Navigating the complexities of student loans can feel overwhelming, especially when faced with hidden fees like origination fees. These fees, charged by lenders to process your loan application, can significantly impact your overall borrowing cost. Understanding how these fees are calculated and their long-term effects on your repayment is crucial for making informed financial decisions. This guide provides a comprehensive overview of student loan origination fees, offering practical tools and insights to help you effectively manage your student loan debt.

We will explore various aspects of student loan origination fees, including their calculation methods, differences between federal and private loans, and the impact on your repayment schedule. We’ll also delve into the practical application of a student loan origination fee calculator, demonstrating how to use it to estimate your total loan cost and make informed comparisons between different loan options. By understanding these factors, you can make strategic choices that minimize the financial burden of your student loans and pave the way for a more financially secure future.

Understanding Student Loan Origination Fees

Student loan origination fees are upfront charges lenders assess when you borrow money for education. These fees are a percentage of your loan amount and directly impact the total cost of borrowing, increasing the overall amount you’ll need to repay. Understanding these fees is crucial for making informed borrowing decisions.

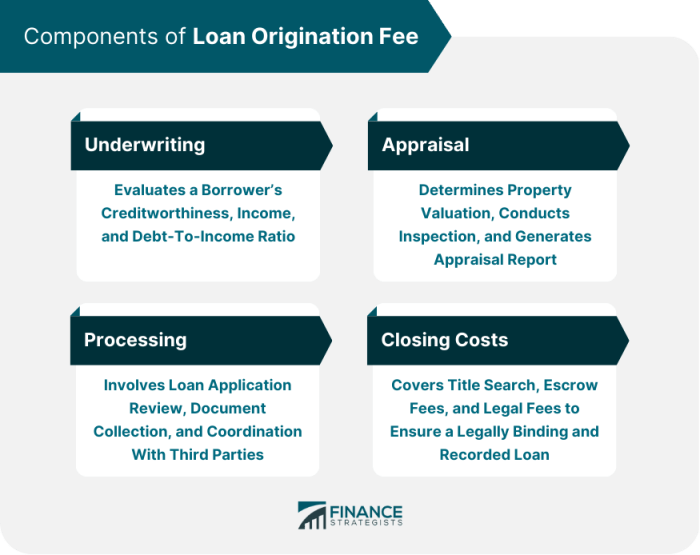

Origination fees are essentially the lender’s administrative costs for processing your loan application. They cover the expenses involved in verifying your information, underwriting the loan, and disbursing the funds. While they might seem like a small percentage, these fees compound over the loan’s life, adding significantly to the final repayment amount.

Origination Fees Across Loan Types

Federal and private student loans differ significantly in their origination fee structures. Federal student loans typically have lower or even no origination fees, depending on the loan program. For example, Direct Subsidized and Unsubsidized Loans have origination fees, usually a percentage of the loan amount, while other federal loan programs might have different structures or no fees at all. Private student loans, on the other hand, often have higher and more variable origination fees, which can vary depending on the lender, your creditworthiness, and the loan terms. These fees can range from 0% to several percentage points of the loan amount. It’s essential to compare offers carefully to minimize this cost.

Calculating and Adding Origination Fees

Origination fees are usually calculated as a percentage of the total loan amount. For instance, if a student takes out a $10,000 loan with a 1% origination fee, the fee would be $100 ($10,000 x 0.01). This fee is then added to the principal loan amount, increasing the total amount the borrower owes. In this example, the borrower would owe $10,100 from the outset. The interest accrues on the entire $10,100, further increasing the total repayment cost. The impact of this additional cost becomes even more significant with larger loan amounts and higher origination fees. Some lenders may deduct the origination fee directly from the loan disbursement, meaning the borrower receives less money than the loan amount.

Comparison of Origination Fees from Different Lenders

The following table compares hypothetical origination fees from different lenders. Remember that actual fees can vary widely and depend on many factors. This table serves as an illustrative example only and should not be considered financial advice.

| Lender | Loan Type | Origination Fee Percentage | Example Fee on $10,000 Loan |

|---|---|---|---|

| Lender A | Federal Direct Unsubsidized Loan | 1.0% | $100 |

| Lender B | Private Undergraduate Loan | 2.5% | $250 |

| Lender C | Private Graduate Loan | 3.0% | $300 |

| Lender D | Federal Direct Subsidized Loan | 1.07% | $107 |

Using a Student Loan Origination Fee Calculator

Student loan origination fee calculators are invaluable tools for prospective borrowers. They provide a quick and easy way to estimate the total cost of a student loan, including the often-overlooked origination fee. Understanding this fee beforehand helps you make informed borrowing decisions and budget effectively.

Calculator Features and Functionalities

Most online student loan origination fee calculators share a similar structure. They typically feature input fields for key loan details and provide an output section displaying the calculated origination fee and total loan cost. Many calculators also include the ability to compare different loan scenarios by allowing users to adjust input parameters and observe the impact on the final cost. Some advanced calculators might even offer loan amortization schedules, illustrating the monthly payment breakdown over the loan term.

Step-by-Step Guide to Using a Student Loan Origination Fee Calculator

Using a student loan origination fee calculator is straightforward. Follow these steps for accurate results:

- Locate a reputable calculator: Begin by searching online for a reputable student loan origination fee calculator. Ensure the source is trustworthy and provides clear explanations of its calculations.

- Input the loan amount: Enter the total amount you plan to borrow for your education. This is typically the total cost of attendance minus any grants or scholarships.

- Enter the interest rate: Input the annual interest rate offered on your student loan. This information is usually provided by the lender.

- Specify the loan term: Indicate the loan’s repayment period (e.g., 10 years, 15 years). The longer the repayment period, the lower your monthly payment will be, but the higher your total interest paid will be.

- Input the origination fee percentage or dollar amount: Some calculators will ask for the origination fee as a percentage of the loan amount, while others may ask for the fee in dollars. This information should be available in your loan documents.

- Review the results: Once you have entered all the necessary information, the calculator will display the calculated origination fee and the total cost of the loan, including both principal and interest. Carefully review these figures.

Input Parameters for Accurate Calculations

Accurate calculations depend on precise input parameters. The most crucial inputs are:

- Loan Amount: The principal amount borrowed.

- Annual Interest Rate: The percentage charged on the loan balance annually.

- Loan Term (Repayment Period): The length of time you have to repay the loan.

- Origination Fee: This fee is charged by the lender to process the loan application. It can be expressed as a percentage of the loan amount or a fixed dollar amount.

Hypothetical Scenario and Calculator Output

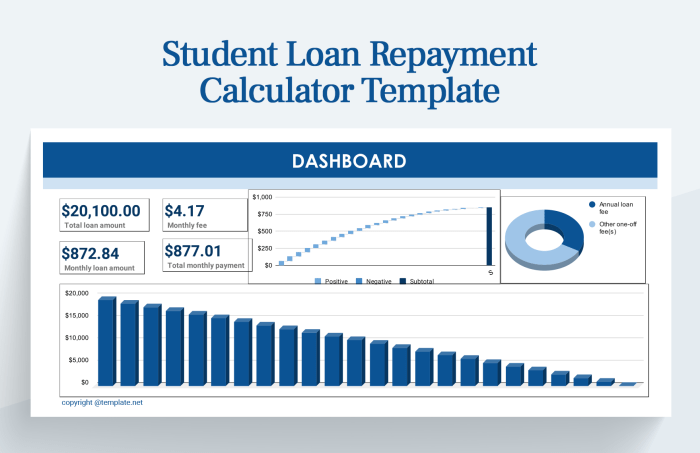

Let’s assume a student is borrowing $20,000 at a 6% annual interest rate for a 10-year term. The lender charges a 1% origination fee.

Using a hypothetical calculator, the inputs would be:

Loan Amount: $20,000

Interest Rate: 6%

Loan Term: 10 years

Origination Fee: 1%

The calculator would then output:

Origination Fee: $200 (1% of $20,000)

Total Loan Cost (Principal + Interest + Origination Fee): Approximately $25,000 (This is an approximation and the exact figure will vary slightly depending on the calculator’s compounding method.)

Impact of Origination Fees on Loan Repayment

Origination fees, charged by lenders when you take out a student loan, directly impact the total cost of your education and your long-term repayment burden. While seemingly small initially, these fees compound over the life of the loan, significantly increasing the overall amount you pay back. Understanding this impact is crucial for informed borrowing decisions.

Understanding how origination fees affect your repayment schedule requires examining both the immediate and long-term financial implications. The fee is added to your principal loan amount, meaning you’re borrowing more than the initial loan amount stated. This larger principal balance then accrues interest, leading to higher monthly payments and a greater total repayment amount over the life of the loan.

Total Repayment Cost Comparison

Let’s illustrate the impact with a hypothetical example. Consider a $10,000 student loan with a 5% origination fee. This means a $500 fee is added to the principal, resulting in a loan of $10,500. Assuming a 5% annual interest rate and a 10-year repayment plan, the total interest paid on the $10,000 loan (without origination fees) might be approximately $2,700. However, with the $500 origination fee included, the total interest paid on the $10,500 loan could be significantly higher, perhaps around $2,900 or more, depending on the amortization schedule. This demonstrates how a seemingly small origination fee can lead to a substantial increase in the total cost of the loan.

Repayment Schedule Differences

The following table demonstrates the differences in repayment schedules for a $10,000 loan with and without a 5% origination fee ($500), assuming a 5% annual interest rate and a 10-year repayment term. Note that these are simplified examples and actual repayment amounts may vary based on the specific loan terms and amortization schedule.

| Month | Loan without Origination Fee (Principal: $10,000) | Loan with Origination Fee (Principal: $10,500) | Difference |

|---|---|---|---|

| 1 | $100 | $105 | $5 |

| 12 | $100 | $105 | $5 |

| 24 | $100 | $105 | $5 |

| 120 | $100 | $105 | $5 |

Note: These figures are simplified estimations for illustrative purposes. Actual monthly payments and total interest paid may differ slightly due to the complexities of loan amortization calculations.

Impact on Different Repayment Plans

Different repayment plans, such as standard, extended, or income-driven repayment, are all affected by origination fees. While the fee itself remains the same regardless of the repayment plan, its impact on the total repayment amount varies. For example, a longer repayment plan (like an extended plan) will lead to higher total interest payments, magnifying the effect of the origination fee. Conversely, a shorter repayment plan will reduce the overall impact of the origination fee because the loan is paid off faster. However, shorter plans often involve higher monthly payments. Income-driven repayment plans adjust monthly payments based on income, but the origination fee still increases the total loan amount subject to interest accumulation, potentially extending the repayment period.

Comparing Different Loan Options

Choosing the right student loan involves careful consideration of various factors, not just the interest rate. Origination fees, while seemingly small, can significantly impact the overall cost of borrowing. Understanding how these fees interact with other loan features is crucial for making informed decisions and minimizing long-term expenses.

Strategies for minimizing the impact of origination fees involve a multi-pronged approach. First, thoroughly compare loan offers from multiple lenders, paying close attention to the total cost of the loan, including the origination fee, rather than focusing solely on the interest rate. Second, explore loan options that offer lower or no origination fees. While not always available, some lenders offer competitive rates without adding this extra charge. Finally, consider the potential for refinancing your loans once your credit improves, allowing you to potentially secure a lower interest rate and eliminate existing origination fees.

Factors Beyond Origination Fees in Student Loan Selection

Beyond origination fees, several other key factors significantly influence the overall cost and suitability of a student loan. Interest rates, of course, play a pivotal role, determining the total interest accrued over the loan’s lifetime. Repayment terms, including the loan’s length and monthly payment amount, directly impact affordability and the total interest paid. Deferment and forbearance options offer temporary relief from payments during periods of financial hardship, but should be carefully considered as they can extend the loan’s repayment period and increase overall interest costs. Finally, the type of loan (federal or private) has significant implications for repayment options, interest rates, and overall borrower protections.

Federal vs. Private Student Loans: Origination Fee Comparison

Federal student loans, while often carrying a slightly higher interest rate than private loans, typically have lower or no origination fees. This is because federal loan programs are designed to prioritize accessibility and affordability for students. Private student loans, on the other hand, often charge origination fees, which can vary significantly depending on the lender and the borrower’s creditworthiness. The advantage of private loans lies in potentially lower interest rates for borrowers with strong credit, but the added origination fee needs to be factored into the overall cost comparison. The disadvantage of private loans is the lack of robust borrower protections offered by federal loan programs.

Key Considerations for Borrowers Evaluating Loan Offers

Before accepting any student loan offer, borrowers should carefully consider the following:

- Total Loan Cost: Calculate the total amount you will repay, including principal, interest, and origination fees.

- Interest Rate: Compare interest rates from different lenders and loan types.

- Repayment Terms: Evaluate the length of the repayment period and the resulting monthly payments.

- Origination Fees: Determine the amount of the origination fee and its impact on the total loan cost.

- Loan Type: Understand the differences between federal and private loans and their respective benefits and drawbacks.

- Borrower Protections: Assess the level of borrower protection offered by the lender.

- Repayment Flexibility: Explore options for deferment, forbearance, and income-driven repayment plans.

Illustrative Examples and Scenarios

Understanding the impact of origination fees requires looking at real-world examples. These examples will illustrate how seemingly small fees can significantly affect the total cost of your student loan over time and how choosing loans with different fee structures can lead to substantial savings.

Let’s explore several scenarios to clarify the effect of origination fees on your overall borrowing costs.

Scenario: Savings by Comparing Loan Options

Imagine you’re choosing between two federal student loans for $20,000. Loan A has a 5% interest rate and a 1% origination fee, while Loan B has a 5.5% interest rate but no origination fee. Loan A’s origination fee is $200 (1% of $20,000), meaning you only receive $19,800. Over a ten-year repayment period, even though Loan B has a higher interest rate, the absence of an origination fee could lead to significant savings. The actual savings will depend on the specific repayment plan and amortization schedule, but the absence of the upfront fee immediately reduces the total amount you need to repay. A student loan calculator can provide precise figures for this comparison, demonstrating the potential financial benefit of choosing a loan without an origination fee, even if it comes with a slightly higher interest rate.

Visual Representation of Cumulative Origination Fee Effect

A bar graph would effectively illustrate the cumulative impact of origination fees. The x-axis would represent the loan repayment period (e.g., in years), and the y-axis would represent the loan balance. Two bars would be displayed for each year: one representing the loan balance with origination fees included, and another showing the loan balance without origination fees. The difference between the bars would visually demonstrate the increasing cost of the origination fee over time. The graph would clearly show how the initial origination fee adds to the principal, resulting in a larger overall repayment amount, and how this difference grows over the life of the loan. The graph would also show that the total interest paid increases due to the added principal from the origination fee.

Case Study: Comparing Total Repayment Costs

Let’s compare two similar $10,000 student loans over a 10-year repayment period. Loan C has a 4% interest rate and a 1.5% origination fee ($150), while Loan D has a 4.5% interest rate and no origination fee. Using a student loan amortization calculator, we can determine the total amount repaid for each loan. Loan C, with its origination fee, would result in a higher total repayment cost, even though the interest rate is lower. The additional $150 added to the principal immediately increases the total interest accrued over the life of the loan. Loan D, despite its higher interest rate, would likely have a lower total repayment cost due to the absence of the origination fee. This case study highlights how a seemingly small origination fee can significantly impact the total cost of borrowing over the long term, potentially outweighing the benefit of a slightly lower interest rate.

Closure

In conclusion, understanding student loan origination fees is paramount to responsible borrowing. By utilizing online calculators and carefully comparing loan offers, you can gain a clear picture of the true cost of your student loans. Remember that even seemingly small origination fees can accumulate over time, significantly impacting your total repayment amount. Armed with the knowledge presented in this guide, you can navigate the student loan landscape with confidence, making informed decisions that protect your financial well-being.

Questions and Answers

What happens if I don’t pay my origination fees?

Failure to pay origination fees will likely prevent your loan from being disbursed. The lender may refuse to process your loan application until the fee is paid.

Are origination fees tax deductible?

This depends on your specific circumstances and tax laws. Consult a tax professional for personalized advice.

Can I negotiate origination fees?

Negotiating origination fees is generally not possible. They are typically set by the lender and are a standard part of the loan process.

How do origination fees affect my credit score?

Origination fees themselves don’t directly impact your credit score. However, consistently managing your student loan repayments (including the origination fee) will positively contribute to your creditworthiness.