Navigating the world of student loans can feel overwhelming, especially when considering private options. This guide delves into AM Money private student loans, providing a comprehensive overview of their features, application process, repayment plans, and potential risks. We’ll compare them to federal loans and other private lenders, equipping you with the knowledge to make informed decisions about financing your education.

Understanding the intricacies of interest rates, fees, and repayment schedules is crucial for responsible borrowing. We’ll explore various scenarios, highlighting both successful repayment journeys and potential challenges, offering practical advice on managing your loan effectively and avoiding common pitfalls.

Understanding AM Money Private Student Loans

AM Money private student loans offer a supplemental funding option for students pursuing higher education beyond what federal loans may provide. They can be a valuable tool for bridging the gap between financial aid and the total cost of attendance, but it’s crucial to understand their features and potential implications before applying. This section will detail the key aspects of AM Money private student loans, enabling prospective borrowers to make informed decisions.

Features and Benefits of AM Money Private Student Loans

AM Money private student loans, like other private loans, typically offer several features designed to cater to borrowers’ needs. These may include competitive interest rates (though these vary depending on creditworthiness and market conditions), flexible repayment options such as fixed or variable rates, and potential for loan deferment or forbearance in certain circumstances. Some lenders may also offer borrower benefits such as co-signer release options after a period of on-time payments. It’s essential to review the specific terms and conditions of any loan offer from AM Money carefully. The benefits are largely contingent on individual circumstances and the specific loan agreement.

Eligibility Criteria for AM Money Private Student Loans

Eligibility for AM Money private student loans hinges on several factors. Typically, applicants need to be enrolled or accepted into an eligible educational program at a participating institution. Creditworthiness plays a significant role; a strong credit history often leads to more favorable interest rates. Applicants may need a co-signer if their credit history is limited or weak. Income verification may also be required to assess the borrower’s repayment capacity. Specific eligibility requirements can be found on AM Money’s website or by contacting their customer service directly.

Comparison of AM Money Private Student Loans and Federal Student Loans

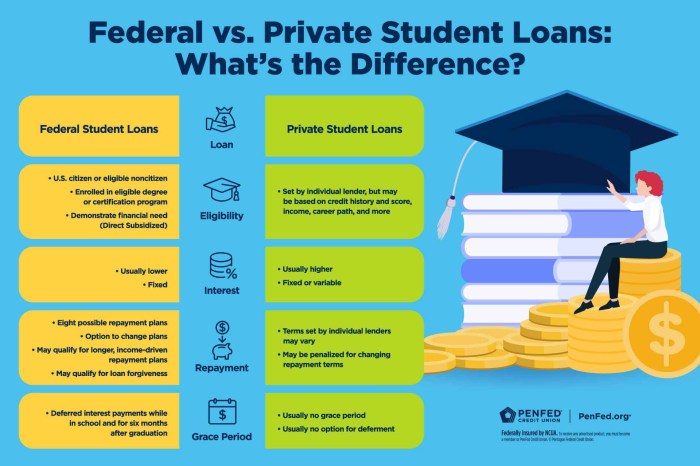

Understanding the key differences between private and federal student loans is critical for making informed borrowing decisions. Federal loans often come with benefits like income-driven repayment plans and loan forgiveness programs, which are not typically available with private loans. Conversely, private loans may offer more flexible terms in some cases. The following table provides a comparison:

| Feature | AM Money Private Student Loan | Federal Student Loan |

|---|---|---|

| Interest Rates | Variable or fixed; typically higher than federal loans, dependent on creditworthiness. | Variable or fixed; generally lower than private loans, set by the government. |

| Repayment Options | Various options may be available, but typically less flexible than federal loan options. | Standard repayment, extended repayment, graduated repayment, income-driven repayment plans available. |

| Eligibility Requirements | Requires enrollment at an eligible institution; credit check; may require a co-signer. | Based on financial need and enrollment at an eligible institution; credit check not always required. |

Application and Approval Process

Applying for an AM Money private student loan involves a straightforward process designed to be completed efficiently. The application itself is generally completed online, requiring you to provide accurate and complete information. This section details the steps involved and the necessary documentation.

The application process for an AM Money private student loan typically begins with completing an online application form. This form will ask for detailed personal information, academic details, and financial information. After submitting the application, AM Money will review your information and may request additional documentation to verify the accuracy and completeness of your application.

Steps in the AM Money Loan Application

The application process usually follows these steps: First, you’ll create an account on the AM Money website. Next, you’ll complete the online application form, providing all required information accurately and completely. Then, AM Money will review your application. Finally, you will receive a decision regarding your loan application. If approved, you’ll receive loan terms and disbursement information.

Required Documentation

To ensure a smooth and timely application process, you should gather the necessary documentation beforehand. This typically includes your Social Security number, driver’s license or state-issued ID, proof of enrollment at your school (acceptance letter or enrollment verification), and your most recent federal tax return (or parent’s tax return if you are a dependent student). You may also be asked to provide bank statements to verify your income and financial stability. Additional documentation might be requested depending on your individual circumstances, such as co-signer information if required. Accurate and timely submission of all required documents is crucial for a swift application review.

Interest Rates and Repayment Plans

Understanding the interest rate and repayment options for your AM Money private student loan is crucial for effective financial planning. This section will clarify how your interest rate is determined and Artikel the various repayment plans available to help you manage your debt effectively.

AM Money private student loan interest rates are variable and are determined by several factors. These include your creditworthiness (credit score and history), the loan amount, the loan term, and prevailing market interest rates. A higher credit score generally translates to a lower interest rate, reflecting a lower perceived risk to the lender. Similarly, a longer loan term may result in a slightly higher interest rate to compensate for the increased lending period. The current market interest rate also plays a significant role, as lenders adjust their rates to reflect broader economic conditions.

Interest Rate Determination

The specific interest rate applied to your loan will be clearly stated in your loan agreement. It’s important to review this document carefully to understand the terms and conditions of your loan, including any potential changes to the interest rate over the life of the loan. For example, a loan with a variable interest rate may fluctuate based on an index rate, such as the LIBOR (London Interbank Offered Rate) or a similar benchmark. This means your monthly payment could change over time, and it is advisable to plan accordingly.

Repayment Options

AM Money offers several repayment options designed to accommodate various financial situations. Choosing the right repayment plan can significantly impact your monthly payment and the total interest you pay over the life of the loan. Careful consideration of your budget and long-term financial goals is crucial when selecting a repayment plan.

- Standard Repayment Plan: This plan typically involves fixed monthly payments over a set period (e.g., 10 or 15 years). The payment amount remains constant throughout the repayment period, making budgeting easier.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time. This option can be beneficial for borrowers anticipating increased income in the future.

- Extended Repayment Plan: This option allows for a longer repayment period, resulting in lower monthly payments. However, it’s important to note that extending the repayment term will likely lead to a higher total interest paid over the life of the loan.

- Income-Driven Repayment Plan (IDR): While not always available for private student loans, some lenders may offer an income-driven repayment plan. These plans tie your monthly payments to your income, making them more manageable during periods of lower earnings. It’s important to check with AM Money to see if this option is available for your loan.

Sample Repayment Schedule

The following table illustrates sample repayment schedules for a $20,000 loan with a 7% annual interest rate under different repayment plans. These are simplified examples and actual payments may vary based on your individual loan terms and interest rate.

| Repayment Plan | Loan Term (Years) | Approximate Monthly Payment | Approximate Total Interest Paid |

|---|---|---|---|

| Standard | 10 | $222 | $4,640 |

| Graduated (starting lower) | 10 | (Variable, starting at ~$180, increasing gradually) | ~$4,800 (approximate) |

| Extended | 15 | ~$160 | ~$6,000 (approximate) |

Note: These figures are for illustrative purposes only and do not represent a guaranteed repayment schedule. Your actual repayment schedule will be determined by your specific loan terms and interest rate.

Fees and Charges Associated with AM Money Loans

Understanding the fees and charges associated with your AM Money private student loan is crucial for effective financial planning. These fees can significantly impact the overall cost of your loan, so it’s essential to review them carefully before accepting the loan terms. Failing to understand these charges can lead to unexpected expenses and potential financial difficulties.

It’s important to note that specific fees and their amounts can vary depending on the loan terms, your creditworthiness, and other factors. Always refer to your official loan documents for the most accurate and up-to-date information.

Loan Origination Fees

Loan origination fees are charges levied by the lender to cover the administrative costs of processing your loan application. These fees are typically a percentage of the total loan amount and are usually deducted from the disbursed loan funds. For example, an origination fee of 1% on a $10,000 loan would result in a $100 fee. This means you would receive $9,900 instead of the full $10,000. Understanding this upfront deduction is vital to accurately budgeting for your educational expenses.

Late Payment Fees

Late payments on your AM Money private student loan will incur penalties. These fees can vary but are usually a fixed dollar amount or a percentage of the missed payment. Consistent late payments can negatively impact your credit score, making it more difficult to obtain loans or credit in the future. Furthermore, repeated late payments can lead to your loan going into default.

Default Implications

Defaulting on your student loan has severe consequences. This occurs when you fail to make payments for a specified period (usually 90 days). Default can result in:

- Damage to your credit score, significantly impacting your ability to secure future loans or credit cards.

- Wage garnishment, where a portion of your earnings is directly deducted to repay the loan.

- Bank levy, where funds in your bank accounts can be seized to repay the debt.

- Legal action, which can lead to court judgments and further financial penalties.

- Collection agency involvement, resulting in additional fees and potentially aggressive collection tactics.

Avoiding default is paramount. If you anticipate difficulty making payments, contact AM Money immediately to explore options like deferment or forbearance. Proactive communication is key to mitigating the serious repercussions of default.

Other Potential Fees

While origination fees and late payment fees are common, other potential fees might apply depending on your specific loan agreement. These could include fees for returned payments, administrative fees for certain requests, or other charges Artikeld in your loan documents. Carefully review your loan agreement to fully understand all associated costs.

Comparing AM Money to Other Private Lenders

Choosing a private student loan can feel overwhelming, given the numerous lenders and varying loan terms available. Understanding the key differences between lenders is crucial for securing the best possible financing for your education. This section compares AM Money to other major private student loan providers, highlighting their strengths and weaknesses to aid in your decision-making process.

Direct comparison of private student loan providers requires careful consideration of several factors. These factors include interest rates, repayment options, fees, and customer service. While specific rates and terms fluctuate based on individual creditworthiness and market conditions, a general comparison can provide valuable insights.

Key Differences Between AM Money and Other Private Lenders

The following table provides a comparative overview of AM Money and three other prominent private student loan providers (names are replaced with Lender A, Lender B, and Lender C to avoid endorsing specific companies and maintain generality). Remember that these are generalized comparisons, and individual experiences may vary.

| Feature | AM Money | Lender A | Lender B | Lender C |

|---|---|---|---|---|

| Interest Rates (Variable) | Example: 6.5% – 12% | Example: 7% – 13% | Example: 6% – 11% | Example: 7.5% – 12.5% |

| Interest Rates (Fixed) | Example: 7.5% – 13% | Example: 8% – 14% | Example: 7% – 12% | Example: 8.5% – 13.5% |

| Repayment Options | Standard, Graduated, Extended | Standard, Income-Driven, Deferred | Standard, Graduated | Standard, Extended, Income-Based |

| Fees | Origination fee: Example: 1%-3%; Late payment fee: Example: $25 | Origination fee: Example: 0%-2%; Late payment fee: Example: $30 | Origination fee: Example: 1.5%-3.5%; Late payment fee: Example: $20 | Origination fee: Example: 0.5%-2.5%; Late payment fee: Example: $25 |

Note: The interest rate and fee examples provided are illustrative and subject to change. Actual rates and fees will depend on creditworthiness, loan amount, and other factors. Always check the lender’s website for the most up-to-date information.

Advantages of Choosing AM Money

AM Money might offer advantages such as competitive interest rates in certain market conditions, flexible repayment options tailored to individual needs, or a streamlined application process. However, these advantages are dependent on the individual borrower’s circumstances and should be carefully evaluated against other lenders’ offerings.

Disadvantages of Choosing AM Money

Potential disadvantages could include less favorable interest rates compared to competitors in some situations, limited repayment plan choices compared to other lenders, or less robust customer service. These are potential drawbacks, and the actual experience may vary significantly.

Managing Your AM Money Student Loan

Successfully navigating your student loan journey requires proactive management. Understanding your repayment options, budgeting effectively, and employing smart strategies will significantly impact your financial well-being after graduation. This section provides practical advice on managing your AM Money student loan responsibly and efficiently.

Responsible Borrowing and Repayment Strategies

Effective loan management begins with responsible borrowing. Before accepting any loan, carefully consider your educational goals, the potential return on your investment (ROI), and your projected post-graduation earning potential. Avoid borrowing more than absolutely necessary. A strong understanding of your repayment plan is crucial. Familiarize yourself with the terms, interest rates, and any potential fees associated with your loan. Explore different repayment options offered by AM Money, such as graduated repayment or income-driven repayment plans, to find the one that best aligns with your anticipated income after graduation. Creating a realistic budget that incorporates your loan payments is paramount. This budget should include all expenses, such as housing, transportation, food, and entertainment, alongside your loan payment.

Loan Payment Tracking and Debt Management

Tracking your loan payments and managing your debt effectively requires diligence and organization. Maintain detailed records of all loan payments, including the date, amount, and payment method. Utilize online banking tools or dedicated budgeting apps to monitor your loan balance and track your progress towards repayment. Consider setting up automatic payments to avoid missed payments and potential late fees. Regularly review your credit report to ensure accuracy and identify any potential issues. If you anticipate difficulty making your payments, contact AM Money immediately to explore options like deferment or forbearance. Proactive communication can prevent serious financial repercussions.

Consolidating or Refinancing AM Money Student Loans

Consolidating or refinancing your AM Money student loans might be beneficial under certain circumstances. Loan consolidation combines multiple loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment by reducing the number of payments you need to track. Refinancing involves replacing your existing loan with a new one from a different lender, potentially securing a lower interest rate or more favorable terms. Before considering either option, carefully compare the terms and conditions of the new loan with your existing loan. Assess whether the potential benefits outweigh any associated fees or costs. Consider factors such as your credit score, interest rates, and the length of the repayment period. Consult a financial advisor to determine the best course of action for your individual circumstances.

Potential Risks and Considerations

Taking out a private student loan, such as one from AM Money, involves inherent risks. It’s crucial to understand these potential drawbacks before committing to a loan, as failing to do so could have significant financial consequences. Borrowers should carefully weigh the benefits against the potential downsides to make an informed decision.

Private student loans, unlike federal loans, generally don’t offer the same level of consumer protection or flexible repayment options. This means that borrowers are more vulnerable to financial hardship if unforeseen circumstances arise. Furthermore, the interest rates on private loans are often higher than federal loan rates, leading to a larger overall debt burden.

Defaulting on an AM Money Student Loan

Defaulting on an AM Money student loan can have severe repercussions. This occurs when you fail to make your loan payments according to the agreed-upon terms. The consequences can include damage to your credit score, making it difficult to obtain future loans, credit cards, or even rent an apartment. AM Money may also pursue legal action to recover the outstanding debt, which could involve wage garnishment or the seizure of assets. In short, defaulting can have far-reaching and long-lasting negative impacts on your financial well-being. It’s essential to prioritize loan repayment and contact AM Money immediately if you anticipate difficulty meeting your obligations. They may offer options such as forbearance or deferment to help you manage your payments.

Factors to Consider Before Borrowing from AM Money

Before taking out a private student loan from AM Money, carefully consider the following factors:

- Your Financial Situation: Assess your current income, expenses, and overall financial stability. Can you comfortably afford the monthly loan payments in addition to your other financial obligations? Consider potential changes in your income or expenses that might impact your ability to repay the loan.

- Interest Rates and Fees: Compare AM Money’s interest rates and fees to those offered by other private lenders. Look for the lowest interest rate possible and be aware of any hidden fees or prepayment penalties. A seemingly small difference in interest rates can significantly impact the total cost of the loan over time.

- Repayment Options: Understand the different repayment plans offered by AM Money. Some plans may offer lower monthly payments but result in higher total interest paid. Choose a repayment plan that aligns with your financial capabilities and long-term goals.

- Alternatives to Private Loans: Explore alternative funding options, such as federal student loans, scholarships, grants, and part-time employment. Federal loans often offer more favorable terms and greater consumer protections than private loans. Exhausting these options before resorting to private loans can help minimize your debt burden.

- Future Earning Potential: Consider whether the education you are pursuing will likely lead to employment that allows you to comfortably repay the loan. A realistic assessment of your post-graduation employment prospects is crucial in determining whether taking on a significant private loan is a sound financial decision. For example, a student pursuing a high-demand field like engineering might be better positioned to repay a large loan compared to a student pursuing a less lucrative field.

Customer Service and Support

AM Money prioritizes providing excellent customer service to its borrowers. Understanding your loan and having access to support when needed is crucial for a positive borrowing experience. Several channels are available to help you manage your account and address any questions or concerns.

AM Money offers a multi-faceted approach to customer support, ensuring borrowers can easily access assistance through various methods. This includes phone support, email correspondence, and a comprehensive online help center with frequently asked questions and detailed explanations of loan-related processes. Proactive communication regarding account updates and important deadlines is also a key component of their service strategy.

Contacting AM Money

To contact AM Money with questions or concerns, borrowers can utilize several methods. The primary method is through their dedicated customer service phone line, available during extended business hours. Alternatively, borrowers can submit inquiries via email using a designated customer service address provided on the AM Money website. The website also features a comprehensive FAQ section covering many common questions. For more complex issues, a secure online messaging system allows for direct communication with a loan specialist.

Sample Customer Service Email

Subject: Inquiry Regarding Loan Payment Due Date

Dear AM Money Customer Service,

I am writing to inquire about the due date for my next student loan payment. My loan number is [Loan Number]. I am unable to locate this information on my online account statement. Could you please provide the due date and the amount due?

Thank you for your time and assistance.

Sincerely,

[Borrower Name]

[Borrower Email Address]

[Borrower Phone Number]

Illustrative Scenarios

Understanding the potential outcomes of taking out a private student loan is crucial for informed decision-making. The following scenarios illustrate both positive and negative experiences with AM Money private student loans, highlighting the importance of responsible borrowing and financial planning.

Successful Loan Repayment Scenario

Sarah, a bright and ambitious student, secured an AM Money private student loan of $25,000 to cover her tuition and living expenses during her four-year undergraduate program. She carefully researched her options and chose a ten-year repayment plan with a fixed interest rate of 7%. Throughout her studies, Sarah maintained a part-time job, diligently budgeting her income to cover her living expenses and loan payments. Upon graduation, she secured a well-paying position in her field, allowing her to comfortably make her monthly loan payments. By strategically managing her finances and sticking to her repayment plan, Sarah successfully repaid her loan within the allotted timeframe without incurring any penalties or additional interest charges. This demonstrates the positive impact of responsible borrowing and proactive financial planning. Her disciplined approach allowed her to achieve her educational goals without long-term financial strain.

Struggling with Loan Repayment Scenario

Mark, also an undergraduate student, took out a similar AM Money private student loan of $25,000. However, he underestimated the financial demands of his education and lifestyle. He struggled to find a part-time job that fit his demanding course load, leading to insufficient funds for living expenses and loan payments. He initially fell behind on his payments, accumulating late fees and increasing his overall debt burden. The accumulating interest significantly impacted his financial stability. Mark eventually sought help from AM Money’s customer service, exploring options like deferment or forbearance. He also started working with a financial advisor to create a realistic budget and explore options for debt consolidation or refinancing. This scenario highlights the importance of careful budgeting, realistic financial planning, and seeking assistance when facing repayment difficulties. Early intervention and proactive communication with the lender are vital in mitigating negative consequences.

Final Review

Securing a student loan is a significant financial commitment. By carefully weighing the benefits and drawbacks of AM Money private student loans against other options, and by understanding the associated responsibilities, you can confidently navigate the path to higher education. Remember to thoroughly review the terms and conditions, explore all available resources, and prioritize responsible borrowing practices to ensure a positive outcome.

FAQ Section

What is the minimum credit score required for an AM Money private student loan?

Credit score requirements vary depending on the applicant’s circumstances and the loan amount. It’s best to check directly with AM Money for the most up-to-date information.

Can I refinance my AM Money student loan with another lender?

Yes, refinancing is an option once you’ve made some payments. However, carefully compare interest rates and terms from various lenders before refinancing.

What happens if I miss a payment on my AM Money student loan?

Late payments can result in late fees and negatively impact your credit score. Contact AM Money immediately if you anticipate difficulty making a payment to explore options for avoiding default.

Does AM Money offer any hardship programs for borrowers experiencing financial difficulty?

AM Money may offer forbearance or deferment programs under specific circumstances. Contact their customer service department to inquire about available options.