Navigating the complex world of higher education financing can feel overwhelming, especially when faced with the decision between a student loan and a parent loan. Both options offer pathways to funding college, but they differ significantly in terms of interest rates, repayment terms, and long-term financial implications. Understanding these differences is crucial for making informed decisions that align with your family’s financial goals and risk tolerance. This guide will delve into the key aspects of each loan type, enabling you to choose the most suitable path for your educational journey.

We will explore the intricacies of interest rates, repayment schedules, eligibility criteria, and the impact on credit scores. Furthermore, we’ll examine the tax implications, potential loan forgiveness programs, and the influence of each loan type on financial aid eligibility. Ultimately, our aim is to empower you with the knowledge necessary to confidently navigate the process and secure the best financial outcome for your educational investment.

Interest Rates and Repayment Terms

Understanding the interest rates and repayment terms for student loans and parent loans is crucial for effective financial planning. Both loan types have distinct characteristics that significantly impact the borrower’s overall cost and repayment burden. This section will detail these differences to provide a clearer picture of the financial commitments involved.

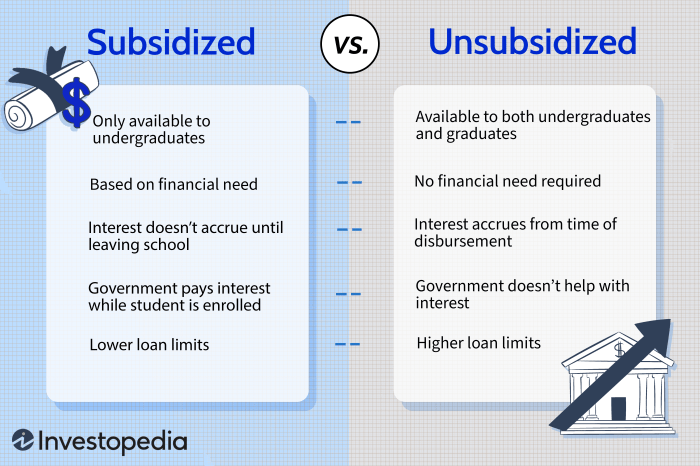

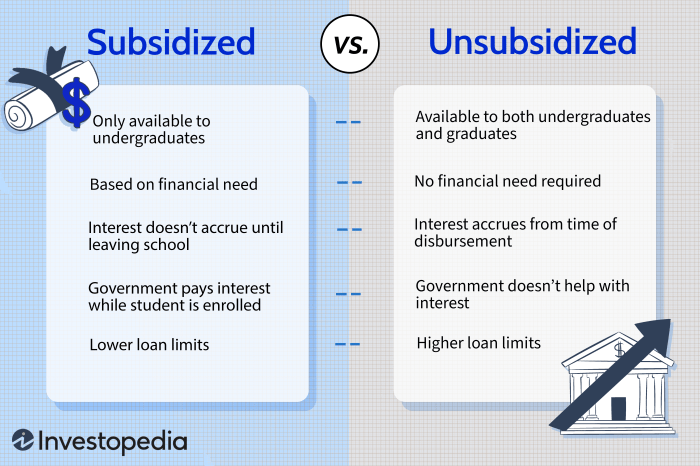

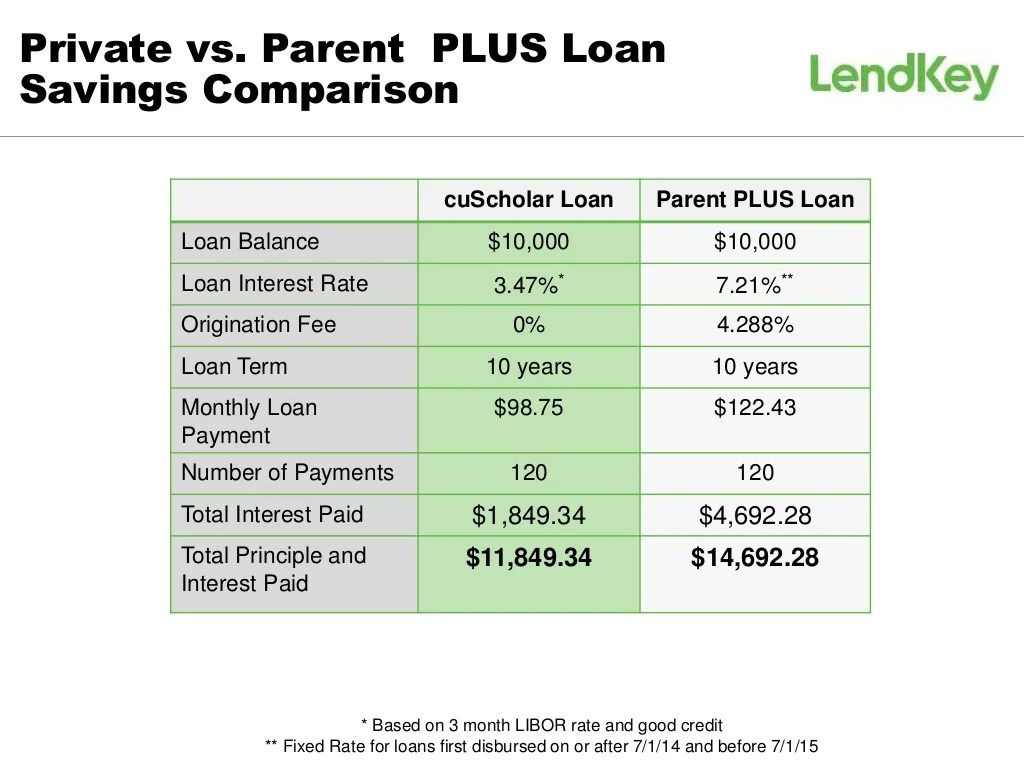

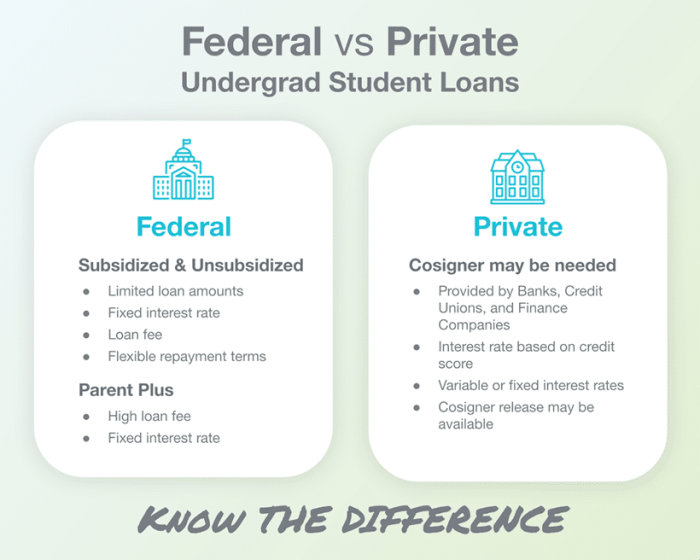

Interest rates on student loans and parent loans vary considerably depending on several factors, including the lender, the creditworthiness of the borrower (or co-signer), the loan type (federal vs. private), and the prevailing market interest rates. Generally, federal student loans tend to offer lower interest rates than private student loans or parent loans. This is because federal loans often carry lower risk for the lender due to government backing. Parent loans, on the other hand, are frequently subject to higher interest rates due to the higher perceived risk associated with lending to parents.

Student Loan Interest Rates and Repayment Options

Student loans offer various repayment plans designed to cater to different financial situations. These plans often include options like standard repayment (fixed monthly payments over 10 years), extended repayment (longer repayment period leading to lower monthly payments but higher total interest), graduated repayment (payments start low and gradually increase), and income-driven repayment (payments are tied to a percentage of the borrower’s income). The specific options available depend on the type of loan (federal or private).

Parent Loan Interest Rates and Repayment Options

Parent loans, similar to student loans, also have varying repayment options, although these are typically less flexible than those offered for student loans. Common repayment plans for parent loans often include standard amortization schedules, typically spanning 10 to 15 years. However, the availability of income-driven repayment plans is less common for parent loans compared to federal student loans. Private parent loans may offer more flexible repayment options but usually come with higher interest rates.

Repayment Schedule Examples

The following table illustrates examples of potential repayment schedules for both student and parent loans. Remember that these are examples only, and actual interest rates and monthly payments will vary based on several factors.

| Borrower | Loan Type | Interest Rate | Monthly Payment |

|---|---|---|---|

| Student | Federal Subsidized Loan | 4.5% | $250 |

| Student | Private Student Loan | 7.0% | $325 |

| Parent | Federal Parent PLUS Loan | 6.0% | $400 |

| Parent | Private Parent Loan | 8.5% | $500 |

Credit Score Impact

Taking out a student loan or a parent loan can significantly impact your credit score, both positively and negatively. Responsible borrowing and repayment habits can boost your creditworthiness, while neglect can lead to serious long-term financial consequences. Understanding these implications is crucial for making informed borrowing decisions.

Your credit score is a numerical representation of your creditworthiness, influencing your ability to secure loans, rent an apartment, or even get a job in some cases. Both student and parent loans are installment loans, meaning they are reported to credit bureaus monthly. On-time payments build a positive credit history, contributing to a higher credit score. Conversely, missed or late payments can severely damage your credit score, potentially impacting your financial opportunities for years to come.

Credit Score Impact of Student and Parent Loans

The impact of student and parent loans on your credit score depends largely on your repayment behavior. Consistent on-time payments contribute positively, while late or missed payments negatively affect your credit score. The amount borrowed also plays a role, with larger loan amounts potentially leading to a more significant impact on your credit utilization ratio (the percentage of your available credit you’re using), which is a factor in your credit score calculation. Furthermore, the type of loan (federal vs. private) can influence reporting practices and the potential for negative impacts. Federal loans, for example, often have more lenient reporting policies than private loans in the early stages of repayment.

Long-Term Implications of Loan Default

Defaulting on either a student or parent loan carries severe long-term consequences. Default means you have failed to make payments for a specified period, typically 90 days. The repercussions can include: damaged credit score (significantly lowering your score, making it difficult to obtain credit in the future), wage garnishment (a portion of your earnings can be seized to repay the debt), tax refund offset (your tax refund can be used to repay the debt), difficulty securing employment (some employers conduct credit checks), and legal action (lawsuits can be filed to recover the debt). The negative impact on your credit history can persist for seven years or more, making it challenging to obtain loans, mortgages, or even rent an apartment during that time. The effects can extend beyond your personal finances, potentially impacting your family and future financial stability.

Comparison of Credit Score Impact

The following table illustrates potential credit score impacts under different loan scenarios. Note that these are examples and actual impacts may vary based on individual circumstances and credit bureau scoring models.

| Scenario | Loan Type | Repayment Behavior | Potential Credit Score Impact |

|---|---|---|---|

| Scenario 1 | Federal Student Loan | Consistent on-time payments | Positive impact; score increase possible |

| Scenario 2 | Private Parent Loan | Multiple late payments | Significant negative impact; score decrease likely |

| Scenario 3 | Federal Student Loan | Loan Default | Severe negative impact; significant score decrease; potential for collection actions |

| Scenario 4 | Private Parent Loan | On-time payments, responsible credit management | Positive impact; score improvement possible, especially if other credit factors are strong |

Tax Implications

Understanding the tax implications of student loans, whether taken out by the student or their parents, is crucial for effective financial planning. Tax laws can significantly impact the overall cost of borrowing and repayment. This section will Artikel the key tax benefits and considerations for both student and parent loans.

Student Loan Interest Deduction

This deduction allows eligible taxpayers to deduct the amount they paid in student loan interest during the tax year. The deduction is claimed as an above-the-line deduction, meaning it reduces your adjusted gross income (AGI) before calculating your taxable income. This can lower your overall tax liability. The maximum amount you can deduct is $2,500, regardless of how much interest you actually paid. However, eligibility requirements exist, such as modified AGI limits and the requirement that the student must be pursuing a degree or other credential at an eligible educational institution.

Tax Implications for Parent PLUS Loans

Parent PLUS loans, while taken out by parents to fund their child’s education, don’t offer the same direct tax benefits as student loans taken out by the student themselves. There is no specific tax deduction for the interest paid on Parent PLUS loans. However, the interest paid is still a legitimate expense, and parents should maintain records of their loan payments for tax purposes. This documentation may be useful for financial aid applications in the future or in other situations. The interest paid is not tax deductible, but it does represent a legitimate expense that can be considered when analyzing overall financial situations.

Comparison of Tax Implications

| Feature | Student Loans | Parent PLUS Loans |

|---|---|---|

| Interest Deduction | Deductible up to $2,500 (subject to AGI limitations and other eligibility requirements) | Not deductible |

| Tax Form | Form 1098-E (Student Loan Interest Statement) | No specific tax form for interest paid; records of payments should be kept |

| Impact on Tax Liability | Reduces taxable income, potentially lowering tax liability | No direct impact on tax liability |

Loan Forgiveness Programs

Loan forgiveness programs offer the potential to eliminate a portion or all of your student loan debt under specific circumstances. These programs are designed to incentivize borrowers to pursue certain careers or address specific economic hardships. However, eligibility requirements vary significantly, and the availability of such programs can change. It’s crucial to understand the nuances of each program before relying on them for debt relief.

The landscape of loan forgiveness differs substantially between federal student loans and parent PLUS loans. While federal student loans have several established forgiveness programs, parent PLUS loans generally do not offer the same opportunities for forgiveness.

Federal Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, offering debt relief based on factors like employment in public service or income-driven repayment plan participation. These programs can significantly reduce the burden of student loan repayment, but accessing them often requires meeting stringent criteria and navigating complex application processes.

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance of your Direct Loans after you’ve made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility requires employment by a government organization at any level or a 501(c)(3) non-profit organization. Payments must be made under an income-driven repayment plan.

- Teacher Loan Forgiveness Program: This program can forgive up to $17,500 of your federal student loans if you’ve taught full-time for five complete and consecutive academic years in a low-income school or educational service agency. This requires employment in a designated low-income school or educational service agency and fulfilling the full-time teaching requirement for five consecutive academic years.

- Income-Driven Repayment (IDR) Plans and Forgiveness: IDR plans adjust your monthly payments based on your income and family size. After a set number of years (typically 20 or 25), any remaining balance may be forgiven. Eligibility is based on income and family size; the specific forgiveness amount depends on the chosen IDR plan and repayment period.

Parent PLUS Loan Forgiveness Programs

Unlike federal student loans, Parent PLUS loans do not have dedicated forgiveness programs mirroring those available to student borrowers. While parent borrowers may be able to consolidate their loans into other federal loan programs, direct forgiveness opportunities are extremely limited. This means that parent borrowers generally must rely on traditional repayment methods to eliminate their debt.

Impact on Financial Aid

Choosing between parent and student loans significantly impacts a student’s financial aid eligibility. The complexities of the Free Application for Federal Student Aid (FAFSA) process and how it considers parental income and assets mean that the type of loan taken out can directly influence the amount of grants, scholarships, and subsidized loans a student receives. Understanding these implications is crucial for maximizing financial aid opportunities.

The primary factor influencing financial aid is the student’s and their family’s demonstrated financial need. This need is calculated by the FAFSA using a complex formula that considers income, assets, family size, and number of students in college. Taking out parent loans can affect this calculation in several ways, potentially altering the student’s perceived need and, subsequently, the amount of aid offered.

Parent Loan Impact on Student Financial Aid

Parent PLUS loans, while helping cover educational expenses, are often viewed differently than student loans in the FAFSA calculation. Since the parent is borrowing, the loan amount might not directly reduce the student’s demonstrated financial need as much as a student loan would. Consequently, the student might receive less need-based aid, such as Pell Grants or subsidized federal loans, even if they have significant unmet need. For example, a family relying heavily on Parent PLUS loans might see a reduction in their child’s grant aid compared to a family using primarily student loans, even if their overall financial situation is similar. This is because the FAFSA system prioritizes need-based aid, and the presence of parent loans might signal a greater capacity for repayment, diminishing the perceived need.

Student Loan Impact on Student Financial Aid

Conversely, student loans are often factored more directly into the calculation of financial need. While the total debt still increases, the FAFSA formula may recognize the student’s increased borrowing as a sign of higher financial need. This could lead to a larger amount of need-based financial aid being awarded to offset the student loan debt. For instance, a student with significant unmet need who opts for student loans might receive a larger federal grant or more subsidized loan funds than a student with the same unmet need but relying solely on parent loans. The overall financial aid package might appear larger due to the higher amount of need-based aid received.

Comparison of Loan Types and Their Impact on Financial Aid

The following table summarizes the potential impact of each loan type on a student’s overall financial aid package:

| Loan Type | Impact on Demonstrated Financial Need | Potential Impact on Need-Based Aid | Example |

|---|---|---|---|

| Parent PLUS Loan | May not significantly reduce demonstrated need | May result in less need-based aid (grants, subsidized loans) | A family using primarily Parent PLUS loans might receive less Pell Grant money than a family using primarily student loans, even if both have similar financial situations. |

| Student Loan | May increase demonstrated need | May result in more need-based aid | A student taking out substantial student loans might receive more subsidized federal loans to help cover their expenses. |

It’s important to note that the specific impact varies depending on individual circumstances, the student’s financial situation, and the financial aid policies of the institution. Consulting with a financial aid advisor is crucial for making informed decisions about loan types and maximizing financial aid opportunities.

Long-Term Financial Consequences

Choosing between a student loan and a parent loan carries significant long-term financial implications for both the student and the parent. The decision impacts future borrowing capacity, creditworthiness, and overall financial well-being. Understanding these consequences is crucial for making an informed choice.

The primary difference lies in who is ultimately responsible for repayment. A student loan places the onus directly on the student, while a parent loan burdens the parent. This seemingly simple distinction has far-reaching consequences on credit history, future loan eligibility, and overall financial planning. Both options can affect the individual’s financial trajectory in distinct ways.

Impact on Future Borrowing Capacity

The impact on future borrowing capacity is substantial and differs significantly between student and parent loans. For students, responsible repayment of student loans builds a positive credit history, increasing their chances of securing favorable terms on future loans (such as mortgages or auto loans). Conversely, defaulting on a student loan severely damages credit, potentially leading to higher interest rates or loan denials in the future. For parents, taking out a parent loan can impact their borrowing capacity, especially if they already have other outstanding debts. Responsible repayment maintains their creditworthiness, but defaulting could severely limit their access to credit for other needs, such as home improvements or retirement planning.

Creditworthiness and Credit Score

A student loan’s impact on a student’s credit score is directly tied to their repayment behavior. On-time payments build credit, while missed or late payments negatively impact their credit score. Similarly, a parent’s credit score is affected by their management of the parent loan. A strong repayment history boosts their credit score, while defaults can lead to a significant drop, affecting their ability to secure loans, rent an apartment, or even get certain jobs.

Illustrative Scenarios

The following scenarios illustrate the long-term financial consequences of each loan type:

- Scenario 1: Student Loan (Responsible Repayment): Sarah takes out a $30,000 student loan and diligently makes her monthly payments. This builds her credit history, enabling her to secure a mortgage with a favorable interest rate five years later. Her credit score is high, and she enjoys financial stability.

- Scenario 2: Student Loan (Default): John defaults on his $25,000 student loan. His credit score plummets, making it difficult to secure a car loan or rent an apartment. He faces financial hardship and struggles to rebuild his credit.

- Scenario 3: Parent Loan (Responsible Repayment): Maria’s parents take out a $40,000 parent loan for her education and make consistent payments. Their credit score remains strong, and they maintain their financial stability. They are able to continue to save for retirement without significant interruption.

- Scenario 4: Parent Loan (Financial Strain): David’s parents borrow $50,000 for his education, straining their household budget. While they manage to repay the loan, it significantly impacts their ability to save for retirement, potentially affecting their long-term financial security.

Choosing the Right Loan

Selecting between a student loan and a parent loan requires careful consideration of several factors. The best choice depends heavily on your family’s financial situation, your student’s academic goals, and your long-term financial planning. Understanding the nuances of each loan type is crucial to making an informed decision that minimizes financial burden and maximizes educational opportunities.

Factors to Consider When Choosing Between Student and Parent Loans

The decision of whether to take out a student loan or a parent loan hinges on a variety of interconnected factors. These factors should be carefully weighed against each other to arrive at the most appropriate financing strategy. A thorough analysis will help avoid potential pitfalls and ensure a smoother path towards financing higher education.

- Family Income and Assets: Parents should assess their financial stability before taking on a parent loan. A high debt-to-income ratio or limited savings could negatively impact their financial health. If parents are comfortable with the financial commitment and the loan won’t significantly strain their budget, a parent loan might be preferable. Conversely, if the financial burden would be excessive, a student loan might be a more responsible option.

- Student’s Credit History: A student’s credit history plays a crucial role. Students with limited or poor credit history will likely face higher interest rates or loan denials on student loans. In such cases, a parent loan, backed by the parent’s credit, may be more accessible and offer better terms. Conversely, a student with good credit may be able to secure a more favorable student loan.

- Loan Repayment Terms: Both student and parent loans have varying repayment terms. Parents need to consider their ability to repay the loan promptly without disrupting their financial stability. Student loans often offer longer repayment periods, potentially lowering monthly payments but increasing the total interest paid. The choice should align with the family’s long-term financial plan and risk tolerance.

- Impact on Future Financial Aid: Taking out parent loans might not directly impact future financial aid eligibility for the student, whereas large student loan debt could affect future financial aid opportunities. It’s crucial to carefully consider the long-term implications of each loan type on the student’s financial aid prospects.

A Step-by-Step Guide to Choosing the Most Suitable Loan Option

Making a well-informed decision about student loan financing requires a systematic approach. This step-by-step guide helps families navigate the process effectively.

- Assess Family Finances: Begin by comprehensively evaluating the family’s income, assets, debts, and monthly expenses. This assessment helps determine the family’s borrowing capacity and risk tolerance.

- Compare Loan Options: Research and compare interest rates, repayment terms, and fees for both student and parent loans from different lenders. Consider both federal and private loan options.

- Check Credit Scores: Review both the parent’s and student’s credit scores. A higher credit score typically translates to more favorable loan terms. This step informs the feasibility of each loan type.

- Estimate Future Earnings: Project the student’s likely post-graduation earnings to assess their ability to repay student loans. This helps determine the loan amount that is manageable without undue financial strain.

- Explore Financial Aid: Exhaust all available financial aid options, including grants, scholarships, and work-study programs, before resorting to loans. This reduces the overall borrowing needed.

- Consult a Financial Advisor: Seek professional advice from a financial advisor to gain an objective perspective and receive personalized guidance based on the family’s specific financial situation and goals.

- Make an Informed Decision: Weigh all the factors considered above and choose the loan option that best aligns with the family’s financial situation and the student’s educational goals. A written plan detailing repayment strategies is crucial.

Summary

Choosing between a student loan and a parent loan requires careful consideration of numerous factors. While student loans place the responsibility directly on the student, parent loans shift the burden to the parents, potentially impacting their credit and financial stability. Ultimately, the best choice depends on individual circumstances, including credit scores, financial resources, and long-term financial goals. By carefully weighing the advantages and disadvantages of each option, and utilizing the resources and information provided in this guide, families can make informed decisions that best support their educational aspirations without jeopardizing their long-term financial well-being.

FAQ Section

What happens if I default on a parent PLUS loan?

Defaulting on a parent PLUS loan will severely damage the parent’s credit score, impacting their ability to obtain future loans or credit. It can also lead to wage garnishment and tax refund offset.

Can I refinance a parent loan?

Refinancing options for parent loans are generally less readily available compared to student loans. The availability depends on the lender and the specific terms of the loan.

Are there income-driven repayment plans for parent PLUS loans?

No, income-driven repayment plans are typically not available for parent PLUS loans. Repayment terms are usually fixed.

Can I use a parent loan to pay for living expenses?

While parent loans are intended to cover educational expenses, some lenders may allow for flexibility. It’s best to clarify this with the lender directly.