOC allows you to borrow money as needed throughout your studies, up to a pre-approved credit limit. This offers greater control over your finances and allows you to only borrow what you actually require each term. This flexibility makes it a potentially attractive option for students whose educational expenses may vary from year to year.

Mechanics of a Student Loan Line of Credit

A student loan line of credit operates similarly to a credit card. You are given a credit limit, and you can borrow funds up to that limit. Interest typically accrues on the outstanding balance from the moment you borrow the funds. You will receive regular statements showing your outstanding balance, interest accrued, and minimum payment due. As you make payments, your available credit increases, allowing you to borrow more if needed. Importantly, repayment usually begins after you finish your studies or when your enrollment falls below a certain threshold (e.g., part-time status), and various repayment options may be available.

Differences Between Student Loan Lines of Credit and Other Loan Types

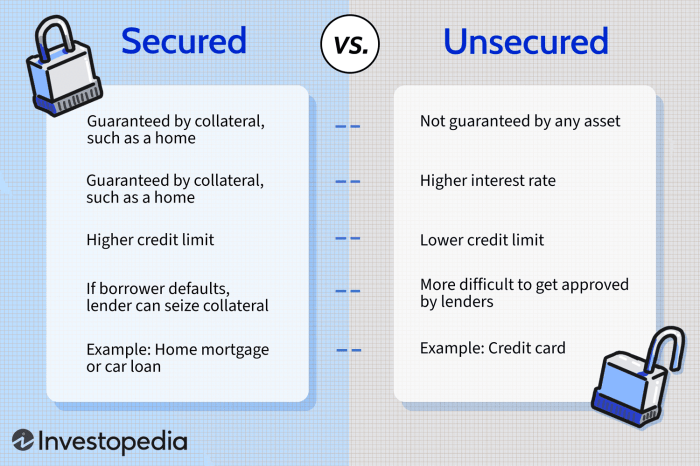

Student loan lines of credit differ from other student loan types in several key ways. Traditional student loans, often disbursed directly to the educational institution, provide a fixed amount for the entire academic year or program. Unlike a LOC, this amount cannot be increased during the term. Government-backed loans, such as federal student loans, typically have lower interest rates and more favorable repayment options, but often have stricter eligibility requirements and disbursement processes. Private student loans also offer fixed amounts, but typically come with higher interest rates than federal loans. The key difference with a LOC is the flexibility to borrow as needed within a set limit, offering a more tailored approach to financing education.

Applying for a Student Loan Line of Credit

Applying for a student loan line of credit typically involves these steps:

1. Check your creditworthiness: Lenders will assess your credit history and score. A strong credit history can improve your chances of approval and secure a more favorable interest rate.

2. Compare lenders: Research different lenders to compare interest rates, fees, and repayment terms.

3. Complete the application: Fill out the application form provided by the lender, supplying accurate and complete information.

4. Provide documentation: This usually includes proof of enrollment, transcripts, and financial information.

5. Await approval: The lender will review your application and inform you of their decision.

6. Sign the loan agreement: Once approved, carefully review and sign the loan agreement.

7. Access your funds: Once the agreement is signed, you can begin accessing your funds as needed.

Interest Rates and Repayment Terms Comparison

The interest rates and repayment terms for student loan lines of credit vary significantly among lenders. It’s crucial to compare offers before making a decision. The following table provides a hypothetical comparison – actual rates and terms will vary depending on the lender, applicant’s creditworthiness, and prevailing market conditions.

| Lender | Interest Rate (Variable) | Repayment Term (Years) | Other Key Features |

|---|---|---|---|

| Lender A | 7.5% – 10% | 5-10 | Interest-only payments during studies, deferment options |

| Lender B | 6.0% – 9.0% | 7-12 | No prepayment penalties, flexible repayment schedule |

| Lender C | 8.0% – 11% | 5-7 | Grace period of 6 months post-graduation |

| Lender D | 7.0% – 10.5% | 8-15 | Option for co-signer, online account management |

Eligibility and Application Process

Securing a student loan line of credit involves meeting specific eligibility criteria and navigating an application process. Understanding these aspects is crucial for prospective borrowers to successfully obtain the necessary funding for their education. This section details the typical requirements, the application procedure, necessary documentation, and potential challenges students might encounter.

Eligibility for a student loan line of credit typically hinges on several factors. Lenders assess applicants based on their creditworthiness, academic standing, and financial capacity. Meeting these criteria increases the likelihood of approval and favorable loan terms.

Eligibility Requirements

Lenders generally consider several key factors when assessing eligibility for a student loan line of credit. These include:

- Credit History: While not always mandatory for students, a positive credit history or a co-signer with good credit significantly improves the chances of approval. A strong credit history demonstrates responsible financial management.

- Enrollment Status: Applicants must be enrolled or accepted at an eligible educational institution. This ensures the loan funds are used for educational purposes.

- Academic Standing: Maintaining satisfactory academic progress is often a requirement. This demonstrates commitment to completing studies and reducing the risk of loan default.

- Financial Need: While not always a strict requirement for all lines of credit, some lenders may consider the applicant’s overall financial situation and demonstrated need for funding.

- Citizenship and Residency: Applicants usually need to be a citizen or permanent resident of the country where they are applying for the loan.

Application Process Flowchart

The application process for a student loan line of credit can be visualized as a flowchart. This provides a clear, step-by-step guide to the procedure.

Imagine a flowchart starting with a “Start” box. The next box would be “Complete Application Form,” followed by “Gather Required Documentation.” Then, a decision box would ask, “Is all documentation complete and accurate?” A “Yes” branch leads to “Submit Application,” and a “No” branch loops back to “Gather Required Documentation.” After “Submit Application,” there’s another decision box: “Application Approved?” A “Yes” branch leads to “Loan Disbursement,” and a “No” branch leads to “Application Denied/Further Information Required.” The flowchart ends with an “End” box.

Required Documentation

Preparing the necessary documentation beforehand streamlines the application process. This ensures a smoother and more efficient experience.

- Completed Application Form: This form typically requests personal information, educational details, and financial information.

- Proof of Enrollment: Documents like acceptance letters, enrollment confirmations, or transcripts are usually required.

- Financial Aid Award Letter (if applicable): This demonstrates other funding sources and helps lenders assess financial need.

- Credit Report (if required): Some lenders may request a credit report to assess creditworthiness. A co-signer’s credit report may also be necessary.

- Government-Issued Identification: Passport, driver’s license, or other official identification is usually required.

Potential Application Challenges

Students may encounter various challenges during the application process. Understanding these potential hurdles can help them prepare and mitigate difficulties.

- Insufficient Credit History: Lack of credit history can hinder approval, especially for those without a co-signer.

- Incomplete or Inaccurate Documentation: Missing or incorrect information can delay processing or lead to rejection.

- Complex Application Procedures: Navigating the application process can be daunting for first-time borrowers.

- Long Processing Times: Applications can take time to process, potentially delaying access to funds.

- Rejection of Application: Not meeting eligibility criteria or having a poor credit history can lead to application rejection.

Managing and Repaying Student Loan Lines of Credit

Successfully managing and repaying your student loan line of credit requires proactive planning and disciplined financial habits. Understanding your repayment options, creating a realistic budget, and seeking assistance when needed are crucial for avoiding financial strain and ensuring timely repayment. This section Artikels strategies and resources to help you navigate this process effectively.

Effective Debt Management Strategies

Effective management of student loan debt involves a multifaceted approach. Prioritizing repayment, exploring different repayment plans, and maintaining open communication with your lender are key components. For instance, making extra payments when possible can significantly reduce the overall interest paid and shorten the repayment period. Similarly, understanding and choosing the right repayment plan (e.g., graduated, extended, or income-driven) can make a substantial difference in monthly affordability. Regularly reviewing your loan statement and contacting your lender to address any concerns or questions promotes transparency and prevents potential issues from escalating.

Budgeting Techniques for Loan Repayment

Creating a comprehensive budget is paramount to successful loan repayment. This involves tracking income and expenses meticulously to identify areas for potential savings. A simple budgeting method is the 50/30/20 rule: allocate 50% of your income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. Alternatively, the zero-based budget method involves assigning every dollar of your income to a specific category, ensuring that all income is accounted for and allocated. Consider using budgeting apps or spreadsheets to simplify this process and monitor your progress. For example, tracking daily expenses using a spreadsheet allows for easy identification of unnecessary spending, facilitating adjustments to your budget and enabling more funds to be directed towards loan repayment.

Calculating the Total Cost of a Student Loan Line of Credit

Calculating the total cost of your student loan involves understanding the principal amount borrowed, the interest rate, and the repayment period. The total cost will always be higher than the principal amount due to accumulated interest. A simple way to estimate the total cost is to use an online loan calculator, readily available from many financial institutions. These calculators allow you to input the loan amount, interest rate, and repayment period to determine the total amount repaid over the life of the loan. For example, a $10,000 loan with a 5% interest rate over 10 years will result in a significantly higher total repayment amount than the initial principal. Remember to factor in any fees associated with the loan as well. The formula for simple interest is:

Total Interest = Principal x Interest Rate x Time

However, most student loans use compound interest, which is more complex to calculate manually and best determined using a loan calculator.

Resources for Students Struggling with Loan Repayment

Several resources are available to assist students facing difficulties with loan repayment. Your lender may offer forbearance or deferment options, temporarily suspending or reducing payments during financial hardship. Government programs, such as income-driven repayment plans, adjust monthly payments based on your income and family size. Non-profit credit counseling agencies can provide guidance on budgeting, debt management strategies, and exploring options for loan consolidation or refinancing. Furthermore, many universities offer financial aid offices that provide support and guidance to students facing financial challenges. These resources can provide valuable support and prevent loan default.

Advantages and Disadvantages of Student Loan Lines of Credit

Student loan lines of credit offer a flexible financing option for higher education, but like any financial product, they come with both advantages and disadvantages. Understanding these aspects is crucial for making an informed decision about whether this type of loan is the right fit for your individual circumstances. Weighing the pros and cons carefully will help you navigate the complexities of financing your education.

Choosing the right financing method for your education is a significant decision. Student loan lines of credit present a different approach compared to traditional student loans or other funding sources like scholarships or savings. A thorough comparison helps determine the best path for your financial future.

Comparison with Other Financing Options

Student loan lines of credit offer several key advantages over other financing options. Unlike traditional student loans, which disburse a fixed amount upfront, a line of credit allows you to borrow only the amount you need, when you need it, throughout your studies. This flexibility can be particularly beneficial for students whose tuition costs may vary from year to year or who anticipate unexpected expenses. Furthermore, interest typically accrues only on the amount borrowed, unlike some fixed-amount loans where interest begins accruing immediately upon disbursement of the full loan amount. This can result in lower overall interest payments if you borrow less than the maximum available. However, scholarships and grants remain preferable as they don’t require repayment, and personal savings help avoid accumulating debt.

Potential Disadvantages and Risks

While offering flexibility, student loan lines of credit also carry potential risks. The primary concern is the possibility of accumulating significant debt if borrowing is not carefully managed. The flexible nature of the loan can tempt overspending, leading to higher overall interest payments and a longer repayment period. Interest rates on lines of credit can be variable, meaning they can fluctuate over the life of the loan, potentially increasing your monthly payments. Furthermore, if you fail to make timely payments, your credit score can be negatively impacted, making it more difficult to secure future loans or credit cards. Finally, the repayment process can be more complex compared to a standard loan, especially if you’ve borrowed incrementally over several years.

Pros and Cons of Student Loan Lines of Credit

The decision of whether or not to utilize a student loan line of credit requires careful consideration of the advantages and disadvantages. Understanding these points is crucial to making a well-informed financial choice.

- Pros: Flexibility in borrowing amounts and timing; potential for lower interest payments if only borrowing what’s needed; access to funds for unexpected expenses.

- Cons: Risk of overspending and accumulating significant debt; variable interest rates can lead to unpredictable payments; potential for negative credit impact if payments are missed; complex repayment process.

Implications of Defaulting on a Student Loan Line of Credit

Defaulting on a student loan line of credit can have severe consequences. Your credit score will be significantly damaged, making it difficult to obtain future loans, rent an apartment, or even secure certain jobs. Collection agencies may pursue aggressive debt recovery methods, potentially leading to wage garnishment or legal action. In some cases, default may impact your ability to obtain government benefits or even travel internationally. The long-term financial repercussions of default can be substantial and far-reaching. It is imperative to prioritize repayment and seek assistance if you are struggling to meet your payment obligations.

Alternatives to Student Loan Lines of Credit

Securing funding for higher education involves careful consideration of various options beyond student loan lines of credit. While lines of credit offer flexibility, they also come with the responsibility of managing debt. Exploring alternative funding sources can significantly impact your overall financial burden and long-term well-being. Understanding the nuances of each option is crucial in making an informed decision.

Several avenues exist to finance your education, each with its own set of benefits and drawbacks. These alternatives can be categorized into scholarships and grants (free money), work-study programs (earning while learning), and federal and private student loans (borrowed money). A strategic combination of these funding sources often proves the most effective approach.

Scholarships and Grants

Scholarships and grants represent non-repayable financial aid. Scholarships are typically merit-based, awarded based on academic achievement, athletic prowess, or other talents and skills. Grants, on the other hand, are often need-based, considering the student’s and family’s financial circumstances. Both significantly reduce the reliance on loans, minimizing long-term debt. Numerous organizations, including colleges, universities, private foundations, and corporations, offer scholarships and grants. The application process for each varies, often requiring essays, transcripts, and letters of recommendation. Successfully securing these awards requires proactive research and diligent application.

Work-Study Programs

Federal Work-Study programs allow students to earn money while attending college. These programs are need-based and offer part-time jobs on or off campus, providing income to help cover educational expenses. The earnings are not considered loans and don’t need to be repaid. While the income generated might not cover all expenses, it can significantly reduce the amount of borrowing required. The availability of work-study positions and the hours available can vary depending on the institution and the student’s need.

Federal Student Loan Programs

Federal student loan programs offer subsidized and unsubsidized loans with varying interest rates and repayment plans. Subsidized loans don’t accrue interest while the student is enrolled at least half-time, while unsubsidized loans accrue interest from the time the loan is disbursed. Federal loans typically offer lower interest rates and more flexible repayment options than private loans. The federal government provides several types of loans, including Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans for parents or graduate students. Eligibility is based on financial need and enrollment status.

Private Student Loan Programs

Private student loans are offered by banks and other financial institutions. These loans often have higher interest rates and less favorable repayment terms than federal loans. Private loans are typically not need-based and require a credit check. While they can supplement federal loans, they should be considered carefully due to the potential for higher costs. It is advisable to exhaust federal loan options before considering private loans, as the terms are often more favorable.

Illustrative Example

Sarah, a bright and ambitious student pursuing a degree in engineering, faced the daunting prospect of financing her education. After exploring various options, she opted for a student loan line of credit to supplement her savings and part-time job income. This allowed her greater flexibility in managing her funds throughout her studies.

Sarah’s Loan Application and Approval

Sarah meticulously researched different lenders, comparing interest rates, fees, and repayment terms. She chose a lender offering a competitive interest rate and a flexible repayment plan. Her strong academic record and part-time work history strengthened her application, leading to a swift approval process. The loan amount approved covered her tuition fees, accommodation costs, and essential living expenses for the academic year.

Budgeting and Expense Management

Understanding the importance of responsible financial management, Sarah created a detailed budget. This budget allocated funds for tuition, rent, groceries, utilities, transportation, and entertainment. She tracked her expenses diligently using a budgeting app, ensuring she stayed within her allocated limits. She prioritized essential expenses, limiting discretionary spending to avoid overspending and potential debt accumulation.

Challenges and Solutions

During her second year, an unexpected medical bill threatened to derail her financial plan. Sarah immediately contacted her lender to discuss her situation. The lender offered temporary payment deferment, providing her with the breathing room she needed to manage the unexpected expense. She also explored options to increase her part-time work hours to bolster her income and expedite repayment.

Visual Representation of Sarah’s Financial Journey

A line graph would visually depict Sarah’s loan balance over time. The graph would start high, reflecting the initial loan amount, then gradually decrease as she made regular repayments. The slope of the line would steepen during periods when she made larger payments or received additional income. A bar chart would show the breakdown of her monthly expenses, illustrating the proportion allocated to tuition, rent, and other necessities. A pie chart would represent the percentage of her income allocated to loan repayment versus other expenses, showcasing the evolving balance between these aspects of her financial life. A smaller inset graph could show the fluctuation of her part-time income throughout her studies. The overall visual representation would demonstrate a clear, positive trajectory, highlighting the success of her financial planning and responsible management of her student loan line of credit.

Final Conclusion

Securing a student loan line of credit requires careful consideration and planning. By understanding the terms, comparing lenders, and developing a sound repayment strategy, you can leverage this financial tool to achieve your educational goals without incurring undue financial burden. Remember to explore all available options and choose the financing method that best aligns with your individual circumstances and financial capabilities. Responsible borrowing and proactive management are crucial for a successful outcome.

FAQ Summary

What is the difference between a student loan line of credit and a traditional student loan?

A traditional student loan provides a fixed amount upfront, while a line of credit allows you to borrow funds as needed, up to a pre-approved limit, over a specified period. This offers greater flexibility but also carries the risk of accruing more debt if not managed carefully.

Can I use a student loan line of credit for living expenses?

While the funds can technically be used for any educational expense, including living costs, it’s generally advisable to prioritize essential tuition and fees first. Overextending yourself financially can lead to difficulties in repayment.

What happens if I default on my student loan line of credit?

Defaulting can severely damage your credit score, impacting your ability to obtain loans or credit in the future. It may also lead to wage garnishment or legal action by the lender.

How do I choose the best student loan line of credit for me?

Compare interest rates, repayment terms, and fees from multiple lenders. Consider factors like your credit history, academic standing, and expected income after graduation to determine the most suitable option.