Navigating the complexities of higher education often involves the crucial decision of student loan financing. A well-informed approach to student loans can unlock significant opportunities, but it also requires careful planning and understanding of the potential long-term implications. This exploration delves into the advantages and disadvantages of student loans, providing insights into responsible borrowing and effective debt management strategies to empower students in their pursuit of higher education.

We will examine the various types of student loans, comparing federal and private options, and analyzing their impact on career prospects and long-term financial stability. Furthermore, we’ll explore alternative funding sources and address the psychological aspects of managing student loan debt, offering practical advice and resources to support students throughout their academic journey and beyond.

Understanding Student Loan Advantages

Accessing student loans can be a crucial step towards achieving higher education, opening doors to potentially lucrative career paths and improved financial stability. While carrying debt can be daunting, understanding the advantages can help prospective students make informed decisions. The benefits extend beyond simply affording tuition; they encompass long-term financial gains and enhanced career prospects.

Student loans provide access to higher education that might otherwise be unattainable. The financial advantages stem from the increased earning potential associated with a college degree. Studies consistently show that individuals with higher education degrees earn significantly more over their lifetimes than those without. While the cost of education, including tuition, fees, and living expenses, can be substantial, the return on investment (ROI) from a degree often outweighs the initial loan burden. This is especially true for fields with high demand and strong salary prospects, such as engineering, medicine, and technology.

Financial Advantages of Higher Education Financed by Student Loans

The financial advantages of pursuing higher education financed by student loans are substantial and should be carefully considered. A key factor is the potential increase in lifetime earnings. For instance, a person with a bachelor’s degree in engineering might earn, on average, $100,000 annually, while someone with only a high school diploma might earn $40,000 annually. Over a 40-year career, this difference represents a substantial financial gain. This increased earning potential allows for better financial security, earlier retirement, and greater ability to invest and build wealth. While student loan repayments represent a significant expense, the increased earning power often makes these payments manageable and worthwhile in the long term. This positive ROI is further enhanced by factors such as career advancement opportunities and reduced unemployment rates associated with higher education.

Situations Where Student Loans are Particularly Advantageous

Student loans are particularly advantageous in several specific scenarios. For instance, individuals pursuing high-demand professions with substantial earning potential, such as medicine or law, can readily justify the cost of their education through future income. Furthermore, students from low-income backgrounds who might not otherwise have access to higher education can use student loans to overcome financial barriers and unlock their potential. Students pursuing advanced degrees, such as master’s or doctoral programs, also often find that the increased earning potential justifies the additional loan burden. Finally, students attending expensive private institutions, where tuition costs are significantly higher than public institutions, may find that student loans are necessary to access the quality of education offered.

Comparison of Federal and Private Student Loans

The following table compares the advantages of federal and private student loans:

| Feature | Federal Student Loans | Private Student Loans | Considerations |

|---|---|---|---|

| Interest Rates | Generally lower and fixed | Generally higher and can be variable | Federal loans typically offer more favorable interest rates. |

| Repayment Options | Various income-driven repayment plans available | Fewer repayment options, typically standard amortization | Federal loans provide more flexibility in repayment. |

| Loan Forgiveness Programs | Eligible for certain loan forgiveness programs (e.g., Public Service Loan Forgiveness) | Generally not eligible for federal loan forgiveness programs | Federal loans offer potential for loan forgiveness under specific circumstances. |

| Credit Check | Generally does not require a credit check | Requires a credit check; creditworthiness is a major factor | Private loans often have stricter eligibility requirements. |

Impact on Career Prospects

A college education, often financed through student loans, significantly impacts an individual’s career trajectory and earning potential. The investment in higher education translates to a wider range of job opportunities, increased earning capacity throughout a career, and enhanced professional mobility. This section will explore the correlation between higher education and career advancement, providing specific examples and salary comparisons to illustrate the benefits.

The relationship between a college degree and career success is well-documented. Studies consistently show that college graduates earn significantly more over their lifetimes than those with only a high school diploma. This increased earning potential is driven by several factors, including access to higher-paying jobs, increased opportunities for promotions, and greater job security. Furthermore, a college education often equips individuals with valuable skills such as critical thinking, problem-solving, and communication—skills highly valued by employers across various industries.

Salary Expectations Across Different Fields

The disparity in earning potential between college graduates and non-graduates varies considerably depending on the chosen field. For instance, in STEM fields (Science, Technology, Engineering, and Mathematics), the salary difference is often substantial. A software engineer with a bachelor’s degree can expect a significantly higher starting salary and greater earning potential throughout their career compared to someone without a degree working in a related field. Similarly, medical professionals, such as doctors and surgeons, require extensive college education and typically command high salaries. In contrast, while a college degree can still be beneficial in fields like skilled trades, the salary difference might be less pronounced than in professional fields. However, even in these areas, specialized training and certifications often require some form of post-secondary education. Consider the example of a construction manager versus a construction worker; the former typically holds a degree in construction management and earns considerably more.

Essential College Education in Specific Careers

Many professions require a college degree as a minimum qualification for entry. These professions often involve specialized knowledge and skills that necessitate years of formal education. For example, becoming a physician, lawyer, or engineer necessitates years of rigorous academic study at the college and, in many cases, postgraduate levels. Similarly, advanced roles in fields such as finance, research, and academia often demand at least a master’s or doctoral degree. These fields not only offer higher earning potential but also contribute significantly to societal progress and innovation. A Master of Business Administration (MBA) is frequently cited as a significant stepping stone for those aspiring to leadership roles in business and management, demonstrating the continuing need for advanced education to reach certain career heights. In short, in many sectors, a college degree acts as a gateway to high-paying, impactful careers.

Long-Term Financial Planning with Student Loans

Navigating student loan debt after graduation requires a proactive and well-defined financial strategy. Effective planning is crucial for long-term financial stability, ensuring you can meet your financial goals while responsibly managing your debt. This section Artikels a step-by-step guide to help you effectively manage your student loans and build a secure financial future.

Managing Student Loan Debt After Graduation

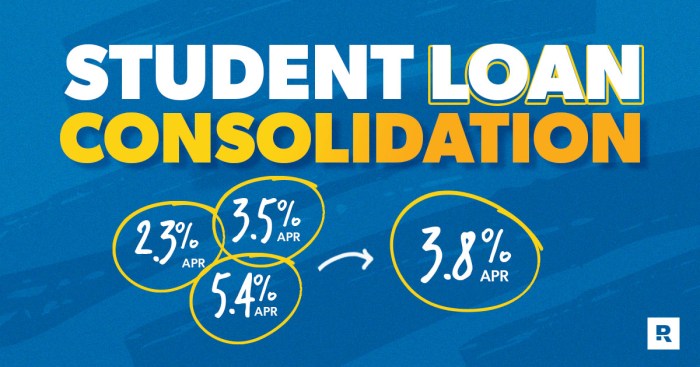

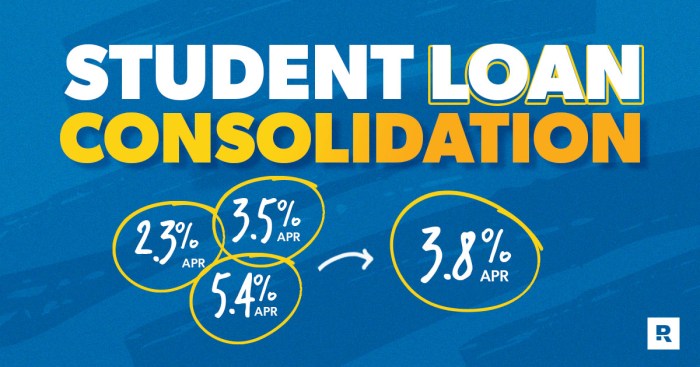

A comprehensive approach to student loan repayment involves several key steps. First, understand your loans: consolidate if possible, identify the interest rates and repayment terms for each loan. Next, create a realistic budget that incorporates your loan payments. Prioritize essential expenses and identify areas where you can reduce spending to free up funds for loan repayment. Finally, actively monitor your progress and make adjustments to your budget as needed. Regularly review your loan statements and consider exploring different repayment options to optimize your repayment plan.

Student Loan Repayment Strategies and Their Impacts

Several repayment strategies exist, each with its own implications for long-term financial health. Standard repayment involves fixed monthly payments over a set period (typically 10 years). Extended repayment stretches payments over a longer timeframe, reducing monthly payments but increasing the total interest paid. Income-driven repayment plans (IDR) adjust monthly payments based on income and family size, offering lower payments but potentially extending the repayment period significantly. Finally, accelerated repayment involves paying more than the minimum amount each month to reduce the principal faster and minimize overall interest costs. For example, choosing an accelerated repayment strategy might save you thousands of dollars in interest over the life of the loan compared to a standard repayment plan. The best strategy depends on individual circumstances and financial goals.

Potential Risks of High Student Loan Debt and Mitigation

High student loan debt poses several risks, including difficulty saving for retirement, homeownership challenges, and potential financial stress. The risk of defaulting on loans can lead to serious consequences, including damage to credit scores and wage garnishment. To mitigate these risks, prioritize building an emergency fund, which can help cover unexpected expenses and prevent loan default. Additionally, actively manage your budget, explore options for refinancing loans to lower interest rates, and consider seeking professional financial advice. For instance, if facing financial hardship, exploring options like income-driven repayment plans or deferment can provide temporary relief and prevent default.

Resources for Student Loan Repayment and Financial Planning

Accessing reliable resources is crucial for effective student loan management. Many organizations offer assistance and guidance.

- National Student Loan Data System (NSLDS): Provides a centralized location to view your federal student loan information.

- Federal Student Aid (FSA): Offers information and resources on federal student loans and repayment plans.

- Your Loan Servicer: Your loan servicer can answer specific questions about your loans and repayment options.

- Nonprofit Credit Counseling Agencies: These agencies offer free or low-cost financial counseling services, including help with student loan management.

- Financial Advisors: A financial advisor can help you create a personalized financial plan that incorporates your student loan debt.

Student Loan Alternatives and Comparisons

Securing funding for higher education is a crucial step, and while student loans offer a readily available option, exploring alternatives is vital for making informed financial decisions. Understanding the advantages and disadvantages of each funding source, including their long-term financial implications, empowers students to choose the path best suited to their individual circumstances. This section compares and contrasts student loans with scholarships, grants, and savings plans, highlighting scenarios where one option might be more beneficial than another.

Comparison of Funding Options for Higher Education

This section details the key characteristics of student loans, scholarships, grants, and savings plans, allowing for a direct comparison of their benefits and drawbacks. Each option presents a unique set of considerations regarding accessibility, repayment, and overall financial impact.

| Funding Option | Advantages | Disadvantages | Long-Term Financial Impact | Example Scenario |

|---|---|---|---|---|

| Student Loans | Readily available, covers a wide range of educational costs. | Accumulates debt with interest, impacting future financial flexibility. Repayment can be a significant burden. | Potential for significant long-term debt, affecting credit score and future financial decisions (e.g., buying a house, investing). | A student needing to finance a large portion of their tuition and living expenses may rely heavily on student loans, leading to considerable debt after graduation. |

| Scholarships | Free money, does not need to be repaid. Can significantly reduce overall educational costs. | Highly competitive, requires strong academic performance and often specific criteria. Availability varies greatly. | Positive; reduces or eliminates debt, freeing up financial resources for other life goals. | A high-achieving student with strong extracurricular involvement may secure multiple scholarships, significantly lowering their tuition burden. |

| Grants | Free money, does not need to be repaid. Often based on financial need. | Often limited in amount and highly competitive. Specific eligibility criteria may apply. | Positive; similar to scholarships, reducing the overall cost of education. | A low-income student may qualify for a federal Pell Grant to help cover tuition and fees. |

| Savings Plans (e.g., 529 Plans) | Tax-advantaged savings specifically for education expenses. Allows for long-term financial planning. | Requires proactive saving over many years. May not cover the entire cost of education. | Positive; reduces reliance on loans, leading to less debt and greater financial freedom post-graduation. | A family consistently contributing to a 529 plan for their child can significantly reduce their college expenses, potentially eliminating the need for loans. |

Decision-Making Flowchart for Choosing a Funding Option

Choosing the right funding option requires careful consideration of various factors. This flowchart Artikels a step-by-step process to aid in this decision.

The flowchart would visually represent a decision tree. Starting with the question “What is your financial need?”, branches would lead to different options based on answers (e.g., “High need” leads to exploring grants and scholarships first; “Moderate need” leads to considering a combination of savings, grants, and loans; “Low need” might focus on savings plans and scholarships). Each branch would have further questions and options, eventually leading to the most suitable funding plan. The flowchart would incorporate factors like academic merit, family income, and desired education level to guide the decision-making process. This visual aid would streamline the selection process by offering a clear and concise pathway to determine the optimal financial strategy for higher education.

The Psychological Aspects of Student Loan Debt

The significant financial burden of student loan debt extends far beyond the purely monetary; it significantly impacts the mental and emotional well-being of borrowers. The stress and anxiety associated with repayment can permeate various aspects of life, affecting relationships, career choices, and overall life satisfaction. Understanding these psychological effects is crucial for developing effective coping strategies and accessing available support.

The weight of student loan debt can manifest in various ways, impacting mental health and overall well-being. Many borrowers experience chronic stress, anxiety, and even depression. The constant pressure of looming payments, coupled with the uncertainty of future financial stability, can lead to feelings of overwhelm and hopelessness. This can manifest physically as sleep disturbances, changes in appetite, and decreased energy levels. The long-term impact can include decreased productivity and difficulty forming and maintaining healthy relationships. For some, the pressure can lead to unhealthy coping mechanisms such as substance abuse or social withdrawal.

Stress and Anxiety Management Strategies

Effective strategies for managing the stress and anxiety associated with student loan repayment are crucial for maintaining mental well-being. These strategies encompass a multifaceted approach, combining financial planning with self-care techniques. Developing a realistic budget, exploring repayment options (such as income-driven repayment plans), and actively communicating with lenders can reduce financial anxieties. Simultaneously, prioritizing self-care activities such as regular exercise, mindfulness practices, and maintaining a strong social support network can mitigate the psychological impact of debt. Seeking professional guidance from a financial advisor or therapist can also provide valuable support and personalized strategies. For example, budgeting apps can help visualize spending and track progress towards repayment goals, providing a sense of control and reducing anxiety. Mindfulness exercises, even short daily meditations, can help center the mind and reduce feelings of overwhelm.

Available Resources and Support Systems

Numerous resources and support systems are available to students and graduates struggling with the emotional burden of student loan debt. Many universities offer counseling services and financial aid workshops specifically designed to address these concerns. National non-profit organizations, such as the National Foundation for Credit Counseling (NFCC), provide free or low-cost credit counseling and debt management services. Online forums and support groups offer a platform for sharing experiences, connecting with others facing similar challenges, and gaining emotional support. Additionally, many lenders offer resources and assistance programs, including hardship deferments or forbearance options, to help borrowers manage their debt during challenging times. These resources provide a critical lifeline, connecting individuals with the tools and support needed to navigate the emotional and financial complexities of student loan repayment.

Impact of Student Loan Debt on Mental Health

The pervasive impact of student loan debt on mental health is increasingly recognized. Studies have shown a correlation between high levels of student loan debt and increased rates of depression, anxiety, and other mental health challenges. The constant worry about repayment can lead to chronic stress, impacting sleep, appetite, and overall physical health. This chronic stress can weaken the immune system and increase the risk of developing various health problems. The long-term effects can include difficulties in forming and maintaining healthy relationships, reduced career satisfaction, and decreased overall life satisfaction. The impact is particularly significant for those struggling to find employment in their chosen field or facing unexpected life events, such as job loss or illness. Understanding this connection is crucial for developing effective interventions and promoting mental health support for students and graduates navigating the complexities of student loan repayment.

Final Conclusion

Ultimately, the decision to utilize student loans for higher education is a personal one, requiring careful consideration of individual circumstances and financial goals. By understanding the advantages and disadvantages, exploring alternative funding options, and developing effective debt management strategies, students can make informed decisions that maximize the benefits of higher education while mitigating the potential risks associated with student loan debt. A proactive and informed approach is key to harnessing the power of education to build a successful and fulfilling future.

FAQ

What is the difference between federal and private student loans?

Federal loans are offered by the government and generally have more favorable repayment terms and protections for borrowers. Private loans are offered by banks and credit unions and may have higher interest rates and less flexible repayment options.

How can I reduce my student loan debt?

Strategies include income-driven repayment plans, refinancing to a lower interest rate, and exploring loan forgiveness programs.

What happens if I can’t repay my student loans?

Defaulting on student loans can have serious consequences, including damage to credit score, wage garnishment, and tax refund offset. Contact your loan servicer immediately if you’re facing difficulties.

Are there any tax benefits associated with student loan interest?

In some countries, you may be able to deduct student loan interest from your taxes, subject to income limitations and other criteria. Check with your tax advisor for details.