Navigating the complex landscape of federal student loans can be daunting. Millions of Americans rely on these programs to finance their higher education, but understanding the various loan types, repayment options, and forgiveness programs requires careful consideration. This guide provides a clear overview of the federal government’s role in student loan programs, from their historical context to the current challenges and proposed solutions addressing the significant national student loan debt crisis.

We’ll explore the different types of federal student loans, comparing interest rates and repayment plans. We’ll delve into the staggering statistics surrounding student loan debt, its economic impact, and the various forgiveness and income-driven repayment programs designed to alleviate the burden. Finally, we will examine the ongoing political and social debates surrounding student loan debt and potential solutions.

The Federal Government’s Role in Student Loan Programs

The federal government’s involvement in student loan programs has significantly shaped higher education access and affordability in the United States. This role has evolved over time, expanding from modest beginnings to a complex system encompassing various loan types and repayment options. Understanding this history and the intricacies of these programs is crucial for prospective and current students navigating the complexities of financing their education.

History of Federal Involvement in Student Loan Programs

Federal involvement in student financial aid began modestly, with the initial focus primarily on veterans returning from World War II. The Servicemen’s Readjustment Act of 1944 (the GI Bill) provided educational benefits, including financial assistance, laying the groundwork for future federal student aid programs. Subsequent legislation, such as the National Defense Education Act of 1958, further expanded federal support for higher education, responding to the Cold War’s demands for a more skilled workforce. The Higher Education Act of 1965 marked a pivotal moment, establishing the foundation for the modern federal student loan system, including the introduction of subsidized and unsubsidized loans. Over the decades, these programs have undergone numerous revisions and expansions, reflecting changing economic conditions, educational costs, and societal priorities. The increasing cost of higher education has led to a substantial growth in the scale and scope of federal student loan programs.

Types of Federal Student Loans

The federal government offers several types of student loans, each with its own eligibility requirements and terms. These loans are broadly categorized as either subsidized or unsubsidized. Subsidized loans are awarded based on financial need and the government pays the interest while the student is enrolled at least half-time. Unsubsidized loans are available to all students regardless of financial need, and interest accrues from the time the loan is disbursed. Direct Subsidized Loans and Direct Unsubsidized Loans are the primary loan types offered under the federal Direct Loan Program, replacing the earlier Federal Family Education Loan (FFEL) program. Additionally, there are Direct PLUS Loans, available to parents of dependent students and graduate students, to help cover educational expenses. These loans typically have higher interest rates than subsidized and unsubsidized loans.

Interest Rates and Repayment Options for Federal Student Loans

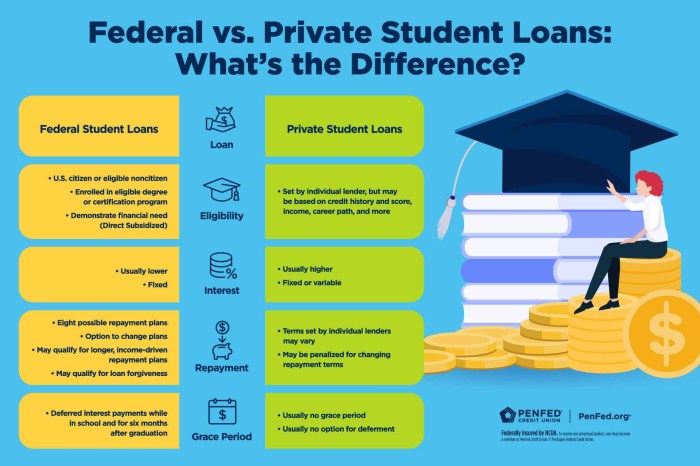

Interest rates for federal student loans are set annually by the government and are generally lower than private student loan interest rates. Subsidized loans typically have lower interest rates than unsubsidized loans. The interest rate for a particular loan depends on the loan type, the student’s loan disbursement year, and the type of repayment plan. Several repayment plans are available to borrowers, including standard repayment, graduated repayment, extended repayment, and income-driven repayment (IDR) plans. Standard repayment plans typically involve fixed monthly payments over a 10-year period. Graduated repayment plans start with lower monthly payments that increase over time, while extended repayment plans stretch payments over a longer period (up to 25 years). IDR plans calculate monthly payments based on a percentage of the borrower’s discretionary income, offering flexibility to those facing financial hardship.

Summary of Federal Student Loan Programs

| Loan Type | Interest Rate Type | Repayment Plans | Eligibility Criteria |

|---|---|---|---|

| Direct Subsidized Loan | Fixed, determined annually | Standard, Graduated, Extended, IDR | Demonstrated financial need, enrolled at least half-time |

| Direct Unsubsidized Loan | Fixed, determined annually | Standard, Graduated, Extended, IDR | Enrolled at least half-time (undergraduate or graduate) |

| Direct PLUS Loan | Fixed, determined annually | Standard, Extended | Parent of a dependent undergraduate student or graduate student; credit check required |

| Direct Consolidation Loan | Fixed, determined at consolidation | Standard, Graduated, Extended, IDR | Borrower with multiple federal student loans |

The Current State of Student Loan Debt

The burden of student loan debt in the United States has reached staggering proportions, significantly impacting individuals’ financial well-being and the overall economy. Understanding the current state of this debt is crucial for developing effective solutions and mitigating its long-term consequences. This section will explore the scale of the problem, the demographics affected, and the broader economic implications.

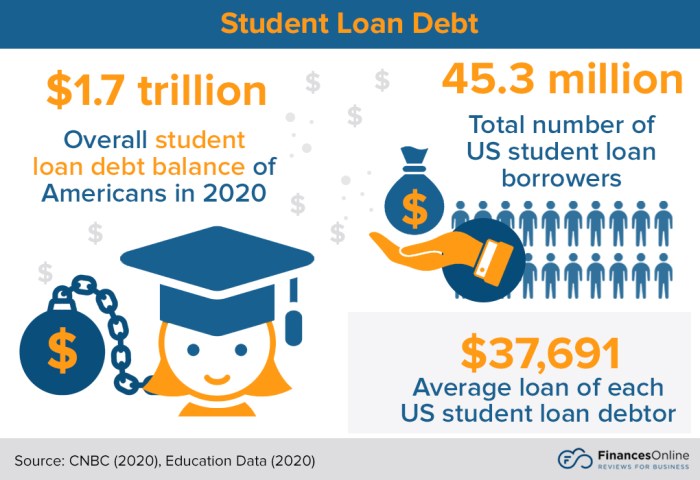

The total amount of student loan debt in the US is currently over $1.7 trillion, surpassing both auto loan and credit card debt. This represents a massive increase from just a few decades ago, and the growth continues. This enormous figure underscores the severity of the crisis and highlights the urgent need for comprehensive strategies to address it.

Student Loan Borrower Demographics

The individuals carrying this debt represent a broad swathe of the population, although certain demographics are disproportionately affected. A significant portion of borrowers are young adults, aged 25-34, who are navigating the early stages of their careers while grappling with substantial loan repayments. Lower-income borrowers often face greater challenges in managing their debt due to limited financial resources. While student loans are utilized across various educational levels, borrowers with graduate or professional degrees frequently have significantly higher debt balances.

Economic Impact of High Student Loan Debt

High student loan debt exerts a considerable drag on individual financial health and the broader economy. For individuals, it can delay major life milestones such as homeownership, starting a family, and retirement planning. The constant pressure of loan repayments can limit spending and investment, hindering economic growth. Furthermore, high levels of student loan debt can contribute to increased rates of personal bankruptcy and financial stress. The ripple effects are felt across the economy, potentially impacting consumer spending, business investment, and overall economic productivity.

Growth of Student Loan Debt (2003-2023): A Chart Representation

The following text describes a chart illustrating the growth of student loan debt over the past two decades. The horizontal axis represents the years, from 2003 to 2023, in two-year increments. The vertical axis represents the total student loan debt in trillions of US dollars.

The chart would show a consistently upward sloping line, starting at approximately $0.5 trillion in 2003 and steadily increasing to over $1.7 trillion in 2023. The rate of increase is not uniform; it shows periods of more rapid growth, particularly during the years following the 2008 financial crisis and again in more recent years. The overall visual representation would clearly demonstrate the exponential growth of student loan debt over the past two decades. This visual representation would highlight the dramatic increase in the total amount of student loan debt.

Federal Student Loan Forgiveness and Repayment Programs

The federal government offers a range of programs designed to help borrowers manage and potentially eliminate their student loan debt. These programs vary significantly in their eligibility requirements, repayment structures, and the ultimate amount of forgiveness offered. Understanding the nuances of each program is crucial for borrowers to navigate the complexities of student loan repayment effectively. These programs are designed to provide relief based on income, employment in public service, or other qualifying factors.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans calculate monthly payments based on your discretionary income and family size. This means your payment amount adjusts annually, potentially lowering your monthly burden. Several IDR plans exist, each with slightly different eligibility criteria and payment calculations. These plans are designed to make repayment more manageable for borrowers facing financial hardship. Failing to recertify your income annually could result in higher payments than necessary.

- Income-Based Repayment (IBR): Available to borrowers with federal loans who received their first loan on or after July 1, 2014. Payments are calculated based on your discretionary income and family size. After 20 or 25 years of payments (depending on loan type and disbursement date), any remaining balance is forgiven.

- Pay As You Earn (PAYE): Similar to IBR, but generally offers lower monthly payments. Available to borrowers who received their first loan on or after October 1, 2007. After 20 years of payments, any remaining balance is forgiven.

- Revised Pay As You Earn (REPAYE): This plan is available to most federal student loan borrowers. It considers all federal student loans in the calculation, including undergraduate and graduate loans. After 20 or 25 years, depending on loan type, remaining balance is forgiven.

- Income-Contingent Repayment (ICR): This plan calculates payments based on your income and family size, loan amount, and repayment period. It has a longer repayment period (25 years) than other IDR plans and can result in a larger total amount paid over the life of the loan.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program offers complete loan forgiveness for borrowers who make 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization. This program is intended to incentivize individuals to pursue careers in public service. However, strict eligibility requirements and a history of administrative challenges have made it difficult for some borrowers to successfully utilize the program. Careful documentation of employment and loan repayment is essential.

Teacher Loan Forgiveness Program

This program provides forgiveness for qualified teachers who have taught full-time for five complete and consecutive academic years in a low-income school or educational service agency. The amount of forgiveness is up to $17,500 of qualifying federal student loans. Specific requirements regarding the type of school and teaching position apply.

Comparison of Effectiveness

The effectiveness of different forgiveness and repayment plans varies greatly depending on individual circumstances. IDR plans provide immediate relief through lower monthly payments, but forgiveness may take decades. PSLF offers complete forgiveness, but the stringent requirements make it difficult for many to qualify. Teacher Loan Forgiveness offers a more targeted and quicker path to forgiveness but only for a specific group of professionals. Each plan has its own set of trade-offs between immediate relief and long-term forgiveness. The best plan for an individual depends heavily on their income, career path, and loan amount.

The Impact of Federal Student Loan Policies on Higher Education

Federal student loan policies exert a profound influence on the landscape of higher education in the United States, shaping tuition costs, enrollment rates, and access to college for diverse student populations. The availability and terms of these loans directly impact institutional decisions, student choices, and ultimately, the nation’s human capital.

Federal Student Loan Policies and Tuition Costs

The relationship between federal student loan availability and tuition increases is a complex and hotly debated topic. The argument often made is that the readily available federal loans allow colleges and universities to raise tuition prices, knowing that students will be able to finance their education through loans. This “moral hazard” argument suggests that institutions, knowing students have access to funds, may raise tuition beyond what would be necessary to cover actual costs. Conversely, some argue that tuition increases are driven by rising operational costs, faculty salaries, and research expenditures, and that federal student aid simply helps students afford these increases. Empirical evidence on this relationship is mixed, with some studies showing a positive correlation between loan availability and tuition increases, while others find no significant relationship. Further research is needed to fully understand this intricate dynamic.

Federal Student Loans and College Enrollment Rates

The availability of federal student loans has demonstrably increased college enrollment rates. By providing financial aid to students who would otherwise be unable to afford college, these programs have expanded access to higher education. This has led to a rise in the number of college graduates in the workforce, positively impacting economic productivity and innovation. However, increased enrollment also brings challenges, such as the need for more resources and infrastructure to accommodate the growing student population. The expansion of access also raises questions about the affordability and value of a college degree, particularly in light of rising student debt levels.

Consequences of Changes in Federal Student Loan Policies on Access to Higher Education

Changes in federal student loan policies can significantly impact access to higher education, particularly for vulnerable populations. For example, reductions in loan amounts or stricter eligibility requirements could limit access for low-income students and students from underrepresented minority groups. Similarly, changes to repayment plans or forgiveness programs can affect students’ ability to manage their debt and potentially deter them from pursuing higher education. Conversely, policies that expand loan availability or offer more generous repayment terms could increase access to higher education and improve educational attainment rates. The potential consequences of such policy changes need to be carefully considered, with attention paid to their impact on equity and access.

Impact of Federal Loan Policies on Different Demographic Groups

| Policy Change | Impact on Low-Income Students | Impact on Minority Students | Impact on First-Generation Students |

|---|---|---|---|

| Increased Loan Limits | Improved access to higher education | Improved access to higher education | Improved access to higher education |

| Reduced Loan Limits | Decreased access to higher education; increased reliance on private loans with higher interest rates | Decreased access to higher education; potential for increased disparities | Decreased access to higher education; increased barriers to entry |

| Income-Driven Repayment Plans | More manageable repayment; reduced risk of default | More manageable repayment; reduced risk of default | More manageable repayment; reduced risk of default |

| Loan Forgiveness Programs | Potential for significant debt reduction; increased incentive to pursue public service | Potential for significant debt reduction; improved equity | Potential for significant debt reduction; improved access to careers |

Political and Social Debates Surrounding Student Loan Debt

The issue of student loan debt in the United States has become a significant political and social battleground, sparking intense debate over the role of the federal government, the fairness of the current system, and the best path forward. Differing viewpoints often align with broader political ideologies, leading to starkly contrasting proposals and predictions regarding their economic and social consequences.

Major Political Viewpoints on Federal Student Loan Policies

The political spectrum reveals a wide range of opinions on federal student loan policies. Generally, progressive Democrats advocate for significant reforms, including broad debt forgiveness or cancellation programs, increased funding for need-based aid, and stricter regulations on for-profit colleges. Their arguments center on the idea that student debt disproportionately burdens lower-income students and hinders economic mobility. Conversely, many conservative Republicans tend to favor market-based solutions, emphasizing personal responsibility and advocating for reforms that reduce government intervention. They often propose measures such as increased transparency in college pricing, promoting competition among institutions, and encouraging alternative financing options. Centrists often seek a middle ground, supporting targeted debt relief for specific groups (like those with disabilities or those who pursued public service) while implementing measures to prevent future debt accumulation. The debate is further complicated by disagreements on the appropriate level of government involvement in higher education financing.

Proposed Solutions to Address the Student Loan Debt Crisis

Numerous solutions have been proposed to tackle the student loan debt crisis. These range from large-scale debt forgiveness or cancellation programs to more targeted approaches focusing on income-driven repayment plans and reforms to the higher education system itself. For example, some proposals suggest forgiving all or a portion of federal student loan debt, often capped at a certain amount per borrower. Others focus on expanding and improving income-driven repayment (IDR) plans, making monthly payments more affordable for borrowers based on their income. Another common proposal is to increase funding for Pell Grants and other need-based financial aid programs, reducing the reliance on loans in the first place. Finally, significant reforms to the higher education system, such as increased price transparency and regulation of for-profit colleges, are often suggested to address the root causes of the debt crisis.

Social and Economic Implications of Proposed Solutions

The social and economic implications of various proposed solutions are complex and far-reaching. For example, widespread student loan forgiveness could stimulate the economy by freeing up disposable income for borrowers, potentially boosting consumer spending and economic growth. However, it could also lead to increased inflation and potentially raise taxes for those who did not benefit from the program. Expanding IDR plans could provide immediate relief for struggling borrowers but might not address the underlying issues driving rising tuition costs. Increased funding for need-based aid could improve equity in access to higher education but may not be sufficient to solve the debt problem for existing borrowers. Each proposed solution carries potential benefits and drawbacks, requiring careful consideration of its broader economic and social effects.

Arguments For and Against Student Loan Debt Forgiveness

The debate over student loan forgiveness is particularly heated. The arguments for and against are often framed in terms of economic fairness, social justice, and fiscal responsibility.

Arguments for student loan forgiveness:

- Stimulates the economy by freeing up disposable income for borrowers.

- Addresses systemic inequalities in access to higher education.

- Provides relief to individuals struggling under the weight of debt, improving mental and physical health.

- Could lead to increased consumer spending and economic growth.

Arguments against student loan forgiveness:

- Could lead to increased inflation and potentially raise taxes for those who did not benefit.

- May not be the most efficient use of taxpayer money.

- Could discourage future responsible borrowing and financial planning.

- May reward those who made poor financial decisions or attended expensive institutions.

Final Wrap-Up

The federal student loan system plays a crucial role in higher education access, but it also presents significant challenges. Understanding the intricacies of federal student loan programs, from eligibility requirements to repayment options and forgiveness programs, is essential for both current and prospective borrowers. By examining the historical context, current state of affairs, and ongoing debates, we can better appreciate the complexities of this system and advocate for informed and equitable solutions to address the pervasive issue of student loan debt.

Essential Questionnaire

What happens if I don’t repay my federal student loans?

Failure to repay federal student loans can lead to wage garnishment, tax refund offset, and damage to your credit score. Ultimately, it could affect your ability to obtain loans or credit in the future.

Can I consolidate my federal student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new repayment plan. This can simplify repayment, but it might not always lower your overall interest rate.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and deferment. Unsubsidized loans accrue interest from the time they are disbursed.

How do I apply for federal student loan forgiveness programs?

Eligibility requirements vary depending on the program. You’ll need to apply through the appropriate government agency, providing documentation to demonstrate your eligibility.