Navigating the complexities of financing a higher education can be daunting, particularly at a large institution like Texas State University. This guide provides a comprehensive overview of student loan options available to Texas State students, covering federal and private loans, repayment strategies, and crucial financial aid resources. Understanding the nuances of each loan type, from subsidized to unsubsidized federal loans and the various private lender offerings, is key to making informed decisions and avoiding future financial strain.

We’ll explore the application processes, interest rates, repayment terms, and potential pitfalls to help you chart a course towards responsible debt management. Furthermore, we’ll highlight resources available at Texas State University to support students throughout their financial journey, emphasizing proactive strategies for minimizing debt and maximizing financial well-being.

Texas State University Student Loan Programs

Texas State University doesn’t directly offer student loan programs. Instead, it works with the federal government and private lenders to help students access funding for their education. Understanding the different loan options available is crucial for effective financial planning during your time at Texas State. This information Artikels the major categories of student loans and the process of applying for them.

Federal Student Loan Programs

Federal student loans are government-backed loans with various benefits, including potentially lower interest rates and flexible repayment options. These loans are generally preferred due to their borrower protections. Eligibility is determined by the Free Application for Federal Student Aid (FAFSA).

Texas State participates in the federal student aid programs. These include Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans.

The application process begins with completing the FAFSA. Once processed, Texas State will determine your eligibility for federal student aid, including loans. You’ll then accept your loan offer through your student account portal. Further information regarding loan disbursement and repayment plans will be provided after loan acceptance.

Private Student Loan Programs

Private student loans are offered by banks and other financial institutions. While these loans may have higher interest rates than federal loans, they can be an option if you don’t qualify for sufficient federal aid. Eligibility criteria vary widely among lenders, typically based on creditworthiness (for parent loans) and credit history (for student loans), and often require a co-signer.

The application process involves researching different private lenders, comparing interest rates and terms, and completing each lender’s individual application. It’s important to carefully review the terms and conditions before accepting a private loan. Pre-qualification can help you compare offers without affecting your credit score.

Comparison of Loan Options

The following table compares key features of federal and private student loans. Note that interest rates and terms can change, so always check with the lender for the most current information.

| Loan Type | Interest Rate | Repayment Terms | Other Key Features |

|---|---|---|---|

| Direct Subsidized Loan (Federal) | Variable; check the Federal Student Aid website for current rates. | Typically begins 6 months after graduation or leaving school. Various repayment plans available. | Interest not accrued while in school (under certain conditions). Government-backed, borrower protections. |

| Direct Unsubsidized Loan (Federal) | Variable; check the Federal Student Aid website for current rates. | Typically begins 6 months after graduation or leaving school. Various repayment plans available. | Interest accrues while in school. Government-backed, borrower protections. |

| Direct PLUS Loan (Federal) | Variable; check the Federal Student Aid website for current rates. | Typically begins 6 months after graduation or leaving school. Various repayment plans available. | Available to parents of dependent students. Credit check required. Government-backed, borrower protections. |

| Private Student Loan | Variable; depends on lender and borrower’s creditworthiness. | Varies by lender; typically begins shortly after loan disbursement. | Higher interest rates possible. May require a co-signer. No government backing. |

Federal Student Loan Options for Texas State Students

Securing funding for your education at Texas State University often involves exploring various federal student loan options. These loans, offered by the U.S. Department of Education, provide a crucial pathway to financing your higher education goals. Understanding the different types of federal loans and their associated terms is essential for making informed financial decisions.

Federal student loans are generally preferred over private loans due to their fixed interest rates, income-driven repayment plans, and various borrower protections. However, careful consideration of the loan terms and your financial capacity to repay is still necessary.

Direct Subsidized Loans

Direct Subsidized Loans are need-based loans awarded to undergraduate students demonstrating financial need as determined by the Free Application for Federal Student Aid (FAFSA). A key benefit is that the government pays the interest while you are enrolled at least half-time, during grace periods, and during periods of deferment. This means your loan balance doesn’t grow during these periods. However, the amount you can borrow is limited based on your financial need and year in school.

Direct Unsubsidized Loans

Unlike subsidized loans, Direct Unsubsidized Loans are not based on financial need. Undergraduate, graduate, and professional students are eligible to receive these loans. Interest accrues from the time the loan is disbursed, regardless of your enrollment status. This means your loan balance increases over time, even while you are still in school. The advantage is that you can borrow a higher amount than with subsidized loans, though this comes with the increased cost of interest.

Direct PLUS Loans

Direct PLUS Loans are designed for graduate and professional students, as well as parents of dependent undergraduate students. These loans are credit-based, meaning your credit history is reviewed. Borrowers with adverse credit history may still be approved, but they might be required to have a credit-worthy co-signer or accept a higher interest rate. While offering the flexibility to borrow a larger amount, it’s crucial to understand the responsibility of repaying a potentially significant loan amount with potentially higher interest rates.

Key Differences Between Subsidized and Unsubsidized Loans

Understanding the core differences between subsidized and unsubsidized loans is critical for effective financial planning. The following points highlight the key distinctions:

- Financial Need: Subsidized loans are need-based; unsubsidized loans are not.

- Interest Accrual: Interest accrues on unsubsidized loans from disbursement; interest is paid by the government on subsidized loans during certain periods.

- Eligibility: Subsidized loans are primarily for undergraduate students with demonstrated financial need; unsubsidized loans are available to undergraduate, graduate, and professional students.

- Loan Limits: Loan limits for subsidized loans are lower than for unsubsidized loans.

Applying for Federal Student Loans

The application process for federal student loans begins with completing the FAFSA. This form gathers information about your financial situation and determines your eligibility for federal aid, including loans. After submitting the FAFSA, you’ll receive a Student Aid Report (SAR) summarizing your information. Your school will then use this information to determine your financial aid package. You’ll need to accept your loan offer through your student portal and complete master promissory note(s) to finalize the loan process. Remember to carefully review all loan documents before signing.

Private Student Loan Options for Texas State Students

Choosing a private student loan can supplement federal aid, but it’s crucial to understand the differences and potential risks involved. Unlike federal loans, private loans are offered by banks and credit unions, and their terms and conditions can vary significantly. Careful consideration of interest rates, fees, and repayment options is essential before committing to a private loan.

Advantages and Disadvantages of Private Student Loans Compared to Federal Loans

Federal student loans generally offer more borrower protections, including income-driven repayment plans and loan forgiveness programs. Private loans, on the other hand, often require a creditworthy co-signer, and may have higher interest rates and less flexible repayment options. The lack of government oversight means less protection for borrowers in the event of financial hardship. Federal loans often have lower interest rates, especially for undergraduate students, making them a more affordable option for many. However, federal loan limits can be restrictive, leading some students to seek private loans to cover the remaining educational expenses.

Examples of Private Lenders that Commonly Work with Texas State University Students

Many private lenders work with universities across the country, and Texas State is no exception. Some common examples include Sallie Mae, Discover Student Loans, and Citizens Bank. These lenders often have streamlined application processes specifically designed for students and may offer promotional periods with reduced interest rates. It’s advisable to compare offers from multiple lenders before making a decision, as terms and conditions can vary significantly even among well-known institutions.

Typical Interest Rates and Repayment Terms Offered by Private Lenders

Interest rates on private student loans are variable and depend on several factors, including the borrower’s credit score, co-signer’s creditworthiness (if applicable), and the loan’s term. Generally, private loans have higher interest rates than federal loans. Repayment terms also vary, ranging from 5 to 20 years, with shorter terms leading to higher monthly payments but lower overall interest paid. Some lenders may offer grace periods before repayment begins, usually after graduation or leaving school. Understanding the total cost of borrowing, including interest and fees, is vital in making an informed decision.

Comparison of Three Private Loan Providers

The following table compares three common private student loan providers. Note that these are examples and actual rates and terms can change. Always check the lender’s website for the most up-to-date information.

| Lender | Interest Rate (Example) | Fees (Example) | Repayment Options (Example) |

|---|---|---|---|

| Sallie Mae | Variable, starting at 6.5% | Origination fee, may vary | Standard, graduated, extended |

| Discover Student Loans | Variable, starting at 7% | Origination fee, may vary | Standard, income-based (some restrictions may apply) |

| Citizens Bank | Variable, starting at 7.25% | Origination fee, may vary | Standard, fixed-term |

Managing Student Loan Debt at Texas State University

Navigating student loan debt after graduation can feel overwhelming, but proactive planning and resource utilization can significantly ease the burden. Texas State University offers various resources and support to help students understand and manage their loan repayment responsibilities effectively. This section Artikels key strategies and available assistance.

Effective debt management begins with a comprehensive understanding of your financial situation. Creating a realistic budget is crucial for tracking income and expenses, allowing you to allocate funds towards loan repayment. A well-structured budget identifies areas where spending can be adjusted to free up more money for debt reduction. Simultaneously, exploring various repayment plans offered by your loan providers can significantly impact your monthly payments and overall repayment timeline. Choosing a plan that aligns with your current financial capacity is vital to avoid default.

Budgeting and Creating a Repayment Plan

Developing a detailed budget involves listing all sources of income and meticulously tracking all expenses. Categorize expenses (housing, transportation, food, entertainment, etc.) to pinpoint areas for potential savings. Numerous budgeting apps and online tools are available to simplify this process. Once a clear picture of your financial situation emerges, you can begin exploring various student loan repayment plans. These plans often offer different payment schedules (e.g., standard, graduated, extended) and interest rates, influencing your monthly payment amount and total interest paid. The federal government offers various repayment plans, such as Income-Driven Repayment (IDR) plans, which adjust payments based on your income and family size. Carefully compare these plans to determine the most suitable option for your circumstances. Consider seeking professional financial advice to navigate the complexities of repayment plans.

Resources Available at Texas State University

Texas State University’s Financial Aid Office provides comprehensive support to students managing their student loan debt. They offer individual counseling sessions to help students understand their loan terms, explore repayment options, and create personalized repayment strategies. Additionally, the university may offer workshops and seminars on financial literacy and debt management. These resources provide valuable guidance and support to students throughout the repayment process. Furthermore, the university’s counseling services can offer assistance with stress management and financial decision-making, helping students cope with the emotional and psychological challenges associated with student loan debt. Contacting the Financial Aid Office or counseling services is a crucial first step for any student struggling with student loan management.

Implications of Defaulting on Student Loans

Defaulting on student loans has severe consequences. It negatively impacts your credit score, making it challenging to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, tax refund offset, and even legal action are possible outcomes of loan default. Furthermore, defaulting on federal student loans can result in the loss of eligibility for future federal student aid. Avoiding default is paramount; proactive communication with your loan servicer is crucial if you anticipate difficulty making payments. Exploring options like deferment or forbearance can help prevent default, providing temporary relief from payments while preserving your credit standing. Remember, open communication with your loan servicer is key to preventing negative consequences.

Consolidating or Refinancing Student Loans

Consolidating student loans combines multiple federal loans into a single loan, simplifying repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount. Refinancing, on the other hand, involves replacing your existing student loans with a new loan from a private lender, potentially offering a lower interest rate or a shorter repayment term. However, refinancing federal loans with a private lender means losing access to federal repayment plans and protections. Carefully weigh the pros and cons of each option before making a decision. It’s advisable to compare interest rates and terms from various lenders before proceeding with either consolidation or refinancing. Consider seeking guidance from a financial advisor to make an informed choice based on your specific financial circumstances.

Financial Aid and Scholarships at Texas State University

Securing funding for your education is a crucial step in planning your time at Texas State University. Fortunately, the university offers a comprehensive range of financial aid and scholarship opportunities to help students manage the costs of higher education. These options are designed to support students from diverse backgrounds and financial situations, making a Texas State education more accessible.

Texas State University provides various financial aid options to help students fund their education. These include federal grants, loans, and work-study programs, as well as university-specific scholarships and grants. The process of applying for these funds involves completing the Free Application for Federal Student Aid (FAFSA) and the Texas Application for State Financial Aid (TASFA), if applicable. Submitting these applications opens the door to a wide array of potential funding sources.

Types of Financial Aid and Scholarships

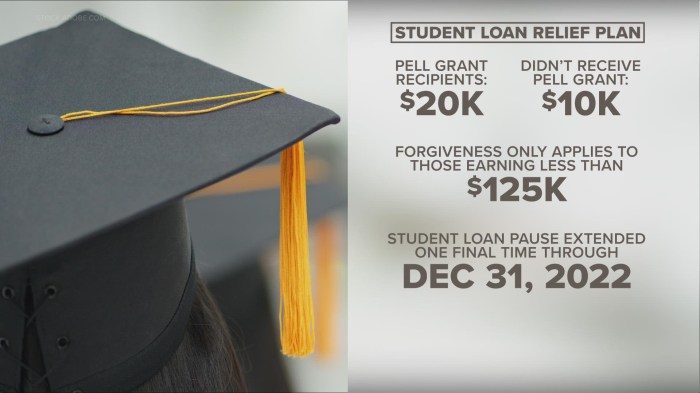

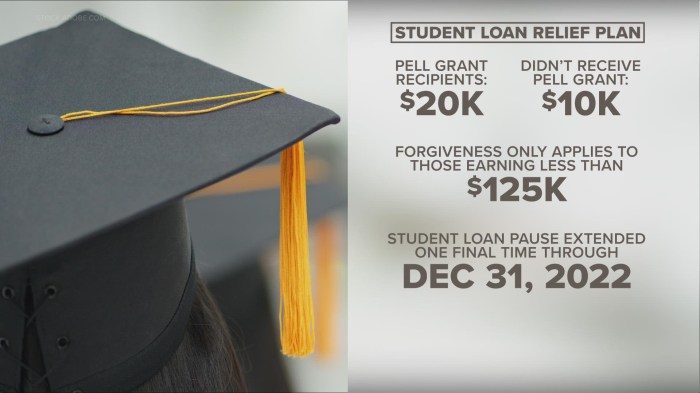

Financial aid at Texas State encompasses several categories. Federal grants, such as the Pell Grant, are awarded based on financial need and do not need to be repaid. Federal student loans provide funding that must be repaid after graduation, with various repayment plans available. Federal work-study programs offer part-time employment opportunities on campus, allowing students to earn money while pursuing their studies. In addition to federal aid, Texas State offers its own institutional grants and scholarships based on academic merit, financial need, or specific criteria, such as major or involvement in extracurricular activities. These university-specific funds often supplement federal aid, helping students cover a larger portion of their educational expenses.

Applying for Financial Aid and Scholarships

The application process typically begins with completing the FAFSA, a crucial step for accessing most federal and state aid programs. The FAFSA requires students to provide information about their family’s financial situation, which is then used to determine their eligibility for need-based aid. The TASFA is a state-specific application for Texas residents seeking additional state-funded financial aid. Once these applications are submitted, Texas State will review the information and determine the student’s eligibility for various aid programs. Students are then notified of their award package, outlining the types and amounts of financial aid they’ve been offered. Many scholarships require separate applications, often with specific criteria and deadlines. Students should actively search for and apply to scholarships that align with their academic interests, talents, and background.

Examples of Texas State Scholarships

Texas State offers a diverse range of scholarships, many tailored to specific student populations. For example, the Bobcat Excellence Scholarship recognizes outstanding academic achievement, while other scholarships may focus on specific majors, such as engineering or nursing. Scholarships are also available for students from underrepresented groups, first-generation college students, and students with demonstrated financial need. Many departmental scholarships exist within specific colleges, rewarding students for excellence within their chosen field of study. These scholarships can significantly reduce the overall cost of tuition and fees. Prospective students should consult the Texas State University financial aid website for a complete list of available scholarships and their specific eligibility requirements.

Resources for Finding Additional Funding Opportunities

Finding additional funding sources can significantly impact a student’s financial burden. Exploring external scholarship opportunities expands the pool of potential funding.

- Texas State University Financial Aid Website: This website is the primary resource for information on all university-specific aid programs.

- Fastweb: This online database provides a searchable directory of thousands of scholarships from various organizations.

- Scholarships.com: Similar to Fastweb, this website offers a comprehensive listing of scholarship opportunities.

- The Texas Higher Education Coordinating Board: This state agency provides information on state-funded financial aid programs and scholarships.

- Individual Department Websites: Many academic departments within Texas State offer their own scholarships; checking individual department websites can reveal additional funding possibilities.

Illustrative Examples of Student Loan Scenarios at Texas State

Understanding how student loans can impact your financial future is crucial. The following scenarios illustrate both successful and unsuccessful loan management strategies, as well as the benefits of combining loan types. These examples are for illustrative purposes and may not reflect every individual’s experience. Always consult with a financial advisor for personalized guidance.

Successful Student Loan Management

Maria, a Texas State student pursuing a degree in nursing, meticulously planned her finances. She secured a combination of federal subsidized and unsubsidized loans, totaling $20,000 per year. Her annual income from a part-time job and summer internships averaged $10,000. Her monthly expenses, including rent, utilities, groceries, and transportation, totaled $1,200. She diligently tracked her spending and prioritized loan repayment. Upon graduation, Maria had a total loan debt of $80,000. She secured a high-paying nursing job and implemented an aggressive repayment plan, focusing on higher payments to reduce the principal quickly. By prioritizing saving and avoiding unnecessary expenses, she successfully managed her debt and paid off her loans within seven years.

Consequences of Poor Student Loan Management

David, another Texas State student, took out the maximum amount in loans each year without carefully considering his repayment ability. He lacked a budget and spent freely, neglecting his loan payments. Eventually, he fell behind on his payments, leading to loan default. This resulted in a significant drop in his credit score, impacting his ability to secure a loan for a car or a mortgage in the future. Furthermore, the collection agencies aggressively pursued him for the outstanding debt, adding to his financial stress and potentially leading to wage garnishment.

Successful Combination of Federal and Private Loans

Sarah, a Texas State student studying computer science, strategically used a combination of federal and private loans to finance her education. She first maximized her federal loan eligibility, utilizing subsidized and unsubsidized loans to cover her tuition and living expenses. To cover the remaining costs, she obtained a private student loan with a competitive interest rate from a reputable lender. This approach allowed her to manage her debt effectively by utilizing the lower interest rates and flexible repayment options of federal loans while supplementing with private loans to meet her educational needs. Careful budgeting and timely payments allowed her to maintain a strong credit history.

Final Wrap-Up

Securing funding for higher education is a significant step, and choosing the right student loan path is critical for long-term financial success. By carefully considering the various federal and private loan options, understanding repayment plans, and utilizing the resources available at Texas State University, students can effectively manage their debt and graduate with a clearer path to financial independence. Remember, proactive planning and responsible borrowing are crucial for a positive outcome.

Question Bank

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into a single loan with a new interest rate and repayment plan. Texas State’s financial aid office can provide information on consolidation options.

What happens if I default on my student loans?

Defaulting on student loans can severely damage your credit score, leading to difficulty obtaining loans, credit cards, or even renting an apartment. Wage garnishment and tax refund offset are also potential consequences.

Where can I find additional scholarship opportunities?

Texas State University’s financial aid website and the university’s scholarship database are excellent starting points. External scholarship search engines can also be helpful.